Key Insights

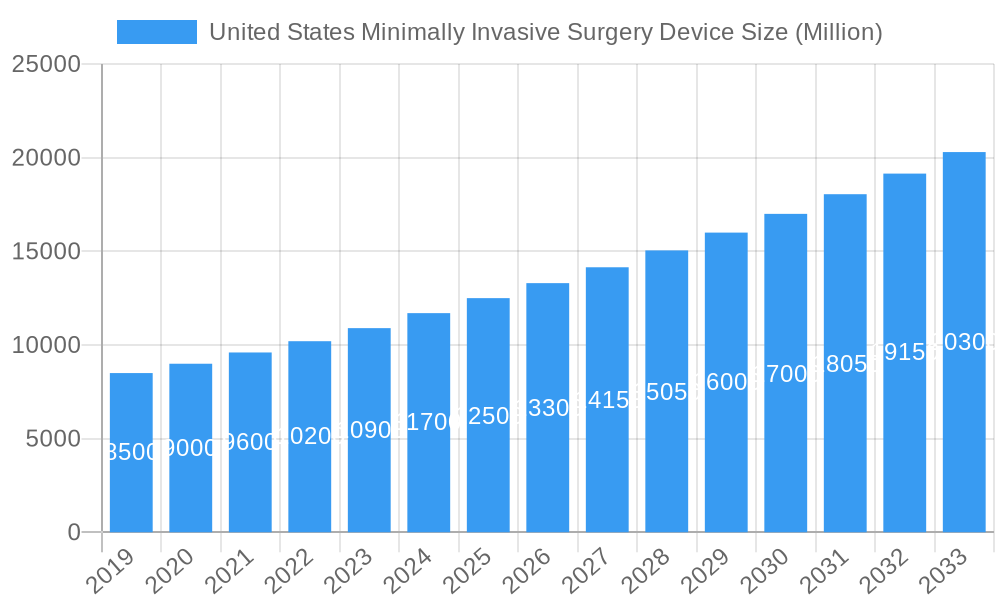

The United States Minimally Invasive Surgery (MIS) device market is poised for robust expansion, projected to reach an estimated $XX billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.40%. This substantial growth trajectory is underpinned by several key drivers, including the increasing prevalence of chronic diseases, the growing demand for less invasive and faster recovery surgical procedures, and significant advancements in surgical technology. The aesthetic, cardiovascular, gastrointestinal, gynecological, orthopedic, and urological application segments are expected to be major contributors to this market expansion. Particularly, the increasing adoption of robotic-assisted surgical systems, advanced handheld instruments, and sophisticated guiding devices are revolutionizing surgical outcomes and patient care. The continuous innovation in electrosurgical and endoscopic devices, alongside the emergence of novel ablation and laser-based technologies, further fuels market dynamism.

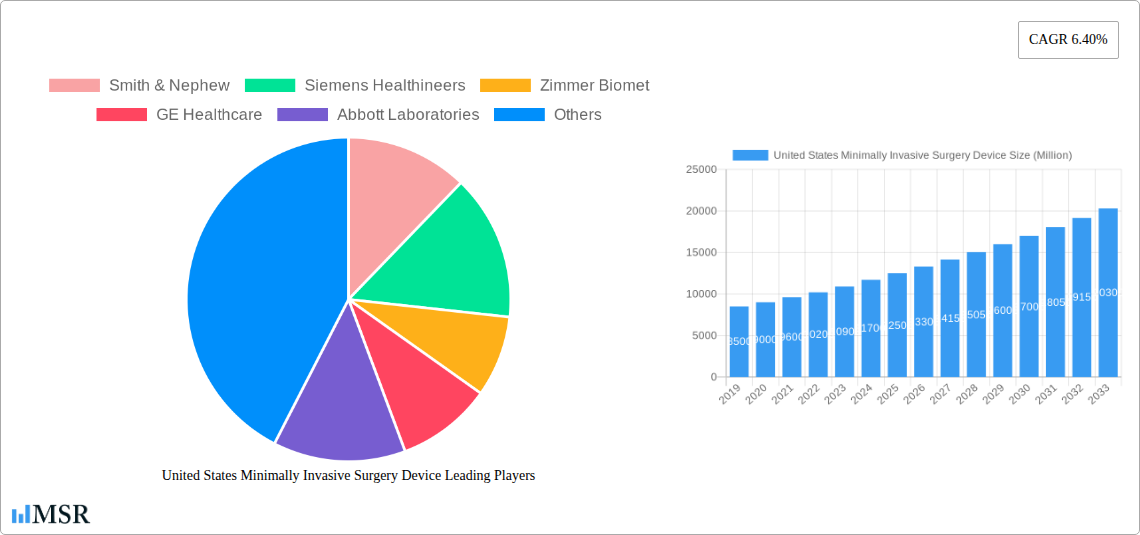

United States Minimally Invasive Surgery Device Market Size (In Billion)

Restraints such as the high initial cost of sophisticated MIS devices and the need for extensive training for healthcare professionals are being progressively mitigated by government initiatives promoting healthcare access and technological adoption. Furthermore, the increasing number of skilled surgeons and the growing awareness among patients about the benefits of MIS procedures are expected to overcome these challenges. Key players like Medtronic PLC, Intuitive Surgical Inc., Stryker Corporation, and Abbott Laboratories are actively investing in research and development to introduce cutting-edge solutions, solidifying their market positions. The United States, as a frontrunner in medical technology adoption and healthcare expenditure, will continue to dominate the global MIS device landscape, driven by its advanced healthcare infrastructure and a strong emphasis on patient-centric treatment modalities. The forecast period, spanning from 2025 to 2033, indicates sustained and accelerated growth within this critical medical device sector.

United States Minimally Invasive Surgery Device Company Market Share

Here's the SEO-optimized report description for the United States Minimally Invasive Surgery Device Market:

United States Minimally Invasive Surgery Device Market: Comprehensive Growth Analysis (2019–2033)

Unlock critical insights into the burgeoning United States Minimally Invasive Surgery (MIS) Device Market. This in-depth report provides a strategic roadmap for stakeholders navigating the evolving landscape of advanced surgical technologies. Covering the historical period of 2019–2024 and projecting growth through 2033, with a base and estimated year of 2025, this analysis delves into market dynamics, segmentation, product innovation, and key player strategies.

United States Minimally Invasive Surgery Device Market Concentration & Dynamics

The United States Minimally Invasive Surgery (MIS) Device Market exhibits a moderate to high concentration, with a few dominant players commanding significant market share. Key companies like Medtronic PLC, Intuitive Surgical Inc., and Stryker Corporation are at the forefront, driving innovation and setting industry standards. The innovation ecosystem is robust, fueled by continuous research and development in areas such as robotics, advanced imaging, and precision instrumentation. Regulatory frameworks, primarily overseen by the FDA, play a crucial role in market entry and product approval, ensuring patient safety and efficacy. The market is characterized by a low threat of substitute products due to the inherent advantages of MIS, such as reduced recovery times and smaller incisions. End-user trends are increasingly favoring less invasive procedures due to patient demand for faster recovery and improved outcomes. Mergers and acquisitions (M&A) are a significant dynamic, with recent activities aimed at consolidating portfolios and expanding technological capabilities. For instance, the acquisition of IMACTIS by GE HealthCare exemplifies strategic moves to enhance MIS offerings. The M&A deal count remains active, indicating ongoing consolidation and strategic partnerships.

United States Minimally Invasive Surgery Device Industry Insights & Trends

The United States Minimally Invasive Surgery (MIS) Device Market is poised for substantial growth, driven by an increasing demand for advanced surgical techniques, a growing aging population, and rising prevalence of chronic diseases requiring surgical intervention. The market size is projected to reach USD XXX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. Key growth drivers include the technological advancements in robotic-assisted surgery, leading to enhanced precision and reduced invasiveness, and the development of novel endoscopic and laparoscopic devices that offer improved visualization and maneuverability. Furthermore, the increasing adoption of MIS procedures in specialties like cardiology, orthopedics, and gynecology contributes significantly to market expansion. Economic factors, such as rising healthcare expenditure and favorable reimbursement policies for minimally invasive procedures, also play a pivotal role. Technological disruptions, including the integration of artificial intelligence (AI) and machine learning (ML) in surgical navigation and robotics, are revolutionizing the field, offering unprecedented levels of accuracy and personalized treatment. Evolving consumer behaviors, with patients actively seeking less painful and faster recovery options, are compelling healthcare providers to invest more heavily in MIS technologies. The shift towards value-based healthcare also incentivizes the adoption of MIS due to its potential for reduced hospital stays and overall healthcare costs. The market is also seeing a trend towards the development of single-use MIS devices, addressing concerns related to infection control and sterilization. The expanding application of MIS in aesthetic procedures further diversifies the market and opens new revenue streams.

Key Markets & Segments Leading United States Minimally Invasive Surgery Device

The United States Minimally Invasive Surgery (MIS) Device Market is dominated by several key segments and applications, reflecting the broad applicability and continuous innovation in this field. The Robotic Assisted Surgical Systems segment stands out as a major growth driver, with its ability to offer unparalleled precision, dexterity, and visualization, leading to improved patient outcomes across various surgical disciplines. This dominance is fueled by significant investments in R&D and a growing acceptance by surgeons and patients alike.

Dominant Product Segments:

- Robotic Assisted Surgical Systems: This segment is leading the market due to its advanced capabilities in complex procedures, offering surgeons enhanced control and minimally invasive approaches.

- Drivers: Technological sophistication, expanding applications in oncology and general surgery, and increasing surgeon training programs.

- Market Penetration: High adoption rates in major surgical centers and academic hospitals.

- Endoscopic Devices: Essential for visualization and diagnosis within body cavities, endoscopic devices are crucial for minimally invasive procedures in gastrointestinal, pulmonary, and urological applications.

- Drivers: Miniaturization, high-definition imaging, and integration with advanced imaging modalities.

- Market Penetration: Widespread use in diagnostic and therapeutic procedures across multiple specialties.

- Laparoscopic Devices: These instruments, used for abdominal surgeries, continue to be a cornerstone of MIS, benefiting from ongoing improvements in design and functionality.

- Drivers: Cost-effectiveness, versatility, and a wide range of specialized instruments available.

- Market Penetration: Standard of care for many abdominal procedures.

- Electrosurgical Devices: Crucial for cutting and coagulation during MIS, these devices are indispensable for a wide array of surgical interventions.

- Drivers: Advancements in energy delivery technology, safety features, and integration with robotic platforms.

- Market Penetration: High demand across virtually all surgical specialties.

- Drivers: Technological sophistication, expanding applications in oncology and general surgery, and increasing surgeon training programs.

- Market Penetration: High adoption rates in major surgical centers and academic hospitals.

- Drivers: Miniaturization, high-definition imaging, and integration with advanced imaging modalities.

- Market Penetration: Widespread use in diagnostic and therapeutic procedures across multiple specialties.

- Drivers: Cost-effectiveness, versatility, and a wide range of specialized instruments available.

- Market Penetration: Standard of care for many abdominal procedures.

- Drivers: Advancements in energy delivery technology, safety features, and integration with robotic platforms.

- Market Penetration: High demand across virtually all surgical specialties.

Dominant Application Segments:

- Cardiovascular: The application of MIS in cardiovascular procedures, such as minimally invasive valve repair and coronary artery bypass grafting, has seen significant growth due to reduced patient trauma and faster recovery.

- Drivers: Aging population, rising incidence of cardiovascular diseases, and development of specialized MIS tools for cardiac interventions.

- Orthopedic: MIS techniques are increasingly employed in orthopedic surgeries, including joint replacements and spinal procedures, offering benefits like smaller incisions and quicker rehabilitation.

- Drivers: Demand for less invasive joint replacement surgeries and advancements in arthroscopic techniques.

- Urological: MIS has become the standard of care for many urological conditions, including prostatectomy and kidney stone removal, due to its effectiveness and minimal side effects.

- Drivers: High success rates in treating prostate cancer and kidney-related ailments with minimally invasive approaches.

- Gastrointestinal: MIS is extensively used for procedures like appendectomies, cholecystectomies, and bariatric surgeries, providing faster recovery and reduced scarring.

- Drivers: High prevalence of gastrointestinal disorders and the inherent benefits of laparoscopy for abdominal surgeries.

- Drivers: Aging population, rising incidence of cardiovascular diseases, and development of specialized MIS tools for cardiac interventions.

- Drivers: Demand for less invasive joint replacement surgeries and advancements in arthroscopic techniques.

- Drivers: High success rates in treating prostate cancer and kidney-related ailments with minimally invasive approaches.

- Drivers: High prevalence of gastrointestinal disorders and the inherent benefits of laparoscopy for abdominal surgeries.

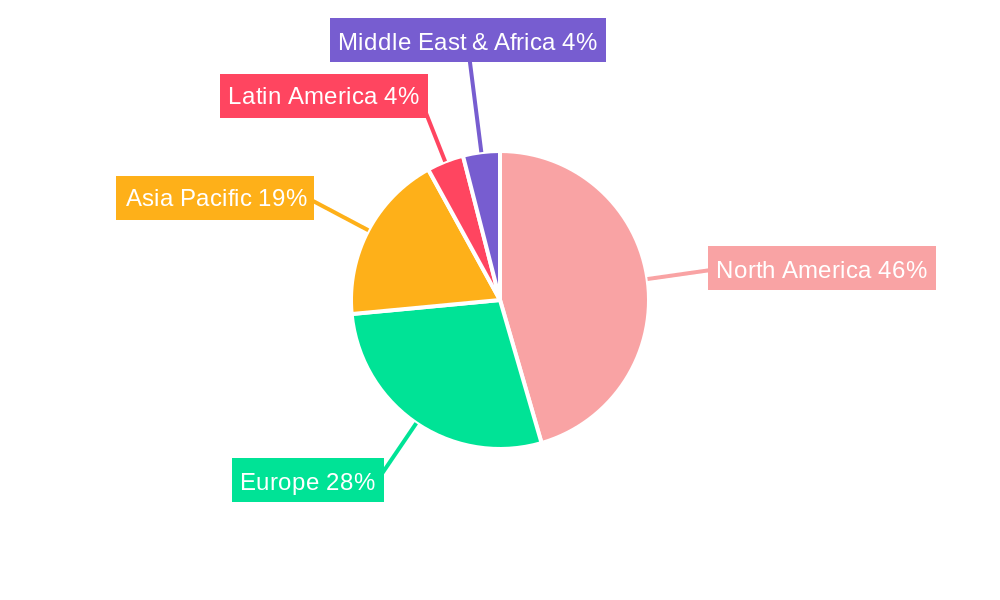

The United States market, as a whole, is the leading region due to its advanced healthcare infrastructure, high disposable income, and strong emphasis on adopting cutting-edge medical technologies.

United States Minimally Invasive Surgery Device Product Developments

Recent product developments in the United States Minimally Invasive Surgery (MIS) Device Market are centered on enhancing precision, reducing invasiveness, and integrating smart technologies. Innovations include miniaturized endoscopes with enhanced optical clarity and articulation, advanced robotic surgical platforms with haptic feedback, and intelligent instruments that provide real-time data to surgeons. The development of single-use devices is also gaining traction, addressing infection control concerns and improving workflow efficiency. These advancements are expanding the applicability of MIS into more complex procedures, improving patient outcomes, and driving market growth by offering surgeons superior tools for diagnosis and treatment.

Challenges in the United States Minimally Invasive Surgery Device Market

Despite robust growth, the United States Minimally Invasive Surgery (MIS) Device Market faces several challenges. High acquisition and maintenance costs for advanced robotic systems remain a significant barrier for many healthcare facilities. Reimbursement complexities and variations can also hinder adoption, particularly for newer technologies. Stringent regulatory approval processes by the FDA, while ensuring safety, can lead to extended development timelines and increased costs. Furthermore, limited availability of trained surgical personnel for complex MIS procedures and the need for continuous upskilling present an ongoing challenge.

Forces Driving United States Minimally Invasive Surgery Device Growth

Several powerful forces are driving the growth of the United States Minimally Invasive Surgery (MIS) Device Market. Technological advancements, particularly in robotics, AI integration, and imaging, are enabling more complex procedures with greater precision and patient safety. Increasing patient preference for less invasive treatments due to faster recovery, reduced pain, and minimal scarring is a significant consumer-led driver. The rising prevalence of chronic diseases and an aging population necessitate more surgical interventions, with MIS offering a more favorable option. Additionally, favorable reimbursement policies for MIS procedures in many specialties and the ongoing expansion of MIS applications into new therapeutic areas are accelerating market growth.

Challenges in the United States Minimally Invasive Surgery Device Market

Long-term growth catalysts for the United States Minimally Invasive Surgery (MIS) Device Market are firmly rooted in continuous innovation and strategic market expansion. The development of next-generation robotic systems with enhanced AI capabilities for predictive analytics and autonomous functions will significantly push the boundaries of what is surgically possible. Strategic partnerships and collaborations between device manufacturers, academic institutions, and healthcare providers will foster the development and adoption of novel MIS techniques and technologies. Furthermore, market expansion into underserved segments and the development of cost-effective MIS solutions will broaden access to these advanced procedures, creating sustained growth momentum.

Emerging Opportunities in United States Minimally Invasive Surgery Device

Emerging opportunities within the United States Minimally Invasive Surgery (MIS) Device Market are abundant and diverse. The integration of augmented reality (AR) and virtual reality (VR) in surgical planning and intraoperative guidance presents a significant frontier, enhancing surgeon visualization and precision. The growing demand for personalized medicine is driving the development of specialized MIS devices tailored to individual patient anatomy and conditions. The expansion of MIS into emerging applications, such as neurosurgery and advanced ophthalmology, offers new avenues for market penetration. Furthermore, the focus on remote surgery and telesurgery, facilitated by advancements in connectivity and robotics, is poised to revolutionize access to specialized surgical care, particularly in rural or underserved areas.

Leading Players in the United States Minimally Invasive Surgery Device Sector

- Smith & Nephew

- Siemens Healthineers

- Zimmer Biomet

- GE Healthcare

- Abbott Laboratories

- Medtronic PLC

- Koninklijke Philips NV

- Intuitive Surgical Inc.

- Stryker Corporation

- Olympus Corporation

Key Milestones in United States Minimally Invasive Surgery Device Industry

- January 2023: GE HealthCare acquired IMACTIS. The acquisition would strengthen the portfolio of GE HealthCare with the diverse product line of IMACTIS CT-Navigation used for performing a wide variety of minimally invasive percutaneous procedures.

- November 2022: New View Surgical Inc., a minimally invasive surgery (MIS) device company, received funding worth USD 12.1 million from its investors in the Series B-1 round. The funding accelerated the commercialization of the company's VisionPort System and its launch in the United States.

Strategic Outlook for United States Minimally Invasive Surgery Device Market

The strategic outlook for the United States Minimally Invasive Surgery (MIS) Device Market is exceptionally positive, characterized by sustained innovation and expanding adoption. Growth accelerators will include the continued evolution of robotic surgery, the integration of AI for enhanced diagnostic and therapeutic capabilities, and the development of more intuitive and user-friendly MIS instruments. The increasing focus on value-based care will further propel the adoption of MIS due to its demonstrated ability to reduce patient recovery times and overall healthcare costs. Strategic opportunities lie in expanding MIS applications into new surgical specialties, developing cost-effective solutions to improve market accessibility, and leveraging digital health technologies to enhance surgical training and patient monitoring, ensuring a trajectory of robust and sustained market growth.

United States Minimally Invasive Surgery Device Segmentation

-

1. Products

- 1.1. Handheld Instruments

- 1.2. Guiding Devices

- 1.3. Electrosurgical Devices

- 1.4. Endoscopic Devices

- 1.5. Laproscopic Devices

- 1.6. Robotic Assisted Surgical Systems

- 1.7. Ablation Devices

- 1.8. Laser Based Devices

- 1.9. Other MIS Devices

-

2. Application

- 2.1. Aesthetic

- 2.2. Cardiovascular

- 2.3. Gastrointestinal

- 2.4. Gynecological

- 2.5. Orthopedic

- 2.6. Urological

- 2.7. Other Applications

United States Minimally Invasive Surgery Device Segmentation By Geography

- 1. United States

United States Minimally Invasive Surgery Device Regional Market Share

Geographic Coverage of United States Minimally Invasive Surgery Device

United States Minimally Invasive Surgery Device REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Acceptance Rate of Minimally Invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders

- 3.3. Market Restrains

- 3.3.1. Shortage of Experienced Professionals; Uncertain Regulatory Framework

- 3.4. Market Trends

- 3.4.1. The Laparoscopic Devices Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Minimally Invasive Surgery Device Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. Handheld Instruments

- 5.1.2. Guiding Devices

- 5.1.3. Electrosurgical Devices

- 5.1.4. Endoscopic Devices

- 5.1.5. Laproscopic Devices

- 5.1.6. Robotic Assisted Surgical Systems

- 5.1.7. Ablation Devices

- 5.1.8. Laser Based Devices

- 5.1.9. Other MIS Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Aesthetic

- 5.2.2. Cardiovascular

- 5.2.3. Gastrointestinal

- 5.2.4. Gynecological

- 5.2.5. Orthopedic

- 5.2.6. Urological

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Smith & Nephew

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens Healthineers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zimmer Biomet

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GE Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abbott Laboratories

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Medtronic PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Koninklijke Philips NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Intuitive Surgical Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stryker Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olympus Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Smith & Nephew

List of Figures

- Figure 1: United States Minimally Invasive Surgery Device Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Minimally Invasive Surgery Device Share (%) by Company 2025

List of Tables

- Table 1: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Region 2020 & 2033

- Table 2: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Products 2020 & 2033

- Table 4: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Products 2020 & 2033

- Table 5: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Application 2020 & 2033

- Table 6: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Country 2020 & 2033

- Table 11: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Products 2020 & 2033

- Table 12: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Products 2020 & 2033

- Table 13: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Application 2020 & 2033

- Table 14: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: United States Minimally Invasive Surgery Device Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United States Minimally Invasive Surgery Device Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Minimally Invasive Surgery Device?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the United States Minimally Invasive Surgery Device?

Key companies in the market include Smith & Nephew, Siemens Healthineers, Zimmer Biomet, GE Healthcare, Abbott Laboratories, Medtronic PLC, Koninklijke Philips NV, Intuitive Surgical Inc, Stryker Corporation, Olympus Corporation.

3. What are the main segments of the United States Minimally Invasive Surgery Device?

The market segments include Products, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Acceptance Rate of Minimally Invasive Surgeries over Traditional Surgeries; Increasing Prevalence of Lifestyle-related and Chronic Disorders.

6. What are the notable trends driving market growth?

The Laparoscopic Devices Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Shortage of Experienced Professionals; Uncertain Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: GE HealthCare acquired IMACTIS. The acquisition would strengthen the portfolio of GE HealthCare with the diverse product line of IMACTIS CT-Navigation used for performing a wide variety of minimally invasive percutaneous procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Minimally Invasive Surgery Device," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Minimally Invasive Surgery Device report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Minimally Invasive Surgery Device?

To stay informed about further developments, trends, and reports in the United States Minimally Invasive Surgery Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence