Key Insights

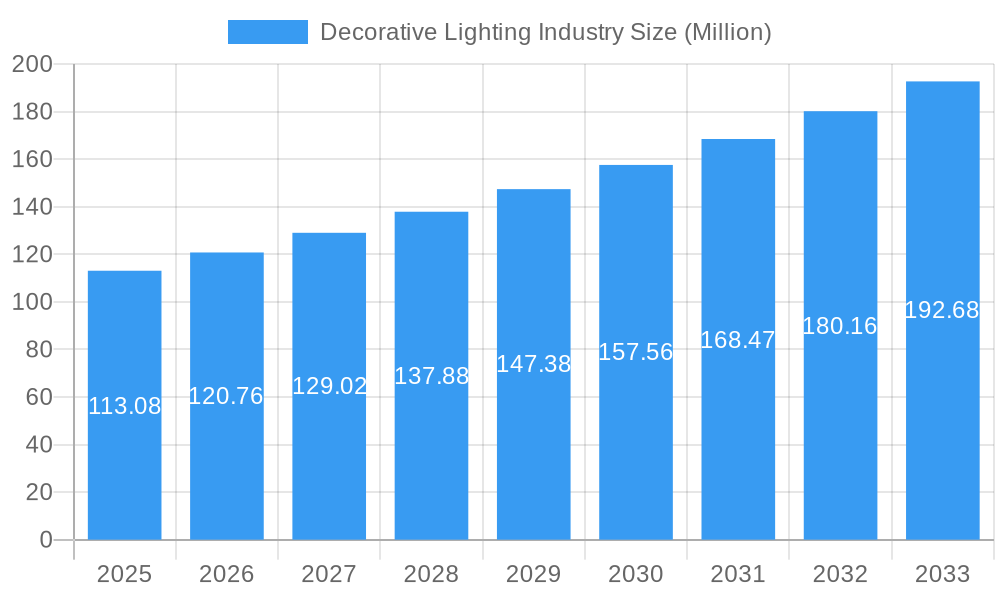

The global decorative lighting market, valued at $113.08 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033. This expansion is fueled by several key factors. The increasing preference for aesthetically pleasing and energy-efficient lighting solutions in both residential and commercial spaces is a significant driver. The rising adoption of LED technology, offering superior energy efficiency and longer lifespan compared to traditional incandescent and fluorescent bulbs, is further boosting market growth. Moreover, innovative product designs, incorporating smart features and customizable options, are attracting consumers seeking personalized lighting solutions. E-commerce platforms are also playing a crucial role, expanding market reach and providing consumers with greater access to a wider variety of products and brands. While the market faces challenges such as fluctuating raw material prices and intense competition, the overall outlook remains positive, driven by the continuous evolution of lighting technology and increasing consumer demand for sophisticated and stylish lighting fixtures.

Decorative Lighting Industry Market Size (In Million)

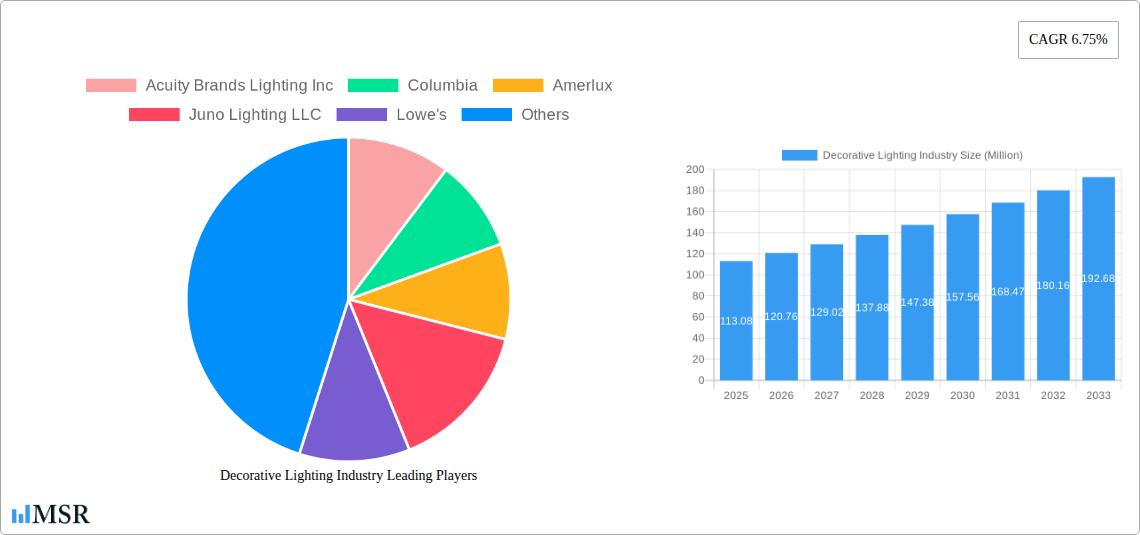

The market segmentation reveals a diverse landscape. LED lighting dominates the light source segment due to its aforementioned benefits. Ceiling lights constitute the largest share within the product category, followed by wall-mounted options. The commercial sector holds a larger market share compared to the household segment, reflecting increased investment in aesthetically appealing and functional lighting for businesses. Offline distribution channels, particularly through hypermarkets and specialty stores, currently maintain a significant presence, although online channels are rapidly gaining traction, offering convenience and wider product selection to consumers. Key players like Acuity Brands Lighting Inc., Columbia, Amerlux, and Juno Lighting LLC are shaping the competitive landscape through innovation and strategic partnerships. Regional analysis indicates strong growth potential in Asia-Pacific and North America, driven by expanding economies and rising disposable incomes. The continued focus on sustainability and the integration of smart home technology within lighting systems are poised to further propel market growth in the coming years.

Decorative Lighting Industry Company Market Share

Illuminating the Future: A Comprehensive Report on the Decorative Lighting Industry (2019-2033)

This comprehensive report provides an in-depth analysis of the Decorative Lighting Industry, projecting a market size exceeding $XX Million by 2033. With a focus on the period 2019-2033 (base year 2025), this study offers crucial insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report analyzes market concentration, leading players like Acuity Brands Lighting Inc, Columbia Lighting, Amerlux, Juno Lighting LLC, Lowe's, and GE Lighting, alongside emerging competitors, and identifies key trends shaping the future of decorative lighting.

Decorative Lighting Industry Market Concentration & Dynamics

This section provides a comprehensive analysis of the competitive landscape within the decorative lighting industry. It delves into market share dynamics, the intricate web of innovation ecosystems, the pervasive influence of regulatory frameworks, and the strategic impact of mergers and acquisitions (M&A). The report meticulously examines the interplay between established industry giants like Acuity Brands Lighting Inc. and agile emerging companies such as Cree and Osram, offering insights into their competitive strategies and market positioning.

- Market Concentration: The decorative lighting market currently exhibits a moderately concentrated structure. In 2025, the top five players collectively commanded an estimated XX% of the market share. Projections indicate a slight dilution of this concentration to approximately XX% by 2033, attributed to the increasing competitive pressures from a growing number of smaller, innovative players and new entrants disrupting the status quo.

- Innovation Ecosystems: The industry thrives on a dynamic and vibrant ecosystem of innovation. Companies are making substantial investments in Research and Development (R&D) to pioneer energy-efficient, aesthetically superior, and technologically advanced products. Key breakthroughs include the widespread integration of smart lighting technologies, enabling enhanced control and personalization, and the development of highly adaptable and customizable lighting solutions.

- Regulatory Frameworks: Government regulations, particularly those mandating energy efficiency standards (e.g., stringent lighting performance benchmarks), exert a significant influence on market dynamics. Compliance with these regulations, coupled with the technological advancements spurred by their requirements, are critical determinants shaping the strategic decisions and operational efficiencies of industry players.

- Substitute Products & Competition: Competitive pressures also stem from alternative lighting solutions. Strategies focused on maximizing natural light, alongside the burgeoning adoption of integrated smart home systems that offer seamless lighting control, present significant competitive challenges and opportunities for differentiation.

- End-User Trends: A discernible shift in consumer preferences towards smart, energy-efficient, and aesthetically captivating lighting solutions is profoundly impacting product development and marketing strategies. There is a growing demand for minimalist designs and a strong inclination towards sustainable materials and manufacturing processes.

- M&A Activities: The report provides a detailed analysis of M&A activities that have shaped the decorative lighting industry throughout the study period (2019-2024), identifying approximately XX significant transactions. This trend of consolidation and strategic acquisition is anticipated to persist and potentially accelerate during the forecast period, as companies seek to enhance their market position and capabilities.

Decorative Lighting Industry Industry Insights & Trends

This section delves into the growth drivers, technological disruptions, and evolving consumer behaviors that are transforming the decorative lighting industry. The global decorative lighting market is estimated at $XX Million in 2025 and is projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033.

The market's growth is fueled by several factors, including the rising adoption of LED lighting, the increasing demand for energy-efficient solutions, the growth of the construction industry (both residential and commercial), and the growing popularity of smart homes and integrated lighting systems. Technological advancements like LED technology, wireless connectivity, and smart home integration are revolutionizing the industry, creating new opportunities for innovation and market expansion. Changing consumer preferences, including a focus on personalized lighting experiences and aesthetic appeal, are driving demand for innovative and stylish lighting products. The report analyzes these trends in detail, providing insights into their impact on the market's future trajectory.

Key Markets & Segments Leading Decorative Lighting Industry

This section illuminates the pivotal markets and segments that are currently driving growth and defining leadership within the decorative lighting industry.

- By Light Source: Light Emitting Diode (LED) lighting unequivocally dominates the market, capturing an estimated XX% share in 2025. The market share of LED technology is projected to continue its upward trajectory throughout the forecast period. This dominance is fueled by significant cost reductions, demonstrable increases in energy efficiency, and superior lifespan compared to traditional lighting technologies such as fluorescent and incandescent lamps.

- By Product: Ceiling lights represent the largest and most influential product segment, accounting for an estimated XX% of the market share in 2025. Wall-mounted lighting fixtures also hold a substantial market position, driven by their inherent design versatility and the relative ease of installation, making them a popular choice for various applications.

- By End Use: The commercial sector remains a primary engine of market growth, propelled by ongoing new construction projects, extensive renovation initiatives, and the widespread adoption of energy-efficient lighting solutions in diverse commercial environments. Concurrently, the residential segment is demonstrating robust growth potential, fueled by rising disposable incomes and an increasing focus on home improvement and interior design.

- By Distribution Channel: While offline channels, particularly hypermarkets and specialized lighting stores, continue to be the dominant distribution routes, online channels are rapidly gaining significant traction. E-commerce platforms offer consumers an expanded selection, enhanced convenience, and competitive pricing. The ongoing growth of e-commerce and online marketplaces is poised to further amplify online sales in the coming years.

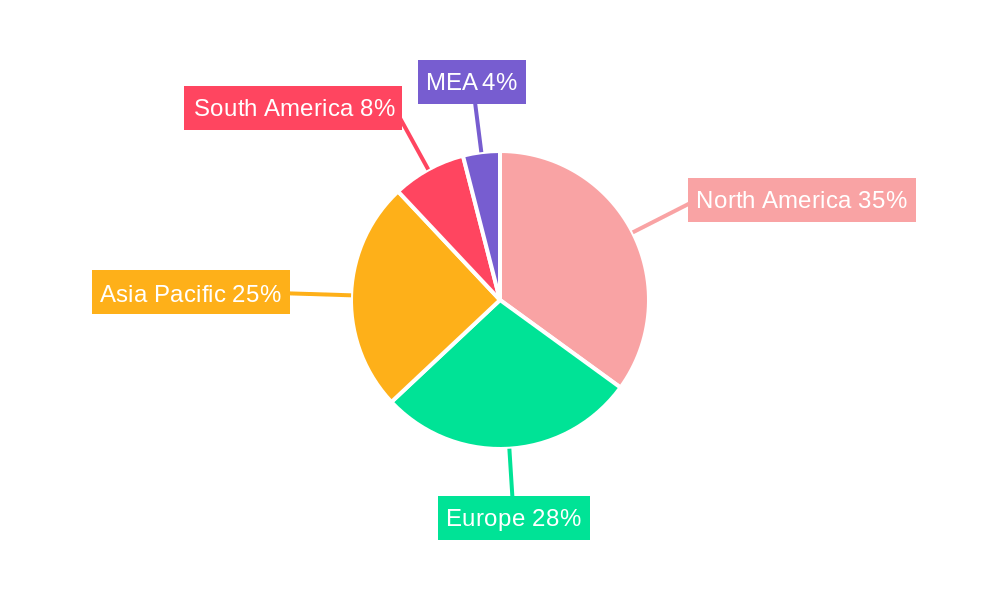

Growth Drivers in Key Regions: North America and Europe currently lead the decorative lighting market, largely due to strong economic performance and substantial investment in infrastructure development. However, the Asia Pacific region is emerging as a high-growth market with a projected Compound Annual Growth Rate (CAGR) significantly above the global average. This rapid expansion is driven by rapid urbanization, a burgeoning middle class, and increasing disposable incomes.

Decorative Lighting Industry Product Developments

Recent groundbreaking product innovations in the decorative lighting industry are revolutionizing how we illuminate our spaces. These advancements include the seamless integration of smart home technologies, enabling sophisticated control and customization, alongside the widespread adoption of highly energy-efficient LED solutions that offer both performance and sustainability. Furthermore, a strong emphasis is placed on the development of aesthetically captivating designs that cater to evolving consumer tastes and the increasing demand for versatile and visually appealing fixtures. These innovations are crucial for manufacturers to maintain a competitive edge, addressing industry demands for lighting that is both sustainable and highly functional. Ongoing exploration into novel materials and advanced production techniques is also contributing to further improvements in energy efficiency and cost reduction.

Challenges in the Decorative Lighting Industry Market

The decorative lighting industry faces challenges including:

- Stringent regulatory compliance: Meeting increasingly strict energy efficiency standards adds to production costs.

- Supply chain disruptions: Global events and raw material shortages have negatively impacted production and delivery times. This is estimated to have reduced market growth by approximately XX% in 2022.

- Intense competition: The market is characterized by intense competition from both established players and emerging companies, putting pressure on pricing and profit margins.

Forces Driving Decorative Lighting Industry Growth

Technological innovation, such as the development of smart lighting and energy-efficient LED technology, is a key driver of market growth. Furthermore, economic growth in emerging markets, and government initiatives promoting energy efficiency are fueling demand.

Long-Term Growth Catalysts in the Decorative Lighting Industry

Long-term growth is expected to be driven by continued innovations in LED technology, strategic partnerships to expand market reach, and the penetration into new geographical markets.

Emerging Opportunities in Decorative Lighting Industry

The decorative lighting industry is ripe with emerging opportunities. Key areas of growth include the deep integration of lighting systems with the Internet of Things (IoT) ecosystem, paving the way for truly connected and intelligent environments. The demand for personalized lighting solutions, allowing users to tailor their lighting experiences to specific moods and activities, is also on the rise. Additionally, there is significant potential for expansion into niche markets that prioritize sustainability and cutting-edge smart lighting technologies, catering to environmentally conscious consumers and early adopters of technology.

Leading Players in the Decorative Lighting Industry Sector

- Acuity Brands Lighting Inc

- Columbia Lighting (website not readily available)

- Amerlux

- Juno Lighting LLC

- Lowe's

- GE Lighting

- Intense LSI Cree

- Osram

- ETC

- Generation Lighting

- Littmann

- AZZ Inc

- Maxim Lighting

Key Milestones in Decorative Lighting Industry Industry

- 2020: A notable acceleration in the adoption of LED lighting technologies was observed, driven by significant reductions in production costs and substantial improvements in energy efficiency.

- 2022: The industry experienced considerable supply chain disruptions, impacting global production schedules and the timely delivery of finished goods.

- 2023: Major industry players launched a series of innovative smart home-integrated lighting systems, signaling a strong commitment to connected living.

- 2024: A period of strategic consolidation was marked by several significant mergers and acquisitions, leading to a notable reshaping of market share among key players.

Strategic Outlook for Decorative Lighting Industry Market

The decorative lighting industry is poised for continued growth driven by technological advancements, increasing consumer demand for smart and sustainable lighting solutions, and expansion into new markets. Strategic partnerships and investment in R&D will be crucial for companies to maintain a competitive edge and capitalize on emerging opportunities.

Decorative Lighting Industry Segmentation

-

1. Light Source

- 1.1. LED

- 1.2. Fluroscent

- 1.3. Incandescent

- 1.4. Other Light Sources

-

2. Product

- 2.1. Ceiling

- 2.2. Wall Mounted

- 2.3. Other Products

-

3. End Use

- 3.1. Commercial

- 3.2. Household

-

4. Distribution Channel

- 4.1. Offline

- 4.2. Online

Decorative Lighting Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Decorative Lighting Industry Regional Market Share

Geographic Coverage of Decorative Lighting Industry

Decorative Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancement booming the industry; Focus on Ergonomics and Comfort

- 3.3. Market Restrains

- 3.3.1. High cost; Limited Target Audience

- 3.4. Market Trends

- 3.4.1. LED Source of Lights Dominated the Decorative Lighting Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Light Source

- 5.1.1. LED

- 5.1.2. Fluroscent

- 5.1.3. Incandescent

- 5.1.4. Other Light Sources

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Ceiling

- 5.2.2. Wall Mounted

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End Use

- 5.3.1. Commercial

- 5.3.2. Household

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Offline

- 5.4.2. Online

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Light Source

- 6. North America Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Light Source

- 6.1.1. LED

- 6.1.2. Fluroscent

- 6.1.3. Incandescent

- 6.1.4. Other Light Sources

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Ceiling

- 6.2.2. Wall Mounted

- 6.2.3. Other Products

- 6.3. Market Analysis, Insights and Forecast - by End Use

- 6.3.1. Commercial

- 6.3.2. Household

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Offline

- 6.4.2. Online

- 6.1. Market Analysis, Insights and Forecast - by Light Source

- 7. Europe Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Light Source

- 7.1.1. LED

- 7.1.2. Fluroscent

- 7.1.3. Incandescent

- 7.1.4. Other Light Sources

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Ceiling

- 7.2.2. Wall Mounted

- 7.2.3. Other Products

- 7.3. Market Analysis, Insights and Forecast - by End Use

- 7.3.1. Commercial

- 7.3.2. Household

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Offline

- 7.4.2. Online

- 7.1. Market Analysis, Insights and Forecast - by Light Source

- 8. Asia Pacific Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Light Source

- 8.1.1. LED

- 8.1.2. Fluroscent

- 8.1.3. Incandescent

- 8.1.4. Other Light Sources

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Ceiling

- 8.2.2. Wall Mounted

- 8.2.3. Other Products

- 8.3. Market Analysis, Insights and Forecast - by End Use

- 8.3.1. Commercial

- 8.3.2. Household

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Offline

- 8.4.2. Online

- 8.1. Market Analysis, Insights and Forecast - by Light Source

- 9. Latin America Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Light Source

- 9.1.1. LED

- 9.1.2. Fluroscent

- 9.1.3. Incandescent

- 9.1.4. Other Light Sources

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Ceiling

- 9.2.2. Wall Mounted

- 9.2.3. Other Products

- 9.3. Market Analysis, Insights and Forecast - by End Use

- 9.3.1. Commercial

- 9.3.2. Household

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Offline

- 9.4.2. Online

- 9.1. Market Analysis, Insights and Forecast - by Light Source

- 10. Middle East and Africa Decorative Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Light Source

- 10.1.1. LED

- 10.1.2. Fluroscent

- 10.1.3. Incandescent

- 10.1.4. Other Light Sources

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Ceiling

- 10.2.2. Wall Mounted

- 10.2.3. Other Products

- 10.3. Market Analysis, Insights and Forecast - by End Use

- 10.3.1. Commercial

- 10.3.2. Household

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Offline

- 10.4.2. Online

- 10.1. Market Analysis, Insights and Forecast - by Light Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Acuity Brands Lighting Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Columbia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amerlux

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Juno Lighting LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lowe's

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GE Lighting

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Other Companies (Intense LSI Cree

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Osram

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ETC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Generation Lighting

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Littmann

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 AZZ Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Maxim Lighting

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Acuity Brands Lighting Inc

List of Figures

- Figure 1: Global Decorative Lighting Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Decorative Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 3: North America Decorative Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 4: North America Decorative Lighting Industry Revenue (Million), by Product 2025 & 2033

- Figure 5: North America Decorative Lighting Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Decorative Lighting Industry Revenue (Million), by End Use 2025 & 2033

- Figure 7: North America Decorative Lighting Industry Revenue Share (%), by End Use 2025 & 2033

- Figure 8: North America Decorative Lighting Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 9: North America Decorative Lighting Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Decorative Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Decorative Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Decorative Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 13: Europe Decorative Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 14: Europe Decorative Lighting Industry Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Decorative Lighting Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Decorative Lighting Industry Revenue (Million), by End Use 2025 & 2033

- Figure 17: Europe Decorative Lighting Industry Revenue Share (%), by End Use 2025 & 2033

- Figure 18: Europe Decorative Lighting Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 19: Europe Decorative Lighting Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Europe Decorative Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Decorative Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Decorative Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 23: Asia Pacific Decorative Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 24: Asia Pacific Decorative Lighting Industry Revenue (Million), by Product 2025 & 2033

- Figure 25: Asia Pacific Decorative Lighting Industry Revenue Share (%), by Product 2025 & 2033

- Figure 26: Asia Pacific Decorative Lighting Industry Revenue (Million), by End Use 2025 & 2033

- Figure 27: Asia Pacific Decorative Lighting Industry Revenue Share (%), by End Use 2025 & 2033

- Figure 28: Asia Pacific Decorative Lighting Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Decorative Lighting Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Decorative Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Decorative Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Decorative Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 33: Latin America Decorative Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 34: Latin America Decorative Lighting Industry Revenue (Million), by Product 2025 & 2033

- Figure 35: Latin America Decorative Lighting Industry Revenue Share (%), by Product 2025 & 2033

- Figure 36: Latin America Decorative Lighting Industry Revenue (Million), by End Use 2025 & 2033

- Figure 37: Latin America Decorative Lighting Industry Revenue Share (%), by End Use 2025 & 2033

- Figure 38: Latin America Decorative Lighting Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Latin America Decorative Lighting Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Latin America Decorative Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Decorative Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Decorative Lighting Industry Revenue (Million), by Light Source 2025 & 2033

- Figure 43: Middle East and Africa Decorative Lighting Industry Revenue Share (%), by Light Source 2025 & 2033

- Figure 44: Middle East and Africa Decorative Lighting Industry Revenue (Million), by Product 2025 & 2033

- Figure 45: Middle East and Africa Decorative Lighting Industry Revenue Share (%), by Product 2025 & 2033

- Figure 46: Middle East and Africa Decorative Lighting Industry Revenue (Million), by End Use 2025 & 2033

- Figure 47: Middle East and Africa Decorative Lighting Industry Revenue Share (%), by End Use 2025 & 2033

- Figure 48: Middle East and Africa Decorative Lighting Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 49: Middle East and Africa Decorative Lighting Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Middle East and Africa Decorative Lighting Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Decorative Lighting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Decorative Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 2: Global Decorative Lighting Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 3: Global Decorative Lighting Industry Revenue Million Forecast, by End Use 2020 & 2033

- Table 4: Global Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Decorative Lighting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Decorative Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 7: Global Decorative Lighting Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Decorative Lighting Industry Revenue Million Forecast, by End Use 2020 & 2033

- Table 9: Global Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Decorative Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Decorative Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 12: Global Decorative Lighting Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 13: Global Decorative Lighting Industry Revenue Million Forecast, by End Use 2020 & 2033

- Table 14: Global Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Decorative Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Decorative Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 17: Global Decorative Lighting Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global Decorative Lighting Industry Revenue Million Forecast, by End Use 2020 & 2033

- Table 19: Global Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Decorative Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Decorative Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 22: Global Decorative Lighting Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Decorative Lighting Industry Revenue Million Forecast, by End Use 2020 & 2033

- Table 24: Global Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Decorative Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Decorative Lighting Industry Revenue Million Forecast, by Light Source 2020 & 2033

- Table 27: Global Decorative Lighting Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 28: Global Decorative Lighting Industry Revenue Million Forecast, by End Use 2020 & 2033

- Table 29: Global Decorative Lighting Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Decorative Lighting Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Decorative Lighting Industry?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Decorative Lighting Industry?

Key companies in the market include Acuity Brands Lighting Inc, Columbia, Amerlux, Juno Lighting LLC, Lowe's, GE Lighting, Other Companies (Intense LSI Cree, Osram, ETC, Generation Lighting, Littmann, AZZ Inc, Maxim Lighting.

3. What are the main segments of the Decorative Lighting Industry?

The market segments include Light Source, Product, End Use, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancement booming the industry; Focus on Ergonomics and Comfort.

6. What are the notable trends driving market growth?

LED Source of Lights Dominated the Decorative Lighting Market.

7. Are there any restraints impacting market growth?

High cost; Limited Target Audience.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Decorative Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Decorative Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Decorative Lighting Industry?

To stay informed about further developments, trends, and reports in the Decorative Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence