Key Insights

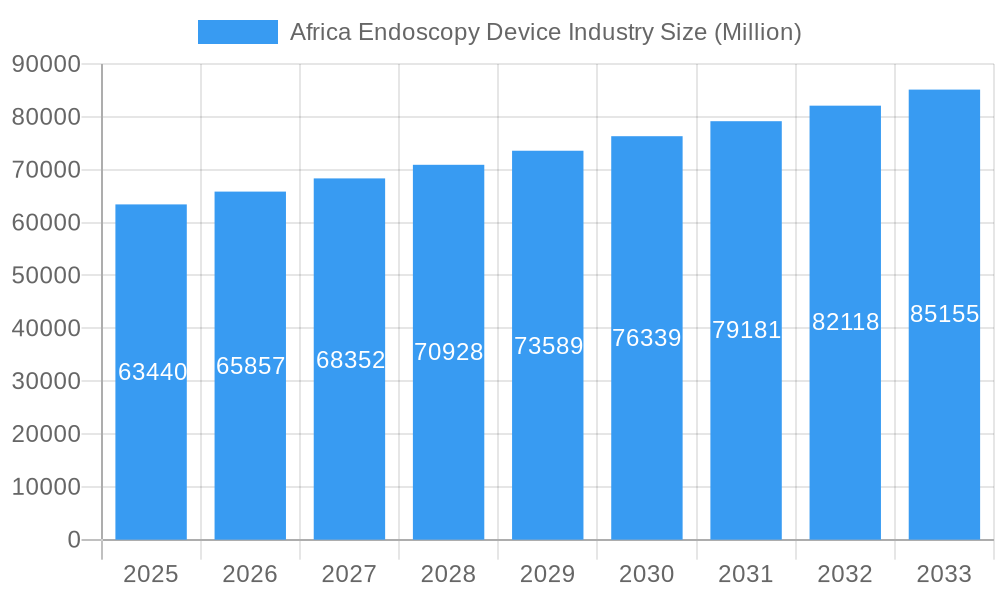

The Africa Endoscopy Device market is projected to reach an impressive USD 63.44 billion by 2025, exhibiting a steady Compound Annual Growth Rate (CAGR) of 3.82% throughout the forecast period of 2025-2033. This robust expansion is primarily fueled by the increasing prevalence of gastrointestinal, pulmonary, and gynecological disorders across the continent, necessitating advanced diagnostic and therapeutic interventions. Furthermore, a growing awareness of minimally invasive surgical procedures and the subsequent demand for sophisticated endoscopic equipment are key drivers. Investments in healthcare infrastructure, particularly in emerging economies within Africa, are also playing a pivotal role in expanding market access and adoption of these technologies. The rising disposable incomes and a burgeoning middle class are contributing to increased healthcare spending, further bolstering the market's growth trajectory.

Africa Endoscopy Device Industry Market Size (In Billion)

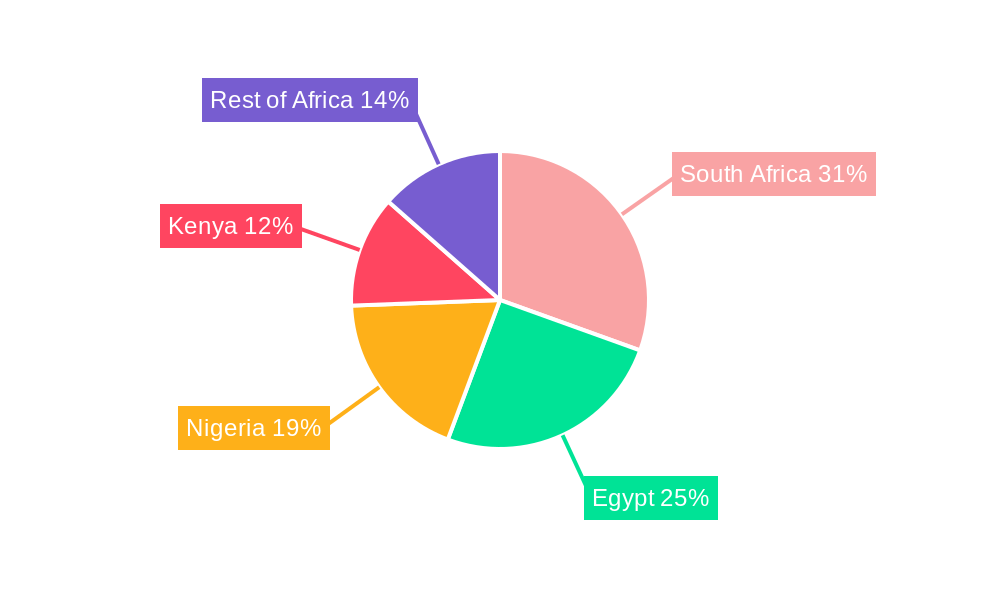

The market segmentation reveals diverse opportunities within the endoscopy device landscape. Endoscopic operative devices, including irrigation/suction systems and operative manual instruments, are anticipated to witness significant demand due to their integral role in facilitating various endoscopic procedures. Visualization systems, comprising HD and SD visualization systems, are also critical components, enabling enhanced clarity and precision for medical professionals. Gastroenterology and Pulmonology represent the leading application segments, driven by the high incidence of related diseases. Geographically, South Africa and Egypt are expected to dominate the market share, supported by well-established healthcare systems and higher adoption rates of advanced medical technologies. However, the rapid development of healthcare infrastructure and increasing patient populations in Nigeria and Kenya present substantial growth potential for the coming years. Addressing the cost of advanced endoscopy devices and ensuring adequate training for healthcare professionals remain key areas for market development.

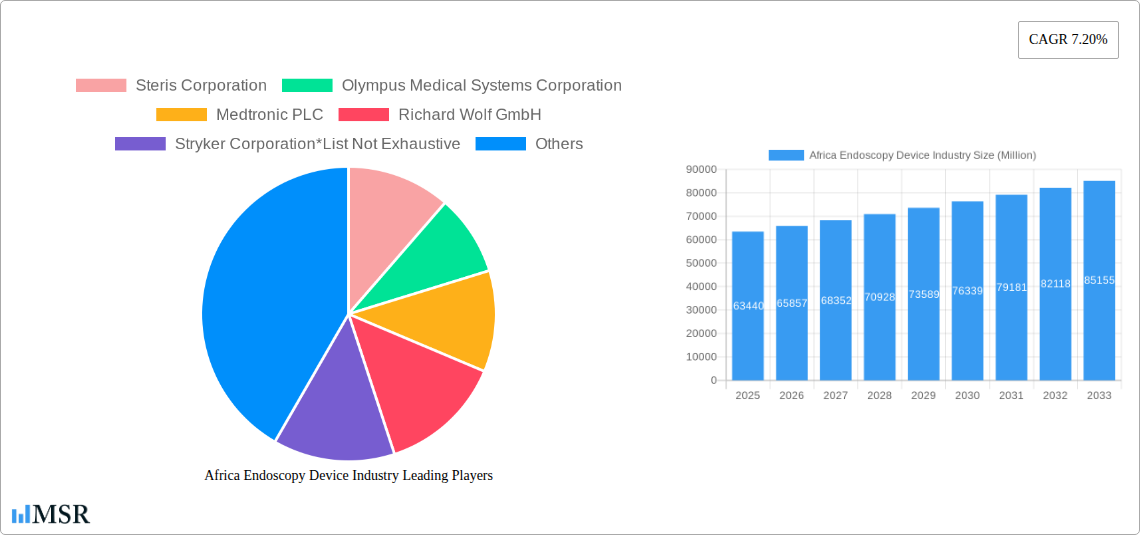

Africa Endoscopy Device Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the Africa Endoscopy Device Industry, a rapidly expanding sector driven by increasing healthcare demand, technological advancements, and growing patient awareness. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study provides critical insights for stakeholders seeking to capitalize on this burgeoning market. Discover market size, CAGR, key growth drivers, emerging trends, competitive landscape, and strategic recommendations for navigating the dynamic African endoscopy device market. This report is essential for endoscopy device manufacturers, medical device distributors, healthcare providers, investors, and policymakers looking to understand the immense potential and opportunities within Africa's gastroenterology, pulmonology, and urology segments, among others.

Africa Endoscopy Device Industry Market Concentration & Dynamics

The Africa Endoscopy Device Industry exhibits a moderate market concentration, with a few global giants holding significant market share, interspersed with emerging regional players. Innovation ecosystems are rapidly developing, fueled by increasing R&D investments and collaborations aimed at adapting advanced endoscopic technologies to the African context. Regulatory frameworks, while evolving, present a mixed landscape across different countries, influencing market access and product approvals. Substitute products, such as less invasive diagnostic tools, pose a minor threat, but the inherent diagnostic and therapeutic capabilities of endoscopy ensure its continued dominance. End-user trends are shifting towards minimally invasive procedures, driven by patient preference for reduced recovery times and improved outcomes. Mergers and acquisitions (M&A) activities are anticipated to increase as larger companies seek to expand their footprint and gain access to new markets and technologies within Africa. This dynamic environment offers substantial growth prospects for adaptable and forward-thinking industry participants.

Africa Endoscopy Device Industry Industry Insights & Trends

The Africa Endoscopy Device Industry is poised for robust growth, projected to reach a market size of USD XX billion by 2025, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily driven by the escalating prevalence of gastrointestinal disorders, respiratory illnesses, and urological conditions across the continent, necessitating advanced diagnostic and therapeutic interventions. Technological disruptions are at the forefront of this growth, with the increasing adoption of high-definition (HD) visualization systems, robot-assisted endoscopes, and advanced flexible endoscopes revolutionizing surgical procedures and patient care. Evolving consumer behaviors, influenced by growing awareness of minimally invasive techniques and their benefits, are further propelling demand for sophisticated endoscopic solutions. The rising disposable incomes in key African economies and government initiatives aimed at improving healthcare infrastructure are also significant contributors to market expansion. Furthermore, the increasing focus on preventive healthcare and early disease detection is creating a sustained demand for routine endoscopic examinations, particularly in gastroenterology. The development of more affordable and user-friendly endoscopy devices tailored to the African healthcare setting is also a key trend shaping the industry.

Key Markets & Segments Leading Africa Endoscopy Device Industry

South Africa and Egypt currently lead the Africa Endoscopy Device Industry, driven by their advanced healthcare infrastructure, higher per capita healthcare spending, and established medical tourism sectors. These regions are at the forefront of adopting innovative endoscopy devices, particularly flexible endoscopes and sophisticated visualization systems like HD visualization systems. The Gastroenterology application segment remains the largest, owing to the high incidence of diseases like peptic ulcers, GERD, and colorectal cancer. However, significant growth is also observed in Pulmonology and Urology, with increasing demand for rigid endoscopes and specialized operative manual instruments.

Dominant Segments:

- Endoscopy Devices:

- Flexible Endoscopes: Widely used in gastroenterology and pulmonology due to their versatility and ability to navigate complex anatomical structures.

- Visualization Systems: HD Visualization Systems are increasingly preferred for their superior image clarity, enabling more precise diagnoses and interventions.

- Application:

- Gastroenterology: Continues to be the primary driver due to the high burden of digestive diseases.

- Pulmonology: Growing demand for diagnostic bronchoscopy and interventional pulmonology procedures.

- Urology: Increasing adoption of ureteroscopes and cystoscopes for diagnosis and treatment of urinary tract conditions.

- Endoscopy Devices:

Growth Drivers:

- Economic Growth & Rising Healthcare Expenditure: Improved economic conditions in countries like Nigeria and Kenya are translating into increased government and private sector investment in healthcare infrastructure and medical equipment.

- Increasing Chronic Disease Prevalence: The rising rates of non-communicable diseases necessitate advanced diagnostic and treatment modalities offered by endoscopy.

- Technological Advancements: The availability of innovative endoscopic operative devices and imaging technologies enhances procedural efficacy and patient outcomes.

- Government Initiatives & Healthcare Reforms: Focus on expanding access to quality healthcare and modernizing medical facilities across the continent.

Africa Endoscopy Device Industry Product Developments

Product innovation is a critical differentiator in the Africa Endoscopy Device Industry. Key developments focus on enhancing image quality, miniaturization of devices, and the integration of artificial intelligence for diagnostic assistance. The introduction of capsule endoscopes offers non-invasive diagnostic solutions, while advancements in robot-assisted endoscopes are paving the way for more precise and minimally invasive surgical interventions. The development of integrated irrigation/suction systems and improved access devices further streamlines endoscopic procedures, contributing to better patient outcomes and procedural efficiency. These advancements are crucial for improving diagnostic accuracy and treatment efficacy across various medical specialties in Africa.

Challenges in the Africa Endoscopy Device Industry Market

The Africa Endoscopy Device Industry faces several challenges that can impede its growth trajectory. These include the high cost of advanced endoscopic equipment, which limits accessibility for many healthcare facilities, particularly in rural areas. Inadequate healthcare infrastructure and a shortage of trained medical professionals capable of operating and maintaining complex endoscopic systems are significant barriers. Furthermore, complex and sometimes inconsistent regulatory environments across different African nations can create hurdles for market entry and product distribution. Supply chain disruptions and logistical challenges in delivering and servicing medical devices across the vast African continent also pose considerable obstacles.

Forces Driving Africa Endoscopy Device Industry Growth

Several powerful forces are propelling the growth of the Africa Endoscopy Device Industry. A primary driver is the increasing global focus on minimally invasive surgery, which endoscopy epitomizes, leading to better patient outcomes and reduced hospital stays. The rising burden of lifestyle-related diseases, such as obesity, diabetes, and gastrointestinal cancers, is significantly boosting the demand for diagnostic and therapeutic endoscopic procedures. Furthermore, a growing middle class across Africa is leading to increased healthcare spending and demand for advanced medical technologies. Government investments in healthcare infrastructure and the establishment of specialized medical centers are also creating a more conducive environment for the adoption of endoscopy devices. The proactive engagement of international organizations and foreign investment in African healthcare further bolsters market expansion.

Challenges in the Africa Endoscopy Device Industry Market

Long-term growth catalysts in the Africa Endoscopy Device Industry lie in the sustained expansion of healthcare access and the continuous push for technological innovation tailored to the African context. The increasing urbanization and the associated rise in non-communicable diseases will continue to fuel demand for diagnostic and interventional endoscopy. Strategic partnerships between global endoscopy device manufacturers and local distributors and healthcare providers will be crucial for market penetration and localized support. Investment in training programs for healthcare professionals on advanced endoscopic techniques and equipment maintenance will further solidify the market's foundation. The development and adoption of more affordable, robust, and user-friendly endoscopy solutions will unlock significant growth potential in underserved regions.

Emerging Opportunities in Africa Endoscopy Device Industry

Emerging opportunities in the Africa Endoscopy Device Industry are abundant, driven by the vast unmet medical needs and the continent's rapid economic development. The growing adoption of robot-assisted endoscopes presents a significant opportunity for advanced surgical interventions. Furthermore, the increasing demand for preventative healthcare services is creating a market for screening endoscopy, especially in gastroenterology. The expansion of telehealth and remote diagnostics, coupled with portable endoscopy solutions, offers potential to reach remote populations. The growing focus on specialized applications like cardiology and neurology opens new avenues for market players. Collaborations for local manufacturing and assembly of endoscopy devices can also reduce costs and improve accessibility.

Leading Players in the Africa Endoscopy Device Industry Sector

- Steris Corporation

- Olympus Medical Systems Corporation

- Medtronic PLC

- Richard Wolf GmbH

- Stryker Corporation

- Karl Storz GmbH & Co KG

- Johnson & Johnson

- B Braun Melsungen AG

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

Key Milestones in Africa Endoscopy Device Industry Industry

- September 2022: Sony Corporation, Olympus Corporation, and Sony Olympus Medical Solutions Inc. entered into a joint venture to develop a surgical endoscopy system offering advanced visualization features like 4K, 3D, IR imaging, and NBI. This venture also aims to boost the value of endoscopic devices in Africa.

- February 2022: Karl Storz joined IFC Africa Medical Equipment Facility (AMEF). This participation supports smaller healthcare businesses in East and West Africa in acquiring endoscopic equipment through purchase or lease options.

Strategic Outlook for Africa Endoscopy Device Industry Market

The strategic outlook for the Africa Endoscopy Device Industry is exceptionally positive, characterized by strong growth accelerators. The increasing focus on improving public health outcomes and expanding access to quality healthcare across the continent will continue to drive demand. Key strategies for success include developing localized and affordable endoscopy solutions, investing in robust training programs for healthcare professionals, and forging strong distribution networks. Strategic partnerships with governments, NGOs, and local healthcare providers will be crucial for market penetration. Embracing technological advancements like AI-powered diagnostics and minimally invasive robotic systems will position companies for long-term success in this dynamic and promising market.

Africa Endoscopy Device Industry Segmentation

-

1. Endoscopy Devices

-

1.1. Endoscopes

- 1.1.1. Flexible Endoscopes

- 1.1.2. Rigid Endoscopes

- 1.1.3. Capsule Endoscopes

- 1.1.4. Robot-assisted Endoscopes

-

1.2. Endoscopic Operative Devices

- 1.2.1. Irrigation/Suction System

- 1.2.2. Access Devices

- 1.2.3. Wound Protector

- 1.2.4. Insufflation Devices

- 1.2.5. Operative Manual Instruments

- 1.2.6. Other Endoscopic Operative Devices

-

1.3. Visualization Systems

- 1.3.1. Endoscopic Camera

- 1.3.2. SD Visualization System

- 1.3.3. HD Visualization System

-

1.1. Endoscopes

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Cardiology

- 2.4. Urology

- 2.5. Neurology

- 2.6. Gynecology

- 2.7. Other Applications

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Nigeria

- 3.4. Kenya

- 3.5. Rest of the Africa

Africa Endoscopy Device Industry Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Nigeria

- 4. Kenya

- 5. Rest of the Africa

Africa Endoscopy Device Industry Regional Market Share

Geographic Coverage of Africa Endoscopy Device Industry

Africa Endoscopy Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Leading to Enhanced Applications; Rising Prevalence of Diseases that Require Endoscopy

- 3.3. Market Restrains

- 3.3.1. Infections Associated with Endoscopy; High Cost of Endoscopy Procedures and Equipment

- 3.4. Market Trends

- 3.4.1. Gastroenterology Segment is Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 5.1.1. Endoscopes

- 5.1.1.1. Flexible Endoscopes

- 5.1.1.2. Rigid Endoscopes

- 5.1.1.3. Capsule Endoscopes

- 5.1.1.4. Robot-assisted Endoscopes

- 5.1.2. Endoscopic Operative Devices

- 5.1.2.1. Irrigation/Suction System

- 5.1.2.2. Access Devices

- 5.1.2.3. Wound Protector

- 5.1.2.4. Insufflation Devices

- 5.1.2.5. Operative Manual Instruments

- 5.1.2.6. Other Endoscopic Operative Devices

- 5.1.3. Visualization Systems

- 5.1.3.1. Endoscopic Camera

- 5.1.3.2. SD Visualization System

- 5.1.3.3. HD Visualization System

- 5.1.1. Endoscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Cardiology

- 5.2.4. Urology

- 5.2.5. Neurology

- 5.2.6. Gynecology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Nigeria

- 5.3.4. Kenya

- 5.3.5. Rest of the Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Nigeria

- 5.4.4. Kenya

- 5.4.5. Rest of the Africa

- 5.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 6. South Africa Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 6.1.1. Endoscopes

- 6.1.1.1. Flexible Endoscopes

- 6.1.1.2. Rigid Endoscopes

- 6.1.1.3. Capsule Endoscopes

- 6.1.1.4. Robot-assisted Endoscopes

- 6.1.2. Endoscopic Operative Devices

- 6.1.2.1. Irrigation/Suction System

- 6.1.2.2. Access Devices

- 6.1.2.3. Wound Protector

- 6.1.2.4. Insufflation Devices

- 6.1.2.5. Operative Manual Instruments

- 6.1.2.6. Other Endoscopic Operative Devices

- 6.1.3. Visualization Systems

- 6.1.3.1. Endoscopic Camera

- 6.1.3.2. SD Visualization System

- 6.1.3.3. HD Visualization System

- 6.1.1. Endoscopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Gastroenterology

- 6.2.2. Pulmonology

- 6.2.3. Cardiology

- 6.2.4. Urology

- 6.2.5. Neurology

- 6.2.6. Gynecology

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Nigeria

- 6.3.4. Kenya

- 6.3.5. Rest of the Africa

- 6.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 7. Egypt Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 7.1.1. Endoscopes

- 7.1.1.1. Flexible Endoscopes

- 7.1.1.2. Rigid Endoscopes

- 7.1.1.3. Capsule Endoscopes

- 7.1.1.4. Robot-assisted Endoscopes

- 7.1.2. Endoscopic Operative Devices

- 7.1.2.1. Irrigation/Suction System

- 7.1.2.2. Access Devices

- 7.1.2.3. Wound Protector

- 7.1.2.4. Insufflation Devices

- 7.1.2.5. Operative Manual Instruments

- 7.1.2.6. Other Endoscopic Operative Devices

- 7.1.3. Visualization Systems

- 7.1.3.1. Endoscopic Camera

- 7.1.3.2. SD Visualization System

- 7.1.3.3. HD Visualization System

- 7.1.1. Endoscopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Gastroenterology

- 7.2.2. Pulmonology

- 7.2.3. Cardiology

- 7.2.4. Urology

- 7.2.5. Neurology

- 7.2.6. Gynecology

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Nigeria

- 7.3.4. Kenya

- 7.3.5. Rest of the Africa

- 7.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 8. Nigeria Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 8.1.1. Endoscopes

- 8.1.1.1. Flexible Endoscopes

- 8.1.1.2. Rigid Endoscopes

- 8.1.1.3. Capsule Endoscopes

- 8.1.1.4. Robot-assisted Endoscopes

- 8.1.2. Endoscopic Operative Devices

- 8.1.2.1. Irrigation/Suction System

- 8.1.2.2. Access Devices

- 8.1.2.3. Wound Protector

- 8.1.2.4. Insufflation Devices

- 8.1.2.5. Operative Manual Instruments

- 8.1.2.6. Other Endoscopic Operative Devices

- 8.1.3. Visualization Systems

- 8.1.3.1. Endoscopic Camera

- 8.1.3.2. SD Visualization System

- 8.1.3.3. HD Visualization System

- 8.1.1. Endoscopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Gastroenterology

- 8.2.2. Pulmonology

- 8.2.3. Cardiology

- 8.2.4. Urology

- 8.2.5. Neurology

- 8.2.6. Gynecology

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Nigeria

- 8.3.4. Kenya

- 8.3.5. Rest of the Africa

- 8.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 9. Kenya Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 9.1.1. Endoscopes

- 9.1.1.1. Flexible Endoscopes

- 9.1.1.2. Rigid Endoscopes

- 9.1.1.3. Capsule Endoscopes

- 9.1.1.4. Robot-assisted Endoscopes

- 9.1.2. Endoscopic Operative Devices

- 9.1.2.1. Irrigation/Suction System

- 9.1.2.2. Access Devices

- 9.1.2.3. Wound Protector

- 9.1.2.4. Insufflation Devices

- 9.1.2.5. Operative Manual Instruments

- 9.1.2.6. Other Endoscopic Operative Devices

- 9.1.3. Visualization Systems

- 9.1.3.1. Endoscopic Camera

- 9.1.3.2. SD Visualization System

- 9.1.3.3. HD Visualization System

- 9.1.1. Endoscopes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Gastroenterology

- 9.2.2. Pulmonology

- 9.2.3. Cardiology

- 9.2.4. Urology

- 9.2.5. Neurology

- 9.2.6. Gynecology

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Egypt

- 9.3.3. Nigeria

- 9.3.4. Kenya

- 9.3.5. Rest of the Africa

- 9.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 10. Rest of the Africa Africa Endoscopy Device Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 10.1.1. Endoscopes

- 10.1.1.1. Flexible Endoscopes

- 10.1.1.2. Rigid Endoscopes

- 10.1.1.3. Capsule Endoscopes

- 10.1.1.4. Robot-assisted Endoscopes

- 10.1.2. Endoscopic Operative Devices

- 10.1.2.1. Irrigation/Suction System

- 10.1.2.2. Access Devices

- 10.1.2.3. Wound Protector

- 10.1.2.4. Insufflation Devices

- 10.1.2.5. Operative Manual Instruments

- 10.1.2.6. Other Endoscopic Operative Devices

- 10.1.3. Visualization Systems

- 10.1.3.1. Endoscopic Camera

- 10.1.3.2. SD Visualization System

- 10.1.3.3. HD Visualization System

- 10.1.1. Endoscopes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Gastroenterology

- 10.2.2. Pulmonology

- 10.2.3. Cardiology

- 10.2.4. Urology

- 10.2.5. Neurology

- 10.2.6. Gynecology

- 10.2.7. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. South Africa

- 10.3.2. Egypt

- 10.3.3. Nigeria

- 10.3.4. Kenya

- 10.3.5. Rest of the Africa

- 10.1. Market Analysis, Insights and Forecast - by Endoscopy Devices

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Steris Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Olympus Medical Systems Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Richard Wolf GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Stryker Corporation*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Karl Storz GmbH & Co KG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boston Scientific Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fujifilm Holdings Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Steris Corporation

List of Figures

- Figure 1: Africa Endoscopy Device Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Endoscopy Device Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Endoscopy Device Industry Revenue undefined Forecast, by Endoscopy Devices 2020 & 2033

- Table 2: Africa Endoscopy Device Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Africa Endoscopy Device Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Africa Endoscopy Device Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Africa Endoscopy Device Industry Revenue undefined Forecast, by Endoscopy Devices 2020 & 2033

- Table 6: Africa Endoscopy Device Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Africa Endoscopy Device Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Africa Endoscopy Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Africa Endoscopy Device Industry Revenue undefined Forecast, by Endoscopy Devices 2020 & 2033

- Table 10: Africa Endoscopy Device Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Africa Endoscopy Device Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Africa Endoscopy Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Africa Endoscopy Device Industry Revenue undefined Forecast, by Endoscopy Devices 2020 & 2033

- Table 14: Africa Endoscopy Device Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Africa Endoscopy Device Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Africa Endoscopy Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Africa Endoscopy Device Industry Revenue undefined Forecast, by Endoscopy Devices 2020 & 2033

- Table 18: Africa Endoscopy Device Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Africa Endoscopy Device Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Africa Endoscopy Device Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Africa Endoscopy Device Industry Revenue undefined Forecast, by Endoscopy Devices 2020 & 2033

- Table 22: Africa Endoscopy Device Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Africa Endoscopy Device Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Africa Endoscopy Device Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Endoscopy Device Industry?

The projected CAGR is approximately 3.82%.

2. Which companies are prominent players in the Africa Endoscopy Device Industry?

Key companies in the market include Steris Corporation, Olympus Medical Systems Corporation, Medtronic PLC, Richard Wolf GmbH, Stryker Corporation*List Not Exhaustive, Karl Storz GmbH & Co KG, Johnson & Johnson, B Braun Melsungen AG, Boston Scientific Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the Africa Endoscopy Device Industry?

The market segments include Endoscopy Devices, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Leading to Enhanced Applications; Rising Prevalence of Diseases that Require Endoscopy.

6. What are the notable trends driving market growth?

Gastroenterology Segment is Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Infections Associated with Endoscopy; High Cost of Endoscopy Procedures and Equipment.

8. Can you provide examples of recent developments in the market?

In September 2022, Sony Corporation, Olympus Corporation, and Sony Olympus Medical Solutions Inc. entered into a joint venture to develop a surgical endoscopy system that offers surgical visualization features, including 4K, 3D, IR imaging, and NBI. This joint venture will also value the endoscopic devices of Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Endoscopy Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Endoscopy Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Endoscopy Device Industry?

To stay informed about further developments, trends, and reports in the Africa Endoscopy Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence