Key Insights

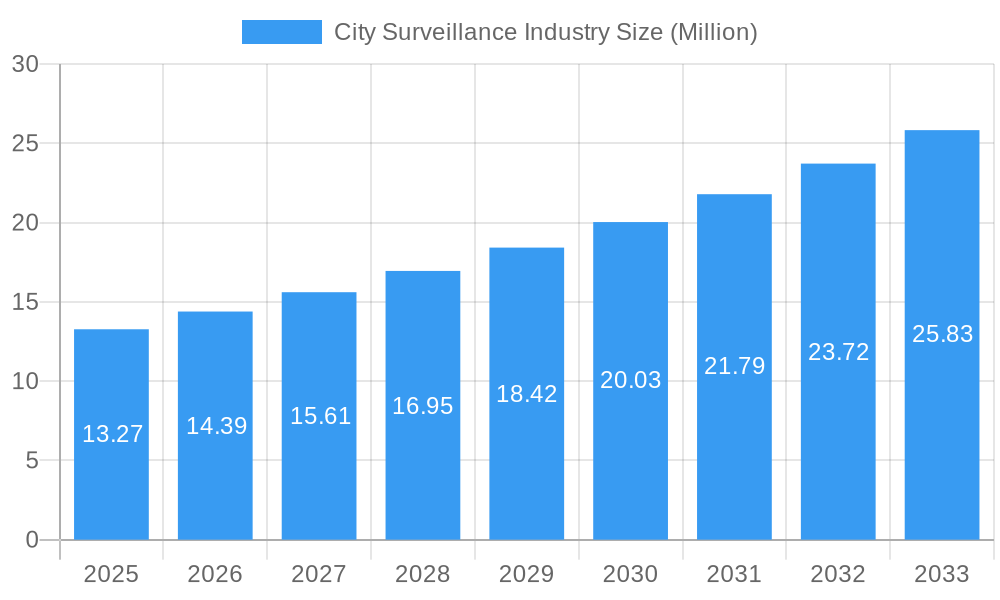

The global City Surveillance Industry is poised for significant expansion, projected to reach a market size of $13.27 million by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 8.50%, indicating robust market momentum. The primary drivers behind this surge are increasing urbanization, a heightened focus on public safety and security, and the continuous technological advancements in video surveillance solutions. As cities worldwide grapple with evolving security challenges, from crime prevention to traffic management and emergency response, the demand for sophisticated city surveillance systems is escalating. These systems are becoming more integrated and intelligent, leveraging AI and advanced analytics to provide real-time insights and proactive threat detection. The industry is witnessing a strong emphasis on upgrading existing infrastructure with higher resolution cameras, advanced storage capabilities, and comprehensive video management systems. Furthermore, the integration of video analytics is a critical trend, enabling cities to extract valuable data for improved urban planning, operational efficiency, and crime pattern analysis, solidifying its importance in creating safer and more efficient urban environments.

City Surveillance Industry Market Size (In Million)

The industry is segmented into key components, with Cameras, Storage solutions, Video Management Systems (VMS), and Video Analytics forming the core of market offerings. Each segment is experiencing its own growth trajectory, driven by innovation and increasing adoption. For instance, the demand for intelligent cameras with AI capabilities is rising, while VMS platforms are becoming more cloud-based and feature-rich. Video analytics, in particular, is a rapidly evolving segment, offering solutions for facial recognition, object detection, crowd monitoring, and anomaly detection. Leading companies such as Hangzhou Hikvision Digital Technology Co Ltd, Dahua Technology Co Ltd, Axis Communications, and Bosch Security and Safety Systems are at the forefront of this market, investing heavily in research and development to offer cutting-edge solutions. While the market presents numerous opportunities, potential restraints include the high initial investment costs for comprehensive surveillance systems, concerns around data privacy and cybersecurity, and the need for skilled personnel to manage and operate these complex systems. Despite these challenges, the overarching need for enhanced urban safety and security ensures a dynamic and expanding future for the City Surveillance Industry.

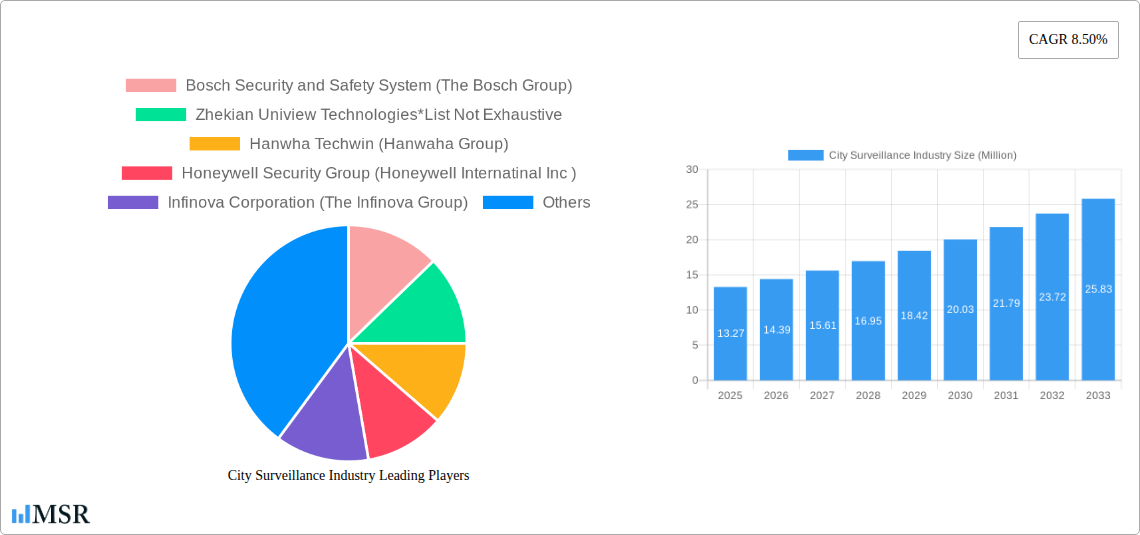

City Surveillance Industry Company Market Share

Unveiling the Future of Urban Safety: A Comprehensive City Surveillance Industry Report

This in-depth market research report offers an unparalleled analysis of the global city surveillance market, delving into its intricate dynamics, growth trajectories, and future potential. Examining the period from 2019 to 2033, with a base and estimated year of 2025, this report provides actionable insights for stakeholders seeking to navigate the rapidly evolving public safety technology landscape. Discover key drivers, emerging trends, and the competitive strategies shaping the smart city security ecosystem, including essential data on the video surveillance market size and CAGR.

City Surveillance Industry Market Concentration & Dynamics

The city surveillance industry exhibits a moderate to high market concentration, with a few key players holding significant market share. Innovation is primarily driven by advancements in Artificial Intelligence (AI), cloud computing, and the Internet of Things (IoT), fostering vibrant innovation ecosystems. Regulatory frameworks, particularly concerning data privacy and ethical surveillance, play a crucial role in shaping market dynamics. Substitute products, while emerging, are largely confined to niche applications, with integrated video surveillance systems remaining dominant. End-user trends point towards increasing demand for intelligent, scalable, and integrated solutions, especially from government agencies and law enforcement. Mergers and acquisitions (M&A) are a significant factor, with an estimated XX M&A deals in the historical period. Key players are actively consolidating to expand their technological capabilities and market reach. The market share of the top 5 players is estimated to be around 65%.

- Key Market Dynamics:

- Rapid adoption of AI-powered video analytics.

- Increasing focus on cybersecurity for surveillance systems.

- Growing demand for cloud-based surveillance solutions.

- Stringent data privacy regulations impacting deployment strategies.

City Surveillance Industry Industry Insights & Trends

The city surveillance industry is experiencing robust growth, projected to reach a market size of over $XXX Billion by 2033. The Compound Annual Growth Rate (CAGR) is estimated at XX% during the forecast period (2025–2033). Key growth drivers include the escalating need for enhanced public safety and security in urban environments, the proliferation of smart city initiatives globally, and the continuous technological advancements in video analytics and AI. The increasing threat of terrorism and crime further fuels the demand for sophisticated surveillance solutions. Furthermore, government investments in smart city infrastructure and a growing awareness of the benefits of proactive crime prevention are significant catalysts. The integration of surveillance systems with other smart city applications, such as traffic management and emergency response, is creating new avenues for growth. Evolving consumer behaviors, characterized by a greater acceptance of technology for public safety, also contribute to market expansion. The market is witnessing a shift towards more intelligent, integrated, and data-driven surveillance platforms.

Key Markets & Segments Leading City Surveillance Industry

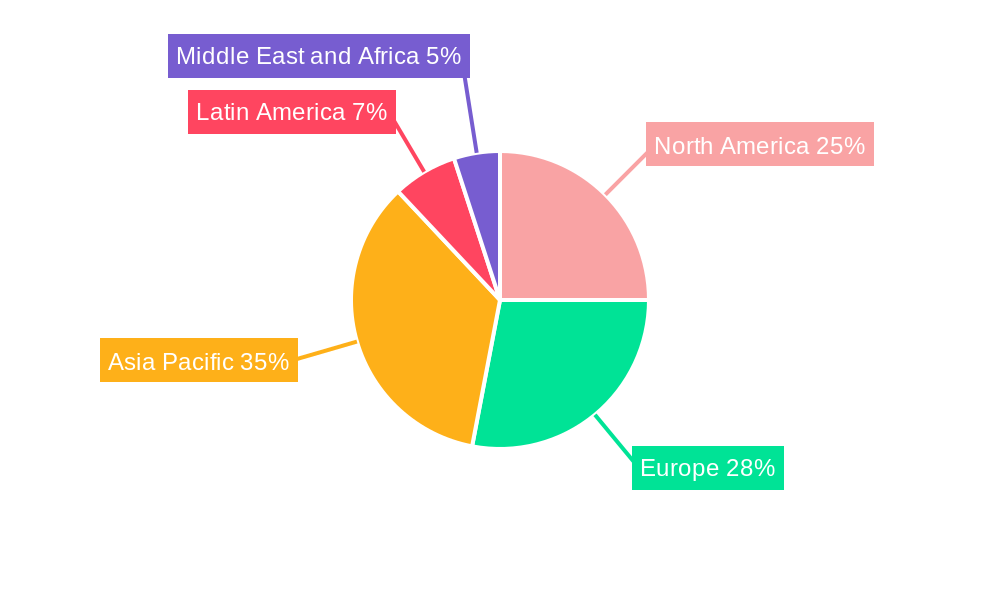

North America currently leads the city surveillance industry, driven by significant government investments in public safety and smart city infrastructure, coupled with a high adoption rate of advanced technologies. The United States, in particular, is a dominant market, influenced by its proactive approach to urban security and the presence of major technology providers.

- Component Segments Dominance:

- Camera: The camera segment is the largest contributor to the market, fueled by the demand for high-resolution, intelligent cameras with advanced features like AI-powered object detection and facial recognition. Technological innovations in PTZ cameras and fixed dome cameras continue to drive adoption.

- Drivers: Technological advancements, increasing deployment in smart city projects, need for high-quality video evidence.

- Video Analytics: This segment is experiencing the fastest growth, driven by the increasing demand for actionable intelligence from surveillance footage. AI and machine learning are transforming video analytics, enabling real-time threat detection, crowd analysis, and behavioral monitoring.

- Drivers: AI integration, demand for proactive security, efficiency gains in data analysis.

- Video Management System (VMS): VMS solutions are crucial for integrating and managing vast amounts of video data from multiple sources. The development of cloud-based and scalable VMS platforms is a key trend.

- Drivers: Need for centralized management, scalability, integration with other security systems.

- Storage: With the exponential increase in video data generation, robust and scalable storage solutions are becoming increasingly critical.

- Drivers: Increasing video resolution, longer retention periods, growth of analytics requiring extensive data.

- Camera: The camera segment is the largest contributor to the market, fueled by the demand for high-resolution, intelligent cameras with advanced features like AI-powered object detection and facial recognition. Technological innovations in PTZ cameras and fixed dome cameras continue to drive adoption.

City Surveillance Industry Product Developments

Recent product developments highlight the industry's commitment to innovation and enhancing situational awareness. For instance, in July 2022, Hangzhou Hikvision Digital Technology Co. Ltd launched its new DeepinView bullet network cameras with TandemVu technology. This advancement extends TandemVu technology beyond PTZ units to bullet-styled models, enabling simultaneous monitoring of large scenes and close-up details. This capability significantly improves situational awareness and security effectiveness. Concurrently, in March 2022, Hanwha Techwin introduced its Wisenet A Series of low-cost cameras and network video recorders. This line is specifically designed for cost-conscious projects, offering NDAA-compliant devices in bullet and dome form factors that integrate Hanwha Techwin's renowned imaging technology, providing a balance of performance and affordability.

Challenges in the City Surveillance Industry Market

The city surveillance industry faces several significant challenges that can impede its growth. Regulatory hurdles, particularly around data privacy, surveillance ethics, and data governance, can lead to complex compliance requirements and slower adoption rates in certain regions. The ongoing global supply chain disruptions can impact the availability and cost of critical components, affecting manufacturing and deployment timelines. Furthermore, intense competitive pressures from both established players and emerging startups drive down profit margins and necessitate continuous innovation. The initial high cost of sophisticated surveillance systems can also be a barrier for smaller municipalities.

- Key Barriers:

- Strict data privacy and ethical regulations.

- Global supply chain volatility.

- Intense market competition.

- High upfront investment costs.

Forces Driving City Surveillance Industry Growth

The city surveillance industry is propelled by a confluence of powerful growth drivers. An escalating global focus on public safety and security, driven by rising crime rates and terrorism threats, is a primary catalyst. Smart city initiatives worldwide are increasingly incorporating advanced surveillance as a foundational element for urban management and citizen safety. Technological advancements, particularly in AI, machine learning, and IoT, are enabling more intelligent, proactive, and efficient surveillance solutions. Government investments in homeland security and urban infrastructure modernization further fuel market expansion.

- Primary Growth Accelerators:

- Rising global security concerns.

- Expansion of smart city projects.

- Rapid advancements in AI and IoT technologies.

- Increased government spending on public safety.

Challenges in the City Surveillance Industry Market

Long-term growth catalysts for the city surveillance market are deeply intertwined with ongoing innovation and strategic market expansion. The continuous evolution of AI and machine learning algorithms promises to unlock new functionalities, from predictive analytics to anomaly detection, making surveillance systems more sophisticated and effective. Partnerships and collaborations between technology providers, system integrators, and government entities are crucial for developing tailored solutions and fostering wider adoption. Exploring and penetrating emerging markets with developing urban centers and increasing security needs presents significant long-term growth opportunities. The development of more user-friendly interfaces and accessible pricing models will also contribute to sustained market expansion.

Emerging Opportunities in City Surveillance Industry

The city surveillance industry is brimming with emerging opportunities. The integration of surveillance systems with other smart city platforms, such as smart grids, public transportation, and emergency services, presents a significant avenue for creating comprehensive urban management solutions. The growing demand for edge computing capabilities in surveillance devices allows for real-time data processing and reduced latency, especially in remote or bandwidth-constrained areas. The increasing adoption of cloud-based surveillance solutions offers scalability, flexibility, and cost-efficiency for municipalities of all sizes. Furthermore, the development of specialized surveillance solutions for specific urban challenges, like environmental monitoring or public health tracking, opens up new niche markets.

- Key Emerging Trends:

- Integration with broader smart city ecosystems.

- Growth of edge computing for real-time analytics.

- Increased adoption of cloud-native surveillance platforms.

- Development of AI-powered predictive policing tools.

Leading Players in the City Surveillance Industry Sector

- Bosch Security and Safety Systems (The Bosch Group)

- Zhejiang Uniview Technologies

- Hanwha Techwin (Hanwha Group)

- Honeywell Security Group (Honeywell International Inc.)

- Infinova Corporation (The Infinova Group)

- Nice Systems Limited

- Cisco Systems Inc.

- Verint Systems

- Genetec Inc.

- Axon Enterprise Inc.

- NEC Corporation

- Qognify Inc (Battery Ventures)

- Agent Video Intelligence Ltd.

- Avigilon Corporation (Motorola Solutions Inc.)

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Axis Communications (Canon Inc.)

- CP Plus

- Dahua Technology Co., Ltd.

- Panasonic Corporation

Key Milestones in City Surveillance Industry Industry

- July 2022: Hangzhou Hikvision Digital Technology Co., Ltd. launched new DeepinView bullet network cameras with TandemVu technology, extending its capabilities to bullet-styled models for enhanced situational awareness.

- March 2022: Hanwha Techwin introduced the new Wisenet A Series of low-cost cameras and network video recorders, focusing on NDAA-compliant devices for cost-conscious projects.

Strategic Outlook for City Surveillance Industry Market

The strategic outlook for the city surveillance industry market is exceptionally positive, driven by sustained demand for enhanced urban safety and security. Future growth will be accelerated by the continued integration of advanced AI and machine learning for predictive and proactive security measures. Partnerships between technology providers and municipal governments will be critical for developing and deploying comprehensive smart city surveillance solutions. Exploring new application areas beyond traditional crime prevention, such as traffic management optimization and public health monitoring, presents significant future market potential. Investments in cybersecurity to protect sensitive surveillance data will also be paramount.

- Key Growth Accelerators:

- Deepening integration of AI for advanced analytics.

- Formation of strategic public-private partnerships.

- Expansion into non-traditional urban safety applications.

- Robust focus on cybersecurity and data protection.

City Surveillance Industry Segmentation

-

1. Component

- 1.1. Camera

- 1.2. Storage

- 1.3. Video Management System

- 1.4. Video Analytics

City Surveillance Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

City Surveillance Industry Regional Market Share

Geographic Coverage of City Surveillance Industry

City Surveillance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Spending on Surveillance in Major Cities Across the World; Diminishing IP Camera Prices

- 3.2.2 Coupled with Technological Advancements in Analytics and Software; Growing Security Threat and Smart City Growth Prompting Governments and City Administrations to Adopt Innovative Surveillance Solutions

- 3.3. Market Restrains

- 3.3.1. High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity

- 3.4. Market Trends

- 3.4.1. Camera Segment to Hold Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Camera

- 5.1.2. Storage

- 5.1.3. Video Management System

- 5.1.4. Video Analytics

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Camera

- 6.1.2. Storage

- 6.1.3. Video Management System

- 6.1.4. Video Analytics

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Camera

- 7.1.2. Storage

- 7.1.3. Video Management System

- 7.1.4. Video Analytics

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Camera

- 8.1.2. Storage

- 8.1.3. Video Management System

- 8.1.4. Video Analytics

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Camera

- 9.1.2. Storage

- 9.1.3. Video Management System

- 9.1.4. Video Analytics

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa City Surveillance Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Camera

- 10.1.2. Storage

- 10.1.3. Video Management System

- 10.1.4. Video Analytics

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bosch Security and Safety System (The Bosch Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zhekian Uniview Technologies*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hanwha Techwin (Hanwaha Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell Security Group (Honeywell Internatinal Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Infinova Corporation (The Infinova Group)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nice Systems Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cisco Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Verint Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Genetec Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Axon Enterprise Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NEC Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Qognify Inc (Battery Ventures)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Agent Video Intelligence Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Avigilon Corporation (Motorola Solutions Inc )

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hangzhou Hikvision Digital Technology Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Axis Communications (Canon Inc )

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 CP Plus

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Dahua Technology Co Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Panasonic Corporation

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Bosch Security and Safety System (The Bosch Group)

List of Figures

- Figure 1: Global City Surveillance Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 3: North America City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 7: Europe City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 8: Europe City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Asia Pacific City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Asia Pacific City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 15: Latin America City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 16: Latin America City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa City Surveillance Industry Revenue (Million), by Component 2025 & 2033

- Figure 19: Middle East and Africa City Surveillance Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Middle East and Africa City Surveillance Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa City Surveillance Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global City Surveillance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 10: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global City Surveillance Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 12: Global City Surveillance Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the City Surveillance Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the City Surveillance Industry?

Key companies in the market include Bosch Security and Safety System (The Bosch Group), Zhekian Uniview Technologies*List Not Exhaustive, Hanwha Techwin (Hanwaha Group), Honeywell Security Group (Honeywell Internatinal Inc ), Infinova Corporation (The Infinova Group), Nice Systems Limited, Cisco Systems Inc, Verint Systems, Genetec Inc, Axon Enterprise Inc, NEC Corporation, Qognify Inc (Battery Ventures), Agent Video Intelligence Ltd, Avigilon Corporation (Motorola Solutions Inc ), Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications (Canon Inc ), CP Plus, Dahua Technology Co Ltd, Panasonic Corporation.

3. What are the main segments of the City Surveillance Industry?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending on Surveillance in Major Cities Across the World; Diminishing IP Camera Prices. Coupled with Technological Advancements in Analytics and Software; Growing Security Threat and Smart City Growth Prompting Governments and City Administrations to Adopt Innovative Surveillance Solutions.

6. What are the notable trends driving market growth?

Camera Segment to Hold Largest Market Share.

7. Are there any restraints impacting market growth?

High Installation Cost; Lack of Uninterrupted and Seamless Internet Connectivity.

8. Can you provide examples of recent developments in the market?

July 2022 - The Hangzhou Hikvision Digital Technology Co. Ltd has launched the new DeepinViewbullet network cameras with TandemVutechnology, expanding the reach of TandemVutechnology from PTZ units to bullet-styled models. These new cameras will be able to monitor large scenes and close-up details simultaneously, maintaining both viewpoints for improved situational awareness and security capability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "City Surveillance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the City Surveillance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the City Surveillance Industry?

To stay informed about further developments, trends, and reports in the City Surveillance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence