Key Insights

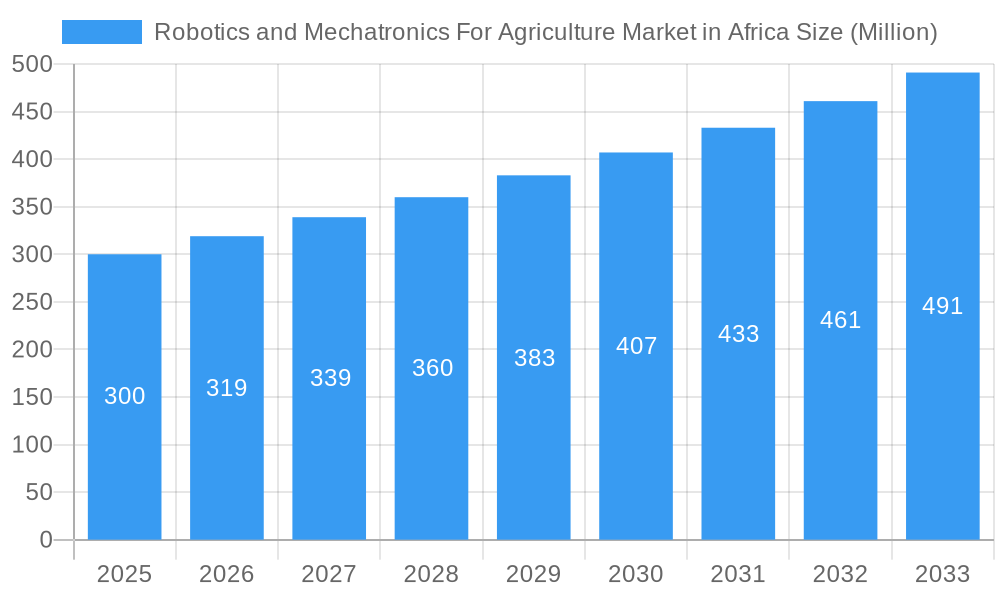

The African agricultural robotics and mechatronics market is poised for significant growth, driven by the increasing need to enhance productivity and efficiency in farming practices across the continent. A 6.20% CAGR from 2019-2033 suggests a substantial market expansion, particularly within the forecast period of 2025-2033. Key applications driving this growth include autonomous tractors, unmanned aerial vehicles (UAVs) for precision agriculture, robotic milking systems, and automated agrochemical application. The market's segmentation by application (animal farming, crop production, forest control) and type reflects the diverse needs of the African agricultural landscape. While the market size for 2025 is not explicitly provided, considering a conservative estimate based on the CAGR and the considerable market potential in Africa, we can expect a market valuation in the hundreds of millions of USD range by 2025. This is driven by factors such as rising labor costs, land scarcity, the need for sustainable farming practices, and government initiatives promoting technological advancements in agriculture. Challenges include high initial investment costs for robotic systems, limited access to technology and infrastructure in certain regions, and the need for skilled labor to operate and maintain these advanced technologies.

Robotics and Mechatronics For Agriculture Market in Africa Market Size (In Million)

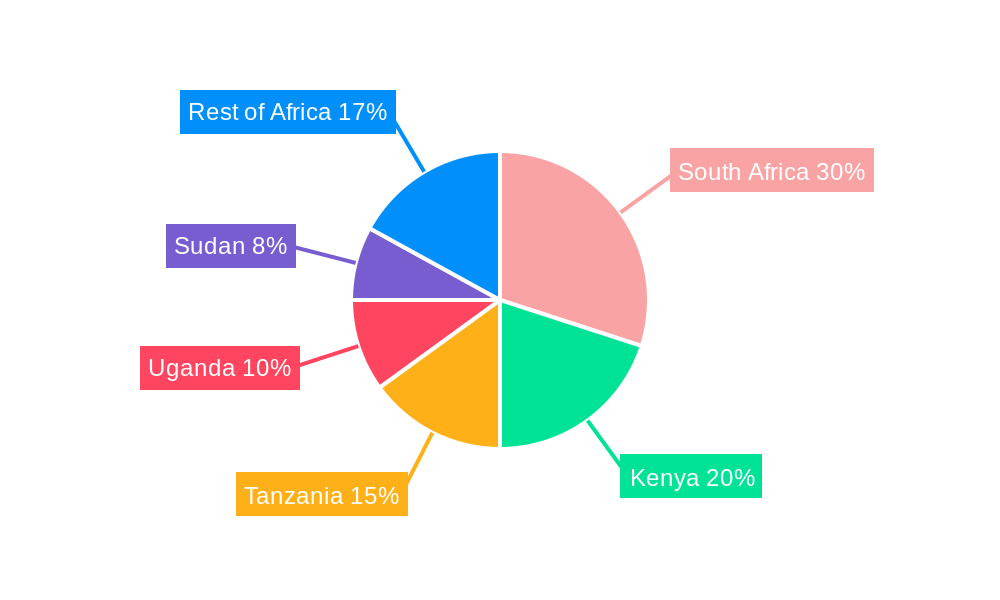

Despite these restraints, the market is experiencing rapid innovation. Companies such as Blue River Technology, Autonomous Tractor Corporation, and others are actively developing and deploying solutions tailored to the specific needs of African agriculture. The adoption of precision agriculture techniques, alongside improved connectivity and access to finance, will accelerate market penetration. Focusing on smaller, more affordable, and robust solutions adapted to the diverse conditions across Africa will be critical for sustained market growth. Regions like South Africa, Kenya, and Tanzania are likely to lead adoption initially, due to better infrastructure and existing agricultural technology presence. The overall outlook remains extremely positive, indicating considerable potential for growth and transformation within the African agricultural sector through the integration of robotics and mechatronics.

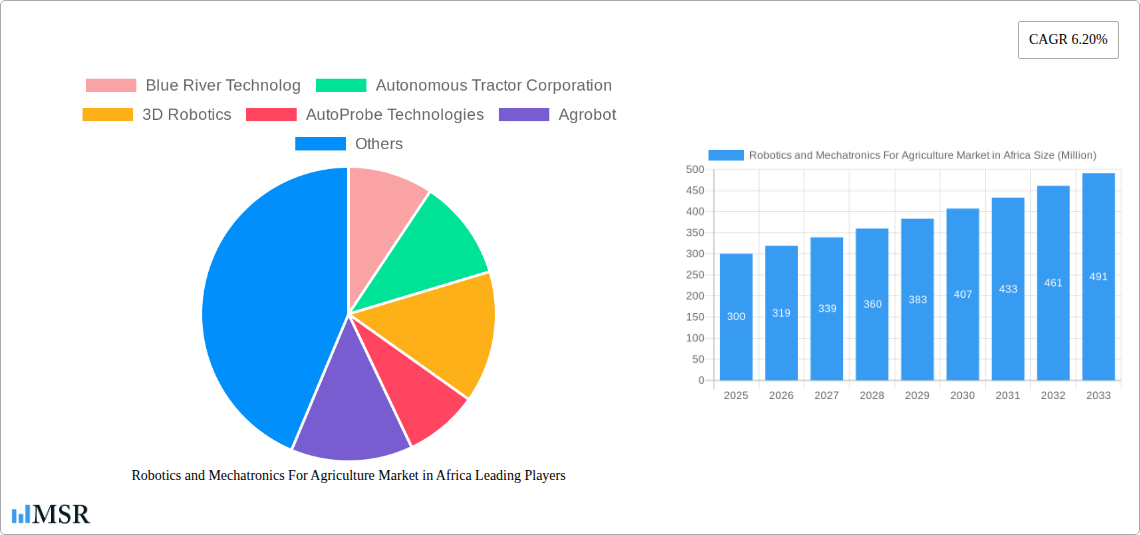

Robotics and Mechatronics For Agriculture Market in Africa Company Market Share

Robotics and Mechatronics for Agriculture Market in Africa: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Robotics and Mechatronics for Agriculture market in Africa, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and future opportunities within this rapidly evolving sector. The report meticulously examines market segmentation by application (Animal Farming, Crop Production, Forest Control, Others) and type (Autonomous Tractors, Unmanned Aerial Vehicles (UAV), Agrochemical Application, Robotic Milking, Others), delivering actionable intelligence for strategic decision-making.

Robotics and Mechatronics For Agriculture Market in Africa Market Concentration & Dynamics

The African Robotics and Mechatronics for Agriculture market exhibits a moderately fragmented landscape, with several key players vying for market share. While a few multinational corporations dominate certain segments, a significant portion is occupied by smaller, specialized firms focusing on niche applications. Market concentration is expected to shift slightly towards consolidation as larger companies acquire smaller players to expand their product portfolios and geographic reach.

Market Concentration Metrics (2025):

- Top 5 players hold approximately xx% of the market share.

- Average market share per player: xx%

- Number of M&A deals in the last 5 years: xx

Market Dynamics:

- Innovation Ecosystems: Africa's burgeoning tech startup scene is fostering innovation in agricultural robotics, with numerous incubators and accelerators supporting the development of novel solutions.

- Regulatory Frameworks: While regulations vary across African nations, there's a growing push towards harmonizing standards to facilitate market expansion. However, bureaucratic hurdles and inconsistent enforcement remain challenges.

- Substitute Products: Traditional farming methods continue to be prevalent, posing competitive pressure. However, the increasing cost-effectiveness and efficiency of robotic solutions are gradually shifting market preference.

- End-User Trends: Growing demand for increased food production, coupled with labor shortages and the need for improved efficiency, fuels the adoption of robotics in agriculture.

- M&A Activities: Consolidation is anticipated as larger players seek to acquire smaller firms with specialized technologies or strong regional presence. The number of M&A deals is expected to increase moderately over the forecast period.

Robotics and Mechatronics For Agriculture Market in Africa Industry Insights & Trends

The African Robotics and Mechatronics for Agriculture market is experiencing significant growth, driven by factors such as rising food demand, labor scarcity, and the increasing adoption of precision agriculture techniques. The market size in 2025 is estimated at $xx Million, with a CAGR of xx% projected from 2025 to 2033. This growth is largely fueled by technological advancements, particularly in AI, machine learning, and sensor technology, leading to more efficient and precise farming practices. Consumer behavior is shifting towards the acceptance of technology as a crucial component for improving agricultural yields and reducing operational costs. Key technological disruptions include the integration of IoT sensors for real-time monitoring, AI-powered decision-making systems, and the increased use of drones for surveying and spraying. Further, government initiatives promoting technological advancement in agriculture are acting as crucial market catalysts.

Key Markets & Segments Leading Robotics and Mechatronics For Agriculture Market in Africa

Dominant Regions and Segments:

- Dominant Region: East Africa and Southern Africa are currently showing the highest growth rates. The increasing investment in agricultural technology and supportive government policies play significant roles.

- Dominant Application Segment: Crop production currently dominates the market due to the widespread adoption of precision farming techniques, especially in large-scale farming operations. Animal farming is showing considerable growth potential.

- Dominant Type Segment: Autonomous tractors and UAVs are currently leading in terms of market share and growth, while robotic milking systems are rapidly gaining traction.

Drivers for Dominant Segments:

- Crop Production:

- High demand for increased food yields.

- Labor shortages in rural areas.

- Government initiatives promoting precision agriculture.

- Animal Farming:

- Growing demand for high-quality dairy products.

- Increased awareness of animal welfare.

- Focus on improving farm efficiency.

Robotics and Mechatronics For Agriculture Market in Africa Product Developments

Recent product developments focus on enhancing the autonomy, precision, and efficiency of robotic systems. This includes advancements in AI-powered navigation, improved sensor integration for real-time environmental monitoring, and the development of specialized tools for specific tasks, such as automated weeding, harvesting, and planting. Manufacturers are also focusing on developing cost-effective and robust solutions tailored to the specific needs and conditions of African farms. The competitive edge is established through superior performance, ease of use, and affordability.

Challenges in the Robotics and Mechatronics For Agriculture Market in Africa Market

The market faces several challenges, including high initial investment costs, limited access to financing, a lack of skilled labor, unreliable power supply, and inadequate infrastructure in many regions. The cost of importing necessary components also represents a significant hurdle. These factors create barriers to entry for smaller companies and limit the widespread adoption of robotic technologies.

Forces Driving Robotics and Mechatronics For Agriculture Market in Africa Growth

Key growth drivers include the increasing demand for food security, labor shortages, and government initiatives promoting technological advancements in agriculture. Rising investments in agricultural research and development, along with favorable government policies are supporting the adoption of advanced technologies. The expanding mobile network infrastructure and increasing access to internet connectivity are also contributing positively.

Long-Term Growth Catalysts in the Robotics and Mechatronics For Agriculture Market in Africa

Long-term growth will be driven by continued technological innovation, strategic partnerships between international and local companies, and government support for agricultural modernization. Further expansions into new markets and the development of tailored solutions for specific crops and farming practices will propel market expansion. The potential for integrating robotics with other precision agriculture technologies promises significant growth opportunities.

Emerging Opportunities in Robotics and Mechatronics For Agriculture Market in Africa

Emerging opportunities include the development of affordable and customized solutions for smallholder farmers, integrating robotics with other precision agriculture technologies (e.g., IoT sensors, data analytics), and expanding into new applications like pest control and disease monitoring. Leveraging AI and machine learning to optimize farm management practices offers immense potential.

Leading Players in the Robotics and Mechatronics For Agriculture Market in Africa Sector

- Blue River Technology

- Autonomous Tractor Corporation

- 3D Robotics

- AutoProbe Technologies

- Agrobot

- AGCO

- Amazonen-Werke

- Agribotix

- Autonomous Solutions (ASI)

Key Milestones in Robotics and Mechatronics For Agriculture Market in Africa Industry

- 2020: Launch of a government-funded program promoting the adoption of drones for agricultural surveying in Kenya.

- 2021: Partnership between a major agricultural company and a robotics startup to develop a robotic weeding system for maize cultivation in South Africa.

- 2022: Introduction of a new robotic milking system designed for smallholder dairy farmers in Tanzania.

- 2023: Successful field testing of an AI-powered precision spraying system for cotton farms in Egypt.

Strategic Outlook for Robotics and Mechatronics For Agriculture Market in Africa Market

The future of the African Robotics and Mechatronics for Agriculture market is bright, driven by strong growth potential across various segments. Strategic opportunities lie in developing tailored solutions for smallholder farmers, fostering partnerships to overcome infrastructure challenges, and actively engaging with government initiatives to promote technological adoption. The market’s long-term success hinges on addressing the challenges of affordability, accessibility, and infrastructure development.

Robotics and Mechatronics For Agriculture Market in Africa Segmentation

-

1. Application

- 1.1. Animal Farming

- 1.2. Crop Production

- 1.3. Forest Control

- 1.4. Others

-

2. Type

- 2.1. Autonomous Tractors

- 2.2. Unmanned Aerial Vehicles (UAV)

- 2.3. Agrochemical Application

- 2.4. Robotic Milking

- 2.5. Others

-

3. Geography

-

3.1. Africa

- 3.1.1. South Africa

- 3.1.2. Rest of Africa

-

3.1. Africa

-

4. Application

- 4.1. Animal Farming

- 4.2. Crop Production

- 4.3. Forest Control

- 4.4. Others

-

5. Type

- 5.1. Autonomous Tractors

- 5.2. Unmanned Aerial Vehicles (UAV)

- 5.3. Agrochemical Application

- 5.4. Robotic Milking

- 5.5. Others

Robotics and Mechatronics For Agriculture Market in Africa Segmentation By Geography

-

1. Africa

- 1.1. South Africa

- 1.2. Rest of Africa

Robotics and Mechatronics For Agriculture Market in Africa Regional Market Share

Geographic Coverage of Robotics and Mechatronics For Agriculture Market in Africa

Robotics and Mechatronics For Agriculture Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increased Adoption of Technology in Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Animal Farming

- 5.1.2. Crop Production

- 5.1.3. Forest Control

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Autonomous Tractors

- 5.2.2. Unmanned Aerial Vehicles (UAV)

- 5.2.3. Agrochemical Application

- 5.2.4. Robotic Milking

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Africa

- 5.3.1.1. South Africa

- 5.3.1.2. Rest of Africa

- 5.3.1. Africa

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Animal Farming

- 5.4.2. Crop Production

- 5.4.3. Forest Control

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Autonomous Tractors

- 5.5.2. Unmanned Aerial Vehicles (UAV)

- 5.5.3. Agrochemical Application

- 5.5.4. Robotic Milking

- 5.5.5. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Blue River Technolog

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Autonomous Tractor Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3D Robotics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AutoProbe Technologies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agrobot

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazonen-Werke

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Agribotix

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Autonomous Solutions (ASI)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Blue River Technolog

List of Figures

- Figure 1: Robotics and Mechatronics For Agriculture Market in Africa Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Robotics and Mechatronics For Agriculture Market in Africa Share (%) by Company 2025

List of Tables

- Table 1: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South Africa Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Africa Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robotics and Mechatronics For Agriculture Market in Africa?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Robotics and Mechatronics For Agriculture Market in Africa?

Key companies in the market include Blue River Technolog, Autonomous Tractor Corporation, 3D Robotics, AutoProbe Technologies, Agrobot, AGCO, Amazonen-Werke, Agribotix, Autonomous Solutions (ASI).

3. What are the main segments of the Robotics and Mechatronics For Agriculture Market in Africa?

The market segments include Application, Type, Geography, Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increased Adoption of Technology in Farming.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robotics and Mechatronics For Agriculture Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robotics and Mechatronics For Agriculture Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robotics and Mechatronics For Agriculture Market in Africa?

To stay informed about further developments, trends, and reports in the Robotics and Mechatronics For Agriculture Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence