Key Insights

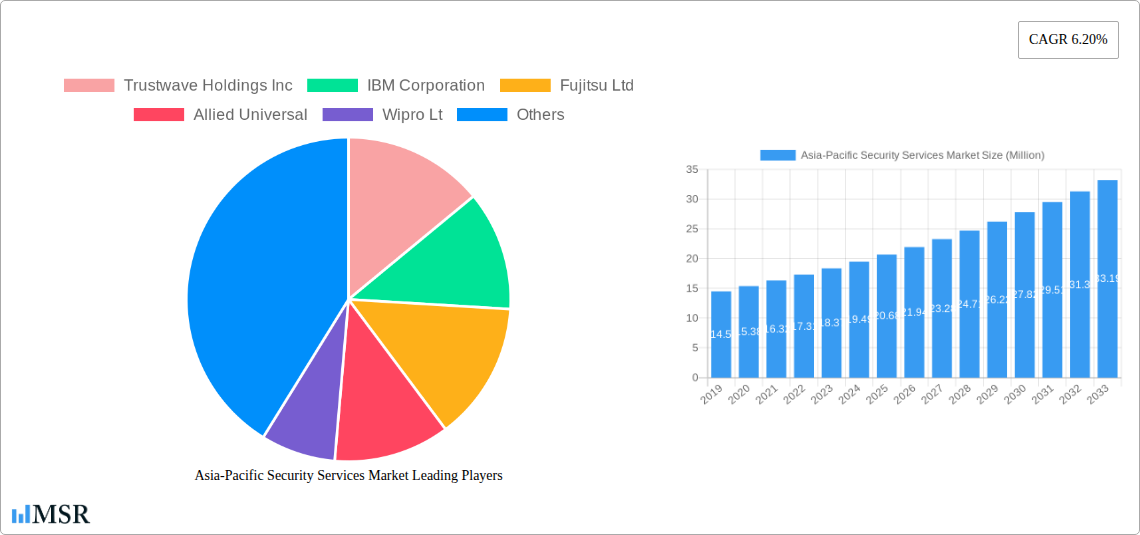

The Asia-Pacific Security Services Market is poised for robust expansion, projected to reach a significant valuation of $24.88 billion by 2033, driven by a steady Compound Annual Growth Rate (CAGR) of 6.20%. This growth is underpinned by escalating cyber threats, increasing digitization across all industries, and a heightened awareness among businesses and governments regarding the imperative of robust security measures. The surge in cloud adoption, while offering scalability and flexibility, also presents new attack vectors, further fueling the demand for comprehensive managed security services. Professional security services are experiencing a parallel rise as organizations seek expert guidance and specialized solutions for complex security challenges. The consulting services segment is also thriving as companies navigate evolving regulatory landscapes and strategic security planning. The market's dynamism is evident in the diverse range of end-user industries actively investing in security, including the rapidly expanding IT and Infrastructure sector, the critical Government and Healthcare segments, and the increasingly vulnerable Industrial and Transportation and Logistics domains.

Asia-Pacific Security Services Market Market Size (In Million)

Further analysis reveals that the market's trajectory is influenced by a combination of factors, including the increasing sophistication of cyber-attacks and the growing need for advanced threat intelligence. While the widespread adoption of cloud-based solutions presents a significant growth driver, it also introduces complexities in security management, necessitating advanced solutions. The market is also experiencing a shift towards proactive security strategies, moving beyond traditional reactive measures. Restraints, such as the high cost of implementing comprehensive security solutions and a persistent shortage of skilled cybersecurity professionals, are being addressed through outsourcing and managed service providers. The Asia-Pacific region, with its diverse economic landscape and varying levels of digital maturity, presents unique opportunities and challenges. Key countries like China, India, Japan, and South Korea are expected to lead the adoption of advanced security services due to their substantial investments in technology and stringent regulatory frameworks.

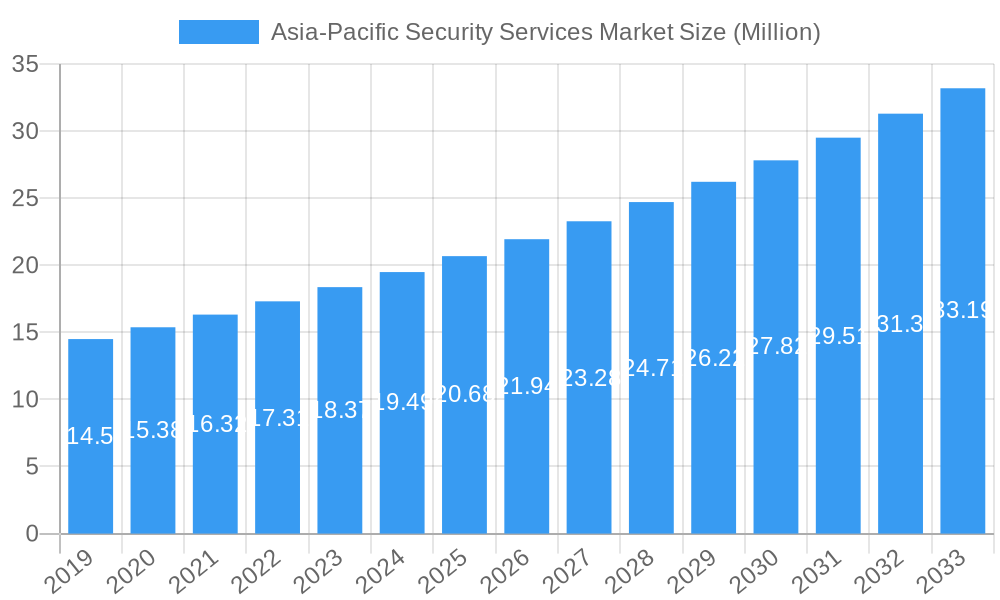

Asia-Pacific Security Services Market Company Market Share

This comprehensive report provides an in-depth analysis of the Asia-Pacific Security Services Market, a rapidly evolving sector crucial for safeguarding digital and physical assets. Driven by increasing cyber threats, escalating geopolitical tensions, and the burgeoning digital transformation across diverse industries, the market is poised for substantial expansion. Our analysis covers the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, offering a detailed perspective on historical trends (2019–2024) and future projections. We delve into key segments including Managed Security Services, Professional Security Services, Consulting Services, and Threat Intelligence Security Services, along with On-premise and Cloud deployment modes. The report examines the impact across various end-user industries such as IT and Infrastructure, Government, Industrial, Healthcare, Transportation and Logistics, and Banking. This report is your definitive guide to understanding the dynamics, challenges, opportunities, and leading players shaping the APAC security services landscape.

Asia-Pacific Security Services Market Market Concentration & Dynamics

The Asia-Pacific Security Services Market exhibits a dynamic blend of concentrated and fragmented characteristics. While a few dominant players, including global giants and regional leaders, hold significant market share, a robust ecosystem of specialized and emerging providers fuels innovation. The market is characterized by intense competition, driven by continuous advancements in cybersecurity technologies and evolving threat landscapes. Innovation ecosystems are flourishing, with significant investment in research and development, particularly in areas like Artificial Intelligence (AI), Machine Learning (ML), and Extended Detection and Response (XDR). Regulatory frameworks are becoming more stringent across the region, with governments implementing robust data protection laws and cybersecurity mandates, thereby influencing market strategies and compliance requirements.

- Market Share: Leading companies like IBM Corporation, Trustwave Holdings Inc., and Wipro Ltd. command substantial market shares, particularly in managed security services.

- M&A Activities: The market has witnessed moderate M&A activity as larger players seek to acquire specialized technologies or expand their geographical reach. For instance, the acquisition of smaller threat intelligence firms by established security providers is a common strategy.

- Innovation Hubs: Countries like Singapore, Australia, and Japan are emerging as key innovation hubs for cybersecurity solutions.

- End-User Trends: Increasing adoption of cloud computing and IoT devices by enterprises across various sectors are creating new demand for advanced security services.

- Substitute Products: While traditional IT security solutions exist, the trend is leaning towards integrated and proactive security services that offer comprehensive protection against sophisticated threats.

Asia-Pacific Security Services Market Industry Insights & Trends

The Asia-Pacific Security Services Market is experiencing a significant surge, projected to reach an estimated market size of USD XXX Million by 2025, with a Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period. This robust growth is primarily propelled by the accelerating digital transformation initiatives across all industries within the region. As businesses increasingly migrate their operations to cloud environments and embrace sophisticated technologies like AI and IoT, the attack surface expands, necessitating advanced and comprehensive security solutions. Furthermore, the escalating sophistication and frequency of cyber threats, ranging from ransomware attacks to advanced persistent threats (APTs), are compelling organizations to invest heavily in proactive security measures. The growing awareness among enterprises about the financial and reputational damage associated with data breaches further underscores the demand for robust managed security services and consulting services. The regulatory landscape in countries like China, Japan, and South Korea is also becoming more prescriptive, mandating specific cybersecurity standards and compliance protocols, thereby acting as a significant growth driver. The demand for threat intelligence security services is on the rise as organizations strive to stay ahead of evolving threats by leveraging real-time data and predictive analytics. The increasing adoption of cloud-based security solutions over on-premise deployments is a prominent trend, driven by the scalability, cost-effectiveness, and flexibility that cloud platforms offer. This shift is particularly evident in sectors like IT and Infrastructure, and Banking, where rapid adaptation to new technologies is crucial.

Key Markets & Segments Leading Asia-Pacific Security Services Market

The Asia-Pacific Security Services Market is characterized by dominant regions and segments that are spearheading its growth. Among the end-user industries, IT and Infrastructure emerges as a leading segment, driven by the sheer volume of digital assets and the constant evolution of technology. The increasing reliance on cloud computing, big data, and AI necessitates sophisticated security services to protect sensitive information and critical systems.

Dominant Regions:

- China: With its massive digital economy and significant government investment in cybersecurity, China is a powerhouse in the APAC security services market. Its large enterprise base and increasing adoption of advanced technologies create a substantial demand.

- Japan: A mature market with a high level of technological adoption and stringent data privacy regulations, Japan is a consistent contributor to market growth. The focus on IoT security and critical infrastructure protection is particularly strong.

- Australia: Driven by robust government initiatives and a strong focus on cyber resilience, Australia represents a significant market, especially in the financial services and government sectors.

- South Korea: Known for its advanced technological infrastructure, South Korea's demand for cutting-edge security services, particularly in areas like threat intelligence and managed security, is substantial.

Dominant Segments:

- Service Type: Managed Security Services (MSS) are leading the charge due to the growing complexity of cybersecurity management and the shortage of in-house expertise. Businesses are increasingly outsourcing their security operations to specialized providers for continuous monitoring, threat detection, and incident response. Professional Security Services also command a significant share, encompassing a range of specialized offerings like vulnerability assessments and penetration testing.

- Mode of Deployment: The Cloud deployment model is experiencing rapid adoption, outpacing on-premise solutions. Cloud-based security offers scalability, flexibility, and cost-effectiveness, aligning with the digital transformation strategies of most organizations.

- End-user Industry:

- IT and Infrastructure: As mentioned, this sector leads due to its inherent reliance on digital assets and continuous technological innovation.

- Banking: The financial sector is a prime target for cyberattacks, making it a significant investor in comprehensive security services to protect sensitive financial data and customer transactions.

- Government: Governments across the APAC region are investing heavily in cybersecurity to protect critical infrastructure, national security interests, and citizen data from state-sponsored attacks and cybercrime.

- Healthcare: With the digitization of patient records and the increasing use of connected medical devices, the healthcare industry faces unique security challenges, driving demand for specialized security solutions.

- Industrial: The growing adoption of Industrial IoT (IIoT) in manufacturing and other industrial sectors is expanding the attack surface, leading to increased demand for industrial cybersecurity services.

Asia-Pacific Security Services Market Product Developments

The Asia-Pacific Security Services Market is witnessing a rapid pace of product development, primarily driven by the integration of advanced technologies. Companies are focusing on enhancing their offerings with AI and ML capabilities to provide predictive threat detection and automated response. Innovations in Extended Detection and Response (XDR) platforms are gaining traction, offering a unified approach to security across various security layers. Furthermore, the development of specialized solutions for cloud security, IoT security, and Industrial IoT (IIoT) security is a key trend, addressing the unique challenges posed by these evolving technological landscapes. The emphasis is on providing more proactive, intelligent, and integrated security services that can effectively counter sophisticated cyber threats.

Challenges in the Asia-Pacific Security Services Market Market

Despite the robust growth, the Asia-Pacific Security Services Market faces several challenges. A significant hurdle is the shortage of skilled cybersecurity professionals, hindering the effective deployment and management of complex security solutions. Fragmented regulatory landscapes across different countries within the APAC region add to compliance complexities for multinational corporations. The high cost of advanced security solutions can also be a barrier for small and medium-sized enterprises (SMEs), limiting their ability to adopt comprehensive protection. Furthermore, the ever-evolving nature of cyber threats demands continuous adaptation and investment, making it challenging for organizations to keep pace with emerging attack vectors.

Forces Driving Asia-Pacific Security Services Market Growth

Several key forces are propelling the growth of the Asia-Pacific Security Services Market. The accelerating digital transformation across industries, leading to an expanded attack surface, is a primary driver. Increasing awareness of cyber threats and the potential for severe financial and reputational damage from data breaches are compelling organizations to invest in robust security services. Government initiatives and stricter regulations regarding data protection and cybersecurity compliance are further bolstering market demand. The growing adoption of cloud computing and IoT devices necessitates specialized security solutions. Finally, the increasing sophistication of cyberattacks requires businesses to adopt advanced security measures, including managed security services and threat intelligence platforms.

Challenges in the Asia-Pacific Security Services Market Market

Long-term growth catalysts for the Asia-Pacific Security Services Market are rooted in continuous innovation and strategic market expansion. The advancement of AI and ML in cybersecurity promises more intelligent and automated threat detection and response mechanisms, driving the adoption of next-generation security solutions. Strategic partnerships and collaborations between security providers, technology vendors, and cloud service providers are crucial for creating integrated security ecosystems and expanding market reach. Furthermore, market expansion into emerging economies within the APAC region, coupled with tailored security offerings for local needs, presents significant untapped potential for sustained growth.

Emerging Opportunities in Asia-Pacific Security Services Market

Emerging trends and opportunities in the Asia-Pacific Security Services Market are abundant. The burgeoning adoption of 5G technology will create new avenues for network security solutions and edge computing security. The increasing demand for secure remote work solutions presents opportunities for endpoint security and identity management services. The growing focus on Data Privacy Regulations across the region, such as the upcoming data privacy laws in India and updates in existing ones, will drive demand for compliance-focused security services. Furthermore, the rise of Zero Trust Architecture adoption offers significant potential for providers offering identity and access management, micro-segmentation, and continuous verification solutions.

Leading Players in the Asia-Pacific Security Services Market Sector

- Trustwave Holdings Inc.

- IBM Corporation

- Fujitsu Ltd.

- Allied Universal

- Wipro Ltd.

- Broadcom Inc.

- Security HQ

- Palo Alto Networks

- G4S Limited

- Fortra LLC

- Securitas Inc.

Key Milestones in Asia-Pacific Security Services Market Industry

- September 2023: Symantec (a division of Broadcom Inc.) announced a collaboration with Google Cloud to enhance its AI platform, Gen AI. This partnership aims to leverage Google Cloud SBA Workbench and LLM-Sec-PALM 2 to improve threat detection, comprehension, and remediation, enabling natural language interfaces for threat analyses and accelerating AI utilization in the security environment.

- July 2023: Palo Alto Networks introduced the Software Delivery Pipeline Security Module (CI/CD Security) for its Prisma Cloud CNAPP platform. This module integrates code-to-cloud capabilities, offering CI/CD security and protection from open-source vulnerabilities through software composition analysis, thereby providing comprehensive security for the entire engineering environment.

Strategic Outlook for Asia-Pacific Security Services Market Market

The strategic outlook for the Asia-Pacific Security Services Market is exceptionally positive, fueled by continuous technological innovation and increasing global cybersecurity concerns. The market is expected to witness sustained growth driven by the adoption of advanced technologies like AI, ML, and cloud-native security solutions. Strategic investments in threat intelligence and proactive defense mechanisms will be crucial for market players. Furthermore, focusing on providing integrated security solutions that address the evolving needs of diverse end-user industries, alongside geographical expansion into untapped markets within the region, will be key to capturing future market potential and solidifying competitive positions.

Asia-Pacific Security Services Market Segmentation

-

1. Service Type

- 1.1. Managed Security Services

- 1.2. Professional Security Services

- 1.3. Consulting Services

- 1.4. Threat Intelligence Security Services

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. IT and Infrastructure

- 3.2. Government

- 3.3. Industrial

- 3.4. Healthcare

- 3.5. Transportation and Logistics

- 3.6. Banking

- 3.7. Other End-User Industries

Asia-Pacific Security Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Security Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Security Services Market

Asia-Pacific Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Proliferation of IoT Devices in Smart Cities and Manufacturing Sector; Increasing Investments in CyberSecurity Measures; Rise in Insider Threats

- 3.3. Market Restrains

- 3.3.1. Integration issues with traditional systems; Data quality and accuracy issues

- 3.4. Market Trends

- 3.4.1. Cloud Adoption to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Security Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Managed Security Services

- 5.1.2. Professional Security Services

- 5.1.3. Consulting Services

- 5.1.4. Threat Intelligence Security Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Infrastructure

- 5.3.2. Government

- 5.3.3. Industrial

- 5.3.4. Healthcare

- 5.3.5. Transportation and Logistics

- 5.3.6. Banking

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Trustwave Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Allied Universal

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wipro Lt

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Broadcom Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Security HQ

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Palo Alto Networks

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 G4S Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortra LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Securitas Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Trustwave Holdings Inc

List of Figures

- Figure 1: Asia-Pacific Security Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Security Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Security Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Asia-Pacific Security Services Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 3: Asia-Pacific Security Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Security Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Security Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Asia-Pacific Security Services Market Revenue Million Forecast, by Mode of Deployment 2020 & 2033

- Table 7: Asia-Pacific Security Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Asia-Pacific Security Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Security Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Security Services Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Asia-Pacific Security Services Market?

Key companies in the market include Trustwave Holdings Inc, IBM Corporation, Fujitsu Ltd, Allied Universal, Wipro Lt, Broadcom Inc, Security HQ, Palo Alto Networks, G4S Limited, Fortra LLC, Securitas Inc.

3. What are the main segments of the Asia-Pacific Security Services Market?

The market segments include Service Type, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.88 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Proliferation of IoT Devices in Smart Cities and Manufacturing Sector; Increasing Investments in CyberSecurity Measures; Rise in Insider Threats.

6. What are the notable trends driving market growth?

Cloud Adoption to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Integration issues with traditional systems; Data quality and accuracy issues.

8. Can you provide examples of recent developments in the market?

September 2023: Symantec (a division of Broadcom Inc.) announced that it is gradually collaborating with Google Cloud to expand its AI platform, Gen AI, to provide customers with a significant technical advantage in detecting, comprehending, and remedying complex cyber-attacks. Symantec will utilize the Google Cloud SBA Workbench and Security-specific Large Language Model (LLM)-Sec-PALM 2, across its portfolio to achieve this. This step will enable natural language interfaces and the generation of more comprehensive and understandable threat analyses. This partnership will contribute to accelerating the utilization of AI in the broader security environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Security Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence