Key Insights

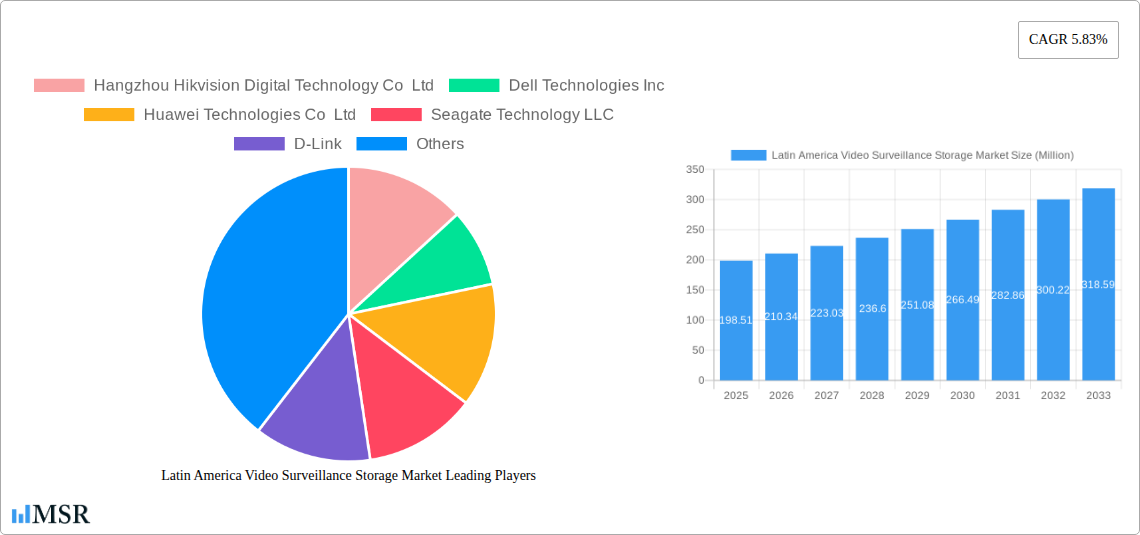

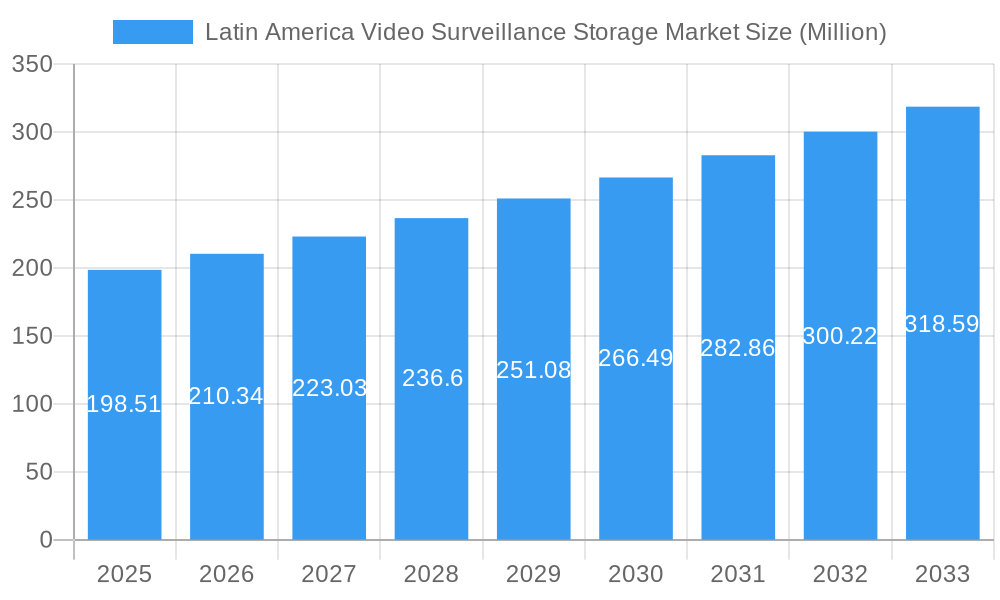

The Latin American video surveillance storage market is experiencing robust growth, projected to reach \$198.51 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.83% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing urbanization and the resulting need for enhanced public safety are driving significant demand for video surveillance systems across the region. Secondly, the rising adoption of cloud-based storage solutions offers scalability and cost-effectiveness, further propelling market growth. Finally, the growing awareness of cybersecurity threats and the need for robust data protection are pushing organizations to invest in advanced storage solutions with enhanced security features. Major players like Hangzhou Hikvision, Dell Technologies, Huawei, Seagate, and others are capitalizing on this expanding market, offering a diverse range of storage solutions tailored to the specific needs of various sectors, including government, commercial, and residential applications.

Latin America Video Surveillance Storage Market Market Size (In Million)

However, market growth faces certain challenges. Infrastructure limitations in some parts of Latin America, especially in terms of reliable internet connectivity, can hinder the widespread adoption of cloud-based solutions. Furthermore, economic fluctuations and political instability in certain regions might impact investment in video surveillance infrastructure. Nevertheless, the long-term outlook remains positive, driven by sustained government initiatives promoting public safety, the increasing adoption of smart city technologies, and the ongoing expansion of the private sector's focus on security. The market segmentation likely encompasses diverse storage types (e.g., network video recorders, cloud storage, hybrid solutions) and applications (e.g., traffic monitoring, retail security, banking). Further analysis of specific country data within Latin America would reveal more granular insights into regional variations in market size and growth potential.

Latin America Video Surveillance Storage Market Company Market Share

Latin America Video Surveillance Storage Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America Video Surveillance Storage Market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market size, growth drivers, challenges, and emerging opportunities. The analysis encompasses key players such as Hangzhou Hikvision Digital Technology Co Ltd, Dell Technologies Inc, Huawei Technologies Co Ltd, Seagate Technology LLC, D-Link, AXIS Communications, Wester Digital, Dahua Technology Co Ltd, Rasilient Systems Inc, and Vivotek, among others. The report segments the market to provide a granular understanding of its various facets and offers actionable strategies for success. Expected market value for 2025 is projected at xx Million.

Latin America Video Surveillance Storage Market Concentration & Dynamics

The Latin America video surveillance storage market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of several smaller, specialized companies fosters innovation and competition. The market is influenced by robust regulatory frameworks focused on data privacy and security, driving demand for advanced storage solutions. Substitute products, such as cloud-based storage, present competitive challenges, although on-premise solutions remain dominant due to latency concerns and data sovereignty requirements. End-user trends show a growing preference for high-capacity, reliable, and cost-effective storage solutions, particularly in the government and enterprise sectors. M&A activities have been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding geographic reach and technological capabilities.

- Market Share: Top 5 players hold approximately xx% of the market.

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: Varying data protection laws across Latin American countries.

- Substitute Products: Cloud storage, but limited adoption due to latency and security concerns.

Latin America Video Surveillance Storage Market Industry Insights & Trends

The Latin America video surveillance storage market is experiencing robust growth, driven by increasing adoption of video surveillance systems across various sectors, including government, commercial, and residential. The market size in 2024 was estimated at xx Million, and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is fueled by factors such as rising crime rates, increasing demand for enhanced security, and government initiatives promoting smart city development. Technological advancements, such as the introduction of higher-capacity hard disk drives (HDDs) and solid-state drives (SSDs), are further driving market expansion. Evolving consumer behaviors, including increased reliance on digital technologies and growing awareness of data security, also contribute to the market's expansion. The shift towards AI-powered video analytics is further impacting the demand for larger storage capacities.

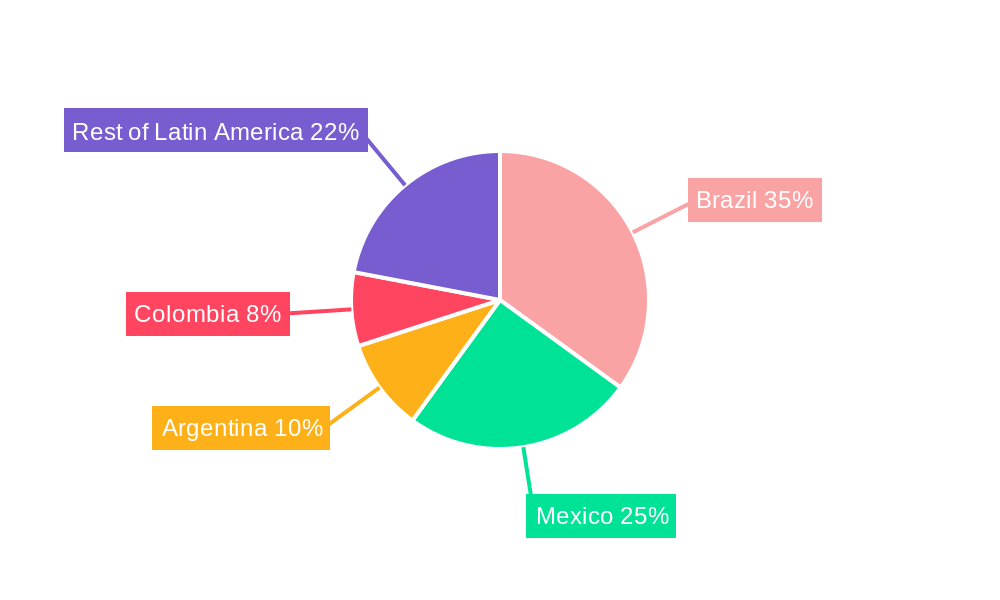

Key Markets & Segments Leading Latin America Video Surveillance Storage Market

Brazil and Mexico represent the largest markets within Latin America, accounting for approximately xx% of the total market value. This dominance is attributable to several key factors:

- Brazil: Significant government investments in infrastructure projects, coupled with a large commercial sector adopting video surveillance solutions.

- Mexico: High rates of urbanization and crime, along with the expansion of private security services, fueling demand for storage solutions.

Drivers for Market Dominance:

- High population density

- Rapid urbanization

- Stringent security concerns

- Government investments in infrastructure

- Growing adoption of smart city initiatives

Latin America Video Surveillance Storage Market Product Developments

Recent product developments focus on increasing storage capacity, improving performance, and enhancing data security. The introduction of high-capacity HDDs (e.g., Seagate SkyHawk AI 24TB) and advanced SSDs caters to the growing demand for larger storage solutions to handle high-resolution video feeds and AI-powered analytics. Features like improved data security measures and enhanced durability are also crucial in meeting the stringent requirements of the video surveillance sector. The development of specialized storage solutions optimized for video analytics applications is gaining traction.

Challenges in the Latin America Video Surveillance Storage Market Market

The Latin America video surveillance storage market faces challenges, including inconsistent regulatory frameworks across different countries, leading to complexities in compliance. Supply chain disruptions can impact the availability and cost of storage solutions. The highly competitive market also puts pressure on pricing, and maintaining profitability is a concern for many vendors. The initial investment cost can be prohibitive for some smaller end-users.

Forces Driving Latin America Video Surveillance Storage Market Growth

Technological advancements, such as higher-capacity storage devices and AI-powered analytics, are key growth drivers. Government initiatives focused on public safety and smart city projects further boost market expansion. The rising adoption of video surveillance in commercial and residential sectors fuels this growth. Economic growth in certain Latin American countries also contributes to increased spending on security infrastructure.

Long-Term Growth Catalysts in Latin America Video Surveillance Storage Market

Long-term growth will be driven by continued innovation in storage technologies, including the development of more energy-efficient and cost-effective solutions. Strategic partnerships between storage vendors and system integrators will further expand market reach. The expansion of video surveillance into new sectors, such as transportation and healthcare, will also contribute to sustained growth.

Emerging Opportunities in Latin America Video Surveillance Storage Market

The adoption of cloud-based storage solutions, while still limited, represents a significant opportunity. The rising demand for edge computing and AI-powered video analytics creates demand for specialized storage solutions. Expansion into underserved markets within Latin America holds substantial potential.

Leading Players in the Latin America Video Surveillance Storage Market Sector

Key Milestones in Latin America Video Surveillance Storage Market Industry

- December 2023: Seagate Technology Holdings PLC launched the Seagate SkyHawk AI 24 TB HDD, enhancing storage capacity for video analytics applications.

- March 2024: ADATA Technology Co. Ltd. announced new BiCS5 3D(e)TLC storage solutions, high DWPD SSDs, and industrial-grade ECC memory modules, improving performance, durability, and data security for video surveillance applications.

Strategic Outlook for Latin America Video Surveillance Storage Market Market

The Latin America video surveillance storage market is poised for continued growth, driven by technological advancements, increasing demand for security solutions, and expanding adoption across diverse sectors. Companies focused on innovation in storage technologies, particularly those offering high-capacity, secure, and cost-effective solutions, are well-positioned to capitalize on the market's significant potential. Strategic partnerships and expansions into underserved markets will further enhance growth prospects.

Latin America Video Surveillance Storage Market Segmentation

-

1. Product Type

- 1.1. Storage Area Network (SAN)

- 1.2. Network Attached Storage (NAS)

- 1.3. Direct Attached Storage (DAS)

- 1.4. Video Recorders

- 1.5. Services

-

2. Deployment

- 2.1. On-Premises

- 2.2. Cloud

-

3. Storage Media

- 3.1. Solid State Drives (SSDs)

- 3.2. Hard Disk Drives (HDDs)

-

4. End-user Vertical

- 4.1. Retail

- 4.2. BFSI

- 4.3. Government and Defense

- 4.4. Home Security

- 4.5. Healthcare

- 4.6. Media & Entertainment

- 4.7. Transportation and Logistics

- 4.8. Education

- 4.9. Others

Latin America Video Surveillance Storage Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Video Surveillance Storage Market Regional Market Share

Geographic Coverage of Latin America Video Surveillance Storage Market

Latin America Video Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing

- 3.2.2 Data Analytics

- 3.2.3 and Cloud

- 3.3. Market Restrains

- 3.3.1 The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing

- 3.3.2 Data Analytics

- 3.3.3 and Cloud

- 3.4. Market Trends

- 3.4.1. Solid State Drive (SSDs) is Expected to Register the Fastest Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Video Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Storage Area Network (SAN)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Direct Attached Storage (DAS)

- 5.1.4. Video Recorders

- 5.1.5. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premises

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by Storage Media

- 5.3.1. Solid State Drives (SSDs)

- 5.3.2. Hard Disk Drives (HDDs)

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Retail

- 5.4.2. BFSI

- 5.4.3. Government and Defense

- 5.4.4. Home Security

- 5.4.5. Healthcare

- 5.4.6. Media & Entertainment

- 5.4.7. Transportation and Logistics

- 5.4.8. Education

- 5.4.9. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Huawei Technologies Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Seagate Technology LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 D-Link

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXIS Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wester Digital

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dahua Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rasilient Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vivotek*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: Latin America Video Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Video Surveillance Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Latin America Video Surveillance Storage Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Latin America Video Surveillance Storage Market Volume Million Forecast, by Deployment 2020 & 2033

- Table 5: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 6: Latin America Video Surveillance Storage Market Volume Million Forecast, by Storage Media 2020 & 2033

- Table 7: Latin America Video Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: Latin America Video Surveillance Storage Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Latin America Video Surveillance Storage Market Volume Million Forecast, by Region 2020 & 2033

- Table 11: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Latin America Video Surveillance Storage Market Volume Million Forecast, by Product Type 2020 & 2033

- Table 13: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Latin America Video Surveillance Storage Market Volume Million Forecast, by Deployment 2020 & 2033

- Table 15: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 16: Latin America Video Surveillance Storage Market Volume Million Forecast, by Storage Media 2020 & 2033

- Table 17: Latin America Video Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Latin America Video Surveillance Storage Market Volume Million Forecast, by End-user Vertical 2020 & 2033

- Table 19: Latin America Video Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Latin America Video Surveillance Storage Market Volume Million Forecast, by Country 2020 & 2033

- Table 21: Brazil Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Brazil Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Argentina Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Chile Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Chile Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Colombia Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Colombia Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Peru Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Peru Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Venezuela Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Venezuela Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Ecuador Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Ecuador Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 37: Bolivia Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Bolivia Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 39: Paraguay Latin America Video Surveillance Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Paraguay Latin America Video Surveillance Storage Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Video Surveillance Storage Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Latin America Video Surveillance Storage Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Dell Technologies Inc, Huawei Technologies Co Ltd, Seagate Technology LLC, D-Link, AXIS Communications, Wester Digital, Dahua Technology Co Ltd, Rasilient Systems Inc, Vivotek*List Not Exhaustive.

3. What are the main segments of the Latin America Video Surveillance Storage Market?

The market segments include Product Type, Deployment, Storage Media, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 198.51 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing. Data Analytics. and Cloud.

6. What are the notable trends driving market growth?

Solid State Drive (SSDs) is Expected to Register the Fastest Growth in the Market.

7. Are there any restraints impacting market growth?

The Rising Installation of Video Surveillance Due to Growing Security Concerns; Rising Adoption of Emerging Technologies Such As AI Edge Computing. Data Analytics. and Cloud.

8. Can you provide examples of recent developments in the market?

March 2024: ADATA Technology Co. Ltd revealed its plans to present its latest BiCS5 3D(e)TLC storage solutions, high DWPD SSDs, and high-performance/low-power industrial-grade ECC memory modules such as U-DIMM, SO-DIMM, and R-DIMM. These products have a wide operating temperature range, anti-sulfuration properties, enhanced durability, improved data security measures, moisture-proofing capabilities, and anti-fouling technology.December 2023: Seagate Technology Holdings PLC introduced the latest addition to their product line, the Seagate SkyHawk AI 24 TB hard disk drive (HDD) designed specifically for video and imaging applications (VIA). This new release comes after the successful launch of the Seagate Exos X24 24 TB conventional magnetic recording (CMR) hard drive, further catering to the growing demand for mass data storage in the edge security sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Video Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Video Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Video Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the Latin America Video Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence