Key Insights

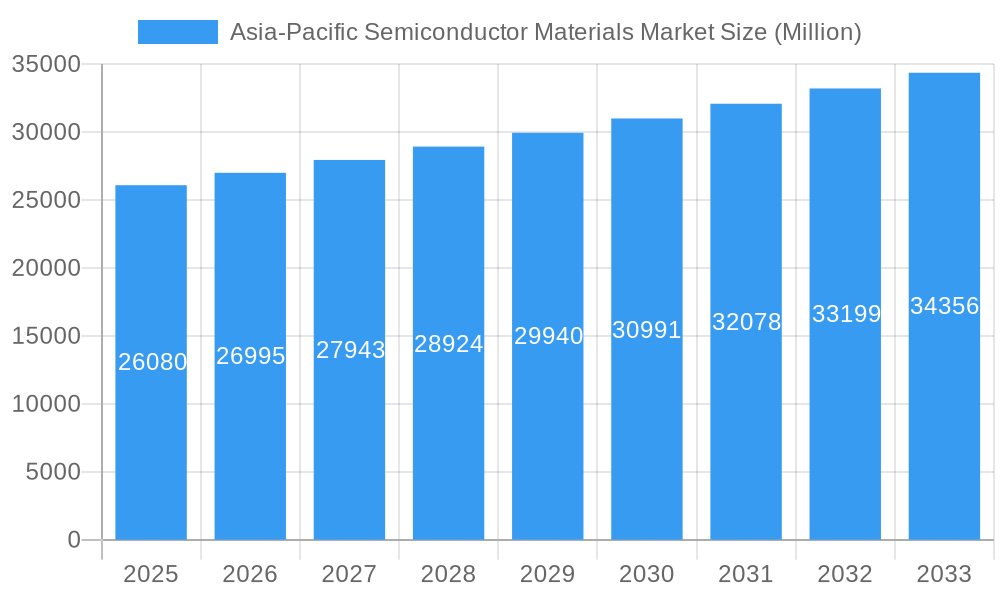

The Asia-Pacific semiconductor materials market, valued at $26.08 billion in 2025, is projected to experience robust growth, driven by the region's burgeoning electronics manufacturing sector and increasing demand for advanced semiconductor devices. A compound annual growth rate (CAGR) of 3.40% from 2025 to 2033 indicates a steady expansion, fueled primarily by the rising adoption of 5G technology, the proliferation of IoT devices, and the increasing demand for electric vehicles (EVs). Key drivers include significant investments in semiconductor fabrication plants in countries like Taiwan, South Korea, and China, along with government initiatives promoting technological advancement. The market is segmented by material type (Silicon Carbide, Gallium Arsenide, etc.), end-user industry (consumer electronics, automotive, telecommunications), and country. While the dominance of established players like Sumitomo Chemical and LG Chem is expected to continue, opportunities exist for new entrants specializing in niche materials and advanced fabrication techniques. The growth trajectory, however, might be tempered by potential supply chain disruptions and fluctuations in global economic conditions. Further growth is anticipated from increasing demand in emerging applications like renewable energy and medical devices.

Asia-Pacific Semiconductor Materials Market Market Size (In Billion)

The substantial growth within the Asia-Pacific region stems from its significant concentration of semiconductor manufacturing hubs. China's massive domestic market and ongoing investments in technological infrastructure are key contributors to this market expansion. Japan and South Korea, known for their technological expertise and high-quality manufacturing, remain vital players. Growth within the region is expected to be further fueled by the increasing adoption of advanced packaging technologies to enhance the performance and efficiency of semiconductor devices. This positive outlook, however, requires careful consideration of potential challenges, such as geopolitical uncertainties and fluctuations in raw material prices, which could influence the overall market trajectory. The continued focus on research and development into novel semiconductor materials will likely play a significant role in shaping future market dynamics and driving long-term growth.

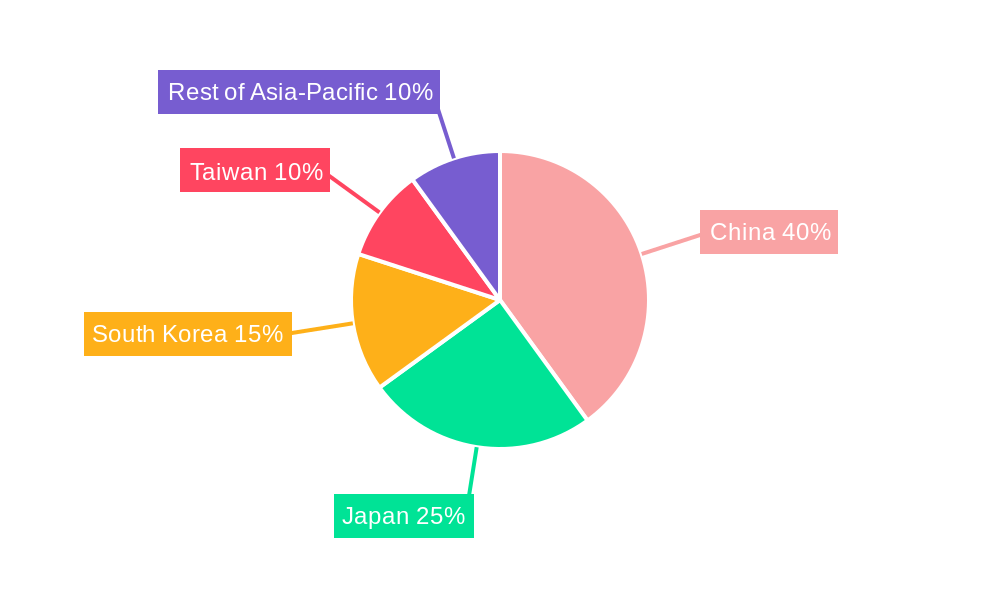

Asia-Pacific Semiconductor Materials Market Company Market Share

Asia-Pacific Semiconductor Materials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific semiconductor materials market, encompassing market size, growth drivers, key segments, leading players, and future outlook. The study period covers 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report is crucial for industry stakeholders, investors, and researchers seeking actionable insights into this rapidly evolving market. The market is segmented by material (Silicon Carbide (SiC), Gallium Manganese Arsenide (GaAs), Copper Indium Gallium Selenide (CIGS), Molybdenum Disulfide (MoS), Bismuth Telluride (Bi2Te3)), application (Fabrication, Packaging), end-user industry (Consumer Electronics, Telecommunication, Manufacturing, Automotive, Energy and Utility, Other End-User Industries), and country (Taiwan, South Korea, China, Japan, Rest of Asia-Pacific). Key players analyzed include UTAC Holdings Ltd, Sumitomo Chemical Co Ltd, Indium Corporation, Kyocera Corporation, LG Chem Ltd, Dow Chemical Co, Henkel AG & Company KGAA, BASF SE, Showa Denko Materials Co Ltd, and Intel Corporation. The report projects a market value reaching xx Million by 2033.

Asia-Pacific Semiconductor Materials Market Market Concentration & Dynamics

The Asia-Pacific semiconductor materials market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. The market's dynamics are shaped by several factors:

- Market Concentration: The top five players account for approximately xx% of the total market share in 2025, indicating a moderately concentrated market structure. This concentration is expected to shift slightly by 2033, with the top players potentially capturing xx%.

- Innovation Ecosystems: Robust R&D investments and collaborations among industry players, research institutions, and government agencies drive innovation in materials science and semiconductor technology. This fuels the development of advanced materials with improved performance and efficiency.

- Regulatory Frameworks: Government policies supporting semiconductor manufacturing and technological advancements play a crucial role in shaping market growth. Regulations regarding environmental compliance and material safety also influence market dynamics.

- Substitute Products: The emergence of alternative materials and technologies poses a potential challenge to the established players. Continuous research and development are essential to maintain a competitive edge.

- End-User Trends: Growing demand for advanced electronics in various end-user industries, including consumer electronics, automotive, and telecommunications, drives market growth. The increasing adoption of 5G technology and the proliferation of IoT devices further fuel demand.

- M&A Activities: Mergers and acquisitions play a significant role in shaping market consolidation and expanding market reach. The number of M&A deals in the Asia-Pacific semiconductor materials market averaged xx per year during the historical period (2019-2024). This number is projected to increase to xx per year by 2033.

Asia-Pacific Semiconductor Materials Market Industry Insights & Trends

The Asia-Pacific semiconductor materials market is experiencing robust growth, driven by several key factors. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by several factors:

- Technological advancements: Continuous innovations in semiconductor technology, such as the development of advanced materials like SiC and GaAs, drive the demand for specialized semiconductor materials. Miniaturization trends and the need for higher performance electronics further fuel this demand.

- Economic growth: Strong economic growth across several Asia-Pacific countries, particularly in China, South Korea, and Taiwan, contributes significantly to the growth of the semiconductor industry and its associated materials market. The increasing disposable incomes and rising consumer spending patterns are also important factors.

- Government support: Government initiatives and incentives aimed at promoting semiconductor manufacturing and technological advancements contribute to market expansion. This support includes investments in research and development, tax benefits, and infrastructure development.

- Evolving consumer behaviors: The increasing demand for sophisticated electronic devices, such as smartphones, smartwatches, and high-performance computing devices, drives the need for advanced semiconductor materials. The growing adoption of electric vehicles and renewable energy solutions also plays a role.

Key Markets & Segments Leading Asia-Pacific Semiconductor Materials Market

The Asia-Pacific semiconductor materials market is highly diverse, with several key markets and segments driving growth:

- Dominant Region: China is expected to remain the largest market for semiconductor materials in the Asia-Pacific region, followed by South Korea, Taiwan, and Japan. The Rest of Asia-Pacific region is also anticipated to showcase significant growth. China’s robust electronics manufacturing sector and government support for domestic semiconductor production significantly contribute to this dominance.

- Dominant Material: Silicon (Si) remains the dominant material due to its cost-effectiveness and established applications. However, the demand for advanced materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) is rapidly increasing due to their superior performance characteristics for high-power and high-frequency applications.

- Dominant End-user Industry: The consumer electronics industry is the largest end-user of semiconductor materials, driven by the explosive growth in smartphones, tablets, and other consumer devices. However, the automotive and telecommunications sectors are showing significant growth potential owing to the increasing adoption of advanced driver-assistance systems (ADAS) and 5G infrastructure.

Key Growth Drivers:

- Rapid economic growth in major Asian economies.

- Increasing demand for advanced electronics and consumer devices.

- Government initiatives and investments in semiconductor manufacturing.

- Technological advancements leading to higher performance devices.

- Growth of emerging applications like electric vehicles, renewable energy, and IoT.

Asia-Pacific Semiconductor Materials Market Product Developments

Recent years have witnessed significant product innovations in the Asia-Pacific semiconductor materials market. Companies are focusing on developing advanced materials with improved properties such as higher purity, enhanced performance, and greater efficiency. This includes the development of new silicon wafers with reduced defects, novel packaging materials for improved thermal management, and specialized materials for next-generation semiconductor devices. These advancements enhance the overall performance, reliability, and cost-effectiveness of electronic devices, giving manufacturers a significant competitive edge.

Challenges in the Asia-Pacific Semiconductor Materials Market Market

The Asia-Pacific semiconductor materials market faces several challenges:

- Supply chain disruptions: Geopolitical tensions and natural disasters can cause significant supply chain disruptions, impacting material availability and pricing. This unpredictability poses significant risk to manufacturers.

- Regulatory hurdles: Stringent environmental regulations and compliance requirements can increase the cost of production and slow down innovation. Navigating complex regulatory landscapes is challenging for companies.

- Intense competition: The market is characterized by fierce competition among established players and new entrants, resulting in price pressure and margin erosion. Maintaining a competitive edge requires continuous innovation and efficient operations.

Forces Driving Asia-Pacific Semiconductor Materials Market Growth

Several factors contribute to the growth of the Asia-Pacific semiconductor materials market:

- Technological advancements: Continued innovation in semiconductor technology, such as the development of advanced materials, leads to more powerful and efficient electronic devices, increasing demand for specialized materials.

- Economic growth: Strong economic growth across several Asia-Pacific nations fuels demand for electronics and other applications requiring semiconductors, driving up the demand for materials.

- Government support: Numerous governments in the region are investing heavily in semiconductor manufacturing and related research, creating favorable conditions for market expansion.

Challenges in the Asia-Pacific Semiconductor Materials Market Market

Long-term growth in the Asia-Pacific semiconductor materials market hinges on the successful navigation of technological complexities and market dynamics. Companies must prioritize R&D to develop advanced materials with superior performance and efficiency, and form strategic partnerships to secure a consistent supply chain. Expansion into emerging markets, coupled with diversification of product offerings, will be critical to sustained long-term growth.

Emerging Opportunities in Asia-Pacific Semiconductor Materials Market

Emerging opportunities abound in the Asia-Pacific semiconductor materials market:

- 5G infrastructure deployment: The widespread adoption of 5G technology will drive significant demand for advanced materials used in 5G devices and infrastructure.

- Electric vehicle (EV) revolution: The increasing popularity of EVs and hybrid vehicles presents an excellent growth opportunity for semiconductor materials used in power electronics and batteries.

- Internet of Things (IoT) expansion: The burgeoning IoT sector fuels the need for high-performance and low-power semiconductor materials, creating a strong market for specialized materials.

Leading Players in the Asia-Pacific Semiconductor Materials Market Sector

Key Milestones in Asia-Pacific Semiconductor Materials Market Industry

- August 2021: Sumitomo Chemical announced expansion of its high-purity chemical production capacity for semiconductors, boosting supply to meet growing demand. This strategic move strengthens their position in the market.

- December 2021: Intel Corporation's announcement to establish a semiconductor manufacturing facility in India signifies a significant investment in the Asia-Pacific region, promising substantial growth and job creation within the industry. This development is expected to stimulate further growth in the semiconductor materials market.

Strategic Outlook for Asia-Pacific Semiconductor Materials Market Market

The Asia-Pacific semiconductor materials market holds immense potential for future growth, fueled by technological advancements, economic expansion, and government support. Companies can capitalize on this growth by focusing on R&D to create superior materials, forging strategic partnerships for efficient supply chains, and expanding into new markets, particularly in emerging economies. The long-term outlook is exceptionally positive, with the market poised for significant expansion in the coming years.

Asia-Pacific Semiconductor Materials Market Segmentation

-

1. Material

- 1.1. Silicon Carbide (SiC)

- 1.2. Gallium Manganese Arsenide (GaAs)

- 1.3. Copper Indium Gallium Selenide (CIGS)

- 1.4. Molybdenum Disulfide (MoS)

- 1.5. Bismuth Telluride (Bi2Te3)

-

2. Application

- 2.1. Fabrication

- 2.2. Packaging

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Telecommunication

- 3.3. Manufacturing

- 3.4. Automotive

- 3.5. Energy and Utility

- 3.6. Other End-User Industries

Asia-Pacific Semiconductor Materials Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Semiconductor Materials Market Regional Market Share

Geographic Coverage of Asia-Pacific Semiconductor Materials Market

Asia-Pacific Semiconductor Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Progress and Product Innovation in Electronic Materials; Increased Demand for Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Complexity of the Manufacturing Process

- 3.4. Market Trends

- 3.4.1. Silicon Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Silicon Carbide (SiC)

- 5.1.2. Gallium Manganese Arsenide (GaAs)

- 5.1.3. Copper Indium Gallium Selenide (CIGS)

- 5.1.4. Molybdenum Disulfide (MoS)

- 5.1.5. Bismuth Telluride (Bi2Te3)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fabrication

- 5.2.2. Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Telecommunication

- 5.3.3. Manufacturing

- 5.3.4. Automotive

- 5.3.5. Energy and Utility

- 5.3.6. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UTAC Holdings Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Indium Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kyocera Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LG Chem Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dow Chemical Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Henkel AG & Company KGAA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Showa Denko Materials Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UTAC Holdings Ltd

List of Figures

- Figure 1: Asia-Pacific Semiconductor Materials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Semiconductor Materials Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 3: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 11: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Asia-Pacific Semiconductor Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Semiconductor Materials Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Semiconductor Materials Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Semiconductor Materials Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Asia-Pacific Semiconductor Materials Market?

Key companies in the market include UTAC Holdings Ltd, Sumitomo Chemical Co Ltd, Indium Corporation, Kyocera Corporation, LG Chem Ltd, Dow Chemical Co, Henkel AG & Company KGAA, BASF SE, Showa Denko Materials Co Ltd, Intel Corporation.

3. What are the main segments of the Asia-Pacific Semiconductor Materials Market?

The market segments include Material, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Progress and Product Innovation in Electronic Materials; Increased Demand for Consumer Electronics.

6. What are the notable trends driving market growth?

Silicon Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Complexity of the Manufacturing Process.

8. Can you provide examples of recent developments in the market?

December 2021: Intel Corporation announced that it would open a semiconductor manufacturing facility in India. The announcement by the company comes after Union Cabinet's recent decision on semiconductors, which will support research and innovation in the industry and enhance production, bolstering the 'Aatmanirbhar Bharat' program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Semiconductor Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Semiconductor Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Semiconductor Materials Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Semiconductor Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence