Key Insights

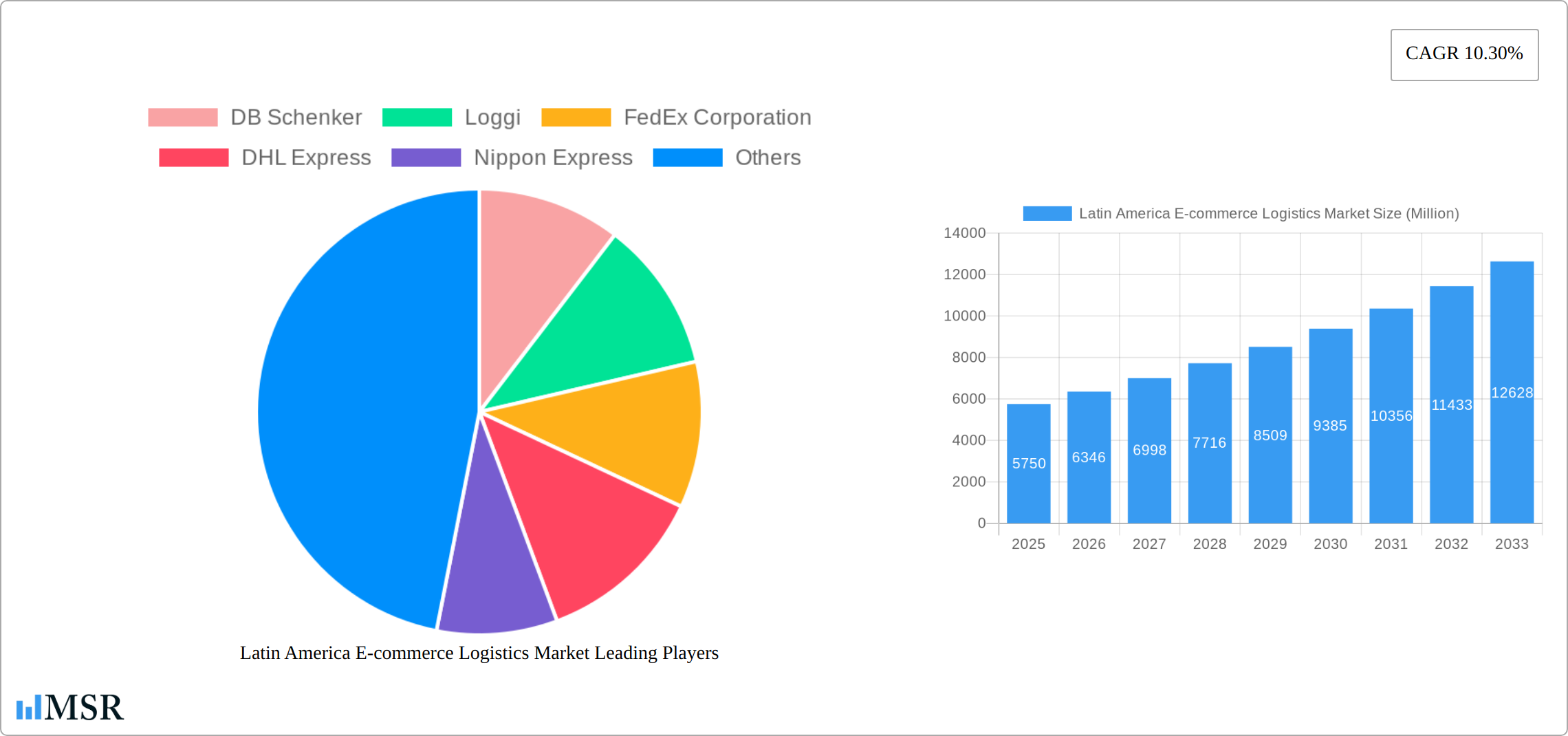

The Latin American e-commerce logistics market is experiencing robust growth, projected to reach $5.75 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.30% from 2025 to 2033. This expansion is fueled by several key factors. The rising adoption of e-commerce across Brazil, Mexico, and Colombia, driven by increasing internet and smartphone penetration, is a major driver. Furthermore, the burgeoning middle class in the region, coupled with a preference for convenient online shopping experiences, significantly boosts demand for efficient and reliable logistics services. The market is segmented by service type (transportation, warehousing, value-added services), business model (B2B, B2C), destination (domestic, international), product category (fashion, electronics, beauty, etc.), and country. The growth in cross-border e-commerce, facilitated by improved infrastructure and streamlined customs procedures, presents a significant opportunity for logistics providers. Increased investment in technology, including advanced analytics and automation, is improving supply chain efficiency and enhancing customer experience. However, challenges remain, including infrastructure limitations in certain regions, fluctuating currency exchange rates, and security concerns impacting delivery reliability. The competitive landscape is characterized by a mix of global players like FedEx, DHL, and Kuehne + Nagel, and regional leaders such as Loggi and B2W Digital, creating a dynamic market environment.

Latin America E-commerce Logistics Market Market Size (In Billion)

The continued expansion of the e-commerce sector in Latin America is expected to drive significant investment in logistics infrastructure and technology. This includes the development of improved warehousing facilities, last-mile delivery networks, and advanced technology solutions for order management and tracking. The growth of specialized services, such as temperature-controlled transportation for perishable goods and customized packaging solutions, further enhances the market's complexity and potential. Successful players will need to adapt to the unique challenges posed by the region's diverse geography and regulatory landscape. This includes navigating varying customs regulations across different countries and adapting to the specific needs of individual product categories. The market's strong growth trajectory indicates substantial opportunities for logistics companies that can effectively meet the evolving demands of e-commerce businesses and consumers in Latin America.

Latin America E-commerce Logistics Market Company Market Share

Latin America E-commerce Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America e-commerce logistics market, offering valuable insights for investors, businesses, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key players, and future growth potential. The market is segmented by service (Transportation, Warehousing & Inventory Management, Value-Added Services), business type (B2B, B2C), destination (Domestic, International/Cross-border), product type (Fashion & Apparel, Consumer Electronics, Beauty & Personal Care, Other Products), and country (Brazil, Mexico, Colombia, Rest of Latin America). Key players analyzed include DB Schenker, Loggi, FedEx Corporation, DHL Express, Nippon Express, Gefco Logistics, CEVA Logistics, Kuehne Nagel, B2W Digital, Kerry Logistics, CH Robinson Worldwide Inc, and Bollore Logistics, among others. The report projects a market size of xx Million by 2025, with a CAGR of xx% during the forecast period.

Latin America E-commerce Logistics Market Concentration & Dynamics

The Latin American e-commerce logistics market exhibits a moderately concentrated landscape, with several large multinational players and a growing number of regional specialists vying for market share. Market concentration is influenced by the significant investments made by major players like DHL and Maersk, and the ongoing consolidation through M&A activity as seen in Cubbo's acquisition of Dedalog. The innovative ecosystem is dynamic, with the adoption of technologies like robotics and automation driving efficiency gains. Regulatory frameworks vary across countries, impacting cross-border operations and compliance. Substitute products pose limited threats, as specialized logistics solutions are often necessary for e-commerce fulfillment. End-user trends show a clear preference for faster delivery times and increased transparency in the supply chain.

- Market Share: DHL, FedEx, and local players like Loggi hold significant market share, with estimates suggesting a combined share of approximately xx%.

- M&A Activity: The number of M&A deals in the sector has increased in recent years, indicating consolidation and expansion strategies among players seeking to gain a competitive edge. An estimated xx M&A deals occurred between 2019 and 2024.

Latin America E-commerce Logistics Market Industry Insights & Trends

The Latin American e-commerce logistics market is experiencing robust growth, driven by a surge in online shopping, expanding internet penetration, and increasing smartphone usage. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of AI-powered solutions for route optimization and warehouse management, are revolutionizing the industry. Evolving consumer behaviors, including a preference for same-day or next-day delivery, are putting pressure on logistics providers to enhance their speed and efficiency. The growth is further fueled by increasing investment in infrastructure and the rise of e-commerce marketplaces. Challenges include infrastructure limitations in some areas and the need for improved last-mile delivery solutions.

Key Markets & Segments Leading Latin America E-commerce Logistics Market

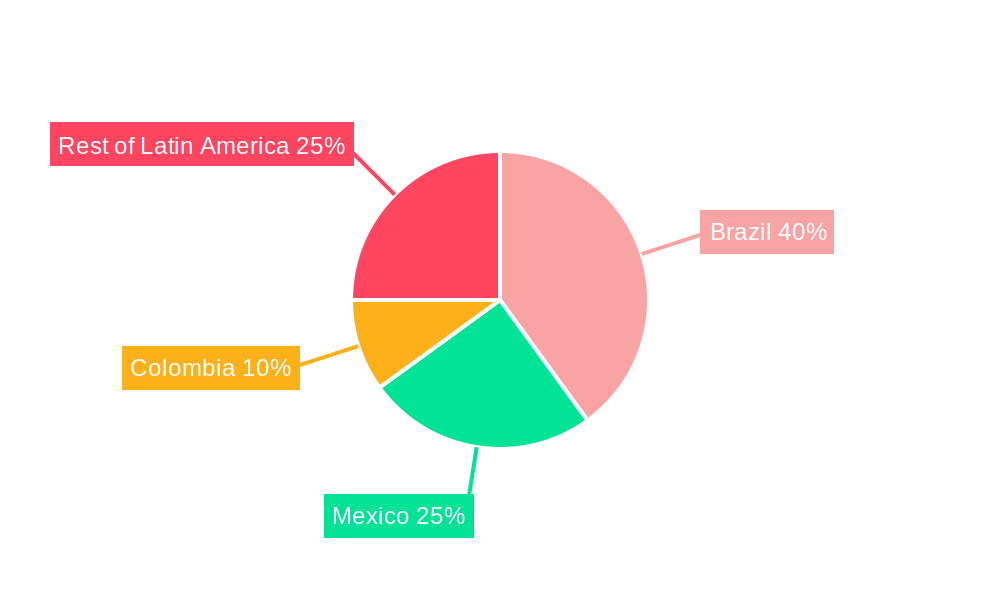

Latin America's e-commerce logistics landscape is experiencing dynamic growth, with Brazil consistently leading the charge, closely followed by burgeoning markets like Mexico and Colombia. The Business-to-Consumer (B2C) segment remains the dominant force and the primary engine of growth, fueled by an ever-increasing adoption of online shopping by consumers across the region. Essential to the value chain are robust warehousing and inventory management services, with a notable rise in the adoption of value-added services such as specialized labeling and customized packaging. The burgeoning field of cross-border e-commerce is also creating significant opportunities, paving the way for specialized logistics providers to offer tailored solutions. Within product categories, Fashion and Apparel continues to hold the largest market share, reflecting its strong online sales performance.

- Growth Drivers:

- Accelerated growth of e-commerce penetration in key markets like Brazil, Mexico, and Colombia.

- Substantial and ongoing investments in upgrading and expanding logistics infrastructure.

- Widespread adoption of advanced technologies such as Artificial Intelligence (AI), automation, and Internet of Things (IoT) solutions.

- Escalating consumer demand for faster, more reliable, and transparent delivery services.

- Continuous expansion and increasing sophistication of cross-border e-commerce operations.

- Growing adoption of omnichannel retail strategies by businesses.

Latin America E-commerce Logistics Market Product Developments

Innovations in the Latin America e-commerce logistics market are primarily focused on revolutionizing speed, enhancing operational efficiency, and ensuring end-to-end transparency. Key advancements include the widespread implementation of automated warehouse systems, the strategic deployment of sophisticated route optimization software, and the insightful utilization of data analytics for more accurate demand forecasting and inventory management. A significant trend is the growing investment in sustainable logistics solutions, encompassing the adoption of electric delivery vehicles and the use of eco-friendly packaging materials, directly addressing the increasing consumer and regulatory demand for environmentally responsible practices. These strategic product developments are instrumental in providing a significant competitive edge, leading to improved operational performance and elevated customer satisfaction.

Challenges in the Latin America E-commerce Logistics Market

The Latin America e-commerce logistics market grapples with several significant hurdles. Underdeveloped infrastructure in certain regions continues to impede efficient last-mile delivery, impacting delivery times and costs. Navigating the complexities of regulatory frameworks and varying customs procedures across different countries adds substantial operational complexity, particularly for cross-border e-commerce operations. Intense competition, especially in prominent markets like Brazil, exerts considerable pressure on pricing strategies and overall profitability. Furthermore, ongoing security concerns and the persistent risk of package theft remain critical challenges that logistics providers must continually address. These combined factors collectively impact the overall efficiency, cost-effectiveness, and scalability of e-commerce logistics operations, potentially reducing profitability by an estimated 15-20% if not effectively managed.

Forces Driving Latin America E-commerce Logistics Market Growth

Technological advancements such as AI-driven route optimization and automation in warehousing are streamlining operations and reducing costs. Growing middle classes in major Latin American countries are driving increased disposable income and online shopping. Government initiatives to improve infrastructure and ease regulatory hurdles are creating a more favorable environment for e-commerce logistics.

Long-Term Growth Catalysts in Latin America E-commerce Logistics Market

Long-term growth will be fueled by continued investments in technology, strategic partnerships between logistics providers and e-commerce platforms, and expansion into underserved markets. The rise of omnichannel retail will create further demand for flexible and integrated logistics solutions. Sustainable logistics practices are gaining traction, creating opportunities for eco-friendly solutions.

Emerging Opportunities in Latin America E-commerce Logistics Market

Emerging opportunities exist in the expansion of last-mile delivery solutions, particularly in underserved areas. The growing demand for specialized logistics solutions for temperature-sensitive products presents a niche market opportunity. The rise of subscription-based services creates demand for reliable and efficient delivery management. The adoption of blockchain technology offers potential for greater transparency and security in supply chains.

Leading Players in the Latin America E-commerce Logistics Market Sector

- DB Schenker

- Loggi

- FedEx Corporation (FedEx)

- DHL Express (DHL)

- Nippon Express

- Gefco Logistics

- CEVA Logistics

- Kuehne Nagel

- B2W Digital

- Kerry Logistics

- CH Robinson Worldwide Inc (CH Robinson)

- Bollore Logistics

- Mercado Libre (for its internal logistics arm, Mercado Envios)

- Correos Chile

Key Milestones in Latin America E-commerce Logistics Market Industry

- July 2023: DHL Supply Chain announces significant investments in Latin American markets, focusing on decarbonization, infrastructure upgrades, and technology adoption.

- September 2022: AP Moller–Maersk opens a new warehouse in Brazil, expanding its supply chain management services.

- March 2022: Cubbo acquires Dedalog, consolidating its position in the e-commerce fulfillment logistics market.

Strategic Outlook for Latin America E-commerce Logistics Market

The Latin American e-commerce logistics market presents significant long-term growth potential, driven by sustained e-commerce expansion, technological advancements, and increasing investments in infrastructure. Strategic opportunities exist for companies that can adapt to evolving consumer expectations, leverage technological innovations, and establish efficient and reliable last-mile delivery networks. Focusing on sustainability and fostering strategic partnerships will be crucial for long-term success.

Latin America E-commerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value-Added Services (Labeling, Packaging, etc.)

-

2. Business

- 2.1. B2B (Business-to-Business)

- 2.2. B2C (Business-to-Customrs)

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics and Home Appliances

- 4.3. Beauty and Personal Care Products

- 4.4. Other Pr

Latin America E-commerce Logistics Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America E-commerce Logistics Market Regional Market Share

Geographic Coverage of Latin America E-commerce Logistics Market

Latin America E-commerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In Population; Rapid growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Integration Complexities; Technical reliability issues can hinder entry into the region

- 3.4. Market Trends

- 3.4.1. E-commerce Boom Spearheading Last-mile Delivery Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America E-commerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value-Added Services (Labeling, Packaging, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B (Business-to-Business)

- 5.2.2. B2C (Business-to-Customrs)

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics and Home Appliances

- 5.4.3. Beauty and Personal Care Products

- 5.4.4. Other Pr

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Loggi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FedEx Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gefco Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 B2W Digital*List Not Exhaustive 7 3 Other Companies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CH Robinson Worldwide Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bollore Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Latin America E-commerce Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America E-commerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: Latin America E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: Latin America E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Latin America E-commerce Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America E-commerce Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Latin America E-commerce Logistics Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: Latin America E-commerce Logistics Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: Latin America E-commerce Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Latin America E-commerce Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Brazil Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Argentina Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Chile Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Colombia Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Peru Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Venezuela Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Ecuador Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bolivia Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Paraguay Latin America E-commerce Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America E-commerce Logistics Market?

The projected CAGR is approximately 10.30%.

2. Which companies are prominent players in the Latin America E-commerce Logistics Market?

Key companies in the market include DB Schenker, Loggi, FedEx Corporation, DHL Express, Nippon Express, Gefco Logistics, CEVA Logistics, Kuehne Nagel, B2W Digital*List Not Exhaustive 7 3 Other Companies, Kerry Logistics, CH Robinson Worldwide Inc, Bollore Logistics.

3. What are the main segments of the Latin America E-commerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In Population; Rapid growth in Urbanization.

6. What are the notable trends driving market growth?

E-commerce Boom Spearheading Last-mile Delivery Demand.

7. Are there any restraints impacting market growth?

Integration Complexities; Technical reliability issues can hinder entry into the region.

8. Can you provide examples of recent developments in the market?

July 2023: DHL Supply Chain invested a substantial amount of money in Latin American markets, intending to continue these investments until 2028. These investments aim to bolster DHL's operations in Latin America. Their initiatives include decarbonizing their domestic fleet by adopting greener alternatives, constructing and renovating real estate and warehouses, and investing in new technologies such as robotics and automation solutions. These advancements are geared towards enhancing workplaces, improving operational efficiency, and providing greater flexibility for customers. This forms a pivotal part of DHL's strategic investment plan, intended to fortify logistics capabilities in key industries such as healthcare, automotive, technology, retail, and e-commerce.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America E-commerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America E-commerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America E-commerce Logistics Market?

To stay informed about further developments, trends, and reports in the Latin America E-commerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence