Key Insights

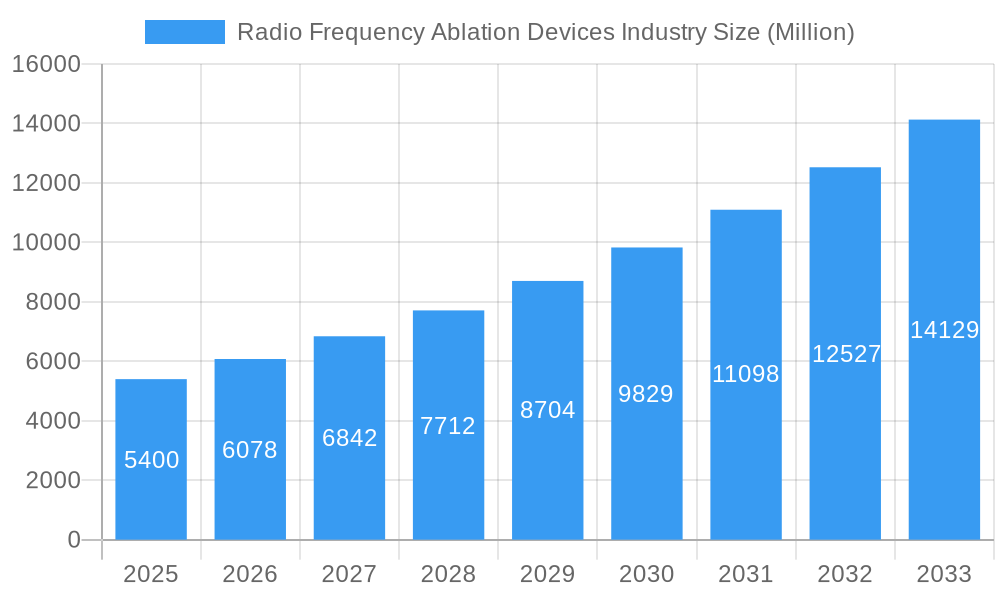

The global Radio Frequency Ablation Devices market is poised for substantial expansion, projected to reach an estimated $5.4 billion in 2025. This growth is driven by a robust CAGR of 12.14% over the forecast period, indicating a dynamic and evolving industry. The increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, and chronic pain is a primary catalyst for this market surge. Advancements in RF ablation technology, offering minimally invasive treatment options with reduced recovery times and improved patient outcomes, are further bolstering demand. Key applications like oncology and cardiology are witnessing significant adoption, supported by technological innovations in radiofrequency generators and specialized consumables designed for precise tissue ablation. The market's trajectory is strongly influenced by rising healthcare expenditures globally and a growing preference for less invasive surgical procedures.

Radio Frequency Ablation Devices Industry Market Size (In Billion)

The market's upward momentum is supported by innovative trends such as the development of sophisticated navigation systems and advanced energy delivery devices that enhance treatment efficacy and safety across diverse medical specialties. While the market benefits from strong demand, certain factors could influence its trajectory. These include the cost of advanced RF ablation devices, the need for specialized physician training, and the emergence of alternative therapies. However, the continuous innovation pipeline, coupled with a widening array of applications beyond traditional areas, suggests a resilient growth path. Major industry players are actively investing in research and development and strategic partnerships to capture market share, particularly in rapidly growing regions like Asia Pacific, which presents significant untapped potential due to its expanding healthcare infrastructure and increasing access to advanced medical technologies.

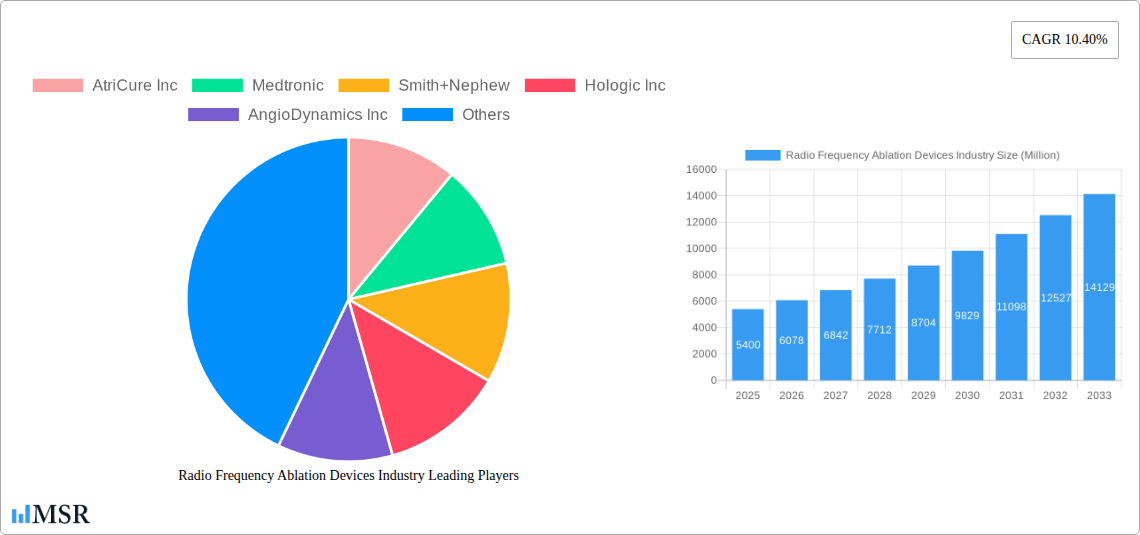

Radio Frequency Ablation Devices Industry Company Market Share

Dive into the dynamic Radio Frequency Ablation Devices Market, a rapidly expanding sector projected to reach $25 billion by 2033. This comprehensive report, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offers deep insights into market concentration, key trends, leading segments, product developments, challenges, and emerging opportunities. Discover the strategic landscape shaped by key players like AtriCure Inc, Medtronic, Smith+Nephew, Hologic Inc, AngioDynamics Inc, Koninklijke Philips N V, Stryker, Abbott, Boston Scientific Corporation, Becton Dickinson and Company (Venclose Inc ), Avanos Medical Inc, and Baylis Medical Company Inc.

Radio Frequency Ablation Devices Industry Market Concentration & Dynamics

The Radio Frequency Ablation Devices Market exhibits a moderate level of concentration, with established players like Medtronic, Abbott, and Boston Scientific Corporation holding significant market shares. Innovation remains a key differentiator, fostering vibrant ecosystems driven by continuous R&D. Regulatory frameworks, particularly those from the FDA and EMA, are robust and influence product development and market entry. While direct substitutes are limited, advancements in alternative minimally invasive techniques pose indirect competition. End-user trends are shifting towards less invasive procedures, improved patient outcomes, and shorter recovery times, directly impacting demand for RF ablation devices. Mergers and acquisitions (M&A) activities, evidenced by approximately 15 major deals annually over the historical period, are a strategic tool for market expansion and portfolio enhancement. The market share of leading players is estimated to be around 60-70%, with key M&A deal counts stabilizing at 15-20 per year.

Radio Frequency Ablation Devices Industry Industry Insights & Trends

The global Radio Frequency Ablation Devices Market is poised for substantial growth, estimated to reach a valuation of $25 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.5% during the forecast period. This robust expansion is fueled by a confluence of factors, including the increasing prevalence of chronic diseases requiring minimally invasive treatments and a growing preference for outpatient procedures. Technological advancements play a pivotal role, with ongoing innovations in generator technology, electrode design, and imaging integration enhancing the precision, efficacy, and safety of RF ablation procedures. For instance, the development of advanced mapping systems and real-time feedback mechanisms allows for more targeted ablation, minimizing collateral damage and improving patient outcomes.

The aging global population is another significant market driver. As individuals age, the incidence of conditions like cardiac arrhythmias, chronic pain, and certain types of cancer increases, leading to a higher demand for effective treatment modalities like RF ablation. Furthermore, the growing awareness among both patients and healthcare professionals about the benefits of RF ablation, such as reduced pain, shorter hospital stays, and faster recovery compared to traditional surgical interventions, is contributing to market penetration. The healthcare industry's continuous push towards cost-effectiveness also favors RF ablation, as it often results in lower overall treatment costs.

The integration of artificial intelligence (AI) and machine learning (ML) in RF ablation systems is emerging as a key disruptive trend. These technologies are enabling more personalized treatment plans, predicting patient response, and optimizing ablation parameters for improved results. The expansion of healthcare infrastructure in developing economies and increasing healthcare expenditure in these regions are also opening up new avenues for market growth.

Key Markets & Segments Leading Radio Frequency Ablation Devices Industry

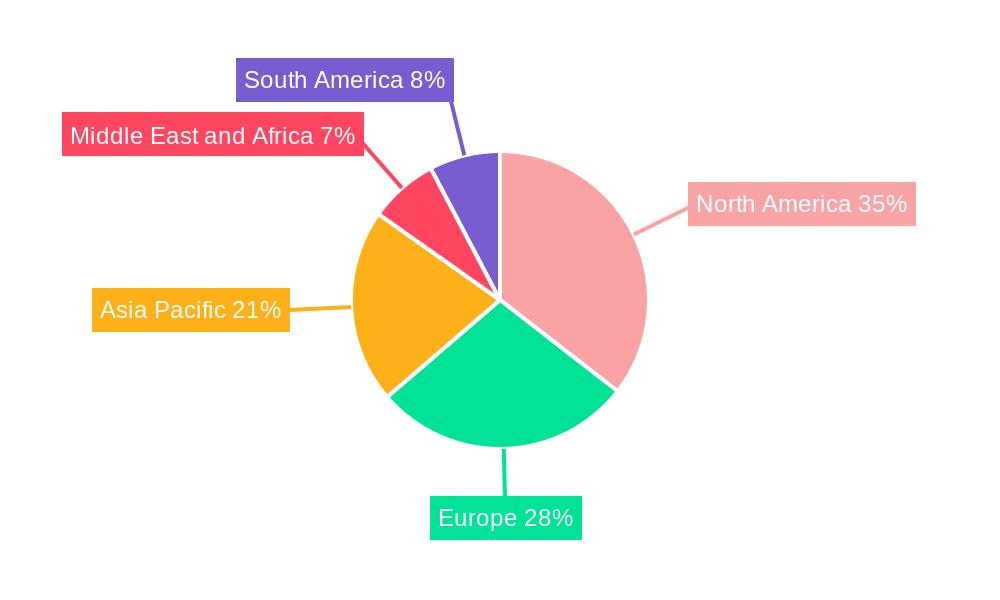

North America currently dominates the Radio Frequency Ablation Devices Market, driven by advanced healthcare infrastructure, high disposable incomes, early adoption of new technologies, and a high prevalence of cardiovascular and oncological diseases. The United States, in particular, represents a significant portion of this market, owing to favorable reimbursement policies and a strong presence of key market players.

Product Type Dominance:

- Radiofrequency Generators: This segment holds the largest market share due to their essential role in delivering the controlled energy required for ablation. Continuous innovation in generator technology, focusing on precision and versatility, further bolsters its market leadership.

- Consumables: This segment, including electrodes and other disposables, is expected to witness robust growth, driven by the increasing volume of RF ablation procedures.

Application Dominance:

- Cardiology and Cardiac Rhythm Management: This is the leading application segment, fueled by the escalating global burden of atrial fibrillation and other cardiac arrhythmias, for which RF ablation is a primary treatment.

- Oncology: The application of RF ablation in treating various cancers, including liver, lung, and bone tumors, is a rapidly growing area, driven by the need for minimally invasive tumor destruction.

- Pain Management: RF ablation is increasingly utilized for chronic pain relief, particularly for conditions like spinal pain and osteoarthritis, contributing significantly to market expansion.

- Gynecology: Applications in treating conditions like uterine fibroids and endometriosis are gaining traction, showcasing the versatility of RF ablation.

The Asia-Pacific region is emerging as the fastest-growing market, propelled by rising healthcare expenditure, increasing awareness of minimally invasive procedures, a growing patient pool, and improving healthcare infrastructure. Countries like China and India are key contributors to this growth.

Radio Frequency Ablation Devices Industry Product Developments

Recent product developments in the Radio Frequency Ablation Devices Industry underscore a commitment to enhancing procedural efficiency, patient safety, and therapeutic outcomes. Innovations are focused on creating more intelligent, adaptable, and user-friendly systems. These advancements aim to broaden the applicability of RF ablation across diverse medical specialties and improve the success rates of complex procedures. The competitive landscape is being reshaped by these technological leaps, with companies striving to offer differentiated solutions that provide superior precision and reduced invasiveness.

Challenges in the Radio Frequency Ablation Devices Industry Market

The Radio Frequency Ablation Devices Market faces several challenges that could impede its growth trajectory. High initial investment costs for advanced RF ablation systems can be a significant barrier, especially for smaller healthcare facilities and in developing economies. Stringent regulatory approvals for new devices and modifications add to the time-to-market and increase development costs, estimated to add 12-18 months to product launch timelines. The availability of alternative minimally invasive treatments, such as cryoablation and high-intensity focused ultrasound (HIFU), also presents competitive pressure, potentially diverting market share. Furthermore, the need for specialized training for healthcare professionals to effectively operate these complex devices can lead to a slower adoption rate.

Forces Driving Radio Frequency Ablation Devices Industry Growth

The Radio Frequency Ablation Devices Industry is experiencing robust growth driven by several key factors. The escalating global prevalence of chronic diseases, including cardiovascular disorders, cancer, and chronic pain conditions, is a primary catalyst. The increasing demand for minimally invasive procedures, driven by patient preference for reduced pain, shorter hospital stays, and faster recovery times, directly benefits RF ablation. Technological advancements, such as the development of sophisticated imaging and navigation systems integrated with RF ablation platforms, are enhancing procedural precision and safety, further stimulating adoption. Favorable reimbursement policies in various regions also contribute to the market's upward trend.

Challenges in the Radio Frequency Ablation Devices Industry Market

Long-term growth catalysts for the Radio Frequency Ablation Devices Industry are deeply rooted in continuous innovation and strategic market expansion. The development of novel applications for RF ablation in emerging therapeutic areas, such as neurological disorders and autoimmune diseases, holds significant promise. Partnerships between device manufacturers and research institutions are crucial for driving innovation and clinical validation of new technologies. Furthermore, expanding into underserved emerging markets through strategic distribution networks and localized manufacturing can unlock substantial growth potential. The increasing focus on personalized medicine and the integration of AI for treatment optimization will also be key drivers.

Emerging Opportunities in Radio Frequency Ablation Devices Industry

Emerging opportunities in the Radio Frequency Ablation Devices Industry are abundant, particularly in the development of next-generation devices with enhanced functionalities. The integration of robotics and AI in RF ablation systems presents a significant avenue for innovation, promising greater precision and automation. The growing adoption of percutaneous techniques for a wider range of indications, including benign prostatic hyperplasia and certain gynecological conditions, offers substantial market expansion potential. Furthermore, the increasing focus on remote patient monitoring and telementoring capabilities for ablation procedures can improve access to expertise and expand the reach of advanced treatments globally. The development of cost-effective and portable RF ablation devices for resource-limited settings also represents a crucial unmet need and a significant opportunity.

Leading Players in the Radio Frequency Ablation Devices Industry Sector

- AtriCure Inc

- Medtronic

- Smith+Nephew

- Hologic Inc

- AngioDynamics Inc

- Koninklijke Philips N V

- Stryker

- Abbott

- Boston Scientific Corporation

- Becton Dickinson and Company (Venclose Inc )

- Avanos Medical Inc

- Baylis Medical Company Inc

Key Milestones in Radio Frequency Ablation Devices Industry Industry

- April 2022: AtriCure launched the EnCompass Clamp as part of its Isolator Synergy ablation system. This platform features parallel closure, uniform pressure, and custom power using synergy radiofrequency, aimed at improving the efficiency of concomitant surgical ablations during cardiac surgery.

- April 2022: Royal Philips launched the latest release of its KODEX-EPD system, enhancing imaging and mapping capabilities for RF ablation. This release includes the new Tissue Engagement Viewer and support for the Medtronic DiamondTemp ablation system, signifying advancements in visualization and compatibility.

Strategic Outlook for Radio Frequency Ablation Devices Industry Market

The strategic outlook for the Radio Frequency Ablation Devices Market is exceptionally positive, with growth accelerators firmly in place. Future market potential will be driven by continued innovation in miniaturization, enhanced energy delivery, and improved user interfaces for RF ablation systems. Strategic collaborations between medical device manufacturers, healthcare providers, and research institutions will be crucial for developing and validating new applications and refining existing ones. The increasing demand for patient-centric care and the shift towards value-based healthcare models will favor the adoption of cost-effective and highly efficacious RF ablation solutions. Expansion into emerging markets, coupled with product diversification to address a wider spectrum of medical needs, represents key strategic opportunities for sustained growth and market leadership.

Radio Frequency Ablation Devices Industry Segmentation

-

1. Product Type

- 1.1. Radiofrequency Generators

- 1.2. Consumables

-

2. Application

- 2.1. Oncology

- 2.2. Cardiology and Cardiac Rhythm Management

- 2.3. Gynecology

- 2.4. Pain Management

- 2.5. Other Applications

Radio Frequency Ablation Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Radio Frequency Ablation Devices Industry Regional Market Share

Geographic Coverage of Radio Frequency Ablation Devices Industry

Radio Frequency Ablation Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Preference for Minimally Invasive Procedures; Increasing Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Low awareness and availability of alternative treatment method; High treatment cost

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Account for the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Radio Frequency Ablation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Radiofrequency Generators

- 5.1.2. Consumables

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Cardiology and Cardiac Rhythm Management

- 5.2.3. Gynecology

- 5.2.4. Pain Management

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Radio Frequency Ablation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Radiofrequency Generators

- 6.1.2. Consumables

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Oncology

- 6.2.2. Cardiology and Cardiac Rhythm Management

- 6.2.3. Gynecology

- 6.2.4. Pain Management

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Radio Frequency Ablation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Radiofrequency Generators

- 7.1.2. Consumables

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Oncology

- 7.2.2. Cardiology and Cardiac Rhythm Management

- 7.2.3. Gynecology

- 7.2.4. Pain Management

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Radio Frequency Ablation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Radiofrequency Generators

- 8.1.2. Consumables

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Oncology

- 8.2.2. Cardiology and Cardiac Rhythm Management

- 8.2.3. Gynecology

- 8.2.4. Pain Management

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Radio Frequency Ablation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Radiofrequency Generators

- 9.1.2. Consumables

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Oncology

- 9.2.2. Cardiology and Cardiac Rhythm Management

- 9.2.3. Gynecology

- 9.2.4. Pain Management

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Radio Frequency Ablation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Radiofrequency Generators

- 10.1.2. Consumables

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Oncology

- 10.2.2. Cardiology and Cardiac Rhythm Management

- 10.2.3. Gynecology

- 10.2.4. Pain Management

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AtriCure Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smith+Nephew

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hologic Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AngioDynamics Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koninklijke Philips N V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stryker

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Abbott

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boston Scientific Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Becton Dickinson and Company (Venclose Inc )

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Avanos Medical Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Baylis Medical Company Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 AtriCure Inc

List of Figures

- Figure 1: Global Radio Frequency Ablation Devices Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Radio Frequency Ablation Devices Industry Volume Breakdown (K unit, %) by Region 2025 & 2033

- Figure 3: North America Radio Frequency Ablation Devices Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 4: North America Radio Frequency Ablation Devices Industry Volume (K unit), by Product Type 2025 & 2033

- Figure 5: North America Radio Frequency Ablation Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Radio Frequency Ablation Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Radio Frequency Ablation Devices Industry Revenue (undefined), by Application 2025 & 2033

- Figure 8: North America Radio Frequency Ablation Devices Industry Volume (K unit), by Application 2025 & 2033

- Figure 9: North America Radio Frequency Ablation Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Radio Frequency Ablation Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Radio Frequency Ablation Devices Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Radio Frequency Ablation Devices Industry Volume (K unit), by Country 2025 & 2033

- Figure 13: North America Radio Frequency Ablation Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Radio Frequency Ablation Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Radio Frequency Ablation Devices Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 16: Europe Radio Frequency Ablation Devices Industry Volume (K unit), by Product Type 2025 & 2033

- Figure 17: Europe Radio Frequency Ablation Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Radio Frequency Ablation Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Radio Frequency Ablation Devices Industry Revenue (undefined), by Application 2025 & 2033

- Figure 20: Europe Radio Frequency Ablation Devices Industry Volume (K unit), by Application 2025 & 2033

- Figure 21: Europe Radio Frequency Ablation Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Radio Frequency Ablation Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Radio Frequency Ablation Devices Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Radio Frequency Ablation Devices Industry Volume (K unit), by Country 2025 & 2033

- Figure 25: Europe Radio Frequency Ablation Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Radio Frequency Ablation Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Radio Frequency Ablation Devices Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Radio Frequency Ablation Devices Industry Volume (K unit), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Radio Frequency Ablation Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Radio Frequency Ablation Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Radio Frequency Ablation Devices Industry Revenue (undefined), by Application 2025 & 2033

- Figure 32: Asia Pacific Radio Frequency Ablation Devices Industry Volume (K unit), by Application 2025 & 2033

- Figure 33: Asia Pacific Radio Frequency Ablation Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Radio Frequency Ablation Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Radio Frequency Ablation Devices Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Radio Frequency Ablation Devices Industry Volume (K unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Radio Frequency Ablation Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Radio Frequency Ablation Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Radio Frequency Ablation Devices Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 40: Middle East and Africa Radio Frequency Ablation Devices Industry Volume (K unit), by Product Type 2025 & 2033

- Figure 41: Middle East and Africa Radio Frequency Ablation Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East and Africa Radio Frequency Ablation Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Radio Frequency Ablation Devices Industry Revenue (undefined), by Application 2025 & 2033

- Figure 44: Middle East and Africa Radio Frequency Ablation Devices Industry Volume (K unit), by Application 2025 & 2033

- Figure 45: Middle East and Africa Radio Frequency Ablation Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Radio Frequency Ablation Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Radio Frequency Ablation Devices Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Radio Frequency Ablation Devices Industry Volume (K unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Radio Frequency Ablation Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Radio Frequency Ablation Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Radio Frequency Ablation Devices Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 52: South America Radio Frequency Ablation Devices Industry Volume (K unit), by Product Type 2025 & 2033

- Figure 53: South America Radio Frequency Ablation Devices Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: South America Radio Frequency Ablation Devices Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: South America Radio Frequency Ablation Devices Industry Revenue (undefined), by Application 2025 & 2033

- Figure 56: South America Radio Frequency Ablation Devices Industry Volume (K unit), by Application 2025 & 2033

- Figure 57: South America Radio Frequency Ablation Devices Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Radio Frequency Ablation Devices Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Radio Frequency Ablation Devices Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Radio Frequency Ablation Devices Industry Volume (K unit), by Country 2025 & 2033

- Figure 61: South America Radio Frequency Ablation Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Radio Frequency Ablation Devices Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Application 2020 & 2033

- Table 5: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Region 2020 & 2033

- Table 7: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Application 2020 & 2033

- Table 11: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Country 2020 & 2033

- Table 13: United States Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 19: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 20: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Application 2020 & 2033

- Table 23: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Country 2020 & 2033

- Table 25: Germany Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 29: France Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 37: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 38: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Application 2020 & 2033

- Table 41: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Country 2020 & 2033

- Table 43: China Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 47: India Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 55: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 56: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 58: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Application 2020 & 2033

- Table 59: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Country 2020 & 2033

- Table 61: GCC Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 67: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 68: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Product Type 2020 & 2033

- Table 69: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 70: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Application 2020 & 2033

- Table 71: Global Radio Frequency Ablation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Radio Frequency Ablation Devices Industry Volume K unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Radio Frequency Ablation Devices Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Radio Frequency Ablation Devices Industry Volume (K unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Radio Frequency Ablation Devices Industry?

The projected CAGR is approximately 12.14%.

2. Which companies are prominent players in the Radio Frequency Ablation Devices Industry?

Key companies in the market include AtriCure Inc, Medtronic, Smith+Nephew, Hologic Inc, AngioDynamics Inc, Koninklijke Philips N V, Stryker, Abbott, Boston Scientific Corporation, Becton Dickinson and Company (Venclose Inc ), Avanos Medical Inc, Baylis Medical Company Inc.

3. What are the main segments of the Radio Frequency Ablation Devices Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preference for Minimally Invasive Procedures; Increasing Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Account for the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Low awareness and availability of alternative treatment method; High treatment cost.

8. Can you provide examples of recent developments in the market?

In April 2022, AtriCure launched the EnCompass Clamp as part of its Isolator Synergy ablation system. The platform includes parallel closure, uniform pressure, and custom power using synergy radiofrequency, which will be used for the ablation of cardiac tissue during cardiac surgery to make concomitant surgical ablations more efficient.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Radio Frequency Ablation Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Radio Frequency Ablation Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Radio Frequency Ablation Devices Industry?

To stay informed about further developments, trends, and reports in the Radio Frequency Ablation Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence