Key Insights

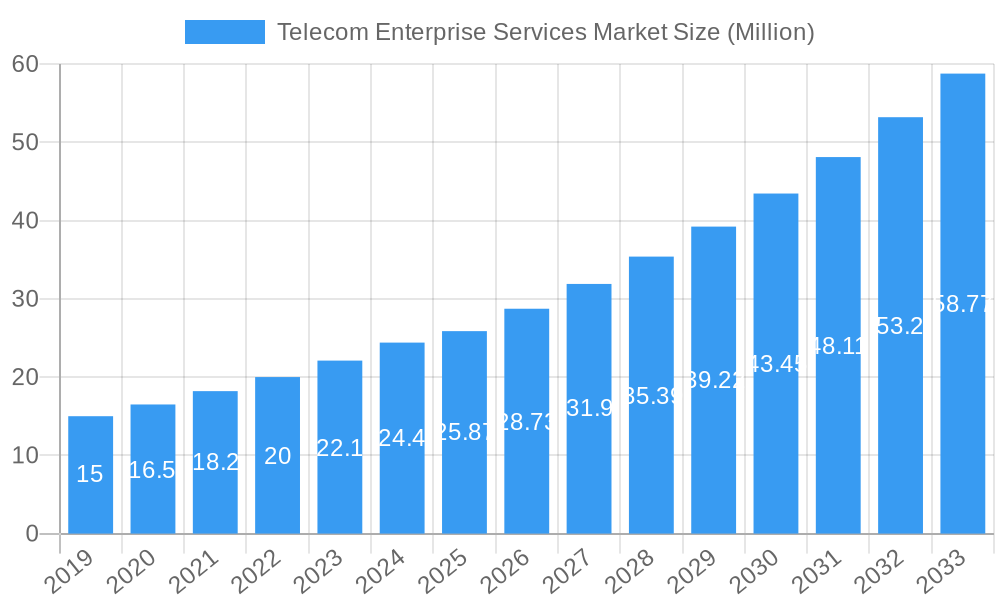

The global Telecom Enterprise Services Market is experiencing robust growth, projected to reach a substantial valuation of USD 25.87 billion. This expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.19% over the forecast period. A primary driver of this surge is the escalating demand for advanced managed data center services, as businesses increasingly outsource their IT infrastructure to enhance efficiency and reduce operational costs. Managed security services are also witnessing significant uptake, driven by the persistent and evolving threat landscape, compelling organizations to adopt comprehensive cybersecurity solutions. Furthermore, the growing adoption of managed network services is pivotal, enabling enterprises to optimize their connectivity, ensure seamless communication, and support the widespread integration of cloud technologies.

Telecom Enterprise Services Market Market Size (In Million)

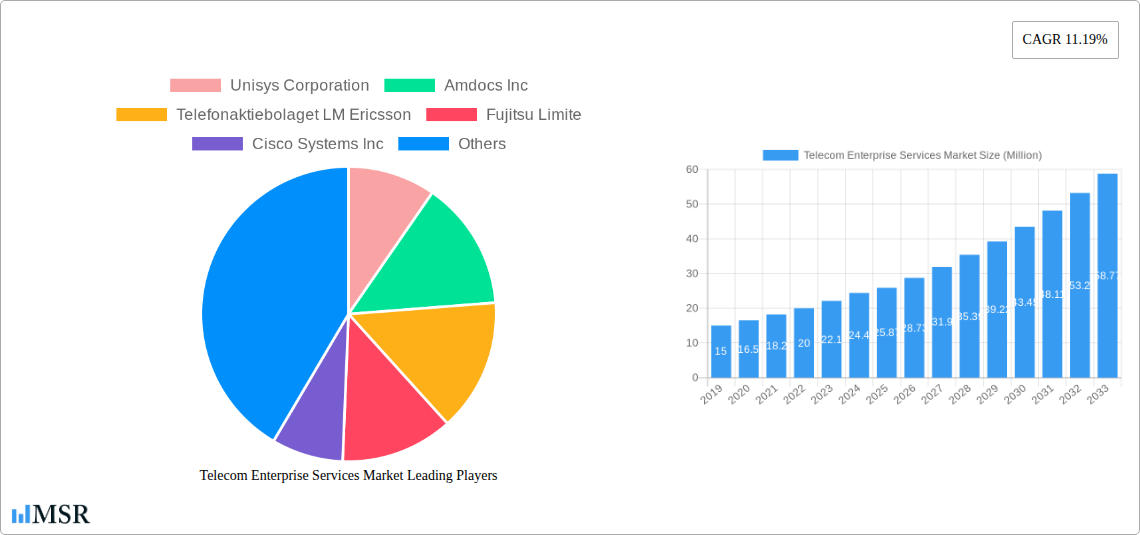

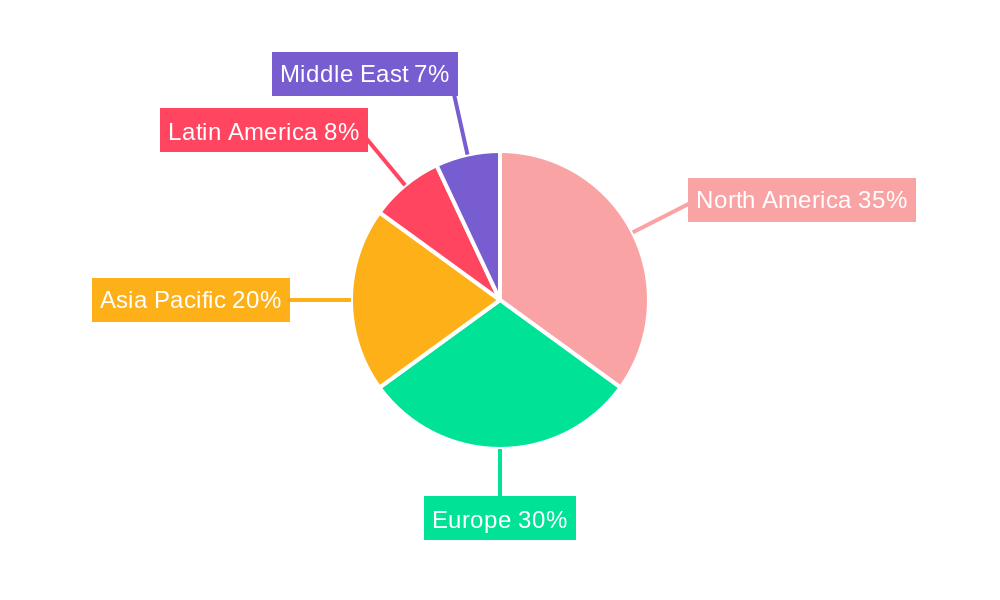

The market is characterized by a dynamic competitive landscape, with key players like Unisys Corporation, Amdocs Inc., Telefonaktiebolaget LM Ericsson, Fujitsu Limited, and Cisco Systems Inc. actively innovating and expanding their offerings. The dominance of large enterprises in the market segment is notable, owing to their substantial IT investments and complex operational requirements. However, the small and medium-sized enterprises (SMEs) segment is emerging as a significant growth opportunity, as more SMEs recognize the strategic advantages and cost-effectiveness of managed telecom services. Regionally, North America and Europe are expected to lead in market share, driven by early adoption of advanced technologies and a mature enterprise IT spending environment. Asia Pacific is poised for substantial growth, fueled by digital transformation initiatives and increasing investments in network infrastructure. While the market presents immense opportunities, potential restraints such as intense competition leading to price pressures and the complexities of integrating new managed services with existing legacy systems, need careful consideration by market participants.

Telecom Enterprise Services Market Company Market Share

This in-depth report provides a definitive analysis of the Telecom Enterprise Services Market, offering critical insights for stakeholders navigating the dynamic landscape of enterprise connectivity and digital transformation. Spanning a Study Period of 2019–2033, with a Base Year of 2025 and a Forecast Period from 2025–2033, this report delves into market size, growth drivers, key trends, competitive strategies, and future opportunities. Essential for large enterprises and small and medium enterprises (SMEs) seeking to leverage advanced managed network services, managed security services, managed data center services, and managed data and information services, this research is your definitive guide.

Telecom Enterprise Services Market Market Concentration & Dynamics

The Telecom Enterprise Services Market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, while a robust ecosystem of innovative players fosters healthy competition. Key innovation hubs are emerging globally, driven by advancements in 5G, IoT, AI, and cloud technologies, which are continually shaping the service offerings. Regulatory frameworks are evolving to support market growth and ensure fair competition, though variations across regions present unique challenges and opportunities. Substitute products, such as in-house IT solutions, are increasingly being displaced by the superior scalability, efficiency, and cost-effectiveness of specialized managed services. End-user trends highlight a growing demand for agility, enhanced security, seamless connectivity, and data-driven insights, compelling providers to continuously innovate. Mergers and Acquisitions (M&A) activities are prevalent as companies seek to expand their service portfolios, geographical reach, and technological capabilities, consolidating market power and driving industry evolution. The number of M&A deals is projected to increase by xx% over the forecast period.

- Market Share Analysis: Leading players like AT&T Inc., Verizon Communications Inc., and Huawei Technologies Co Ltd. command substantial portions of the market, but niche players are carving out significant shares in specialized segments.

- Innovation Ecosystems: Collaborative efforts between telecom operators, technology providers, and cloud service providers are accelerating the development of integrated solutions for enterprises.

- Regulatory Landscape: Ongoing efforts to harmonize regulations for cross-border data flows and ensure cybersecurity standards are shaping the competitive environment.

- Substitute Product Impact: The shift from traditional on-premise solutions to cloud-based and managed services continues to gain momentum due to their flexibility and reduced capital expenditure.

- M&A Activity Drivers: Strategic acquisitions are driven by the need to gain access to new technologies (e.g., AI, edge computing), expand customer bases, and enhance service delivery platforms.

Telecom Enterprise Services Market Industry Insights & Trends

The Telecom Enterprise Services Market is experiencing robust growth, driven by the accelerating digital transformation initiatives across industries. The estimated market size for the Telecom Enterprise Services Market is valued at over $XXX Billion in 2025, projected to reach $XXX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by an increasing reliance on robust and secure connectivity, the adoption of cloud-based solutions, and the growing complexity of IT infrastructures. Technological disruptions, including the widespread deployment of 5G networks, the rise of edge computing, and the integration of artificial intelligence (AI) and machine learning (ML) into service delivery, are fundamentally reshaping how enterprises operate. AI-powered network optimization, predictive maintenance, and enhanced cybersecurity are becoming standard offerings.

Evolving consumer behaviors, particularly the demand for seamless remote work capabilities, real-time data access, and hyper-personalized customer experiences, are compelling businesses to invest heavily in advanced telecom enterprise services. The shift towards hybrid and multi-cloud environments necessitates sophisticated network management and security solutions that can ensure consistent performance and data integrity across diverse platforms. Furthermore, the increasing threat landscape of cyberattacks is driving demand for comprehensive managed security services, including threat detection, prevention, and incident response. The growing emphasis on sustainability and operational efficiency is also pushing enterprises towards managed services that can optimize resource utilization and reduce their environmental footprint. The ability to deliver scalable, on-demand services that adapt to fluctuating business needs is a key trend. The market is witnessing a surge in demand for integrated solutions that combine connectivity, cloud, security, and data analytics, offering enterprises a single point of contact for their complex IT requirements.

Key Markets & Segments Leading Telecom Enterprise Services Market

Large Enterprises are currently the dominant segment within the Telecom Enterprise Services Market, driven by their extensive IT infrastructure, higher bandwidth demands, and the critical need for secure, reliable, and scalable connectivity to support complex global operations. These organizations often have dedicated budgets for digital transformation and are early adopters of advanced technologies like 5G, IoT, and AI. Their reliance on robust managed network services for global operations, sophisticated managed security services to protect vast amounts of sensitive data, and comprehensive managed data center services for their critical applications underscores their leadership.

- Dominant Segments:

- Organization Size: Large Enterprises

- Service Type: Managed Network Services, Managed Security Services

Drivers for Large Enterprise Dominance:

- Economic Growth: Significant IT spending budgets allocated by large corporations.

- Infrastructure Requirements: Need for high-capacity, reliable, and secure networks to support global operations and complex applications.

- Digital Transformation Mandates: Strong impetus to modernize IT infrastructure and adopt cloud-first strategies.

- Cybersecurity Imperatives: Critical need to protect extensive data assets and intellectual property from evolving threats.

Small and Medium Enterprises (SMEs) represent a rapidly growing segment, increasingly recognizing the value proposition of outsourced telecom enterprise services. Initially hindered by budget constraints, SMEs are now leveraging flexible, cost-effective managed solutions to compete with larger organizations. The accessibility of cloud-based managed network services and managed security services at competitive price points is a significant growth catalyst for this segment. As SMEs embrace digital transformation to enhance customer engagement and operational efficiency, their demand for these services is set to surge.

- Emerging Segment: Small and Medium Enterprises (SMEs)

Drivers for SME Growth:

- Cost-Effectiveness: Access to enterprise-grade solutions without significant upfront capital investment.

- Scalability and Flexibility: Ability to scale services up or down based on business needs.

- Access to Expertise: Leveraging specialized IT and cybersecurity knowledge they may lack internally.

- Competitive Parity: Enabling SMEs to adopt advanced technologies and improve their competitive standing.

Telecom Enterprise Services Market Product Developments

Innovations in the Telecom Enterprise Services Market are centered on delivering integrated, intelligent, and secure solutions. Companies are focusing on developing AI-driven network management platforms that offer predictive analytics for proactive issue resolution and enhanced performance optimization. The proliferation of 5G technology is enabling new applications, such as ultra-low latency services for real-time data processing and enhanced IoT connectivity. Furthermore, advancements in cybersecurity are leading to more sophisticated threat intelligence platforms and zero-trust security architectures integrated into managed service offerings. The market is also witnessing the development of flexible, cloud-native service delivery models that allow enterprises to customize and adapt their service packages to meet evolving business requirements, fostering greater agility and competitive advantage.

Challenges in the Telecom Enterprise Services Market Market

Despite robust growth, the Telecom Enterprise Services Market faces several challenges. Regulatory complexities and varying compliance requirements across different geographies can hinder global service deployment. Intense competition, particularly from agile cloud providers and specialized managed service providers, puts pressure on pricing and margins for traditional telecom operators. Supply chain disruptions, as evidenced in recent years, can impact the deployment of critical network infrastructure. Furthermore, the increasing sophistication of cyber threats necessitates continuous investment in advanced security solutions, posing a significant financial and technical challenge.

- Regulatory Hurdles: Navigating diverse data privacy laws and telecommunications regulations globally.

- Intense Competition: Price wars and the need for continuous innovation to differentiate from competitors.

- Supply Chain Volatility: Potential delays and cost overruns in procuring network hardware and components.

- Cybersecurity Sophistication: The evolving nature of cyber threats demands constant vigilance and investment.

Forces Driving Telecom Enterprise Services Market Growth

The Telecom Enterprise Services Market is propelled by several key growth drivers. The accelerating pace of digital transformation across all industries necessitates robust, reliable, and secure connectivity, forming the bedrock of modern business operations. The widespread adoption of cloud computing and multi-cloud strategies demands sophisticated network management and integration services. The increasing prevalence of remote and hybrid work models further amplifies the need for seamless and secure access to corporate resources. Technological advancements, particularly the rollout of 5G networks, are unlocking new possibilities for bandwidth-intensive applications and the Internet of Things (IoT), creating demand for specialized managed services.

Challenges in the Telecom Enterprise Services Market Market

The long-term growth of the Telecom Enterprise Services Market is underpinned by continuous innovation and strategic partnerships. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into network management and security solutions is enhancing efficiency, predictive capabilities, and automated responses, driving significant value for enterprises. The expansion of edge computing infrastructure requires specialized telecom services to manage distributed data processing and enable real-time analytics. Furthermore, strategic alliances between telecom providers, cloud hyperscalers, and specialized technology vendors are creating comprehensive end-to-end solutions that address the increasingly complex needs of enterprises.

Emerging Opportunities in Telecom Enterprise Services Market

Emerging opportunities in the Telecom Enterprise Services Market are abundant. The burgeoning Internet of Things (IoT) ecosystem presents a significant avenue for growth, with enterprises requiring robust connectivity, data management, and security solutions for a vast array of connected devices. The continued expansion of edge computing is creating demand for localized data processing and ultra-low latency services. Furthermore, the increasing focus on sustainability and digital responsibility is driving demand for managed services that can optimize energy consumption and promote environmentally friendly IT practices. The growing adoption of AI-powered applications across industries will also fuel the need for high-performance, low-latency network infrastructure and specialized data analytics services.

Leading Players in the Telecom Enterprise Services Market Sector

- Unisys Corporation

- Amdocs Inc

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limite

- Cisco Systems Inc

- Verizon Communications Inc

- GTT Communications Inc

- International Business Machines Corporation

- NTT Data Corporation

- Huawei Technologies Co Ltd

- ZTE Corporation

- Comarch SA

- Nokia Corporation

- Tech Mahindra Limited

- AT&T Inc

Key Milestones in Telecom Enterprise Services Market Industry

- December 2022: Endeavor Managed Services announced the acquisition of SOVA Inc., enhancing its digital transformation capabilities with 5G connectivity.

- November 2022: Wipro Limited and Verizon Business launched a global Network-as-a-Service (NaaS) alliance to accelerate business network modernization and cloud transition.

Strategic Outlook for Telecom Enterprise Services Market Market

The strategic outlook for the Telecom Enterprise Services Market is highly positive, driven by a sustained demand for digital transformation, advanced connectivity, and robust security solutions. Key growth accelerators include the continued rollout and adoption of 5G technology, which will unlock new revenue streams through enhanced mobile broadband, massive IoT, and ultra-reliable low-latency communications. The increasing complexity of hybrid and multi-cloud environments will fuel demand for sophisticated network orchestration and management services. Furthermore, a strategic focus on developing integrated service offerings that combine connectivity, cybersecurity, cloud, and data analytics will be crucial for market leaders. Embracing AI and automation in service delivery will also enhance operational efficiency and customer experience, positioning providers for long-term success.

Telecom Enterprise Services Market Segmentation

-

1. Organization Size

- 1.1. Large Enterprises

- 1.2. Small and Medium Enterprises

-

2. Service Type

- 2.1. Managed Data Center Services

- 2.2. Managed Security Services

- 2.3. Managed Network Services

- 2.4. Managed Data and Information Services

- 2.5. Other

Telecom Enterprise Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Telecom Enterprise Services Market Regional Market Share

Geographic Coverage of Telecom Enterprise Services Market

Telecom Enterprise Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Demand for Enhanced Operational Efficiency

- 3.2.2 Security

- 3.2.3 and Agility in Telecom Business Process; Cost Minimization in Managing Enterprise Infrastructure

- 3.3. Market Restrains

- 3.3.1. Assuring the Optimum Business Functionality of the Customers

- 3.4. Market Trends

- 3.4.1. Rise in the Usage of Cloud Computing is Expected to Drive the Market Growth Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Enterprise Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Large Enterprises

- 5.1.2. Small and Medium Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Managed Data Center Services

- 5.2.2. Managed Security Services

- 5.2.3. Managed Network Services

- 5.2.4. Managed Data and Information Services

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. North America Telecom Enterprise Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 6.1.1. Large Enterprises

- 6.1.2. Small and Medium Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Managed Data Center Services

- 6.2.2. Managed Security Services

- 6.2.3. Managed Network Services

- 6.2.4. Managed Data and Information Services

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Organization Size

- 7. Europe Telecom Enterprise Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 7.1.1. Large Enterprises

- 7.1.2. Small and Medium Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Managed Data Center Services

- 7.2.2. Managed Security Services

- 7.2.3. Managed Network Services

- 7.2.4. Managed Data and Information Services

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Organization Size

- 8. Asia Pacific Telecom Enterprise Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 8.1.1. Large Enterprises

- 8.1.2. Small and Medium Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Managed Data Center Services

- 8.2.2. Managed Security Services

- 8.2.3. Managed Network Services

- 8.2.4. Managed Data and Information Services

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Organization Size

- 9. Latin America Telecom Enterprise Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 9.1.1. Large Enterprises

- 9.1.2. Small and Medium Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Managed Data Center Services

- 9.2.2. Managed Security Services

- 9.2.3. Managed Network Services

- 9.2.4. Managed Data and Information Services

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Organization Size

- 10. Middle East Telecom Enterprise Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 10.1.1. Large Enterprises

- 10.1.2. Small and Medium Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Service Type

- 10.2.1. Managed Data Center Services

- 10.2.2. Managed Security Services

- 10.2.3. Managed Network Services

- 10.2.4. Managed Data and Information Services

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Organization Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Unisys Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amdocs Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Telefonaktiebolaget LM Ericsson

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujitsu Limite

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Verizon Communications Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GTT Communications Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Business Machines Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NTT Data Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huawei Technologies Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZTE Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Comarch SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nokia Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tech Mahindra Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AT&T Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Unisys Corporation

List of Figures

- Figure 1: Global Telecom Enterprise Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Telecom Enterprise Services Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 3: North America Telecom Enterprise Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 4: North America Telecom Enterprise Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 5: North America Telecom Enterprise Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Telecom Enterprise Services Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Telecom Enterprise Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Telecom Enterprise Services Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 9: Europe Telecom Enterprise Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 10: Europe Telecom Enterprise Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Telecom Enterprise Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Telecom Enterprise Services Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Telecom Enterprise Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Telecom Enterprise Services Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 15: Asia Pacific Telecom Enterprise Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 16: Asia Pacific Telecom Enterprise Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 17: Asia Pacific Telecom Enterprise Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 18: Asia Pacific Telecom Enterprise Services Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Telecom Enterprise Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Telecom Enterprise Services Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 21: Latin America Telecom Enterprise Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 22: Latin America Telecom Enterprise Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 23: Latin America Telecom Enterprise Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 24: Latin America Telecom Enterprise Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Telecom Enterprise Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Telecom Enterprise Services Market Revenue (Million), by Organization Size 2025 & 2033

- Figure 27: Middle East Telecom Enterprise Services Market Revenue Share (%), by Organization Size 2025 & 2033

- Figure 28: Middle East Telecom Enterprise Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 29: Middle East Telecom Enterprise Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Middle East Telecom Enterprise Services Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East Telecom Enterprise Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecom Enterprise Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 2: Global Telecom Enterprise Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Global Telecom Enterprise Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Telecom Enterprise Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 5: Global Telecom Enterprise Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Telecom Enterprise Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Telecom Enterprise Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 8: Global Telecom Enterprise Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Telecom Enterprise Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Telecom Enterprise Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 11: Global Telecom Enterprise Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Telecom Enterprise Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Telecom Enterprise Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 14: Global Telecom Enterprise Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 15: Global Telecom Enterprise Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Telecom Enterprise Services Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 17: Global Telecom Enterprise Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global Telecom Enterprise Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Enterprise Services Market?

The projected CAGR is approximately 11.19%.

2. Which companies are prominent players in the Telecom Enterprise Services Market?

Key companies in the market include Unisys Corporation, Amdocs Inc, Telefonaktiebolaget LM Ericsson, Fujitsu Limite, Cisco Systems Inc, Verizon Communications Inc, GTT Communications Inc, International Business Machines Corporation, NTT Data Corporation, Huawei Technologies Co Ltd, ZTE Corporation, Comarch SA, Nokia Corporation, Tech Mahindra Limited, AT&T Inc.

3. What are the main segments of the Telecom Enterprise Services Market?

The market segments include Organization Size, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 25.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Enhanced Operational Efficiency. Security. and Agility in Telecom Business Process; Cost Minimization in Managing Enterprise Infrastructure.

6. What are the notable trends driving market growth?

Rise in the Usage of Cloud Computing is Expected to Drive the Market Growth Significantly.

7. Are there any restraints impacting market growth?

Assuring the Optimum Business Functionality of the Customers.

8. Can you provide examples of recent developments in the market?

December 2022 - Endeavor Managed Services, a pioneering provider of managed services platforms for digital transformation, announced the acquisition of SOVA Inc. The acquisition combines the overall strengths of a global transformation company with 5G connectivity and digital transformation capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Enterprise Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Enterprise Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Enterprise Services Market?

To stay informed about further developments, trends, and reports in the Telecom Enterprise Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence