Key Insights

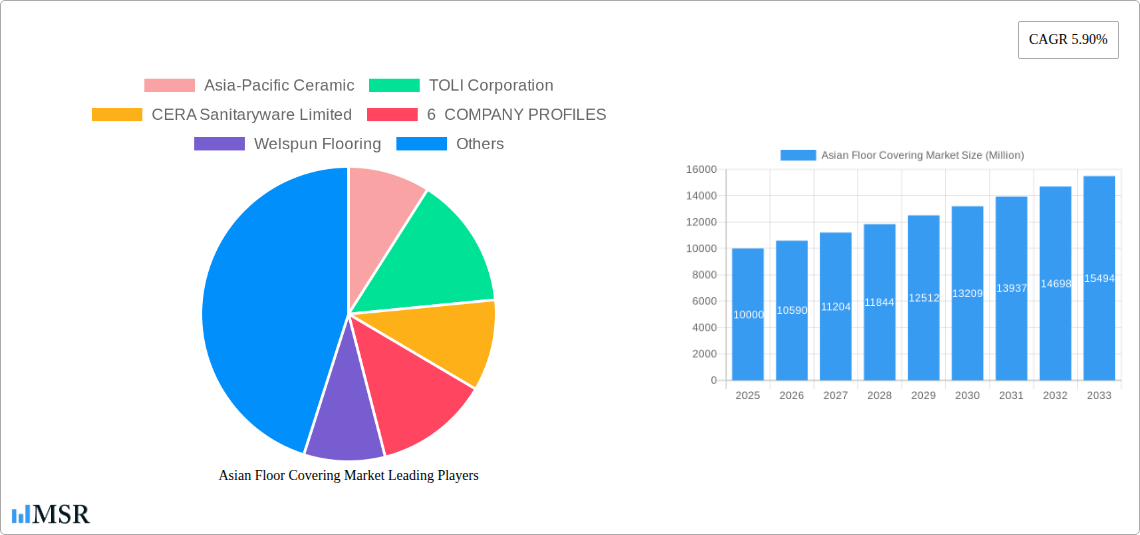

The Asia-Pacific floor covering market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Firstly, rapid urbanization and infrastructure development across major economies like China, India, and Southeast Asian nations fuel significant demand for new residential and commercial construction, consequently boosting flooring material consumption. Secondly, rising disposable incomes and a growing middle class in the region are elevating consumer spending on home improvement and refurbishment, leading to increased purchases of high-quality and aesthetically appealing floor coverings. Furthermore, the shift towards modern aesthetics and design preferences is driving demand for innovative flooring solutions like resilient and stone flooring options, surpassing traditional carpet and area rug choices in certain segments. However, fluctuations in raw material prices and economic instability in some parts of the region pose potential restraints to market growth. The market is segmented by distribution channels (contractors, specialty stores, home centers, others), end-users (residential replacement, commercial, builder), countries (China, Japan, South Korea, Taiwan, India, Southeast Asian Countries, Australia), and materials (carpet and area rugs, non-resilient flooring, resilient flooring, stone flooring). China and India are expected to remain the largest markets due to their significant population size and ongoing infrastructure projects. Competition amongst established players like Asia-Pacific Ceramic, TOLI Corporation, and CERA Sanitaryware Limited, along with emerging local manufacturers, is driving innovation and creating opportunities for market entrants.

Asian Floor Covering Market Market Size (In Billion)

The competitive landscape is characterized by a mix of multinational corporations and regional players. Multinationals benefit from established brand recognition and global distribution networks, while regional companies often leverage localized expertise and cost advantages. Future growth will be influenced by factors such as technological advancements in flooring materials (e.g., sustainable and eco-friendly options), evolving consumer preferences, and government initiatives promoting sustainable construction practices. The market is poised for continued expansion, presenting significant opportunities for businesses across the value chain, from manufacturers and distributors to installers and retailers. The strategic focus on innovative product development, targeted marketing campaigns, and efficient supply chain management will be crucial for success in this dynamic market.

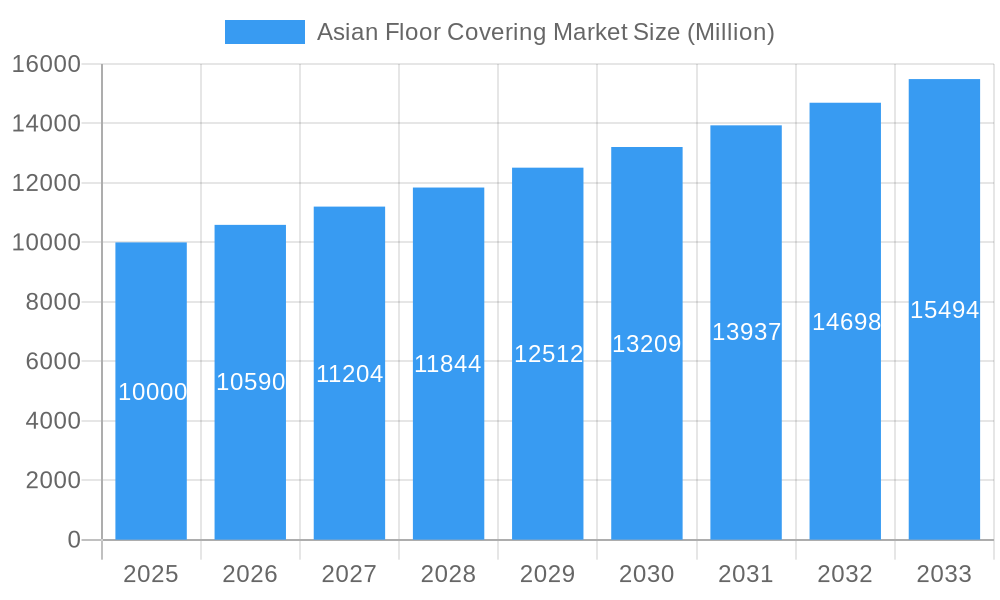

Asian Floor Covering Market Company Market Share

Asian Floor Covering Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asian floor covering market, offering invaluable insights for industry stakeholders. From market dynamics and leading players to emerging trends and future opportunities, this report covers all key aspects of this dynamic sector. With a focus on key regions like China, Japan, India, and Southeast Asia, it unveils growth drivers, challenges, and strategic imperatives shaping the future of the Asian floor covering market. The report uses data spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering a holistic view of market evolution and projections. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Asian Floor Covering Market Market Concentration & Dynamics

The Asian floor covering market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Asia-Pacific Ceramic, TOLI Corporation, and CERA Sanitaryware Limited are among the leading companies, each commanding a substantial portion of the market. However, the presence of numerous regional and smaller players creates a competitive environment. Innovation is primarily driven by advancements in material science, focusing on durability, aesthetics, and sustainability. Regulatory frameworks, particularly concerning environmental standards and building codes, significantly impact market dynamics. Substitute products, such as alternative flooring materials, pose a competitive threat. End-user trends, influenced by changing lifestyles and design preferences, are shaping product demand. Mergers and acquisitions (M&A) activity remains moderate, with approximately xx M&A deals recorded in the past five years. This activity is largely driven by strategic expansion and consolidation within the industry.

- Market Share: Top 3 players hold approximately xx% of the market share.

- M&A Activity: xx deals completed between 2019 and 2024.

- Innovation Focus: Sustainable materials, improved durability, and aesthetic designs.

- Regulatory Landscape: Increasingly stringent environmental regulations and building codes.

Asian Floor Covering Market Industry Insights & Trends

The Asian floor covering market is experiencing robust growth, driven by several key factors. Rapid urbanization and infrastructure development, especially in emerging economies like India and Southeast Asia, are significantly boosting demand. Rising disposable incomes and changing consumer preferences towards aesthetically pleasing and high-quality flooring solutions are also fueling market expansion. Technological disruptions, such as the introduction of innovative materials and manufacturing processes, are enhancing product quality and efficiency. Consumer behavior is evolving towards more sustainable and eco-friendly options, creating new opportunities for manufacturers. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, indicating a substantial growth trajectory. This robust growth is expected to be sustained by continued infrastructure investments, rising urbanization, and the growing demand for better living spaces.

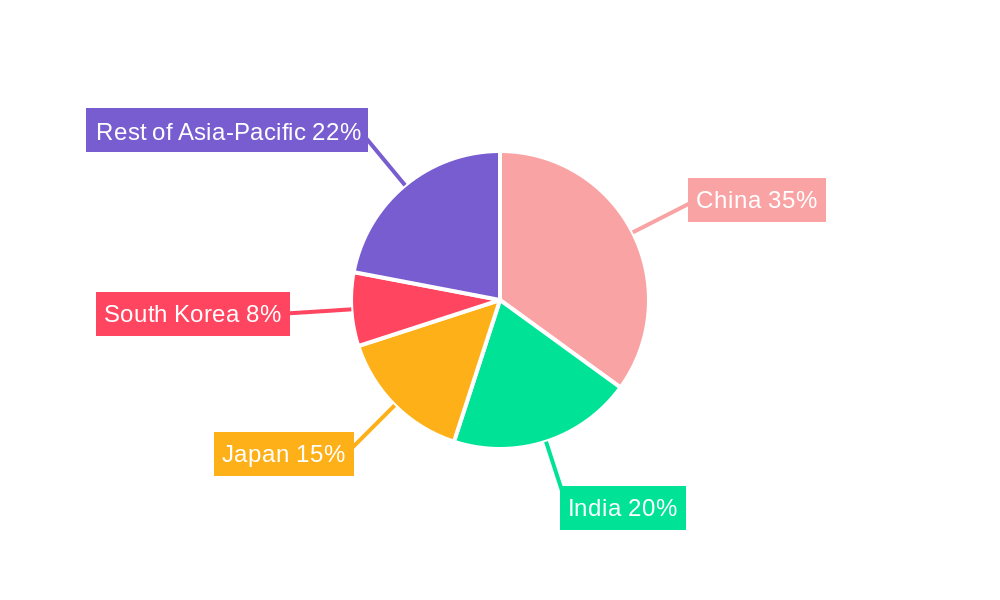

Key Markets & Segments Leading Asian Floor Covering Market

China remains the dominant market in Asia, followed by Japan, India, and South Korea. The residential replacement segment constitutes the largest share of the end-user market, reflecting a significant renovation and replacement cycle. The commercial segment is also experiencing substantial growth due to rapid infrastructure development and increasing construction activity. Contractors represent the largest distribution channel, followed by specialty stores and home centers. Resilient flooring, particularly vinyl and laminate, holds a significant market share due to cost-effectiveness and durability, while the carpet and area rugs segment is experiencing steady growth, fueled by increasing disposable income and a rise in home renovation projects. Stone flooring is also showing positive momentum.

Key Growth Drivers:

- Rapid urbanization and infrastructure development.

- Rising disposable incomes and improving living standards.

- Increasing home renovation and construction activities.

- Growing demand for sustainable and eco-friendly flooring solutions.

Dominant Regions/Segments:

- China is the largest national market.

- Residential replacement is the largest end-user segment.

- Contractors are the largest distribution channel.

- Resilient flooring accounts for a significant market share.

Asian Floor Covering Market Product Developments

Recent product developments focus on technological advancements such as improved water resistance, enhanced durability, and the use of sustainable materials. Innovation in design and aesthetics, particularly in pattern and color, has broadened product appeal. These developments reflect the increasing emphasis on consumer preferences for high-performance, eco-friendly, and aesthetically pleasing floor covering solutions. The integration of smart technology in certain products is also enhancing market appeal.

Challenges in the Asian Floor Covering Market Market

The Asian floor covering market faces several challenges. Fluctuations in raw material prices, particularly for synthetic materials, directly impact production costs and profitability. Supply chain disruptions, exacerbated by geopolitical events, can hinder timely product delivery. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization to maintain market share. Stringent environmental regulations add to compliance costs. These challenges necessitate agile strategies focused on supply chain resilience, innovation, and cost management.

Forces Driving Asian Floor Covering Market Growth

The Asian floor covering market is experiencing growth propelled by several factors. Rapid economic growth in several Asian countries fuels increased construction activity and home renovation projects. Government initiatives promoting infrastructure development significantly impact market growth. Technological advancements in materials science are leading to superior and more sustainable products, thus encouraging greater adoption. The shift in consumer preference towards improved aesthetics and durability further supports market expansion.

Long-Term Growth Catalysts in the Asian Floor Covering Market

Long-term growth will be fueled by increased investments in sustainable and eco-friendly flooring materials, including recycled and bio-based options. Strategic partnerships between manufacturers and designers will drive product innovation and meet evolving consumer preferences. Market expansion into new and emerging markets within Asia will also contribute to the long-term growth trajectory. The continuous improvement of technology will also play a vital role.

Emerging Opportunities in Asian Floor Covering Market

Emerging opportunities lie in the adoption of smart flooring technologies, such as integrated heating and cooling systems. The growing demand for customized and personalized flooring solutions presents a significant opportunity for manufacturers. Expansion into niche segments, such as specialized flooring for healthcare facilities and sports venues, is another area of considerable potential. These trends reflect the evolution of consumer preferences and technological advancements.

Leading Players in the Asian Floor Covering Market Sector

- Asia-Pacific Ceramic

- TOLI Corporation

- CERA Sanitaryware Limited

- Welspun Flooring

- Flooring India Company

- Fujian Floors China Co Ltd

- DAIKEN Corporation

- Pergo

- Inovar Resources Sdn Bhd

- Hanhent International China Co Ltd

Key Milestones in Asian Floor Covering Market Industry

- 2020: Introduction of new sustainable flooring materials by several key players.

- 2021: Significant investment in automation and robotics by major manufacturers.

- 2022: Increased focus on online sales and e-commerce platforms.

- 2023: Several M&A deals were announced, shaping market consolidation.

- 2024: Launch of new product lines featuring improved durability and aesthetics.

Strategic Outlook for Asian Floor Covering Market Market

The Asian floor covering market holds significant future potential, driven by continuous urbanization, economic growth, and evolving consumer preferences. Strategic opportunities lie in focusing on sustainability, technological innovation, and expanding into new market segments. Companies that effectively adapt to changing consumer demands and adopt sustainable manufacturing practices will be well-positioned to capitalize on the market's future growth.

Asian Floor Covering Market Segmentation

-

1. Material

- 1.1. Carpet and Area Rugs

-

1.2. Non Resilient Flooring

- 1.2.1. Wood Flooring

- 1.2.2. Ceramic Floor and Wall Tile

- 1.2.3. Laminate Flooring

- 1.2.4. Stone Flooring

- 1.3. Vinyl sheet and Floor Tile

- 1.4. Other Resilient Flooring

-

2. Distribution Channel

- 2.1. Contractors

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Others

-

3. End-User

- 3.1. Residential Replacement

- 3.2. Commercial

- 3.3. Builder

Asian Floor Covering Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Floor Covering Market Regional Market Share

Geographic Coverage of Asian Floor Covering Market

Asian Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential.

- 3.3. Market Restrains

- 3.3.1 In many Asian markets

- 3.3.2 consumers are highly price-sensitive

- 3.3.3 which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials

- 3.4.2 sustainably sourced wood

- 3.4.3 and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Non Resilient Flooring

- 5.1.2.1. Wood Flooring

- 5.1.2.2. Ceramic Floor and Wall Tile

- 5.1.2.3. Laminate Flooring

- 5.1.2.4. Stone Flooring

- 5.1.3. Vinyl sheet and Floor Tile

- 5.1.4. Other Resilient Flooring

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contractors

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.3.3. Builder

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Asia-Pacific Ceramic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TOLI Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CERA Sanitaryware Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 6 COMPANY PROFILES

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Welspun Flooring

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flooring India Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujian Floors China Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DAIKEN Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pergo

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Inovar Resources Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hanhent International China Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Asia-Pacific Ceramic

List of Figures

- Figure 1: Asian Floor Covering Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asian Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Asian Floor Covering Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Asian Floor Covering Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asian Floor Covering Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 4: Asian Floor Covering Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asian Floor Covering Market Revenue undefined Forecast, by Material 2020 & 2033

- Table 6: Asian Floor Covering Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asian Floor Covering Market Revenue undefined Forecast, by End-User 2020 & 2033

- Table 8: Asian Floor Covering Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asian Floor Covering Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Floor Covering Market?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Asian Floor Covering Market?

Key companies in the market include Asia-Pacific Ceramic, TOLI Corporation, CERA Sanitaryware Limited, 6 COMPANY PROFILES, Welspun Flooring, Flooring India Company, Fujian Floors China Co Ltd, DAIKEN Corporation, Pergo, Inovar Resources Sdn Bhd, Hanhent International China Co Ltd.

3. What are the main segments of the Asian Floor Covering Market?

The market segments include Material, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Government-led housing initiatives and infrastructure development projects across Asia are boosting demand for floor coverings. Affordable housing schemes and smart city projects are particularly influential..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly flooring options in Asia. Consumers are increasingly seeking products made from recycled materials. sustainably sourced wood. and low-VOC (volatile organic compounds) products. Bamboo and cork flooring are examples of sustainable choices gaining popularity..

7. Are there any restraints impacting market growth?

In many Asian markets. consumers are highly price-sensitive. which can limit the adoption of premium or high-end floor coverings. Economic fluctuations and inflation can also affect purchasing decisions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Floor Covering Market?

To stay informed about further developments, trends, and reports in the Asian Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence