Key Insights

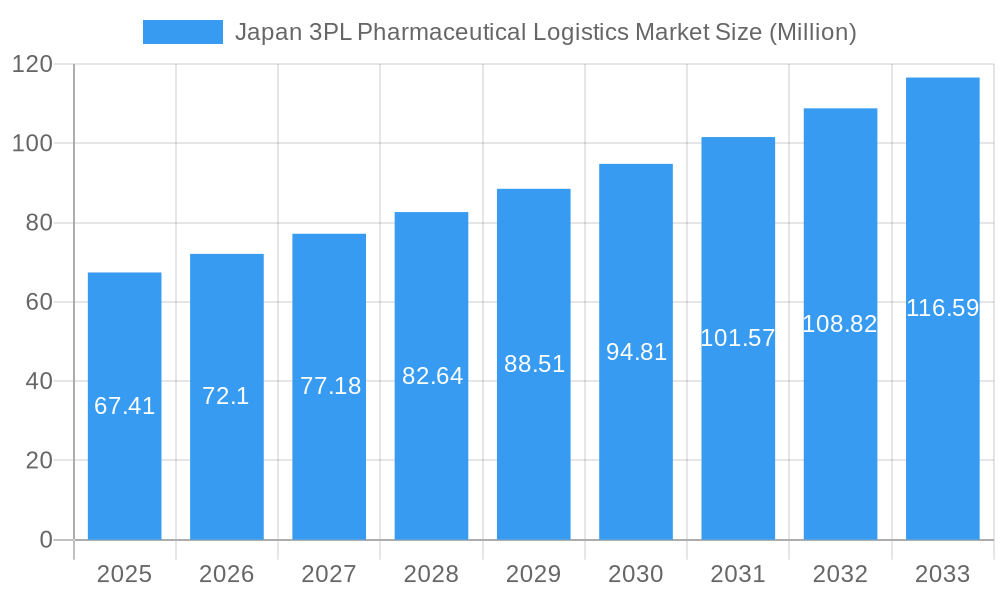

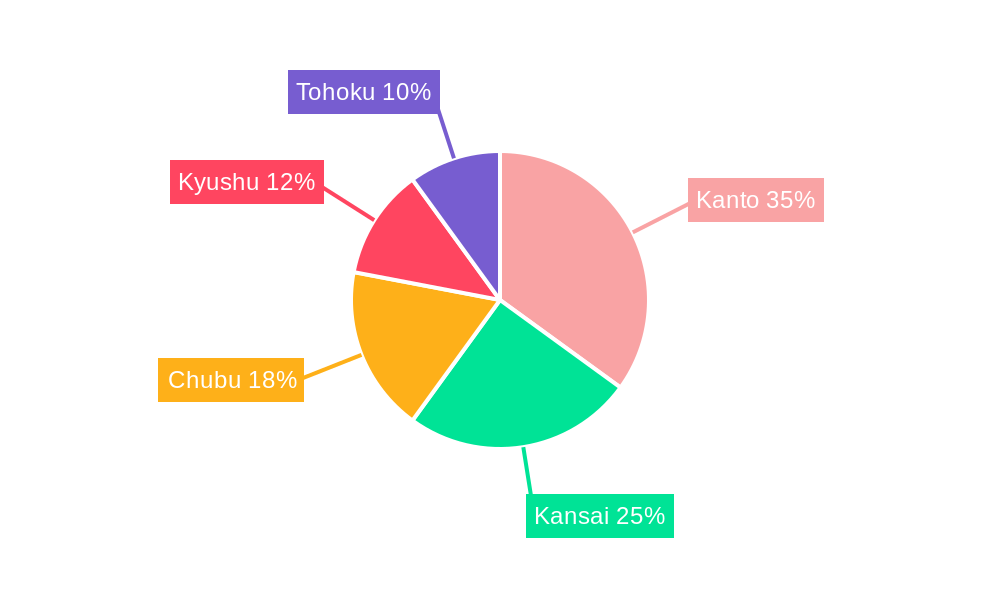

The Japan 3PL Pharmaceutical Logistics market, valued at $67.41 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for temperature-sensitive pharmaceutical products, coupled with stringent regulatory requirements for storage and transportation, necessitates the use of specialized 3PL providers. Furthermore, the growing e-commerce sector in Japan, particularly for pharmaceuticals and healthcare products, is fueling demand for efficient and reliable logistics solutions. Japanese pharmaceutical companies are increasingly outsourcing logistics functions to focus on core competencies, driving further market growth. The market is segmented by service type (domestic and international transportation management, value-added warehousing and distribution) and temperature control (controlled/cold chain and non-controlled/non-cold chain logistics). Major players like DB Schenker, DHL Logistics, and Kuehne + Nagel are actively competing within this market, investing in advanced technologies and expanding their service offerings to meet growing demand. The regional distribution across Japan's key areas—Kanto, Kansai, Chubu, Kyushu, and Tohoku—reflects population density and healthcare infrastructure.

Japan 3PL Pharmaceutical Logistics Market Market Size (In Million)

The forecast period (2025-2033) anticipates continuous market expansion, fueled by technological advancements within the logistics sector. Automation, real-time tracking systems, and improved data analytics are enhancing efficiency and transparency. Increasing investments in cold chain infrastructure, particularly in the controlled/cold chain logistics segment, are crucial for maintaining product integrity and meeting regulatory compliance. However, factors such as rising fuel costs and potential supply chain disruptions could pose challenges to market growth. Nonetheless, the long-term outlook for the Japan 3PL Pharmaceutical Logistics market remains optimistic, driven by a combination of industry trends, regulatory pressures, and evolving consumer expectations.

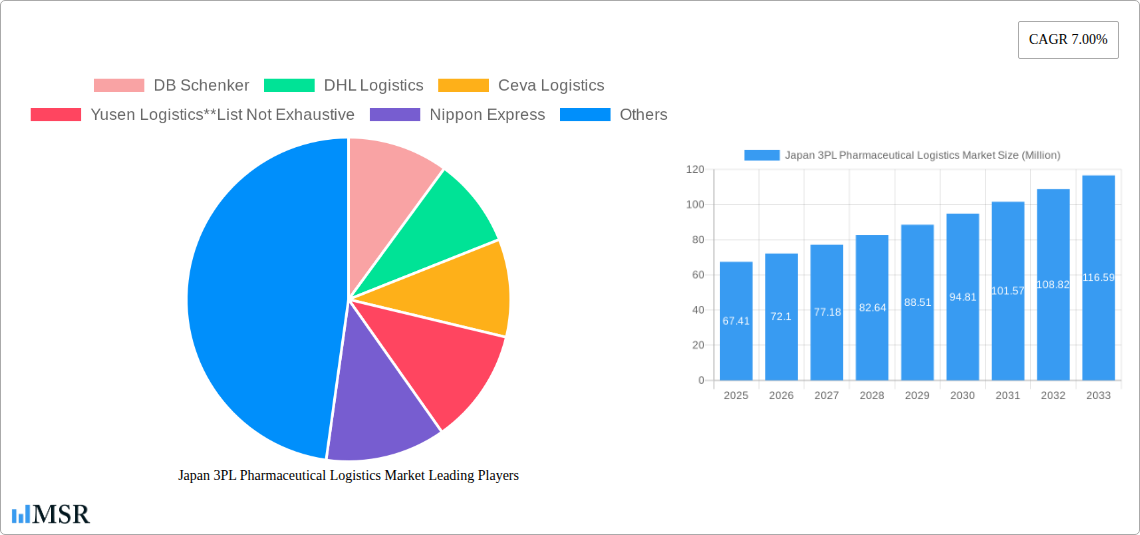

Japan 3PL Pharmaceutical Logistics Market Company Market Share

Japan 3PL Pharmaceutical Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan 3PL Pharmaceutical Logistics market, covering market dynamics, industry trends, key segments, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is essential for industry stakeholders, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The market is estimated to be worth xx Million in 2025 and is projected to grow at a CAGR of xx% during the forecast period (2025-2033).

Japan 3PL Pharmaceutical Logistics Market Market Concentration & Dynamics

This section delves into the competitive landscape of the Japanese pharmaceutical logistics market. We analyze market concentration, identifying key players and their respective market shares. The report also examines the innovation ecosystem, exploring technological advancements and their impact on market dynamics. Furthermore, we assess the regulatory framework, highlighting its influence on market operations and future growth. Substitute products and their market penetration are also analyzed, alongside end-user trends impacting demand. Finally, we cover significant mergers and acquisitions (M&A) activities within the sector, providing insights into strategic shifts and market consolidation.

- Market Concentration: The Japanese 3PL pharmaceutical logistics market exhibits a moderately concentrated structure, with a few major players holding significant market share. Data indicates that the top five players account for approximately xx% of the market.

- Innovation Ecosystem: The market showcases a dynamic innovation ecosystem with continuous advancements in temperature-controlled logistics, automation, and data analytics.

- Regulatory Framework: Stringent regulatory compliance requirements, including GDP (Good Distribution Practice) standards, significantly influence market operations.

- Substitute Products: While direct substitutes are limited, alternative logistics models and cost-optimization strategies pose some competitive pressure.

- End-User Trends: Increased demand for specialized logistics solutions for temperature-sensitive pharmaceuticals and a growing focus on supply chain visibility are driving market growth.

- M&A Activities: Recent years have witnessed a moderate level of M&A activity, suggesting strategic consolidation within the market. For instance, the Nippon Express acquisition of Cargo-Partner exemplifies this trend. The number of M&A deals from 2019-2024 is estimated at xx.

Japan 3PL Pharmaceutical Logistics Market Industry Insights & Trends

This section provides a detailed analysis of the Japan 3PL Pharmaceutical Logistics market size and growth drivers. It examines technological disruptions, evolving consumer behavior, and other factors influencing market expansion. The analysis considers the impact of factors like increased healthcare spending, growing pharmaceutical production, and stringent regulatory requirements. The report highlights challenges such as increasing fuel costs and potential supply chain disruptions. Specific trends examined include the rising adoption of cold chain logistics for temperature-sensitive pharmaceutical products and the increasing demand for value-added services such as packaging and labeling.

The market size in 2024 was approximately xx Million, indicating substantial growth compared to the xx Million recorded in 2019. This trajectory underscores the market’s dynamic nature and underscores its substantial potential for continued expansion.

Key Markets & Segments Leading Japan 3PL Pharmaceutical Logistics Market

This section delves into the dominant segments within the Japan 3PL pharmaceutical logistics market, categorizing them by service type and temperature control requirements. We analyze the pivotal drivers contributing to each segment's expansion, taking into account evolving economic landscapes, advancements in logistical infrastructure, and dynamic regulatory frameworks.

By Service:- Domestic Transportation Management: This segment commands the largest market share, propelled by the substantial volume of pharmaceutical products transported within Japan. Key growth catalysts include the enduring strength of Japan's domestic pharmaceutical industry and the sophisticated efficiency of its national transportation networks.

- International Transportation Management: Witnessing robust expansion, this segment is fueled by the escalating global trade in pharmaceuticals. Drivers include the increasing trend of pharmaceutical exports from Japan and continuous improvements in international logistics infrastructure, facilitating smoother cross-border movements.

- Value-added Warehousing and Distribution: The demand for specialized, value-added services is on the rise. This growth is underpinned by the critical need for meticulous handling and tailored storage solutions for pharmaceutical products. Enhanced supply chain efficiency and the potential for reduced operational costs are significant driving factors.

- Controlled/Cold Chain Logistics: This segment is a primary engine for market growth, given the substantial proportion of temperature-sensitive pharmaceutical products that necessitate specialized handling and storage environments. The burgeoning demand for biologics, vaccines, and other temperature-critical medications is a key driver.

- Non-controlled/Non-Cold Chain Logistics: This segment serves pharmaceutical products that do not require stringent temperature-controlled storage and transportation. While representing a smaller portion of the market, it still contributes significantly due to the sheer volume of non-temperature sensitive pharmaceuticals.

Geographically, the Kanto region emerges as the preeminent market for 3PL pharmaceutical logistics in Japan. This dominance is attributed to its high concentration of leading pharmaceutical manufacturers and its status as a hub for highly developed and integrated logistics infrastructure.

Japan 3PL Pharmaceutical Logistics Market Product Developments

Recent product innovations include advancements in temperature-controlled containers, real-time tracking systems, and data analytics platforms that enhance supply chain visibility and efficiency. These innovations improve traceability and reduce the risk of product damage or spoilage, enhancing product quality and safety. These technological advancements are crucial for maintaining the integrity of temperature-sensitive pharmaceuticals during transport and storage, providing significant competitive advantages to logistics providers who adopt them.

Challenges in the Japan 3PL Pharmaceutical Logistics Market Market

The Japan 3PL pharmaceutical logistics market navigates a complex landscape characterized by several significant challenges. Chief among these are the stringent regulatory compliance requirements, which impose considerable operational costs and add layers of complexity to logistics processes. Furthermore, the market remains vulnerable to supply chain disruptions, exacerbated by the inherent risks posed by Japan's susceptibility to natural disasters and potential geopolitical instabilities. The industry also grapples with intense competition among established, long-standing players, alongside the substantial capital investments required for infrastructure upgrades and the adoption of cutting-edge technologies. These factors collectively present formidable hurdles for new entrants aiming to establish a foothold and for existing companies seeking to expand their operations, often leading to increased operational expenditures and potentially impacting profit margins.

Forces Driving Japan 3PL Pharmaceutical Logistics Market Growth

The Japan 3PL pharmaceutical logistics market is propelled by a confluence of potent growth drivers. A primary catalyst is the expanding pharmaceutical market itself, largely fueled by Japan's rapidly aging population and a corresponding increase in healthcare expenditure. Concurrently, rapid technological advancements in logistics, particularly in areas such as real-time tracking, automation, and sophisticated cold chain management solutions, are significantly enhancing efficiency and enabling new service offerings. Government initiatives aimed at fostering more efficient and resilient supply chains, coupled with increasingly stringent regulations designed to bolster product safety and integrity, also play a crucial role in shaping and driving market expansion.

Long-Term Growth Catalysts in Japan 3PL Pharmaceutical Logistics Market

Long-term growth will be driven by continuous innovation in cold chain technology, strategic partnerships between pharmaceutical companies and 3PL providers, and expansion into emerging markets. Increased investment in technology, notably in automation and data analytics, is also crucial for optimizing logistics operations and fostering sustained growth.

Emerging Opportunities in Japan 3PL Pharmaceutical Logistics Market

Emerging opportunities lie in the growing demand for specialized logistics solutions for advanced therapies and personalized medicine. The increasing adoption of digital technologies, such as blockchain and AI, offers opportunities for enhanced supply chain transparency and efficiency. Expansion into regional markets beyond the Kanto region presents further growth potential.

Leading Players in the Japan 3PL Pharmaceutical Logistics Market Sector

- DB Schenker

- DHL Logistics

- Ceva Logistics

- Yusen Logistics

- Nippon Express

- FedEx

- Mitsubishi Logistics

- Kuehne + Nagel

- Kerry Logistics

- Suzuken Group

Key Milestones in Japan 3PL Pharmaceutical Logistics Market Industry

- May 2023: Nippon Express's strategic acquisition of Cargo-Partner represents a significant consolidation move within the global freight forwarding sector. This development is poised to reshape the competitive dynamics within the Japanese 3PL pharmaceutical logistics landscape.

- December 2022: The establishment of a dedicated European logistics platform in Luxembourg by JCR Pharmaceuticals underscores the escalating importance of international pharmaceutical logistics. This move signifies the strategic global expansion initiatives undertaken by prominent Japanese pharmaceutical companies to better serve global markets and manage their complex supply chains.

Strategic Outlook for Japan 3PL Pharmaceutical Logistics Market Market

The Japan 3PL pharmaceutical logistics market presents significant growth potential driven by technological advancements, increasing healthcare spending, and the need for robust and efficient supply chains. Strategic opportunities exist in developing specialized services for temperature-sensitive products, embracing digitalization to improve supply chain visibility and efficiency, and fostering strategic partnerships to leverage expertise and resources. The market's future hinges on adapting to evolving regulatory landscapes and navigating global supply chain uncertainties.

Japan 3PL Pharmaceutical Logistics Market Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Temperature Control

- 2.1. Controlled/Cold Chain Logistics

- 2.2. Non-controlled/Non-Cold Chain Logistics

Japan 3PL Pharmaceutical Logistics Market Segmentation By Geography

- 1. Japan

Japan 3PL Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of Japan 3PL Pharmaceutical Logistics Market

Japan 3PL Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Generics drugs market growing in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan 3PL Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Temperature Control

- 5.2.1. Controlled/Cold Chain Logistics

- 5.2.2. Non-controlled/Non-Cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suzuken Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Japan 3PL Pharmaceutical Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan 3PL Pharmaceutical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 3: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 6: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan 3PL Pharmaceutical Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Japan 3PL Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL Logistics, Ceva Logistics, Yusen Logistics**List Not Exhaustive, Nippon Express, FedEx, Mitsubishi Logistics, Kuehne + Nagel, Kerry Logistics, Suzuken Group.

3. What are the main segments of the Japan 3PL Pharmaceutical Logistics Market?

The market segments include Service, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Generics drugs market growing in the country.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

May 2023: Nippon Express, the seventh-largest third-party logistics provider in the world by gross revenue, has agreed to acquire Austrian logistics company Cargo-Partner for up to $1.5 billion, advancing its strategy to become a global mega-freight forwarder.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan 3PL Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan 3PL Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan 3PL Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Japan 3PL Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence