Key Insights

The Spanish Third-Party Logistics (3PL) market, valued at €14.46 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.03% from 2025 to 2033. This expansion is primarily propelled by the burgeoning e-commerce sector, which drives demand for sophisticated warehousing and distribution. Key industries such as manufacturing and automotive also rely on 3PL providers for optimized domestic and international supply chain management. The increasing adoption of advanced technologies, including Warehouse Management Systems (WMS) and Transportation Management Systems (TMS), is enhancing operational efficiency and supply chain visibility. Despite potential economic volatility and labor challenges, the Spanish 3PL market presents substantial growth opportunities for both established and emerging companies.

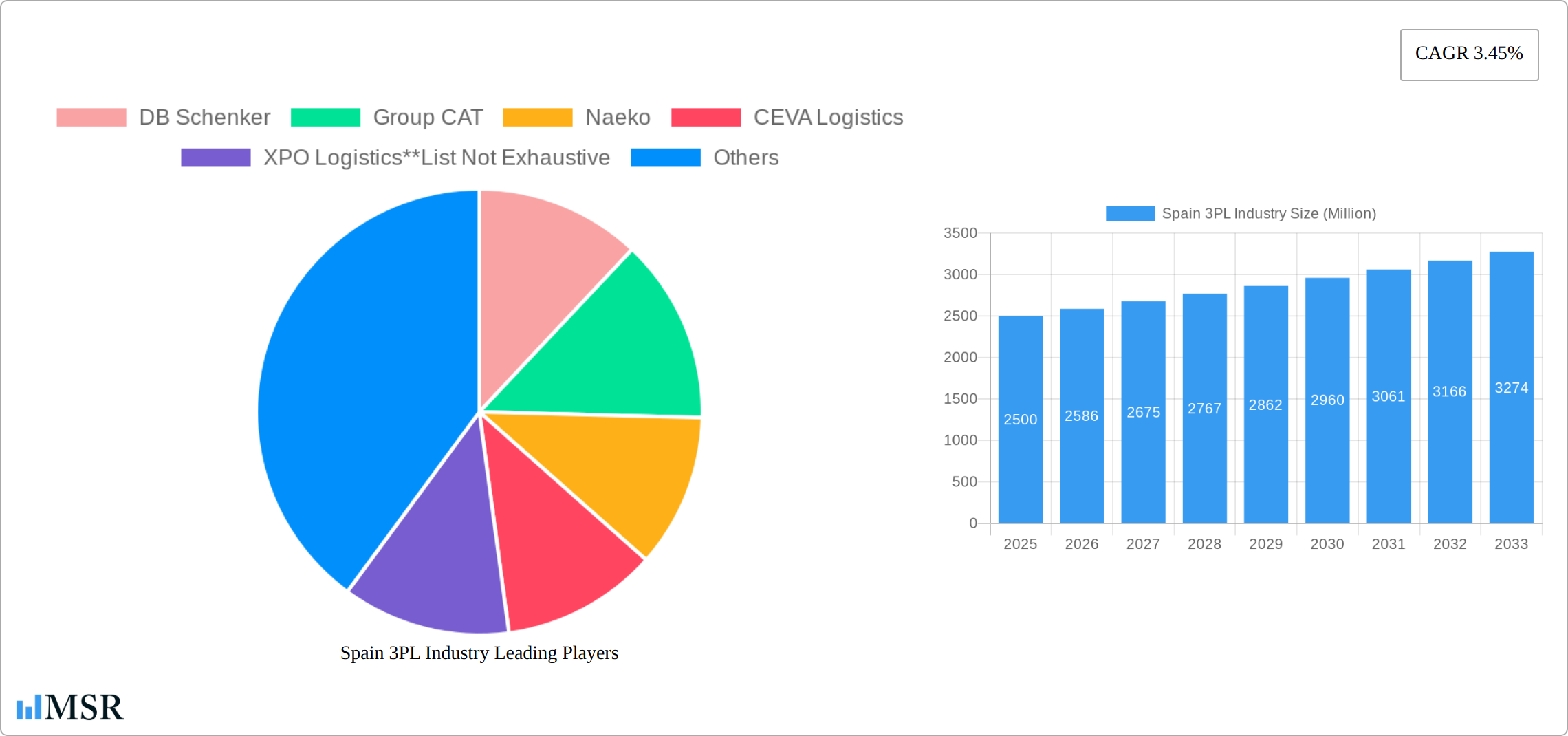

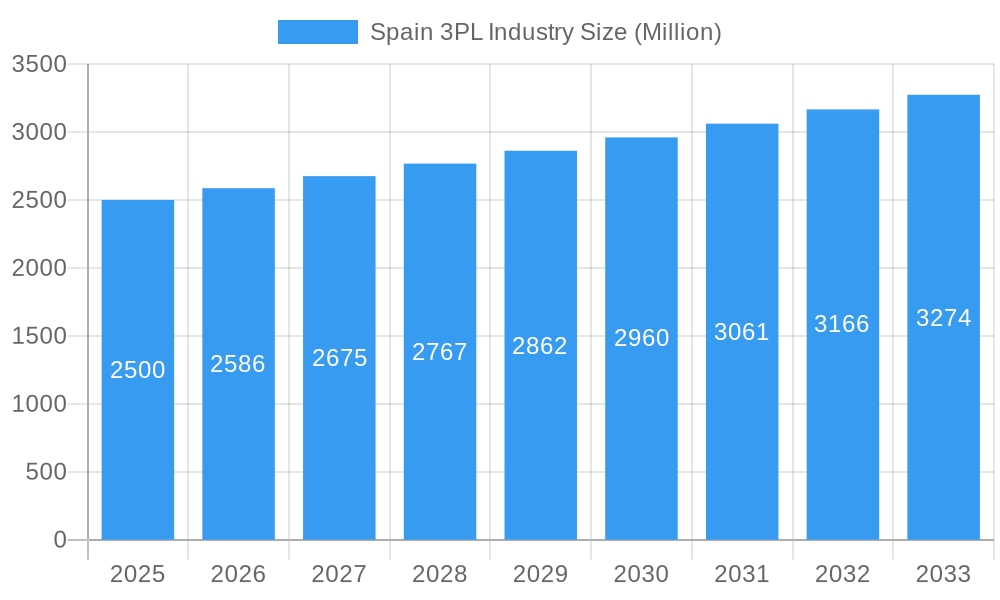

Spain 3PL Industry Market Size (In Billion)

The distributive trade segment, significantly influenced by e-commerce expansion, represents a core market driver. International transportation management is also experiencing robust growth as Spanish enterprises extend their global presence. Leading providers such as DB Schenker and Grupo CAT are strategically positioned to capitalize on these trends. Value-added services, encompassing specialized warehousing and distribution for sectors like pharmaceuticals and healthcare, are emerging as significant growth avenues. Continued development in manufacturing, automotive, and oil & gas will further bolster the Spanish 3PL market throughout the forecast period. Intense competition will likely persist, with a focus on technological innovation and specialized service offerings for market differentiation.

Spain 3PL Industry Company Market Share

Spain 3PL Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Spain 3PL industry, offering invaluable insights for stakeholders including logistics providers, investors, and businesses operating within the Spanish market. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, key players, emerging trends, and future growth potential. The report leverages extensive data analysis to project a market size of xx Million by 2033, showcasing a compelling CAGR of xx%.

Spain 3PL Industry Market Concentration & Dynamics

The Spain 3PL market exhibits a moderately concentrated structure, with a few major players holding significant market share. While precise figures are proprietary to the full report, estimates suggest that the top 5 players (including DB Schenker, CEVA Logistics, XPO Logistics, and others) collectively account for approximately xx% of the total market. This concentration is influenced by factors such as economies of scale, technological capabilities, and established client relationships.

Market Share: The exact market share of each company is detailed in the full report. However, we can anticipate a relatively uneven distribution, with larger multinational companies dominating certain segments.

M&A Activities: The past five years have seen a moderate level of M&A activity, with xx major deals recorded in the historical period (2019-2024). This activity reflects the strategic consolidation and expansion observed within the industry, especially in the value-added warehousing and distribution sector.

Innovation Ecosystems: Spain's 3PL sector is increasingly fostering innovation, with investments in technologies like automation and AI driving operational efficiencies and enhancing service offerings. The regulatory environment, while generally supportive, presents some challenges for rapid innovation.

Regulatory Frameworks: Spanish regulations, particularly regarding customs and transport, influence the operational strategies of 3PL providers. Compliance and adherence to these regulations are crucial for maintaining market competitiveness.

Substitute Products: While direct substitutes are limited, advancements in technology and the rise of e-commerce are presenting indirect substitution. This is driving the need for 3PL providers to adapt and offer a broad range of value-added services.

End-User Trends: The growing preference for e-commerce and omnichannel distribution strategies is driving demand for flexible and efficient 3PL solutions, particularly in the distributive trade and pharma & healthcare sectors.

Spain 3PL Industry Industry Insights & Trends

The Spanish 3PL market is poised for significant growth, driven by factors such as the expansion of e-commerce, increasing globalization, and the need for supply chain resilience. The market size is estimated at xx Million in 2025, projected to reach xx Million by 2033. Key factors contributing to this expansion include:

E-commerce Boom: The rapid growth of online retail is a primary driver, creating significant demand for efficient warehousing, distribution, and last-mile delivery services.

Technological Disruptions: The adoption of automation technologies such as automated storage and retrieval systems (AS/RS) and AI-powered solutions is enhancing operational efficiency and improving service delivery.

Globalization and International Trade: Spain's strategic geographic location and its participation in global trade networks fuel demand for international transportation management services.

Supply Chain Optimization: Businesses are increasingly focusing on optimizing their supply chains to reduce costs, improve responsiveness, and enhance customer satisfaction. This is driving demand for integrated 3PL solutions.

Evolving Consumer Behaviors: Consumers are demanding faster delivery times and enhanced transparency throughout the supply chain, which further fuels the growth of 3PL services.

Key Markets & Segments Leading Spain 3PL Industry

The Spanish 3PL market is characterized by dynamic segment dominance, reflecting evolving industry needs and strategic investments.

By Service:

- Value-added Warehousing and Distribution: This segment is experiencing the most significant expansion, propelled by the robust growth of e-commerce and the increasing demand for sophisticated, technology-driven logistics solutions. This includes services like kitting, customized packaging, and inventory management optimization.

- International Transportation Management: Leveraging Spain's strategic geographic location as a vital nexus connecting Europe, North Africa, and Latin America, this segment is witnessing substantial growth. This encompasses multimodal freight forwarding, customs brokerage, and global supply chain visibility solutions.

- Domestic Transportation Management: While continuing to be a foundational element of the 3PL offering, this segment is experiencing more measured growth compared to its international and value-added counterparts. Focus is shifting towards efficiency gains through network optimization and fleet modernization.

By End User:

- Distributive Trade (Wholesale and Retail including e-commerce): This remains the largest and most influential end-user segment. The relentless expansion of e-commerce and the imperative for seamless omnichannel fulfillment strategies underscore its critical importance to 3PL providers.

- Manufacturing & Automotive: Benefiting from Spain's established industrial prowess and continued inward investment, particularly within the automotive sector, this segment demands specialized inbound and outbound logistics, just-in-time delivery, and sophisticated supply chain integration.

- Pharma & Healthcare: This high-stakes segment necessitates stringent adherence to compliance and specialized handling. The demand for temperature-controlled warehousing, secure transportation, and meticulous inventory management for pharmaceuticals and medical supplies is a key driver.

Growth Drivers:

- Economic Resilience and Growth: A stable and growing Spanish economy directly translates into increased consumer spending and business activity, stimulating investment in logistics infrastructure and advanced supply chain capabilities.

- Infrastructure Modernization: Continuous strategic investments in Spain's transportation infrastructure, including enhanced road networks, modernized port facilities, high-speed rail expansion, and airport cargo hubs, are crucial enablers of efficient and cost-effective logistics operations.

- Proactive Government Initiatives: Supportive government policies, digital transformation incentives, and regulatory frameworks designed to foster innovation and sustainability within the logistics sector play a pivotal role in propelling industry development.

Spain 3PL Industry Product Developments

The Spanish 3PL sector is at the forefront of embracing innovation to boost efficiency and enhance competitive advantage. A notable example is the increasing adoption of cutting-edge automation technologies, exemplified by Factor 5's investment in AutoStore™ systems. This integration of advanced robotics is crucial for optimizing e-commerce order fulfillment and warehousing operations. Looking ahead, the industry anticipates deeper integration of Artificial Intelligence (AI) and advanced data analytics to drive unparalleled operational optimization, enable predictive logistics, and deliver highly personalized service offerings tailored to client needs.

Challenges in the Spain 3PL Industry Market

The Spanish 3PL market navigates a landscape marked by intense competition, persistent labor shortages, and escalating operational costs, including fuel price volatility. Furthermore, the industry is susceptible to global supply chain disruptions stemming from geopolitical events and natural disasters, which impact operational fluidity and cost structures. Navigating evolving regulatory environments and the imperative for continuous adaptation to rapid technological advancements also present significant challenges, all of which can affect profitability and hinder growth trajectories.

Forces Driving Spain 3PL Industry Growth

The burgeoning e-commerce sector stands as a primary growth engine, coupled with the escalating demand for specialized logistics services such as cold chain solutions vital for the pharmaceutical industry. Ongoing advancements in logistics technology, including automation and digital platforms, are further accelerating this positive momentum. Significant government investment in infrastructure upgrades, alongside the expansion of cross-border e-commerce and the strategic adoption of omnichannel distribution models, are creating a sustained demand for agile, reliable, and technologically adept 3PL services.

Long-Term Growth Catalysts in Spain 3PL Industry

Long-term growth will be driven by strategic partnerships, the adoption of innovative technologies (such as blockchain and IoT), and expansion into new markets and customer segments. The industry will also benefit from a growing focus on sustainability and green logistics initiatives. Further integration across the supply chain and the development of sophisticated data analytics capabilities will also fuel ongoing success.

Emerging Opportunities in Spain 3PL Industry

Significant opportunities lie within specialized segments, including the expanding cold chain logistics for pharmaceuticals and the development of innovative last-mile delivery solutions tailored for the e-commerce boom. The growing emphasis on sustainability and the circular economy is also opening doors for 3PL providers to excel in reverse logistics services. Furthermore, continued investment in pioneering technological solutions, such as AI-driven route optimization, predictive analytics for inventory management, and the development of smart warehousing, presents substantial avenues for future growth and market leadership.

Leading Players in the Spain 3PL Industry Sector

- DB Schenker

- Group CAT

- Naeko

- CEVA Logistics

- XPO Logistics

- OIA Global

- Carcaba

- TIBA

- Rhenus Logistics

- DSV

- Decal FM Logistics

Key Milestones in Spain 3PL Industry Industry

- June 2023: Factor 5 implements an AutoStore™ automated system, enhancing order processing and competitiveness.

- April 2023: CEVA Logistics expands its finished vehicle logistics (FVL) services through the acquisition of BERGÉ GEFCO's remaining 50%.

Strategic Outlook for Spain 3PL Industry Market

The Spanish 3PL market presents a significant growth opportunity, particularly for providers who embrace technological advancements, offer specialized services, and form strategic partnerships. Future market potential lies in providing efficient, scalable, and sustainable solutions, with an emphasis on innovation and adaptability to meet the dynamic needs of both businesses and consumers.

Spain 3PL Industry Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Manufacturing & Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharma & Healthcare

- 2.5. Construction

- 2.6. Other End Users

Spain 3PL Industry Segmentation By Geography

- 1. Spain

Spain 3PL Industry Regional Market Share

Geographic Coverage of Spain 3PL Industry

Spain 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. Growth in Refrigerated Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing & Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharma & Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Group CAT

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Naeko

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CEVA Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XPO Logistics**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OIA Global

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carcaba

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TIBA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DSV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Decal FM Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Spain 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Spain 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Spain 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain 3PL Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Spain 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Spain 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain 3PL Industry?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the Spain 3PL Industry?

Key companies in the market include DB Schenker, Group CAT, Naeko, CEVA Logistics, XPO Logistics**List Not Exhaustive, OIA Global, Carcaba, TIBA, Rhenus Logistics, DSV, Decal FM Logistics.

3. What are the main segments of the Spain 3PL Industry?

The market segments include Service, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.46 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Growth in Refrigerated Logistics.

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

June 2023: Third-party logistics operator Factor 5 recently commissioned a goods-to-person solution featuring an AutoStore™ automated storage and picking system provided by intelligent automation solution provider Dematic. The solution enhances its order process for perfumes and cosmetics products with the aim of boosting sales and strengthening its ability to compete in the long term. The solution went live in March at Factor 5’s Alovera site northeast of Madrid.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain 3PL Industry?

To stay informed about further developments, trends, and reports in the Spain 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence