Key Insights

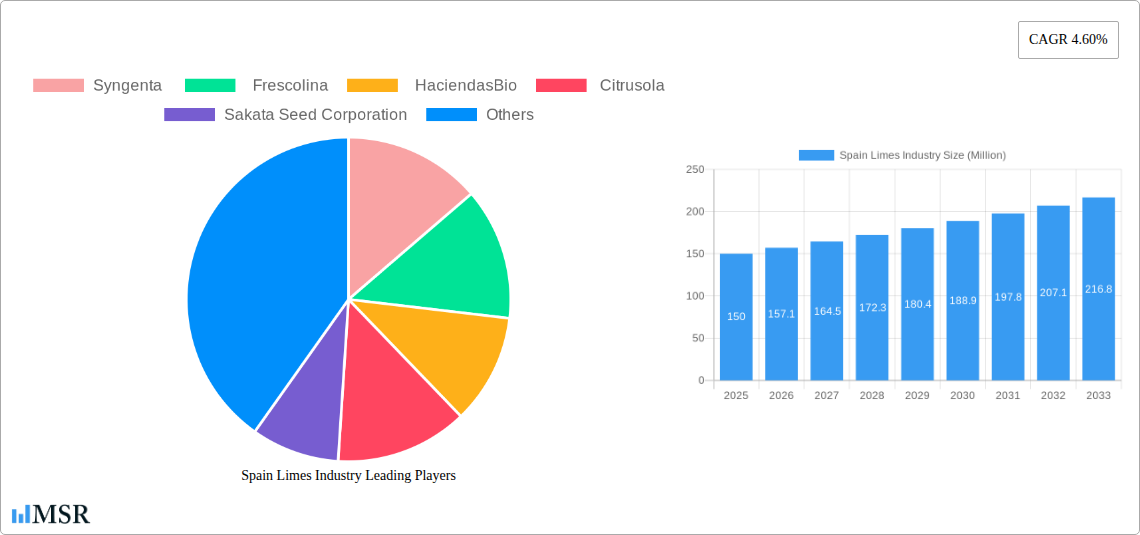

The Spain lime industry, valued at approximately €150 million in 2025, exhibits a steady growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 4.60% from 2025 to 2033. This growth is fueled by rising consumer demand for fresh, healthy produce, increasing popularity of lime-based beverages and culinary applications, and Spain's favorable climate for lime cultivation. Key players like Syngenta, Frescolina, and HaciendasBio contribute significantly to production, leveraging their expertise in high-yield varieties and efficient farming practices. Export opportunities are crucial, with significant volumes shipped to other European markets and beyond, capitalizing on the growing global demand for Spanish agricultural produce. However, challenges remain, including potential price volatility influenced by weather patterns and global market fluctuations, and competition from other lime-producing regions. The industry's success will depend on the ability of companies to adapt to evolving consumer preferences, implement sustainable farming practices, and effectively manage supply chains to meet increasing demand.

Spain Limes Industry Market Size (In Million)

Further segment analysis reveals that Spain's lime market is primarily driven by strong domestic consumption, coupled with significant export volumes. Production is concentrated in specific regions, which are strategically positioned to optimize transport and distribution networks. While precise figures on import/export volumes are unavailable, the strong growth projection implies a consistent rise in both production and international trade. Companies are likely focusing on premiumization strategies, offering specialized lime varieties or products catering to specific consumer needs (e.g., organic limes). The market is likely to see increased automation and technological advancements aimed at improving efficiency and yield. The long-term outlook for the Spanish lime industry is positive, underpinned by consistent growth and the potential for further expansion into new markets.

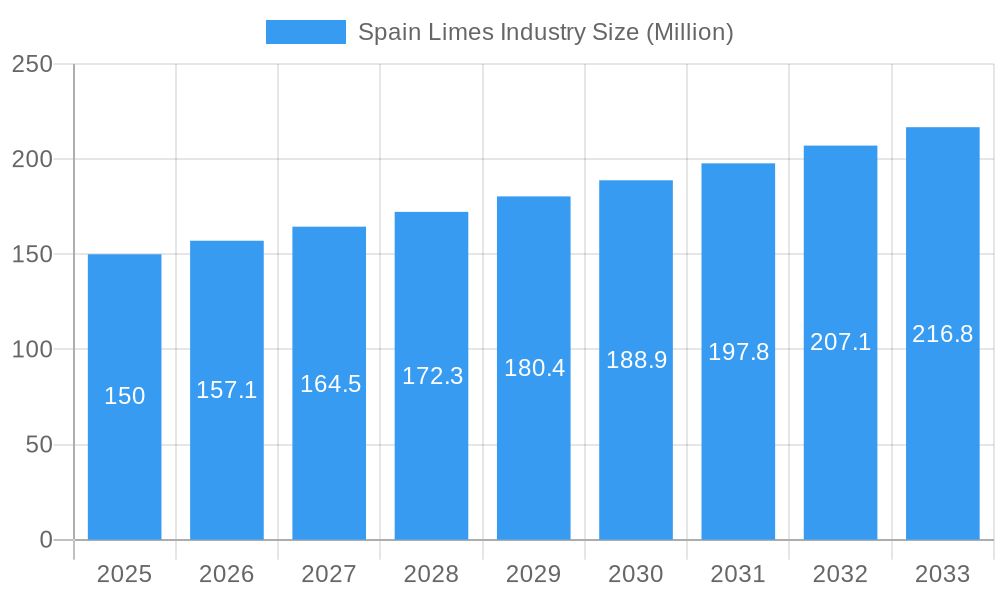

Spain Limes Industry Company Market Share

Spain Limes Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spain limes industry, offering invaluable insights for stakeholders across the value chain. From production and consumption patterns to export dynamics and future growth projections, this report covers all key aspects of this vibrant market. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for businesses, investors, and policymakers seeking a clear understanding of the current market landscape and future opportunities within the Spanish lime sector.

Spain Limes Industry Market Concentration & Dynamics

The Spanish limes industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. Frescolina, Citrus Juan, and Grupo Agrotecnología are estimated to collectively account for approximately xx% of the market in 2025. However, a substantial number of smaller-scale producers also contribute to the overall production volume.

The industry's innovation ecosystem is moderately active, with ongoing research and development focusing on improving lime varieties, enhancing yields, and optimizing post-harvest handling. Regulatory frameworks are generally supportive, focusing on food safety and environmental sustainability. Substitute products, such as lemons and other citrus fruits, exert some competitive pressure. End-user trends indicate a growing preference for high-quality, sustainably produced limes, driving demand for premium varieties. M&A activity has been relatively modest in recent years, with an estimated xx M&A deals concluded between 2019 and 2024.

Spain Limes Industry Industry Insights & Trends

The Spanish limes industry is characterized by fluctuating market growth, influenced by factors such as weather patterns, global demand, and competition from other producing regions. The market size was valued at approximately €xx Million in 2024 and is projected to reach €xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in irrigation and pest control techniques, are enhancing productivity and efficiency. Evolving consumer behaviors, including a growing preference for organic and sustainably produced limes, are also influencing market dynamics. Increased health consciousness and the rising use of limes in culinary applications and beverages are key growth drivers.

Key Markets & Segments Leading Spain Limes Industry

- Spain: Production Analysis: Andalusia and Valencia are the dominant lime-producing regions in Spain, accounting for approximately xx% of the total production volume.

- Spain: Consumption Analysis & Market Value: Domestic consumption of limes in Spain is significant, driven by robust demand from the food service and processing industries. The market value for domestic consumption was estimated at €xx Million in 2024.

- Import Analysis (Volume & Value): Spain imports a relatively small volume of limes, primarily to supplement domestic production and cater to specific market demands. Import value in 2024 was approximately €xx Million.

- Export Analysis (Volume & Value): Spain exports a substantial volume of limes, primarily to European Union countries. The export value was estimated at €xx Million in 2024.

- Price Trend Analysis: Lime prices are subject to seasonal variations and influenced by factors such as supply, demand, and global market conditions. The average price per kg in 2024 was approximately €xx.

Drivers for Dominance:

- Favorable climatic conditions.

- Established infrastructure and supply chains.

- Government support for the agricultural sector.

Spain Limes Industry Product Developments

Product innovation in the Spanish limes industry focuses on developing new lime varieties with enhanced flavor, juiciness, and disease resistance. Technological advancements in post-harvest handling, such as improved storage and transportation methods, are extending the shelf life of limes and reducing waste. These developments are enhancing the competitiveness of Spanish limes in the global market.

Challenges in the Spain Limes Industry Market

The Spanish limes industry faces several challenges, including:

- Climate Change: Increasingly unpredictable weather patterns (droughts, floods) impact yields and production costs. This has led to an estimated xx% reduction in yields in some regions during recent years.

- Competition: Intense competition from other lime-producing countries, particularly from countries in South America, exerts pressure on prices and market share.

- Labor Shortages: Finding sufficient skilled labor for harvesting and post-harvest operations is becoming increasingly difficult, impacting labor costs.

Forces Driving Spain Limes Industry Growth

Key growth drivers include:

- Rising Consumer Demand: Growing demand for limes in both domestic and international markets due to increased consumption in food and beverages.

- Technological Advancements: Improvements in farming practices, pest control, and post-harvest handling lead to better quality and increased yield.

- Government Support: Government policies promoting sustainable agriculture and exports are fostering industry development.

Long-Term Growth Catalysts in Spain Limes Industry

Long-term growth will be propelled by continued innovation in lime varieties, investment in sustainable farming practices, and strategic partnerships across the value chain. Expansion into new export markets, coupled with increasing demand from the food processing industry, are expected to drive substantial future growth.

Emerging Opportunities in Spain Limes Industry

Emerging opportunities include:

- Organic and Sustainable Limes: Growing demand for sustainably produced limes will open up new market segments.

- Value-Added Products: Processing limes into value-added products such as lime juice concentrates and essential oils offers increased profitability.

- New Markets: Exploring new export markets with a strong demand for high-quality limes, especially in Asia and North America.

Leading Players in the Spain Limes Industry Sector

- Syngenta

- Frescolina

- HaciendasBio

- Citrusola

- Sakata Seed Corporation

- Citrus Juan

- Unilink

- Frutas Torrecilla

- Grupo Agrotecnología

Key Milestones in Spain Limes Industry Industry

- 2020: Increased investment in automated harvesting technologies by Grupo Agrotecnología.

- 2021: Frescolina launched a new organic lime variety.

- 2022: Citrus Juan partnered with a major European retailer to increase their export volume.

- 2023: Significant increase in investment in sustainable farming practices across the industry.

Strategic Outlook for Spain Limes Industry Market

The Spanish limes industry is poised for considerable growth in the coming years, driven by factors such as increasing global demand, technological advancements, and a focus on sustainable production practices. Strategic partnerships, targeted marketing efforts, and a commitment to innovation will be key to maximizing future market opportunities. The long-term potential of the Spanish limes industry is substantial, with the possibility of significant market expansion both domestically and internationally.

Spain Limes Industry Segmentation

-

1. Spain

- 1.1. Production Analysis

- 1.2. Consumption Analysis and Market Value

- 1.3. Import Analysis by Volume and Value

- 1.4. Export Analysis by Volume and Value

- 1.5. Price Trend Analysis

-

2. Spain

- 2.1. Production Analysis

- 2.2. Consumption Analysis and Market Value

- 2.3. Import Analysis by Volume and Value

- 2.4. Export Analysis by Volume and Value

- 2.5. Price Trend Analysis

Spain Limes Industry Segmentation By Geography

- 1. Spain

Spain Limes Industry Regional Market Share

Geographic Coverage of Spain Limes Industry

Spain Limes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lime Ingredients is Encouraging the Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Limes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Spain

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis and Market Value

- 5.1.3. Import Analysis by Volume and Value

- 5.1.4. Export Analysis by Volume and Value

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Spain

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis and Market Value

- 5.2.3. Import Analysis by Volume and Value

- 5.2.4. Export Analysis by Volume and Value

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Spain

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Syngenta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Frescolina

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HaciendasBio

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Citrusola

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sakata Seed Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Citrus Juan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unilink

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Frutas Torrecilla

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo Agrotecnología

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Syngenta

List of Figures

- Figure 1: Spain Limes Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Spain Limes Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 2: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 3: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 4: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 5: Spain Limes Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Spain Limes Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 8: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 9: Spain Limes Industry Revenue undefined Forecast, by Spain 2020 & 2033

- Table 10: Spain Limes Industry Volume Kiloton Forecast, by Spain 2020 & 2033

- Table 11: Spain Limes Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Spain Limes Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Limes Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Spain Limes Industry?

Key companies in the market include Syngenta , Frescolina , HaciendasBio , Citrusola, Sakata Seed Corporation , Citrus Juan , Unilink, Frutas Torrecilla, Grupo Agrotecnología .

3. What are the main segments of the Spain Limes Industry?

The market segments include Spain, Spain.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Growing Demand for Lime Ingredients is Encouraging the Production.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Limes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Limes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Limes Industry?

To stay informed about further developments, trends, and reports in the Spain Limes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence