Key Insights

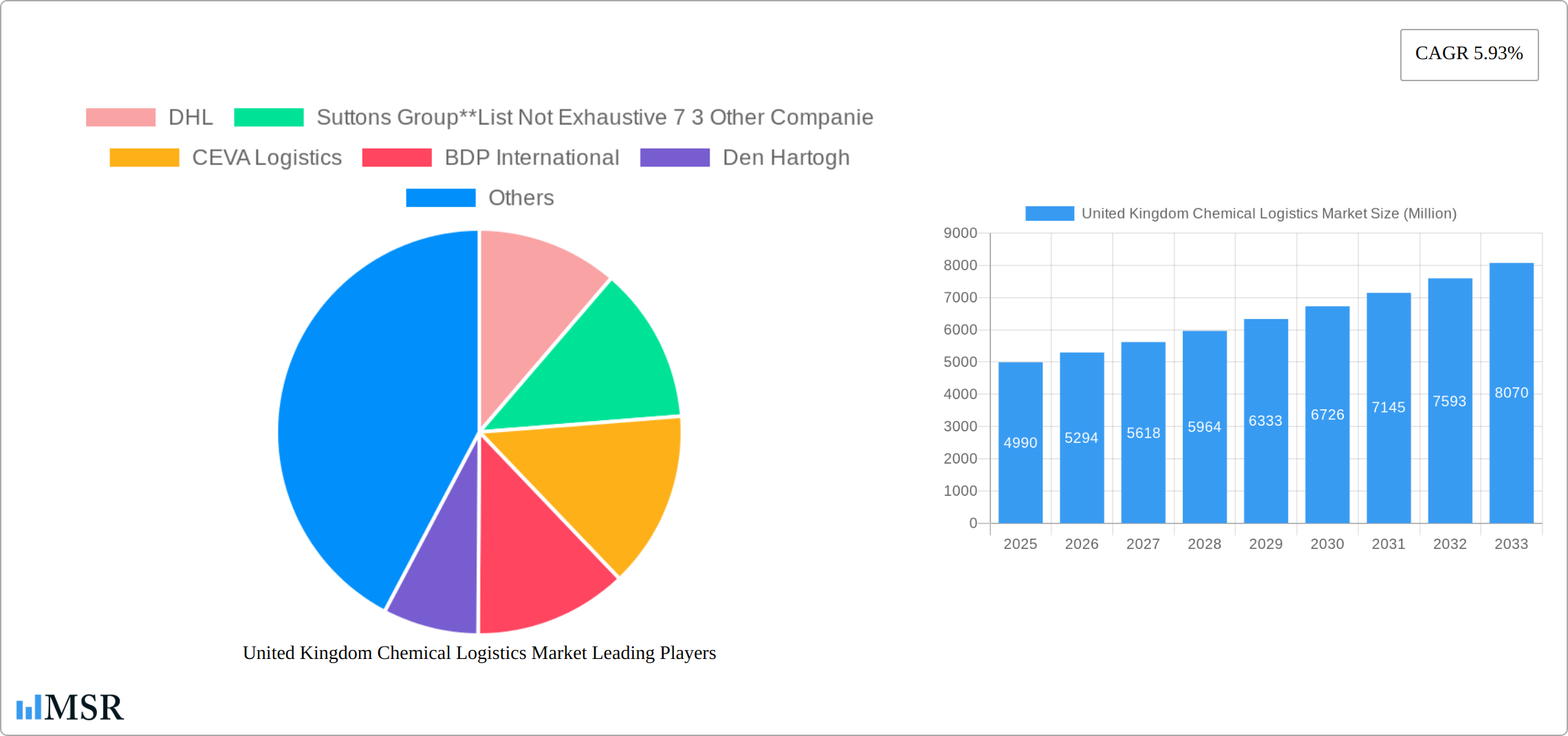

The United Kingdom chemical logistics market, valued at approximately £4.99 billion in 2025 (assuming "Million" refers to USD and a conversion rate applied), is projected to experience robust growth, driven by several key factors. The pharmaceutical and cosmetic industries are major contributors, demanding efficient and specialized transportation and warehousing solutions for sensitive chemical products. Stringent regulatory compliance, requiring secure handling and documentation, further fuels market expansion. The increasing adoption of green logistics initiatives, aimed at reducing the environmental impact of chemical transportation, presents a significant growth opportunity. Growth is also expected from the expansion of e-commerce, which necessitates a reliable and efficient logistics network for the timely delivery of chemical products to consumers. However, challenges such as fluctuating fuel prices and potential supply chain disruptions due to geopolitical uncertainties can act as market restraints. The market segmentation reveals a significant portion of revenue stemming from road transport, though the increasing emphasis on sustainability may drive growth in rail and potentially waterway transportation options in the coming years. Key players like DHL, Suttons Group, CEVA Logistics, and others are actively shaping the market through their advanced technologies and strategic partnerships. The UK's strategic location within Europe also provides a logistical advantage for international chemical trade.

United Kingdom Chemical Logistics Market Market Size (In Billion)

Furthermore, the market's projected Compound Annual Growth Rate (CAGR) of 5.93% from 2025 to 2033 indicates a continuous upward trend. This growth is anticipated to be driven by the increasing demand for chemical products across various sectors, necessitating enhanced logistics capabilities. The continued investment in technological advancements within the logistics sector, including the implementation of sophisticated tracking systems, automation technologies, and data analytics tools, will contribute significantly to efficiency gains and market expansion. Growth in the consulting and management services segment, offering strategic guidance on optimizing chemical supply chains, will further contribute to market expansion. The UK's focus on infrastructure development will also play a supporting role in facilitating smooth chemical transportation. Competition among established players and new entrants is expected to remain intense, with a focus on innovation, service diversification and optimized pricing strategies.

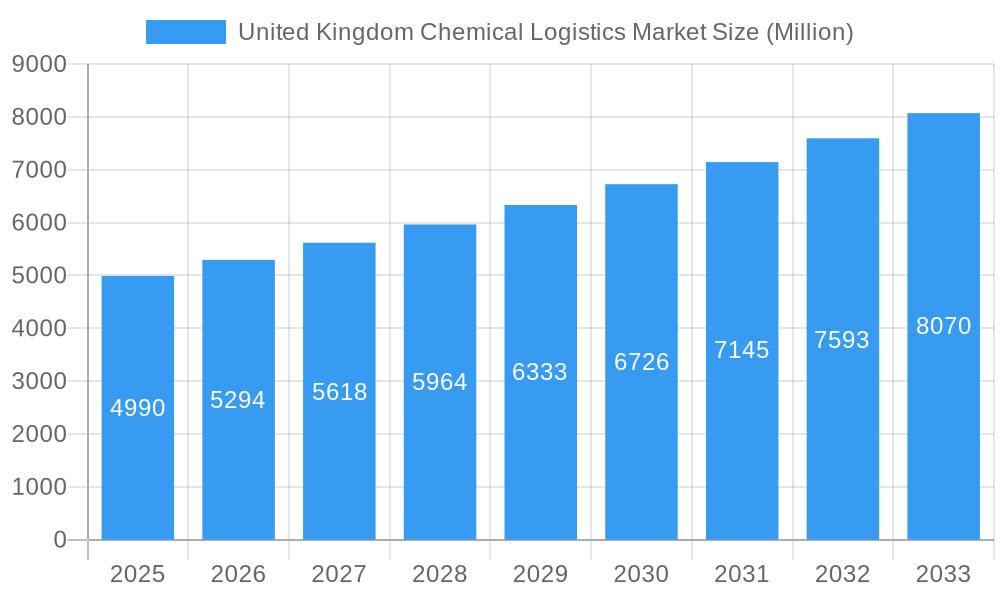

United Kingdom Chemical Logistics Market Company Market Share

United Kingdom Chemical Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom Chemical Logistics Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, key players, emerging trends, and future growth prospects, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages a robust methodology, incorporating extensive primary and secondary research to deliver accurate and actionable intelligence. The market is projected to reach £XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

United Kingdom Chemical Logistics Market Market Concentration & Dynamics

The UK chemical logistics market demonstrates a moderately concentrated structure, with several major players holding significant market share. DHL and Suttons Group are prominent examples, alongside seven other companies including CEVA Logistics, BDP International, Den Hartogh, DACHSER, C.H. Robinson, Streamline Shipping, Rhenus Logistics, and Hoyer Group. These companies compete intensely, driving innovation and efficiency improvements. Market share analysis reveals DHL holding approximately XX% of the market in 2025, while Suttons Group holds approximately XX%. The remaining share is distributed among numerous smaller companies and niche players.

The market's dynamics are shaped by several factors:

- Innovation Ecosystems: Ongoing investments in technology like AI and blockchain are transforming supply chain management, optimizing logistics processes, and enhancing security.

- Regulatory Frameworks: Stringent environmental regulations and safety standards influence operational strategies and necessitate compliance investments.

- Substitute Products: The emergence of alternative transportation modes and logistics solutions poses a competitive threat, requiring companies to adapt.

- End-User Trends: Growing demand for specialized chemical handling and secure transportation is driving market growth, particularly within the pharmaceutical and specialty chemicals sectors.

- M&A Activities: Consolidation in the sector is expected to continue, driven by the need for scale and enhanced service offerings. We project approximately XX M&A deals within the next five years.

United Kingdom Chemical Logistics Market Industry Insights & Trends

The United Kingdom's chemical logistics market is a dynamic and rapidly evolving sector, exhibiting substantial growth driven by a confluence of powerful economic and technological forces. The market size was estimated at £XX Million in 2025 and is on a trajectory for significant expansion in the foreseeable future. Key catalysts underpinning this robust growth include:

- Expansion of Key End-Use Industries: The sustained growth of the pharmaceutical sector, alongside the burgeoning demand from the cosmetics industry, is a primary driver. These sectors necessitate specialized handling and secure, compliant transportation of sensitive and high-value chemicals.

- Technological Advancements and Digitalization: The widespread adoption of automation, artificial intelligence (AI), data analytics, and the Internet of Things (IoT) is revolutionizing operational efficiency. These technologies are streamlining supply chains, enhancing real-time visibility, optimizing inventory management, and improving predictive capabilities for demand forecasting and route planning.

- Evolving Consumer and Corporate Demands: A pronounced shift towards environmentally conscious logistics solutions is influencing market dynamics. Businesses are increasingly prioritizing sustainability, prompting logistics providers to invest in greener fleet options, optimized route management to reduce emissions, and waste reduction strategies.

- E-commerce Growth: The continued surge in e-commerce activities is directly translating into an elevated demand for agile, reliable, and expedited delivery services for a wide array of chemical products, from industrial inputs to consumer goods.

- Government Infrastructure Investments: Strategic investments by the UK government in improving national infrastructure, including ports, road networks, and rail connectivity, are creating a more efficient and resilient logistical framework for the movement of chemicals across the nation.

Key Markets & Segments Leading United Kingdom Chemical Logistics Market

By End User:

- The Pharmaceutical Industry dominates, driven by stringent regulatory compliance requirements and the need for secure and temperature-controlled transportation.

- The Specialty Chemicals Industry is another major segment, with demand for specialized handling and transportation solutions for various chemicals.

By Service:

- Transportation remains the largest service segment, accounting for the largest portion of market revenue.

- Warehousing and Distribution are crucial support services, experiencing steady growth due to the expanding need for efficient storage and handling solutions.

- Green Logistics is an emerging segment witnessing significant growth driven by increasing environmental concerns.

By Mode of Transportation:

- Roadways dominate due to their flexibility and accessibility.

- Railways are gaining importance for long-distance transportation, offering cost-effectiveness and environmental benefits.

Drivers include:

- Strong economic growth in the UK, boosting industrial activity and chemical production.

- Investments in transportation infrastructure, improving connectivity and efficiency.

United Kingdom Chemical Logistics Market Product Developments

Recent product innovations focus on enhancing safety, efficiency, and sustainability. This includes the adoption of advanced tracking technologies, specialized containers for hazardous materials, and the implementation of eco-friendly transportation options. Companies are increasingly focusing on providing integrated logistics solutions, combining transportation, warehousing, and other services to offer comprehensive support to clients. These innovations enhance competitive advantage by improving service quality and reducing operational costs.

Challenges in the United Kingdom Chemical Logistics Market Market

Despite its promising growth trajectory, the UK chemical logistics market navigates a complex landscape of challenges that necessitate strategic mitigation and continuous adaptation. These hurdles include:

- Stringent Regulatory Compliance: The transportation and handling of hazardous materials are subject to rigorous and evolving regulations. Adhering to these mandates, including safety protocols, documentation, and specialized training, imposes significant compliance costs and operational complexities.

- Supply Chain Vulnerabilities: The market remains susceptible to disruptions stemming from labor shortages across various logistics roles, port congestion, and geopolitical events. These disruptions can lead to significant delays, increased lead times, and elevated operational expenses.

- Intense Market Competition: The presence of established, large-scale logistics providers alongside agile new entrants fuels fierce competition. This competitive pressure can impact profit margins and necessitates a constant focus on service differentiation and cost optimization.

- Rising Operational Costs: Fluctuations in fuel prices, increasing insurance premiums, and the ongoing need for investment in specialized equipment and safety infrastructure contribute to rising operational costs.

Forces Driving United Kingdom Chemical Logistics Market Growth

Technological advancements are creating more efficient and secure supply chain solutions. The growing demand for chemical products across various sectors is fueling market expansion. Favorable government policies promoting infrastructure development and environmental sustainability are stimulating growth. These factors collectively contribute to the overall positive trajectory of the UK chemical logistics market.

Long-Term Growth Catalysts in the United Kingdom Chemical Logistics Market

Long-term growth will be fueled by ongoing technological innovations leading to the development of more sophisticated and efficient logistics solutions. Strategic partnerships and collaborations between logistics providers and chemical manufacturers will enhance coordination and efficiency. Expansion into new markets and the integration of advanced technologies such as AI and blockchain will further drive long-term growth.

Emerging Opportunities in United Kingdom Chemical Logistics Market

The UK chemical logistics market is ripe with emerging opportunities that present significant avenues for growth and innovation. Forward-thinking companies can capitalize on these trends by:

- Embracing Green Logistics: The escalating demand for sustainable practices creates a substantial opportunity for logistics providers to differentiate themselves. This includes investing in electric or alternative fuel vehicles, optimizing routes for reduced emissions, and offering circular economy solutions for packaging and waste management.

- Leveraging Advanced Technologies: The integration of cutting-edge technologies such as the Internet of Things (IoT) for real-time asset tracking and condition monitoring, blockchain for enhanced supply chain transparency and traceability, and AI for predictive analytics offers immense potential to improve efficiency, reduce risks, and enhance customer service.

- Specialized Niche Sector Growth: The increasing complexity and specific handling requirements of chemicals within niche sectors, such as advanced materials, biopharmaceuticals, and specialty chemicals, are creating a demand for highly specialized logistics services. Companies that can offer tailored solutions and possess deep domain expertise are well-positioned for growth.

- Value-Added Services: Beyond core transportation, there is a growing demand for value-added services like chemical blending, repackaging, temperature-controlled warehousing, and regulatory consulting. Offering these integrated solutions can create sticky customer relationships and unlock new revenue streams.

Leading Players in the United Kingdom Chemical Logistics Market Sector

- DHL

- Suttons Group

- CEVA Logistics

- BDP International

- Den Hartogh

- DACHSER

- C.H. Robinson

- Streamline Shipping

- Rhenus Logistics

- Hoyer Group

Key Milestones in United Kingdom Chemical Logistics Market Industry

- 2021: Introduction of enhanced regulations governing the transportation and storage of hazardous materials, emphasizing stricter compliance and safety standards.

- 2022: Several prominent logistics providers launched sophisticated real-time tracking and visibility systems, significantly improving supply chain transparency and enabling proactive management of shipments.

- 2023: A notable surge in investments by key players in warehouse automation technologies, including robotic systems and automated guided vehicles (AGVs), to boost efficiency and reduce labor dependency.

- Early 2024: Increased focus and investment in developing and implementing sustainable logistics solutions, with several companies announcing ambitious carbon reduction targets and the adoption of greener fleets.

Strategic Outlook for United Kingdom Chemical Logistics Market Market

The UK chemical logistics market holds immense potential for future growth, driven by continuous technological advancements, increasing demand for specialized services, and a growing focus on sustainability. Strategic investments in infrastructure, innovative solutions, and sustainable practices will be crucial for companies to capitalize on the market's growth opportunities. Companies focusing on providing integrated and technologically advanced solutions will be best positioned for success.

United Kingdom Chemical Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Consulting & Management Services

- 1.4. Customs & Security

- 1.5. Green Logistics

- 1.6. Other Services

-

2. Mode of Transportation

- 2.1. Roadways

- 2.2. Railways

- 2.3. Airways

- 2.4. Waterways

- 2.5. Pipelines

-

3. End User

- 3.1. Pharmaceutical Industry

- 3.2. Cosmetic Industry

- 3.3. Oil and Gas Industry

- 3.4. Specialty Chemicals Industry

- 3.5. Other End Users

United Kingdom Chemical Logistics Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Chemical Logistics Market Regional Market Share

Geographic Coverage of United Kingdom Chemical Logistics Market

United Kingdom Chemical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adherence to Stringent Regulations; Globalization of Supply Chains

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns

- 3.4. Market Trends

- 3.4.1. The Impact of Brexit on Trade with the United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Consulting & Management Services

- 5.1.4. Customs & Security

- 5.1.5. Green Logistics

- 5.1.6. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.2.1. Roadways

- 5.2.2. Railways

- 5.2.3. Airways

- 5.2.4. Waterways

- 5.2.5. Pipelines

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical Industry

- 5.3.2. Cosmetic Industry

- 5.3.3. Oil and Gas Industry

- 5.3.4. Specialty Chemicals Industry

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suttons Group**List Not Exhaustive 7 3 Other Companie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CEVA Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BDP International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Den Hartogh

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DACHSER

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 C H Robinson

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Streamline Shipping

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rhenus Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hoyer Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: United Kingdom Chemical Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Chemical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Chemical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: United Kingdom Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 3: United Kingdom Chemical Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: United Kingdom Chemical Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Chemical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: United Kingdom Chemical Logistics Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 7: United Kingdom Chemical Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: United Kingdom Chemical Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Chemical Logistics Market?

The projected CAGR is approximately 5.93%.

2. Which companies are prominent players in the United Kingdom Chemical Logistics Market?

Key companies in the market include DHL, Suttons Group**List Not Exhaustive 7 3 Other Companie, CEVA Logistics, BDP International, Den Hartogh, DACHSER, C H Robinson, Streamline Shipping, Rhenus Logistics, Hoyer Group.

3. What are the main segments of the United Kingdom Chemical Logistics Market?

The market segments include Service, Mode of Transportation, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Adherence to Stringent Regulations; Globalization of Supply Chains.

6. What are the notable trends driving market growth?

The Impact of Brexit on Trade with the United Kingdom.

7. Are there any restraints impacting market growth?

Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Chemical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Chemical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Chemical Logistics Market?

To stay informed about further developments, trends, and reports in the United Kingdom Chemical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence