Key Insights

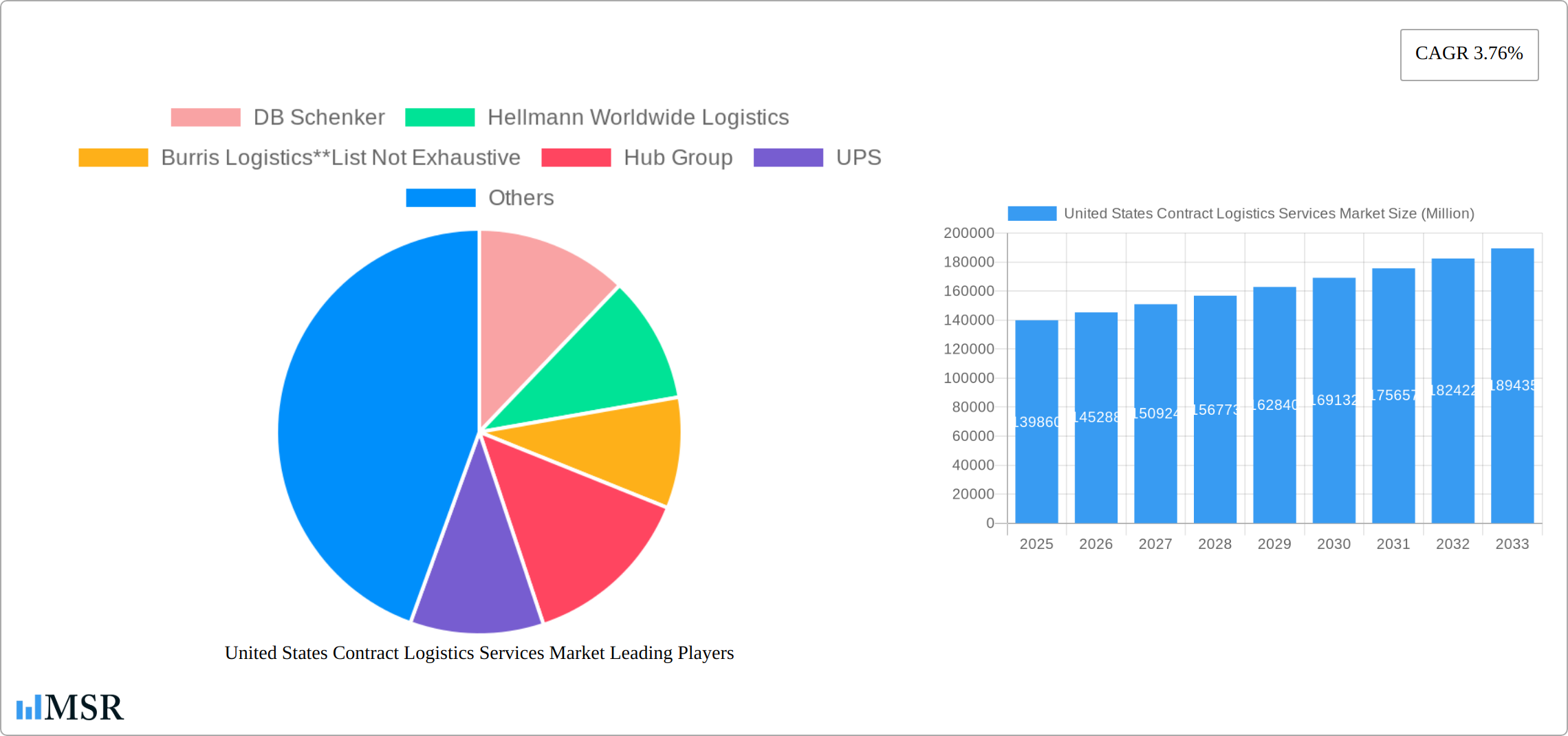

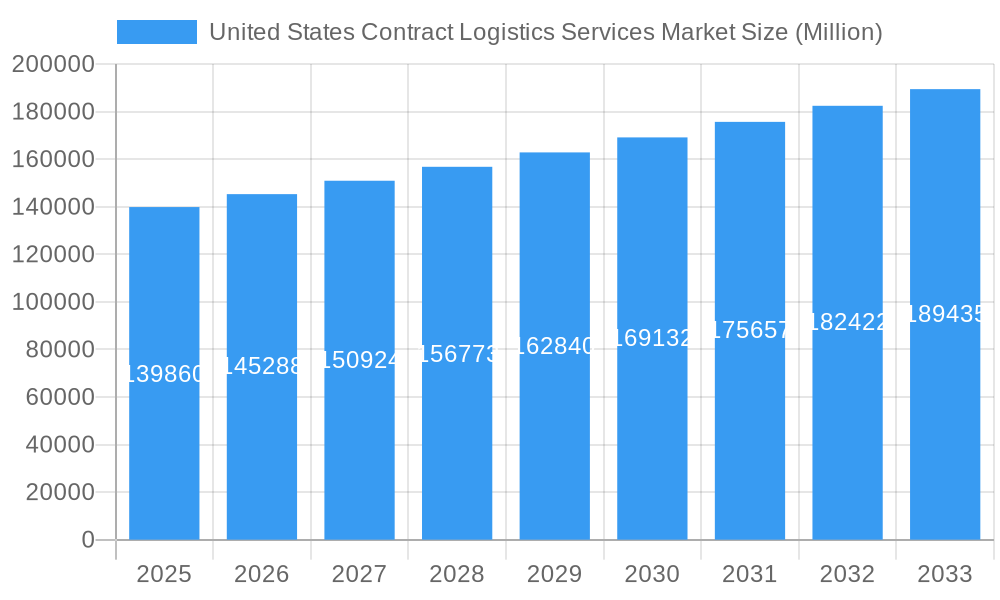

The United States contract logistics services market, valued at $139.86 billion in 2025, is projected to experience steady growth, driven by the increasing adoption of e-commerce, the expansion of global supply chains, and the rising demand for efficient and cost-effective logistics solutions across various sectors. The market's Compound Annual Growth Rate (CAGR) of 3.76% from 2025 to 2033 indicates a consistent upward trajectory. Key growth drivers include the need for greater supply chain visibility and resilience in response to recent global disruptions, the increasing complexity of logistics operations, and the rising adoption of advanced technologies like AI and automation to enhance efficiency and reduce costs. The outsourcing of logistics functions, particularly by companies focusing on core competencies, is a significant factor contributing to market expansion. While specific regional data for the US is absent, we can infer a strong concentration within key industrial hubs and major population centers given the market's overall size and the presence of major logistics providers. The segmental breakdown indicates strong growth potential within sectors like high-tech, healthcare, and pharmaceuticals, which require specialized handling and stringent regulatory compliance. Competition is fierce, with established players like DHL, FedEx, UPS, and others competing alongside emerging specialized providers.

United States Contract Logistics Services Market Market Size (In Billion)

The market's segmentation by type (insourced vs. outsourced) and end-user (manufacturing, retail, healthcare, etc.) provides valuable insights into specific market dynamics. The dominance of outsourced services suggests a preference for leveraging specialized expertise and reducing internal operational burdens. Furthermore, the significant presence of major logistics companies indicates a consolidated market structure with high barriers to entry. However, the continued growth of e-commerce and the emergence of innovative logistics solutions, such as last-mile delivery optimization and drone technology, present opportunities for both existing players and new entrants. The market's future growth will likely depend on adapting to evolving consumer demands, integrating advanced technologies, and maintaining robust and resilient supply chains in the face of ongoing global uncertainties.

United States Contract Logistics Services Market Company Market Share

United States Contract Logistics Services Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Contract Logistics Services Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market size, segmentation, key players, growth drivers, challenges, and future opportunities, utilizing data from 2019-2024 (Historical Period), with projections extending to 2033 (Forecast Period). The Base Year for this analysis is 2025, and the Estimated Year is also 2025.

United States Contract Logistics Services Market Market Concentration & Dynamics

The United States contract logistics services market exhibits a moderately concentrated landscape, with several large multinational players and numerous smaller, specialized providers. Market share is largely held by established giants like UPS, FedEx Logistics, and DHL Supply Chain North America, while regional and niche players compete for specific market segments. The market's dynamics are shaped by a complex interplay of factors:

Innovation Ecosystems: Technological advancements in automation, AI, and data analytics are driving innovation, leading to improved efficiency and supply chain visibility. This is fostering competition and creating opportunities for specialized service providers.

Regulatory Frameworks: Stringent regulations surrounding transportation, safety, and data privacy influence operational costs and strategies for logistics providers. Compliance requirements vary across states and present ongoing challenges.

Substitute Products: The emergence of alternative transportation methods (e.g., drone delivery) and the growth of e-commerce fulfillment networks offer substitute solutions impacting market share.

End-User Trends: E-commerce growth, omnichannel strategies, and the demand for faster delivery times are shaping end-user needs, driving demand for flexible and efficient contract logistics services.

M&A Activities: The market has witnessed significant M&A activity recently, as exemplified by Yusen Logistics' acquisition of Taylored Services and DSV's acquisitions of S&M Moving Systems West and Global Diversity Logistics (both in March 2023). These mergers and acquisitions aim to expand market reach, enhance service offerings, and improve operational efficiency. The number of M&A deals in the past five years is estimated at xx. The market share of the top 5 players is approximately xx%.

United States Contract Logistics Services Market Industry Insights & Trends

The United States contract logistics services market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by several key trends:

E-commerce Boom: The rapid growth of e-commerce continues to drive demand for efficient last-mile delivery, warehousing, and fulfillment services. This is significantly impacting market size and segmentation.

Globalization and Supply Chain Complexity: Increased global trade and intricate supply chains require specialized logistics solutions to manage inventory, transportation, and customs processes.

Technological Disruptions: Automation technologies, AI-powered analytics, and blockchain solutions are revolutionizing logistics operations, improving efficiency, and transparency.

Focus on Sustainability: Growing environmental concerns are pushing companies to adopt more sustainable logistics practices, increasing demand for green solutions and impacting operational decisions.

Demand for Visibility and Data Analytics: Companies increasingly prioritize data-driven decision-making, leading to a growing demand for real-time visibility into their supply chains and advanced analytics to optimize operations.

Key Markets & Segments Leading United States Contract Logistics Services Market

The United States contract logistics services market is geographically diverse, with significant activity across various regions. However, key segments exhibit differing growth rates:

By Type: The outsourced segment dominates the market, reflecting a growing preference for outsourcing logistics functions to specialized providers, thereby reducing operational costs and improving efficiency. The insourced segment still holds a sizable share, particularly among large enterprises with extensive internal logistics capabilities.

By End-User: The Manufacturing and Automotive segment is a major driver, followed by Consumer Goods and Retail. The High-tech and Healthcare and Pharmaceuticals sectors also contribute significantly, demanding specialized handling and compliance standards. The "Other End-Users" segment, encompassing energy, construction, and aerospace, presents a growing market with unique logistics needs.

Drivers for Growth Across Segments:

- Economic Growth: Strong economic activity fuels demand for goods and services, driving the need for efficient logistics.

- Infrastructure Development: Investment in transportation infrastructure, including roads, rail, and ports, enhances logistics efficiency.

- Technological Advancements: Automation and data analytics improve efficiency and reduce costs across all end-user segments.

- Government Regulations: Regulations impacting environmental sustainability and security drive demand for compliance-focused logistics solutions.

United States Contract Logistics Services Market Product Developments

The United States contract logistics services market is experiencing a dynamic evolution driven by technological advancements and a growing emphasis on efficiency, sustainability, and customer-centric solutions. Key product developments are centered around:

- Enhanced Visibility and Real-Time Tracking: The integration of IoT devices, AI-powered analytics, and advanced telematics is providing unprecedented real-time visibility across the entire supply chain. This allows for proactive identification and mitigation of potential disruptions, improved inventory management, and more accurate delivery estimations.

- Automation and Robotics: Significant investments are being made in warehouse automation, including autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and robotic picking solutions. These technologies are not only boosting throughput and accuracy but also addressing labor shortages and reducing operational costs.

- Advanced Warehouse Management Systems (WMS) and Transportation Management Systems (TMS): Sophisticated WMS and TMS platforms are becoming more integrated and intelligent. They leverage AI and machine learning for predictive analytics, dynamic routing optimization, load building, and labor management, leading to substantial gains in efficiency and cost savings.

- Sustainable Logistics Solutions: A growing imperative for environmental responsibility is driving the development and adoption of sustainable logistics practices. This includes the deployment of electric and alternative fuel vehicles, route optimization to minimize mileage and emissions, eco-friendly packaging solutions, and energy-efficient warehouse operations.

- Data Analytics and AI-Driven Insights: The use of big data analytics and artificial intelligence is transforming contract logistics from a reactive service to a proactive strategic partner. Providers are leveraging these tools to gain deeper insights into customer demand, optimize inventory placement, predict potential bottlenecks, and personalize service offerings.

- Last-Mile Delivery Innovations: With the surge in e-commerce, there's a heightened focus on optimizing last-mile delivery. This includes the development of micro-fulfillment centers, crowd-sourced delivery networks, and drone delivery capabilities, all aimed at improving speed, cost-effectiveness, and customer satisfaction.

Providers who successfully integrate these innovative solutions are gaining a significant competitive edge by offering more agile, efficient, cost-effective, and environmentally responsible contract logistics services.

Challenges in the United States Contract Logistics Services Market Market

The U.S. contract logistics services market, while robust, is not without its significant hurdles:

- Persistent Driver Shortages: A chronic and deepening shortage of qualified truck drivers continues to be a major impediment. This directly translates to increased labor costs, longer transit times, reduced capacity, and a diminished ability to meet escalating demand.

- Volatile Fuel Prices: Fluctuations and consistent upward trends in fuel prices exert considerable pressure on operational budgets. These unpredictable costs directly impact transportation expenses, affecting profitability and requiring constant recalibration of pricing strategies.

- Escalating Supply Chain Disruptions: The market remains highly susceptible to various forms of disruptions, including geopolitical tensions, extreme weather events, pandemics, and port congestion. These unforeseen events can cripple delivery reliability, lead to inventory stockouts, and significantly damage customer trust.

- Intensifying Competition and Margin Pressures: The contract logistics landscape is characterized by fierce competition from a wide array of players, from global giants to niche providers. This intense rivalry necessitates continuous innovation and service excellence, while also compressing profit margins. The average profit margin for companies in this sector is estimated to be between 3-5% on average, though this can vary significantly based on specialization and scale.

- Rising Labor Costs and Labor Management: Beyond driver shortages, the broader labor market for warehouse staff, pickers, and packers is also experiencing increasing wage pressures and difficulties in recruitment and retention. Managing a dynamic and often transient workforce presents ongoing operational challenges.

- Technological Integration Complexity: While technology offers solutions, the integration of disparate systems, the need for skilled personnel to manage them, and the significant upfront investment can be a barrier for some organizations.

Forces Driving United States Contract Logistics Services Market Growth

Several factors drive long-term growth:

- Technological advancements: Automation, AI, and data analytics enhance efficiency and optimize supply chains.

- E-commerce expansion: The continued growth of online retail fuels demand for fulfillment and last-mile delivery services.

- Government initiatives: Investments in infrastructure and support for technological innovation foster industry growth.

Challenges in the United States Contract Logistics Services Market Market

The U.S. contract logistics services market, while robust, is not without its significant hurdles:

- Persistent Driver Shortages: A chronic and deepening shortage of qualified truck drivers continues to be a major impediment. This directly translates to increased labor costs, longer transit times, reduced capacity, and a diminished ability to meet escalating demand.

- Volatile Fuel Prices: Fluctuations and consistent upward trends in fuel prices exert considerable pressure on operational budgets. These unpredictable costs directly impact transportation expenses, affecting profitability and requiring constant recalibration of pricing strategies.

- Escalating Supply Chain Disruptions: The market remains highly susceptible to various forms of disruptions, including geopolitical tensions, extreme weather events, pandemics, and port congestion. These unforeseen events can cripple delivery reliability, lead to inventory stockouts, and significantly damage customer trust.

- Intensifying Competition and Margin Pressures: The contract logistics landscape is characterized by fierce competition from a wide array of players, from global giants to niche providers. This intense rivalry necessitates continuous innovation and service excellence, while also compressing profit margins. The average profit margin for companies in this sector is estimated to be between 3-5% on average, though this can vary significantly based on specialization and scale.

- Rising Labor Costs and Labor Management: Beyond driver shortages, the broader labor market for warehouse staff, pickers, and packers is also experiencing increasing wage pressures and difficulties in recruitment and retention. Managing a dynamic and often transient workforce presents ongoing operational challenges.

- Technological Integration Complexity: While technology offers solutions, the integration of disparate systems, the need for skilled personnel to manage them, and the significant upfront investment can be a barrier for some organizations.

Emerging Opportunities in United States Contract Logistics Services Market

The United States contract logistics services market is ripe with emerging opportunities that are shaping its future landscape:

- Ubiquitous Omnichannel Fulfillment: The continued growth of e-commerce and the blurring lines between online and brick-and-mortar retail has fueled an insatiable demand for sophisticated omnichannel fulfillment capabilities. Companies are actively seeking logistics partners who can seamlessly manage inventory across multiple channels, provide flexible fulfillment options (e.g., buy online, pick up in-store; ship from store), and ensure consistent customer experiences.

- Surge in Demand for Sustainable and Green Logistics Solutions: Environmental consciousness is no longer a niche concern but a mainstream expectation. This presents a significant opportunity for logistics providers who can offer and effectively market eco-friendly solutions, including fleets powered by alternative fuels, optimized routing for reduced emissions, sustainable packaging, and energy-efficient warehousing. Consumers and corporations alike are prioritizing partners with a demonstrable commitment to sustainability.

- Expansion into Underserved and Niche Markets: Beyond established hubs, significant growth potential lies in serving less-penetrated geographic regions and specialized industry sectors. This includes catering to the unique logistics needs of industries such as pharmaceuticals, perishable goods, hazardous materials, and e-grocery, where specialized infrastructure, regulatory compliance, and temperature control are critical.

- The Rise of Reshoring and Nearshoring: Geopolitical shifts and a desire for more resilient supply chains are driving a trend towards reshoring and nearshoring of manufacturing. This creates new demands for domestic logistics services, including warehousing, transportation, and value-added services to support these repatriated operations.

- Personalized and High-Touch Logistics: As consumer expectations evolve, there is an increasing demand for personalized and high-touch logistics services. This can range from white-glove delivery for high-value items to customized packaging and kitting services, offering opportunities for providers who can offer tailored and premium solutions.

- Advanced Analytics and AI as a Service: Beyond core logistics operations, there's an opportunity to offer advanced data analytics and AI-driven insights as a standalone service. This allows clients to leverage the provider's expertise in predictive forecasting, demand planning, and network optimization without needing to invest in their own extensive analytical infrastructure.

Leading Players in the United States Contract Logistics Services Market Sector

Key Milestones in United States Contract Logistics Services Market Industry

- March 2023: Yusen Logistics acquires Taylored Services, expanding its U.S. warehouse network and strengthening its end-to-end supply chain portfolio.

- March 2023: DSV acquires S&M Moving Systems West and Global Diversity Logistics, strengthening its position in the semiconductor industry and cross-border services to Latin America.

Strategic Outlook for United States Contract Logistics Services Market Market

The U.S. contract logistics services market is poised for continued growth, driven by e-commerce expansion, technological innovation, and increasing demand for efficient and sustainable supply chain solutions. Companies that can adapt to changing market dynamics, invest in advanced technologies, and offer customized solutions will be well-positioned to capitalize on future opportunities. The market presents a compelling investment opportunity for stakeholders, promising high returns on investments in scalable and sustainable logistics solutions.

United States Contract Logistics Services Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other En

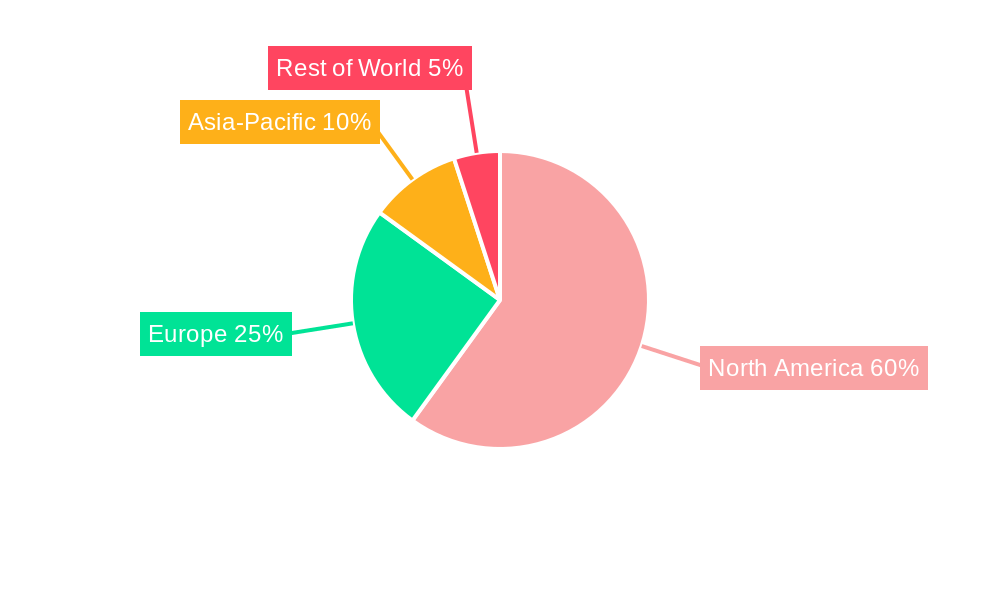

United States Contract Logistics Services Market Segmentation By Geography

- 1. United States

United States Contract Logistics Services Market Regional Market Share

Geographic Coverage of United States Contract Logistics Services Market

United States Contract Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency and Time Efficiency; Increasing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory Environment; Technical Limitations

- 3.4. Market Trends

- 3.4.1. Growth of Optimized Warehousing Network

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Contract Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hellmann Worldwide Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Burris Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hub Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEODIS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GXO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ryder Supply Chain Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kuehne + Nagel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DHL Supply Chain North America

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GAC United States

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 FedEx Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: United States Contract Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Contract Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: United States Contract Logistics Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: United States Contract Logistics Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: United States Contract Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Contract Logistics Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: United States Contract Logistics Services Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: United States Contract Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Contract Logistics Services Market?

The projected CAGR is approximately 3.76%.

2. Which companies are prominent players in the United States Contract Logistics Services Market?

Key companies in the market include DB Schenker, Hellmann Worldwide Logistics, Burris Logistics**List Not Exhaustive, Hub Group, UPS, GEODIS, XPO Logistics, GXO Logistics, Ryder Supply Chain Solutions, Kuehne + Nagel, DHL Supply Chain North America, GAC United States, FedEx Logistics.

3. What are the main segments of the United States Contract Logistics Services Market?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency and Time Efficiency; Increasing E-commerce Sector.

6. What are the notable trends driving market growth?

Growth of Optimized Warehousing Network.

7. Are there any restraints impacting market growth?

Regulatory Environment; Technical Limitations.

8. Can you provide examples of recent developments in the market?

March 2023: Yusen Logistics, a leading global supply chain provider, has acquired ownership of Taylored Services, a U.S. multichannel 3PL fulfillment organization. The deal expands Yusen Logistics' Contract Logistics Group's warehouse network in key distribution areas of the United States and further strengthens its end-to-end supply chain portfolio with specialized services, such as omnichannel retail, wholesale, and e-Commerce fulfillment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Contract Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Contract Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Contract Logistics Services Market?

To stay informed about further developments, trends, and reports in the United States Contract Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence