Key Insights

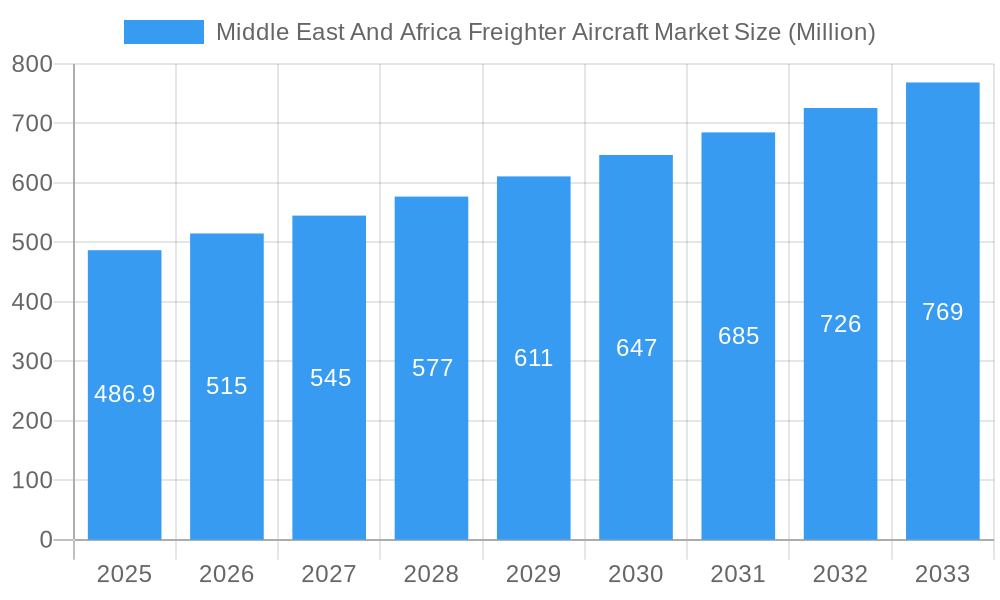

The Middle East and Africa freighter aircraft market is projected to experience robust growth, reaching a market size of $486.90 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 5.59% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector across the region fuels the demand for efficient and reliable air freight solutions, particularly in rapidly developing economies like those in East Africa. Furthermore, the growth of cross-border trade and the increasing reliance on air cargo for time-sensitive goods contribute significantly to market expansion. The expansion of air cargo hubs in major cities within the Middle East, like Dubai and Doha, further boosts the demand for freighter aircraft. The regional air freight market is segmented by aircraft type (dedicated cargo and derivatives of passenger aircraft), engine type (turboprop and turbofan), and key countries, including the United Arab Emirates, Saudi Arabia, Turkey, and others within the broader Middle East and Africa region. Competition in the market is intense, with major players such as Boeing, Airbus, and Textron Inc. vying for market share. The preference for fuel-efficient aircraft and advancements in aircraft technology are also influencing market dynamics, pushing manufacturers towards innovation and potentially impacting future market growth.

Middle East And Africa Freighter Aircraft Market Market Size (In Million)

Growth is expected to continue beyond 2025, fueled by sustained economic growth in several key markets within the region, along with ongoing investment in infrastructure upgrades to support increased air freight capacity. The continued development of regional trade agreements could also stimulate further demand for efficient air cargo services. However, potential headwinds include economic volatility, fluctuating fuel prices, and the impact of geopolitical events on regional trade. The market will likely see a continued shift towards more fuel-efficient and technologically advanced aircraft as airlines look to reduce operational costs and minimize their environmental impact. Careful consideration of these factors is crucial for stakeholders seeking to navigate the complexities of this dynamic market.

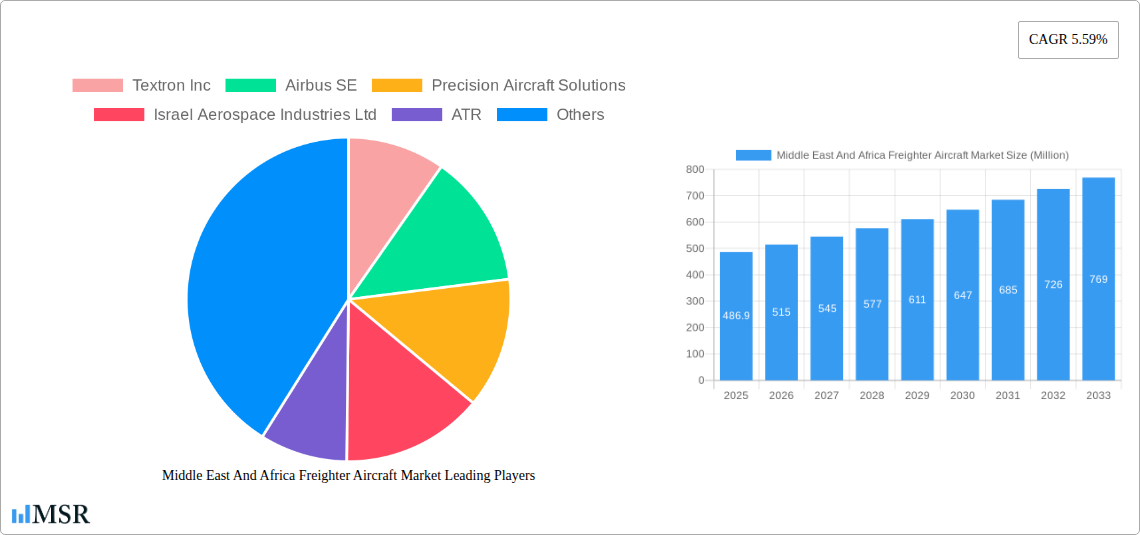

Middle East And Africa Freighter Aircraft Market Company Market Share

Middle East & Africa Freighter Aircraft Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East & Africa freighter aircraft market, offering valuable insights for stakeholders across the aviation industry. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and emerging opportunities. The report uses Million (M) for all monetary values.

Middle East & Africa Freighter Aircraft Market Market Concentration & Dynamics

This section analyzes the competitive landscape, regulatory environment, and market trends influencing the Middle East & Africa freighter aircraft market. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The precise market share of each player is xx%, but the top three players likely account for over 60% of the total market value. The innovation ecosystem is driven by advancements in aircraft technology, engine efficiency, and passenger-to-freighter (P2F) conversions. Regulatory frameworks, including those concerning airworthiness, safety, and emissions, heavily influence market growth. Substitute products, such as road and sea freight, pose some competition, particularly for shorter distances. End-user trends, particularly the rise of e-commerce and the increasing demand for faster delivery times, are significant drivers. Mergers and acquisitions (M&A) activity has been moderate in the region, with xx M&A deals recorded in the last five years.

- Market Concentration: Moderately concentrated, with top three players holding approximately 60% market share.

- Innovation Ecosystem: Strong focus on P2F conversions, engine efficiency, and advanced materials.

- Regulatory Framework: Stringent safety and environmental regulations influence market dynamics.

- Substitute Products: Road and sea freight offer limited competition.

- End-User Trends: E-commerce growth fuels demand for air freight.

- M&A Activity: xx deals over the past five years.

Middle East & Africa Freighter Aircraft Market Industry Insights & Trends

The Middle East & Africa freighter aircraft market is experiencing robust growth, driven by factors such as the expansion of e-commerce, rising air cargo volumes, and increasing investment in infrastructure development within the region. The market size in 2025 is estimated to be xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Technological disruptions, including the adoption of more fuel-efficient aircraft and advanced logistics technologies, are reshaping the industry. Changing consumer behaviors, characterized by a preference for faster and more reliable delivery, are further boosting demand for air freight services. This positive trend is expected to continue, supported by continued economic expansion and investments in airport and logistics infrastructure across the region.

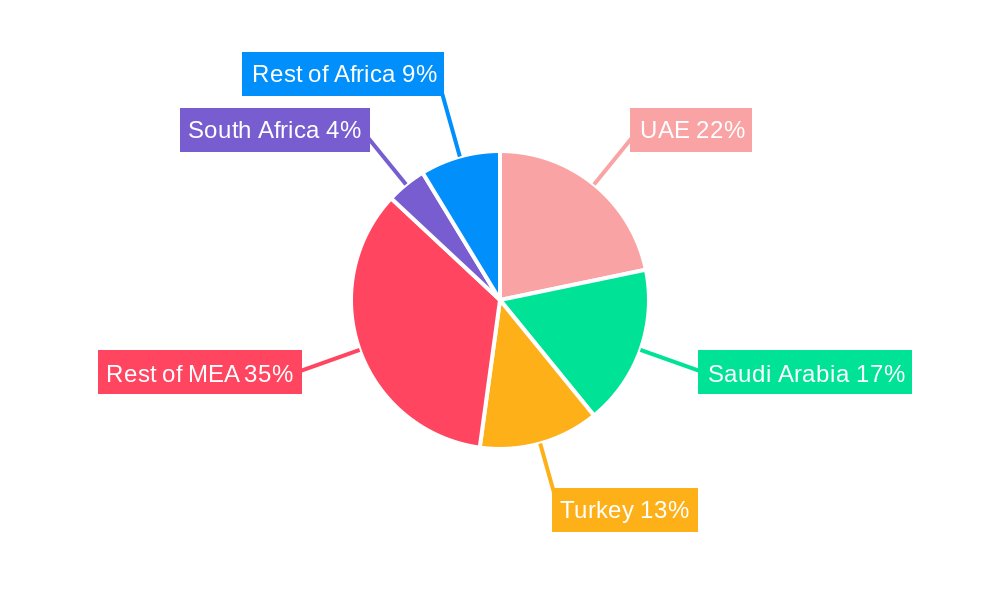

Key Markets & Segments Leading Middle East And Africa Freighter Aircraft Market

The UAE, Saudi Arabia, and Turkey represent the most significant national markets within the Middle East & Africa region, together accounting for over 70% of the total market value. The dedicated cargo aircraft segment dominates the aircraft type market, owing to its specialized design and efficiency in cargo operations. Turbofan aircraft hold a larger market share compared to turboprop aircraft due to their longer range capabilities and higher payload capacity.

- Dominant Regions/Countries:

- United Arab Emirates: Strong aviation infrastructure and strategic location.

- Saudi Arabia: Growing e-commerce sector and robust economic development.

- Turkey: Expanding logistics and transportation networks.

- Dominant Segments:

- Aircraft Type: Dedicated Cargo Aircraft (Market Share: xx%)

- Engine Type: Turbofan Aircraft (Market Share: xx%)

Drivers for Key Markets:

- UAE: Extensive airport infrastructure, thriving e-commerce sector, and strategic geographical location.

- Saudi Arabia: Government initiatives to boost logistics and the Vision 2030 plan's focus on economic diversification.

- Turkey: Growing e-commerce market and strategic location bridging Europe and Asia.

Middle East & Africa Freighter Aircraft Market Product Developments

Recent product innovations focus on enhancing fuel efficiency, increasing payload capacity, and improving operational reliability. Manufacturers are investing in lighter-weight materials, advanced aerodynamics, and more efficient engines. The growing demand for larger cargo aircraft and specialized solutions for specific goods is driving the development of new aircraft designs and configurations. These advancements provide significant competitive advantages in terms of cost savings and operational efficiency.

Challenges in the Middle East And Africa Freighter Aircraft Market Market

Several factors hinder market growth. Regulatory hurdles, including complex licensing processes and varying safety standards across countries, pose significant challenges. Supply chain disruptions, particularly those related to parts and maintenance, can impact operational efficiency and lead to increased costs. Intense competition among established players and new entrants creates pressure on pricing and profitability. These challenges represent obstacles to sustained market growth and require effective strategies to mitigate their negative impact.

Forces Driving Middle East And Africa Freighter Aircraft Market Growth

Several factors are driving market growth. The rapid expansion of e-commerce necessitates faster and more reliable delivery, boosting demand for air freight services. Economic growth across the region is fueling investments in infrastructure development, supporting the growth of air cargo operations. Government initiatives promoting trade and logistics contribute to a favorable business environment. Furthermore, technological advancements in aircraft design and engine technology lead to improved efficiency and reduced operational costs.

Challenges in the Middle East And Africa Freighter Aircraft Market Market

Long-term growth will be fueled by ongoing investments in airport infrastructure, increasing e-commerce penetration, and the adoption of innovative logistics solutions. Strategic partnerships between airlines and cargo handlers are vital to optimizing efficiency and reducing costs. Market expansion into less-developed regions of Africa presents opportunities for future growth, although it requires addressing infrastructure limitations and regulatory challenges.

Emerging Opportunities in Middle East And Africa Freighter Aircraft Market

Emerging opportunities include the expansion of air freight services into underserved markets across Africa, the development of specialized cargo solutions for temperature-sensitive goods, and the increased adoption of digital technologies in cargo handling and logistics. These opportunities require investments in infrastructure, technological advancements, and regulatory harmonization across the region.

Leading Players in the Middle East And Africa Freighter Aircraft Market Sector

- Textron Inc

- Airbus SE

- Precision Aircraft Solutions

- Israel Aerospace Industries Ltd

- ATR

- Singapore Technologies Engineering Ltd

- KF Aerospace

- Aeronautical Engineers Inc

- The Boeing Company

Key Milestones in Middle East And Africa Freighter Aircraft Market Industry

- June 2023: Israel Aerospace Industries (IAI) announced plans to open a new passenger-to-freighter conversion (P2F) facility in Abu Dhabi, capable of converting up to 100 Boeing B777-300ERSFs. This significantly expands P2F conversion capacity in the region.

- May 2022: Saudia Airlines ordered seven Boeing B777-300 passenger-to-freighter conversions from Mammoth Freighters, doubling its freighter fleet. This indicates increasing demand for larger cargo aircraft within the region.

Strategic Outlook for Middle East And Africa Freighter Aircraft Market Market

The Middle East & Africa freighter aircraft market presents significant growth potential driven by expanding e-commerce, infrastructure development, and the increasing adoption of advanced technologies. Strategic partnerships and investments in sustainable aviation technologies will be crucial for long-term success. Addressing regulatory challenges and improving regional infrastructure will be key to unlocking the full potential of this rapidly developing market.

Middle East And Africa Freighter Aircraft Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Middle East And Africa Freighter Aircraft Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Freighter Aircraft Market Regional Market Share

Geographic Coverage of Middle East And Africa Freighter Aircraft Market

Middle East And Africa Freighter Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Turbofan Segment Dominates the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Freighter Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Precision Aircraft Solutions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Israel Aerospace Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ATR

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Singapore Technologies Engineering Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KF Aerospace

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aeronautical Engineers Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Boeing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Middle East And Africa Freighter Aircraft Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East And Africa Freighter Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East And Africa Freighter Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East And Africa Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Freighter Aircraft Market?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the Middle East And Africa Freighter Aircraft Market?

Key companies in the market include Textron Inc, Airbus SE, Precision Aircraft Solutions, Israel Aerospace Industries Ltd, ATR, Singapore Technologies Engineering Ltd, KF Aerospace, Aeronautical Engineers Inc, The Boeing Company.

3. What are the main segments of the Middle East And Africa Freighter Aircraft Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 486.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Turbofan Segment Dominates the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

June 2023: Israel Aerospace Industries (IAI) announced that it is planning to open its new Abu Dhabi passenger-to-freighter conversion (P2F) facility in the second half of this year. The facility could convert up to 100 Boeing B777-300ERSFs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Freighter Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Freighter Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Freighter Aircraft Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Freighter Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence