Key Insights

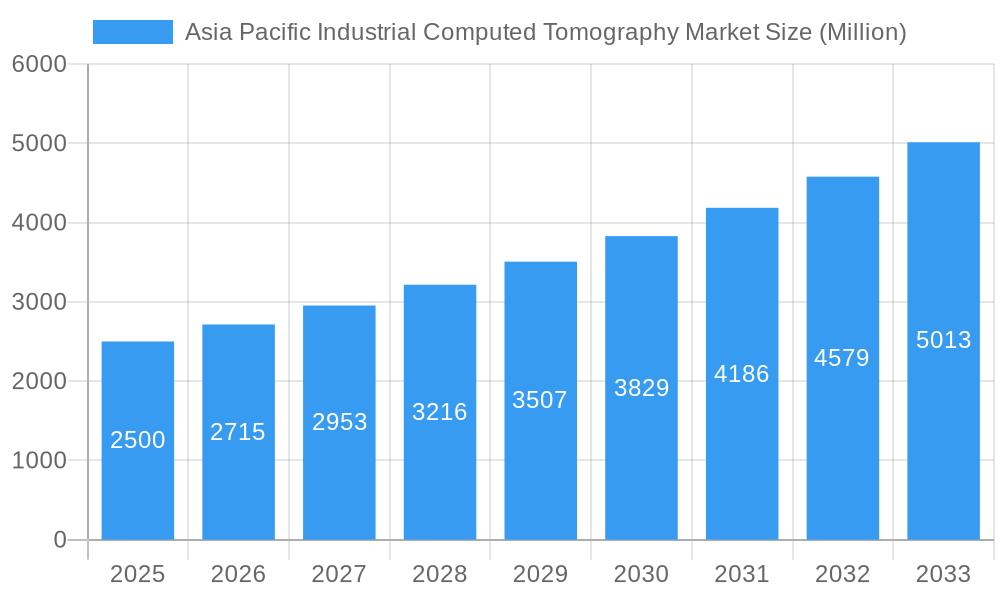

The Asia Pacific Industrial Computed Tomography (ICT) market is poised for significant expansion, driven by escalating adoption across key sectors including aerospace, automotive, and electronics. This growth is underpinned by the region's robust manufacturing base and the increasing demand for advanced quality control and non-destructive testing (NDT) solutions. With a projected CAGR of 19.04%, the market is expected to reach an estimated market size of $536 million by 2025. Primary growth drivers include the need for precise flaw detection and inspection, failure analysis, and assembly verification, especially for increasingly complex components in advanced industries. Stringent quality regulations further necessitate the adoption of ICT for enhanced product reliability and safety.

Asia Pacific Industrial Computed Tomography Market Market Size (In Million)

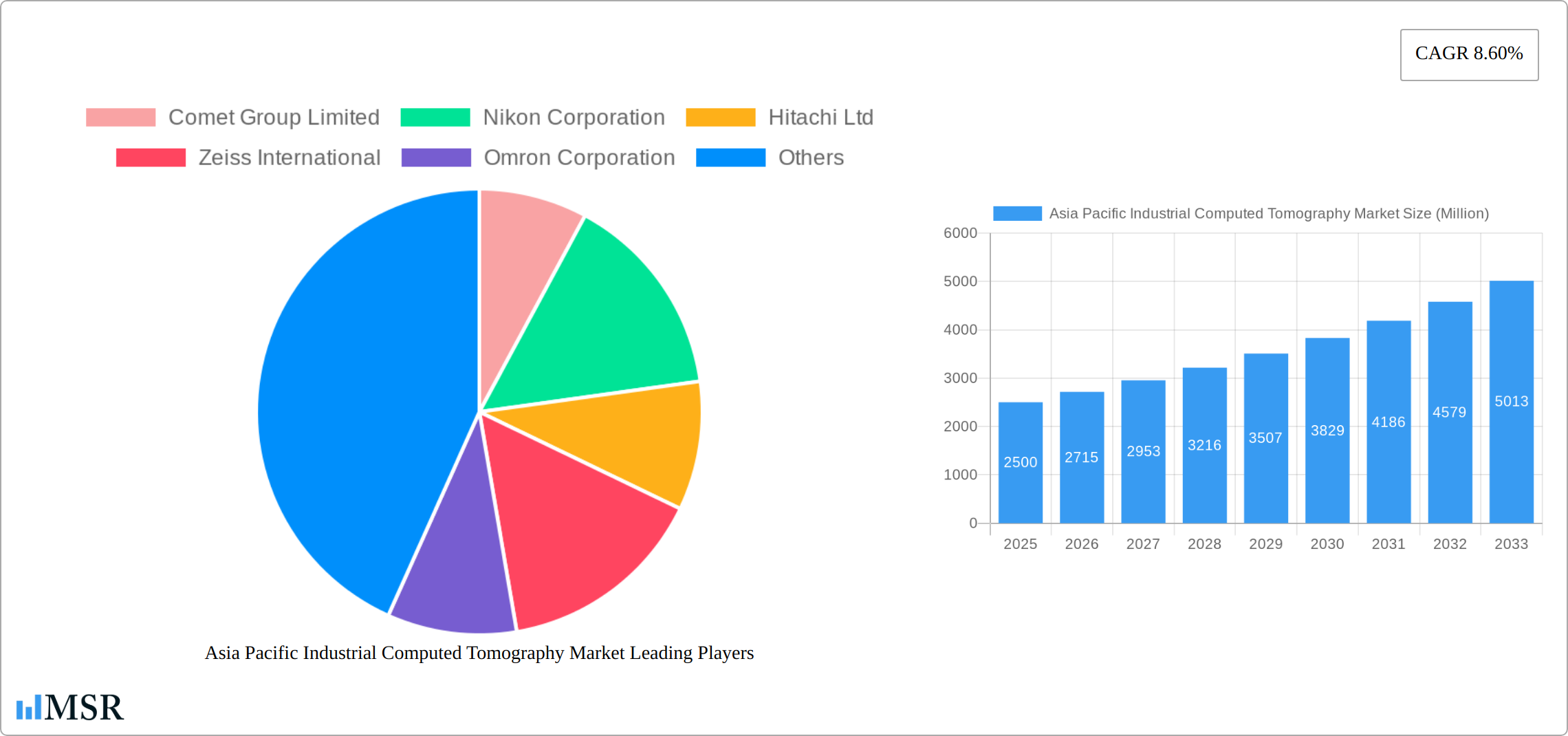

Key players such as Comet Group, Nikon, and Zeiss are accelerating market growth through continuous innovation and strategic collaborations. Investments in R&D, focusing on developing high-resolution, faster scanning ICT systems, are also pivotal. While high initial investment costs may present a challenge for smaller enterprises, the forecast period (2025-2033) anticipates sustained growth fueled by manufacturing automation, Industry 4.0 integration, and the demand for advanced materials in sectors like aerospace. Major economies including China, Japan, India, and South Korea will remain central to this expansion, supported by their advanced industrial capabilities. Emerging trends in sophisticated software and data analysis for ICT scans will further enhance market potential.

Asia Pacific Industrial Computed Tomography Market Company Market Share

Asia Pacific Industrial Computed Tomography Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Industrial Computed Tomography (CT) market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this study unravels market dynamics, growth drivers, key segments, and leading players shaping this rapidly evolving landscape. The report forecasts robust growth, with the market size expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific Industrial Computed Tomography Market Market Concentration & Dynamics

The Asia Pacific Industrial Computed Tomography market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of several smaller, specialized companies fosters a competitive environment driven by innovation and technological advancements. The market is influenced by stringent regulatory frameworks related to industrial safety and quality control, particularly in sectors like aerospace and automotive. Substitute products, such as conventional non-destructive testing (NDT) methods, pose some competition, but the superior capabilities of industrial CT in terms of detailed internal inspection are driving market adoption.

End-user trends, characterized by a growing emphasis on product quality, enhanced efficiency, and reduced production downtime, are significantly boosting demand. Furthermore, mergers and acquisitions (M&A) activities are playing a crucial role in shaping the competitive landscape. Over the past five years, the Asia Pacific region witnessed approximately xx M&A deals in the industrial CT sector, primarily driven by strategic expansion and technological integration. Key metrics like market share concentration (xx%) and M&A deal counts highlight the dynamic nature of this market.

Asia Pacific Industrial Computed Tomography Market Industry Insights & Trends

The Asia Pacific Industrial Computed Tomography market is experiencing significant growth, propelled by several key factors. The rising demand for high-quality products across various end-user industries, such as automotive, electronics, and aerospace, is a primary driver. Technological advancements, including the development of faster, more precise, and cost-effective CT systems, are further fueling market expansion. The increasing adoption of Industry 4.0 principles and the growing focus on digitalization across manufacturing sectors are also contributing to the market's growth trajectory. Furthermore, the increasing prevalence of stringent quality control standards and regulations is driving the adoption of industrial CT for improved product inspection and failure analysis. The market size reached xx Million in 2024 and is projected to expand significantly, with a CAGR of xx% from 2025 to 2033. This growth reflects the increasing preference for advanced inspection techniques and the growing adoption of industrial CT across diverse industries. The rising demand for high-resolution imaging, coupled with a growing need for efficient and reliable quality control measures, is further underpinning the market's expansion. The integration of AI and machine learning into industrial CT systems offers enhanced analytical capabilities, leading to improved efficiency and accuracy in defect detection. This trend is expected to drive growth in the coming years.

Key Markets & Segments Leading Asia Pacific Industrial Computed Tomography Market

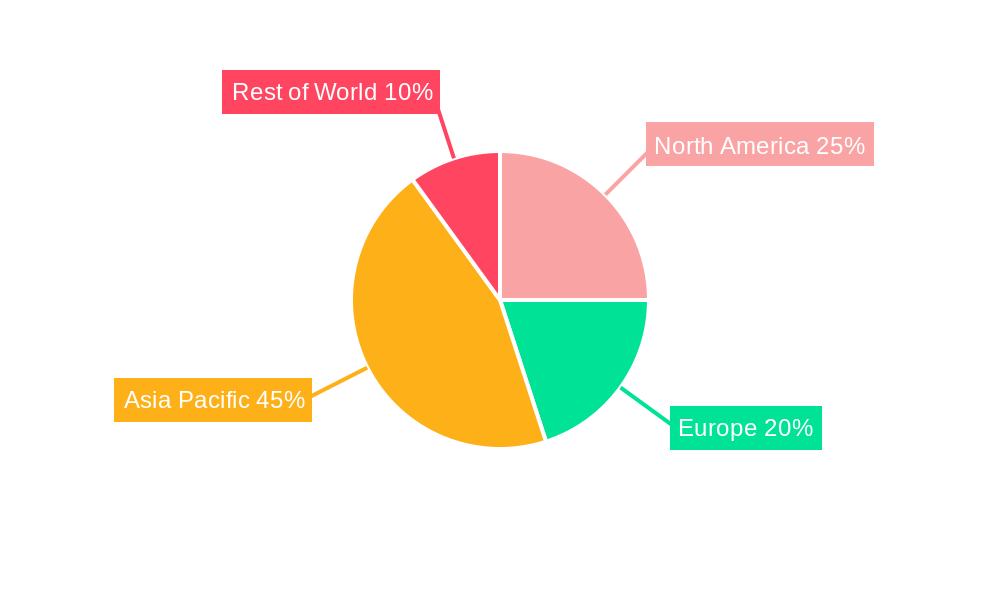

The Asia Pacific Industrial Computed Tomography (CT) market is a dynamic landscape, with China, Japan, and South Korea at its forefront. This dominance is fueled by the region's robust industrial growth, substantial investments in cutting-edge manufacturing technologies, and an escalating demand for precision in quality control.

-

By Application: Within the diverse applications of industrial CT, flaw detection and inspection currently represents the largest and most significant segment. This is closely followed by applications in failure analysis and assembly analysis. The continuous drive to minimize production defects, enhance overall product reliability, and ensure the integrity of complex components is a primary catalyst for the growth of these segments.

-

By End-User Industry: The automotive and electronics sectors are the primary engines propelling the Asia Pacific industrial CT market forward. The inherent need for highly precise quality control in the intricate manufacturing processes of these industries makes industrial CT an indispensable tool. Furthermore, the aerospace sector is demonstrating significant growth potential, driven by the increasing adoption of advanced lightweight materials and the stringent safety regulations that necessitate thorough inspection of critical components.

Key growth drivers across these industries include:

- Accelerated industrialization and sustained economic expansion across the diverse Asia-Pacific region.

- The increasing integration and adoption of advanced manufacturing methodologies and automation.

- A heightened global and regional emphasis on superior product quality, performance, and long-term reliability.

- The enforcement of increasingly stringent regulatory frameworks and safety standards across various industrial verticals.

China's leading position is intrinsically linked to its vast and expanding manufacturing base and its rapid industrialization initiatives. Concurrently, Japan and South Korea leverage their advanced technological prowess and the presence of prominent industrial CT system manufacturers. While these three nations lead, other countries within the Asia-Pacific region are also exhibiting strong and promising growth trajectories, indicating a widespread adoption of industrial CT technologies.

Asia Pacific Industrial Computed Tomography Market Product Developments

The Asia Pacific industrial CT market has been a hotbed of innovation in recent years, with manufacturers consistently pushing the boundaries of what's possible. The focus is squarely on developing systems that offer higher resolution imaging, significantly faster scan times, and more sophisticated software capabilities to enhance data analysis and improve the accuracy of defect detection. A notable trend is the introduction of more compact and accessible benchtop systems, exemplified by offerings like Shimadzu's XSeeker 8000. These advancements are not only improving portability and accessibility for a wider range of applications but are also providing manufacturers with a critical competitive edge. By enabling improved quality assurance, increased operational efficiency, and greater cost-effectiveness in industrial inspection processes, these innovations are shaping the future of the market.

Challenges in the Asia Pacific Industrial Computed Tomography Market Market

The Asia Pacific industrial CT market faces several challenges. High initial investment costs associated with purchasing and maintaining industrial CT systems can pose a barrier to entry for smaller companies. Furthermore, the complexity of the technology and the need for skilled operators can limit adoption, especially in developing regions. Supply chain disruptions and fluctuations in raw material prices also impact market growth. Increased competition from established and emerging players puts pressure on profit margins. These factors collectively impact market expansion, necessitating innovative strategies for overcoming these obstacles. The estimated impact of these challenges on market growth is a reduction in CAGR by approximately xx%.

Forces Driving Asia Pacific Industrial Computed Tomography Market Growth

Several factors drive growth within the Asia Pacific industrial CT market. Technological advancements such as higher resolution imaging, faster scan times, and advanced software functionalities enhance efficiency and accuracy, making industrial CT more attractive. Economic factors like rising industrial output and increasing disposable income fuel demand in various sectors. Favorable government regulations supporting technological adoption and quality control further stimulate market expansion. For instance, the "Made in China 2025" initiative underscores the importance of advanced manufacturing technologies. The combined effect of these factors creates a positive growth environment.

Long-Term Growth Catalysts in Asia Pacific Industrial Computed Tomography Market

The Asia Pacific Industrial Computed Tomography market anticipates sustained long-term growth driven by several factors. Ongoing technological innovations, including the integration of artificial intelligence (AI) and machine learning (ML) in CT systems, will enhance analytical capabilities, improving defect detection accuracy. Strategic collaborations and partnerships between industrial CT manufacturers and end-users will foster the development of tailored solutions and expand market penetration. The expansion of industrial CT applications into emerging sectors such as renewable energy and medical devices will further fuel market growth. These long-term catalysts paint a positive outlook for sustained market expansion.

Emerging Opportunities in Asia Pacific Industrial Computed Tomography Market

The Asia Pacific industrial CT market is ripe with emerging opportunities, largely driven by several transformative trends. The burgeoning adoption of additive manufacturing (3D printing) is creating a significant demand for in-process quality control solutions, where industrial CT plays a crucial role in verifying the integrity of printed parts. Furthermore, the growing industry-wide shift towards lightweight materials and the design of complex geometries necessitates detailed internal inspection capabilities, a domain where CT excels. The ongoing development of more portable and cost-effective CT systems is poised to democratize access to this technology, particularly benefiting smaller enterprises and manufacturers in developing economies. These converging trends signal substantial and exciting growth prospects for the industrial CT market in the coming years.

Leading Players in the Asia Pacific Industrial Computed Tomography Market Sector

Key Milestones in Asia Pacific Industrial Computed Tomography Market Industry

May 2022: Shimadzu Corporation launched the XSeeker 8000 bench-top X-ray CT system, setting a new standard for compact and lightweight systems with superior imaging capabilities. This innovation significantly expands the accessibility of industrial CT technology.

November 2021: Omron Corporation introduced the VT-X750-V3 system, touted as the fastest CT-type X-ray inspection device. This advancement highlights the continuous pursuit of speed and efficiency in industrial inspection processes.

Strategic Outlook for Asia Pacific Industrial Computed Tomography Market Market

The Asia Pacific Industrial Computed Tomography market is poised for substantial future expansion. Strategic investments in research and development, particularly focusing on pioneering advanced imaging techniques and the integration of artificial intelligence (AI) for enhanced analysis, will be pivotal in driving this growth. Expanding the reach of industrial CT into new application areas and diverse end-user industries, with a special emphasis on emerging economies within the region, presents significant untapped opportunities. Furthermore, fostering robust partnerships and collaborations between technology providers and end-users will be crucial for accelerating market adoption and ensuring tailored solutions. Companies that adopt proactive and forward-thinking strategies will be well-positioned to capitalize on the considerable growth potential inherent in this dynamic and evolving market.

Asia Pacific Industrial Computed Tomography Market Segmentation

-

1. Application

- 1.1. Flaw Detection and Inspection

- 1.2. Failure Analysis

- 1.3. Assembly Analysis

- 1.4. Other Applications

-

2. End-User Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Electronics

- 2.4. Oil and Gas

- 2.5. Other End-User Industries

Asia Pacific Industrial Computed Tomography Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Industrial Computed Tomography Market Regional Market Share

Geographic Coverage of Asia Pacific Industrial Computed Tomography Market

Asia Pacific Industrial Computed Tomography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Portable Radiography Equipment; Technology Advancements in Resolution and Image Processing

- 3.3. Market Restrains

- 3.3.1. High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters

- 3.4. Market Trends

- 3.4.1. Automotive to Gain Significant Growth in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Industrial Computed Tomography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Flaw Detection and Inspection

- 5.1.2. Failure Analysis

- 5.1.3. Assembly Analysis

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Electronics

- 5.2.4. Oil and Gas

- 5.2.5. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Comet Group Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nikon Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zeiss International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Omron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thermo Fischer Scientific Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shimadzu Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Waygate Technologies (Baker Hughes Digital Solutions GmbH)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bruker Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shimadzu Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Comet Group Limited

List of Figures

- Figure 1: Asia Pacific Industrial Computed Tomography Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Industrial Computed Tomography Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Asia Pacific Industrial Computed Tomography Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Asia Pacific Industrial Computed Tomography Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Industrial Computed Tomography Market Revenue million Forecast, by Application 2020 & 2033

- Table 5: Asia Pacific Industrial Computed Tomography Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Asia Pacific Industrial Computed Tomography Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Industrial Computed Tomography Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Industrial Computed Tomography Market?

The projected CAGR is approximately 19.04%.

2. Which companies are prominent players in the Asia Pacific Industrial Computed Tomography Market?

Key companies in the market include Comet Group Limited, Nikon Corporation, Hitachi Ltd, Zeiss International, Omron Corporation, Thermo Fischer Scientific Inc, Shimadzu Corporation, Waygate Technologies (Baker Hughes Digital Solutions GmbH), Bruker Corporation, Shimadzu Corporation.

3. What are the main segments of the Asia Pacific Industrial Computed Tomography Market?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 536 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Portable Radiography Equipment; Technology Advancements in Resolution and Image Processing.

6. What are the notable trends driving market growth?

Automotive to Gain Significant Growth in the Region.

7. Are there any restraints impacting market growth?

High Installation Cost and Longer ROI Period; Longer Replacement Cycle of Water Meters.

8. Can you provide examples of recent developments in the market?

May 2022 - Shimadzu Corporation announced the release of the XSeeker 8000 bench-top X-ray CT system. It is considered to be the smallest and lightest X-ray system. It offers clear images of a variety of samples, from resin molded parts to aluminum die cast and other metallic elements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Industrial Computed Tomography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Industrial Computed Tomography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Industrial Computed Tomography Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Industrial Computed Tomography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence