Key Insights

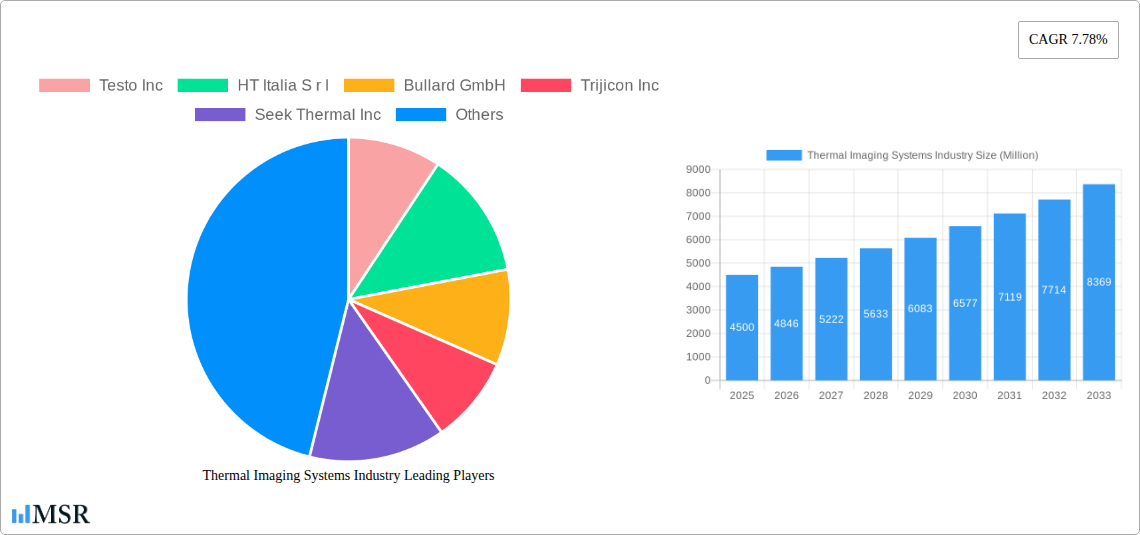

The global Thermal Imaging Systems market is projected to reach $7,210 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.78%. This significant expansion is propelled by technological advancements in infrared imaging, leading to improved resolution and increased affordability of thermal cameras. Key growth drivers include the escalating adoption of thermal imaging in defense and surveillance for enhanced situational awareness, and its critical role in firefighting for identifying hazards in low-visibility environments. Emerging applications in industrial maintenance for predictive diagnostics and in the automotive sector for driver assistance systems further underscore the market's broad appeal and potential.

Thermal Imaging Systems Industry Market Size (In Billion)

The market's growth is further stimulated by the development of more compact and user-friendly thermal imaging devices, particularly handheld systems catering to both professional and consumer needs. While the initial cost of advanced systems and the requirement for specialized training may present some segment-specific challenges, ongoing innovation in sensor technology and miniaturization is expected to drive wider market penetration and sustained value creation. The competitive landscape is dynamic, with established players and emerging innovators focused on product differentiation and strategic partnerships, particularly in high-growth regions such as the Asia Pacific.

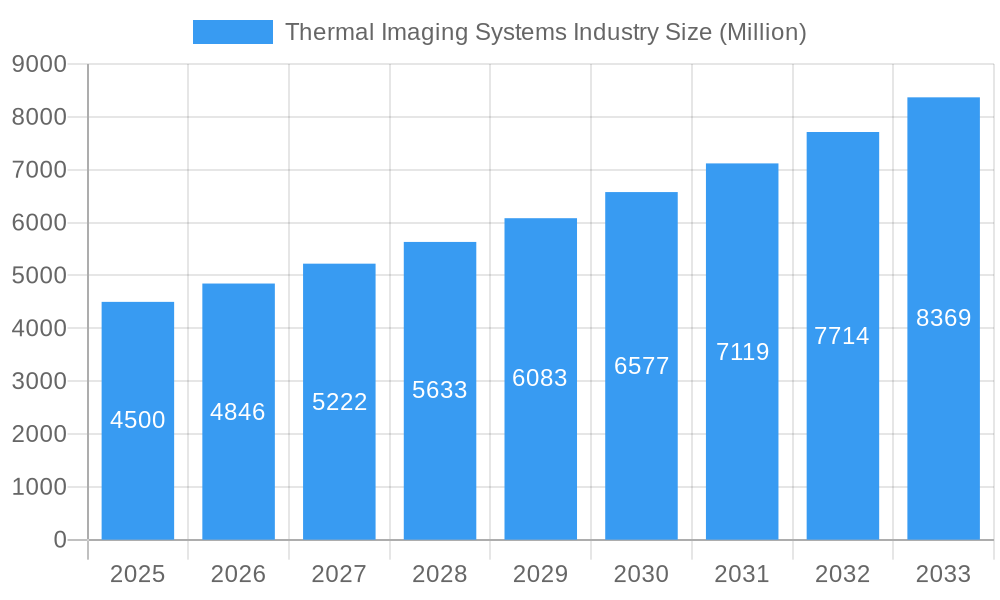

Thermal Imaging Systems Industry Company Market Share

Gain comprehensive insights into the rapidly evolving thermal imaging systems market. This report provides critical analysis for manufacturers, investors, and defense contractors, covering the infrared imaging market, thermography solutions, and night vision technology. Analyzing the period from 2019 to 2033, with a base year of 2025, this study details market dynamics, growth drivers, challenges, and emerging opportunities in the global thermal imaging market. Key segments explored include military thermal optics, surveillance cameras, firefighting equipment, and ruggedized smartphones, with an emphasis on dominant form factors such as handheld imaging devices and fixed mounted systems.

Thermal Imaging Systems Industry Market Concentration & Dynamics

The thermal imaging systems industry exhibits moderate to high market concentration, with key players investing heavily in research and development to maintain a competitive edge. The innovation ecosystem is vibrant, driven by advancements in sensor technology, artificial intelligence for image processing, and miniaturization of components. Regulatory frameworks, particularly concerning defense and security applications, play a significant role in market access and product development. Substitute products, primarily enhanced low-light optical systems, pose a limited threat due to the inherent advantages of thermal imaging in complete darkness and adverse weather conditions. End-user trends indicate a growing demand for integrated solutions that offer enhanced situational awareness and predictive maintenance capabilities. Mergers and acquisitions (M&A) activities are prevalent as larger companies seek to expand their product portfolios and market reach. For instance, Teledyne FLIR Defense's agreement with the United States Army underscores strategic M&A and supply chain consolidation. The market has witnessed an average of 4-6 significant M&A deals annually over the historical period, with an estimated market share distribution showing the top 3 players holding approximately 55-60% of the global market.

Thermal Imaging Systems Industry Industry Insights & Trends

The thermal imaging systems market is poised for substantial growth, projected to reach an estimated USD 18,500 Million by 2025 and expand to USD 30,000 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 7.8% during the forecast period. This growth is primarily fueled by escalating demand across diverse sectors, including defense, homeland security, industrial inspection, and automotive. Technological advancements in uncooled bolometer arrays, improved resolution, and enhanced thermal sensitivity are driving innovation and making thermal cameras more accessible and versatile. The integration of AI and machine learning algorithms is transforming thermal data into actionable intelligence, enabling more sophisticated applications such as autonomous navigation and advanced threat detection. Evolving consumer behaviors are also contributing, with a growing interest in personal vision systems for outdoor activities and safety applications. The rise of smart city initiatives and the increasing need for infrastructure monitoring further bolster the demand for advanced infrared thermal cameras. The market size in 2025 is estimated at USD 18,500 Million.

Key Markets & Segments Leading Thermal Imaging Systems Industry

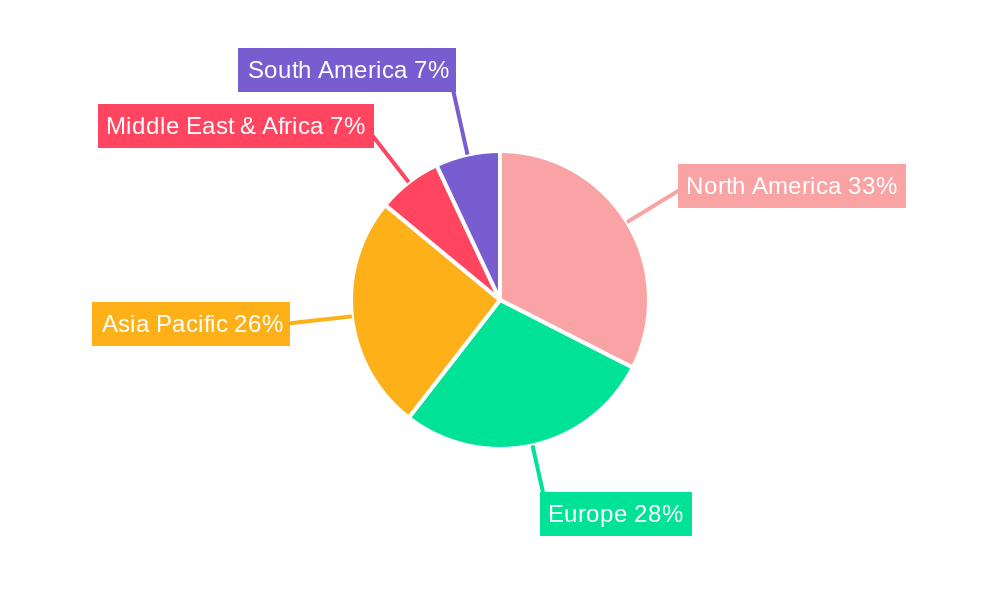

The thermal imaging systems industry is predominantly led by the Military and Surveillance applications, driven by global security concerns and the continuous need for enhanced battlefield awareness and border protection. The North America region, particularly the United States, emerges as the largest market due to significant defense spending and advanced technological adoption.

- Military: This segment benefits from substantial government investment in advanced defense technologies. The demand for military thermal optics for target acquisition, reconnaissance, and night operations is consistently high. Initiatives like the FWS-I system for the U.S. Army highlight the critical role of thermal imaging systems in modern warfare.

- Surveillance: Both government and private sector surveillance applications are experiencing rapid growth. This includes border security, critical infrastructure monitoring, and public safety. The development of long-range, high-resolution thermal cameras is a key driver.

- Thermography: In the industrial sector, thermography for predictive maintenance in energy, manufacturing, and construction remains a significant segment. Early detection of anomalies like overheating electrical components or insulation defects reduces downtime and prevents failures. The global thermography market is valued at approximately USD 3,000 Million in 2025.

- Personal Vision Systems: This segment is gaining traction with the increasing popularity of outdoor recreation, hunting, and wildlife observation. Compact and user-friendly thermal imaging devices are becoming more popular.

- Fire Fighting: Thermal cameras are indispensable tools for firefighters, enabling them to visualize heat signatures through smoke and identify victims or fire origins quickly.

- Smartphones (Ruggedized): The integration of thermal sensors into ruggedized smartphones offers on-the-go diagnostic and inspection capabilities for field technicians and first responders.

- Form Factor - Handheld Imaging Devices and Systems: These remain the most popular form factor due to their portability and ease of use across various applications.

- Form Factor - Fixed Mounted (Rotary and Non-Rotary): Fixed mounted systems are crucial for continuous surveillance and industrial monitoring applications, offering uninterrupted thermal data streams.

Thermal Imaging Systems Industry Product Developments

Recent product developments in the thermal imaging systems industry focus on enhancing resolution, improving detection ranges, and integrating advanced analytics. Companies are introducing more compact and ruggedized devices for diverse applications, from industrial inspection to personal use. Innovations include miniaturized thermal sensors for smartphones, higher frame rates for dynamic scene capture, and AI-powered object recognition for automated threat detection. The development of advanced thermal cameras with radiometric capabilities for precise temperature measurement and the integration of Wi-Fi and Bluetooth for seamless data transfer are key competitive advantages.

Challenges in the Thermal Imaging Systems Industry Market

The thermal imaging systems market faces several challenges, including high initial costs for advanced systems, which can limit adoption in price-sensitive segments. Intense competition among established players and emerging manufacturers can lead to price wars and impact profit margins. Furthermore, evolving regulatory requirements, particularly for export controls on high-performance systems, can create market access hurdles. Supply chain disruptions and the availability of raw materials for sophisticated sensor components also pose potential risks. The market faces an estimated 10-15% price pressure due to competition.

Forces Driving Thermal Imaging Systems Industry Growth

The growth of the thermal imaging systems industry is propelled by several key factors. Increasing global security threats and defense spending are driving demand for military thermal imaging systems and surveillance technologies. The growing adoption of predictive maintenance strategies in various industrial sectors, to reduce operational costs and enhance efficiency, is a significant growth catalyst. Advancements in sensor technology, leading to more affordable and higher-performance infrared cameras, are expanding market accessibility. The development of new applications in areas like autonomous vehicles and medical diagnostics further fuels market expansion.

Challenges in the Thermal Imaging Systems Industry Market

Long-term growth catalysts for the thermal imaging systems market are rooted in continuous technological innovation and strategic market expansion. The ongoing miniaturization and cost reduction of thermal sensors will open doors to new consumer markets and broader industrial applications. Partnerships and collaborations between technology providers and end-users will foster the development of tailored solutions for specific industry needs. Furthermore, the increasing awareness of the benefits of thermal imaging for safety, security, and efficiency will drive market penetration in developing economies.

Emerging Opportunities in Thermal Imaging Systems Industry

Emerging opportunities in the thermal imaging systems industry lie in the untapped potential of the consumer electronics market, particularly with the integration of thermal capabilities into everyday devices. The growing demand for smart home security systems and the expansion of the electric vehicle (EV) market, where thermal imaging can be used for battery monitoring and diagnostics, present significant growth avenues. Furthermore, the development of advanced thermal solutions for environmental monitoring, such as detecting pollution sources or assessing forest fire risks, offers new market frontiers. The smartphones (ruggedized) segment, with an estimated growth of 9-11% CAGR, is a key emerging opportunity.

Leading Players in the Thermal Imaging Systems Industry Sector

- Testo Inc

- HT Italia S r l

- Bullard GmbH

- Trijicon Inc

- Seek Thermal Inc

- Raytheon Co

- Fluke Corporation

- Opgal Optronic Industries Ltd

- Flir Systems Inc

Key Milestones in Thermal Imaging Systems Industry Industry

- May 2022: Teledyne FLIR System Inc. Defense secured a significant agreement worth up to USD 500.2 Million to supply advanced thermal imaging systems (FWS-I system) to the United States Army, enhancing soldier capabilities in all weather and illumination conditions.

- May 2022: Trijicon Inc. launched Q-LOC Technology Quick Release Mounts, compatible with their red dots, thermal optics, and riflescopes, offering enhanced versatility for various optical platforms in the hunting, shooting, military, and law enforcement sectors.

Strategic Outlook for Thermal Imaging Systems Industry Market

The strategic outlook for the thermal imaging systems market is highly positive, driven by continued innovation and expanding application landscapes. Focus on developing cost-effective solutions, enhancing user-friendliness, and integrating AI for advanced data analysis will be crucial for market leadership. Strategic partnerships with companies in adjacent industries, such as IoT and cybersecurity, will unlock new revenue streams and foster integrated solutions. The increasing global emphasis on safety, security, and operational efficiency will continue to fuel demand for infrared technology, ensuring sustained growth and market expansion for thermal imaging solutions. The market is projected to continue its upward trajectory, with continued investment in R&D and strategic market penetration.

Thermal Imaging Systems Industry Segmentation

-

1. Application

- 1.1. Thermography

- 1.2. Military

- 1.3. Surveillance

- 1.4. Personal Vision Systems

- 1.5. Fire Fighting

- 1.6. Smartphones (Ruggedized)

- 1.7. Other Ap

-

2. Form Factor

- 2.1. Handheld Imaging Devices and Systems

- 2.2. Fixed Mounted (Rotary and Non-Rotary)

Thermal Imaging Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Thermal Imaging Systems Industry Regional Market Share

Geographic Coverage of Thermal Imaging Systems Industry

Thermal Imaging Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reducing Cost of Thermal Imaging Systems has Led to the Adoption Across various End Users; Increasing Spending by Government and Defense Activities

- 3.3. Market Restrains

- 3.3.1. Lack of Regular Support and Services

- 3.4. Market Trends

- 3.4.1. Applications in Military to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Thermography

- 5.1.2. Military

- 5.1.3. Surveillance

- 5.1.4. Personal Vision Systems

- 5.1.5. Fire Fighting

- 5.1.6. Smartphones (Ruggedized)

- 5.1.7. Other Ap

- 5.2. Market Analysis, Insights and Forecast - by Form Factor

- 5.2.1. Handheld Imaging Devices and Systems

- 5.2.2. Fixed Mounted (Rotary and Non-Rotary)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Thermography

- 6.1.2. Military

- 6.1.3. Surveillance

- 6.1.4. Personal Vision Systems

- 6.1.5. Fire Fighting

- 6.1.6. Smartphones (Ruggedized)

- 6.1.7. Other Ap

- 6.2. Market Analysis, Insights and Forecast - by Form Factor

- 6.2.1. Handheld Imaging Devices and Systems

- 6.2.2. Fixed Mounted (Rotary and Non-Rotary)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Thermography

- 7.1.2. Military

- 7.1.3. Surveillance

- 7.1.4. Personal Vision Systems

- 7.1.5. Fire Fighting

- 7.1.6. Smartphones (Ruggedized)

- 7.1.7. Other Ap

- 7.2. Market Analysis, Insights and Forecast - by Form Factor

- 7.2.1. Handheld Imaging Devices and Systems

- 7.2.2. Fixed Mounted (Rotary and Non-Rotary)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Thermography

- 8.1.2. Military

- 8.1.3. Surveillance

- 8.1.4. Personal Vision Systems

- 8.1.5. Fire Fighting

- 8.1.6. Smartphones (Ruggedized)

- 8.1.7. Other Ap

- 8.2. Market Analysis, Insights and Forecast - by Form Factor

- 8.2.1. Handheld Imaging Devices and Systems

- 8.2.2. Fixed Mounted (Rotary and Non-Rotary)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Thermography

- 9.1.2. Military

- 9.1.3. Surveillance

- 9.1.4. Personal Vision Systems

- 9.1.5. Fire Fighting

- 9.1.6. Smartphones (Ruggedized)

- 9.1.7. Other Ap

- 9.2. Market Analysis, Insights and Forecast - by Form Factor

- 9.2.1. Handheld Imaging Devices and Systems

- 9.2.2. Fixed Mounted (Rotary and Non-Rotary)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Thermal Imaging Systems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Thermography

- 10.1.2. Military

- 10.1.3. Surveillance

- 10.1.4. Personal Vision Systems

- 10.1.5. Fire Fighting

- 10.1.6. Smartphones (Ruggedized)

- 10.1.7. Other Ap

- 10.2. Market Analysis, Insights and Forecast - by Form Factor

- 10.2.1. Handheld Imaging Devices and Systems

- 10.2.2. Fixed Mounted (Rotary and Non-Rotary)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Testo Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HT Italia S r l

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bullard GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trijicon Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seek Thermal Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Raytheon Co *List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fluke Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Opgal Optronic Industries Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Flir Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Testo Inc

List of Figures

- Figure 1: Global Thermal Imaging Systems Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Thermal Imaging Systems Industry Revenue (million), by Application 2025 & 2033

- Figure 3: North America Thermal Imaging Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Thermal Imaging Systems Industry Revenue (million), by Form Factor 2025 & 2033

- Figure 5: North America Thermal Imaging Systems Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 6: North America Thermal Imaging Systems Industry Revenue (million), by Country 2025 & 2033

- Figure 7: North America Thermal Imaging Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Thermal Imaging Systems Industry Revenue (million), by Application 2025 & 2033

- Figure 9: South America Thermal Imaging Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Thermal Imaging Systems Industry Revenue (million), by Form Factor 2025 & 2033

- Figure 11: South America Thermal Imaging Systems Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 12: South America Thermal Imaging Systems Industry Revenue (million), by Country 2025 & 2033

- Figure 13: South America Thermal Imaging Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Thermal Imaging Systems Industry Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Thermal Imaging Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Thermal Imaging Systems Industry Revenue (million), by Form Factor 2025 & 2033

- Figure 17: Europe Thermal Imaging Systems Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 18: Europe Thermal Imaging Systems Industry Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Thermal Imaging Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Thermal Imaging Systems Industry Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Thermal Imaging Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Thermal Imaging Systems Industry Revenue (million), by Form Factor 2025 & 2033

- Figure 23: Middle East & Africa Thermal Imaging Systems Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 24: Middle East & Africa Thermal Imaging Systems Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Thermal Imaging Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Thermal Imaging Systems Industry Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Thermal Imaging Systems Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Thermal Imaging Systems Industry Revenue (million), by Form Factor 2025 & 2033

- Figure 29: Asia Pacific Thermal Imaging Systems Industry Revenue Share (%), by Form Factor 2025 & 2033

- Figure 30: Asia Pacific Thermal Imaging Systems Industry Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Thermal Imaging Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermal Imaging Systems Industry Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Thermal Imaging Systems Industry Revenue million Forecast, by Form Factor 2020 & 2033

- Table 3: Global Thermal Imaging Systems Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Thermal Imaging Systems Industry Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Thermal Imaging Systems Industry Revenue million Forecast, by Form Factor 2020 & 2033

- Table 6: Global Thermal Imaging Systems Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Thermal Imaging Systems Industry Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Thermal Imaging Systems Industry Revenue million Forecast, by Form Factor 2020 & 2033

- Table 12: Global Thermal Imaging Systems Industry Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Thermal Imaging Systems Industry Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Thermal Imaging Systems Industry Revenue million Forecast, by Form Factor 2020 & 2033

- Table 18: Global Thermal Imaging Systems Industry Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Thermal Imaging Systems Industry Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Thermal Imaging Systems Industry Revenue million Forecast, by Form Factor 2020 & 2033

- Table 30: Global Thermal Imaging Systems Industry Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Thermal Imaging Systems Industry Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Thermal Imaging Systems Industry Revenue million Forecast, by Form Factor 2020 & 2033

- Table 39: Global Thermal Imaging Systems Industry Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Thermal Imaging Systems Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Imaging Systems Industry?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Thermal Imaging Systems Industry?

Key companies in the market include Testo Inc, HT Italia S r l, Bullard GmbH, Trijicon Inc, Seek Thermal Inc, Raytheon Co *List Not Exhaustive, Fluke Corporation, Opgal Optronic Industries Ltd, Flir Systems Inc.

3. What are the main segments of the Thermal Imaging Systems Industry?

The market segments include Application, Form Factor.

4. Can you provide details about the market size?

The market size is estimated to be USD 7210 million as of 2022.

5. What are some drivers contributing to market growth?

Reducing Cost of Thermal Imaging Systems has Led to the Adoption Across various End Users; Increasing Spending by Government and Defense Activities.

6. What are the notable trends driving market growth?

Applications in Military to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Regular Support and Services.

8. Can you provide examples of recent developments in the market?

May 2022 - Teledyne FLIR System Inc., Defense will supply thermal imaging systems to the United States Army. The FWS-I system will provide infrared imaging to soldiers in all weather and illumination circumstances. Teledyne Technologies' Teledyne FLIR Defense has made a new agreement worth up to USD 500.2 Million to supply advanced thermal imaging systems to the United States Army.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Imaging Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Imaging Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Imaging Systems Industry?

To stay informed about further developments, trends, and reports in the Thermal Imaging Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence