Key Insights

The APAC Wireless Audio Market is set for substantial growth, projected to reach $34371.3 million by 2024, with a CAGR of 26.1% through 2033. This expansion is driven by technological innovation, rising disposable incomes, and increasing demand for convenient audio solutions. The widespread adoption of smartphones and the popularity of streaming services are fueling the demand for wireless audio devices offering superior sound quality and advanced features. Key growth catalysts include smart home integration, the rise of wearable technology, and advancements in audio codecs and noise-cancellation. True Wireless Stereo (TWS) earbuds are expected to lead this growth due to their portability and sophisticated features, while smart speakers are gaining traction for their voice-controlled convenience within smart home ecosystems.

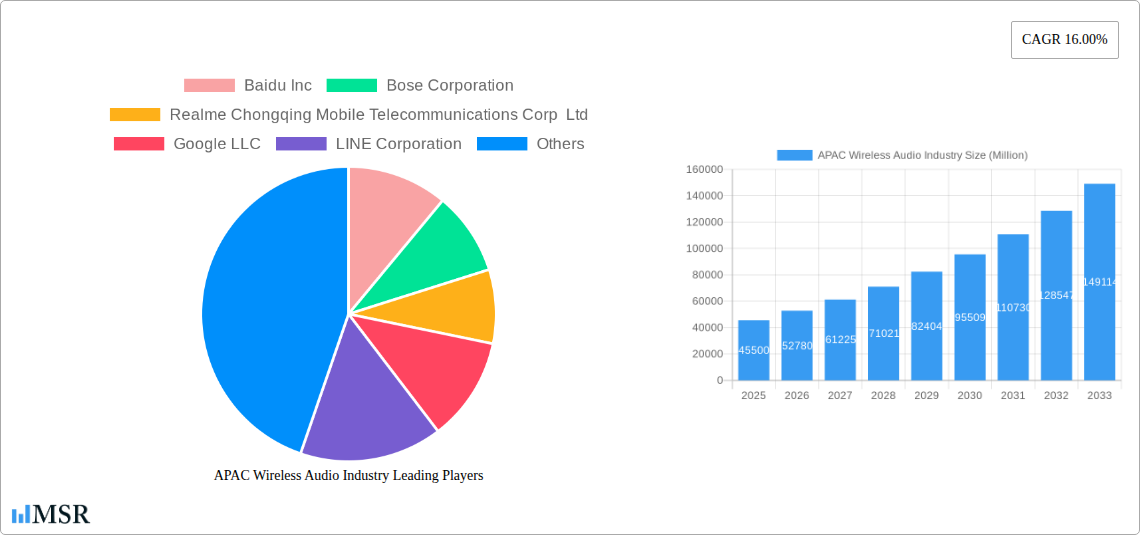

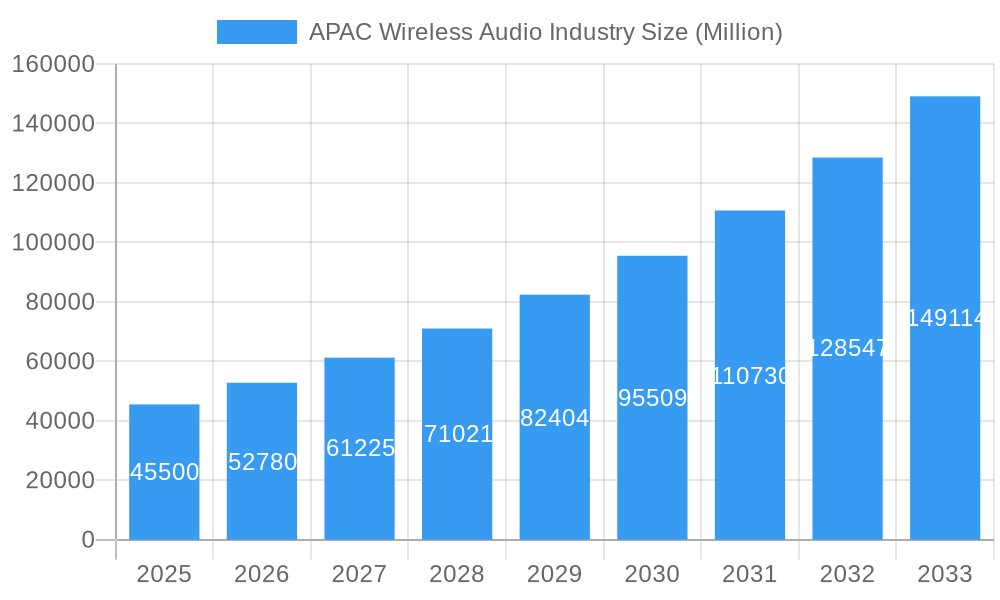

APAC Wireless Audio Industry Market Size (In Billion)

The competitive environment features both global leaders and local manufacturers. Major players like Apple, Samsung, Xiaomi, and Huawei are prominent, supported by their strong brand presence and diverse product ranges. Emerging companies are also making significant impacts, particularly in China and India, through localized strategies and competitive pricing. The market is trending towards premiumization, with consumers investing in high-fidelity wireless audio. Potential restraints include the cost of advanced technologies, battery life concerns for some devices, and the necessity for robust cybersecurity for smart audio products. Despite these challenges, the APAC wireless audio market outlook remains highly positive, presenting significant opportunities for innovation and expansion.

APAC Wireless Audio Industry Company Market Share

APAC Wireless Audio Market: Forecast and Strategic Analysis (2024-2033)

This report provides comprehensive insights and strategic recommendations for the dynamic APAC Wireless Audio Market. Our analysis spans the base year (2024) and a robust forecast period (2024-2033), projecting a market size of $34371.3 million by 2024, with a CAGR of 26.1%. This report is optimized for search engines, targeting keywords such as "APAC wireless audio market," "True Wireless Stereo APAC," "smart speaker market Asia Pacific," "Bluetooth headphone demand," and "wireless audio industry trends."

APAC Wireless Audio Industry Market Concentration & Dynamics

The APAC Wireless Audio Industry is characterized by a moderately concentrated market, driven by intense competition and rapid technological advancements. Innovation ecosystems thrive, fueled by a blend of global giants and burgeoning local players. Regulatory frameworks are evolving, with governments increasingly focusing on consumer electronics standards and data privacy, impacting market entry and product development. Substitute products, primarily wired audio devices and increasingly sophisticated integrated audio solutions within other consumer electronics, pose a continuous challenge. End-user trends are heavily influenced by rising disposable incomes, a growing demand for portable and convenient audio solutions, and an increasing adoption of smart home technologies. Mergers and acquisitions (M&A) remain a key dynamic, with XX M&A deals recorded historically. Leading companies like Samsung Electronics Co Ltd and Apple Inc (Including Beats Electronics LLC) hold significant market share, estimated at XX% and XX% respectively. Other key players contributing to market dynamics include Xiaomi Corp and Sony Corporation. The interplay of these factors shapes a competitive yet opportunity-rich landscape for wireless audio solutions.

APAC Wireless Audio Industry Industry Insights & Trends

The APAC Wireless Audio Industry is poised for substantial growth, projected to reach a market size of $XX Million by 2033, exhibiting a compelling CAGR of XX% during the forecast period (2025-2033). This expansion is predominantly fueled by several key market growth drivers. Firstly, the burgeoning middle class across Asia Pacific, particularly in countries like India and Indonesia, is increasing disposable incomes, leading to greater spending on premium consumer electronics, including advanced wireless audio devices. Secondly, the rapid proliferation of smartphones and wearable technology acts as a significant catalyst, as these devices are intrinsically linked to the consumption of wireless audio. The demand for seamless integration and enhanced audio experiences is driving adoption of True Wireless Stereo (TWS) earphones and advanced wireless headsets.

Technological disruptions are at the forefront of market evolution. The continuous miniaturization of components, coupled with advancements in battery technology, enables longer listening times and more compact designs for devices like wireless speakers and earphones. The integration of Artificial Intelligence (AI) and voice assistants within smart speakers and even headphones is transforming user interaction and creating new product categories. Furthermore, the increasing adoption of higher-fidelity audio codecs and active noise cancellation (ANC) technologies is catering to the sophisticated demands of audiophiles and consumers seeking immersive sound experiences.

Evolving consumer behaviors are also shaping the market. There is a discernible shift towards personalized audio experiences, with consumers seeking devices that offer customizable sound profiles and seamless connectivity across multiple platforms. The rise of streaming services and the increasing consumption of digital content, from music and podcasts to online gaming, further amplify the demand for high-quality wireless audio. The convenience and freedom offered by wireless technology are paramount, driving a preference for devices that eliminate cables and offer greater mobility. This trend is particularly evident in the burgeoning wireless earphones and True Wireless Stereo segments.

Key Markets & Segments Leading APAC Wireless Audio Industry

The APAC Wireless Audio Industry is experiencing a vibrant expansion, with several key markets and segments demonstrating remarkable dominance. Among the Type of Device segments, Wireless Earphones and True Wireless Stereo (TWS) are emerging as the primary growth engines, collectively accounting for an estimated XX% of the market share by 2025. This surge is propelled by factors such as increasing consumer preference for portability, the declining average selling price (ASP) of TWS devices, and the continuous innovation in features like active noise cancellation and improved battery life.

Drivers for Wireless Earphones & TWS Dominance:

- Urbanization and increasing disposable incomes: Particularly in countries like China, South Korea, and Japan, a growing urban population with higher disposable incomes readily adopts premium audio accessories.

- Smartphones as primary audio source: The ubiquity of smartphones, which often lack traditional headphone jacks, directly fuels the demand for wireless alternatives.

- Fitness and wellness trend: The rise in fitness activities and outdoor pursuits necessitates convenient, cable-free audio solutions for workouts.

- Technological advancements: Continuous improvements in Bluetooth connectivity, audio quality, and battery efficiency make TWS and wireless earphones increasingly attractive.

- Influence of social media and influencers: Marketing campaigns and endorsements from popular figures significantly impact consumer purchasing decisions in these segments.

Within the broader Wireless Speakers category, Smart Speakers are demonstrating significant traction, driven by the increasing adoption of smart home ecosystems and AI-powered voice assistants. This segment is projected to grow at a CAGR of XX% between 2025 and 2033. The integration of voice control for managing smart home devices, accessing information, and controlling entertainment is a key adoption driver.

Drivers for Smart Speaker Growth:

- Growing smart home penetration: As more households adopt smart home devices, the demand for centralized voice control solutions like smart speakers escalates.

- Advancements in voice recognition and AI: Improved natural language processing makes smart speakers more intuitive and user-friendly.

- Integration with streaming services: Seamless connectivity with popular music and entertainment platforms enhances the appeal of smart speakers.

- Government initiatives supporting digital infrastructure: Investments in broadband internet and smart city initiatives create a conducive environment for smart device adoption.

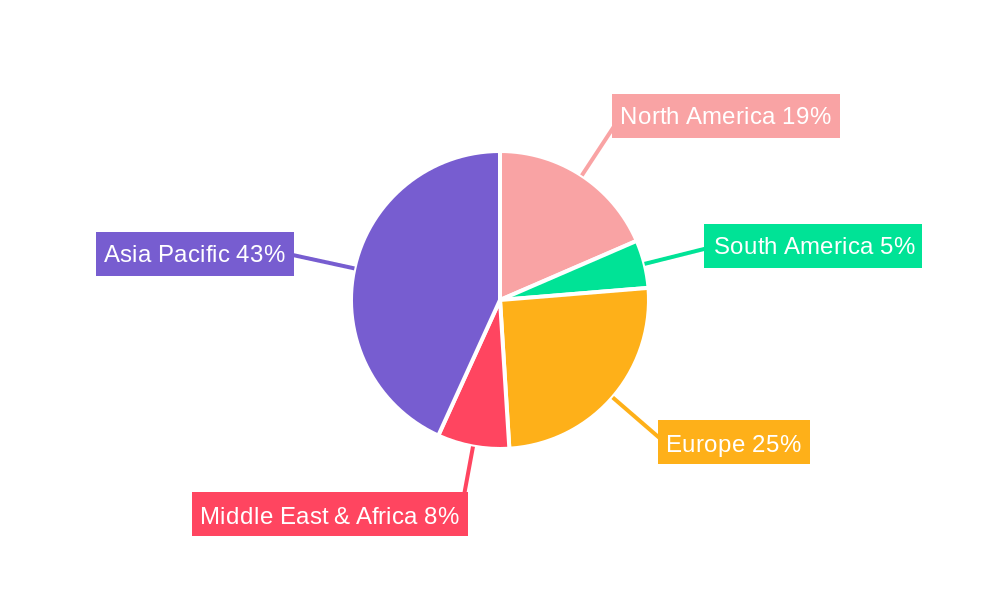

The dominant regions for wireless audio in APAC continue to be East Asia, led by China, South Korea, and Japan, followed by Southeast Asia, driven by markets like India, Indonesia, and Vietnam. These regions benefit from large populations, robust economic growth, and a high adoption rate of new technologies.

APAC Wireless Audio Industry Product Developments

Product innovation in the APAC Wireless Audio Industry is accelerating, with a focus on enhancing user experience and expanding functionality. Advancements in Active Noise Cancellation (ANC) technology, now featuring adaptive and transparency modes, are becoming standard in premium wireless earphones and headsets. The integration of advanced AI-powered voice assistants, offering seamless control and personalized recommendations, is redefining smart speakers and high-end headphones. Furthermore, the development of multi-device connectivity, allowing effortless switching between smartphones, tablets, and laptops, addresses a critical consumer need. The miniaturization of components and improvements in battery efficiency are leading to smaller, lighter, and longer-lasting devices across all wireless audio categories, reinforcing the competitive edge of leading brands.

Challenges in the APAC Wireless Audio Industry Market

The APAC Wireless Audio Industry faces several significant challenges that could impede its growth trajectory. Intense price competition from both established and emerging players, particularly in the wireless earphones and Bluetooth-only speakers segments, squeezes profit margins, estimated to impact profitability by XX%. Supply chain disruptions, exacerbated by geopolitical tensions and material shortages, continue to pose a risk to production volumes and timely product launches, leading to potential delays impacting market share by XX%. Regulatory hurdles concerning data privacy and product safety standards vary across different APAC nations, creating complexities for market entry and compliance, potentially increasing operational costs by XX%. Counterfeiting and intellectual property infringement remain persistent issues, particularly for popular brands, diluting brand value and revenue streams.

Forces Driving APAC Wireless Audio Industry Growth

Several potent forces are propelling the APAC Wireless Audio Industry forward. The relentless pace of technological innovation, particularly in areas like AI integration, superior audio codecs, and extended battery life, continually enhances product appeal and creates new market opportunities. The robust economic growth across key APAC nations, coupled with a rapidly expanding middle class, is leading to increased consumer spending power on discretionary electronics. Furthermore, favorable government initiatives promoting digital transformation and smart city development create a conducive environment for the adoption of connected audio devices. The increasing consumer demand for convenience and mobility, driven by smartphone proliferation and active lifestyles, underpins the preference for wireless solutions.

Challenges in the APAC Wireless Audio Industry Market

Long-term growth catalysts in the APAC Wireless Audio Industry are deeply rooted in continuous innovation and strategic market expansion. The ongoing pursuit of next-generation audio technologies, such as spatial audio and advanced hearable functionalities beyond basic listening, will unlock new premium market segments. Strategic partnerships between audio manufacturers and technology giants, particularly in AI and software development, will foster the creation of more intelligent and integrated audio ecosystems. Furthermore, the expansion into underserved emerging markets within Southeast Asia and parts of South Asia, with tailored product offerings and localized marketing strategies, presents significant untapped potential. Sustainability and eco-friendly product development are also becoming increasingly important, potentially driving brand loyalty and market differentiation.

Emerging Opportunities in APAC Wireless Audio Industry

Emerging opportunities in the APAC Wireless Audio Industry are ripe for exploration. The burgeoning demand for personalized audio experiences, including custom sound profiles and adaptive audio based on user environment and activity, presents a significant avenue for product differentiation. The integration of wearable health and wellness tracking features within audio devices, such as heart rate monitoring or posture correction reminders, taps into the growing health-conscious consumer base. The expansion of the gaming audio market across APAC, with a specific focus on low-latency, high-fidelity wireless headsets and speakers, offers substantial growth potential. Furthermore, the development of specialized audio solutions for enterprise and professional use, such as advanced communication headsets with superior noise cancellation and voice clarity, represents a less saturated but highly profitable niche.

Leading Players in the APAC Wireless Audio Industry Sector

- Baidu Inc

- Bose Corporation

- Realme Chongqing Mobile Telecommunications Corp Ltd

- Google LLC

- LINE Corporation

- Apple Inc (Including Beats Electronics LLC)

- Samsung Electronics Co Ltd

- Xiaomi Corp

- Skullcandy Inc

- Amazon com Inc

- Alibaba Group

- GN Audio AS (Jabra)

- Harman International Industries Incorporated (JBL)

- Huawei Device Co Ltd

- Sony Corporation

Key Milestones in APAC Wireless Audio Industry Industry

- 2019: Introduction of advanced Active Noise Cancellation (ANC) in mainstream wireless earphones by major players.

- 2020: Significant surge in True Wireless Stereo (TWS) earphone adoption, surpassing traditional wireless earbuds.

- 2021: Increased integration of voice assistants (e.g., Google Assistant, Alexa) into a wider range of smart speakers and headphones.

- 2022: Release of first-generation spatial audio enabled wireless earbuds, enhancing immersive listening experiences.

- 2023: Focus on sustainability and eco-friendly materials in product design and packaging gains momentum.

- 2024: Advancements in low-latency Bluetooth codecs significantly improve audio synchronization for gaming and video consumption.

- 2025 (Estimated): Continued miniaturization of components leads to even smaller and lighter TWS earbuds with extended battery life.

- 2026 (Forecast): Widespread adoption of adaptive ANC that intelligently adjusts to ambient noise levels.

- 2028 (Forecast): Increased integration of hearable health monitoring features into wireless earbuds.

- 2030 (Forecast): Emergence of AI-powered personalized audio tuning becoming a standard feature across premium devices.

- 2033 (Forecast): Significant market share for AR/VR integrated audio solutions driving immersive entertainment experiences.

Strategic Outlook for APAC Wireless Audio Industry Market

The strategic outlook for the APAC Wireless Audio Industry is exceptionally bright, driven by continuous technological evolution and expanding consumer demand. Growth accelerators include the persistent innovation in AI and spatial audio, promising more immersive and personalized listening experiences that will command premium pricing. Furthermore, the increasing integration of wireless audio devices with the burgeoning smart home and wearable technology ecosystems will create interconnected value chains, driving unit sales. Strategic partnerships with content providers and app developers will unlock new revenue streams and enhance user engagement. The expansion into developing markets within APAC, offering affordable yet feature-rich wireless audio solutions, remains a crucial strategy for sustained market share growth.

APAC Wireless Audio Industry Segmentation

-

1. Type of Device

-

1.1. Wireless Speakers

- 1.1.1. Bluetooth-Only

- 1.1.2. Smart Speakers

- 1.1.3. Wi-Fi Sp

- 1.2. Wireless Earphones

- 1.3. Wireless Headsets

- 1.4. True Wireless Stereo

-

1.1. Wireless Speakers

APAC Wireless Audio Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Wireless Audio Industry Regional Market Share

Geographic Coverage of APAC Wireless Audio Industry

APAC Wireless Audio Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development

- 3.3. Market Restrains

- 3.3.1. High costs associated with software and procurement

- 3.4. Market Trends

- 3.4.1. Bluetooth Speakers to Witness Higest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Wireless Speakers

- 5.1.1.1. Bluetooth-Only

- 5.1.1.2. Smart Speakers

- 5.1.1.3. Wi-Fi Sp

- 5.1.2. Wireless Earphones

- 5.1.3. Wireless Headsets

- 5.1.4. True Wireless Stereo

- 5.1.1. Wireless Speakers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Wireless Speakers

- 6.1.1.1. Bluetooth-Only

- 6.1.1.2. Smart Speakers

- 6.1.1.3. Wi-Fi Sp

- 6.1.2. Wireless Earphones

- 6.1.3. Wireless Headsets

- 6.1.4. True Wireless Stereo

- 6.1.1. Wireless Speakers

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Wireless Speakers

- 7.1.1.1. Bluetooth-Only

- 7.1.1.2. Smart Speakers

- 7.1.1.3. Wi-Fi Sp

- 7.1.2. Wireless Earphones

- 7.1.3. Wireless Headsets

- 7.1.4. True Wireless Stereo

- 7.1.1. Wireless Speakers

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Europe APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Wireless Speakers

- 8.1.1.1. Bluetooth-Only

- 8.1.1.2. Smart Speakers

- 8.1.1.3. Wi-Fi Sp

- 8.1.2. Wireless Earphones

- 8.1.3. Wireless Headsets

- 8.1.4. True Wireless Stereo

- 8.1.1. Wireless Speakers

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East & Africa APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Wireless Speakers

- 9.1.1.1. Bluetooth-Only

- 9.1.1.2. Smart Speakers

- 9.1.1.3. Wi-Fi Sp

- 9.1.2. Wireless Earphones

- 9.1.3. Wireless Headsets

- 9.1.4. True Wireless Stereo

- 9.1.1. Wireless Speakers

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. Asia Pacific APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Wireless Speakers

- 10.1.1.1. Bluetooth-Only

- 10.1.1.2. Smart Speakers

- 10.1.1.3. Wi-Fi Sp

- 10.1.2. Wireless Earphones

- 10.1.3. Wireless Headsets

- 10.1.4. True Wireless Stereo

- 10.1.1. Wireless Speakers

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baidu Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bose Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Realme Chongqing Mobile Telecommunications Corp Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LINE Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Apple Inc (Including Beats Electronics LLC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Electronics Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xiaomi Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Skullcandy Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amazon com Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Alibaba Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GN Audio AS (Jabra)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Harman International Industries Incorporated (JBL)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Huawei Device Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sony Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Baidu Inc

List of Figures

- Figure 1: Global APAC Wireless Audio Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 3: North America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 4: North America APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 5: North America APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 7: South America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 8: South America APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 9: South America APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 11: Europe APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 12: Europe APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 15: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 16: Middle East & Africa APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 19: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 20: Asia Pacific APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 2: Global APAC Wireless Audio Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 4: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 9: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 14: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 25: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 33: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 34: China APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Wireless Audio Industry?

The projected CAGR is approximately 26.1%.

2. Which companies are prominent players in the APAC Wireless Audio Industry?

Key companies in the market include Baidu Inc, Bose Corporation, Realme Chongqing Mobile Telecommunications Corp Ltd, Google LLC, LINE Corporation, Apple Inc (Including Beats Electronics LLC), Samsung Electronics Co Ltd, Xiaomi Corp, Skullcandy Inc, Amazon com Inc, Alibaba Group, GN Audio AS (Jabra), Harman International Industries Incorporated (JBL), Huawei Device Co Ltd, Sony Corporation.

3. What are the main segments of the APAC Wireless Audio Industry?

The market segments include Type of Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 34371.3 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development.

6. What are the notable trends driving market growth?

Bluetooth Speakers to Witness Higest Market Growth.

7. Are there any restraints impacting market growth?

High costs associated with software and procurement.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Wireless Audio Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Wireless Audio Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Wireless Audio Industry?

To stay informed about further developments, trends, and reports in the APAC Wireless Audio Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence