Key Insights

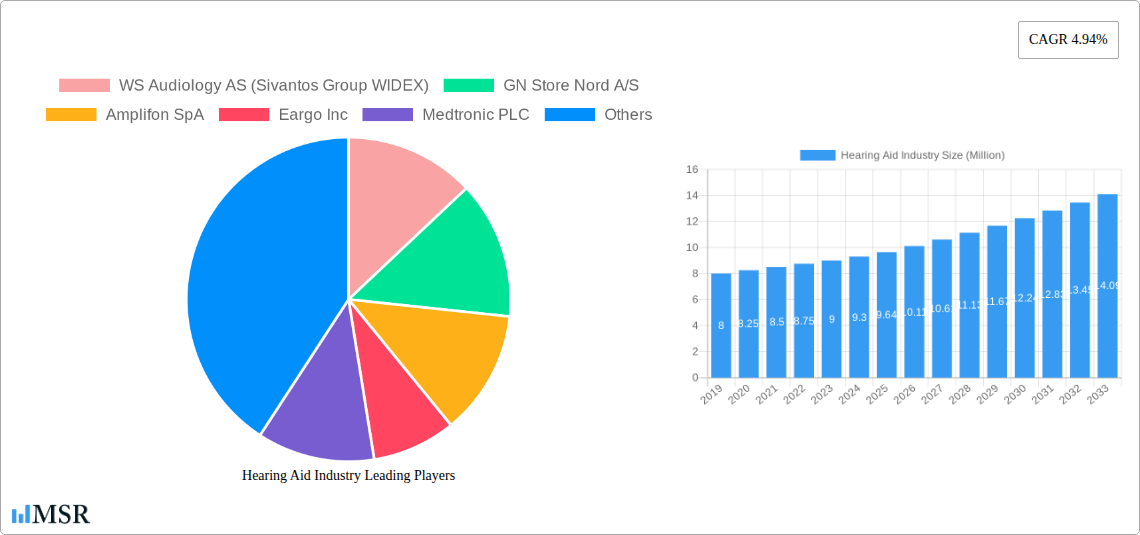

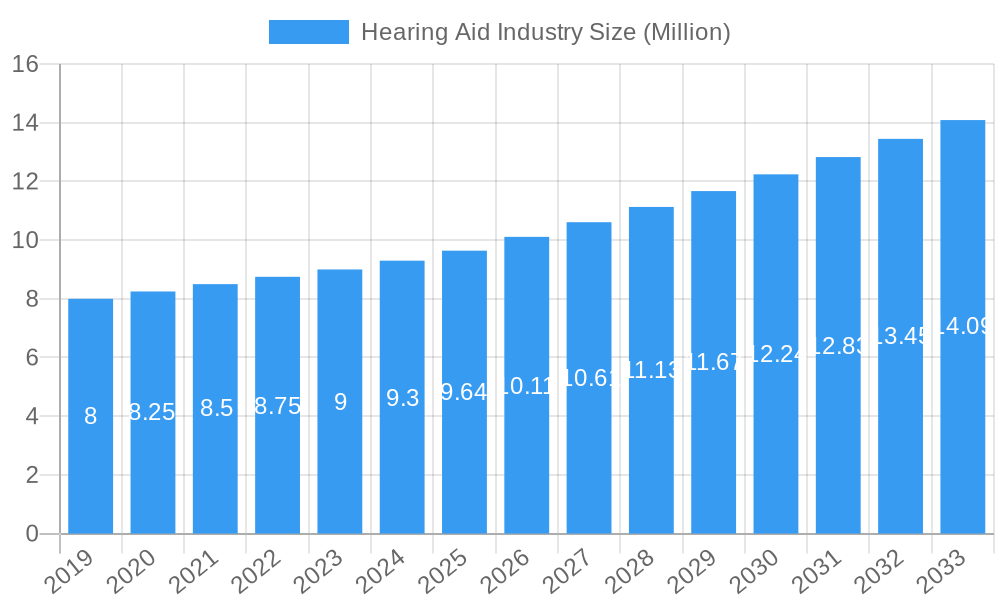

The global Hearing Aid Industry is poised for significant expansion, currently valued at $9.64 million and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 4.94% from 2025 to 2033. This upward trajectory is primarily fueled by an aging global population, increasing awareness of hearing health, and advancements in hearing aid technology. The rising prevalence of age-related hearing loss, coupled with a growing demand for discreet and sophisticated solutions, are key drivers. Furthermore, improved diagnostic capabilities and increased healthcare spending, particularly in emerging economies, are contributing to market penetration. The industry is witnessing a strong shift towards digital hearing aids, offering enhanced features and connectivity, catering to the evolving needs of consumers seeking personalized auditory experiences.

Hearing Aid Industry Market Size (In Million)

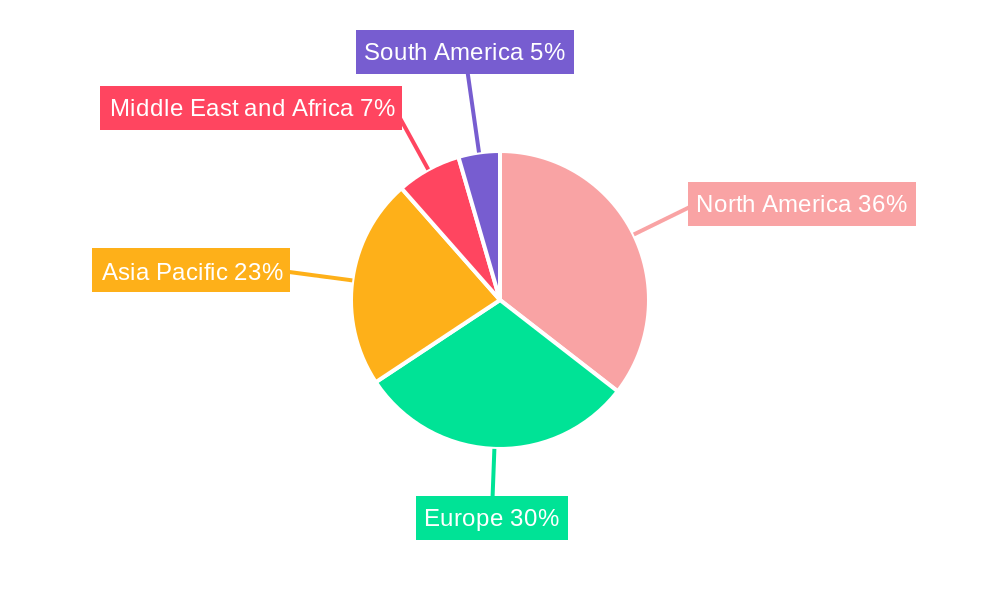

Segmentation analysis reveals a diverse market landscape. The "Behind the Ear (BTE)" and "Receiver in the Ear (RIE)" segments are expected to maintain significant market share due to their versatility and improved aesthetics. Sensorineural hearing loss remains the dominant type of hearing impairment driving demand. The transition from conventional to digital hearing aids is a defining trend, with digital solutions offering superior sound processing and customization. Adults constitute the largest patient demographic, but the pediatric segment is also showing promising growth as early intervention becomes more recognized. Geographically, North America and Europe currently lead the market, driven by high disposable incomes and advanced healthcare infrastructure. However, the Asia Pacific region is anticipated to exhibit the fastest growth due to a large, aging population, increasing disposable incomes, and a rising number of hearing loss cases. Key restraints include the high cost of advanced hearing devices, limited insurance coverage in certain regions, and the persistent stigma associated with hearing loss.

Hearing Aid Industry Company Market Share

Unlocking a $100 Billion+ Future: Comprehensive Analysis of the Global Hearing Aid Industry (2019-2033)

Gain unparalleled insights into the rapidly evolving global hearing aid industry. This in-depth report, spanning 2019–2033 with a base and estimated year of 2025, delivers critical data and strategic foresight for manufacturers, distributors, investors, and healthcare providers. Discover key market drivers, emerging technologies, competitive landscapes, and the trajectory of digital hearing aids, OTC hearing aids, and innovative solutions for sensorineural hearing loss and conductive hearing loss. With a projected market size exceeding $100 Billion, this report is your essential guide to navigating this high-growth sector.

Hearing Aid Industry Market Concentration & Dynamics

The global hearing aid market exhibits a moderately concentrated landscape, characterized by a few dominant players holding significant market share, alongside a growing number of innovative mid-sized companies and startups. Key players like Sonova Holding AG, Demant AS, and WS Audiology AS (Sivantos Group WIDEX) consistently lead the market, fueled by extensive R&D investments and broad distribution networks. The innovation ecosystem is vibrant, with advancements in miniaturization, connectivity, and artificial intelligence driving the development of sophisticated digital hearing aids. Regulatory frameworks, while stringent in some regions, are gradually adapting to accommodate over-the-counter (OTC) sales and new device classifications, fostering greater accessibility. Substitute products, primarily cochlear implants for severe to profound hearing loss and assistive listening devices, represent a smaller but relevant competitive force. End-user trends are shifting towards discreet, feature-rich devices with seamless integration into daily life, with a growing demand for hearing aids for adults and an increasing awareness of pediatrics/children audiological care. Mergers and acquisition (M&A) activities, although not overtly aggressive in the recent historical period (2019-2024), remain a strategic avenue for market consolidation and expansion. Notable M&A deals in the past have reshaped the competitive dynamics, and future consolidation is anticipated as companies seek to broaden their product portfolios and geographical reach. The total number of M&A deals in the sector has averaged approximately 5-10 per year during the historical period.

Hearing Aid Industry Industry Insights & Trends

The hearing aid industry is poised for substantial growth, driven by an aging global population, increasing awareness of hearing health, and technological advancements. The market size for hearing aids is estimated to reach $110 Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period (2025–2033). Several key factors are propelling this expansion. Firstly, the rising prevalence of age-related hearing loss, a natural consequence of increased life expectancy worldwide, creates a perpetually growing consumer base. As individuals live longer and remain active, the demand for solutions that enhance their quality of life, including audiological support, escalates significantly. Secondly, a growing global consciousness surrounding hearing health and the detrimental effects of untreated hearing loss on cognitive function, social engagement, and overall well-being is a critical catalyst. Public health initiatives, educational campaigns, and the normalization of hearing aid use are contributing to reduced stigma and earlier adoption of assistive devices.

Technological disruptions are revolutionizing the hearing aid market. The transition from analog to digital hearing aids has been a monumental shift, offering superior sound quality, advanced noise reduction, and personalized amplification. Further innovations include the integration of Artificial Intelligence (AI) for real-time sound processing and adaptive listening environments, Bluetooth connectivity for seamless streaming of audio and calls, and the development of rechargeable batteries for enhanced user convenience. The emergence of Over-the-Counter (OTC) hearing aids, as exemplified by Sony Electronics' entry in October 2022, is a game-changer, aiming to democratize access and reduce costs for individuals with mild to moderate hearing loss. This segment is expected to witness exponential growth, challenging traditional distribution channels and empowering consumers.

Evolving consumer behaviors are also shaping the industry. There is a discernible shift towards discreet and aesthetically pleasing hearing devices. Consumers are seeking not just improved hearing but also a holistic audiological experience that integrates seamlessly with their digital lifestyles. This includes demand for smart features, mobile app control, and personalized settings that cater to individual preferences and listening environments. The report analyzes the market segmentation by Product Type, including Behind the Ear (BTE), Receiver-in-Canal (RIC), In the Ear (ITE), Completely-in-canal (CIC), and Other Hearing Aid Devices. It also examines the segmentation by Type of Hearing Loss, encompassing Sensorineural Hearing Loss and Conductive Hearing Loss, and by Technology, distinguishing between Conventional Hearing Aids and Digital Hearing Aids. Furthermore, the analysis delves into the Patient Type, covering Adults and Pediatrics/Children, highlighting the unique needs and market dynamics within each category.

Key Markets & Segments Leading Hearing Aid Industry

The hearing aid industry is experiencing robust growth across various key markets and segments, with North America currently leading in market value, driven by high disposable incomes, a strong awareness of hearing health, and early adoption of advanced technologies, particularly digital hearing aids. Within North America, the United States represents a dominant country market, with a substantial installed base and a burgeoning interest in OTC hearing aids. Europe, particularly Western European nations, also holds a significant market share due to its aging demographics and well-established healthcare systems.

In terms of Product Type, Receiver-in-Canal (RIC) devices have emerged as the most popular category, accounting for an estimated 35% of the market share. Their popularity stems from their discreet design, comfort, and versatility in addressing a wide range of hearing loss degrees. Behind the Ear (BTE) devices remain a strong segment, particularly for severe to profound hearing losses and for pediatric use, representing approximately 25% of the market. In the Ear (ITE) and Completely-in-canal (CIC) devices cater to a segment of the market seeking maximum discretion, accounting for roughly 20% and 15% respectively. Other Hearing Aid Devices, including assistive listening devices and specialized aids, make up the remaining 5%.

The market segmentation by Type of Hearing Loss underscores the dominance of Sensorineural Hearing Loss, which accounts for over 90% of all hearing loss cases. This is directly linked to age-related hearing loss and noise-induced hearing loss, making it the primary target for most hearing aid manufacturers. Conductive Hearing Loss, while less prevalent, still represents a significant niche, particularly in developing regions and in cases of ear infections or structural abnormalities.

Analyzing by Technology, Digital Hearing Aids have completely overtaken Conventional Hearing Aids, holding a market share exceeding 98%. The superior performance, customization, and advanced features of digital technology have rendered analog devices largely obsolete. This dominance is expected to continue with ongoing advancements in digital signal processing and AI integration.

The Patient Type segmentation reveals that Adults represent the largest consumer group, estimated at 90% of the market. This is primarily due to the higher prevalence of hearing loss in older age demographics. However, the market for Pediatrics/Children is also crucial, though smaller in volume, representing about 10%. This segment demands specialized devices with enhanced durability, safety features, and connectivity options for educational and social development. Drivers for pediatric segment growth include increased newborn hearing screening programs and greater parental awareness.

Hearing Aid Industry Product Developments

The hearing aid industry is witnessing a relentless wave of product innovations focused on enhancing user experience, connectivity, and therapeutic benefits. Miniaturization continues to drive the development of smaller, more discreet devices, while advancements in AI and machine learning are enabling hearing aids to intelligently adapt to diverse soundscapes, reducing listening effort. Seamless Bluetooth connectivity allows for direct streaming of calls, music, and other audio content from smartphones and other devices. Furthermore, the integration of advanced features like fall detection and health monitoring is transforming hearing aids into comprehensive personal wellness devices. These continuous product developments are crucial for maintaining competitive edges in a rapidly evolving market, with companies investing heavily in R&D to stay at the forefront of technological advancements and to address the growing demand for smart, connected audiological solutions.

Challenges in the Hearing Aid Industry Market

Despite robust growth, the hearing aid industry faces several significant challenges. High costs remain a substantial barrier for many potential users, particularly in countries without comprehensive insurance coverage or government subsidies. The average price of a premium hearing aid can range from $2,000 to $6,000 per pair, limiting affordability for a significant portion of the population. Regulatory hurdles, particularly for new market entrants and for the classification of OTC devices, can slow down product launches and market penetration. Supply chain disruptions, exacerbated by global events, can impact manufacturing timelines and material availability, potentially leading to delays and increased production costs. Intense competition among established players and the emergence of new market entrants, especially in the OTC space, create pressure on pricing and market share.

Forces Driving Hearing Aid Industry Growth

The hearing aid industry is propelled by a confluence of powerful growth drivers. The continuously increasing global aging population is the most significant factor, as age-related hearing loss is a prevalent condition among seniors. A growing awareness and de-stigmatization of hearing loss and hearing aid use are encouraging more individuals to seek solutions. Technological advancements, particularly in digital hearing aids, offering superior performance, miniaturization, and connectivity, are creating more desirable and effective products. Favorable government initiatives and healthcare policies in many regions, aimed at improving audiological care access, also contribute to market expansion. The increasing disposable income in many emerging economies further enhances the purchasing power for hearing healthcare solutions.

Challenges in the Hearing Aid Industry Market

Long-term growth catalysts for the hearing aid industry are deeply intertwined with ongoing innovation and market expansion strategies. The continued development of personalized and AI-driven hearing solutions will unlock new levels of user satisfaction and address a wider spectrum of hearing needs. Strategic partnerships between hearing aid manufacturers and technology companies, as well as with telehealth providers, will expand service delivery models and reach. Market expansion into underserved regions and demographic segments, such as greater focus on pediatric audiology and accessible solutions for developing nations, offers significant untapped potential. Furthermore, the ongoing evolution of the OTC market, with a focus on ease of use and affordability, will drive adoption and contribute to sustained long-term growth.

Emerging Opportunities in Hearing Aid Industry

Emerging opportunities within the hearing aid industry are abundant and multifaceted. The burgeoning OTC hearing aid market presents a significant avenue for growth by lowering entry barriers and appealing to a broader consumer base. Innovations in telehealth and remote audiologist services offer opportunities to expand reach and reduce the burden of in-person appointments, particularly in rural areas. The integration of hearing aids with other wearable technology, creating comprehensive health and wellness ecosystems, is another promising frontier. Furthermore, exploring untapped markets in developing countries, where the prevalence of hearing loss is high but access to care is limited, presents substantial long-term potential through the development of more affordable and robust solutions.

Leading Players in the Hearing Aid Industry Sector

- WS Audiology AS (Sivantos Group WIDEX)

- GN Store Nord A/S

- Amplifon SpA

- Eargo Inc

- Medtronic PLC

- Sonova Holding AG

- Starkey Hearing Technologies

- Cochlear Ltd

- Demant AS

- Audina Hearing Instruments Inc

- MED-EL

- Horentek Hearing Diagnostics

Key Milestones in Hearing Aid Industry Industry

- October 2022: Sony Electronics announced the availability of its first over-the-counter (OTC) hearing aids for the United States market, signaling a significant shift towards consumer accessibility.

- July 2022: LINNER launched NOVA, an antibacterial hearing aid with distinctive features, highlighting advancements in hygiene and user-centric design.

Strategic Outlook for Hearing Aid Industry Market

The strategic outlook for the hearing aid industry is exceptionally positive, driven by sustained demographic trends and accelerating technological innovation. The continued maturation of digital hearing aids, coupled with the disruptive potential of OTC solutions, will redefine market access and affordability. Focus on integrating advanced AI capabilities, expanding connectivity options, and developing comprehensive audiological care pathways will be paramount for competitive advantage. Strategic investments in emerging markets and the exploration of novel distribution channels, including telehealth and direct-to-consumer models, will unlock substantial future growth opportunities. The industry is well-positioned for continued expansion, transforming from purely rehabilitative devices to integral components of personal health and wellness management.

Hearing Aid Industry Segmentation

-

1. Product Type

- 1.1. Behind the Ear (BTE)

- 1.2. Receiver

- 1.3. In the Ear (ITE)

- 1.4. Completely-in canal (CIC)

- 1.5. Other Hearing Aid Devices

-

2. Type of Hearing Loss

- 2.1. Sensorineural Hearing Loss

- 2.2. Conductive Hearing Loss

-

3. Technology

- 3.1. Conventional Hearing Aids

- 3.2. Digital Hearing Aids

-

4. Patient Type

- 4.1. Adults

- 4.2. Pediatrics/Children

Hearing Aid Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hearing Aid Industry Regional Market Share

Geographic Coverage of Hearing Aid Industry

Hearing Aid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Hearing Loss; Technological Advancements in Hearing Aid Devices; Rising Awareness and Initiatives about Hearing Aid Devices

- 3.3. Market Restrains

- 3.3.1. High Cost of Hearing Aid Devices and the Presence of Substitute Products

- 3.4. Market Trends

- 3.4.1. Behind the Ear (BTE) Segment is Expected to Hold a Significant Market Share in the Product Type Segment Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hearing Aid Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Behind the Ear (BTE)

- 5.1.2. Receiver

- 5.1.3. In the Ear (ITE)

- 5.1.4. Completely-in canal (CIC)

- 5.1.5. Other Hearing Aid Devices

- 5.2. Market Analysis, Insights and Forecast - by Type of Hearing Loss

- 5.2.1. Sensorineural Hearing Loss

- 5.2.2. Conductive Hearing Loss

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Conventional Hearing Aids

- 5.3.2. Digital Hearing Aids

- 5.4. Market Analysis, Insights and Forecast - by Patient Type

- 5.4.1. Adults

- 5.4.2. Pediatrics/Children

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Hearing Aid Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Behind the Ear (BTE)

- 6.1.2. Receiver

- 6.1.3. In the Ear (ITE)

- 6.1.4. Completely-in canal (CIC)

- 6.1.5. Other Hearing Aid Devices

- 6.2. Market Analysis, Insights and Forecast - by Type of Hearing Loss

- 6.2.1. Sensorineural Hearing Loss

- 6.2.2. Conductive Hearing Loss

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Conventional Hearing Aids

- 6.3.2. Digital Hearing Aids

- 6.4. Market Analysis, Insights and Forecast - by Patient Type

- 6.4.1. Adults

- 6.4.2. Pediatrics/Children

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Hearing Aid Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Behind the Ear (BTE)

- 7.1.2. Receiver

- 7.1.3. In the Ear (ITE)

- 7.1.4. Completely-in canal (CIC)

- 7.1.5. Other Hearing Aid Devices

- 7.2. Market Analysis, Insights and Forecast - by Type of Hearing Loss

- 7.2.1. Sensorineural Hearing Loss

- 7.2.2. Conductive Hearing Loss

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Conventional Hearing Aids

- 7.3.2. Digital Hearing Aids

- 7.4. Market Analysis, Insights and Forecast - by Patient Type

- 7.4.1. Adults

- 7.4.2. Pediatrics/Children

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Hearing Aid Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Behind the Ear (BTE)

- 8.1.2. Receiver

- 8.1.3. In the Ear (ITE)

- 8.1.4. Completely-in canal (CIC)

- 8.1.5. Other Hearing Aid Devices

- 8.2. Market Analysis, Insights and Forecast - by Type of Hearing Loss

- 8.2.1. Sensorineural Hearing Loss

- 8.2.2. Conductive Hearing Loss

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Conventional Hearing Aids

- 8.3.2. Digital Hearing Aids

- 8.4. Market Analysis, Insights and Forecast - by Patient Type

- 8.4.1. Adults

- 8.4.2. Pediatrics/Children

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Hearing Aid Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Behind the Ear (BTE)

- 9.1.2. Receiver

- 9.1.3. In the Ear (ITE)

- 9.1.4. Completely-in canal (CIC)

- 9.1.5. Other Hearing Aid Devices

- 9.2. Market Analysis, Insights and Forecast - by Type of Hearing Loss

- 9.2.1. Sensorineural Hearing Loss

- 9.2.2. Conductive Hearing Loss

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. Conventional Hearing Aids

- 9.3.2. Digital Hearing Aids

- 9.4. Market Analysis, Insights and Forecast - by Patient Type

- 9.4.1. Adults

- 9.4.2. Pediatrics/Children

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Hearing Aid Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Behind the Ear (BTE)

- 10.1.2. Receiver

- 10.1.3. In the Ear (ITE)

- 10.1.4. Completely-in canal (CIC)

- 10.1.5. Other Hearing Aid Devices

- 10.2. Market Analysis, Insights and Forecast - by Type of Hearing Loss

- 10.2.1. Sensorineural Hearing Loss

- 10.2.2. Conductive Hearing Loss

- 10.3. Market Analysis, Insights and Forecast - by Technology

- 10.3.1. Conventional Hearing Aids

- 10.3.2. Digital Hearing Aids

- 10.4. Market Analysis, Insights and Forecast - by Patient Type

- 10.4.1. Adults

- 10.4.2. Pediatrics/Children

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WS Audiology AS (Sivantos Group WIDEX)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GN Store Nord A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amplifon SpA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eargo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medtronic PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sonova Holding AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Starkey Hearing Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cochlear Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Demant AS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Audina Hearing Instruments Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MED-EL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Horentek Hearing Diagnostics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 WS Audiology AS (Sivantos Group WIDEX)

List of Figures

- Figure 1: Global Hearing Aid Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Hearing Aid Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Hearing Aid Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Hearing Aid Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Hearing Aid Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Hearing Aid Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Hearing Aid Industry Revenue (Million), by Type of Hearing Loss 2025 & 2033

- Figure 8: North America Hearing Aid Industry Volume (K Unit), by Type of Hearing Loss 2025 & 2033

- Figure 9: North America Hearing Aid Industry Revenue Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 10: North America Hearing Aid Industry Volume Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 11: North America Hearing Aid Industry Revenue (Million), by Technology 2025 & 2033

- Figure 12: North America Hearing Aid Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 13: North America Hearing Aid Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: North America Hearing Aid Industry Volume Share (%), by Technology 2025 & 2033

- Figure 15: North America Hearing Aid Industry Revenue (Million), by Patient Type 2025 & 2033

- Figure 16: North America Hearing Aid Industry Volume (K Unit), by Patient Type 2025 & 2033

- Figure 17: North America Hearing Aid Industry Revenue Share (%), by Patient Type 2025 & 2033

- Figure 18: North America Hearing Aid Industry Volume Share (%), by Patient Type 2025 & 2033

- Figure 19: North America Hearing Aid Industry Revenue (Million), by Country 2025 & 2033

- Figure 20: North America Hearing Aid Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Hearing Aid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Hearing Aid Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Hearing Aid Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 24: Europe Hearing Aid Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 25: Europe Hearing Aid Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Hearing Aid Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 27: Europe Hearing Aid Industry Revenue (Million), by Type of Hearing Loss 2025 & 2033

- Figure 28: Europe Hearing Aid Industry Volume (K Unit), by Type of Hearing Loss 2025 & 2033

- Figure 29: Europe Hearing Aid Industry Revenue Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 30: Europe Hearing Aid Industry Volume Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 31: Europe Hearing Aid Industry Revenue (Million), by Technology 2025 & 2033

- Figure 32: Europe Hearing Aid Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 33: Europe Hearing Aid Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: Europe Hearing Aid Industry Volume Share (%), by Technology 2025 & 2033

- Figure 35: Europe Hearing Aid Industry Revenue (Million), by Patient Type 2025 & 2033

- Figure 36: Europe Hearing Aid Industry Volume (K Unit), by Patient Type 2025 & 2033

- Figure 37: Europe Hearing Aid Industry Revenue Share (%), by Patient Type 2025 & 2033

- Figure 38: Europe Hearing Aid Industry Volume Share (%), by Patient Type 2025 & 2033

- Figure 39: Europe Hearing Aid Industry Revenue (Million), by Country 2025 & 2033

- Figure 40: Europe Hearing Aid Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Hearing Aid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Hearing Aid Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Hearing Aid Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 44: Asia Pacific Hearing Aid Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Hearing Aid Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Hearing Aid Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 47: Asia Pacific Hearing Aid Industry Revenue (Million), by Type of Hearing Loss 2025 & 2033

- Figure 48: Asia Pacific Hearing Aid Industry Volume (K Unit), by Type of Hearing Loss 2025 & 2033

- Figure 49: Asia Pacific Hearing Aid Industry Revenue Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 50: Asia Pacific Hearing Aid Industry Volume Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 51: Asia Pacific Hearing Aid Industry Revenue (Million), by Technology 2025 & 2033

- Figure 52: Asia Pacific Hearing Aid Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 53: Asia Pacific Hearing Aid Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Asia Pacific Hearing Aid Industry Volume Share (%), by Technology 2025 & 2033

- Figure 55: Asia Pacific Hearing Aid Industry Revenue (Million), by Patient Type 2025 & 2033

- Figure 56: Asia Pacific Hearing Aid Industry Volume (K Unit), by Patient Type 2025 & 2033

- Figure 57: Asia Pacific Hearing Aid Industry Revenue Share (%), by Patient Type 2025 & 2033

- Figure 58: Asia Pacific Hearing Aid Industry Volume Share (%), by Patient Type 2025 & 2033

- Figure 59: Asia Pacific Hearing Aid Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Hearing Aid Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Hearing Aid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Hearing Aid Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Hearing Aid Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 64: Middle East and Africa Hearing Aid Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 65: Middle East and Africa Hearing Aid Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 66: Middle East and Africa Hearing Aid Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 67: Middle East and Africa Hearing Aid Industry Revenue (Million), by Type of Hearing Loss 2025 & 2033

- Figure 68: Middle East and Africa Hearing Aid Industry Volume (K Unit), by Type of Hearing Loss 2025 & 2033

- Figure 69: Middle East and Africa Hearing Aid Industry Revenue Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 70: Middle East and Africa Hearing Aid Industry Volume Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 71: Middle East and Africa Hearing Aid Industry Revenue (Million), by Technology 2025 & 2033

- Figure 72: Middle East and Africa Hearing Aid Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 73: Middle East and Africa Hearing Aid Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 74: Middle East and Africa Hearing Aid Industry Volume Share (%), by Technology 2025 & 2033

- Figure 75: Middle East and Africa Hearing Aid Industry Revenue (Million), by Patient Type 2025 & 2033

- Figure 76: Middle East and Africa Hearing Aid Industry Volume (K Unit), by Patient Type 2025 & 2033

- Figure 77: Middle East and Africa Hearing Aid Industry Revenue Share (%), by Patient Type 2025 & 2033

- Figure 78: Middle East and Africa Hearing Aid Industry Volume Share (%), by Patient Type 2025 & 2033

- Figure 79: Middle East and Africa Hearing Aid Industry Revenue (Million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Hearing Aid Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Hearing Aid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Hearing Aid Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: South America Hearing Aid Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 84: South America Hearing Aid Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 85: South America Hearing Aid Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: South America Hearing Aid Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 87: South America Hearing Aid Industry Revenue (Million), by Type of Hearing Loss 2025 & 2033

- Figure 88: South America Hearing Aid Industry Volume (K Unit), by Type of Hearing Loss 2025 & 2033

- Figure 89: South America Hearing Aid Industry Revenue Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 90: South America Hearing Aid Industry Volume Share (%), by Type of Hearing Loss 2025 & 2033

- Figure 91: South America Hearing Aid Industry Revenue (Million), by Technology 2025 & 2033

- Figure 92: South America Hearing Aid Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 93: South America Hearing Aid Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 94: South America Hearing Aid Industry Volume Share (%), by Technology 2025 & 2033

- Figure 95: South America Hearing Aid Industry Revenue (Million), by Patient Type 2025 & 2033

- Figure 96: South America Hearing Aid Industry Volume (K Unit), by Patient Type 2025 & 2033

- Figure 97: South America Hearing Aid Industry Revenue Share (%), by Patient Type 2025 & 2033

- Figure 98: South America Hearing Aid Industry Volume Share (%), by Patient Type 2025 & 2033

- Figure 99: South America Hearing Aid Industry Revenue (Million), by Country 2025 & 2033

- Figure 100: South America Hearing Aid Industry Volume (K Unit), by Country 2025 & 2033

- Figure 101: South America Hearing Aid Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: South America Hearing Aid Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hearing Aid Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Hearing Aid Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Hearing Aid Industry Revenue Million Forecast, by Type of Hearing Loss 2020 & 2033

- Table 4: Global Hearing Aid Industry Volume K Unit Forecast, by Type of Hearing Loss 2020 & 2033

- Table 5: Global Hearing Aid Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Hearing Aid Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 7: Global Hearing Aid Industry Revenue Million Forecast, by Patient Type 2020 & 2033

- Table 8: Global Hearing Aid Industry Volume K Unit Forecast, by Patient Type 2020 & 2033

- Table 9: Global Hearing Aid Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Hearing Aid Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Hearing Aid Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Hearing Aid Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: Global Hearing Aid Industry Revenue Million Forecast, by Type of Hearing Loss 2020 & 2033

- Table 14: Global Hearing Aid Industry Volume K Unit Forecast, by Type of Hearing Loss 2020 & 2033

- Table 15: Global Hearing Aid Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 16: Global Hearing Aid Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 17: Global Hearing Aid Industry Revenue Million Forecast, by Patient Type 2020 & 2033

- Table 18: Global Hearing Aid Industry Volume K Unit Forecast, by Patient Type 2020 & 2033

- Table 19: Global Hearing Aid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Hearing Aid Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mexico Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Global Hearing Aid Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Hearing Aid Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 29: Global Hearing Aid Industry Revenue Million Forecast, by Type of Hearing Loss 2020 & 2033

- Table 30: Global Hearing Aid Industry Volume K Unit Forecast, by Type of Hearing Loss 2020 & 2033

- Table 31: Global Hearing Aid Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 32: Global Hearing Aid Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 33: Global Hearing Aid Industry Revenue Million Forecast, by Patient Type 2020 & 2033

- Table 34: Global Hearing Aid Industry Volume K Unit Forecast, by Patient Type 2020 & 2033

- Table 35: Global Hearing Aid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Hearing Aid Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Germany Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Germany Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Hearing Aid Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Global Hearing Aid Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 51: Global Hearing Aid Industry Revenue Million Forecast, by Type of Hearing Loss 2020 & 2033

- Table 52: Global Hearing Aid Industry Volume K Unit Forecast, by Type of Hearing Loss 2020 & 2033

- Table 53: Global Hearing Aid Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 54: Global Hearing Aid Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 55: Global Hearing Aid Industry Revenue Million Forecast, by Patient Type 2020 & 2033

- Table 56: Global Hearing Aid Industry Volume K Unit Forecast, by Patient Type 2020 & 2033

- Table 57: Global Hearing Aid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Hearing Aid Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 59: China Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: China Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Japan Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Japan Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: India Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: India Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Australia Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Australia Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: South Korea Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: South Korea Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Rest of Asia Pacific Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Global Hearing Aid Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 72: Global Hearing Aid Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 73: Global Hearing Aid Industry Revenue Million Forecast, by Type of Hearing Loss 2020 & 2033

- Table 74: Global Hearing Aid Industry Volume K Unit Forecast, by Type of Hearing Loss 2020 & 2033

- Table 75: Global Hearing Aid Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 76: Global Hearing Aid Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 77: Global Hearing Aid Industry Revenue Million Forecast, by Patient Type 2020 & 2033

- Table 78: Global Hearing Aid Industry Volume K Unit Forecast, by Patient Type 2020 & 2033

- Table 79: Global Hearing Aid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Hearing Aid Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 81: GCC Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: GCC Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: South Africa Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: South Africa Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Global Hearing Aid Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 88: Global Hearing Aid Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 89: Global Hearing Aid Industry Revenue Million Forecast, by Type of Hearing Loss 2020 & 2033

- Table 90: Global Hearing Aid Industry Volume K Unit Forecast, by Type of Hearing Loss 2020 & 2033

- Table 91: Global Hearing Aid Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 92: Global Hearing Aid Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 93: Global Hearing Aid Industry Revenue Million Forecast, by Patient Type 2020 & 2033

- Table 94: Global Hearing Aid Industry Volume K Unit Forecast, by Patient Type 2020 & 2033

- Table 95: Global Hearing Aid Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 96: Global Hearing Aid Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 97: Brazil Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Brazil Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: Argentina Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Argentina Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Rest of South America Hearing Aid Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Rest of South America Hearing Aid Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hearing Aid Industry?

The projected CAGR is approximately 4.94%.

2. Which companies are prominent players in the Hearing Aid Industry?

Key companies in the market include WS Audiology AS (Sivantos Group WIDEX), GN Store Nord A/S, Amplifon SpA, Eargo Inc, Medtronic PLC, Sonova Holding AG, Starkey Hearing Technologies, Cochlear Ltd, Demant AS, Audina Hearing Instruments Inc, MED-EL, Horentek Hearing Diagnostics.

3. What are the main segments of the Hearing Aid Industry?

The market segments include Product Type, Type of Hearing Loss, Technology, Patient Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Hearing Loss; Technological Advancements in Hearing Aid Devices; Rising Awareness and Initiatives about Hearing Aid Devices.

6. What are the notable trends driving market growth?

Behind the Ear (BTE) Segment is Expected to Hold a Significant Market Share in the Product Type Segment Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Hearing Aid Devices and the Presence of Substitute Products.

8. Can you provide examples of recent developments in the market?

October 2022- Sony Electronics announced the availability of its first over-the-counter (OTC) hearing aids for the United States market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hearing Aid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hearing Aid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hearing Aid Industry?

To stay informed about further developments, trends, and reports in the Hearing Aid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence