Key Insights

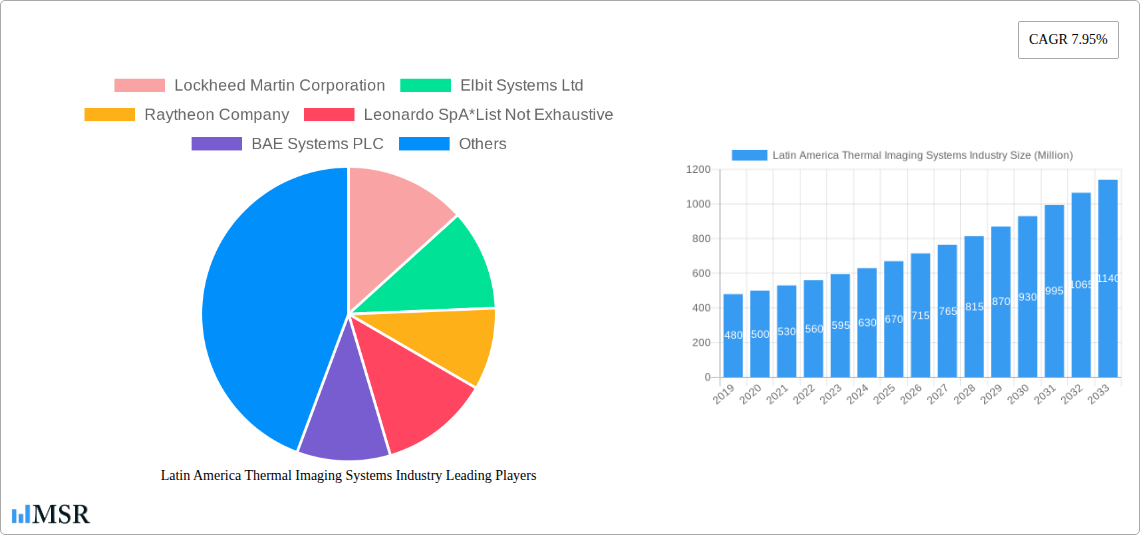

The Latin America Thermal Imaging Systems Industry is poised for significant expansion, projected to reach an estimated market size of approximately $750 million by 2025, and continuing its upward trajectory with a Compound Annual Growth Rate (CAGR) of 7.95% through 2033. This robust growth is primarily fueled by escalating demand for advanced security and surveillance solutions across the region, particularly in countries like Brazil, Mexico, and Colombia, which are investing heavily in critical infrastructure protection and public safety initiatives. Furthermore, the increasing adoption of thermal imaging in industrial monitoring and inspection applications, driven by the need for predictive maintenance and operational efficiency in sectors such as oil and gas and food and beverage, significantly contributes to market expansion. The burgeoning automotive sector's integration of thermal cameras for enhanced driver assistance systems and collision avoidance also presents a substantial growth avenue. The market's dynamism is further supported by continuous technological advancements leading to more compact, affordable, and higher-resolution thermal imaging devices.

Latin America Thermal Imaging Systems Industry Market Size (In Million)

Despite the optimistic outlook, certain factors could influence the pace of market penetration. The initial high cost of sophisticated thermal imaging hardware and the need for specialized training for effective operation can pose a restraint, especially for smaller enterprises and in less developed economies within Latin America. However, as manufacturing scales and competition intensifies, prices are expected to become more accessible. The market is also being shaped by the diverse applications, with fixed thermal cameras dominating the security and surveillance segment due to their continuous monitoring capabilities, while handheld thermal cameras are gaining traction for their versatility in inspection and detection tasks. Key players like FLIR Systems Inc., Lockheed Martin Corporation, and Raytheon Company are actively innovating and expanding their presence in the region, introducing a range of solutions from advanced hardware to integrated software and comprehensive services, further stimulating market development and adoption.

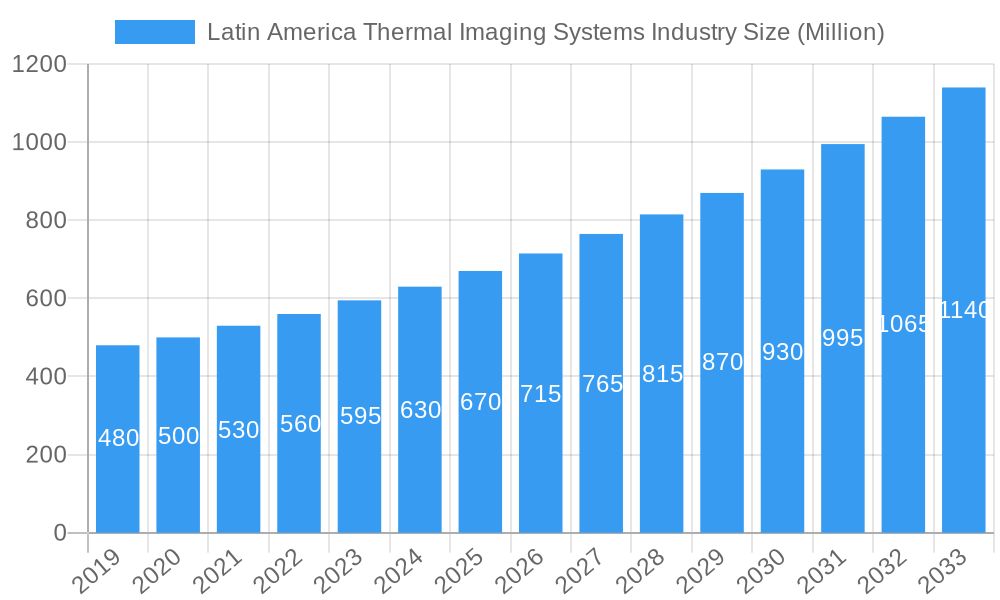

Latin America Thermal Imaging Systems Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Latin America Thermal Imaging Systems Industry, offering critical insights into market dynamics, growth drivers, challenges, and emerging opportunities. Covering the Study Period: 2019–2033, with a Base Year: 2025 and Forecast Period: 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving thermal imaging market in the region.

Latin America Thermal Imaging Systems Industry Market Concentration & Dynamics

The Latin America thermal imaging systems market exhibits moderate concentration, with key players investing in technological advancements and market expansion. Innovation ecosystems are flourishing, driven by increasing demand for advanced security and surveillance thermal cameras, monitoring and inspection thermal solutions, and detection and measurement thermal devices. Regulatory frameworks are evolving to support the adoption of thermal imaging technologies across various sectors. The presence of substitute products remains a factor, but the unique capabilities of thermal imaging, particularly in low-light and challenging environmental conditions, ensure its sustained relevance. End-user trends highlight a growing preference for integrated thermal imaging hardware, sophisticated thermal imaging software, and comprehensive thermal imaging services. Mergers and acquisitions (M&A) activities, while not as frequent as in more mature markets, are strategically shaping the competitive landscape, with an estimated xx M&A deal counts in the historical period. Key companies like Lockheed Martin Corporation, Elbit Systems Ltd, Raytheon Company, Leonardo SpA, BAE Systems PLC, Fluke Corporation, L-3 Communications Holdings, Flir Systems Inc, and Axis Communications are actively participating, holding a significant collective market share.

Latin America Thermal Imaging Systems Industry Industry Insights & Trends

The Latin America thermal imaging systems market is poised for substantial growth, projected to reach an estimated US$ XX Million in 2025 and expand at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing investments in national security and defense infrastructure across countries like Brazil, Mexico, and Colombia are significantly boosting the demand for advanced security and surveillance solutions. The burgeoning oil and gas sector, particularly in regions like Venezuela and Argentina, requires robust monitoring and inspection systems for pipeline integrity, asset management, and safety compliance, driving the adoption of fixed thermal cameras and handheld thermal cameras. Furthermore, the growing emphasis on predictive maintenance in manufacturing and industrial sectors, along with the expansion of healthcare facilities and the automotive industry's focus on advanced driver-assistance systems (ADAS), are opening new avenues for detection and measurement thermal applications. Technological disruptions, such as the miniaturization of sensors, improved image resolution, and the integration of AI and machine learning into thermal imaging software, are enhancing the capabilities and affordability of these systems, making them more accessible to a wider range of end-users. Evolving consumer behaviors, driven by increased awareness of safety and efficiency, are further accelerating market penetration. The Aerospace and Defense segment is expected to remain a dominant end-user, followed by Oil and Gas, and Security and Surveillance applications.

Key Markets & Segments Leading Latin America Thermal Imaging Systems Industry

The Security and Surveillance application segment is currently the leading driver of the Latin America thermal imaging systems market, accounting for an estimated XX% of the market share in 2025. This dominance is attributed to the persistent need for enhanced border security, critical infrastructure protection, and urban surveillance across the region. Economic growth and infrastructure development, particularly in countries like Brazil, Mexico, and Argentina, are indirectly supporting this trend by increasing the number of assets requiring robust monitoring.

Solutions:

- Hardware: The Hardware segment, encompassing fixed thermal cameras and handheld thermal cameras, is expected to continue its stronghold due to the inherent need for reliable imaging devices. The demand for advanced, higher-resolution cameras with improved thermal sensitivity is a key driver.

- Software: The Software segment is experiencing rapid growth as advanced analytics, AI integration, and cloud-based solutions enhance the utility of thermal data. Sophisticated thermal imaging software enables automated threat detection, predictive maintenance, and efficient data management.

- Services: The Services segment, including installation, maintenance, and consulting, is gaining traction as organizations seek specialized expertise to leverage thermal imaging technologies effectively.

Product Type:

- Fixed Thermal Cameras: These are critical for perimeter security, industrial monitoring, and long-term surveillance applications. Their deployment in critical infrastructure and border regions significantly contributes to market growth.

- Handheld Thermal Cameras: Their versatility and portability make them indispensable for inspection, maintenance, and emergency response scenarios across various end-user industries.

Application:

- Security and Surveillance: This segment remains paramount due to geopolitical factors and the need for enhanced public and private security.

- Monitoring and Inspection: Essential for the Oil and Gas, Food and Beverage, and manufacturing sectors, this application drives demand for both fixed and handheld thermal cameras.

- Detection and Measurement: Crucial in Healthcare and Life Sciences for diagnostics and in Automotive for ADAS, this segment is poised for significant future growth.

End User:

- Aerospace and Defense: Continues to be a primary consumer of advanced thermal imaging for reconnaissance, targeting, and situational awareness.

- Oil and Gas: A significant sector relying on thermal imaging for asset integrity, safety, and leak detection.

- Automotive: Growing adoption for ADAS, pedestrian detection, and thermal diagnostics.

- Healthcare and Life Sciences: Increasing use in diagnostics, fever screening, and medical research.

Latin America Thermal Imaging Systems Industry Product Developments

Recent product developments are significantly enhancing the capabilities and market penetration of thermal imaging systems in Latin America. June 2022 saw Teledyne FLIR Systems Inc. enhance its Exx series by adding the E52 camera, featuring professional-level thermal solutions, secure photos, and on-camera routing for improved field survey efficiency. Complementing this, in April 2022, Dahua Technology launched its Thermal Monocular Camera Series M-Series. These handheld cameras, with model options like M20, M40, and M60, are tailored for outdoor applications such as wildlife conservation and search and rescue, boasting industry-leading 12μm Vox sensors with resolutions up to 640 x 512, catering to diverse customer needs and expanding the applicability of thermal imaging.

Challenges in the Latin America Thermal Imaging Systems Industry Market

Despite robust growth, the Latin America thermal imaging systems market faces several challenges. High initial investment costs for advanced systems can be a barrier for smaller enterprises, particularly in emerging economies. Fluctuations in currency exchange rates and economic instability in some countries can impact purchasing power and project timelines. Furthermore, a lack of skilled personnel for operating and interpreting data from sophisticated thermal imaging equipment can hinder widespread adoption. Supply chain disruptions, as experienced globally, can also affect the availability and timely delivery of critical components. Regulatory compliance across different countries can also present complexities.

Forces Driving Latin America Thermal Imaging Systems Industry Growth

Several compelling forces are driving the growth of the Latin America thermal imaging systems industry. Technological advancements, including improved sensor technology, enhanced image processing, and the integration of AI, are making thermal cameras more accurate, versatile, and user-friendly. Increasing government investments in security and defense infrastructure are directly boosting demand for surveillance and reconnaissance solutions. The growing emphasis on industrial safety and efficiency, particularly in the Oil and Gas and manufacturing sectors, is driving the adoption of thermal imaging for predictive maintenance and asset monitoring. Furthermore, the expanding use of thermal imaging in the Automotive sector for ADAS and in Healthcare and Life Sciences for diagnostic purposes is creating new market opportunities.

Challenges in the Latin America Thermal Imaging Systems Industry Market

The long-term growth trajectory of the Latin America thermal imaging systems market is significantly influenced by continuous innovation and strategic market expansion. The development of more affordable and compact thermal imaging solutions will be crucial for broader market penetration across various industries. Strategic partnerships between technology providers and local distributors will facilitate better market access and customer support. Expansion into underserved sectors and regions, coupled with tailored product offerings for specific regional needs, will further accelerate growth. Continued research and development focusing on advanced analytical capabilities and integration with IoT platforms will unlock new applications and revenue streams.

Emerging Opportunities in Latin America Thermal Imaging Systems Industry

Emerging opportunities in the Latin America thermal imaging systems market are ripe for exploitation. The increasing focus on smart city initiatives across the region presents significant potential for thermal imaging in public safety, traffic management, and infrastructure monitoring. The growing demand for sustainable energy solutions is driving the use of thermal imaging in solar panel inspection and wind turbine monitoring. Furthermore, the rising adoption of telemedicine and remote patient monitoring creates opportunities for thermal imaging in healthcare diagnostics. The expansion of e-commerce and logistics also opens avenues for thermal imaging in warehouse management and cold chain monitoring.

Leading Players in the Latin America Thermal Imaging Systems Industry Sector

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Raytheon Company

- Leonardo SpA

- BAE Systems PLC

- Fluke Corporation

- L-3 Communications Holdings

- Flir Systems Inc

- Axis Communications

Key Milestones in Latin America Thermal Imaging Systems Industry Industry

- June 2022: Teledyne FLIR Systems Inc. announced the addition of an E52 camera to its Exx thermal Imaging instrument line, which now includes the E54, E96, E86, and E76 versions. The new E52 camera features a professional-level thermal solution to secure photos, which are simple to see, and on-camera routing functionality to expand field survey efficiency.

- April 2022: Dahua Technology, a world-significant video-centric innovative IoT solution and service provider, launched its Thermal Monocular Camera Series M-Series. It is a series of handheld cameras tailored for outdoor scenarios such as wildlife conservation, hiking, hunting, and search and rescue missions. The M Series provides model options such as M20, M40, and M60 specified on the picture resolution of the cameras, while all of them contain numerous models with different lenses to fulfill diverse customer needs. With an industry-leading 12μm Vox sensor, the most significant resolution can reach 640 x 512.

Strategic Outlook for Latin America Thermal Imaging Systems Industry Market

The strategic outlook for the Latin America thermal imaging systems market is highly promising. Key growth accelerators include the sustained demand for enhanced security and surveillance solutions, the critical need for efficient monitoring and inspection in the booming oil and gas sector, and the expanding applications in automotive safety and healthcare. Continued technological innovation, particularly in AI integration and sensor miniaturization, will unlock new market segments. Furthermore, strategic collaborations, government support for infrastructure development, and a growing awareness of the benefits of thermal imaging across diverse industries will fuel substantial market expansion in the coming years. The region's potential for economic recovery and infrastructure investment presents a fertile ground for the widespread adoption of thermal imaging technologies.

Latin America Thermal Imaging Systems Industry Segmentation

-

1. Solutions

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Product Type

- 2.1. Fixed Thermal Cameras

- 2.2. Handheld Thermal Cameras

-

3. Application

- 3.1. Security and Surveillance

- 3.2. Monitoring and Inspection

- 3.3. Detection and Measurement

-

4. End User

- 4.1. Aerospace and Defense

- 4.2. Automotive

- 4.3. Healthcare and Life Sciences

- 4.4. Oil and Gas

- 4.5. Food and Beverage

- 4.6. Other End Users

Latin America Thermal Imaging Systems Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Thermal Imaging Systems Industry Regional Market Share

Geographic Coverage of Latin America Thermal Imaging Systems Industry

Latin America Thermal Imaging Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Thermal Imaging Increasingly Used in Various Applications; Technological Upgradations in Thermal Imaging Systems

- 3.3. Market Restrains

- 3.3.1. Lack of Regular Support and Services

- 3.4. Market Trends

- 3.4.1. Automotive in Applications to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Fixed Thermal Cameras

- 5.2.2. Handheld Thermal Cameras

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Security and Surveillance

- 5.3.2. Monitoring and Inspection

- 5.3.3. Detection and Measurement

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Aerospace and Defense

- 5.4.2. Automotive

- 5.4.3. Healthcare and Life Sciences

- 5.4.4. Oil and Gas

- 5.4.5. Food and Beverage

- 5.4.6. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Solutions

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lockheed Martin Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elbit Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Raytheon Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leonardo SpA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BAE Systems PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fluke Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L-3 Communications Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flir Systems Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Axis Communications

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Latin America Thermal Imaging Systems Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Latin America Thermal Imaging Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 2: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Solutions 2020 & 2033

- Table 7: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Latin America Thermal Imaging Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Brazil Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Argentina Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Chile Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Colombia Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Peru Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Venezuela Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Ecuador Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Bolivia Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Paraguay Latin America Thermal Imaging Systems Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Thermal Imaging Systems Industry?

The projected CAGR is approximately 7.85%.

2. Which companies are prominent players in the Latin America Thermal Imaging Systems Industry?

Key companies in the market include Lockheed Martin Corporation, Elbit Systems Ltd, Raytheon Company, Leonardo SpA*List Not Exhaustive, BAE Systems PLC, Fluke Corporation, L-3 Communications Holdings, Flir Systems Inc, Axis Communications.

3. What are the main segments of the Latin America Thermal Imaging Systems Industry?

The market segments include Solutions, Product Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Thermal Imaging Increasingly Used in Various Applications; Technological Upgradations in Thermal Imaging Systems.

6. What are the notable trends driving market growth?

Automotive in Applications to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Lack of Regular Support and Services.

8. Can you provide examples of recent developments in the market?

June 2022 - Teledyne FLIR Systems Inc. announced the addition of an E52 camera to its Exx thermal Imaging instrument line, which now includes the E54, E96, E86, and E76 versions. The new E52 camera features a professional-level thermal solution to secure photos, which are simple to see, and on-camera routing functionality to expand field survey efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Thermal Imaging Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Thermal Imaging Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Thermal Imaging Systems Industry?

To stay informed about further developments, trends, and reports in the Latin America Thermal Imaging Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence