Key Insights

The North American agricultural irrigation machinery market, valued at approximately $X billion in 2025, is projected to experience robust growth, driven by factors such as increasing water scarcity, rising demand for high-yield crops, and the growing adoption of precision irrigation technologies. The market's Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033 indicates a significant expansion, with substantial opportunities for established players like The Toro Company, Deere & Company, and Netafim Limited, as well as emerging technology providers. Key market segments include sprinkler and drip irrigation systems, catering to diverse crop types across the region. The United States, being the largest agricultural producer in North America, constitutes a significant portion of the market, followed by Canada and Mexico. Further growth is anticipated from technological advancements in irrigation management, including sensor-based automation, data analytics for optimized water usage, and the integration of IoT (Internet of Things) capabilities for enhanced efficiency and yield. The market is also influenced by government initiatives promoting water conservation and sustainable agricultural practices. Growth will likely be further spurred by the increasing adoption of efficient irrigation techniques in non-crop applications such as landscaping and golf courses.

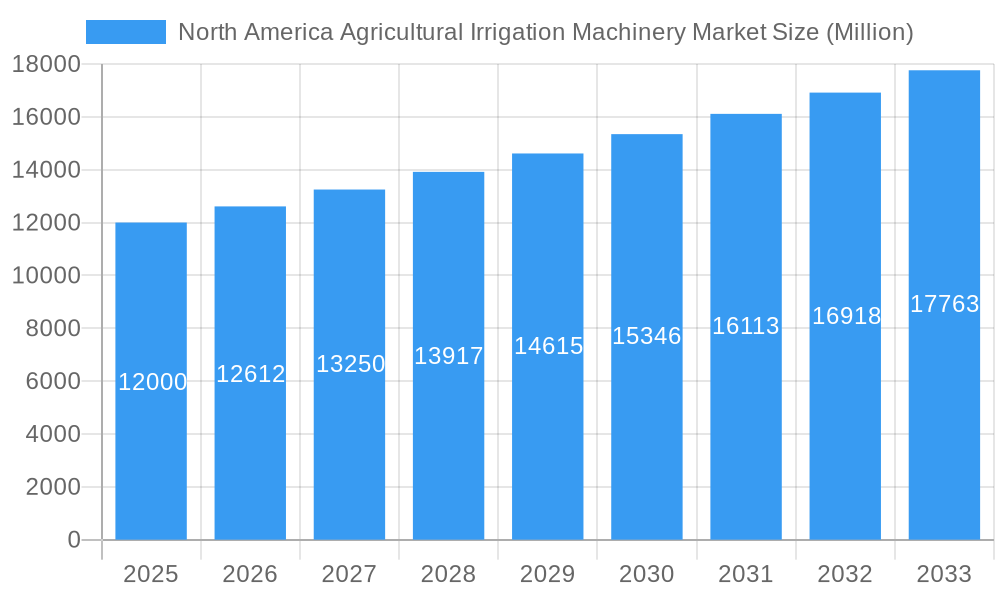

North America Agricultural Irrigation Machinery Market Market Size (In Billion)

The market segmentation reveals that drip irrigation is gaining traction due to its water-saving capabilities, leading to increased profitability for farmers. However, high initial investment costs for certain advanced systems can act as a restraint, particularly for smallholder farmers. The market is expected to witness increased competition, with existing players focusing on product innovation, strategic partnerships, and expansion into new geographical areas. The growing awareness of climate change and its impact on water resources is further bolstering the demand for efficient and sustainable irrigation solutions. This creates lucrative opportunities for companies that can offer integrated solutions combining hardware, software, and data analytics, enabling farmers to make informed decisions about water usage, leading to improved yields and reduced environmental impact. The ongoing research and development efforts in the agricultural technology sector are also expected to propel market growth in the coming years.

North America Agricultural Irrigation Machinery Market Company Market Share

North America Agricultural Irrigation Machinery Market Report: 2019-2033

Dive deep into the lucrative North America Agricultural Irrigation Machinery market with our comprehensive report, offering invaluable insights for strategic decision-making. This in-depth analysis covers the period from 2019 to 2033, with a focus on the year 2025. Uncover key trends, growth drivers, and challenges shaping this dynamic sector. Understand market concentration, leading players like The Toro Company, Deere & Company, and Lindsay Corporation, and emerging opportunities for sustained growth. This report is your essential guide to navigating the complexities of the North American agricultural irrigation machinery landscape.

North America Agricultural Irrigation Machinery Market Market Concentration & Dynamics

The North American agricultural irrigation machinery market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Toro Company, Deere & Company, and Lindsay Corporation are key examples, collectively commanding an estimated xx% of the market in 2025. However, the presence of several smaller, specialized players contributes to a dynamic competitive landscape.

Market concentration is influenced by factors such as:

- Innovation Ecosystems: Robust R&D activities focused on water-efficient irrigation technologies and precision agriculture solutions are driving innovation.

- Regulatory Frameworks: Government regulations promoting water conservation and sustainable agriculture practices significantly impact market dynamics. Stringent environmental regulations are pushing the adoption of efficient irrigation systems.

- Substitute Products: While few direct substitutes exist, alternative water management techniques, such as rainwater harvesting, pose some competition.

- End-User Trends: Growing awareness of water scarcity and increasing adoption of precision agriculture techniques are driving demand for advanced irrigation systems.

- M&A Activities: The market has witnessed xx M&A deals in the past five years, mainly driven by consolidation among smaller players and expansion into new geographical areas.

North America Agricultural Irrigation Machinery Market Industry Insights & Trends

The North American agricultural irrigation machinery market is experiencing significant growth, driven by several key factors. The market size reached approximately $xx Million in 2025, and is projected to grow at a CAGR of xx% from 2025 to 2033, reaching $xx Million by 2033. This growth is fueled by several factors:

- Rising Demand for Food & Feed: Growing global populations and increasing demand for food products are driving the need for efficient irrigation systems to boost crop yields.

- Water Scarcity Concerns: Water scarcity in several regions of North America is promoting the adoption of water-efficient irrigation technologies, like drip irrigation systems.

- Technological Advancements: Innovations in sensor technology, automation, and data analytics are improving irrigation efficiency and optimizing water usage.

- Government Initiatives: Government support programs promoting sustainable agricultural practices and water conservation further accelerate market expansion.

- Precision Agriculture Adoption: The increasing adoption of precision agriculture techniques, enabling targeted irrigation, also drives demand for advanced irrigation machinery.

Key Markets & Segments Leading North America Agricultural Irrigation Machinery Market

The North American agricultural irrigation machinery market is segmented by irrigation type (sprinkler, drip, other) and crop type (crop, non-crop).

By Irrigation Type:

Drip Irrigation: This segment is experiencing the highest growth, driven by its water efficiency and suitability for various crops. Key drivers include:

- Increased government incentives to reduce water waste.

- High adoption rates in high-value crops.

- Improved technology leading to reduced installation costs.

Sprinkler Irrigation: This segment maintains significant market share due to its established presence and cost-effectiveness for large-scale operations. However, growth is relatively slower compared to drip irrigation due to its higher water consumption.

Other: This category includes other irrigation methods like micro-sprinklers and subsurface drip irrigation and is expected to show moderate growth due to niche applications and adoption in specialized farming practices.

By Crop Type:

Crop: This segment accounts for a larger market share due to the substantial demand for efficient irrigation across various crops like corn, wheat, and fruits. Growth is driven by increasing agricultural output requirements to meet global food demands.

Non-crop: This segment includes irrigation for landscaping, nurseries, and other non-agricultural purposes. Growth in this segment is driven by rising urbanization and landscaping projects.

North America Agricultural Irrigation Machinery Market Product Developments

Recent innovations focus on smart irrigation systems incorporating sensors, IoT technology, and cloud-based data analytics for precision water management. These advancements enable efficient water usage, optimized irrigation scheduling, and improved crop yields. Companies are focusing on developing energy-efficient pumps and controllers, further reducing the environmental footprint and operational costs of irrigation systems. This enhances competitive advantages by offering superior efficiency and cost savings.

Challenges in the North America Agricultural Irrigation Machinery Market Market

Significant challenges exist within the North America Agricultural Irrigation Machinery Market. High initial investment costs for advanced irrigation systems can be a barrier for smaller farmers. Supply chain disruptions and fluctuations in raw material prices negatively impact production costs and profitability. Intense competition among established players and the emergence of new entrants create a challenging market dynamic, necessitating continuous innovation and adaptation. Furthermore, regulatory compliance requirements add to operational complexities.

Forces Driving North America Agricultural Irrigation Machinery Market Growth

Key growth drivers include increasing awareness of water conservation, government regulations promoting sustainable agriculture, technological advancements in smart irrigation systems, and rising demand for high-yield crops. These factors collectively fuel market expansion and create significant opportunities for growth. Precision agriculture's increasing adoption also plays a significant role in driving demand for sophisticated irrigation technologies.

Long-Term Growth Catalysts in the North America Agricultural Irrigation Machinery Market

Long-term growth will be fueled by continued innovations in water-efficient irrigation technologies, strategic partnerships between irrigation equipment manufacturers and agricultural technology companies, and expansion into emerging markets within North America. Adoption of smart irrigation technologies and precision agriculture practices is expected to be a key driver of long-term growth.

Emerging Opportunities in North America Agricultural Irrigation Machinery Market

Emerging opportunities lie in developing and deploying more efficient and sustainable irrigation solutions tailored to specific crops and regions. Further integration of artificial intelligence and machine learning in irrigation systems can further optimize water use and improve crop yields. There is also a growing need for customized solutions for different farming practices and scales. Market expansion into regions facing water stress presents substantial growth potential.

Leading Players in the North America Agricultural Irrigation Machinery Sector

- The Toro Company

- EPC Industries Limited

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Deere & Company

- T-L Irrigation Co

- Rain Bird Corporation

- Nelson Irrigation Corporation

- Netafim Limited

- Valmont Industries

Key Milestones in North America Agricultural Irrigation Machinery Industry

- 2020: Introduction of several smart irrigation systems with advanced sensor technology by leading players.

- 2022: Government initiatives launched to promote water-efficient irrigation technologies in several states.

- 2023: Significant M&A activity consolidates market share among leading companies.

- 2024: Several new entrants launched innovative products focusing on sustainable irrigation solutions.

Strategic Outlook for North America Agricultural Irrigation Machinery Market Market

The North America agricultural irrigation machinery market presents substantial opportunities for sustained growth, driven by factors such as increasing food security concerns, technological advancements, and government support for sustainable agriculture. Companies that focus on innovation, strategic partnerships, and efficient water management solutions are poised to capture significant market share in the coming years. The market's long-term prospects remain highly positive.

North America Agricultural Irrigation Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Agricultural Irrigation Machinery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Irrigation Machinery Market Regional Market Share

Geographic Coverage of North America Agricultural Irrigation Machinery Market

North America Agricultural Irrigation Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players

- 3.3. Market Restrains

- 3.3.1. High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming

- 3.4. Market Trends

- 3.4.1. Increasing Water Scarcity Driving the Adoption of Micro-irrigation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 7. Canada North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 8. Mexico North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 9. Rest of North America North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Toro Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EPC Industries Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jain Irrigation Systems Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lindsay Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Deere & Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 T-L Irrigation Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rain Bird Corporatio

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nelson Irrigation Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Netafim Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Valmont Industries

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Toro Company

List of Figures

- Figure 1: North America Agricultural Irrigation Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Irrigation Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 3: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 6: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 7: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Irrigation Machinery Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the North America Agricultural Irrigation Machinery Market?

Key companies in the market include The Toro Company, EPC Industries Limited, Jain Irrigation Systems Ltd, Lindsay Corporation, Deere & Company, T-L Irrigation Co, Rain Bird Corporatio, Nelson Irrigation Corporation, Netafim Limited, Valmont Industries.

3. What are the main segments of the North America Agricultural Irrigation Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players.

6. What are the notable trends driving market growth?

Increasing Water Scarcity Driving the Adoption of Micro-irrigation.

7. Are there any restraints impacting market growth?

High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Irrigation Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Irrigation Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Irrigation Machinery Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Irrigation Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence