Key Insights

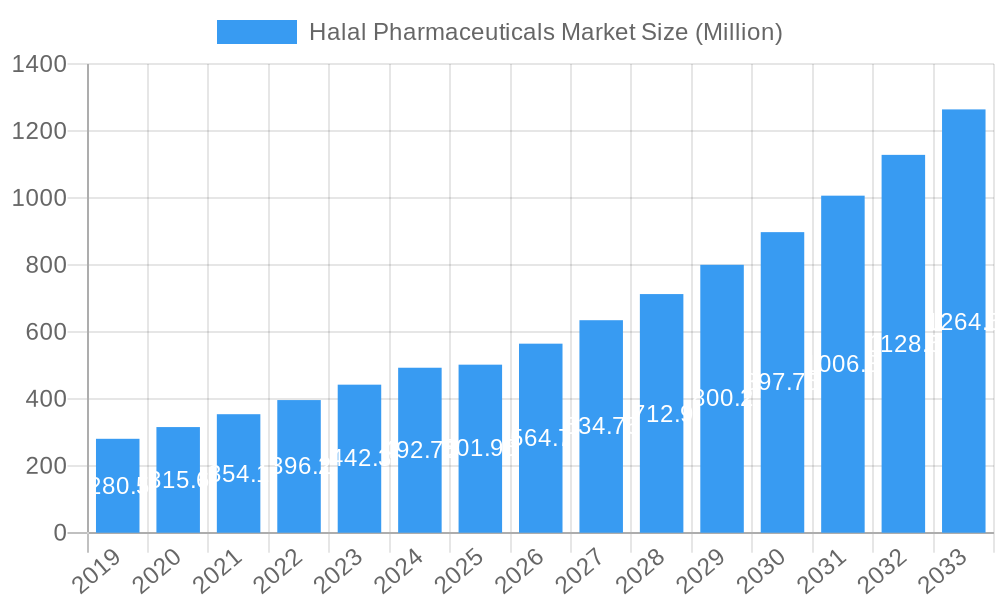

The global Halal Pharmaceuticals market is poised for significant expansion, projected to reach USD 501.95 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.58%. This impressive growth trajectory is propelled by several converging factors. A primary driver is the increasing demand for Halal-certified products across diverse consumer segments, extending beyond religious observance to encompass concerns about ethical sourcing and ingredient transparency. This has led to a heightened awareness and preference for pharmaceuticals that adhere to Islamic principles. Furthermore, the growing Muslim population worldwide, coupled with rising disposable incomes in key regions, fuels the demand for accessible and trustworthy Halal pharmaceutical options. The pharmaceutical industry's commitment to meeting these evolving consumer needs by investing in R&D for Halal-compliant formulations and manufacturing processes is also a critical growth catalyst. Innovations in dosage forms, particularly the expansion of offerings beyond traditional tablets and capsules to include syrups, powders, gels, and ointments, cater to a wider range of patient requirements and preferences, further stimulating market penetration.

Halal Pharmaceuticals Market Market Size (In Million)

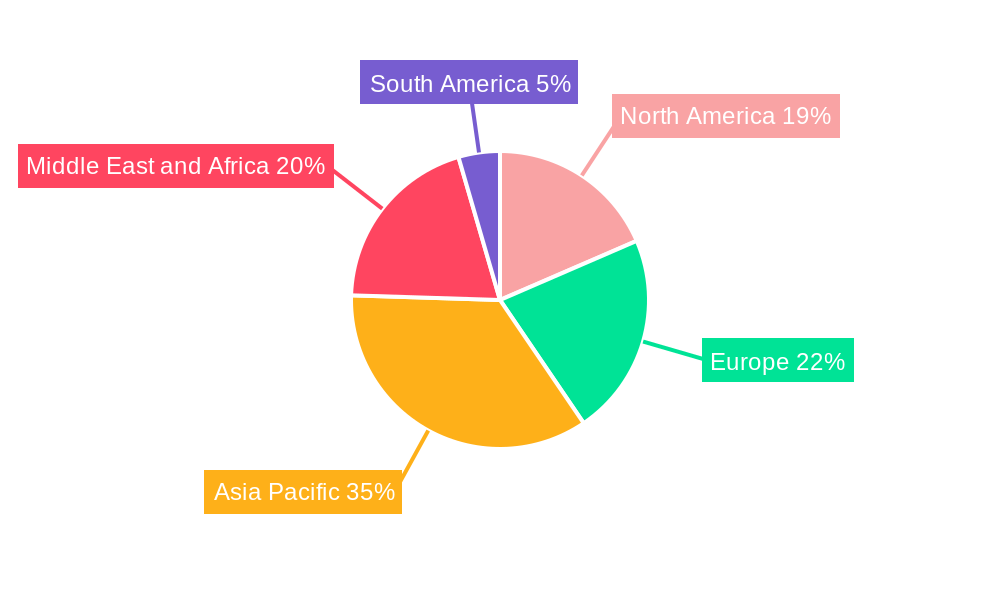

The market's expansion is further shaped by significant trends such as the increasing integration of Halal certification into the mainstream pharmaceutical supply chain, enhancing trust and accessibility. Companies are actively pursuing certifications to gain a competitive edge and appeal to a broader demographic. While the market exhibits strong growth potential, certain restraints warrant attention. Stringent regulatory frameworks for Halal certification across different countries can pose challenges, requiring significant investment and adherence to specific guidelines. The initial cost of obtaining and maintaining Halal certification for manufacturing facilities and raw materials can also be a barrier for smaller players. However, the market is adapting, with a growing number of companies specializing in Halal ingredients and manufacturing solutions. Geographically, regions with large Muslim populations, such as Asia Pacific and the Middle East and Africa, are expected to witness substantial market share, while North America and Europe are experiencing growing demand due to increasing awareness and ethical consumerism. The diverse drug classes addressed, including analgesics, anti-inflammatory, respiratory, and cardiovascular drugs, alongside vaccines, highlight the broad applicability and essential nature of Halal pharmaceuticals.

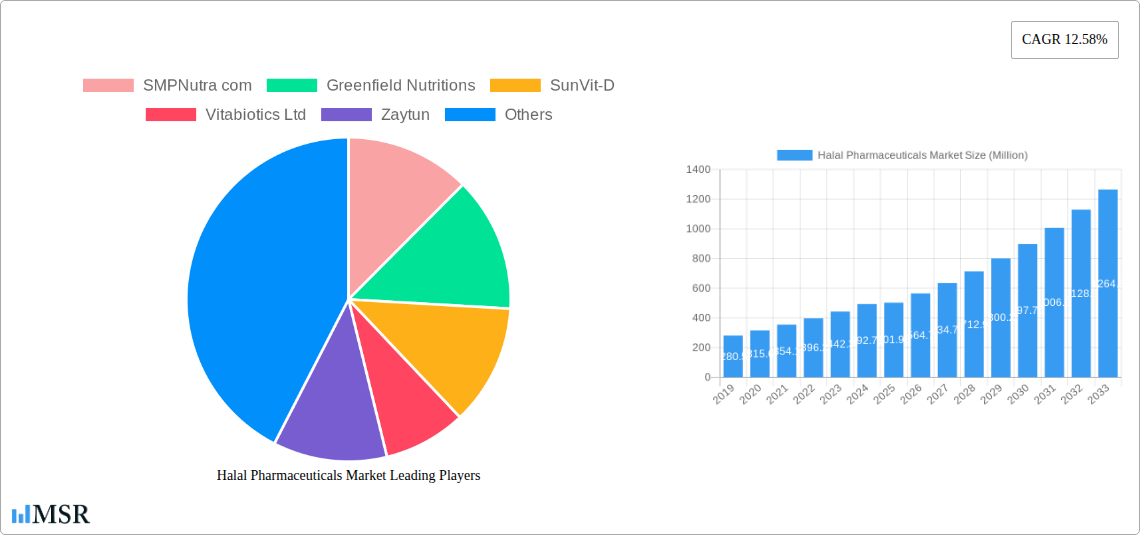

Halal Pharmaceuticals Market Company Market Share

Halal Pharmaceuticals Market: Comprehensive Growth Strategies and Forecast 2019–2033

This comprehensive report offers an in-depth analysis of the Halal Pharmaceuticals Market, providing crucial insights and actionable strategies for stakeholders. Covering the historical period (2019–2024), base year (2025), and forecast period (2025–2033), this study delves into market dynamics, key trends, competitive landscapes, and emerging opportunities within the rapidly expanding global halal drug market. Discover the driving forces, challenges, and strategic imperatives shaping the future of Sharia-compliant pharmaceuticals.

Halal Pharmaceuticals Market Market Concentration & Dynamics

The Halal Pharmaceuticals Market exhibits a moderate to high level of concentration, with a blend of established global pharmaceutical players and specialized halal manufacturers vying for market share. Innovation ecosystems are burgeoning, particularly in regions with strong Muslim populations, driven by increasing demand for certified halal medicines and a growing awareness of Sharia-compliant healthcare. Regulatory frameworks are evolving, with countries like Malaysia and Indonesia taking the lead in establishing robust halal certification standards for pharmaceuticals. The threat of substitute products is relatively low due to the stringent requirements for halal drug manufacturing, focusing on permissible ingredients and production processes. End-user trends are strongly influenced by religious adherence, seeking assurance of halal integrity in their medications. Mergers and acquisition (M&A) activities are expected to increase as larger entities seek to acquire specialized halal expertise and tap into this growing market. An estimated 15-20 M&A deals are projected within the forecast period, significantly impacting market share distribution. The overall market share is projected to reach XX Million by 2033, with key players consolidating their positions.

Halal Pharmaceuticals Market Industry Insights & Trends

The Halal Pharmaceuticals Market is poised for significant growth, driven by a confluence of socio-economic, religious, and technological factors. The market size is projected to reach XX Million by 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by the growing global Muslim population, estimated to exceed 2.5 Billion by 2030, creating an ever-increasing demand for halal-certified pharmaceutical products. Furthermore, heightened awareness and stringent adherence to Islamic principles among Muslim consumers are compelling pharmaceutical companies to prioritize halal compliance in their product portfolios. Technological disruptions are playing a pivotal role, with advancements in biopharmaceuticals and novel drug delivery systems being adapted to meet halal manufacturing standards. The increasing focus on preventive healthcare and the rising prevalence of chronic diseases are also contributing to market expansion. Government initiatives and the development of comprehensive halal industry master plans in key Muslim-majority countries are further bolstering the market by providing regulatory clarity and fostering investment. Evolving consumer behaviors are characterized by a greater demand for transparency and traceability throughout the pharmaceutical supply chain, ensuring that every component of the medication adheres to halal principles. The report anticipates a substantial increase in the adoption of halal vaccines and specialized halal oncology drugs. The market for halal pharmaceutical excipients is also expected to witness substantial growth as manufacturers strive for complete Sharia-compliant formulations.

Key Markets & Segments Leading Halal Pharmaceuticals Market

The Halal Pharmaceuticals Market is experiencing robust growth across several key regions and segments. Asia Pacific, particularly countries like Indonesia, Malaysia, and Pakistan, currently dominates the market due to the large Muslim population and supportive government initiatives. The economic growth in these regions, coupled with improving healthcare infrastructure, further amplifies demand for halal pharmaceutical solutions.

Dominant Segments:

Dosage Form:

- Tablets: This segment leads due to ease of administration, cost-effectiveness, and broad applicability across various therapeutic areas. The demand for halal tablets is consistently high for common ailments.

- Capsules: Preferred for masking taste and odor, halal capsules represent another significant and growing segment.

- Syrups: Particularly important for pediatric and geriatric populations, halal syrups cater to a specific yet substantial market need.

- Other Dosage Forms (Powder, Gel, and Ointment): While smaller, these niche segments are crucial for specialized treatments and are witnessing steady growth as manufacturers develop halal-certified versions.

Drug Class:

- Analgesics and Anti-inflammatory Drugs: These are evergreen segments with high demand for halal pain relief medications and Sharia-compliant anti-inflammatory treatments, driven by widespread usage.

- Respiratory Drugs: With rising air pollution and respiratory ailments, the demand for halal inhalers and Sharia-compliant cough and cold remedies is significant.

- Cardiovascular Drugs: The increasing prevalence of heart disease globally, even within Muslim communities, fuels the demand for halal cardiovascular medications.

- Vaccines: As global health awareness increases, the demand for halal vaccines is expected to see substantial growth, particularly with advancements in vaccine technology and wider accessibility. The report predicts a surge in demand for halal COVID-19 vaccines and other essential immunization programs.

- Other Drug Classes: This broad category encompasses specialized treatments, including halal antibiotics, Sharia-compliant antidiabetics, and halal dermatological preparations, all contributing to the overall market expansion.

The dominance of these segments is driven by factors such as the sheer volume of patient populations requiring these treatments, the established manufacturing capabilities for these forms and classes, and a strong consumer preference for halal-certified options across the board.

Halal Pharmaceuticals Market Product Developments

Product innovation in the Halal Pharmaceuticals Market is characterized by the adaptation of existing therapeutic solutions to meet rigorous Sharia-compliant standards. Companies are actively developing halal-certified versions of over-the-counter (OTC) medications and prescription drugs, ensuring the absence of forbidden ingredients such as pork derivatives or alcohol. Technological advancements are enabling the creation of halal biopharmaceuticals and genetically engineered halal drugs, expanding the scope of treatment options. The focus remains on providing effective and safe halal healthcare solutions that align with the religious beliefs of a substantial global population. Key developments include the introduction of halal-friendly drug delivery systems and the enhancement of halal manufacturing processes for greater transparency and integrity. The market relevance is directly tied to the ability of manufacturers to provide trustworthy and accessible halal pharmaceutical products.

Challenges in the Halal Pharmaceuticals Market Market

Navigating the Halal Pharmaceuticals Market presents several challenges. Establishing and maintaining halal certification can be a complex and costly process, requiring stringent adherence to evolving guidelines. Supply chain disruptions, particularly in sourcing halal-certified raw materials and excipients, can impact production timelines and costs. Intense competition from both conventional and emerging halal pharmaceutical companies creates pressure on pricing and market penetration. Regulatory hurdles, although improving, can still vary significantly between different regions, leading to inconsistencies in market access. Quantifiable impacts include an estimated 5-10% increase in production costs due to specialized sourcing and certification.

Forces Driving Halal Pharmaceuticals Market Growth

The Halal Pharmaceuticals Market is propelled by several potent growth drivers. The burgeoning global Muslim population, coupled with increasing religious observance, forms the bedrock of demand for Sharia-compliant medicines. Growing awareness and consumer preference for halal products across various sectors are extending into healthcare. Supportive government initiatives and the establishment of dedicated halal certification bodies in key markets are creating a more conducive business environment. Technological advancements in pharmaceutical manufacturing are enabling the development of innovative halal drug formulations and delivery systems. Economic growth in Muslim-majority countries is leading to increased healthcare spending and greater accessibility to pharmaceutical products, including halal-certified options.

Challenges in the Halal Pharmaceuticals Market Market

While growth is robust, long-term sustainability in the Halal Pharmaceuticals Market hinges on overcoming specific challenges. The perception of halal pharmaceuticals as potentially being less efficacious than conventional counterparts needs to be addressed through rigorous clinical trials and transparent communication. Maintaining consistent global halal certification standards across diverse regulatory landscapes remains a significant undertaking. The need for specialized halal manufacturing facilities and trained personnel can also present an entry barrier for new players. Furthermore, educating healthcare professionals about the safety and efficacy of halal-certified drugs is crucial for widespread adoption. Continuous innovation in halal drug development and the establishment of robust supply chains for halal ingredients are key to sustained growth.

Emerging Opportunities in Halal Pharmaceuticals Market

The Halal Pharmaceuticals Market is ripe with emerging opportunities. Untapped markets in Southeast Asia, Africa, and parts of Europe with significant Muslim populations represent substantial growth potential. The increasing demand for halal biologics and personalized medicine tailored to Sharia principles offers a significant avenue for innovation. Collaborations between established pharmaceutical companies and specialized halal certification agencies can streamline market entry and build consumer trust. The development of digital platforms for halal drug verification and traceability will further enhance market transparency and accessibility. Furthermore, the growing trend of ethical consumerism and the demand for sustainably sourced halal products present a unique opportunity for differentiation.

Leading Players in the Halal Pharmaceuticals Market Sector

- SMPNutra com

- Greenfield Nutritions

- SunVit-D

- Vitabiotics Ltd

- Zaytun

- Canvita

- ACG

- Amanah Vitamins

- NATURAL CAPSULES LIMITED

Key Milestones in Halal Pharmaceuticals Market Industry

- October 2023: The Indonesian Vice President and Chairperson of the National Committee of Sharia Economy and Finance (KNEKS) launched the Indonesian Halal Industry Master Plan (MPIHI) 2023–2029 during the 2023 Indonesia Sharia Economic Festival (ISEF). This initiative signals a significant government commitment to fostering the halal pharmaceutical sector within a major emerging market, promising increased investment and regulatory support.

- June 2023: The Public Investment Fund (PIF), Saudi Arabia's prominent global investment entity, unveiled its latest venture, Lifera. Lifera is a commercial-scale contract development and manufacturing organization (CDMO) that aims to catalyze the expansion of Saudi Arabia's bio/pharmaceutical sector. Lifera supports the manufacture of various halal pharmaceutical products. This development highlights a strategic move by a major global investor to bolster halal drug manufacturing capabilities and infrastructure in the Middle East, potentially attracting more global players to produce Sharia-compliant medicines.

Strategic Outlook for Halal Pharmaceuticals Market Market

The strategic outlook for the Halal Pharmaceuticals Market is exceptionally positive, driven by a sustained increase in demand and a supportive regulatory environment. Future growth will be accelerated by strategic partnerships between global pharmaceutical giants and specialized halal certification bodies, ensuring wider reach and compliance. Investments in research and development for novel halal drug therapies, particularly in areas like oncology and rare diseases, will unlock new market segments. The expansion of halal pharmaceutical manufacturing capabilities in emerging economies and the leveraging of digital technologies for enhanced supply chain transparency will be critical growth accelerators. Companies focusing on building strong brand equity through verifiable halal certifications and ethical practices will gain a significant competitive advantage, solidifying their position in this rapidly evolving and lucrative global halal drug market.

Halal Pharmaceuticals Market Segmentation

-

1. Dosage Form

- 1.1. Syrups

- 1.2. Capsules

- 1.3. Tablets

- 1.4. Other Dosage Forms (Powder, Gel, and Ointment)

-

2. Drug Class

- 2.1. Analgesics

- 2.2. Anti-inflammatory Drugs

- 2.3. Respiratory Drugs

- 2.4. Cardiovascular drugs

- 2.5. Vaccines

- 2.6. Other Drug Classes

Halal Pharmaceuticals Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Halal Pharmaceuticals Market Regional Market Share

Geographic Coverage of Halal Pharmaceuticals Market

Halal Pharmaceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Muslim Population and Rise in Demand for Vegan Products; Surge in Elderly Population

- 3.3. Market Restrains

- 3.3.1. Increase in Muslim Population and Rise in Demand for Vegan Products; Surge in Elderly Population

- 3.4. Market Trends

- 3.4.1. The Tablet Segment is Expected to Witness Positive Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Halal Pharmaceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Dosage Form

- 5.1.1. Syrups

- 5.1.2. Capsules

- 5.1.3. Tablets

- 5.1.4. Other Dosage Forms (Powder, Gel, and Ointment)

- 5.2. Market Analysis, Insights and Forecast - by Drug Class

- 5.2.1. Analgesics

- 5.2.2. Anti-inflammatory Drugs

- 5.2.3. Respiratory Drugs

- 5.2.4. Cardiovascular drugs

- 5.2.5. Vaccines

- 5.2.6. Other Drug Classes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Dosage Form

- 6. North America Halal Pharmaceuticals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Dosage Form

- 6.1.1. Syrups

- 6.1.2. Capsules

- 6.1.3. Tablets

- 6.1.4. Other Dosage Forms (Powder, Gel, and Ointment)

- 6.2. Market Analysis, Insights and Forecast - by Drug Class

- 6.2.1. Analgesics

- 6.2.2. Anti-inflammatory Drugs

- 6.2.3. Respiratory Drugs

- 6.2.4. Cardiovascular drugs

- 6.2.5. Vaccines

- 6.2.6. Other Drug Classes

- 6.1. Market Analysis, Insights and Forecast - by Dosage Form

- 7. Europe Halal Pharmaceuticals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Dosage Form

- 7.1.1. Syrups

- 7.1.2. Capsules

- 7.1.3. Tablets

- 7.1.4. Other Dosage Forms (Powder, Gel, and Ointment)

- 7.2. Market Analysis, Insights and Forecast - by Drug Class

- 7.2.1. Analgesics

- 7.2.2. Anti-inflammatory Drugs

- 7.2.3. Respiratory Drugs

- 7.2.4. Cardiovascular drugs

- 7.2.5. Vaccines

- 7.2.6. Other Drug Classes

- 7.1. Market Analysis, Insights and Forecast - by Dosage Form

- 8. Asia Pacific Halal Pharmaceuticals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Dosage Form

- 8.1.1. Syrups

- 8.1.2. Capsules

- 8.1.3. Tablets

- 8.1.4. Other Dosage Forms (Powder, Gel, and Ointment)

- 8.2. Market Analysis, Insights and Forecast - by Drug Class

- 8.2.1. Analgesics

- 8.2.2. Anti-inflammatory Drugs

- 8.2.3. Respiratory Drugs

- 8.2.4. Cardiovascular drugs

- 8.2.5. Vaccines

- 8.2.6. Other Drug Classes

- 8.1. Market Analysis, Insights and Forecast - by Dosage Form

- 9. Middle East and Africa Halal Pharmaceuticals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Dosage Form

- 9.1.1. Syrups

- 9.1.2. Capsules

- 9.1.3. Tablets

- 9.1.4. Other Dosage Forms (Powder, Gel, and Ointment)

- 9.2. Market Analysis, Insights and Forecast - by Drug Class

- 9.2.1. Analgesics

- 9.2.2. Anti-inflammatory Drugs

- 9.2.3. Respiratory Drugs

- 9.2.4. Cardiovascular drugs

- 9.2.5. Vaccines

- 9.2.6. Other Drug Classes

- 9.1. Market Analysis, Insights and Forecast - by Dosage Form

- 10. South America Halal Pharmaceuticals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Dosage Form

- 10.1.1. Syrups

- 10.1.2. Capsules

- 10.1.3. Tablets

- 10.1.4. Other Dosage Forms (Powder, Gel, and Ointment)

- 10.2. Market Analysis, Insights and Forecast - by Drug Class

- 10.2.1. Analgesics

- 10.2.2. Anti-inflammatory Drugs

- 10.2.3. Respiratory Drugs

- 10.2.4. Cardiovascular drugs

- 10.2.5. Vaccines

- 10.2.6. Other Drug Classes

- 10.1. Market Analysis, Insights and Forecast - by Dosage Form

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SMPNutra com

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Greenfield Nutritions

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SunVit-D

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vitabiotics Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zaytun

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Canvita

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amanah Vitamins

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 NATURAL CAPSULES LIMITED*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 SMPNutra com

List of Figures

- Figure 1: Global Halal Pharmaceuticals Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Halal Pharmaceuticals Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Halal Pharmaceuticals Market Revenue (Million), by Dosage Form 2025 & 2033

- Figure 4: North America Halal Pharmaceuticals Market Volume (Million), by Dosage Form 2025 & 2033

- Figure 5: North America Halal Pharmaceuticals Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 6: North America Halal Pharmaceuticals Market Volume Share (%), by Dosage Form 2025 & 2033

- Figure 7: North America Halal Pharmaceuticals Market Revenue (Million), by Drug Class 2025 & 2033

- Figure 8: North America Halal Pharmaceuticals Market Volume (Million), by Drug Class 2025 & 2033

- Figure 9: North America Halal Pharmaceuticals Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 10: North America Halal Pharmaceuticals Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 11: North America Halal Pharmaceuticals Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Halal Pharmaceuticals Market Volume (Million), by Country 2025 & 2033

- Figure 13: North America Halal Pharmaceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Halal Pharmaceuticals Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Halal Pharmaceuticals Market Revenue (Million), by Dosage Form 2025 & 2033

- Figure 16: Europe Halal Pharmaceuticals Market Volume (Million), by Dosage Form 2025 & 2033

- Figure 17: Europe Halal Pharmaceuticals Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 18: Europe Halal Pharmaceuticals Market Volume Share (%), by Dosage Form 2025 & 2033

- Figure 19: Europe Halal Pharmaceuticals Market Revenue (Million), by Drug Class 2025 & 2033

- Figure 20: Europe Halal Pharmaceuticals Market Volume (Million), by Drug Class 2025 & 2033

- Figure 21: Europe Halal Pharmaceuticals Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Europe Halal Pharmaceuticals Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 23: Europe Halal Pharmaceuticals Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Halal Pharmaceuticals Market Volume (Million), by Country 2025 & 2033

- Figure 25: Europe Halal Pharmaceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Halal Pharmaceuticals Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Halal Pharmaceuticals Market Revenue (Million), by Dosage Form 2025 & 2033

- Figure 28: Asia Pacific Halal Pharmaceuticals Market Volume (Million), by Dosage Form 2025 & 2033

- Figure 29: Asia Pacific Halal Pharmaceuticals Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 30: Asia Pacific Halal Pharmaceuticals Market Volume Share (%), by Dosage Form 2025 & 2033

- Figure 31: Asia Pacific Halal Pharmaceuticals Market Revenue (Million), by Drug Class 2025 & 2033

- Figure 32: Asia Pacific Halal Pharmaceuticals Market Volume (Million), by Drug Class 2025 & 2033

- Figure 33: Asia Pacific Halal Pharmaceuticals Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 34: Asia Pacific Halal Pharmaceuticals Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 35: Asia Pacific Halal Pharmaceuticals Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Halal Pharmaceuticals Market Volume (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Halal Pharmaceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Halal Pharmaceuticals Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Halal Pharmaceuticals Market Revenue (Million), by Dosage Form 2025 & 2033

- Figure 40: Middle East and Africa Halal Pharmaceuticals Market Volume (Million), by Dosage Form 2025 & 2033

- Figure 41: Middle East and Africa Halal Pharmaceuticals Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 42: Middle East and Africa Halal Pharmaceuticals Market Volume Share (%), by Dosage Form 2025 & 2033

- Figure 43: Middle East and Africa Halal Pharmaceuticals Market Revenue (Million), by Drug Class 2025 & 2033

- Figure 44: Middle East and Africa Halal Pharmaceuticals Market Volume (Million), by Drug Class 2025 & 2033

- Figure 45: Middle East and Africa Halal Pharmaceuticals Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 46: Middle East and Africa Halal Pharmaceuticals Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 47: Middle East and Africa Halal Pharmaceuticals Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Halal Pharmaceuticals Market Volume (Million), by Country 2025 & 2033

- Figure 49: Middle East and Africa Halal Pharmaceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Halal Pharmaceuticals Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Halal Pharmaceuticals Market Revenue (Million), by Dosage Form 2025 & 2033

- Figure 52: South America Halal Pharmaceuticals Market Volume (Million), by Dosage Form 2025 & 2033

- Figure 53: South America Halal Pharmaceuticals Market Revenue Share (%), by Dosage Form 2025 & 2033

- Figure 54: South America Halal Pharmaceuticals Market Volume Share (%), by Dosage Form 2025 & 2033

- Figure 55: South America Halal Pharmaceuticals Market Revenue (Million), by Drug Class 2025 & 2033

- Figure 56: South America Halal Pharmaceuticals Market Volume (Million), by Drug Class 2025 & 2033

- Figure 57: South America Halal Pharmaceuticals Market Revenue Share (%), by Drug Class 2025 & 2033

- Figure 58: South America Halal Pharmaceuticals Market Volume Share (%), by Drug Class 2025 & 2033

- Figure 59: South America Halal Pharmaceuticals Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Halal Pharmaceuticals Market Volume (Million), by Country 2025 & 2033

- Figure 61: South America Halal Pharmaceuticals Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Halal Pharmaceuticals Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Dosage Form 2020 & 2033

- Table 2: Global Halal Pharmaceuticals Market Volume Million Forecast, by Dosage Form 2020 & 2033

- Table 3: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 4: Global Halal Pharmaceuticals Market Volume Million Forecast, by Drug Class 2020 & 2033

- Table 5: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Halal Pharmaceuticals Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Dosage Form 2020 & 2033

- Table 8: Global Halal Pharmaceuticals Market Volume Million Forecast, by Dosage Form 2020 & 2033

- Table 9: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 10: Global Halal Pharmaceuticals Market Volume Million Forecast, by Drug Class 2020 & 2033

- Table 11: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Halal Pharmaceuticals Market Volume Million Forecast, by Country 2020 & 2033

- Table 13: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Dosage Form 2020 & 2033

- Table 14: Global Halal Pharmaceuticals Market Volume Million Forecast, by Dosage Form 2020 & 2033

- Table 15: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 16: Global Halal Pharmaceuticals Market Volume Million Forecast, by Drug Class 2020 & 2033

- Table 17: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Halal Pharmaceuticals Market Volume Million Forecast, by Country 2020 & 2033

- Table 19: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Dosage Form 2020 & 2033

- Table 20: Global Halal Pharmaceuticals Market Volume Million Forecast, by Dosage Form 2020 & 2033

- Table 21: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 22: Global Halal Pharmaceuticals Market Volume Million Forecast, by Drug Class 2020 & 2033

- Table 23: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Halal Pharmaceuticals Market Volume Million Forecast, by Country 2020 & 2033

- Table 25: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Dosage Form 2020 & 2033

- Table 26: Global Halal Pharmaceuticals Market Volume Million Forecast, by Dosage Form 2020 & 2033

- Table 27: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 28: Global Halal Pharmaceuticals Market Volume Million Forecast, by Drug Class 2020 & 2033

- Table 29: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Halal Pharmaceuticals Market Volume Million Forecast, by Country 2020 & 2033

- Table 31: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Dosage Form 2020 & 2033

- Table 32: Global Halal Pharmaceuticals Market Volume Million Forecast, by Dosage Form 2020 & 2033

- Table 33: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 34: Global Halal Pharmaceuticals Market Volume Million Forecast, by Drug Class 2020 & 2033

- Table 35: Global Halal Pharmaceuticals Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Halal Pharmaceuticals Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Halal Pharmaceuticals Market?

The projected CAGR is approximately 12.58%.

2. Which companies are prominent players in the Halal Pharmaceuticals Market?

Key companies in the market include SMPNutra com, Greenfield Nutritions, SunVit-D, Vitabiotics Ltd, Zaytun, Canvita, ACG, Amanah Vitamins, NATURAL CAPSULES LIMITED*List Not Exhaustive.

3. What are the main segments of the Halal Pharmaceuticals Market?

The market segments include Dosage Form, Drug Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 501.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Muslim Population and Rise in Demand for Vegan Products; Surge in Elderly Population.

6. What are the notable trends driving market growth?

The Tablet Segment is Expected to Witness Positive Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Increase in Muslim Population and Rise in Demand for Vegan Products; Surge in Elderly Population.

8. Can you provide examples of recent developments in the market?

October 2023: The Indonesian Vice President and Chairperson of the National Committee of Sharia Economy and Finance (KNEKS) launched the Indonesian Halal Industry Master Plan (MPIHI) 2023–2029 during the 2023 Indonesia Sharia Economic Festival (ISEF).June 2023: The Public Investment Fund (PIF), Saudi Arabia's prominent global investment entity, unveiled its latest venture, Lifera. Lifera is a commercial-scale contract development and manufacturing organization (CDMO) that aims to catalyze the expansion of Saudi Arabia's bio/pharmaceutical sector. Lifera supports the manufacture of various halal pharmaceutical products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Halal Pharmaceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Halal Pharmaceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Halal Pharmaceuticals Market?

To stay informed about further developments, trends, and reports in the Halal Pharmaceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence