Key Insights

The Indonesian agrochemical market, projected to reach $3.7 billion by 2025, is poised for sustained expansion. This growth, with an estimated CAGR of 2.7%, is driven by escalating agricultural output to satisfy the needs of a burgeoning population and increasing disposable incomes. The market is segmented by product (fertilizers, pesticides, adjuvants, plant growth regulators) and application (cereals, oilseeds, fruits & vegetables, other crops). Fertilizers are anticipated to lead market share, reflecting Indonesia's agricultural export dependence and the imperative to boost crop yields. The rise in crop diseases and pest infestations is propelling demand for pesticides. Furthermore, the adoption of advanced agricultural techniques, including precision farming, is fueling the adoption of adjuvants and plant growth regulators. Government support for sustainable agriculture and infrastructure investments are key growth enablers.

Indonesia Agrochemical Market Market Size (In Billion)

However, the market navigates challenges such as volatile raw material prices, environmental concerns surrounding pesticide application, and potential regulatory shifts impacting agrochemical registration and usage. The competitive environment features global leaders like BASF, Bayer Crop Science, Syngenta AG, and Corteva Agriscience, alongside domestic entities such as PT Pupuk Iskandar Muda (PIM). These companies prioritize developing innovative and sustainable agrochemical solutions to meet the evolving demands of Indonesian farmers and comply with stringent environmental standards. Strategic alliances, mergers, acquisitions, and product portfolio expansion are central to their strategies for market leadership and share growth. The forecast period of 2025-2033 signals continued positive trajectory, notwithstanding agricultural market volatility and external economic factors.

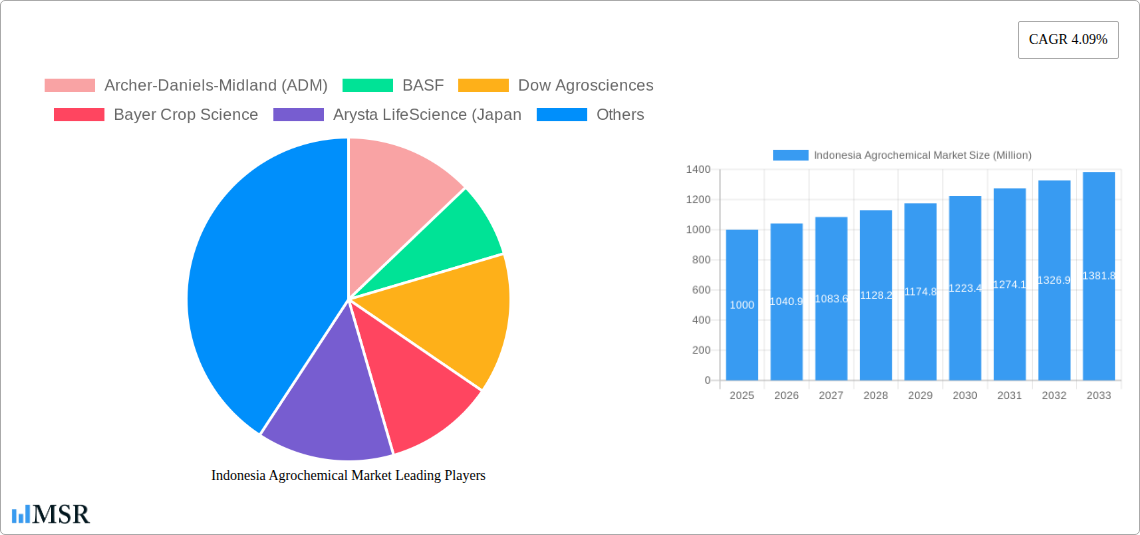

Indonesia Agrochemical Market Company Market Share

Indonesia Agrochemical Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia agrochemical market, covering market dynamics, industry trends, key segments, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers crucial insights for industry stakeholders, investors, and policymakers. The Indonesian agrochemical market is poised for significant growth, driven by factors including increasing agricultural production, rising demand for high-yield crops, and government initiatives promoting sustainable agricultural practices. This report unveils the opportunities and challenges that shape this dynamic market, offering actionable intelligence for strategic decision-making.

Indonesia Agrochemical Market Concentration & Dynamics

The Indonesian agrochemical market exhibits a moderately concentrated structure, with a few multinational corporations holding significant market share. Key players like BASF, Bayer Crop Science, Syngenta AG, and Corteva Agriscience dominate the landscape. However, several regional and local players also contribute significantly. Market share dynamics are influenced by factors like product innovation, pricing strategies, and distribution networks. The level of innovation within the ecosystem is moderate, with major players investing in R&D to develop sustainable and effective agrochemical solutions. Regulatory frameworks, while evolving, play a vital role in shaping market access and product registration. Substitute products, such as biopesticides and organic farming techniques, are gaining traction, although their market penetration remains relatively low. End-user trends are increasingly focused on sustainable and environmentally friendly solutions, driving demand for biopesticides and integrated pest management (IPM) strategies. M&A activity in the Indonesian agrochemical sector has been moderate in recent years, with a total of xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Moderate level of innovation, with R&D investments by major players.

- Regulatory Framework: Evolving and impacting market access.

- Substitute Products: Growing interest in biopesticides and organic alternatives.

- End-User Trends: Increasing demand for sustainable and environmentally friendly products.

- M&A Activity: xx deals between 2019-2024.

Indonesia Agrochemical Market Industry Insights & Trends

The Indonesian agrochemical market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). The market size is estimated at xx Million in 2025 and is expected to reach xx Million by 2033. This growth is fueled by several factors, including the increasing demand for food and agricultural products due to population growth, government support for agricultural modernization, and rising farmer incomes in certain regions. Technological advancements in agrochemicals, such as the development of more targeted and efficient formulations, are also contributing to market expansion. Changing consumer preferences toward healthier and safer food products are pushing for a shift towards sustainable agricultural practices, presenting opportunities for biopesticides and other environmentally friendly agrochemicals. However, challenges such as fluctuating weather patterns, price volatility of raw materials, and stringent regulatory requirements pose certain risks to market growth.

Key Markets & Segments Leading Indonesia Agrochemical Market

The Indonesian agrochemical market is segmented by type (fertilizers, pesticides, adjuvants, plant growth regulators) and application (cereals, oilseeds, fruits and vegetables, other crops). The pesticide segment currently holds the largest market share, driven by the high prevalence of pests and diseases affecting major crops. The fertilizer segment is also substantial, with increasing demand for improved soil fertility. Among the application segments, cereals and oilseeds dominate, reflecting their significant acreage in Indonesian agriculture. The fruits and vegetables segment is also witnessing notable growth.

Key Growth Drivers:

- Economic Growth: Rising disposable incomes and increased purchasing power.

- Government Support: Policies promoting agricultural modernization and sustainable practices.

- Infrastructure Development: Improved irrigation systems and transportation networks.

- Technological Advancements: Development of high-yielding crop varieties and efficient agrochemicals.

Dominance Analysis:

The dominance of pesticides and the cereals/oilseeds application segments highlights the need for effective pest control and improved crop yields. The rapid growth of the fruits and vegetables segment reflects the increasing demand for fresh produce.

Indonesia Agrochemical Market Product Developments

Recent product innovations in the Indonesian agrochemical market have focused on developing more targeted, effective, and environmentally friendly solutions. The commercialization of Nelvium by Provivi and Syngenta Crop Protection in March 2022, a mating disruption solution for rice pest control, marks a significant advancement in sustainable pest management. The launch of BASF Sahabat Planters mobile app in October 2021 provides farmers with access to valuable information and resources, enhancing their efficiency and sustainability practices. These advancements highlight the increasing focus on precision agriculture and sustainable solutions.

Challenges in the Indonesia Agrochemical Market Market

The Indonesian agrochemical market faces challenges such as stringent regulatory approvals, leading to delays in product launches and increased costs. Supply chain disruptions, due to factors like weather events and geopolitical instability, impact the availability and pricing of agrochemicals. Intense competition among major players and the emergence of substitute products also creates pressure on market participants. These combined factors may limit market expansion if not addressed effectively. The estimated impact on market growth is xx%.

Forces Driving Indonesia Agrochemical Market Growth

Several factors drive the growth of the Indonesian agrochemical market: Firstly, the increasing demand for food due to population growth necessitates higher agricultural yields. Secondly, government initiatives promoting agricultural modernization and sustainable farming provide crucial support. Thirdly, advancements in agrochemical technology, such as targeted formulations and biological controls, boost efficiency and crop protection. Finally, rising farmer incomes in some regions increase the affordability and demand for agrochemicals.

Challenges in the Indonesia Agrochemical Market Market

Long-term growth catalysts for the Indonesian agrochemical market include strategic partnerships between multinational companies and local distributors, enhancing market reach and accessibility. Continuous innovation in pesticide and fertilizer technologies, focused on sustainability and bio-based solutions, will be crucial. Expanding into new markets and crop applications, particularly in the horticulture and high-value crops segments, can unlock significant future potential.

Emerging Opportunities in Indonesia Agrochemical Market

Emerging opportunities lie in the increasing demand for biopesticides and biofertilizers, driven by growing environmental concerns and consumer preference for sustainable agriculture. The development of precision farming technologies, including drone-based applications and data analytics, opens avenues for optimized agrochemical usage. The growth of contract farming and farmer cooperatives presents new market segments for customized agrochemical solutions.

Leading Players in the Indonesia Agrochemical Market Sector

- Archer-Daniels-Midland (ADM)

- BASF

- Dow Agrosciences

- Bayer Crop Science

- Arysta LifeScience (Japan)

- FMC Corporation

- Yara International

- PT Pupuk Iskandar Muda (PIM)

- Syngenta AG

- Corteva Agriscience

Key Milestones in Indonesia Agrochemical Market Industry

- October 2021: BASF launched the BASF Sahabat Planters mobile app, improving farmer access to information and resources.

- March 2022: Provivi and Syngenta commercialized Nelvium, a novel mating disruption solution for rice pest control, showcasing innovation in sustainable pest management.

Strategic Outlook for Indonesia Agrochemical Market Market

The Indonesian agrochemical market holds immense long-term potential, driven by population growth, increasing food demand, and government support for agricultural development. Strategic opportunities include focusing on sustainable and environmentally friendly solutions, leveraging technological advancements in precision agriculture, and strengthening partnerships with local stakeholders. Companies focusing on these aspects are well-positioned to capture significant market share in the years to come.

Indonesia Agrochemical Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Agrochemical Market Segmentation By Geography

- 1. Indonesia

Indonesia Agrochemical Market Regional Market Share

Geographic Coverage of Indonesia Agrochemical Market

Indonesia Agrochemical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. The Need for Increased Land Productivity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Agrochemical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Archer-Daniels-Midland (ADM)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow Agrosciences

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer Crop Science

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arysta LifeScience (Japan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FMC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yara International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Pupuk Iskandar Muda (PIM)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Syngenta AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Archer-Daniels-Midland (ADM)

List of Figures

- Figure 1: Indonesia Agrochemical Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Agrochemical Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Agrochemical Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Agrochemical Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Agrochemical Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Agrochemical Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Agrochemical Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Agrochemical Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Agrochemical Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Agrochemical Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Agrochemical Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Agrochemical Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Agrochemical Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Agrochemical Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Agrochemical Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Indonesia Agrochemical Market?

Key companies in the market include Archer-Daniels-Midland (ADM), BASF, Dow Agrosciences, Bayer Crop Science, Arysta LifeScience (Japan, FMC Corporation, Yara International, PT Pupuk Iskandar Muda (PIM), Syngenta AG, Corteva Agriscience.

3. What are the main segments of the Indonesia Agrochemical Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

The Need for Increased Land Productivity is Driving the Market.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

March 2022: Provivi and Syngenta Crop Protection commercialized the Nelvium, a new mating disruption solution, to effectively and more safely control detrimental pests in rice. While pheromones have been utilized in agriculture for more than 30 years as a pest control method, this will be the first time this innovation has been applied to rice in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Agrochemical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Agrochemical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Agrochemical Market?

To stay informed about further developments, trends, and reports in the Indonesia Agrochemical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence