Key Insights

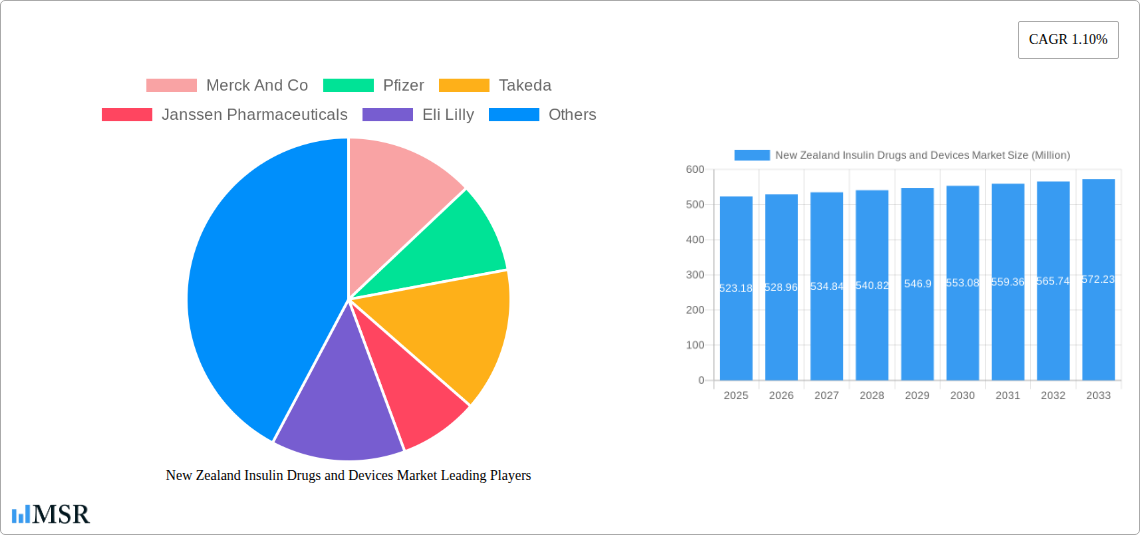

The New Zealand insulin drugs and devices market is projected to reach a valuation of approximately USD 523.18 million by 2025. While exhibiting steady growth, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 1.10% from 2025 to 2033. This modest growth rate suggests a mature market where incremental advancements and sustained demand are the primary drivers. The market's trajectory is influenced by several key factors. Increasing prevalence of diabetes, both Type 1 and Type 2, due to lifestyle changes, aging population, and improved diagnostic rates, forms the bedrock of demand. Furthermore, advancements in insulin formulations, including long-acting and rapid-acting insulins, alongside the growing adoption of biosimilar insulins, are shaping the drug segment. The insulin device market, particularly insulin pens and pumps, is experiencing a boost from technological innovations aimed at improving patient convenience, adherence, and glycemic control, thereby contributing to the overall market value.

New Zealand Insulin Drugs and Devices Market Market Size (In Million)

While the market demonstrates resilience, certain restraints may temper more aggressive growth. The high cost of advanced insulin therapies and sophisticated delivery devices can be a significant barrier for some patient segments and healthcare systems. Reimbursement policies and accessibility also play a crucial role in market penetration. Nevertheless, the continuous innovation pipeline from leading pharmaceutical and medical device manufacturers, including players like Novo Nordisk, Eli Lilly, and Sanofi, is expected to introduce more effective and patient-centric solutions. The growing awareness among healthcare professionals and patients about the benefits of integrated diabetes management, combining advanced drug therapies with smart devices, will continue to fuel market expansion. Key segments within the drugs market include basal, bolus, and traditional human insulins, alongside the emerging biosimilar and combination drug categories. On the devices front, insulin pens, pumps, and syringes remain prominent, with increasing interest in advanced delivery systems.

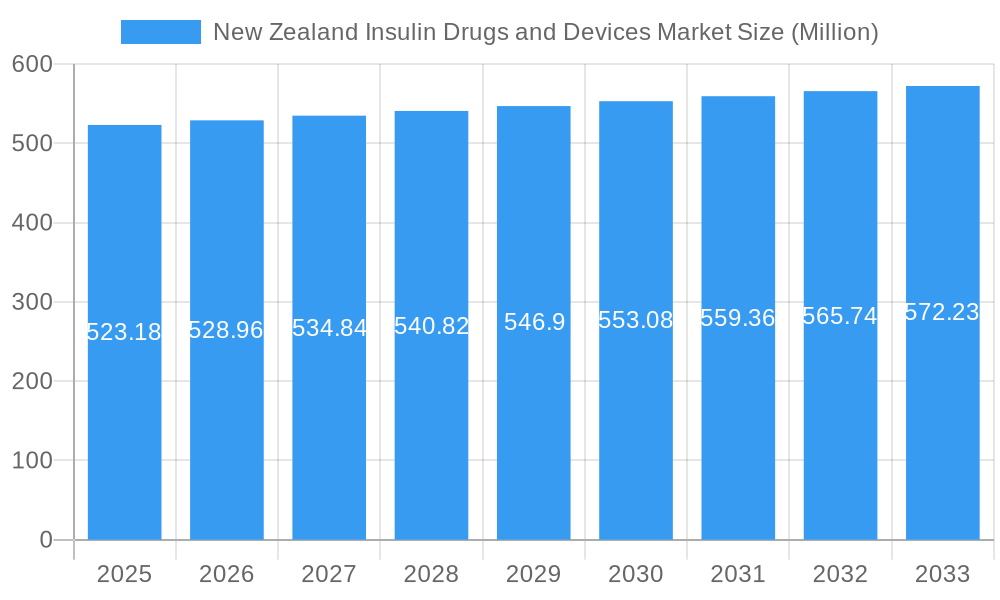

New Zealand Insulin Drugs and Devices Market Company Market Share

This in-depth report provides an exhaustive analysis of the New Zealand insulin drugs and devices market, meticulously examining key trends, growth drivers, and challenges shaping the landscape from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, the forecast period of 2025–2033 offers critical insights for industry stakeholders. The report delves into market concentration, innovation, regulatory dynamics, product segments including basal insulins, bolus insulins, biosimilar insulins, GLP-1 receptor agonists, and essential insulin devices like pumps and pens. We identify leading players such as Novo Nordisk, Eli Lilly, Sanofi, Merck And Co, and AstraZeneca, and highlight pivotal industry developments.

New Zealand Insulin Drugs and Devices Market Market Concentration & Dynamics

The New Zealand insulin drugs and devices market exhibits a moderate level of market concentration, characterized by the presence of both multinational pharmaceutical giants and specialized device manufacturers. Leading companies like Novo Nordisk, Eli Lilly, and Sanofi hold significant market share in the insulin drug segment, driven by robust product portfolios and established distribution networks. The insulin device market sees intense competition from players offering innovative solutions, including insulin pumps and smart pens. Innovation ecosystems are thriving, fueled by ongoing research and development into novel drug formulations, advanced delivery systems, and digital health integration for diabetes management. Regulatory frameworks, overseen by the New Zealand Medicines and Medical Devices Safety Authority (Medsafe), play a crucial role in ensuring product safety and efficacy, impacting market access and adoption timelines. Substitute products, such as oral antidiabetic medications and emerging non-insulin injectables like GLP-1 receptor agonists, present a competitive challenge, influencing prescribing patterns and market dynamics. End-user trends are shifting towards personalized treatment approaches, with a growing demand for user-friendly, connected devices that facilitate better blood glucose monitoring and insulin titration. Merger and acquisition (M&A) activities, while not as prolific as in larger markets, are observed as companies seek to expand their therapeutic offerings or gain access to new technologies. The New Zealand insulin market is dynamic, with companies constantly adapting to evolving clinical guidelines and patient needs.

New Zealand Insulin Drugs and Devices Market Industry Insights & Trends

The New Zealand insulin drugs and devices market is poised for significant growth, projected to reach an estimated XXX million by 2025, with a compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is primarily driven by the rising prevalence of diabetes in New Zealand, a consequence of lifestyle changes, an aging population, and an increasing incidence of type 2 diabetes. Technological disruptions are transforming the landscape, with a notable shift towards digital health solutions. The integration of continuous glucose monitoring (CGM) systems with insulin pumps, for example, offers a more sophisticated and personalized approach to diabetes management, improving glycemic control and reducing the burden of manual blood glucose testing. Smart insulin pens that track dosage and timing, along with mobile applications that provide real-time feedback and data logging, are gaining traction among patients and healthcare providers. Evolving consumer behaviors underscore a growing demand for convenience, accuracy, and self-management tools. Patients are increasingly empowered and seeking solutions that seamlessly integrate into their daily lives, leading to a preference for less invasive and more intuitive insulin delivery devices. The market is also witnessing increased uptake of biosimilar insulins, offering cost-effective alternatives to originator products, which is crucial for enhancing access and affordability, particularly within the New Zealand healthcare system. The growing awareness of diabetes complications and the importance of proactive management further fuel the demand for advanced insulin therapies and devices. The increasing focus on preventative healthcare and early intervention strategies also contributes to a larger patient pool requiring insulin management.

Key Markets & Segments Leading New Zealand Insulin Drugs and Devices Market

The New Zealand insulin drugs and devices market is dominated by the Insulin Drugs segment, within which Basal or Long Acting Insulins and Bolus or Fast Acting Insulins collectively represent the largest share. This dominance is attributed to their widespread prescription for both type 1 and type 2 diabetes management, serving as the cornerstone of glycemic control for millions of New Zealanders. The increasing diagnosis of diabetes, coupled with an aging population, directly translates to a sustained demand for these essential insulin types.

- Drivers for Basal and Bolus Insulins:

- High Prevalence of Diabetes: The persistent rise in diabetes diagnoses in New Zealand creates a constant need for these foundational insulin therapies.

- Clinical Guidelines: Established international and national clinical guidelines consistently recommend basal and bolus insulin regimens for optimal diabetes management.

- Technological Advancements: Continuous innovation in formulation and delivery systems for basal and bolus insulins enhances efficacy and patient compliance.

The Insulin Device segment, particularly Insulin Pumps and Insulin Pens, is experiencing rapid growth and is a key growth driver for the overall market. The adoption of these advanced devices is propelled by their ability to offer more precise insulin delivery, greater flexibility in lifestyle management, and improved patient outcomes compared to traditional syringes.

- Drivers for Insulin Pumps and Pens:

- Demand for Convenience and Accuracy: Patients are increasingly seeking less burdensome and more accurate insulin delivery methods.

- Technological Integration: The integration of pumps with CGM systems offers a closed-loop or semi-closed-loop experience, significantly improving glycemic control.

- Improved Quality of Life: Advanced devices empower patients with greater freedom and control over their diabetes management, enhancing their quality of life.

Within the Non-Insulin Products segment, GLP-1 receptor agonists are emerging as a significant category. These medications offer complementary benefits, including weight loss and cardiovascular protection, making them increasingly prescribed alongside or as alternatives to insulin for certain patient profiles.

- Drivers for GLP-1 Receptor Agonists:

- Dual Benefits: Their efficacy in both glycemic control and weight management makes them attractive treatment options.

- Cardiovascular Protection: Demonstrated cardiovascular benefits are a significant prescribing factor for patients with comorbid heart conditions.

- Growing Awareness: Increased clinical and patient awareness of their therapeutic advantages is driving adoption.

Biosimilar Insulins are also carving out a substantial market share due to their cost-effectiveness, making them crucial for expanding access to insulin therapy within the New Zealand public health system.

- Drivers for Biosimilar Insulins:

- Cost-Effectiveness: They provide a more affordable alternative, easing the financial burden on patients and healthcare providers.

- Increased Accessibility: Lower prices facilitate broader access to essential insulin treatments.

New Zealand Insulin Drugs and Devices Market Product Developments

Product innovation in the New Zealand insulin drugs and devices market is characterized by advancements in drug formulations and delivery systems. New generations of long-acting and rapid-acting insulins offer improved pharmacokinetic profiles, leading to better glycemic control and reduced hypoglycemia risks. The integration of smart technology into insulin pens and pumps is revolutionizing diabetes management, providing real-time data, dose tracking, and connectivity with healthcare providers. Furthermore, the development of novel non-insulin injectables like GLP-1 receptor agonists and amylin analogues offers complementary therapeutic options for patients with complex diabetes management needs. These product developments focus on enhancing patient convenience, improving treatment efficacy, and ultimately, elevating the quality of life for individuals living with diabetes in New Zealand.

Challenges in the New Zealand Insulin Drugs and Devices Market Market

The New Zealand insulin drugs and devices market faces several challenges that could impede its growth and accessibility. Regulatory hurdles in approving new drugs and devices can lead to prolonged market entry timelines. The cost of advanced insulin therapies and devices remains a significant barrier for some patients and the public healthcare system, influencing uptake and prescription patterns. Supply chain complexities, particularly for specialized biologics and devices, can lead to occasional stockouts and disruptions. Furthermore, physician and patient education regarding the benefits and proper use of newer insulin formulations and sophisticated delivery systems is an ongoing challenge, requiring sustained effort. Competitive pressures from established players and emerging alternative therapies also demand continuous innovation and strategic market positioning.

Forces Driving New Zealand Insulin Drugs and Devices Market Growth

Several key forces are driving the growth of the New Zealand insulin drugs and devices market. The increasing prevalence of diabetes due to lifestyle factors and an aging population is the primary demographic driver. Technological advancements, particularly in digital health integration with insulin pumps and continuous glucose monitors (CGMs), are enhancing treatment efficacy and patient convenience. Government initiatives and funding aimed at improving diabetes care access and affordability, including the provision of insulin and devices through public health services, are critical growth catalysts. The growing awareness among healthcare professionals and patients about the benefits of advanced insulin therapies and biosimil options further fuels market expansion.

Challenges in the New Zealand Insulin Drugs and Devices Market Market

Long-term growth in the New Zealand insulin drugs and devices market will be shaped by continued innovation and strategic market expansions. The development of ultra-long-acting insulins and novel delivery mechanisms promising even greater convenience and reduced injection frequency will be key. Strategic partnerships between pharmaceutical companies and technology providers are essential for advancing the integration of smart devices and data analytics for personalized diabetes management. Expanding the availability and affordability of biosimilar insulins will be crucial for sustained market penetration and patient access. Furthermore, exploring new indications and patient populations for existing and emerging therapies, alongside proactive engagement with healthcare policymakers, will ensure long-term market viability and growth.

Emerging Opportunities in New Zealand Insulin Drugs and Devices Market

Emerging opportunities in the New Zealand insulin drugs and devices market are abundant, driven by technological innovation and evolving patient needs. The burgeoning field of digital therapeutics presents a significant avenue for growth, with apps and platforms offering personalized coaching, remote patient monitoring, and data-driven insights to optimize insulin therapy. The increasing adoption of artificial intelligence (AI) in diabetes management, from predictive analytics for glucose trends to AI-powered insulin dosing algorithms, offers substantial potential. Furthermore, the development of novel insulin formulations with improved safety profiles and convenience, such as inhaled insulins or long-acting formulations with reduced injection burden, presents a promising market niche. Growing patient preference for integrated diabetes management solutions that combine insulin delivery, glucose monitoring, and lifestyle tracking will also drive demand for comprehensive device ecosystems.

Leading Players in the New Zealand Insulin Drugs and Devices Market Sector

- Novo Nordisk

- Eli Lilly

- Sanofi

- Merck And Co

- Pfizer

- Takeda

- Janssen Pharmaceuticals

- Novartis

- AstraZeneca

- Boehringer Ingelheim

- Bristol Myers Squibb

- Astellas

Key Milestones in New Zealand Insulin Drugs and Devices Market Industry

- 2019: Increased availability and subsidization of advanced insulin pumps under public health initiatives, enhancing patient access.

- 2020: Introduction of new biosimilar insulin formulations, offering cost-effective treatment alternatives.

- 2021: Growing adoption of connected insulin pens with data logging capabilities, empowering patients with better tracking.

- 2022: Enhanced integration of continuous glucose monitoring (CGM) systems with insulin pumps, paving the way for semi-closed-loop systems.

- 2023: Focus on digital health platforms for remote diabetes management and patient support programs.

- 2024: Continued research and development into next-generation insulins with improved efficacy and safety profiles.

Strategic Outlook for New Zealand Insulin Drugs and Devices Market Market

The strategic outlook for the New Zealand insulin drugs and devices market is positive, driven by a combination of increasing demand and rapid technological advancements. Key growth accelerators include the continued development and adoption of smart insulin delivery systems that integrate with digital health platforms, offering personalized and data-driven diabetes management. The expansion of biosimilar insulin availability will remain crucial for improving affordability and access. Furthermore, strategic collaborations between pharmaceutical companies, device manufacturers, and digital health solution providers are expected to create innovative, integrated diabetes care ecosystems. Emphasis on patient education and support programs will be vital for maximizing the benefits of advanced therapies and devices, ultimately leading to improved health outcomes and sustained market growth in New Zealand.

New Zealand Insulin Drugs and Devices Market Segmentation

-

1. Insulin Drugs

- 1.1. Basal or Long Acting Insulins

- 1.2. Bolus or Fast Acting Insulins

- 1.3. Traditional Human Insulins

- 1.4. Biosimilar Insulins

-

2. Combination drugs

- 2.1. Insulin combinations

- 2.2. Oral Combinations

-

3. Non-Insulin Products

- 3.1. GLP-1 receptor agonists

- 3.2. Amylin Analogue

-

4. Insulin Device

- 4.1. Insulin Pumps

- 4.2. Insulin Pens

- 4.3. Insulin Syringes

- 4.4. Insulin Jet Injectors

New Zealand Insulin Drugs and Devices Market Segmentation By Geography

- 1. New Zealand

New Zealand Insulin Drugs and Devices Market Regional Market Share

Geographic Coverage of New Zealand Insulin Drugs and Devices Market

New Zealand Insulin Drugs and Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures

- 3.3. Market Restrains

- 3.3.1. Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Insulin Drugs and Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insulin Drugs

- 5.1.1. Basal or Long Acting Insulins

- 5.1.2. Bolus or Fast Acting Insulins

- 5.1.3. Traditional Human Insulins

- 5.1.4. Biosimilar Insulins

- 5.2. Market Analysis, Insights and Forecast - by Combination drugs

- 5.2.1. Insulin combinations

- 5.2.2. Oral Combinations

- 5.3. Market Analysis, Insights and Forecast - by Non-Insulin Products

- 5.3.1. GLP-1 receptor agonists

- 5.3.2. Amylin Analogue

- 5.4. Market Analysis, Insights and Forecast - by Insulin Device

- 5.4.1. Insulin Pumps

- 5.4.2. Insulin Pens

- 5.4.3. Insulin Syringes

- 5.4.4. Insulin Jet Injectors

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Insulin Drugs

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Janssen Pharmaceuticals

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Novartis

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanof

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: New Zealand Insulin Drugs and Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: New Zealand Insulin Drugs and Devices Market Share (%) by Company 2025

List of Tables

- Table 1: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Insulin Drugs 2020 & 2033

- Table 2: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Insulin Drugs 2020 & 2033

- Table 3: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Combination drugs 2020 & 2033

- Table 4: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Combination drugs 2020 & 2033

- Table 5: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Non-Insulin Products 2020 & 2033

- Table 6: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Non-Insulin Products 2020 & 2033

- Table 7: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Insulin Device 2020 & 2033

- Table 8: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Insulin Device 2020 & 2033

- Table 9: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Insulin Drugs 2020 & 2033

- Table 12: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Insulin Drugs 2020 & 2033

- Table 13: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Combination drugs 2020 & 2033

- Table 14: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Combination drugs 2020 & 2033

- Table 15: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Non-Insulin Products 2020 & 2033

- Table 16: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Non-Insulin Products 2020 & 2033

- Table 17: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Insulin Device 2020 & 2033

- Table 18: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Insulin Device 2020 & 2033

- Table 19: New Zealand Insulin Drugs and Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: New Zealand Insulin Drugs and Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Insulin Drugs and Devices Market?

The projected CAGR is approximately 1.10%.

2. Which companies are prominent players in the New Zealand Insulin Drugs and Devices Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Janssen Pharmaceuticals, Eli Lilly, Novartis, AstraZeneca, Sanof, Bristol Myers Squibb, Novo Nordisk, Boehringer Ingelheim, Astellas.

3. What are the main segments of the New Zealand Insulin Drugs and Devices Market?

The market segments include Insulin Drugs , Combination drugs, Non-Insulin Products, Insulin Device .

4. Can you provide details about the market size?

The market size is estimated to be USD 523.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Geriatric Population and Changing Dietary Habits; High Prevalence of Irritable bowel syndrome with constipation (IBS-C) and Opioid-induced constipation (OIC) and Chronic Constipation; Development of Latest Drugs and Treatment Procedures.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

Increasing Dependence on Majority of Over-the-Counter (OTC) Drugs; Lack of Awareness and Reluctance Among Patients due to Adverse Effects of Opioid-Induced Constipation (OIC) Drugs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Insulin Drugs and Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Insulin Drugs and Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Insulin Drugs and Devices Market?

To stay informed about further developments, trends, and reports in the New Zealand Insulin Drugs and Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence