Key Insights

The North American feed testing market is poised for significant expansion, driven by escalating consumer demand for secure and superior animal-derived products and stringent regulatory frameworks focused on food safety and animal well-being. Key market segments include pathogen, pesticide residue, and mycotoxin testing, while ruminant, poultry, and swine feed segments lead in overall market share, reflecting dominant livestock industries. Leading organizations such as SGS SA, NSF International, and Eurofins Scientific are instrumental in market development through innovation and strategic initiatives. The market is projected to grow at a compound annual growth rate (CAGR) of 7.7%, indicating substantial opportunities. With an unwavering emphasis on food safety and traceability, demand for advanced testing methodologies is expected to rise throughout the forecast period.

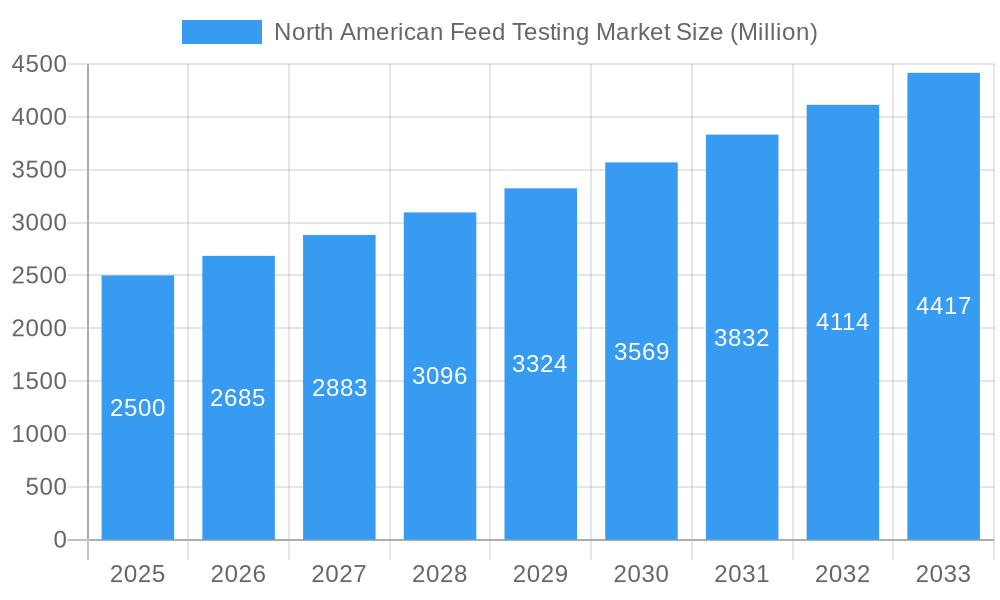

North American Feed Testing Market Market Size (In Million)

Several pivotal trends are accelerating the North American feed testing market's growth. The integration of sophisticated analytical technologies, including PCR and ELISA, enhances the speed and precision of pathogen detection. Heightened awareness of mycotoxin prevalence and their adverse effects on animal health and food safety is increasing the demand for specialized testing. Moreover, a growing emphasis on sustainable feed production is steering the market towards integrated and comprehensive testing solutions. Despite existing hurdles like high testing expenditures and variations in testing protocols, the market's trajectory remains optimistic, underpinned by a steadfast commitment to ensuring the safety and nutritional value of animal feed. The market size is estimated at $539.05 million in the base year 2025, with projections indicating continued robust growth driven by technological advancements and evolving regulatory landscapes.

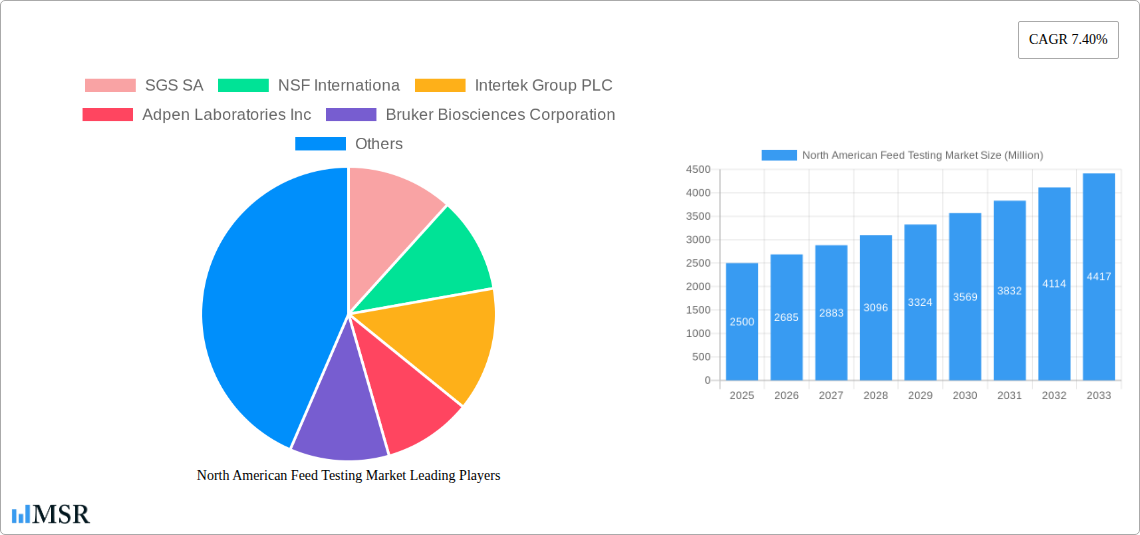

North American Feed Testing Market Company Market Share

North American Feed Testing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American feed testing market, encompassing market size, growth drivers, key segments, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

North American Feed Testing Market Market Concentration & Dynamics

The North American feed testing market exhibits a moderately consolidated structure, with several major players holding significant market share. SGS SA, NSF International, and Intertek Group PLC are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. The market is characterized by a dynamic innovation ecosystem, with companies continuously investing in advanced technologies such as genomics, proteomics, and metabolomics to enhance testing capabilities.

Regulatory frameworks, particularly those related to food safety and animal health, play a crucial role in shaping market dynamics. Stringent regulations drive demand for accurate and reliable feed testing services. Substitute products are limited, as the need for accurate feed composition and safety assessment remains paramount. End-user trends indicate a growing preference for high-quality, safe feed products, boosting demand for testing services. M&A activity within the sector has been moderate, with approximately xx deals recorded between 2019 and 2024. This activity primarily focused on expanding geographical reach and enhancing technological capabilities.

- Market Share (2025):

- Top 3 Players: xx%

- Other Players: xx%

- M&A Activity (2019-2024): Approximately xx deals.

North American Feed Testing Market Industry Insights & Trends

The North American feed testing market is experiencing robust growth, driven by several key factors. Increasing consumer awareness of food safety and animal welfare is fueling demand for rigorous feed quality assurance. Stringent government regulations regarding feed composition and contaminant levels further propel market expansion. Technological advancements, including the development of rapid, accurate, and high-throughput testing methods, are contributing to market growth. The rising adoption of precision livestock farming and the increasing demand for sustainably produced feed are also significant drivers. Evolving consumer behaviors, such as a preference for traceable and ethically sourced feed, are impacting the market. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, driven by a compound annual growth rate (CAGR) of xx%. This growth is primarily attributed to the increasing demand for high-quality animal feed, stringent regulatory frameworks and technological advancements that enhance testing capabilities.

Key Markets & Segments Leading North American Feed Testing Market

The Poultry Feed segment dominates the North American feed testing market, owing to the substantial poultry production in the region. The Pathogen Testing segment holds the largest share within the 'Type' category, driven by concerns over foodborne illnesses. The Midwest region of North America is a key market, benefitting from high livestock density and established feed processing industries.

Key Drivers:

- Poultry Feed: High poultry production volume, stringent quality control measures.

- Pathogen Testing: Increasing consumer focus on food safety, stringent regulatory compliance.

- Midwest Region: High livestock concentration, established agricultural infrastructure.

Dominance Analysis: The dominance of Poultry Feed and Pathogen Testing segments is largely due to the regulatory pressures surrounding food safety and the sheer volume of poultry production across the region. This high volume requires extensive and frequent testing to ensure both safety and product quality, thus driving the demand for testing services within these segments.

North American Feed Testing Market Product Developments

Significant product innovations have characterized the market, including the development of rapid diagnostic tests (RDTs) for pathogens, advanced analytical techniques for pesticide residue analysis, and improved methods for nutritional labeling. These advancements enhance speed, accuracy, and efficiency, allowing for faster turnaround times and improved decision-making in the feed industry. This also gives companies a competitive edge by providing clients with faster and more precise results.

Challenges in the North American Feed Testing Market Market

Several challenges hinder market growth. Regulatory hurdles associated with obtaining testing approvals and maintaining compliance can be costly and time-consuming. Supply chain disruptions, especially those impacting the availability of testing reagents and consumables, can impact operational efficiency. Intense competition among numerous testing laboratories creates pressure on pricing and profitability. These factors combined can potentially lead to a xx% decrease in market revenue growth in the next two years.

Forces Driving North American Feed Testing Market Growth

Several factors drive market growth. Technological advancements, such as automation and miniaturization of testing equipment, increase efficiency and reduce costs. Economic growth in the animal agriculture sector directly increases the demand for feed testing services. Stricter regulatory frameworks for food safety and animal health mandate increased testing. The implementation of new regulations is a notable example. For instance, the introduction of stricter standards regarding mycotoxin limits in animal feed is driving increased demand for mycotoxin testing services.

Long-Term Growth Catalysts in the North American Feed Testing Market

Long-term growth is fueled by continuous innovation in testing technologies, strategic partnerships between testing laboratories and feed manufacturers, and the expansion of testing services into new geographical areas and emerging markets within the North American region.

Emerging Opportunities in North American Feed Testing Market

Emerging opportunities include the growing demand for personalized nutrition in animal feed, which necessitates more sophisticated testing methods. The development of new, faster, and more efficient testing methods opens new avenues of growth. Expanding into new markets, such as organic and specialty feed, presents additional opportunities.

Leading Players in the North American Feed Testing Market Sector

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Genon Laboratories Ltd

- Eurofins Scientific

- Invisible Sentinel Inc

Key Milestones in North American Feed Testing Market Industry

- 2020: Introduction of rapid PCR-based pathogen detection systems by several leading companies.

- 2021: Increased adoption of LC-MS/MS for pesticide residue analysis.

- 2022: Several mergers and acquisitions among smaller testing laboratories.

- 2023: Launch of new, high-throughput testing platforms.

- 2024: Implementation of stricter regulations on mycotoxin levels in feed.

Strategic Outlook for North American Feed Testing Market Market

The North American feed testing market holds significant future potential, driven by continuous technological advancements, the increasing demand for high-quality and safe feed products, and stringent regulatory oversight. Strategic opportunities include expanding into emerging markets, investing in advanced testing technologies, and forming strategic partnerships to enhance service offerings and expand market reach.

North American Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

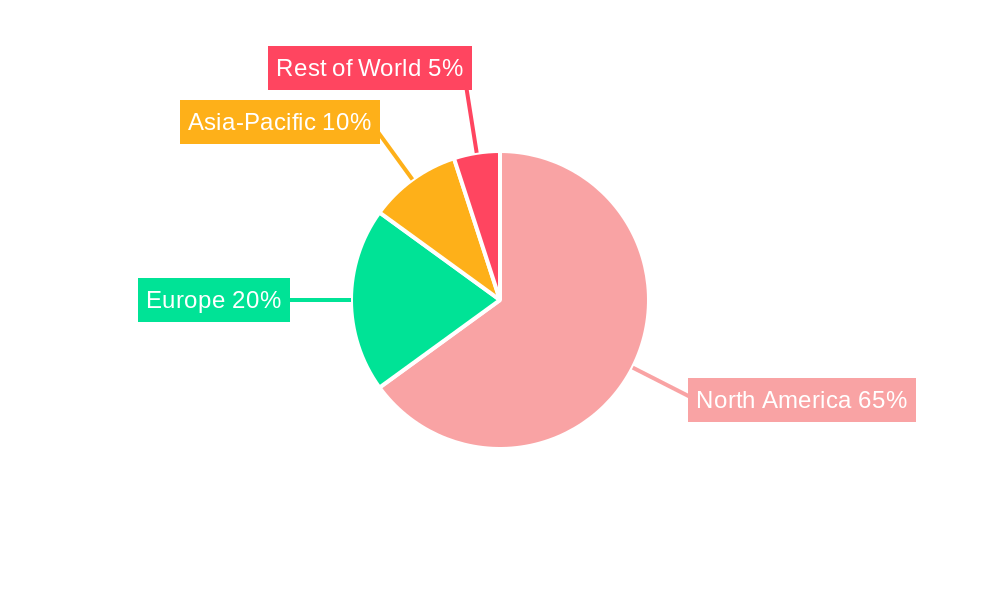

North American Feed Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Feed Testing Market Regional Market Share

Geographic Coverage of North American Feed Testing Market

North American Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Driving Growth of Pet Food Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genon Laboratories Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: North American Feed Testing Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North American Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North American Feed Testing Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North American Feed Testing Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Feed Testing Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the North American Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the North American Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 539.05 million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Driving Growth of Pet Food Testing Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Feed Testing Market?

To stay informed about further developments, trends, and reports in the North American Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence