Key Insights

The North American international express service market, projected to reach $136.11 billion by 2025, is forecast for significant expansion with a Compound Annual Growth Rate (CAGR) of 7.3% from 2025 to 2033. Key growth drivers include the escalating volume of e-commerce, particularly cross-border shipments, and the increasing globalization of businesses demanding efficient international logistics. Technological advancements in tracking and automation further bolster market performance. Challenges include fluctuating fuel prices, geopolitical instability, and evolving trade regulations. The market is segmented by shipment weight (heavy, medium, light), with diverse growth dynamics across each category. Leading companies like UPS, FedEx, and DHL are at the forefront of innovation. The United States, Canada, and Mexico represent the dominant regional markets within North America.

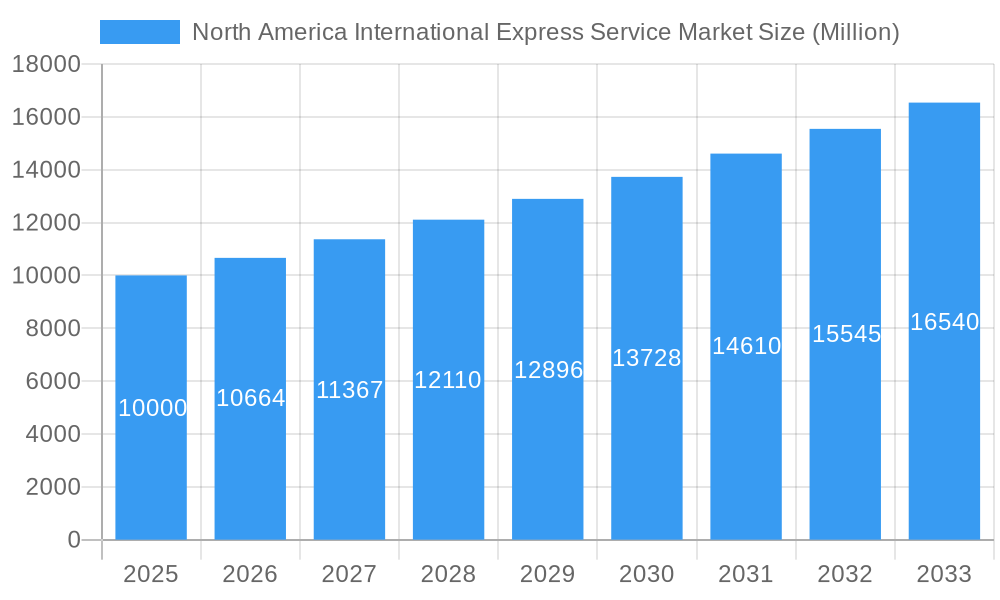

North America International Express Service Market Market Size (In Billion)

Within North America, shipment weight segments are anticipated to exhibit varied growth rates. Medium-weight shipments are expected to capture the largest market share, while the light-weight segment, propelled by e-commerce, is projected to experience the highest growth. The heavy-weight segment, though growing at a slower pace, remains vital for industrial component transportation. Competitive strategies involve investments in technology, network expansion, and strategic partnerships. The forecast period (2025-2033) anticipates sustained growth driven by consumer demand for rapid delivery and the ongoing need for robust international logistics solutions for businesses. The historical period (2019-2024) provides context, influenced by global economic trends and pandemic-related disruptions.

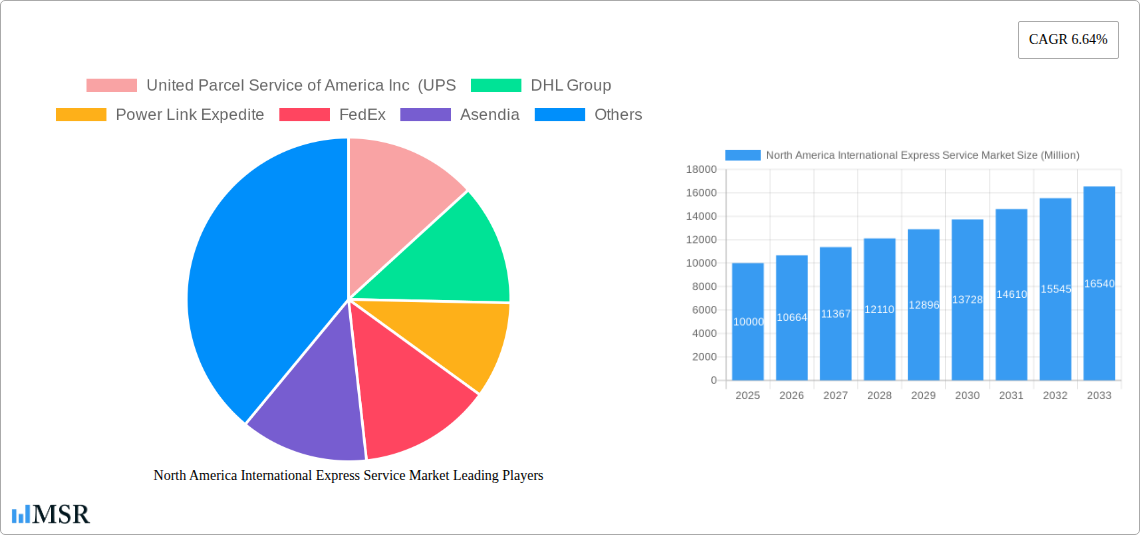

North America International Express Service Market Company Market Share

North America International Express Service Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America International Express Service Market, covering the period 2019-2033. It offers crucial insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report leverages robust data and analysis to forecast market trends, identify key players, and uncover lucrative opportunities. With a focus on shipment weight segments (heavy, light, and medium), this report is essential for understanding the complexities and potential of the North American international express delivery landscape.

North America International Express Service Market Market Concentration & Dynamics

The North America international express service market is characterized by a high degree of concentration, with a few dominant players controlling a significant market share. United Parcel Service (UPS), DHL Group, and FedEx are the major players, holding approximately xx% of the market share collectively (Base Year: 2025). This oligopolistic structure influences pricing strategies and service offerings. However, smaller players like Power Link Expedite, Asendia, International Distributions Services (including GLS), OnTrac, Aramex, and DTDC Express Limited are also making inroads, particularly in niche segments.

The market exhibits a dynamic innovation ecosystem, with ongoing investments in technology such as automated sorting systems, advanced tracking capabilities, and drone delivery initiatives. Regulatory frameworks, including customs regulations and cross-border compliance, significantly impact market operations. Substitute products, such as freight forwarding services, pose competitive pressure, particularly for less time-sensitive shipments. End-user trends indicate a growing preference for faster delivery speeds and enhanced transparency in the shipping process. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals concluded in the historical period (2019-2024). The strategic acquisitions and partnerships by major players reflect the market's consolidation trend and efforts to improve efficiency and expand market reach.

North America International Express Service Market Industry Insights & Trends

The North America International Express Service Market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, reaching a market size of USD xx Million by 2033 (Estimated Year: 2025). Several factors drive this market expansion. E-commerce's rapid growth fuels the demand for efficient and reliable international shipping solutions. Globalization and increased cross-border trade further contribute to market expansion. Technological advancements, such as improved tracking systems and automated warehousing, enhance operational efficiency and customer satisfaction. However, fluctuating fuel prices, geopolitical uncertainties, and supply chain disruptions pose challenges to consistent market growth. Evolving consumer behavior emphasizes speed, transparency, and convenient delivery options, influencing service innovation within the industry.

Key Markets & Segments Leading North America International Express Service Market

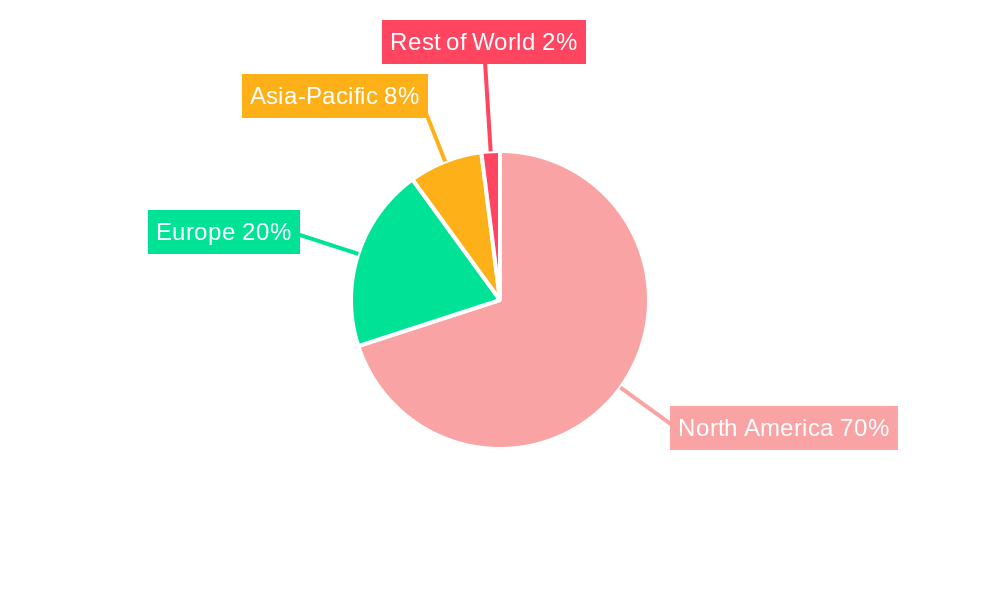

The United States remains the dominant market within North America, accounting for the largest share of the international express service market. This dominance is fueled by a robust economy, extensive infrastructure, and a high volume of cross-border trade. Canada and Mexico also contribute significantly, albeit at a smaller scale, driven by their proximity to the US market and trade agreements like USMCA.

- Shipment Weight Segments:

- Heavy Weight Shipments: This segment benefits from the increasing demand for the transportation of larger and heavier goods associated with manufacturing and industrial sectors. Growth in this segment is particularly strong in regions with significant manufacturing activity.

- Light Weight Shipments: This segment thrives on the explosive growth of e-commerce and the shipment of smaller consumer goods. The increasing demand for faster and more convenient delivery options fuels growth in this area.

- Medium Weight Shipments: This segment experiences steady growth, representing a balanced mix between the needs of businesses and consumers. The ongoing expansion of both e-commerce and traditional business-to-business trade supports its growth. Economic growth and infrastructural development are key drivers for all segments, influencing delivery efficiency and overall market dynamics.

North America International Express Service Market Product Developments

Recent product innovations focus on enhancing tracking capabilities, optimizing delivery routes using AI-driven logistics software, and integrating data-driven analytics to improve efficiency and customer experience. The introduction of automated sorting systems and the exploration of drone delivery systems represent significant technological advancements providing competitive advantages and shaping the future of the industry. These developments are designed to improve speed, reduce costs, and enhance overall customer satisfaction.

Challenges in the North America International Express Service Market Market

The market faces several challenges. Regulatory complexities and cross-border compliance requirements can be costly and time-consuming. Supply chain disruptions, particularly those caused by geopolitical instability or natural disasters, impact delivery times and operational costs. Intense competition among major players leads to price pressures and necessitates continuous investment in innovation and efficiency improvements. These factors impact profitability and market stability. For instance, the recent fuel price increases impacted the industry's operational cost, resulting in approximately xx% increase in the overall transportation cost.

Forces Driving North America International Express Service Market Growth

The market's growth is propelled by several key factors. The expansion of e-commerce, particularly cross-border e-commerce, significantly drives demand for international express services. Technological advancements, including AI and automation, improve efficiency and lower operational costs. Government investments in infrastructure, especially transportation networks, facilitate smoother and faster delivery. Favorable economic conditions in key markets also contribute to overall market expansion.

Challenges in the North America International Express Service Market Market

Long-term growth hinges on sustained investments in technological innovation, strategic partnerships to expand global reach and enhance service offerings, and successful navigation of evolving regulatory landscapes. These elements will support market expansion and improved efficiency.

Emerging Opportunities in North America International Express Service Market

Emerging opportunities include the expansion into underserved markets, the integration of sustainable and eco-friendly delivery solutions, and the adoption of emerging technologies like blockchain for enhanced security and transparency. Focusing on specialized services catering to specific industry needs presents a growth opportunity. The rising demand for same-day and next-day deliveries presents a significant opportunity to expand market penetration.

Leading Players in the North America International Express Service Market Sector

- United Parcel Service of America Inc (UPS)

- DHL Group

- Power Link Expedite

- FedEx

- Asendia

- International Distributions Services (including GLS)

- OnTrac

- Aramex

- DTDC Express Limited

Key Milestones in North America International Express Service Market Industry

- July 2023: DHL Express invested USD 9.6 Million in a new service point in Denver, expanding its operational capacity and presence.

- March 2023: Aramex entered a joint venture with AD Ports Group to develop a new NVOCC enterprise, diversifying its business model and enhancing its market reach.

- February 2023: Aramex reported a 27% drop in annual net profit (USD 45.02 Million) due to currency fluctuations, highlighting the impact of macroeconomic factors on the industry's profitability.

Strategic Outlook for North America International Express Service Market Market

The North America International Express Service Market presents significant long-term growth potential. Strategic investments in technology, expansion into new markets, and focusing on sustainable and efficient solutions will be crucial for success. Companies that effectively adapt to evolving consumer preferences, navigate regulatory changes, and manage supply chain complexities will capture a larger share of the expanding market.

North America International Express Service Market Segmentation

-

1. Shipment Weight

- 1.1. Heavy Weight Shipments

- 1.2. Light Weight Shipments

- 1.3. Medium Weight Shipments

-

2. End User Industry

- 2.1. E-Commerce

- 2.2. Financial Services (BFSI)

- 2.3. Healthcare

- 2.4. Manufacturing

- 2.5. Primary Industry

- 2.6. Wholesale and Retail Trade (Offline)

- 2.7. Others

North America International Express Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America International Express Service Market Regional Market Share

Geographic Coverage of North America International Express Service Market

North America International Express Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America International Express Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.1.1. Heavy Weight Shipments

- 5.1.2. Light Weight Shipments

- 5.1.3. Medium Weight Shipments

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. E-Commerce

- 5.2.2. Financial Services (BFSI)

- 5.2.3. Healthcare

- 5.2.4. Manufacturing

- 5.2.5. Primary Industry

- 5.2.6. Wholesale and Retail Trade (Offline)

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Shipment Weight

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 United Parcel Service of America Inc (UPS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Power Link Expedite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asendia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Distributions Services (including GLS)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OnTrac

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aramex

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DTDC Express Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 United Parcel Service of America Inc (UPS

List of Figures

- Figure 1: North America International Express Service Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America International Express Service Market Share (%) by Company 2025

List of Tables

- Table 1: North America International Express Service Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 2: North America International Express Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 3: North America International Express Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America International Express Service Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: North America International Express Service Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 6: North America International Express Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America International Express Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America International Express Service Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America International Express Service Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America International Express Service Market?

The projected CAGR is approximately 7.3%.

2. Which companies are prominent players in the North America International Express Service Market?

Key companies in the market include United Parcel Service of America Inc (UPS, DHL Group, Power Link Expedite, FedEx, Asendia, International Distributions Services (including GLS), OnTrac, Aramex, DTDC Express Limited.

3. What are the main segments of the North America International Express Service Market?

The market segments include Shipment Weight, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 136.11 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

July 2023: With the USD 9.6 million investment, DHL Express acquired a location closer to the commercial core in downtown Denver. The new DHL Service Point includes nearly 56,000 sq. ft of combined warehouse and office space, along with 60 positions for vehicles to load and unload shipments around its conveyable sorting system.March 2023: Aramex signed a joint venture with AD Ports Group, one of the leading global trade, logistics, and industry facilitators, to develop and operate a new Non-Vessel Operating Common Carrier (“NVOCC”) enterprise.February 2023: Aramex's annual net profit dropped by 27% to USD 45.02 million due to currency fluctuations in certain markets, primarily in Lebanon and Egypt. Its 2022 revenue was broadly in line with 2021, while Q4 2022 revenue decreased 5% to USD 0.416 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America International Express Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America International Express Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America International Express Service Market?

To stay informed about further developments, trends, and reports in the North America International Express Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence