Key Insights

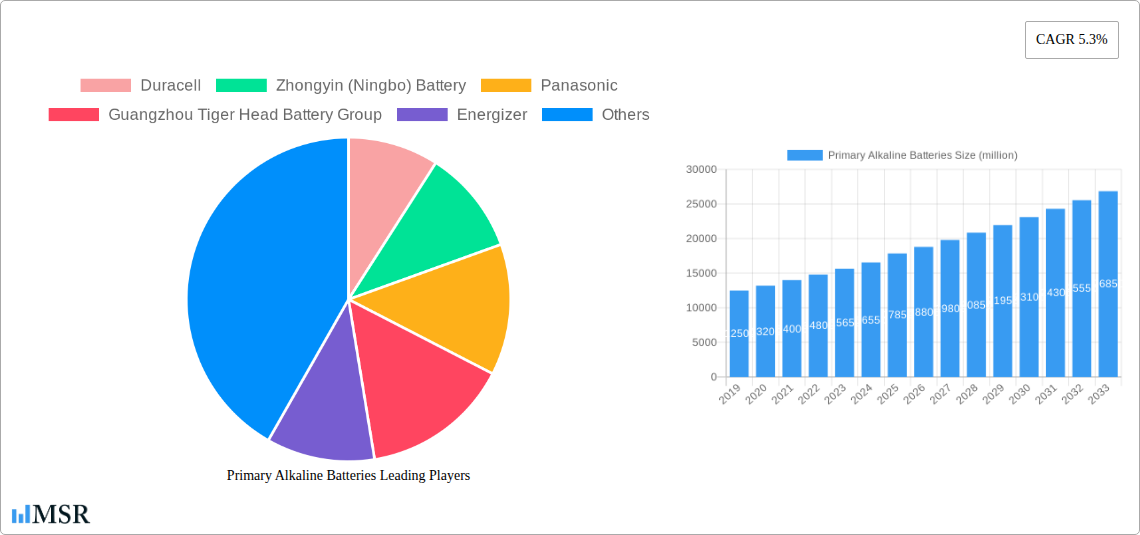

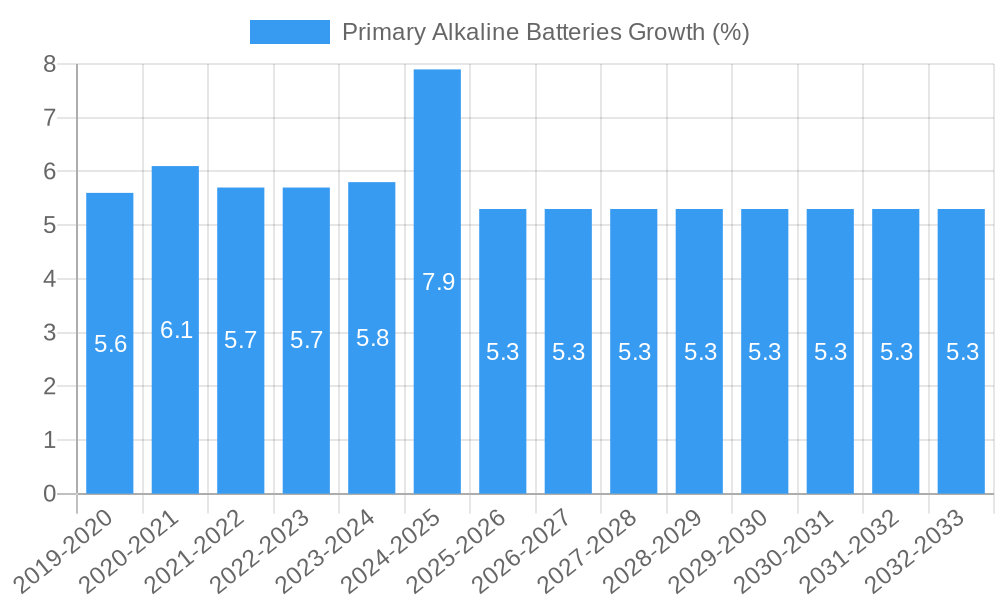

The global Primary Alkaline Batteries market is poised for robust expansion, projected to reach an impressive market size of USD 17,850 million by 2025, and maintain a healthy Compound Annual Growth Rate (CAGR) of 5.3% through the forecast period ending in 2033. This growth is primarily fueled by the indispensable role alkaline batteries play in powering a vast array of consumer electronics and portable devices. The increasing adoption of smart home devices, remote controls, toys, and portable medical equipment continues to drive consistent demand. Furthermore, the growing disposable income in emerging economies is contributing to a higher penetration of battery-powered gadgets, thereby bolstering market performance. The sheer convenience and widespread availability of alkaline batteries, coupled with their relatively low cost and reliable power output, solidify their position as a preferred choice for everyday applications.

Despite the established market presence, the primary alkaline battery sector is not without its evolutionary pathways. Key trends influencing the market include ongoing efforts by manufacturers to enhance battery lifespan and performance, focusing on improved energy density and leakage prevention. Innovations in manufacturing processes are also contributing to cost efficiencies, making these batteries more accessible globally. However, the market faces certain restraints, primarily the growing environmental concerns associated with battery disposal and the increasing adoption of rechargeable battery alternatives and direct-powered devices in specific segments. The regulatory landscape surrounding battery production and recycling also presents challenges. Nevertheless, the sheer ubiquity of single-use applications where quick replacement is paramount, and the continued reliance on these batteries in sectors with limited access to charging infrastructure, ensure a sustained and significant market presence for primary alkaline batteries.

This in-depth report provides a definitive analysis of the global Primary Alkaline Batteries market, offering critical insights and actionable intelligence for industry stakeholders. Covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period extending to 2033, this study meticulously examines market dynamics, growth drivers, technological advancements, and emerging opportunities. The report leverages extensive primary and secondary research, delivering a robust understanding of market concentration, competitive landscape, and future trajectory.

Primary Alkaline Batteries Market Concentration & Dynamics

The Primary Alkaline Batteries market exhibits a moderate to high concentration, with a discernible presence of both established global players and rapidly expanding regional manufacturers. The innovation ecosystem is characterized by continuous refinement of energy density, shelf life, and leak-proof designs. Regulatory frameworks, particularly concerning environmental disposal and material sourcing, are increasingly influencing manufacturing processes and product development. The threat of substitute products, primarily rechargeable batteries in certain applications, remains a significant consideration, though primary alkaline batteries retain dominance in single-use, high-drain, and long-shelf-life applications. End-user trends are shifting towards more sustainable and power-efficient devices, driving demand for reliable and cost-effective energy solutions. Merger and acquisition (M&A) activities, while not at a fever pitch, are strategically driven, focusing on consolidating market share, acquiring advanced technologies, and expanding geographical reach. We anticipate approximately XX significant M&A deals over the forecast period. Market share distribution is dynamic, with top players like Duracell, NANFU Battery, and Panasonic holding substantial but evolving portions of the $XX billion global market.

Primary Alkaline Batteries Industry Insights & Trends

The global Primary Alkaline Batteries market is poised for robust growth, driven by a confluence of factors. The estimated market size for 2025 stands at $XX billion, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This growth is fueled by the pervasive use of alkaline batteries in a vast array of consumer electronics, portable devices, and essential household items. Advancements in material science have led to improved performance characteristics, including extended lifespan and enhanced power delivery, making them the preferred choice for critical applications like medical devices and emergency equipment. The increasing demand for smart home devices, remote controls, wireless peripherals, and portable gaming consoles directly translates to sustained demand for reliable primary power sources. Furthermore, the XX million unit annual production volume underscores the market's scale. Evolving consumer behaviors also play a crucial role; consumers prioritize convenience, affordability, and dependable performance, all of which are strengths of primary alkaline batteries. Despite the rise of rechargeable technologies, the inherent advantages of primary alkaline batteries – their low cost, long shelf life, and instant readiness – secure their continued relevance and drive market expansion. The integration of enhanced sealing technologies and reduced leakage further bolsters consumer confidence and reduces warranty claims, contributing to positive market sentiment.

Key Markets & Segments Leading Primary Alkaline Batteries

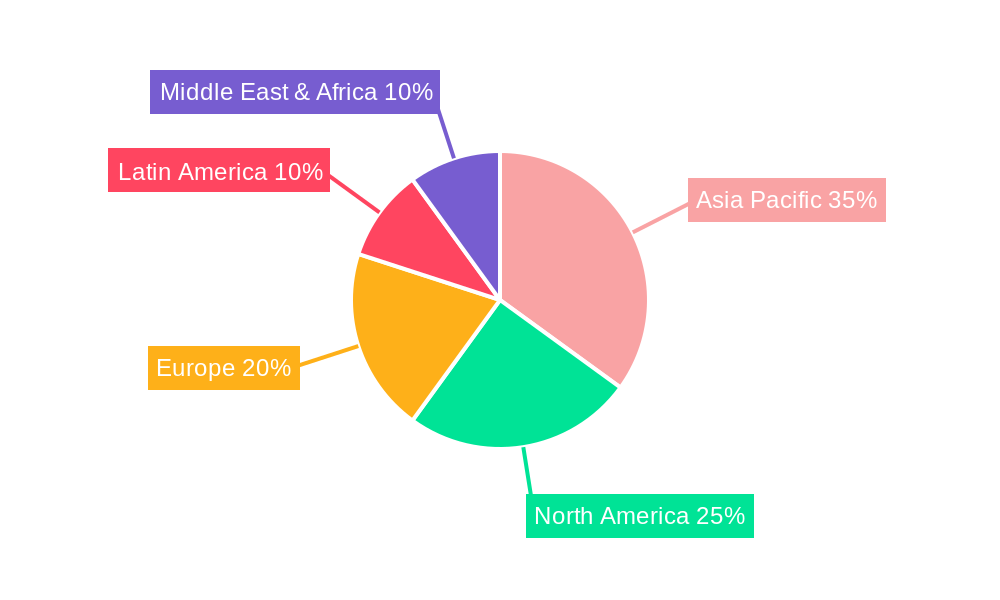

The Asia-Pacific region stands as the dominant market for Primary Alkaline Batteries, driven by its immense population, burgeoning middle class, and rapid industrialization. Countries like China, with its manufacturing prowess and significant domestic consumption, are key contributors, alongside growing markets in India and Southeast Asia.

- Dominant Region: Asia-Pacific

- Driver: High population density and increasing disposable incomes, fueling demand for consumer electronics and portable devices.

- Driver: Robust manufacturing base for electronics and other battery-dependent products, creating a large captive market.

- Driver: Government initiatives promoting electronics adoption and smart home technologies.

The Application segment is led by Consumer Electronics, which accounts for an estimated XX% of the total market share. This encompasses a wide range of devices, from remote controls and toys to portable radios and flashlights. The Type segment is dominated by AA and AAA batteries, representing over XX% of the market revenue, due to their widespread use in the most common consumer electronics.

- Dominant Application: Consumer Electronics

- Analysis: The sheer volume of consumer electronics manufactured and consumed globally ensures a consistent and substantial demand for AA and AAA alkaline batteries. The ubiquity of these devices in households, offices, and educational institutions solidifies this segment's leadership.

- Dominant Type: AA and AAA Batteries

- Analysis: The standardization and versatility of AA and AAA battery form factors make them the workhorses of the primary alkaline battery market. Their compatibility with a vast array of devices, from low-drain remote controls to mid-drain gaming accessories, makes them indispensable for everyday use.

Primary Alkaline Batteries Product Developments

Product innovations in Primary Alkaline Batteries are primarily focused on enhancing performance and sustainability. Key advancements include improved leak-proof designs to protect devices, extended shelf life exceeding XX years, and increased energy density for longer-lasting power. The development of low-self-discharge technologies is crucial for applications requiring consistent power over extended periods. Furthermore, manufacturers are exploring more environmentally friendly materials and manufacturing processes, addressing growing consumer and regulatory concerns. The market relevance of these developments lies in their ability to meet the evolving demands of power-hungry and sensitive electronic devices, offering consumers reliability and convenience.

Challenges in the Primary Alkaline Batteries Market

The Primary Alkaline Batteries market faces several challenges. Regulatory hurdles, particularly concerning battery disposal and the phasing out of certain heavy metals, can increase manufacturing costs and necessitate product redesigns. Supply chain disruptions, exemplified by recent global logistics issues, can impact raw material availability and lead times, affecting production schedules and pricing. Intense competitive pressures from both established brands and lower-cost manufacturers, especially in emerging markets, can squeeze profit margins. The increasing penetration of rechargeable battery alternatives, particularly for high-usage devices, also poses a significant competitive threat, potentially cannibalizing market share in specific segments.

Forces Driving Primary Alkaline Batteries Growth

Several key forces are driving the growth of the Primary Alkaline Batteries market. The persistent and growing demand for consumer electronics, smart devices, and portable gadgets remains a primary catalyst. Technological advancements that enhance battery performance, such as increased energy density and extended shelf life, further bolster their appeal. Economic growth in developing regions, leading to increased disposable income and a greater adoption of electronics, is another significant driver. Government regulations that mandate the use of specific battery types for certain applications (e.g., safety devices) also contribute to sustained demand. The inherent cost-effectiveness and user-friendliness of primary alkaline batteries continue to make them the preferred choice for millions of consumers worldwide.

Challenges in the Primary Alkaline Batteries Market

Long-term growth catalysts for the Primary Alkaline Batteries market are rooted in continued innovation and strategic market expansion. The development of more environmentally sustainable alkaline battery chemistries and recycling initiatives will be crucial for addressing evolving consumer and regulatory demands. Partnerships with device manufacturers to optimize battery integration and performance for new product categories represent a significant opportunity. Furthermore, expanding into underserved or emerging markets with tailored product offerings and competitive pricing strategies can unlock substantial growth potential. The focus on developing batteries with even greater energy density and longer shelf lives will ensure their continued relevance in the face of advancing electronic technologies.

Emerging Opportunities in Primary Alkaline Batteries

Emerging opportunities in the Primary Alkaline Batteries market are multifaceted. The growing adoption of the Internet of Things (IoT) devices, which often require compact and long-lasting power sources, presents a significant growth avenue. Advancements in battery technology, such as improved high-drain performance, can unlock new applications in portable power tools and medical equipment. Consumer preferences for convenience and reliability in remote and off-grid applications continue to drive demand for primary alkaline solutions. Furthermore, the development of "smart" primary batteries with integrated monitoring capabilities could open up new market segments and value-added services. The focus on eco-friendly packaging and responsible disposal initiatives is also an emerging trend that can differentiate brands and attract environmentally conscious consumers.

Leading Players in the Primary Alkaline Batteries Sector

- Duracell

- Zhongyin (Ningbo) Battery

- Panasonic

- Guangzhou Tiger Head Battery Group

- Energizer

- Toshiba

- NANFU Battery

- GP Batteries

- FDK

- Changhong

- Zheijiang Mustang

- Maxell

- Huatai Group

- Xiamen 3-circles Sports Technology

- Guangxi Wuzhou Sunwatt Battery

Key Milestones in Primary Alkaline Batteries Industry

- 2019: Introduction of enhanced leak-proof technologies by several key manufacturers, significantly improving product reliability and device protection.

- 2020: Increased focus on sustainable manufacturing practices and the exploration of recycled materials in response to growing environmental concerns.

- 2021: Significant global supply chain disruptions impacting raw material availability and lead times, prompting strategic adjustments by manufacturers.

- 2022: Launch of new product lines with extended shelf life, targeting niche applications requiring long-term energy storage.

- 2023: Heightened M&A activity in the sector, with companies consolidating to gain market share and technological advantages.

- 2024: Growing consumer awareness and demand for eco-friendly battery options, influencing product development and marketing strategies.

Strategic Outlook for Primary Alkaline Batteries Market

- 2019: Introduction of enhanced leak-proof technologies by several key manufacturers, significantly improving product reliability and device protection.

- 2020: Increased focus on sustainable manufacturing practices and the exploration of recycled materials in response to growing environmental concerns.

- 2021: Significant global supply chain disruptions impacting raw material availability and lead times, prompting strategic adjustments by manufacturers.

- 2022: Launch of new product lines with extended shelf life, targeting niche applications requiring long-term energy storage.

- 2023: Heightened M&A activity in the sector, with companies consolidating to gain market share and technological advantages.

- 2024: Growing consumer awareness and demand for eco-friendly battery options, influencing product development and marketing strategies.

Strategic Outlook for Primary Alkaline Batteries Market

The strategic outlook for the Primary Alkaline Batteries market is one of sustained relevance and evolutionary growth. The market's resilience lies in its fundamental strengths: cost-effectiveness, reliability, and ease of use, which continue to resonate with a broad consumer base. Growth accelerators will be driven by continuous innovation in energy density, shelf life, and environmental sustainability. Key strategic opportunities lie in capitalizing on the expanding IoT ecosystem, developing specialized batteries for new electronic device categories, and fortifying market presence in high-growth emerging economies. The industry will likely see a greater emphasis on circular economy principles, with manufacturers investing in recycling infrastructure and developing batteries with reduced environmental impact. Partnerships with device manufacturers will be crucial for co-optimizing battery solutions for next-generation electronics.

Primary Alkaline Batteries Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Primary Alkaline Batteries Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Primary Alkaline Batteries REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Primary Alkaline Batteries Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Primary Alkaline Batteries Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Primary Alkaline Batteries Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Primary Alkaline Batteries Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Primary Alkaline Batteries Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Primary Alkaline Batteries Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Duracell

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhongyin (Ningbo) Battery

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Panasonic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangzhou Tiger Head Battery Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Energizer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toshiba

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NANFU Battery

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GP Batteries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FDK

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Changhong

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zheijiang Mustang

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Maxell

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huatai Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Xiamen 3-circles Sports Technology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Guangxi Wuzhou Sunwatt Battery

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Duracell

List of Figures

- Figure 1: Global Primary Alkaline Batteries Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Primary Alkaline Batteries Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Primary Alkaline Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Primary Alkaline Batteries Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Primary Alkaline Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Primary Alkaline Batteries Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Primary Alkaline Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Primary Alkaline Batteries Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Primary Alkaline Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Primary Alkaline Batteries Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Primary Alkaline Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Primary Alkaline Batteries Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Primary Alkaline Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Primary Alkaline Batteries Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Primary Alkaline Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Primary Alkaline Batteries Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Primary Alkaline Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Primary Alkaline Batteries Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Primary Alkaline Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Primary Alkaline Batteries Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Primary Alkaline Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Primary Alkaline Batteries Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Primary Alkaline Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Primary Alkaline Batteries Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Primary Alkaline Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Primary Alkaline Batteries Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Primary Alkaline Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Primary Alkaline Batteries Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Primary Alkaline Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Primary Alkaline Batteries Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Primary Alkaline Batteries Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Primary Alkaline Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Primary Alkaline Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Primary Alkaline Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Primary Alkaline Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Primary Alkaline Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Primary Alkaline Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Primary Alkaline Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Primary Alkaline Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Primary Alkaline Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Primary Alkaline Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Primary Alkaline Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Primary Alkaline Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Primary Alkaline Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Primary Alkaline Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Primary Alkaline Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Primary Alkaline Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Primary Alkaline Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Primary Alkaline Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Primary Alkaline Batteries Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Primary Alkaline Batteries?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Primary Alkaline Batteries?

Key companies in the market include Duracell, Zhongyin (Ningbo) Battery, Panasonic, Guangzhou Tiger Head Battery Group, Energizer, Toshiba, NANFU Battery, GP Batteries, FDK, Changhong, Zheijiang Mustang, Maxell, Huatai Group, Xiamen 3-circles Sports Technology, Guangxi Wuzhou Sunwatt Battery.

3. What are the main segments of the Primary Alkaline Batteries?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17850 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Primary Alkaline Batteries," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Primary Alkaline Batteries report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Primary Alkaline Batteries?

To stay informed about further developments, trends, and reports in the Primary Alkaline Batteries, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence