Key Insights

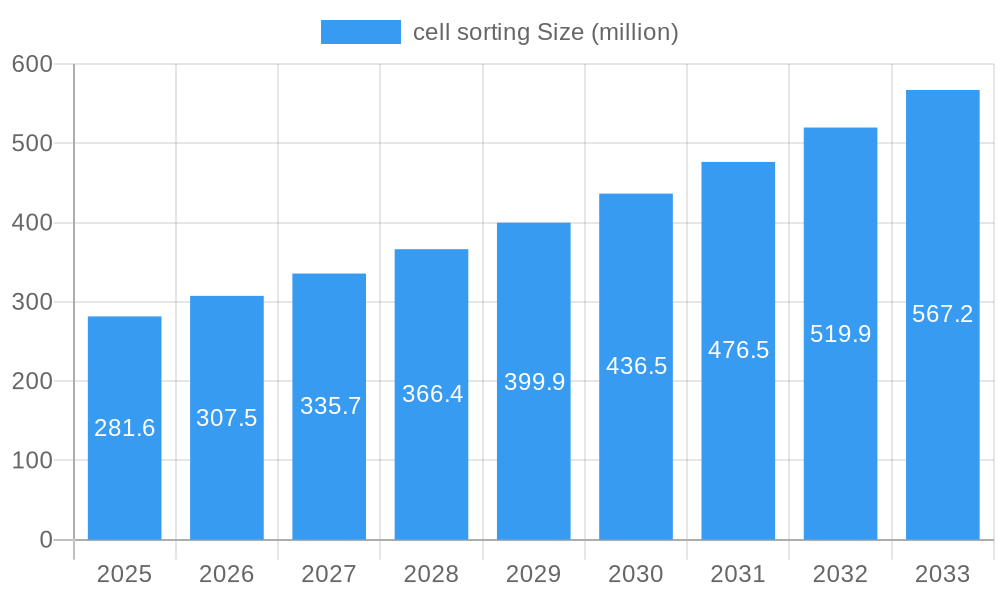

The global cell sorting market is poised for significant expansion, projected to reach $281.6 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 9.2% through 2033. This upward trajectory is primarily fueled by the increasing demand for advanced diagnostics and therapeutic applications, particularly in cancer research, regenerative medicine, and drug discovery. The burgeoning understanding of cellular mechanisms and the development of more sophisticated cell-based assays are creating a substantial need for high-precision cell sorting technologies. Furthermore, growing investments in life sciences research and development, coupled with the expanding pipeline of cell and gene therapies, are acting as strong growth catalysts. The market is also witnessing a surge in adoption of automated and high-throughput cell sorters, driven by the need for increased efficiency and reduced experimental variability in research and clinical settings.

cell sorting Market Size (In Million)

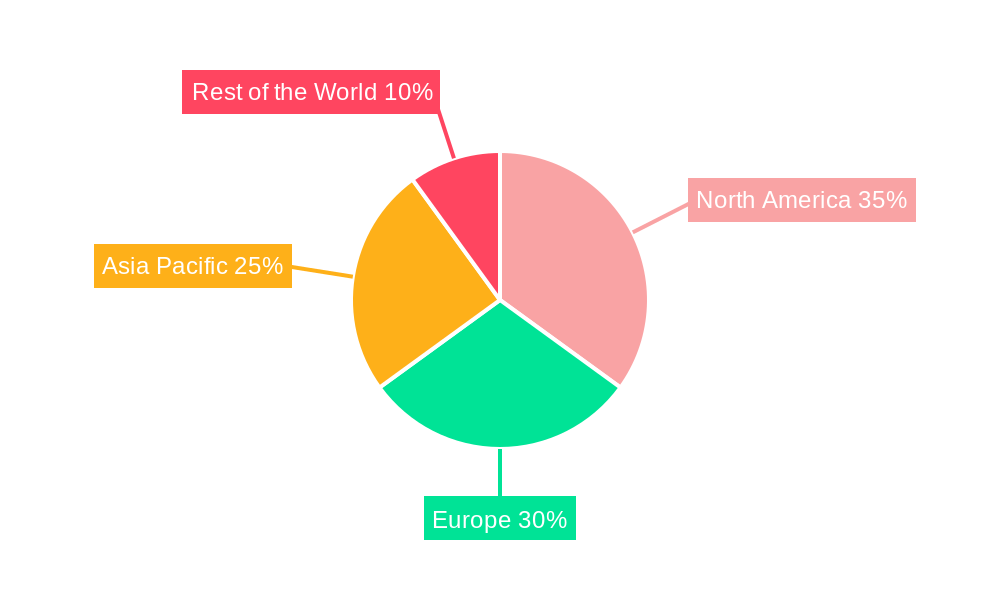

The market segmentation reveals a dynamic landscape, with the High-End Instrument Segment expected to dominate due to its superior capabilities in cell analysis and isolation. In terms of technology, Fluorescent Activated Cell Sorting (FACS) continues to be the leading type, owing to its versatility and widespread adoption in various research areas. However, advancements in Magnetic-activated Cell Sorting (MACS) and the emerging potential of MEMS-Microfluidics technologies are expected to offer compelling alternatives, particularly for specific applications requiring gentle cell handling and multiplexing capabilities. Geographically, North America is anticipated to maintain its leadership position, driven by a well-established research infrastructure, substantial R&D expenditure, and a high prevalence of chronic diseases. Asia Pacific is emerging as a key growth region, propelled by increasing healthcare investments and a growing focus on biopharmaceutical research.

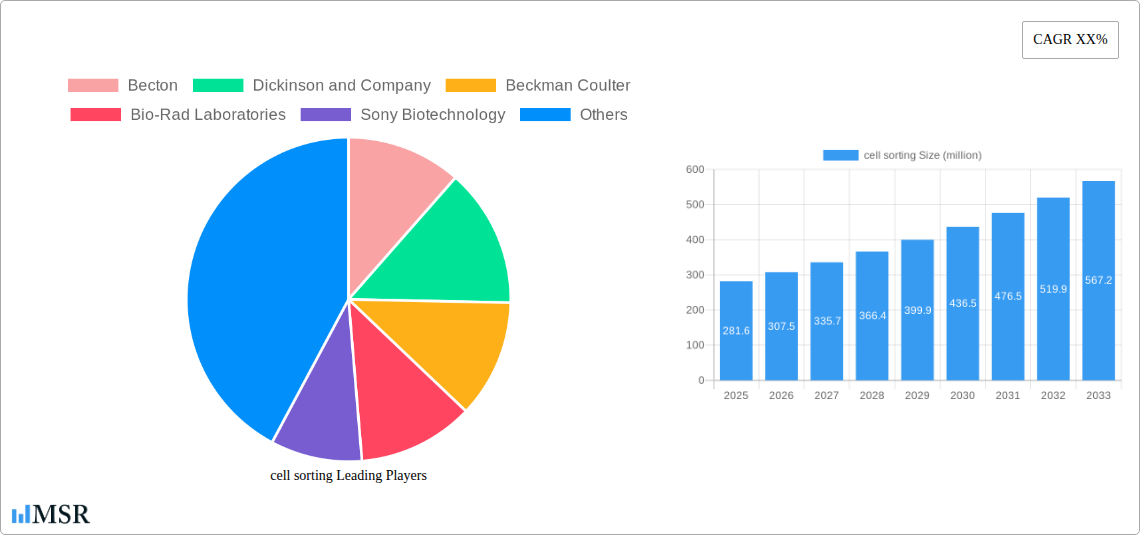

cell sorting Company Market Share

Comprehensive Cell Sorting Market Analysis: Trends, Innovations, and Strategic Outlook (2019-2033)

This in-depth report provides a complete analysis of the global cell sorting market, encompassing a detailed examination of its dynamics, key trends, leading segments, product innovations, challenges, growth drivers, emerging opportunities, and the strategic outlook. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for industry stakeholders seeking to understand market concentration, competitive landscapes, and future growth trajectories. The report leverages millions in market value projections and offers actionable insights for strategic decision-making in this rapidly evolving sector.

cell sorting Market Concentration & Dynamics

The cell sorting market exhibits a dynamic concentration, characterized by the presence of both established giants and emerging innovators. Major players like Becton, Dickinson and Company, Beckman Coulter, and Bio-Rad Laboratories hold significant market share, driven by extensive R&D investments and broad product portfolios. The innovation ecosystem thrives on academic-industry collaborations, fueling advancements in cell sorting technologies. Regulatory frameworks, primarily governed by health agencies, ensure product safety and efficacy, influencing market entry and product development timelines. Substitute products, such as flow cytometry analysis without sorting capabilities, offer alternative solutions but lack the precision of dedicated cell sorters. End-user trends are shifting towards personalized medicine, high-throughput screening, and single-cell analysis, demanding more sophisticated and automated cell sorting solutions. Merger and acquisition (M&A) activities are notable, with an estimated XX M&A deals in the historical period, reflecting a strategy to consolidate market presence and acquire new technologies. For instance, the acquisition of smaller specialized companies by larger entities aims to broaden their technological capabilities and expand their market reach. Key metrics like market share for leading companies are projected to remain competitive, with continuous innovation being the primary differentiator.

- Market Share: Leading companies collectively command over XX% of the market.

- M&A Deal Counts: XX significant M&A deals were recorded during the historical period.

- Innovation Ecosystem: Driven by academic partnerships and venture capital funding for startups.

- Regulatory Landscape: Strict adherence to FDA, EMA, and other regional health authority guidelines.

- End-User Trends: Increasing demand for automation, single-cell resolution, and multi-parametric analysis.

cell sorting Industry Insights & Trends

The cell sorting industry is experiencing robust growth, propelled by increasing demand in research, diagnostics, and therapeutic applications. The global cell sorting market size is projected to reach an estimated USD XX million by 2025, with a compound annual growth rate (CAGR) of XX% projected for the forecast period (2025–2033). This growth is largely attributed to the burgeoning field of immunotherapy, regenerative medicine, and the accelerating pace of drug discovery and development. Technological disruptions are continuously reshaping the market, with advancements in microfluidics, artificial intelligence, and automation enhancing the speed, accuracy, and efficiency of cell sorting processes. Evolving consumer behaviors, particularly among researchers and clinicians, emphasize the need for user-friendly, high-throughput, and cost-effective solutions. The growing prevalence of chronic diseases and the increasing investment in life sciences research globally are further fueling market expansion. Furthermore, the expanding applications of cell sorting in fields like synthetic biology, cell-based assays, and genomics are creating new avenues for market penetration. The demand for high-precision cell isolation for cell and gene therapies is a significant market driver, pushing the development of advanced sorting technologies.

Key Markets & Segments Leading cell sorting

The cell sorting market is segmented by application, type, and end-user, with certain segments exhibiting exceptional dominance and growth potential.

Dominant Regions and Countries:

- North America: Leads the global market due to substantial investments in biotechnology research, a well-established pharmaceutical industry, and the presence of leading research institutions. The United States, in particular, is a major consumer and innovator in cell sorting technologies.

- Europe: Represents another significant market, driven by strong government funding for life sciences research and the presence of numerous pharmaceutical and biotech companies. Countries like Germany, the UK, and Switzerland are key contributors.

- Asia Pacific: This region is emerging as a high-growth market, fueled by increasing healthcare expenditure, rising adoption of advanced technologies, and a growing biotech sector in countries like China and Japan.

Leading Application Segments:

- High-End Instrument Segment: This segment commands a substantial market share due to its superior capabilities in multi-parametric analysis, high-throughput sorting, and sophisticated cell manipulation. It is critical for cutting-edge research in immunology, cancer biology, and stem cell research. The demand for highly purified cell populations for cell and gene therapy applications further bolsters this segment.

- Mid-End Instrument Segment: This segment offers a balance of performance and cost-effectiveness, making it popular among academic research labs and smaller biotech companies. It provides adequate sorting capabilities for a wide range of applications.

- Low-End Instrument Segment: Characterized by more basic sorting functionalities, this segment caters to educational institutions and early-stage research where cost is a primary consideration.

Dominant Cell Sorting Types:

- Fluorescent Activated Cell Sorting (FACS): This is the most prevalent technology, leveraging fluorescently labeled antibodies to identify and sort cells based on their surface or intracellular markers. Its versatility and high accuracy make it indispensable for numerous research and diagnostic applications.

- Magnetic-activated Cell Sorting (MACS): This method utilizes magnetic beads conjugated to specific antibodies to magnetically label target cells, which are then separated using a magnetic field. MACS is often favored for its simplicity, speed, and ability to process larger sample volumes, particularly in immune cell isolation.

- MEMS-Microfluidics: While still an emerging technology, MEMS-based microfluidic cell sorting offers immense potential for miniaturization, reduced reagent consumption, and integration into point-of-care devices. Its adoption is expected to grow as the technology matures and becomes more accessible.

cell sorting Product Developments

Product innovation in the cell sorting market is characterized by a focus on enhanced throughput, precision, and automation. Companies are continuously introducing next-generation instruments that offer higher cell viability post-sorting, improved detection sensitivity, and the ability to sort more complex cell populations. The integration of artificial intelligence for automated gating and analysis, along with user-friendly software interfaces, is a significant trend. Furthermore, advancements in microfluidic chip designs are enabling smaller, more portable, and cost-effective cell sorting solutions, expanding their applicability in diverse research settings and potentially in clinical diagnostics. The development of novel fluorescent dyes and antibodies also contributes to more accurate and multiplexed cell analysis and sorting.

Challenges in the cell sorting Market

The cell sorting market faces several challenges that can impact growth and adoption. High instrument costs can be a significant barrier for smaller research institutions and developing economies. The complexity of some advanced cell sorting techniques requires specialized training and expertise, limiting their widespread use. Stringent regulatory approval processes for cell sorting technologies used in clinical applications can lead to lengthy development cycles and increased costs. Additionally, the supply chain for specialized reagents and consumables can be susceptible to disruptions. Competitive pressures from alternative separation methods and the continuous need for technological upgrades also present ongoing challenges for market players.

- High Capital Investment: The initial cost of advanced cell sorters can be prohibitive for many organizations.

- Technical Expertise Requirement: Sophisticated instruments demand skilled operators and maintenance personnel.

- Regulatory Hurdles: Obtaining approvals for clinical applications can be a time-consuming and expensive process.

- Consumables Cost: The ongoing expense of reagents and specialized consumables adds to the overall operational cost.

Forces Driving cell sorting Growth

Several key forces are propelling the growth of the cell sorting market. The accelerating pace of research in areas like cancer immunology, stem cell biology, and regenerative medicine necessitates precise cell isolation and analysis. The expanding applications of cell and gene therapies, which rely heavily on the purification of specific cell populations, are a major growth driver. Increased government and private sector investments in life sciences research and development globally are also contributing significantly. Technological advancements, including automation, AI integration, and microfluidics, are enhancing the capabilities and accessibility of cell sorting instruments. Furthermore, the growing demand for personalized medicine and the increasing adoption of high-throughput screening in drug discovery are creating substantial market opportunities.

Challenges in the cell sorting Market

Long-term growth catalysts in the cell sorting market are intrinsically linked to continued technological innovation and market expansion. The ongoing refinement of microfluidic cell sorting promises to deliver more portable, cost-effective, and user-friendly devices, opening up new markets and applications, including point-of-care diagnostics. Strategic partnerships between instrument manufacturers, reagent suppliers, and research institutions will foster the development of integrated solutions and accelerate product adoption. Furthermore, the increasing global burden of diseases requiring advanced therapeutic interventions, such as autoimmune disorders and genetic diseases, will continue to drive the demand for sophisticated cell sorting capabilities. Expansion into emerging economies with growing healthcare infrastructure and research capabilities represents another significant long-term growth avenue.

Emerging Opportunities in cell sorting

Emerging opportunities in the cell sorting market are abundant and diverse. The rapid growth of the cell and gene therapy market presents a substantial opportunity, as these therapies fundamentally depend on the precise isolation and expansion of specific cell types. The increasing use of cell sorting in liquid biopsies for early cancer detection and monitoring offers another promising avenue. Advances in AI and machine learning are enabling more sophisticated data analysis and automation in cell sorting, leading to improved efficiency and accuracy. The development of novel, multiplexed sorting capabilities, allowing for the simultaneous isolation of multiple cell populations based on various markers, is also creating new research possibilities. Furthermore, the exploration of cell sorting for quality control in biopharmaceutical manufacturing and the integration of cell sorting into microfluidic lab-on-a-chip devices for high-throughput screening are poised to drive future market expansion.

- Cell and Gene Therapy Expansion: Demand for high-purity cell isolation for novel therapeutics.

- Liquid Biopsy Advancements: Applications in early disease detection and treatment monitoring.

- AI and Machine Learning Integration: Enhancing automation, data analysis, and predictive capabilities.

- Multiplexed Sorting: Enabling the simultaneous isolation of multiple cell populations.

- Point-of-Care Diagnostics: Miniaturized and user-friendly cell sorting solutions.

Leading Players in the cell sorting Sector

- Becton, Dickinson and Company

- Beckman Coulter

- Bio-Rad Laboratories

- Sony Biotechnology

- Miltenyi Biotec GmbH

- Union Biometrica, Inc.

- Bay Bioscience

- Cytonome/St, LLC

Key Milestones in cell sorting Industry

- 2019: Introduction of new high-parameter flow cytometers with enhanced sorting capabilities by leading manufacturers.

- 2020: Increased focus on automation and AI integration in cell sorter software to improve user experience and efficiency.

- 2021: Significant advancements in microfluidic cell sorting technologies, leading to more compact and cost-effective instruments.

- 2022: Growing adoption of cell sorting in clinical trials for cell and gene therapies, driving demand for GMP-compliant solutions.

- 2023: Launch of novel fluorescent probes and reagents enabling more precise and multiplexed cell identification and sorting.

- 2024: Expansion of cell sorting applications into liquid biopsy analysis for early cancer detection and disease monitoring.

Strategic Outlook for cell sorting Market

The strategic outlook for the cell sorting market remains exceptionally positive, driven by sustained innovation and expanding application frontiers. Growth accelerators will center on the continued development of highly automated and intelligent cell sorting systems that can streamline complex workflows and reduce the need for specialized expertise. The increasing convergence of cell sorting with other advanced technologies like single-cell genomics and transcriptomics will unlock new avenues for discovery and therapeutic development. Strategic collaborations between technology providers and end-users will be crucial in tailoring solutions to meet evolving research and clinical needs. Furthermore, the growing demand for cell-based therapies worldwide will ensure a sustained and robust market for advanced cell sorting instrumentation and consumables, positioning the market for significant future expansion.

cell sorting Segmentation

-

1. Application

- 1.1. Low-End Instrument Segment

- 1.2. Mid-End Instrument Segment

- 1.3. High-End Instrument Segment

-

2. Types

- 2.1. Fluorescent Activated Cell Sorting

- 2.2. Magnetic-activated Cell Sorting

- 2.3. MEMS-Microfluidics

cell sorting Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

cell sorting Regional Market Share

Geographic Coverage of cell sorting

cell sorting REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global cell sorting Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Low-End Instrument Segment

- 5.1.2. Mid-End Instrument Segment

- 5.1.3. High-End Instrument Segment

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fluorescent Activated Cell Sorting

- 5.2.2. Magnetic-activated Cell Sorting

- 5.2.3. MEMS-Microfluidics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America cell sorting Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Low-End Instrument Segment

- 6.1.2. Mid-End Instrument Segment

- 6.1.3. High-End Instrument Segment

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fluorescent Activated Cell Sorting

- 6.2.2. Magnetic-activated Cell Sorting

- 6.2.3. MEMS-Microfluidics

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America cell sorting Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Low-End Instrument Segment

- 7.1.2. Mid-End Instrument Segment

- 7.1.3. High-End Instrument Segment

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fluorescent Activated Cell Sorting

- 7.2.2. Magnetic-activated Cell Sorting

- 7.2.3. MEMS-Microfluidics

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe cell sorting Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Low-End Instrument Segment

- 8.1.2. Mid-End Instrument Segment

- 8.1.3. High-End Instrument Segment

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fluorescent Activated Cell Sorting

- 8.2.2. Magnetic-activated Cell Sorting

- 8.2.3. MEMS-Microfluidics

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa cell sorting Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Low-End Instrument Segment

- 9.1.2. Mid-End Instrument Segment

- 9.1.3. High-End Instrument Segment

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fluorescent Activated Cell Sorting

- 9.2.2. Magnetic-activated Cell Sorting

- 9.2.3. MEMS-Microfluidics

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific cell sorting Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Low-End Instrument Segment

- 10.1.2. Mid-End Instrument Segment

- 10.1.3. High-End Instrument Segment

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fluorescent Activated Cell Sorting

- 10.2.2. Magnetic-activated Cell Sorting

- 10.2.3. MEMS-Microfluidics

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dickinson and Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beckman Coulter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bio-Rad Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sony Biotechnology

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Miltenyi Biotec GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Union Biometrica

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bay Bioscience

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cytonome/St

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Becton

List of Figures

- Figure 1: Global cell sorting Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America cell sorting Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America cell sorting Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America cell sorting Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America cell sorting Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America cell sorting Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America cell sorting Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America cell sorting Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America cell sorting Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America cell sorting Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America cell sorting Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America cell sorting Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America cell sorting Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe cell sorting Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe cell sorting Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe cell sorting Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe cell sorting Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe cell sorting Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe cell sorting Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa cell sorting Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa cell sorting Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa cell sorting Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa cell sorting Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa cell sorting Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa cell sorting Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific cell sorting Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific cell sorting Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific cell sorting Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific cell sorting Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific cell sorting Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific cell sorting Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global cell sorting Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global cell sorting Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global cell sorting Revenue undefined Forecast, by Types 2020 & 2033

- Table 4: Global cell sorting Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global cell sorting Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global cell sorting Revenue undefined Forecast, by Types 2020 & 2033

- Table 7: Global cell sorting Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global cell sorting Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global cell sorting Revenue undefined Forecast, by Types 2020 & 2033

- Table 13: Global cell sorting Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global cell sorting Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global cell sorting Revenue undefined Forecast, by Types 2020 & 2033

- Table 19: Global cell sorting Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global cell sorting Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global cell sorting Revenue undefined Forecast, by Types 2020 & 2033

- Table 31: Global cell sorting Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global cell sorting Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global cell sorting Revenue undefined Forecast, by Types 2020 & 2033

- Table 40: Global cell sorting Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific cell sorting Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the cell sorting?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the cell sorting?

Key companies in the market include Becton, Dickinson and Company, Beckman Coulter, Bio-Rad Laboratories, Sony Biotechnology, Miltenyi Biotec GmbH, Union Biometrica, Inc, Bay Bioscience, Cytonome/St, LLC.

3. What are the main segments of the cell sorting?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "cell sorting," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the cell sorting report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the cell sorting?

To stay informed about further developments, trends, and reports in the cell sorting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence