Key Insights

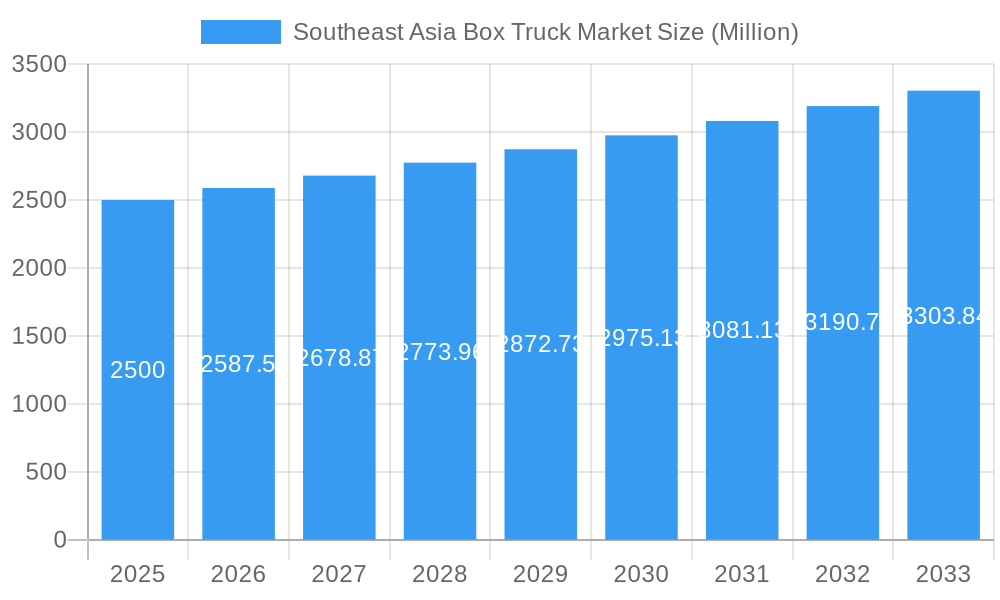

The Southeast Asia box truck market is projected to experience a Compound Annual Growth Rate (CAGR) of 3.5%. The market size was valued at $11.39 billion in the base year 2024. This growth is propelled by the expanding e-commerce sector, which demands efficient last-mile delivery solutions, and ongoing infrastructure development in rapidly urbanizing regions. The increasing adoption of refrigerated box trucks is also a key driver, fueled by the growing demand for temperature-sensitive goods. Challenges include fluctuating fuel prices and the high initial investment for electric vehicles. Stringent emission regulations may accelerate the adoption of electric and hybrid propulsion technologies. The market segment analysis indicates a strong preference for medium and heavy-duty box trucks, aligning with the logistical requirements of growing businesses and distribution networks. While internal combustion engine (ICE) trucks currently dominate, the market is anticipated to see a gradual increase in electric vehicle (EV) adoption as technology matures and charging infrastructure improves. Leading manufacturers such as Hino Motors and Isuzu are strategically expanding their product offerings and distribution channels to leverage market opportunities.

Southeast Asia Box Truck Market Market Size (In Billion)

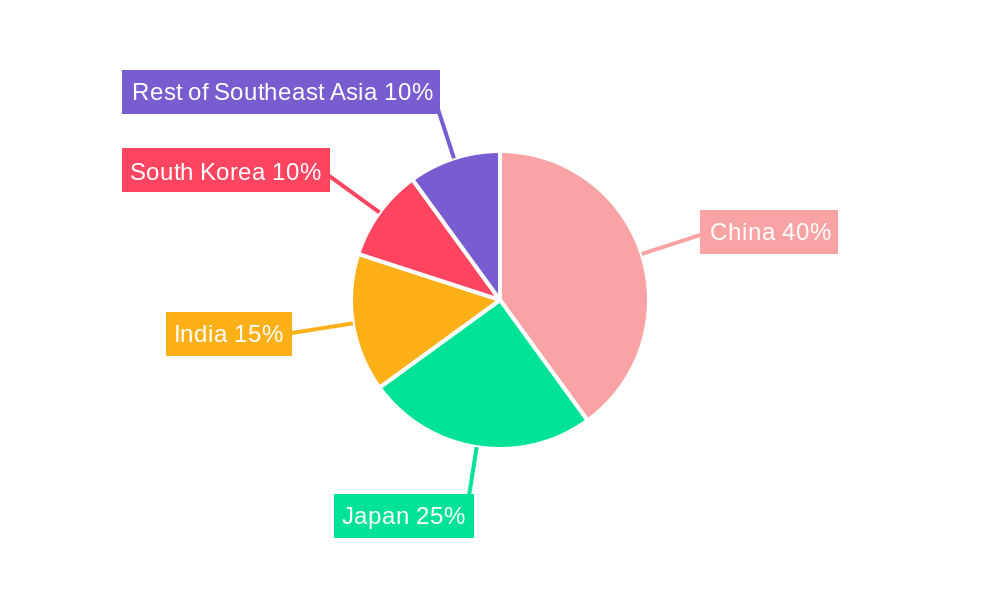

The ICE segment is expected to maintain its dominance in the near term, supported by existing infrastructure and lower upfront costs. However, the long-term forecast indicates robust growth for the electric segment, driven by government incentives for sustainable transportation, heightened environmental consciousness, and declining EV technology costs. China, Japan, and India are anticipated to be the leading markets within Southeast Asia, with South Korea and Taiwan also making significant contributions. The commercial application segment, propelled by the expansion of logistics and delivery services, represents the largest application area. Market participants should focus on adapting to evolving customer demands by providing tailored solutions and prioritizing innovation in telematics and fleet management to enhance operational efficiency, reduce costs, and improve customer satisfaction.

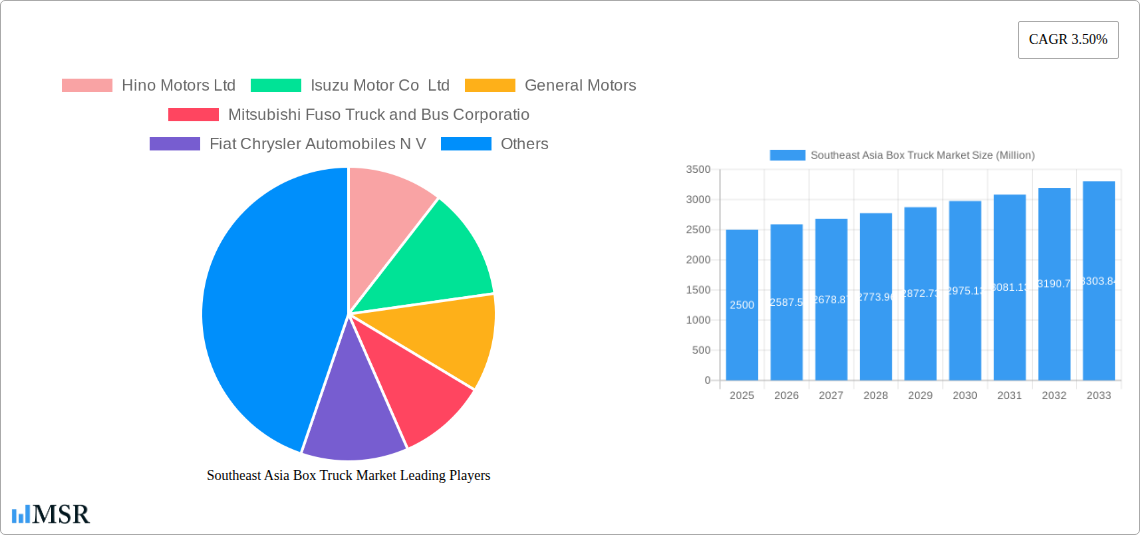

Southeast Asia Box Truck Market Company Market Share

Southeast Asia Box Truck Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Southeast Asia box truck market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report presents a robust overview of market trends, competitive landscapes, and future growth opportunities. The report covers key segments including refrigerated and non-refrigerated box trucks, light-duty, medium-duty, and heavy-duty vehicles, with analysis across internal combustion engine (ICE) and electric propulsion systems. Key players like Hino Motors Ltd, Isuzu Motor Co Ltd, General Motors, Mitsubishi Fuso Truck and Bus Corporation, Fiat Chrysler Automobiles N.V., Mercedes-Benz Group AG, Iveco Motor Group (CNH Industrial NV), and Ford Motor Company are thoroughly examined. The market size is projected to reach xx Million by 2033, demonstrating significant growth potential.

Southeast Asia Box Truck Market Concentration & Dynamics

The Southeast Asia box truck market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller regional players and the increasing entry of new entrants, particularly in the electric vehicle segment, is fostering competition. Innovation is driven by the need for fuel efficiency, emission reduction, and advanced safety features. Regulatory frameworks, varying across Southeast Asian nations, play a crucial role in shaping market dynamics. These regulations often focus on emission standards and vehicle safety. Substitute products, such as smaller delivery vans and motorcycles, pose a degree of competition, particularly in last-mile delivery. End-user trends, such as e-commerce expansion and the growth of the cold chain logistics industry, significantly influence demand.

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025.

- M&A Activity: The number of M&A deals in the Southeast Asia box truck market averaged xx per year during the historical period (2019-2024). This is expected to increase slightly in the forecast period due to consolidation efforts and technological advancements.

- Innovation Ecosystem: The market witnesses ongoing innovations in areas like lightweight materials, telematics integration, and alternative fuel technologies.

Southeast Asia Box Truck Market Industry Insights & Trends

The Southeast Asia box truck market is experiencing robust growth, driven by several key factors. The expanding e-commerce sector fuels demand for efficient last-mile delivery solutions. Furthermore, the growth of the cold chain logistics industry, particularly in the food and beverage sector, boosts the demand for refrigerated box trucks. Technological disruptions, including the adoption of electric and hybrid vehicles, are reshaping the industry. Consumer behavior is shifting towards environmentally friendly and technologically advanced vehicles. The market size is estimated to be xx Million in 2025, with a projected CAGR of xx% from 2025 to 2033. This growth is largely attributed to improving infrastructure and rising disposable incomes across the region. However, challenges like high initial investment costs for electric vehicles and varying infrastructure development across countries impact the overall market growth trajectory.

Key Markets & Segments Leading Southeast Asia Box Truck Market

Thailand, Indonesia, and Vietnam are currently the leading markets for box trucks in Southeast Asia, due to their robust economies and expanding logistics sectors. Within the segment breakdown:

- Type: Non-refrigerated box trucks dominate the market due to broader application across various industries. However, refrigerated box trucks are experiencing faster growth due to rising demand from the food and beverage sector.

- Capacity: Medium-duty box trucks hold the largest market share, catering to a wide range of transportation needs. Light-duty trucks are popular for last-mile delivery.

- Propulsion: Internal combustion engine (ICE) vehicles currently dominate the market; however, electric vehicles are gaining traction due to government incentives and environmental concerns.

- Application: The commercial sector (e.g., logistics, distribution) accounts for the majority of box truck demand.

Drivers of Dominance:

- Economic Growth: Rapid economic growth in key Southeast Asian countries drives increased industrial activity and trade, thus boosting demand for box trucks.

- Infrastructure Development: Ongoing infrastructure improvements, including road networks and port facilities, enhance logistics efficiency and facilitate the transportation of goods.

- E-commerce Boom: The surge in online shopping contributes significantly to the demand for efficient delivery solutions.

Southeast Asia Box Truck Market Product Developments

Recent product innovations focus on enhanced fuel efficiency, improved safety features (e.g., advanced driver-assistance systems), and the integration of telematics for fleet management. The introduction of electric box trucks addresses environmental concerns and offers long-term cost savings through reduced fuel expenses. These advancements provide competitive edges to manufacturers and improve operational efficiency for end-users. Manufacturers are also focusing on developing vehicles specifically tailored to the diverse road conditions and climate in Southeast Asia.

Challenges in the Southeast Asia Box Truck Market

The Southeast Asia box truck market faces several challenges. Varying regulatory frameworks across different countries create complexities for manufacturers in complying with emission standards and safety regulations. Supply chain disruptions, particularly concerning crucial components like batteries for electric vehicles, impact production and delivery timelines. Intense competition among established and emerging players adds pressure on pricing and profitability margins. These factors collectively impact market growth and expansion.

Forces Driving Southeast Asia Box Truck Market Growth

Key growth drivers include the rapid expansion of e-commerce, increasing urbanization, and the growth of the cold chain logistics sector. Government initiatives promoting sustainable transportation, along with investments in infrastructure development, further stimulate market growth. Technological advancements such as the development of electric vehicles and the integration of smart technologies also contribute to market expansion. For instance, the rise of e-commerce in countries like Indonesia and Vietnam significantly drives demand for efficient last-mile delivery solutions.

Long-Term Growth Catalysts in Southeast Asia Box Truck Market

Long-term growth will be fueled by continued investments in infrastructure, the increasing adoption of electric and alternative fuel vehicles, and the growth of cross-border trade within the ASEAN region. Strategic partnerships between manufacturers and logistics companies will optimize supply chains and enhance delivery efficiency. Expansion into underserved rural markets and the development of specialized box truck solutions for niche industries will also contribute to market growth.

Emerging Opportunities in Southeast Asia Box Truck Market

The market presents significant opportunities in developing electric vehicle infrastructure, integrating advanced telematics systems, and expanding into niche applications like specialized refrigerated transport for pharmaceuticals and perishable goods. Government incentives and supportive policies for sustainable transportation further enhance market potential. There's also a growing opportunity to cater to the increasing demand for last-mile delivery solutions in rapidly growing urban centers.

Leading Players in the Southeast Asia Box Truck Market Sector

Key Milestones in Southeast Asia Box Truck Market Industry

- August 2022: REE Automotive introduced the P7-B, a class 3 box truck with a maximum speed of 120 kph, a max range of 241 km, and up to 2,000 kg payload. This signifies a significant step towards the adoption of electric box trucks in the region.

- June 2022: MAN Truck & Bus (M) Sdn Bhd delivered its first batch of Euro V engine trucks, showcasing a commitment to emission reduction and technological advancement.

- April 2022: Mitsubishi Fuso introduced a new lineup of Euro 4-compliant light-duty and mid-duty trucks for Indonesia, demonstrating a response to evolving emission regulations.

Strategic Outlook for Southeast Asia Box Truck Market

The Southeast Asia box truck market is poised for significant growth over the forecast period, driven by strong economic growth, expanding e-commerce, and ongoing infrastructure development. Strategic opportunities exist for companies focusing on sustainable transportation solutions, technological innovation, and the development of efficient and cost-effective delivery systems. By capitalizing on these trends and adapting to evolving market dynamics, businesses can secure a competitive advantage and capture substantial market share in this promising sector.

Southeast Asia Box Truck Market Segmentation

-

1. Type

- 1.1. Refrigerated Box Trucks

- 1.2. Non-Refrigerated Box Trucks

-

2. Capacity Type

- 2.1. Light-Duty Box Trucks

- 2.2. Medium and Heavy-Duty Box Trucks

-

3. Propulsion

- 3.1. Internal Combustion Engine

- 3.2. Electric

-

4. Application

- 4.1. Industrial

- 4.2. Commercial

- 4.3. Other Applications

-

5. Geography

- 5.1. Thailand

- 5.2. Indonesia

- 5.3. Vietnam

- 5.4. Malayasia

- 5.5. Singapore

- 5.6. Philippines

- 5.7. Rest of Southeast Asia

Southeast Asia Box Truck Market Segmentation By Geography

- 1. Thailand

- 2. Indonesia

- 3. Vietnam

- 4. Malayasia

- 5. Singapore

- 6. Philippines

- 7. Rest of Southeast Asia

Southeast Asia Box Truck Market Regional Market Share

Geographic Coverage of Southeast Asia Box Truck Market

Southeast Asia Box Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Electric Box Trucks are dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refrigerated Box Trucks

- 5.1.2. Non-Refrigerated Box Trucks

- 5.2. Market Analysis, Insights and Forecast - by Capacity Type

- 5.2.1. Light-Duty Box Trucks

- 5.2.2. Medium and Heavy-Duty Box Trucks

- 5.3. Market Analysis, Insights and Forecast - by Propulsion

- 5.3.1. Internal Combustion Engine

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Industrial

- 5.4.2. Commercial

- 5.4.3. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Thailand

- 5.5.2. Indonesia

- 5.5.3. Vietnam

- 5.5.4. Malayasia

- 5.5.5. Singapore

- 5.5.6. Philippines

- 5.5.7. Rest of Southeast Asia

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Thailand

- 5.6.2. Indonesia

- 5.6.3. Vietnam

- 5.6.4. Malayasia

- 5.6.5. Singapore

- 5.6.6. Philippines

- 5.6.7. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Thailand Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Refrigerated Box Trucks

- 6.1.2. Non-Refrigerated Box Trucks

- 6.2. Market Analysis, Insights and Forecast - by Capacity Type

- 6.2.1. Light-Duty Box Trucks

- 6.2.2. Medium and Heavy-Duty Box Trucks

- 6.3. Market Analysis, Insights and Forecast - by Propulsion

- 6.3.1. Internal Combustion Engine

- 6.3.2. Electric

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Industrial

- 6.4.2. Commercial

- 6.4.3. Other Applications

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Thailand

- 6.5.2. Indonesia

- 6.5.3. Vietnam

- 6.5.4. Malayasia

- 6.5.5. Singapore

- 6.5.6. Philippines

- 6.5.7. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Indonesia Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Refrigerated Box Trucks

- 7.1.2. Non-Refrigerated Box Trucks

- 7.2. Market Analysis, Insights and Forecast - by Capacity Type

- 7.2.1. Light-Duty Box Trucks

- 7.2.2. Medium and Heavy-Duty Box Trucks

- 7.3. Market Analysis, Insights and Forecast - by Propulsion

- 7.3.1. Internal Combustion Engine

- 7.3.2. Electric

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Industrial

- 7.4.2. Commercial

- 7.4.3. Other Applications

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Thailand

- 7.5.2. Indonesia

- 7.5.3. Vietnam

- 7.5.4. Malayasia

- 7.5.5. Singapore

- 7.5.6. Philippines

- 7.5.7. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Vietnam Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Refrigerated Box Trucks

- 8.1.2. Non-Refrigerated Box Trucks

- 8.2. Market Analysis, Insights and Forecast - by Capacity Type

- 8.2.1. Light-Duty Box Trucks

- 8.2.2. Medium and Heavy-Duty Box Trucks

- 8.3. Market Analysis, Insights and Forecast - by Propulsion

- 8.3.1. Internal Combustion Engine

- 8.3.2. Electric

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Industrial

- 8.4.2. Commercial

- 8.4.3. Other Applications

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Thailand

- 8.5.2. Indonesia

- 8.5.3. Vietnam

- 8.5.4. Malayasia

- 8.5.5. Singapore

- 8.5.6. Philippines

- 8.5.7. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Malayasia Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Refrigerated Box Trucks

- 9.1.2. Non-Refrigerated Box Trucks

- 9.2. Market Analysis, Insights and Forecast - by Capacity Type

- 9.2.1. Light-Duty Box Trucks

- 9.2.2. Medium and Heavy-Duty Box Trucks

- 9.3. Market Analysis, Insights and Forecast - by Propulsion

- 9.3.1. Internal Combustion Engine

- 9.3.2. Electric

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Industrial

- 9.4.2. Commercial

- 9.4.3. Other Applications

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. Thailand

- 9.5.2. Indonesia

- 9.5.3. Vietnam

- 9.5.4. Malayasia

- 9.5.5. Singapore

- 9.5.6. Philippines

- 9.5.7. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Singapore Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Refrigerated Box Trucks

- 10.1.2. Non-Refrigerated Box Trucks

- 10.2. Market Analysis, Insights and Forecast - by Capacity Type

- 10.2.1. Light-Duty Box Trucks

- 10.2.2. Medium and Heavy-Duty Box Trucks

- 10.3. Market Analysis, Insights and Forecast - by Propulsion

- 10.3.1. Internal Combustion Engine

- 10.3.2. Electric

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Industrial

- 10.4.2. Commercial

- 10.4.3. Other Applications

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. Thailand

- 10.5.2. Indonesia

- 10.5.3. Vietnam

- 10.5.4. Malayasia

- 10.5.5. Singapore

- 10.5.6. Philippines

- 10.5.7. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Philippines Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Refrigerated Box Trucks

- 11.1.2. Non-Refrigerated Box Trucks

- 11.2. Market Analysis, Insights and Forecast - by Capacity Type

- 11.2.1. Light-Duty Box Trucks

- 11.2.2. Medium and Heavy-Duty Box Trucks

- 11.3. Market Analysis, Insights and Forecast - by Propulsion

- 11.3.1. Internal Combustion Engine

- 11.3.2. Electric

- 11.4. Market Analysis, Insights and Forecast - by Application

- 11.4.1. Industrial

- 11.4.2. Commercial

- 11.4.3. Other Applications

- 11.5. Market Analysis, Insights and Forecast - by Geography

- 11.5.1. Thailand

- 11.5.2. Indonesia

- 11.5.3. Vietnam

- 11.5.4. Malayasia

- 11.5.5. Singapore

- 11.5.6. Philippines

- 11.5.7. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Southeast Asia Southeast Asia Box Truck Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Refrigerated Box Trucks

- 12.1.2. Non-Refrigerated Box Trucks

- 12.2. Market Analysis, Insights and Forecast - by Capacity Type

- 12.2.1. Light-Duty Box Trucks

- 12.2.2. Medium and Heavy-Duty Box Trucks

- 12.3. Market Analysis, Insights and Forecast - by Propulsion

- 12.3.1. Internal Combustion Engine

- 12.3.2. Electric

- 12.4. Market Analysis, Insights and Forecast - by Application

- 12.4.1. Industrial

- 12.4.2. Commercial

- 12.4.3. Other Applications

- 12.5. Market Analysis, Insights and Forecast - by Geography

- 12.5.1. Thailand

- 12.5.2. Indonesia

- 12.5.3. Vietnam

- 12.5.4. Malayasia

- 12.5.5. Singapore

- 12.5.6. Philippines

- 12.5.7. Rest of Southeast Asia

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Hino Motors Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Isuzu Motor Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Motors

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Mitsubishi Fuso Truck and Bus Corporatio

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fiat Chrysler Automobiles N V

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Mercedes-Benz Group AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Iveco Motor Group (CNH Industrial NV)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ford Motor Company

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Hino Motors Ltd

List of Figures

- Figure 1: Southeast Asia Box Truck Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Box Truck Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 3: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 4: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Box Truck Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 9: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 10: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 15: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 16: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 21: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 22: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 27: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 28: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 33: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 34: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 35: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 36: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 38: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 39: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 40: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 42: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Southeast Asia Box Truck Market Revenue billion Forecast, by Type 2020 & 2033

- Table 44: Southeast Asia Box Truck Market Revenue billion Forecast, by Capacity Type 2020 & 2033

- Table 45: Southeast Asia Box Truck Market Revenue billion Forecast, by Propulsion 2020 & 2033

- Table 46: Southeast Asia Box Truck Market Revenue billion Forecast, by Application 2020 & 2033

- Table 47: Southeast Asia Box Truck Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Southeast Asia Box Truck Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Box Truck Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the Southeast Asia Box Truck Market?

Key companies in the market include Hino Motors Ltd, Isuzu Motor Co Ltd, General Motors, Mitsubishi Fuso Truck and Bus Corporatio, Fiat Chrysler Automobiles N V, Mercedes-Benz Group AG, Iveco Motor Group (CNH Industrial NV), Ford Motor Company.

3. What are the main segments of the Southeast Asia Box Truck Market?

The market segments include Type, Capacity Type, Propulsion, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.39 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Electric Box Trucks are dominating the market.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

August 2022: REE Automotive introduced P7-B, a class 3 box truck built on a P7 cab chassis. The box truck has a maximum speed of 120 kph, a max range of 241 km, and up to 2,000 kg payload.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Box Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Box Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Box Truck Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Box Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence