Key Insights

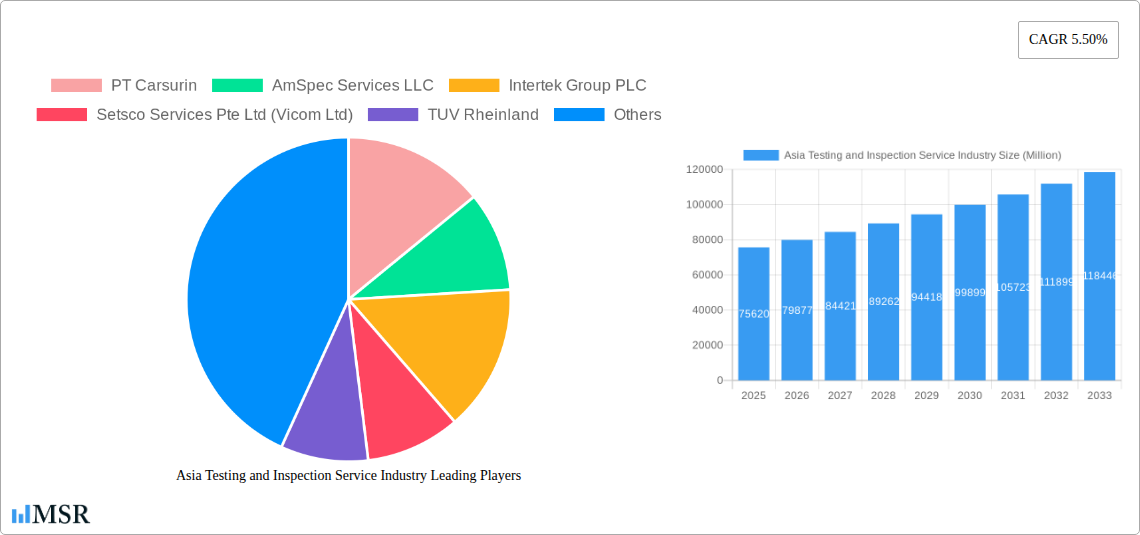

The Asia-Pacific testing and inspection services market, valued at $75.62 billion in 2025, is projected to experience robust growth, driven by factors such as increasing industrialization, stringent regulatory compliance requirements, and a rising focus on product quality and safety across diverse sectors. The region's diverse economic landscape, encompassing rapidly developing economies like China and India alongside technologically advanced nations such as Japan and South Korea, fuels demand for comprehensive testing and inspection services. Growth is further fueled by the burgeoning automotive and transportation, oil and gas, and food and agriculture sectors, all requiring rigorous quality control measures throughout their supply chains. The outsourcing trend within these industries is contributing significantly to market expansion, as companies seek cost-effective and specialized expertise. This trend is particularly noticeable in segments like industrial manufacturing and consumer goods and retail, where ensuring product conformity with international standards is paramount.

Asia Testing and Inspection Service Industry Market Size (In Billion)

While the market enjoys considerable growth potential, challenges remain. Competition among established players and emerging local companies creates pressure on pricing and margins. Maintaining high quality standards and technological advancements to meet evolving industry needs are also crucial for sustained success. Moreover, geopolitical factors and economic fluctuations in certain regional markets could influence growth trajectory. However, the long-term outlook for the Asia-Pacific testing and inspection services market remains positive, with continued expansion anticipated across various segments and countries. The market's projected Compound Annual Growth Rate (CAGR) of 5.50% from 2025 to 2033 highlights its substantial growth potential. This growth will be fueled by continued investments in infrastructure, increasing consumer awareness, and a rising focus on sustainable practices across multiple industries.

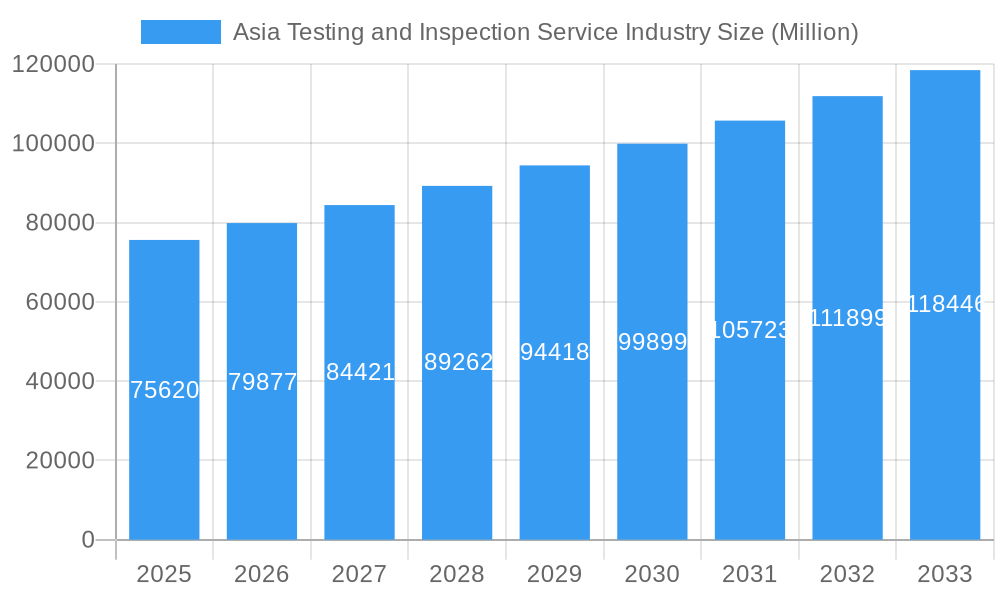

Asia Testing and Inspection Service Industry Company Market Share

Asia Testing and Inspection Service Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia Testing and Inspection Service industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a focus on 2025, incorporating historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). The market size is projected at xx Million for 2025, demonstrating significant growth potential. This report delves into market concentration, key trends, leading players, and emerging opportunities within this dynamic sector.

Asia Testing and Inspection Service Industry Market Concentration & Dynamics

The Asia Testing and Inspection service market exhibits a moderately concentrated landscape, with several multinational corporations and regional players vying for market share. Key players like SGS Group, Bureau Veritas Group, and Intertek Group PLC hold significant positions, but a considerable number of smaller, specialized firms also contribute to the overall market. The market share of the top 5 players is estimated at xx%, indicating room for both organic growth and mergers & acquisitions (M&A) activity.

Innovation ecosystems are evolving, driven by advancements in technologies like AI, big data analytics, and automation, particularly in testing and certification processes. Stringent regulatory frameworks, varying across countries, present both challenges and opportunities, requiring companies to adapt their strategies and invest in compliance measures. Substitute products, though limited, are emerging, particularly in niche areas.

End-user trends, particularly the increasing focus on quality control and supply chain transparency across various sectors, fuel market expansion. The number of M&A deals witnessed in recent years has been around xx, reflecting a trend of consolidation and expansion by major players seeking to diversify their offerings and enhance geographical reach. Examples include [mention specific M&A activities if available, otherwise use placeholder: "recent acquisitions by major players in the consumer goods and automotive sectors"].

Asia Testing and Inspection Service Industry Industry Insights & Trends

The Asia Testing and Inspection Services market is characterized by robust growth, driven by factors such as rising industrialization, expanding infrastructure projects, and increasing awareness of product safety and quality. The market size is estimated to reach xx Million in 2025, showcasing a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth trajectory is expected to continue throughout the forecast period (2025-2033), propelled by several key factors.

Technological disruptions, specifically the implementation of advanced testing methodologies and automation, are significantly improving efficiency and accuracy. This is complemented by the increasing adoption of digital technologies, enabling remote monitoring, data analytics, and improved traceability throughout the supply chain. Evolving consumer behaviors, such as heightened demand for safe and sustainable products, are also driving growth as businesses place greater emphasis on quality assurance and compliance. Furthermore, the increasing prevalence of e-commerce necessitates robust testing and certification services to ensure product authenticity and safety.

Key Markets & Segments Leading Asia Testing and Inspection Service Industry

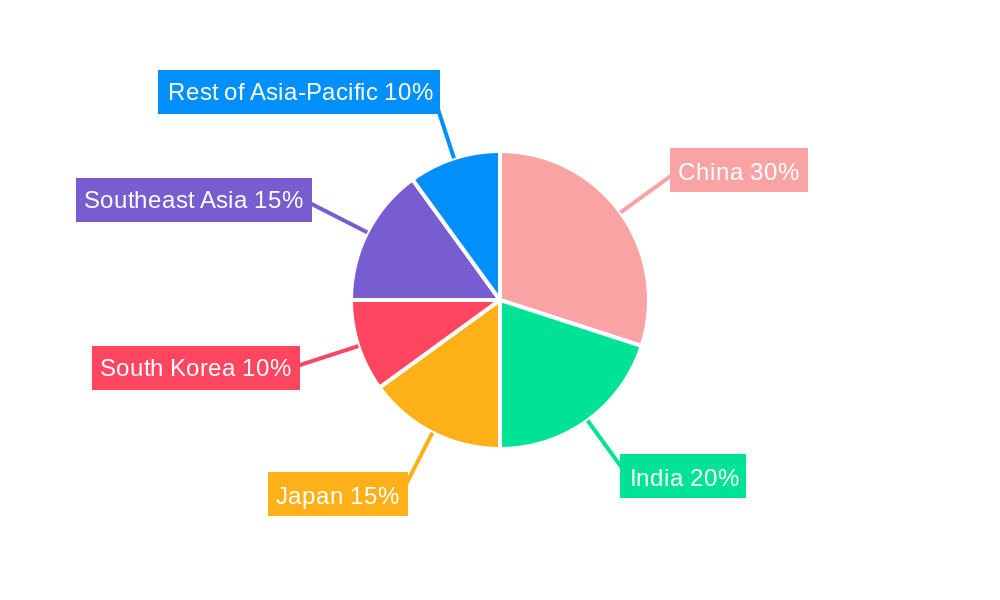

The Asia Testing and Inspection Services market is diverse, with significant variations across different segments and geographies. While China and India represent the largest markets due to their immense industrial base and expanding infrastructure, other markets like Japan, South Korea, and Southeast Asia also showcase strong growth potential. Specific key drivers for various segments include:

By Country:

- China: Rapid industrialization, significant government investment in infrastructure, and increasing consumer demand for quality products.

- India: Growing manufacturing sector, expansion of the middle class, and a rise in infrastructure development projects.

- Japan: Focus on technological advancements, stringent regulatory standards, and a sophisticated manufacturing base.

- Southeast Asia: Economic expansion, increasing foreign direct investment, and rising demand for consumer goods.

By Service Type:

- Testing and Inspection: This segment dominates the market, driven by the increasing demand for quality control and compliance across various industries.

- Certification: Growing demand for certifications, reflecting an emphasis on product quality, safety, and environmental compliance.

By End User:

- Industrial Manufacturing: The largest segment, fueled by the continuous expansion of manufacturing activity across Asia.

- Automotive and Transportation: Strong growth driven by the increasing production of vehicles and the development of related infrastructure.

- Oil and Gas: Consistent demand for testing and inspection services to ensure safety and compliance within this industry.

The Outsourced segment is likely to dominate the "By Type" segment, given the cost-effectiveness and specialized expertise that external service providers offer.

Asia Testing and Inspection Service Industry Product Developments

Recent innovations include advanced analytical techniques, automated inspection systems, and cloud-based data management solutions, enhancing efficiency and accuracy. The development of specialized testing services for emerging industries like renewable energy and advanced materials is also gaining traction. These advancements provide competitive edges by offering faster turnaround times, improved accuracy, and reduced operational costs. Industry players are actively investing in R&D to maintain a competitive advantage in this rapidly evolving sector.

Challenges in the Asia Testing and Inspection Service Industry Market

The industry faces challenges including stringent regulatory requirements varying across countries, leading to high compliance costs. Supply chain disruptions, particularly felt post-pandemic, impacting the availability of materials and equipment, also hinder growth. Intense competition from both established multinational players and regional firms puts pressure on pricing and profit margins. These factors collectively reduce the industry's profitability by an estimated xx%.

Forces Driving Asia Testing and Inspection Service Industry Growth

Key growth drivers include rapid industrialization across several Asian nations, fueling demand for quality control and compliance services. Government initiatives promoting infrastructure development, coupled with increasing investments in renewable energy and technological advancements, are also contributing to growth. The rising awareness of product safety and environmental regulations further fuels demand for testing and certification services.

Long-Term Growth Catalysts in the Asia Testing and Inspection Service Industry

Long-term growth will be sustained by continuous technological innovation, including automation, AI-powered analysis, and big data analytics for improved efficiency and accuracy. Strategic partnerships between testing companies and end-user industries will create synergies, leading to tailored solutions and market expansion. Further market penetration into emerging economies and untapped sectors presents significant growth potential.

Emerging Opportunities in Asia Testing and Inspection Service Industry

Opportunities lie in providing specialized testing services for emerging technologies, such as electric vehicles and renewable energy. Expansion into new markets, particularly in less-developed Asian regions, presents significant potential. Customization of service packages to meet the specific needs of various industry segments provides a competitive advantage.

Leading Players in the Asia Testing and Inspection Service Industry Sector

- PT Carsurin (If link is unavailable, replace with only company name)

- AmSpec Services LLC

- Intertek Group PLC

- Setsco Services Pte Ltd (Vicom Ltd)

- TUV Rheinland

- Apave Japan Co Limited

- Singapore Test Lab Pte Ltd

- SGS Group

- Bureau Veritas Group

- ALS Malaysia (ALS Limited)

- HQTS Group Ltd

- Seoul Inspection & Testing Co Limited

- Cotecna Inspection SA

- PT SUCOFINDO Perseo

- SIRIM QAS International Sdn Bhd

- UL LLC

- ABS Group

- TUV SUD

Key Milestones in Asia Testing and Inspection Service Industry Industry

- December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai, focusing on cosmetic and personal care product testing, enhancing its capabilities and market position.

- October 2022: Intertek Group PLC launched the "As Advertised" Program, aimed at boosting consumer confidence in online marketplaces through enhanced quality assurance and potentially impacting the market by increasing the demand for its services.

Strategic Outlook for Asia Testing and Inspection Service Market

The Asia Testing and Inspection Service market holds significant long-term growth potential, driven by continuous industrialization, infrastructure development, and the increasing emphasis on quality and safety. Strategic opportunities exist for companies to capitalize on technological advancements, expand into underserved markets, and forge strategic partnerships to gain a competitive edge in this dynamic sector. Companies that embrace innovation and adapt to evolving regulatory landscapes are poised for success in this rapidly expanding market.

Asia Testing and Inspection Service Industry Segmentation

-

1. Type

- 1.1. In-house

- 1.2. Outsourced

-

2. Service Type

- 2.1. Testing and Inspection

- 2.2. Certification

-

3. End User

- 3.1. Industrial Manufacturing

- 3.2. Automotive and Transportation

- 3.3. Oil and Gas

- 3.4. Mining and Downstream Applications

- 3.5. Food and Agriculture

- 3.6. Building and Infrastructure

- 3.7. Consumer Goods and Retail

- 3.8. Other End Users

Asia Testing and Inspection Service Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Testing and Inspection Service Industry Regional Market Share

Geographic Coverage of Asia Testing and Inspection Service Industry

Asia Testing and Inspection Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 3.3. Market Restrains

- 3.3.1. Low Awareness about the Facility Management Services

- 3.4. Market Trends

- 3.4.1. Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Testing and Inspection Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Testing and Inspection

- 5.2.2. Certification

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Industrial Manufacturing

- 5.3.2. Automotive and Transportation

- 5.3.3. Oil and Gas

- 5.3.4. Mining and Downstream Applications

- 5.3.5. Food and Agriculture

- 5.3.6. Building and Infrastructure

- 5.3.7. Consumer Goods and Retail

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Carsurin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AmSpec Services LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Setsco Services Pte Ltd (Vicom Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TUV Rheinland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apave Japan Co Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singapore Test Lab Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bureau Veritas Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALS Malaysia (ALS Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HQTS Group Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seoul Inspection & Testing Co Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cotecna Inspection SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 PT SUCOFINDO Perseo*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SIRIM QAS International Sdn Bhd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ABS Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 TUV SUD

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 PT Carsurin

List of Figures

- Figure 1: Asia Testing and Inspection Service Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Testing and Inspection Service Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Testing and Inspection Service Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia Testing and Inspection Service Industry?

Key companies in the market include PT Carsurin, AmSpec Services LLC, Intertek Group PLC, Setsco Services Pte Ltd (Vicom Ltd), TUV Rheinland, Apave Japan Co Limited, Singapore Test Lab Pte Ltd, SGS Group, Bureau Veritas Group, ALS Malaysia (ALS Limited), HQTS Group Ltd, Seoul Inspection & Testing Co Limited, Cotecna Inspection SA, PT SUCOFINDO Perseo*List Not Exhaustive, SIRIM QAS International Sdn Bhd, UL LLC, ABS Group, TUV SUD.

3. What are the main segments of the Asia Testing and Inspection Service Industry?

The market segments include Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

6. What are the notable trends driving market growth?

Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

7. Are there any restraints impacting market growth?

Low Awareness about the Facility Management Services.

8. Can you provide examples of recent developments in the market?

December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai. The laboratory will concentrate on analytical testing - physical, chemical, and microbial contamination - for cosmetic and personal care products. It is ISO/IEC 17025 accredited and has a Class 10,000 cleanroom certification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Testing and Inspection Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Testing and Inspection Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Testing and Inspection Service Industry?

To stay informed about further developments, trends, and reports in the Asia Testing and Inspection Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence