Key Insights

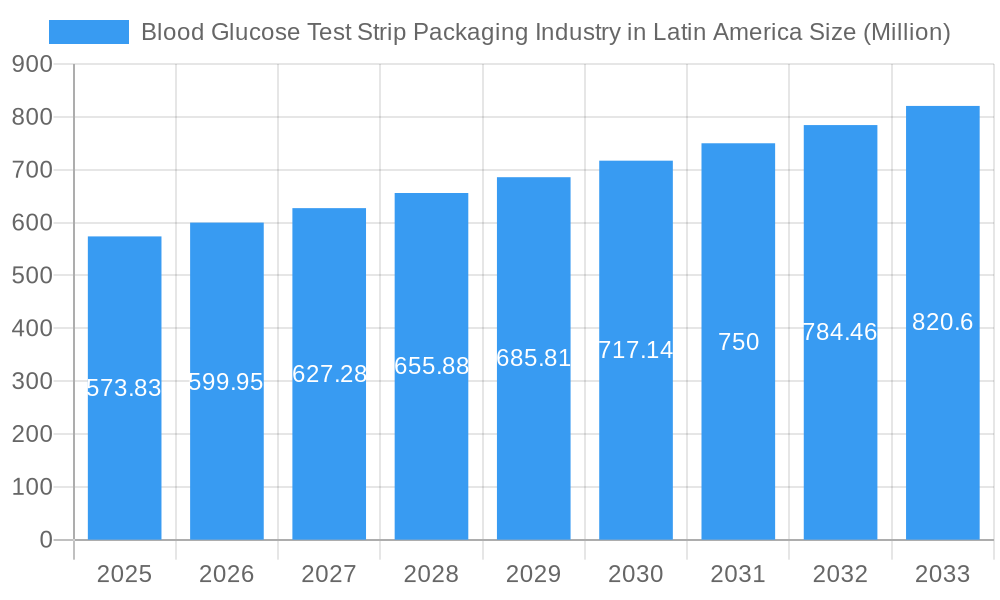

The Latin American market for blood glucose test strip packaging is poised for robust expansion, with an estimated market size of $573.83 million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 4.60% through 2033. This steady growth is underpinned by several key drivers. The increasing prevalence of diabetes across Latin America, particularly in countries like Mexico and Brazil, fuels the demand for regular blood glucose monitoring. This demographic shift is amplified by greater awareness among patients and healthcare providers regarding the importance of proactive diabetes management, leading to higher adoption rates of self-monitoring blood glucose devices, including glucometers and their essential consumables like test strips. Furthermore, advancements in packaging technology, focusing on improved sterility, user convenience, and enhanced shelf-life for test strips, are also contributing to market momentum. These innovations cater to the evolving needs of both diabetic individuals and healthcare professionals, ensuring the integrity and efficacy of the diagnostic tools.

Blood Glucose Test Strip Packaging Industry in Latin America Market Size (In Million)

The market dynamics are further shaped by significant trends and restraints. A prominent trend is the shift towards more sustainable and eco-friendly packaging solutions, driven by regulatory pressures and growing consumer environmental consciousness. This includes exploring biodegradable materials and optimizing packaging designs to minimize waste. The increasing integration of digital health technologies, with smart glucometers and connected testing platforms, also influences packaging requirements, demanding compatibility and ease of integration. However, the market faces certain restraints, including the fluctuating costs of raw materials essential for packaging, which can impact profit margins for manufacturers. Additionally, stringent regulatory requirements for medical device packaging across different Latin American countries necessitate significant investment in compliance, potentially slowing down market entry for smaller players. Despite these challenges, the overall outlook for blood glucose test strip packaging in Latin America remains positive, driven by the persistent and growing need for effective diabetes management solutions.

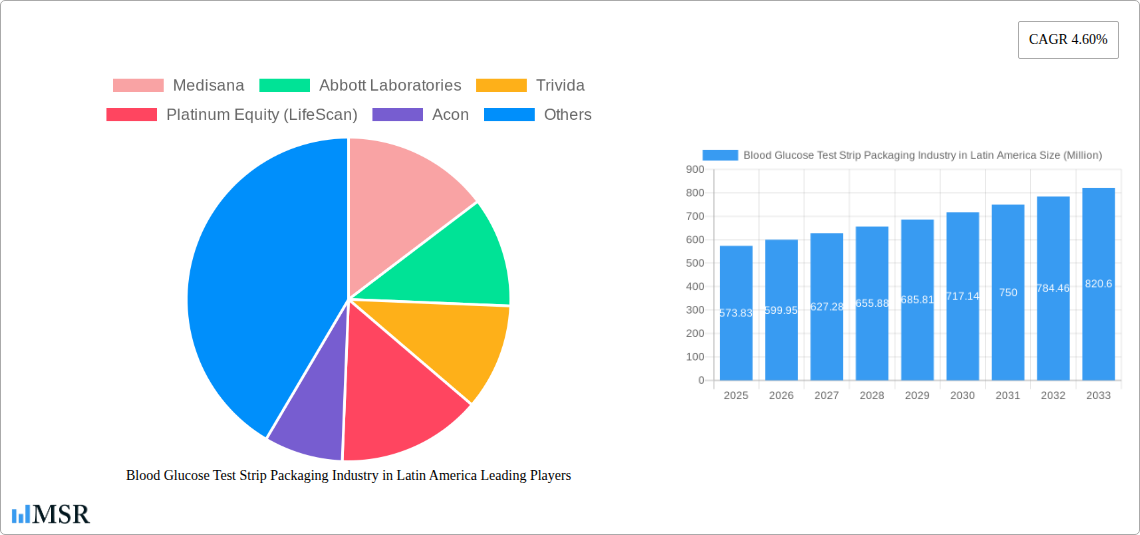

Blood Glucose Test Strip Packaging Industry in Latin America Company Market Share

Blood Glucose Test Strip Packaging Industry in Latin America: Comprehensive Market Analysis & Forecast (2019–2033)

Unlock unparalleled insights into the dynamic Latin American Blood Glucose Test Strip Packaging Industry. This definitive report provides in-depth analysis, strategic recommendations, and future projections for stakeholders seeking to capitalize on this rapidly expanding market. Dive deep into market concentration, key trends, regional dominance, product innovations, challenges, and growth drivers shaping the future of diabetes management packaging across Mexico, Brazil, and the wider Latin American region. With a robust study period spanning 2019–2033 and a base year of 2025, this report is your essential guide to navigating the evolving landscape of blood glucose monitoring solutions.

Blood Glucose Test Strip Packaging Industry in Latin America Market Concentration & Dynamics

The Blood Glucose Test Strip Packaging Industry in Latin America exhibits a moderately concentrated market, driven by a handful of global players and a growing number of regional manufacturers specializing in packaging solutions for self-monitoring blood glucose devices. Innovation ecosystems are steadily developing, with a focus on sustainable packaging materials and enhanced tamper-evident features to ensure product integrity and patient safety. Regulatory frameworks are becoming increasingly stringent, emphasizing compliance with international quality standards for medical device packaging. Substitute products, while not directly impacting test strip packaging, are a consideration in the broader diabetes management landscape, influencing the demand for cost-effective and efficient packaging solutions. End-user trends lean towards user-friendly, discreet, and environmentally conscious packaging designs, reflecting a growing awareness among diabetic patients. Mergers and acquisitions (M&A) activity, while not at its peak, is present, with strategic partnerships aimed at expanding manufacturing capabilities and market reach. For instance, the acquisition of LifeScan by Platinum Equity highlights a trend towards consolidation and focused investment in the diabetes care sector, indirectly impacting packaging demands. The market share distribution among top packaging providers is currently estimated with the top 5 players holding approximately 40% market share. M&A deal counts in the broader medical packaging sector relevant to this industry have averaged 3-5 significant transactions annually over the past two years.

- Market Share Snapshot (Estimated): Top 5 players: ~40%

- M&A Activity: Average 3-5 significant deals annually (relevant medical packaging)

- Innovation Focus: Sustainable materials, tamper-evident features.

- Regulatory Landscape: Evolving stringency, emphasis on international standards.

Blood Glucose Test Strip Packaging Industry in Latin America Industry Insights & Trends

The Blood Glucose Test Strip Packaging Industry in Latin America is poised for significant growth, projected to reach a market size of approximately $250 Million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025–2033. This expansion is primarily fueled by a confluence of increasing diabetes prevalence across the region, a growing awareness of proactive diabetes management, and advancements in self-monitoring blood glucose (SMBG) technologies. Rising disposable incomes in key economies like Brazil and Mexico are enhancing consumer access to essential diabetes care products, including blood glucose test strips and their accompanying packaging. Technological disruptions are playing a crucial role, with a continuous demand for packaging that not only protects the sensitive test strips from environmental factors like humidity and light but also integrates smart features. This includes anti-counterfeiting measures, batch tracking capabilities, and eco-friendly materials that resonate with environmentally conscious consumers. Evolving consumer behaviors are a key driver; patients are increasingly seeking convenient, easy-to-use, and aesthetically pleasing packaging that supports their daily health routines. The integration of digital health platforms, exemplified by LifeScan's use of Bluetooth-connected meters with mobile apps, indirectly influences packaging design by necessitating secure and compatible storage for test strips used with these advanced devices. Furthermore, the growing demand for home healthcare solutions and the aging demographic in Latin America further bolster the need for reliable and accessible SMBG products, consequently driving the market for their specialized packaging. The shift towards personalized medicine also hints at future packaging needs, potentially including smaller, more frequent supply formats. The estimated market size for the Blood Glucose Test Strip Packaging Industry in Latin America in the historical base year of 2019 was approximately $170 Million.

- Market Size (2025 Estimate): ~$250 Million

- CAGR (2025–2033): ~7.2%

- Historical Market Size (2019): ~$170 Million

- Key Growth Drivers: Rising diabetes prevalence, increased health awareness, technological advancements, economic growth.

- Consumer Behavior: Demand for convenience, sustainability, and smart packaging features.

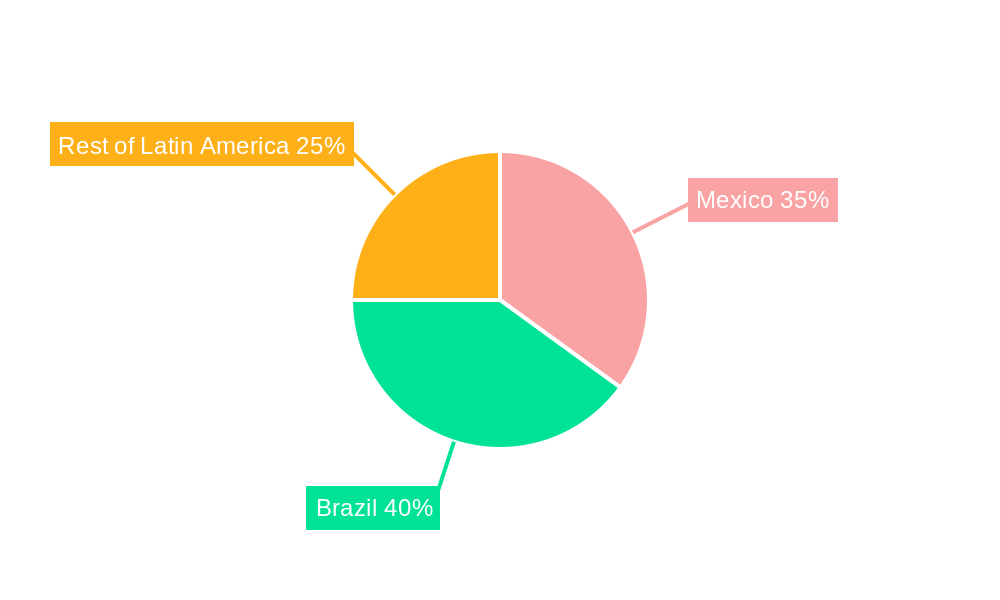

Key Markets & Segments Leading Blood Glucose Test Strip Packaging Industry in Latin America

The Latin American Blood Glucose Test Strip Packaging Industry is predominantly led by Brazil and Mexico, with the Rest of Latin America showing significant growth potential. Within the Self-Monitoring Blood Glucose Devices segment, Blood Glucose Test Strips represent the most substantial driver for specialized packaging demand.

Dominant Geography: Brazil

- Economic Growth: Brazil's robust economy and large population contribute to a significant patient base requiring consistent diabetes management.

- Healthcare Infrastructure: Continued investment in healthcare infrastructure, including primary care and specialized diabetes clinics, facilitates broader access to SMBG devices and consumables.

- Government Initiatives: Public health programs focused on chronic disease management positively impact the demand for diabetes monitoring tools and, consequently, their packaging.

- Consumer Awareness: Growing awareness among the Brazilian population regarding the importance of regular blood glucose monitoring translates into higher sales volumes of test strips.

Dominant Geography: Mexico

- High Diabetes Prevalence: Mexico faces one of the highest diabetes prevalence rates globally, creating a substantial and continuous market for blood glucose test strips.

- Healthcare Access: Expanding healthcare access, both public and private, ensures that a larger segment of the population can afford and utilize SMBG devices.

- Technological Adoption: Increasing adoption of advanced SMBG technologies, including those with digital connectivity, requires sophisticated and secure packaging solutions.

- Manufacturing Hub: Mexico's established position as a manufacturing hub for medical devices and related components provides a conducive environment for packaging manufacturers.

Dominant Segment: Blood Glucose Test Strips

- High Consumption Volume: Blood glucose test strips are consumables with high usage frequency, leading to a consistent and substantial demand for their packaging.

- Sensitivity to Environment: Test strips are highly sensitive to moisture, light, and temperature fluctuations, necessitating robust and protective packaging to maintain their accuracy and shelf-life.

- Regulatory Requirements: Packaging for test strips must adhere to stringent medical device packaging regulations to ensure sterility, tamper-evidence, and traceability.

- Innovation in Packaging: The drive for innovation in test strip packaging, including desiccant integration, anti-fogging properties, and user-friendly dispensing mechanisms, further solidifies its leadership in the packaging market.

Emerging Markets: Rest of Latin America

- Countries like Colombia, Argentina, and Chile are witnessing increasing diabetes rates and improving healthcare access, presenting significant growth opportunities for test strip packaging manufacturers.

Blood Glucose Test Strip Packaging Industry in Latin America Product Developments

Product developments in blood glucose test strip packaging are primarily focused on enhancing product stability, user convenience, and combating counterfeiting. Innovations include advanced moisture-barrier materials to protect sensitive test strips from degradation, improved desiccant technologies integrated directly into packaging to maintain optimal humidity levels, and child-resistant closures for enhanced safety. Furthermore, the industry is seeing advancements in sustainable packaging solutions, utilizing recyclable and biodegradable materials without compromising protective integrity. Market relevance is driven by the need for packaging that aligns with the technological advancements in blood glucose meters, supporting features like Bluetooth connectivity and app integration.

Challenges in the Blood Glucose Test Strip Packaging Industry in Latin America Market

The Blood Glucose Test Strip Packaging Industry in Latin America faces several challenges. Regulatory hurdles remain significant, with varying compliance requirements across different countries, increasing the cost and complexity of market entry and expansion. Supply chain disruptions, exacerbated by logistical complexities in the region and global events, can lead to material shortages and delayed production, impacting delivery timelines and potentially increasing costs by an estimated 5-10%. Intense competitive pressure from both global and local players drives down profit margins, necessitating continuous innovation and cost optimization. The economic volatility in certain Latin American countries can affect consumer purchasing power, impacting the demand for premium packaging features.

- Regulatory Complexity: Divergent national regulations increase compliance costs.

- Supply Chain Vulnerabilities: Logistical challenges and potential disruptions lead to cost increases of 5-10%.

- Competitive Landscape: Intense competition pressures profit margins.

- Economic Instability: Fluctuating economies impact consumer spending.

Forces Driving Blood Glucose Test Strip Packaging Industry in Latin America Growth

Several key forces are driving the growth of the Blood Glucose Test Strip Packaging Industry in Latin America. The increasing prevalence of diabetes across the region, fueled by lifestyle changes and aging demographics, directly translates to a higher demand for blood glucose monitoring solutions and, consequently, their packaging. Growing health awareness and patient empowerment are encouraging individuals to take a more proactive approach to managing their health, leading to increased adoption of SMBG devices. Technological advancements in both blood glucose meters and test strip formulations necessitate innovative packaging solutions that ensure accuracy, stability, and user-friendliness. Furthermore, favorable government policies and healthcare initiatives aimed at managing chronic diseases contribute to market expansion by improving access to essential medical supplies.

- Diabetes Prevalence: Rising rates create consistent demand.

- Health Awareness: Empowered patients drive SMBG adoption.

- Technological Innovation: Demand for protective and advanced packaging.

- Government Support: Health initiatives enhance market accessibility.

Challenges in the Blood Glucose Test Strip Packaging Industry in Latin America Market

Long-term growth catalysts for the Blood Glucose Test Strip Packaging Industry in Latin America are rooted in continuous innovation and strategic market expansion. The ongoing development of more sophisticated SMBG devices, requiring advanced packaging to protect sensitive components and ensure data integrity, will be a key driver. Furthermore, the exploration of sustainable and biodegradable packaging materials presents a significant opportunity, aligning with global environmental trends and consumer preferences. Strategic partnerships between packaging manufacturers and blood glucose meter companies can lead to co-developed solutions, enhancing product integration and market penetration. Expanding into underserved markets within Latin America and focusing on cost-effective solutions for a broader consumer base will also be crucial for sustained growth.

Emerging Opportunities in Blood Glucose Test Strip Packaging Industry in Latin America

Emerging opportunities in the Blood Glucose Test Strip Packaging Industry in Latin America are diverse. The growing trend towards telemedicine and remote patient monitoring creates a demand for packaging that facilitates secure and convenient shipment of test strips. The development of smart packaging with integrated QR codes or NFC tags for supply chain traceability and anti-counterfeiting purposes is a significant emerging area. Furthermore, the increasing focus on personalized medicine may lead to opportunities for customized or smaller-batch packaging solutions tailored to individual patient needs. Exploring emerging economies within the region with growing middle classes and increasing healthcare expenditure presents untapped market potential. The demand for eco-friendly packaging solutions is also on the rise, offering opportunities for manufacturers to differentiate themselves.

- Smart Packaging: Traceability and anti-counterfeiting features.

- Telemedicine Integration: Packaging supporting remote monitoring.

- Personalized Solutions: Customized and smaller-batch packaging.

- Untapped Markets: Expansion into growing economies.

- Sustainable Materials: Eco-friendly packaging demand.

Leading Players in the Blood Glucose Test Strip Packaging Industry in Latin America Sector

- Medisana

- Abbott Laboratories

- Trivida

- Platinum Equity (LifeScan)

- Acon

- Rossmax

- Agamatrix Inc

- F Hoffmann-La Roche AG

- Bionime Corporation

- Arkray

- Ascensia

Key Milestones in Blood Glucose Test Strip Packaging Industry in Latin America Industry

- January 2022: Roche launched its new point-of-care blood glucose monitor designed for hospital professionals, with a companion device shaped like a touchscreen smartphone that will run its apps. The hand-held Cobas pulse includes an automated glucose test strip reader, a camera, and a touchscreen for logging other diagnostic results. It's designed for patients of all ages, including neonates and people in intensive care, highlighting packaging needs for advanced hospital-grade devices.

- June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) had published Real World Evidence of Improved Glycemic Control in People with Diabetes using a Bluetooth-connected Blood Glucose Meter with Mobile Diabetes Management Application using the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter synced via Bluetooth wireless technology - could support improved glycemic control for people with diabetes, emphasizing the evolving packaging requirements for connected SMBG systems.

Strategic Outlook for Blood Glucose Test Strip Packaging Industry in Latin America Market

The strategic outlook for the Blood Glucose Test Strip Packaging Industry in Latin America is exceptionally positive, driven by persistent growth in diabetes prevalence and increasing consumer demand for advanced, user-friendly, and sustainable healthcare solutions. Growth accelerators will include the adoption of smart packaging technologies for enhanced traceability and anti-counterfeiting, alongside the development of eco-friendly packaging alternatives. Strategic opportunities lie in forging strong partnerships with key players like Abbott Laboratories and F Hoffmann-La Roche AG, focusing on product innovation that supports integrated digital health platforms, and expanding manufacturing capabilities to cater to the burgeoning demand in key markets like Brazil and Mexico, as well as exploring the significant potential in the Rest of Latin America.

Blood Glucose Test Strip Packaging Industry in Latin America Segmentation

-

1. Self-Monitoring Blood Glucose Devices

- 1.1. Glucometer Devices

- 1.2. Blood Glucose Test Strips

- 1.3. Lancets

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Rest of Latin America

Blood Glucose Test Strip Packaging Industry in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Rest of Latin America

Blood Glucose Test Strip Packaging Industry in Latin America Regional Market Share

Geographic Coverage of Blood Glucose Test Strip Packaging Industry in Latin America

Blood Glucose Test Strip Packaging Industry in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Blood Glucose Test Strips Held the Largest Market Share in the current year.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 5.1.1. Glucometer Devices

- 5.1.2. Blood Glucose Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 6. Mexico Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 6.1.1. Glucometer Devices

- 6.1.2. Blood Glucose Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 7. Brazil Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 7.1.1. Glucometer Devices

- 7.1.2. Blood Glucose Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 8. Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 8.1.1. Glucometer Devices

- 8.1.2. Blood Glucose Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Self-Monitoring Blood Glucose Devices

- 9. Brazil Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 10. Argentina Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 11. Mexico Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 12. Peru Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 13. Chile Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 14. Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Analysis, Insights and Forecast, 2020-2032

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Medisana

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Abbott Laboratories

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Trivida

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Platinum Equity (LifeScan)

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Acon

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Rossmax

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Agamatrix Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 F Hoffmann-La Roche AG

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Bionime Corporation

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Arkray

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Ascensia

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.1 Medisana

List of Figures

- Figure 1: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Blood Glucose Test Strip Packaging Industry in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 4: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 5: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 11: Brazil Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Brazil Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Argentina Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Mexico Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Mexico Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Peru Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Peru Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Chile Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Chile Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Latin America Blood Glucose Test Strip Packaging Industry in Latin America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 24: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 25: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 26: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 27: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 30: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 31: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 33: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 36: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Self-Monitoring Blood Glucose Devices 2020 & 2033

- Table 37: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Blood Glucose Test Strip Packaging Industry in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Blood Glucose Test Strip Packaging Industry in Latin America Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blood Glucose Test Strip Packaging Industry in Latin America?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Blood Glucose Test Strip Packaging Industry in Latin America?

Key companies in the market include Medisana, Abbott Laboratories, Trivida, Platinum Equity (LifeScan), Acon, Rossmax, Agamatrix Inc, F Hoffmann-La Roche AG, Bionime Corporation, Arkray, Ascensia.

3. What are the main segments of the Blood Glucose Test Strip Packaging Industry in Latin America?

The market segments include Self-Monitoring Blood Glucose Devices, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 573.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Blood Glucose Test Strips Held the Largest Market Share in the current year..

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

June 2022: LifeScan announced that the peer-reviewed journal Diabetes Technology and Therapeutics (DTT) had published Real World Evidence of Improved Glycemic Control in People with Diabetes using a Bluetooth-connected Blood Glucose Meter with Mobile Diabetes Management Application using the OneTouch Reveal mobile app with the OneTouch Verio Reflect meter synced via Bluetooth wireless technology - could support improved glycemic control for people with diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blood Glucose Test Strip Packaging Industry in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blood Glucose Test Strip Packaging Industry in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blood Glucose Test Strip Packaging Industry in Latin America?

To stay informed about further developments, trends, and reports in the Blood Glucose Test Strip Packaging Industry in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence