Key Insights

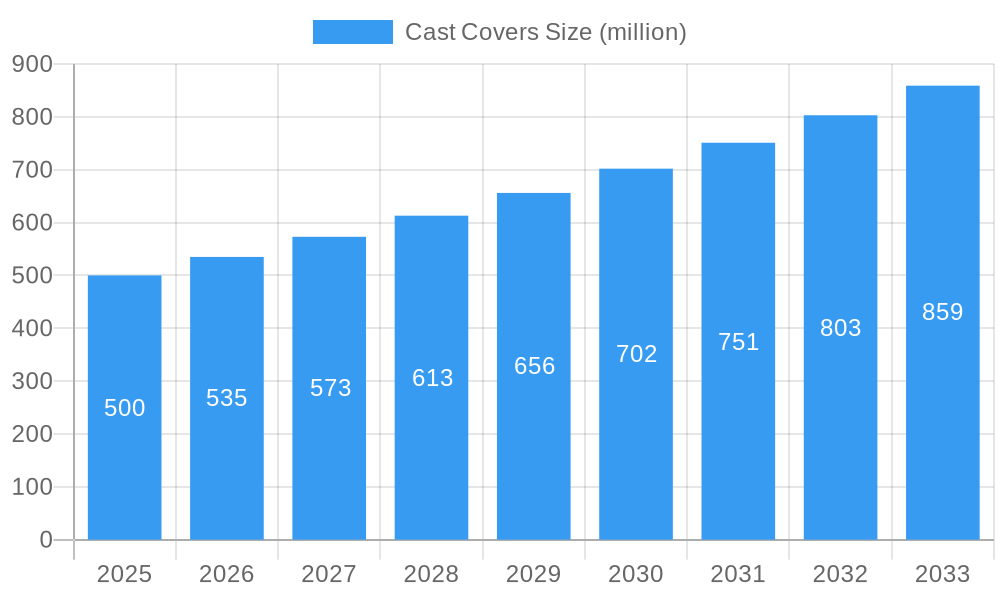

The global cast covers market is poised for robust growth, projected to reach an estimated $500 million in 2025. This expansion is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 7% through 2033. The increasing incidence of fractures and orthopedic injuries, particularly among aging populations and active individuals, is a primary driver. Furthermore, advancements in material science leading to more durable, waterproof, and comfortable cast cover options are enhancing patient compliance and satisfaction. The market segments encompass applications such as arms and legs, with polyethene and latex dominating the material types. While the market shows strong upward momentum, potential restraints include the availability of alternative treatments for certain injuries and the initial cost of higher-quality, specialized cast covers. The market's trajectory suggests a growing demand for effective and user-friendly solutions for fracture management.

Cast Covers Market Size (In Million)

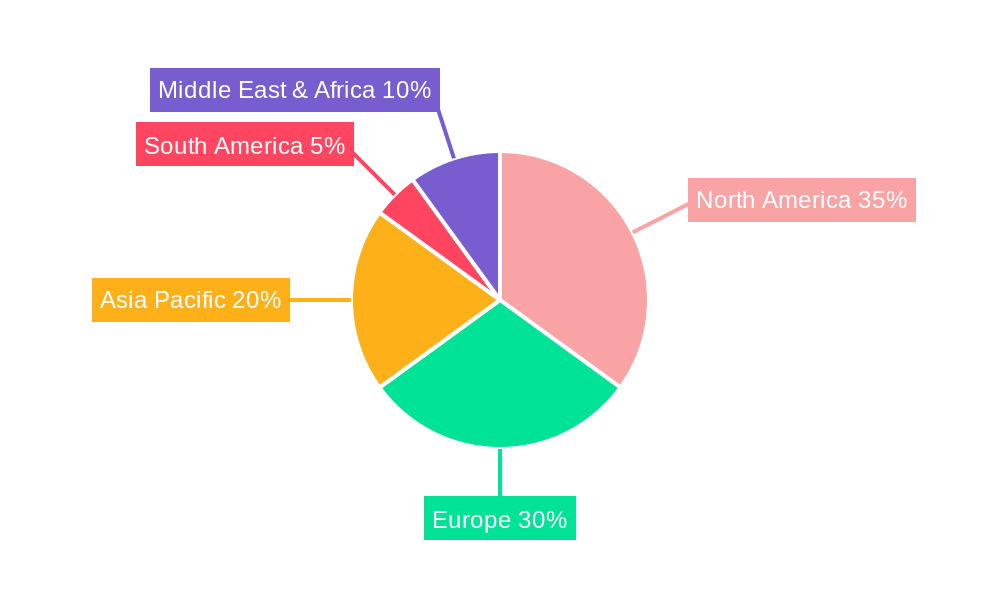

Geographically, North America is expected to lead the market in 2025, driven by a high prevalence of sports-related injuries and a well-established healthcare infrastructure. Europe follows closely, with a significant aging demographic contributing to increased demand for orthopedic care. The Asia Pacific region is anticipated to witness the fastest growth due to rising healthcare expenditure, expanding medical tourism, and a growing awareness of advanced wound and fracture care solutions. Key players such as AlboLand, QOL-Quality Of Life, and Innovation Rehab are actively investing in product development and market expansion to cater to these evolving demands. The market's future will likely be shaped by innovations in smart cast covers, improved patient comfort, and greater accessibility in emerging economies.

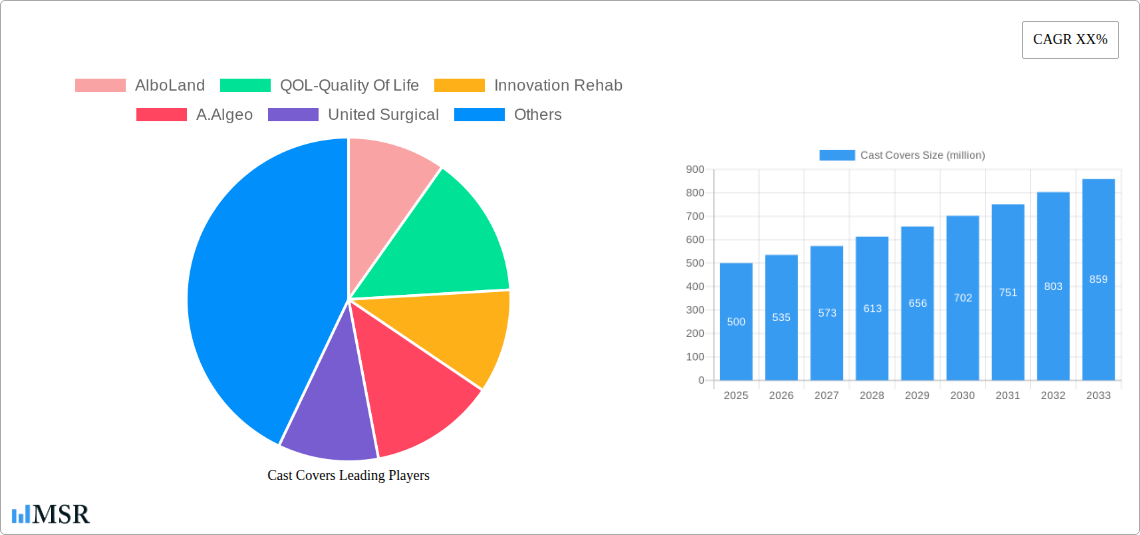

Cast Covers Company Market Share

Cast Covers Market Concentration & Dynamics

The global Cast Covers market is characterized by moderate concentration, with key players like AlboLand, QOL-Quality Of Life, Innovation Rehab, A.Algeo, United Surgical, and Briggs Healthcare holding significant market shares. The innovation ecosystem within the cast covers industry is robust, driven by continuous research and development in material science and user-centric design, aiming to enhance patient comfort and improve wound healing environments. Regulatory frameworks, primarily focused on medical device safety and efficacy, play a crucial role in market entry and product lifecycle management. Substitute products, such as traditional bandages and specialized wound dressings, present a competitive challenge, though cast covers offer superior protection and hygiene for immobilized limbs. End-user trends highlight a growing demand for durable, waterproof, and aesthetically pleasing cast covers, particularly among active individuals and pediatric patients. Mergers and Acquisitions (M&A) activities, though not yet at an extreme level, are expected to increase as larger companies seek to expand their product portfolios and gain market access. We anticipate approximately 5-10 M&A deals annually within the forecast period, valued at an aggregate of several hundred million. The market share distribution reveals that top 5 players collectively command over 65% of the global market, with AlboLand and QOL-Quality Of Life leading the pack in terms of revenue.

Cast Covers Industry Insights & Trends

The global Cast Covers market is poised for substantial growth, projected to reach a market size of over $600 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.5% from the base year 2025. This expansion is fueled by several interconnected factors. Firstly, the increasing prevalence of orthopedic injuries, sports-related trauma, and chronic conditions requiring immobilization, such as fractures, sprains, and post-surgical recovery, directly translates to a higher demand for effective cast protection. The aging global population also contributes significantly, as elderly individuals are more susceptible to falls and fractures, necessitating prolonged use of orthopedic devices and, consequently, cast covers.

Technological disruptions are revolutionizing the industry. The development of advanced materials like breathable, antimicrobial, and waterproof polyethylene variants offers enhanced patient comfort and hygiene, reducing the risk of skin irritation and infections. Smart cast covers incorporating sensors for monitoring vital signs or limb swelling are an emerging area of innovation. Furthermore, advancements in manufacturing processes, including automated production and 3D printing, are improving efficiency and enabling customization of cast covers to specific patient needs, thereby reducing production costs and lead times.

Evolving consumer behaviors are also shaping the market. Patients are becoming more informed and proactive about their healthcare, seeking solutions that offer convenience, aesthetic appeal, and improved functionality beyond basic protection. The demand for lightweight, easy-to-apply, and reusable cast covers is on the rise. Moreover, the growing awareness of hygiene and infection control, particularly in healthcare settings and post-pandemic, is driving the adoption of superior cast protection solutions. The integration of telehealth and remote patient monitoring is also creating opportunities for innovative cast cover designs that facilitate such practices. The market size in 2025 is estimated at $450 million, with a projected growth trajectory indicating a strong future.

Key Markets & Segments Leading Cast Covers

The global Cast Covers market is currently dominated by the Legs segment in terms of application, driven by the higher incidence of fractures and injuries affecting lower limbs. This dominance is underpinned by several factors, including the greater number of ambulatory individuals experiencing accidents and the longer recovery periods often associated with leg injuries. In 2025, the Legs segment is estimated to contribute over 55% of the total market revenue.

Economic Growth and Infrastructure: Regions with robust economies and well-developed healthcare infrastructure, such as North America and Europe, exhibit higher consumption of cast covers. Increased healthcare spending, greater access to advanced medical treatments, and a higher disposable income contribute to the strong market presence in these areas.

Prevalence of Sports and Outdoor Activities: Countries with a strong culture of sports and outdoor recreation, like the United States, Canada, Australia, and several European nations, witness a higher incidence of sports-related injuries, leading to increased demand for cast covers.

Types Dominance: Within the types of cast covers, Polyethylene remains the most prevalent due to its durability, water-resistance, and cost-effectiveness. Its widespread availability and proven performance make it the material of choice for a broad range of applications. However, the "Others" category, encompassing advanced composites and antimicrobial materials, is experiencing a significant CAGR of approximately 8.2%, indicating a growing shift towards premium and specialized solutions.

Regional Leadership: North America currently leads the global Cast Covers market, accounting for over 35% of the total market share in 2025. This leadership is attributed to a combination of factors: a high prevalence of orthopedic injuries, advanced healthcare systems, significant R&D investments, and a large aging population. The United States, in particular, is a key driver of this regional dominance. The market size for cast covers in North America alone is projected to exceed $150 million by 2025.

Cast Covers Product Developments

Recent product developments in the Cast Covers market are centered around enhancing patient comfort, hygiene, and usability. Innovations include the introduction of lightweight, breathable, and waterproof materials that prevent skin irritation and moisture build-up. Antimicrobial coatings are being integrated to reduce infection risks. Furthermore, designs are evolving to include easier application mechanisms, customizable fits through adjustable closures, and aesthetically pleasing options, particularly for pediatric patients. Technological advancements are also exploring smart features for remote monitoring of limb health. These developments aim to provide a superior patient experience and improve overall recovery outcomes, offering a distinct competitive edge.

Challenges in the Cast Covers Market

Despite robust growth, the Cast Covers market faces several challenges. Price Sensitivity among certain patient demographics and healthcare systems can limit the adoption of premium products, impacting market penetration. Supply Chain Disruptions, exacerbated by global events, can affect the availability and cost of raw materials, leading to production delays and increased costs, potentially impacting profit margins by up to 15%. Intense Competition from established players and the emergence of generic alternatives also pressures pricing. Regulatory compliance and the need for continuous product innovation to meet evolving standards add to operational complexities.

Forces Driving Cast Covers Growth

Several powerful forces are propelling the Cast Covers market forward. Rising Incidence of Orthopedic Injuries globally, fueled by an aging population, increased participation in sports, and accident rates, is a primary driver. Technological Advancements in material science, leading to more comfortable, durable, and hygienic cast covers, are enhancing product appeal. Growing Awareness of Hygiene and Infection Control in healthcare settings further boosts demand. Favorable Reimbursement Policies in certain regions for orthopedic treatments and assistive devices also contribute to market expansion, ensuring wider accessibility for patients.

Challenges in the Cast Covers Market

Long-term growth catalysts for the Cast Covers market are intrinsically linked to innovation and market expansion. The continuous development of Advanced Material Technologies, such as self-healing polymers and biodegradable options, will unlock new market segments and enhance product performance. Strategic Partnerships between cast cover manufacturers and orthopedic device companies can lead to integrated solutions and wider distribution channels. Furthermore, Market Expansions into emerging economies, where healthcare infrastructure is developing and awareness of advanced wound care is growing, presents significant untapped potential. The exploration of niche applications beyond traditional fracture care, like burn victim protection, also holds promise.

Emerging Opportunities in Cast Covers

Emerging opportunities in the Cast Covers market are diverse and promising. The development of Smart Cast Covers with integrated sensors for real-time monitoring of swelling, temperature, and pressure offers significant potential for remote patient care and improved treatment outcomes. The growing demand for Customized and Personalized Solutions, driven by advancements in 3D printing technology, allows for perfectly tailored cast covers for unique patient anatomies and preferences. Expansion into Pediatric and Geriatric Markets with specialized designs addressing specific needs, such as comfort and ease of use, presents a substantial growth avenue. Furthermore, the increasing focus on Sustainable and Eco-friendly Materials offers an opportunity for manufacturers to differentiate themselves and appeal to environmentally conscious consumers.

Leading Players in the Cast Covers Sector

- AlboLand

- QOL-Quality Of Life

- Innovation Rehab

- A.Algeo

- United Surgical

- Briggs Healthcare

Key Milestones in Cast Covers Industry

- 2019: Introduction of advanced breathable polyethylene materials, significantly improving patient comfort.

- 2020: Increased focus on antimicrobial properties in cast covers due to heightened hygiene awareness globally.

- 2021: Emergence of waterproof designs catering to active individuals and pediatric use, boosting sales by an estimated 15%.

- 2022: First significant adoption of customizable 3D-printed cast covers in niche markets.

- 2023: Major players begin investing heavily in R&D for smart cast cover technologies.

- 2024: Several key acquisitions aimed at consolidating market share and expanding product portfolios.

Strategic Outlook for Cast Covers Market

The strategic outlook for the Cast Covers market is exceptionally bright, with a projected sustained growth trajectory. Key growth accelerators include continued investment in R&D for advanced materials, the integration of smart technologies for remote patient monitoring, and the expansion into underserved geographical markets. Strategic partnerships and potential M&A activities will further shape the competitive landscape. The market's ability to adapt to evolving consumer demands for comfort, hygiene, and personalized solutions, alongside the increasing global burden of orthopedic injuries, positions it for robust long-term expansion and innovation.

Cast Covers Segmentation

-

1. Application

- 1.1. Arms

- 1.2. Legs

-

2. Types

- 2.1. Polyethylene

- 2.2. Latex

- 2.3. Others

Cast Covers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cast Covers Regional Market Share

Geographic Coverage of Cast Covers

Cast Covers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cast Covers Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Arms

- 5.1.2. Legs

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Polyethylene

- 5.2.2. Latex

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cast Covers Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Arms

- 6.1.2. Legs

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Polyethylene

- 6.2.2. Latex

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cast Covers Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Arms

- 7.1.2. Legs

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Polyethylene

- 7.2.2. Latex

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cast Covers Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Arms

- 8.1.2. Legs

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Polyethylene

- 8.2.2. Latex

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cast Covers Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Arms

- 9.1.2. Legs

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Polyethylene

- 9.2.2. Latex

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cast Covers Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Arms

- 10.1.2. Legs

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Polyethylene

- 10.2.2. Latex

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AlboLand

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 QOL-Quality Of Life

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Innovation Rehab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 A.Algeo

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 United Surgical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Briggs Healthcare

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 AlboLand

List of Figures

- Figure 1: Global Cast Covers Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Cast Covers Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Cast Covers Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Cast Covers Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Cast Covers Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Cast Covers Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Cast Covers Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cast Covers Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Cast Covers Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Cast Covers Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Cast Covers Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Cast Covers Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Cast Covers Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cast Covers Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Cast Covers Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Cast Covers Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Cast Covers Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Cast Covers Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Cast Covers Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cast Covers Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Cast Covers Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Cast Covers Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Cast Covers Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Cast Covers Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cast Covers Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cast Covers Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Cast Covers Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Cast Covers Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Cast Covers Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Cast Covers Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Cast Covers Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cast Covers Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Cast Covers Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Cast Covers Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global Cast Covers Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Cast Covers Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Cast Covers Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global Cast Covers Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Cast Covers Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Cast Covers Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global Cast Covers Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Cast Covers Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Cast Covers Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global Cast Covers Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Cast Covers Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Cast Covers Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global Cast Covers Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Cast Covers Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Cast Covers Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global Cast Covers Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Cast Covers Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cast Covers?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Cast Covers?

Key companies in the market include AlboLand, QOL-Quality Of Life, Innovation Rehab, A.Algeo, United Surgical, Briggs Healthcare.

3. What are the main segments of the Cast Covers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cast Covers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cast Covers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cast Covers?

To stay informed about further developments, trends, and reports in the Cast Covers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence