Key Insights

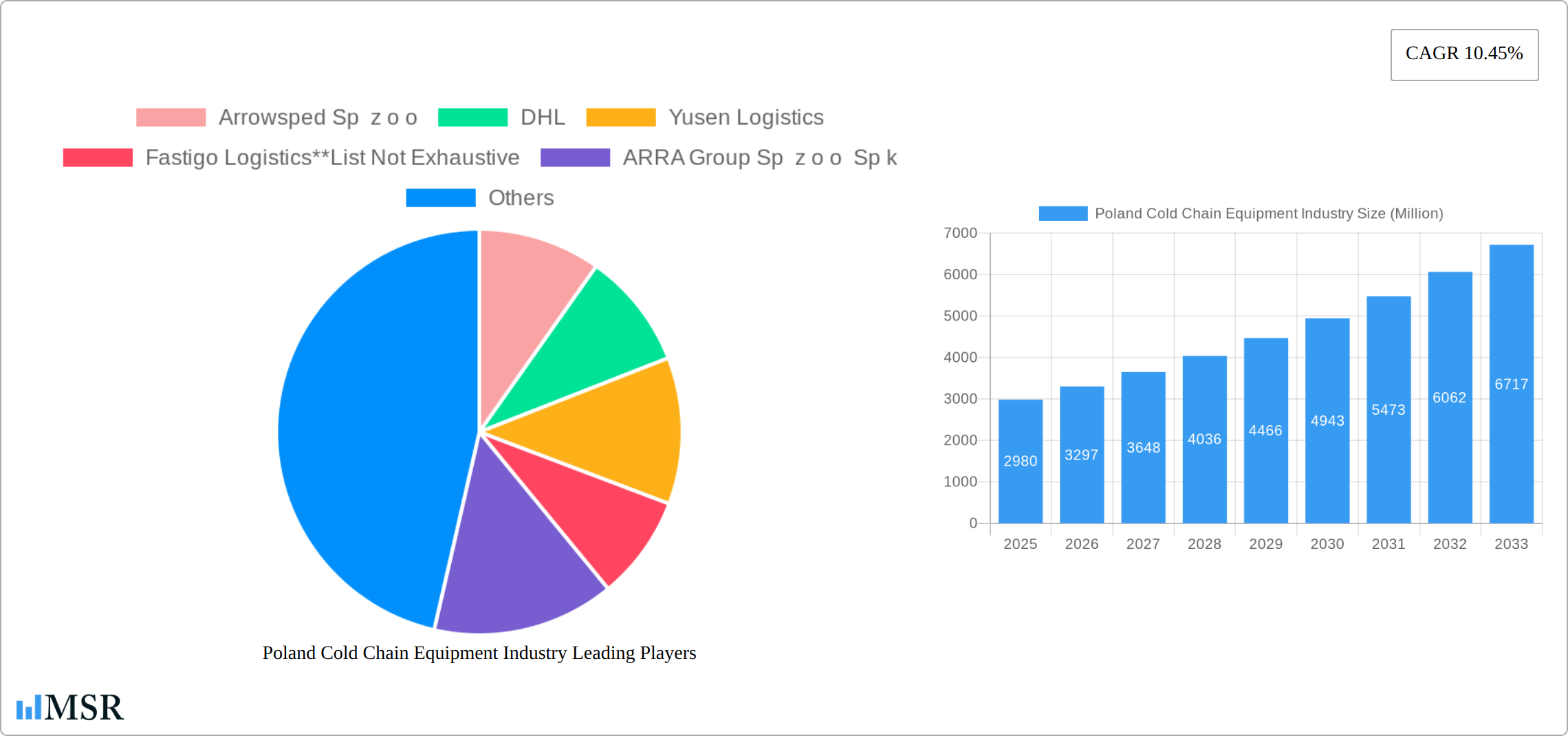

The Polish cold chain equipment market, valued at €2.98 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.45% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for fresh produce, dairy products, and processed foods, fueled by rising disposable incomes and changing consumer preferences towards convenient, high-quality food options, is a primary driver. Furthermore, the growth of e-commerce and online grocery delivery services necessitates efficient cold chain solutions for maintaining product integrity during transportation and storage. Stringent regulations regarding food safety and quality within the European Union further incentivize investments in advanced cold chain technologies. The market segmentation reveals significant opportunities across various services including storage, transportation, and value-added services like blast freezing and inventory management. Growth within the chilled and frozen temperature segments are fairly balanced, reflecting the diverse needs of various industries served. Horticulture, dairy products, and meats are key application segments, showcasing the sector's vital role in the Polish food industry. Leading players such as Arrowsped, DHL, and Yusen Logistics are actively shaping market dynamics through their investments in infrastructure and technological advancements.

Poland Cold Chain Equipment Industry Market Size (In Billion)

The projected growth trajectory suggests a substantial market expansion over the forecast period. While challenges remain, such as potential fluctuations in energy prices and the need for continuous infrastructure upgrades, the overall outlook for the Polish cold chain equipment market remains positive. Continued technological innovations, particularly in areas like temperature monitoring and automation, will further enhance efficiency and sustainability, driving market expansion. The increasing focus on reducing food waste and improving supply chain transparency also presents attractive opportunities for market participants. The robust growth is further expected to be fuelled by government initiatives promoting sustainable and efficient cold chain practices within Poland's agricultural sector. This creates a supportive regulatory environment for market growth and expansion.

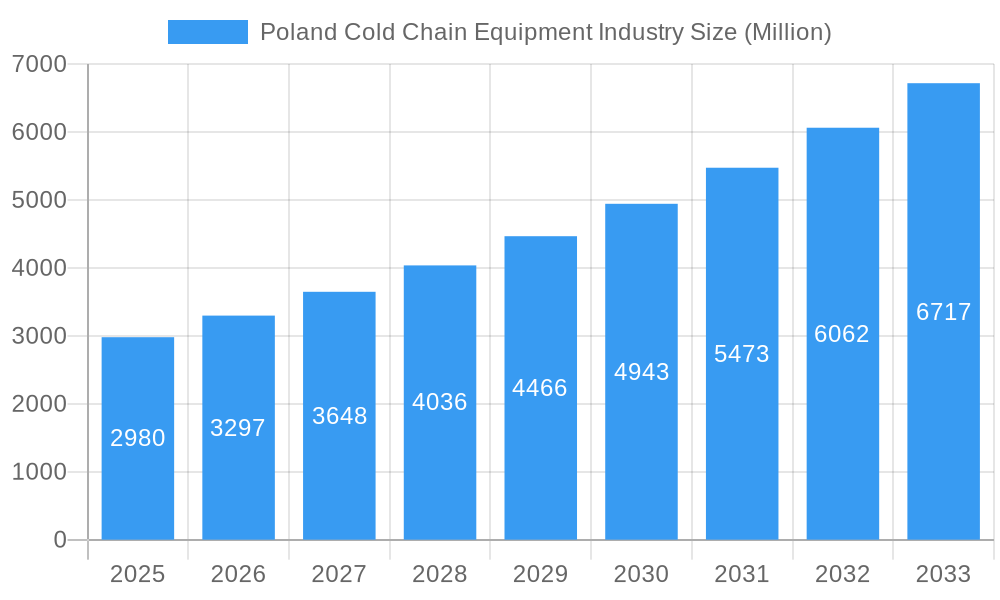

Poland Cold Chain Equipment Industry Company Market Share

Poland Cold Chain Equipment Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland cold chain equipment industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence based on rigorous research and data analysis. The report covers market size, CAGR, leading segments, key players, and emerging trends, providing a complete picture of this vital sector. The market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Poland Cold Chain Equipment Industry Market Concentration & Dynamics

The Polish cold chain equipment market exhibits a moderately concentrated landscape, with several large players holding significant market share. Arrowsped Sp z o o, DHL, Yusen Logistics, and Raben Group are key players, contributing significantly to the overall market volume. However, a substantial number of smaller, regional players also exist, creating a competitive environment. Innovation in the sector is driven by the need for increased efficiency, improved temperature control, and enhanced traceability within the supply chain. The regulatory framework, particularly concerning food safety and hygiene standards, heavily influences industry practices. Substitute products, primarily focusing on alternative packaging and transportation methods, pose a moderate threat. End-user trends, particularly in the increased demand for fresh produce and pharmaceuticals, are key drivers. M&A activities within the sector have been relatively moderate in recent years, with approximately xx deals recorded between 2019 and 2024. This activity is expected to increase over the forecast period driven by consolidation and expansion strategies. Market share data is detailed in the full report.

Poland Cold Chain Equipment Industry Industry Insights & Trends

The Polish cold chain equipment market is experiencing robust growth, driven by several key factors. The expanding e-commerce sector, coupled with rising consumer demand for fresh and processed food products, is a major catalyst for growth. Technological advancements, including the adoption of IoT-enabled sensors and advanced refrigeration technologies, are transforming operational efficiency and optimizing supply chain management. Changes in consumer behavior, such as a preference for convenience and higher quality food, further fuel demand. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), reflecting the strong growth momentum. The market size in 2025 is estimated to be xx Million and is projected to reach xx Million by 2033, indicating a significant market opportunity. The increasing adoption of sustainable practices and the growing focus on food safety and quality standards contribute significantly to this industry's expansion.

Key Markets & Segments Leading Poland Cold Chain Equipment Industry

The Polish cold chain equipment market is characterized by several dominant segments:

By Services: Transportation holds the largest market share, fueled by the rising demand for efficient and reliable delivery of temperature-sensitive goods across the country. Value-added services, particularly blast freezing and inventory management, are witnessing substantial growth, driven by increasing industry focus on supply chain optimization and quality control. Storage, while a crucial component, holds a smaller, yet essential, part of the market.

By Temperature Type: The frozen segment dominates the market, driven by the substantial demand for frozen food products and pharmaceuticals. However, the chilled segment demonstrates healthy growth, reflecting the increasing consumption of fresh produce and dairy products.

By Application: The food and beverage industry, particularly horticulture (fresh fruits & vegetables), dairy products, meats, poultry, and processed food products, represents a major end-use segment. Pharmaceutical and life sciences applications are also significant and rapidly growing, driven by strict temperature-sensitive requirements.

Drivers for growth across all segments include: robust economic growth, expanding retail infrastructure, increasing disposable incomes, and growing awareness of food safety and quality. A detailed dominance analysis of each segment is provided in the full report.

Poland Cold Chain Equipment Industry Product Developments

The Polish cold chain equipment industry showcases continuous innovation, with companies actively developing energy-efficient refrigeration systems, intelligent monitoring solutions, and improved transportation vehicles. These advancements enhance product quality, reduce spoilage, and boost overall supply chain efficiency. The integration of IoT and AI-powered technologies is particularly prominent, enabling real-time tracking and predictive maintenance, reducing operational costs and minimizing downtime. These advancements enhance the competitiveness of Polish companies in the global cold chain equipment market.

Challenges in the Poland Cold Chain Equipment Industry Market

The Polish cold chain equipment industry navigates a complex landscape of challenges. Adhering to increasingly stringent EU and national regulatory compliance requirements for food safety, hygiene, and temperature integrity not only adds significant operational costs but also demands meticulous record-keeping and advanced technological solutions. Supply chain disruptions, exacerbated by geopolitical events, climate change impacts, and fluctuating global demand, can critically affect product delivery timelines and the preservation of product quality, leading to potential revenue loss and reputational damage. Furthermore, the market is characterized by intense competition from established domestic players and agile international entrants, compelling businesses to constantly invest in research and development for continuous innovation, embrace advanced technologies for efficiency gains, and implement robust cost optimization strategies to maintain competitiveness. These multifaceted challenges directly impact overall profitability, investment cycles, and the sustainable growth trajectory of the market. Detailed analysis of quantifiable impacts, such as projected increases in operational expenditures and potential shifts in market share, is comprehensively presented in the full market report.

Forces Driving Poland Cold Chain Equipment Industry Growth

A confluence of powerful drivers is propelling substantial growth within the Polish cold chain equipment market. Key among these are rapid technological advancements. The integration of the Internet of Things (IoT) for real-time monitoring and control, coupled with the application of Artificial Intelligence (AI) for predictive analytics and optimized logistics, is revolutionizing operational efficiency and significantly reducing product spoilage. The explosive expansion of the e-commerce sector, particularly in the grocery and pharmaceutical segments, is creating an insatiable demand for sophisticated and reliable cold chain solutions that ensure the timely, safe, and temperature-controlled delivery of sensitive goods directly to consumers. Simultaneously, a growing middle class with rising disposable incomes and evolving consumer preferences for greater convenience, higher-quality perishable goods, and a wider variety of fresh produce directly fuels the need for enhanced and expanded cold chain infrastructure. Additionally, proactive government initiatives aimed at promoting sustainable business practices, reducing carbon footprints, and supporting green technologies within the logistics sector are providing a favorable ecosystem for the market's sustained expansion.

Long-Term Growth Catalysts in the Poland Cold Chain Equipment Industry

Long-term growth is supported by continued investments in technological innovation, fostering strategic partnerships between equipment providers and logistics companies, and expanding into new market segments, such as specialized pharmaceutical cold chains. The industry's future hinges on the capacity to adapt to technological developments and address the increasing demand for traceability, sustainable solutions, and enhanced food safety across the supply chain. This will drive future market expansion and competitiveness.

Emerging Opportunities in Poland Cold Chain Equipment Industry

The dynamic Polish cold chain equipment market is ripe with burgeoning opportunities. A significant area of growth lies in the development and deployment of highly energy-efficient and environmentally sustainable cold chain solutions, aligning with global and EU sustainability mandates. The integration of blockchain technology presents a transformative opportunity for enhancing product traceability, ensuring supply chain transparency, and bolstering security, particularly for high-value or regulated goods. Strategic expansion into specialized niche markets, such as tailored cold chain solutions for the rapidly growing pharmaceutical and healthcare sectors requiring ultra-low temperature storage and specialized handling, offers substantial untapped growth potential. Furthermore, the increasing demand for innovative and adaptable last-mile delivery solutions, specifically designed to meet the unique logistical challenges of the e-commerce sector in urban and suburban environments, presents a compelling opportunity for service providers and equipment manufacturers alike.

Leading Players in the Poland Cold Chain Equipment Industry Sector

- Arrowsped Sp z o o

- DHL Supply Chain & Parcel Poland

- Yusen Logistics (Poland) Sp. z o.o.

- Fastigo Logistics

- ARRA Group Sp z o o Sp k

- Raben Group

- ZBYNEK - Transport Spedycja

- United Parcel Service (UPS) Polska

- Artrans Transport

- Fructus Transport

- Kuehne+Nagel

- DSV Solutions Polska

Key Milestones in Poland Cold Chain Equipment Industry Industry

- 2020: Launch and widespread adoption of next-generation, highly energy-efficient refrigeration units and advanced insulation technologies by leading manufacturers, significantly reducing operational energy consumption.

- 2021: Accelerated integration and increased adoption of advanced IoT-enabled monitoring systems, providing real-time data analytics and predictive maintenance capabilities across the entire cold chain supply network.

- 2022: A notable period of market consolidation characterized by several strategic mergers and acquisitions, leading to the emergence of larger, more integrated players with expanded service portfolios and geographical reach.

- 2023: Significant implementation and enforcement of enhanced regulatory standards for food safety, product traceability, and hygiene protocols, driving demand for sophisticated compliance-enabling equipment and software solutions.

- 2024: Marked by substantial strategic investments in the expansion and modernization of national cold chain infrastructure, including the development of new temperature-controlled warehousing facilities and advanced logistics hubs to support growing domestic and international trade demands.

- 2025 (Projected): Anticipated surge in demand for specialized cold chain equipment tailored for rapid e-commerce fulfillment and last-mile delivery, alongside increased investment in automation and robotics within cold storage facilities.

Strategic Outlook for Poland Cold Chain Equipment Industry Market

The Polish cold chain equipment market is poised for sustained growth driven by technological innovation, evolving consumer preferences, and strong economic growth. Strategic partnerships, investments in sustainable solutions, and expansion into niche market segments will be critical for achieving long-term success. The market exhibits significant potential for expansion, offering attractive opportunities for both established players and new entrants. Companies that can adapt to the changing market dynamics and embrace new technologies will be best positioned to capitalize on the growth potential.

Poland Cold Chain Equipment Industry Segmentation

-

1. Services

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

Poland Cold Chain Equipment Industry Segmentation By Geography

- 1. Poland

Poland Cold Chain Equipment Industry Regional Market Share

Geographic Coverage of Poland Cold Chain Equipment Industry

Poland Cold Chain Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market

- 3.3. Market Restrains

- 3.3.1. 4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market

- 3.4. Market Trends

- 3.4.1. Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Cold Chain Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arrowsped Sp z o o

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fastigo Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ARRA Group Sp z o o Sp k

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Raben Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ZBYNEK - Transport Spedycja

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Parcel Service of America

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Artrans Transport

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fructus Transport

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arrowsped Sp z o o

List of Figures

- Figure 1: Poland Cold Chain Equipment Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Poland Cold Chain Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 6: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Poland Cold Chain Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Cold Chain Equipment Industry?

The projected CAGR is approximately 10.45%.

2. Which companies are prominent players in the Poland Cold Chain Equipment Industry?

Key companies in the market include Arrowsped Sp z o o, DHL, Yusen Logistics, Fastigo Logistics**List Not Exhaustive, ARRA Group Sp z o o Sp k, Raben Group, ZBYNEK - Transport Spedycja, United Parcel Service of America, Artrans Transport, Fructus Transport.

3. What are the main segments of the Poland Cold Chain Equipment Industry?

The market segments include Services, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Globalization boosting the market4.; Technological advancements bolstering the market.

6. What are the notable trends driving market growth?

Changes in Consumer Habits Fueling the Demand for Cold Chain Facilities.

7. Are there any restraints impacting market growth?

4.; Infrastructure limitation affecting the market4.; Shortage of Labour force affecting the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Cold Chain Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Cold Chain Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Cold Chain Equipment Industry?

To stay informed about further developments, trends, and reports in the Poland Cold Chain Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence