Key Insights

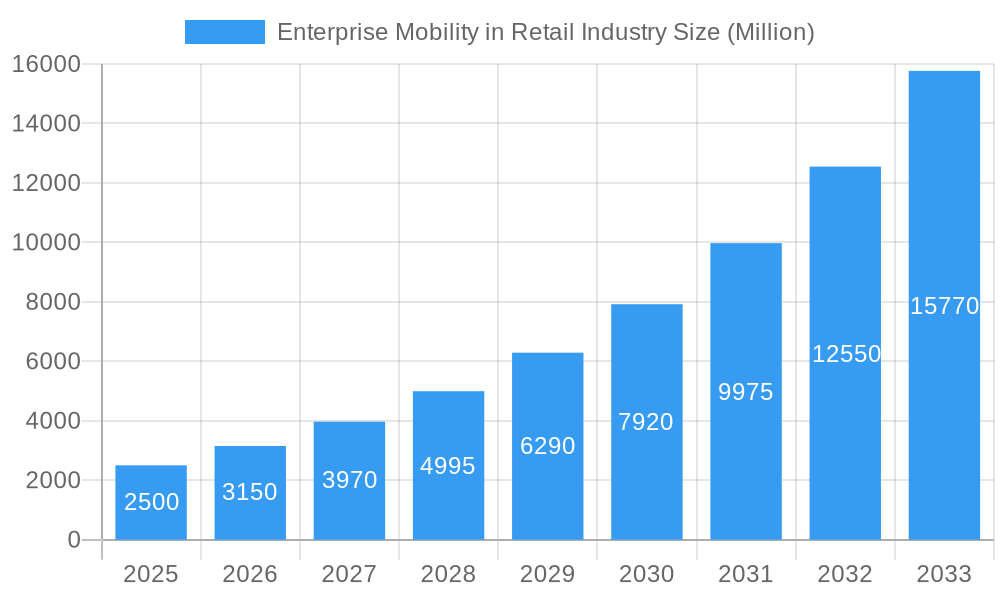

The Enterprise Mobility in Retail Industry is poised for remarkable growth, projected to reach a substantial market size driven by a compelling Compound Annual Growth Rate (CAGR) of 26.25%. This surge is primarily fueled by the escalating adoption of smart devices like smartphones, tablets, and laptops within retail operations to enhance customer experiences, streamline inventory management, and optimize workforce productivity. Retailers are increasingly leveraging mobile solutions for real-time data access, enabling faster decision-making and personalized customer engagement. The integration of AI-powered analytics and the growing demand for secure mobile platforms are further propelling this expansion. Key players are investing heavily in developing advanced mobile applications and cloud-based solutions tailored to the unique needs of the retail sector, including point-of-sale (POS) systems, inventory tracking, and field service management.

Enterprise Mobility in Retail Industry Market Size (In Billion)

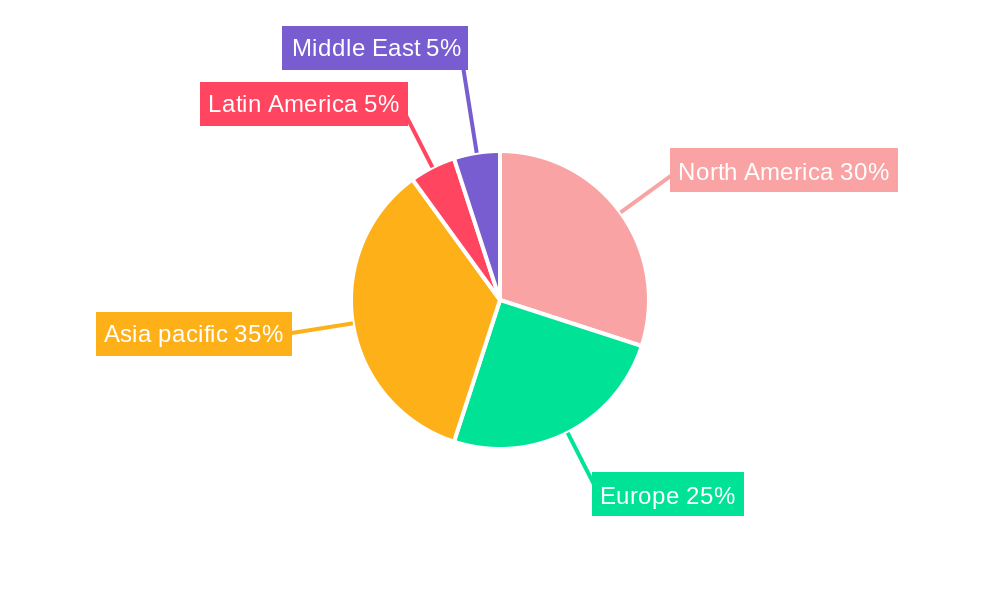

However, the rapid evolution of technology also presents certain challenges. Concerns surrounding data security and privacy remain paramount, necessitating robust security measures to protect sensitive customer and business information. The cost of implementing and maintaining sophisticated enterprise mobility solutions can also be a restraining factor for smaller retail businesses, potentially widening the gap between large enterprises and SMEs. Despite these hurdles, the industry is characterized by significant innovation, with trends like the rise of Bring Your Own Device (BYOD) policies, the integration of IoT devices for enhanced supply chain visibility, and the development of mobile-first strategies for both customer interaction and internal operations. The Asia Pacific region is expected to witness the most dynamic growth, driven by a burgeoning e-commerce landscape and a large, tech-savvy population.

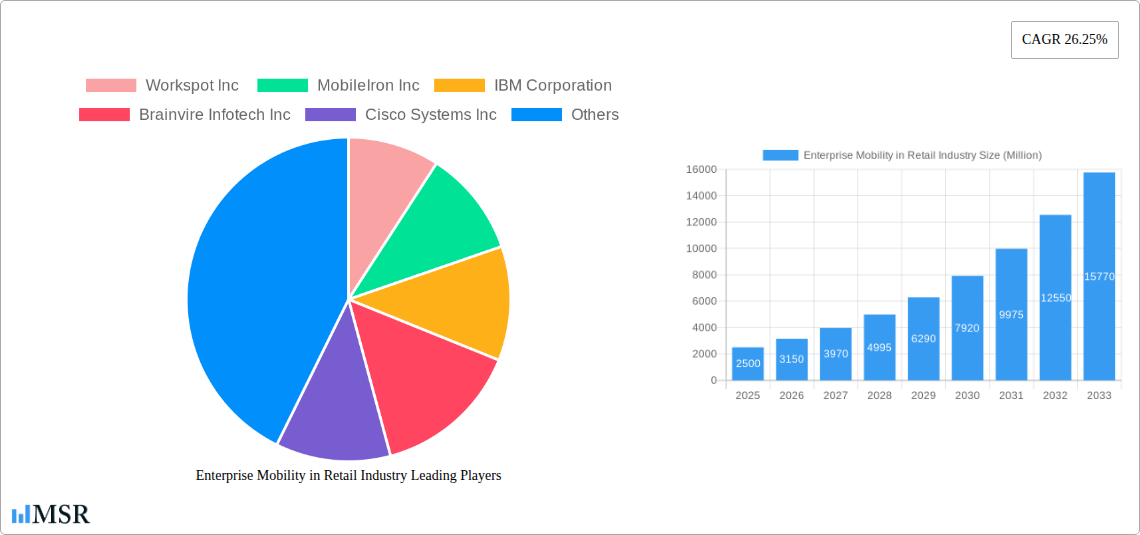

Enterprise Mobility in Retail Industry Company Market Share

Unleash Retail's Potential: Enterprise Mobility in Retail Industry Market Report (2019-2033)

Dive deep into the transformative landscape of enterprise mobility in the retail industry with this comprehensive report. Discover how leading retailers are leveraging cutting-edge mobile solutions for retail to enhance customer experiences, streamline operations, and drive significant revenue growth. This analysis spans from 2019 to 2033, with a detailed focus on the Base Year 2025 and the Forecast Period 2025–2033. We meticulously examine the market's trajectory, identifying key drivers, emerging trends, and strategic imperatives for success in the retail mobility market.

Enterprise Mobility in Retail Industry Market Concentration & Dynamics

The enterprise mobility in retail industry market exhibits a dynamic concentration influenced by a robust innovation ecosystem. Leading players are continuously investing in research and development to deliver advanced retail mobile applications and mobile device management (MDM) for retail. Regulatory frameworks, while evolving, generally support the adoption of secure and efficient mobile solutions, fostering an environment conducive to growth. The presence of substitute products, primarily traditional on-premise systems, is diminishing as retailers recognize the agility and scalability offered by cloud-based mobility solutions. End-user trends are heavily skewed towards personalized customer experiences and seamless omnichannel integration, directly fueling demand for sophisticated enterprise mobility. Merger and acquisition (M&A) activities are a significant indicator of market consolidation and strategic growth, with an estimated XX M&A deals recorded within the historical period. Market share distribution is undergoing constant shifts as companies like Workspot Inc, MobileIron Inc, and IBM Corporation vie for dominance, alongside innovative providers such as Brainvire Infotech Inc and Cisco Systems Inc.

Enterprise Mobility in Retail Industry Industry Insights & Trends

The enterprise mobility in retail industry market is poised for substantial expansion, driven by a confluence of technological advancements and evolving consumer behaviors. The market size was estimated at $50,000 Million in the Base Year 2025, projected to reach $150,000 Million by the end of the Forecast Period in 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 15%. Key growth drivers include the escalating demand for enhanced in-store customer experiences, the need for real-time inventory management, and the imperative for efficient supply chain visibility. Technological disruptions, such as the widespread adoption of 5G, the integration of Artificial Intelligence (AI) and Machine Learning (ML) in retail mobile platforms, and the burgeoning use of the Internet of Things (IoT) in retail environments, are fundamentally reshaping the market. Evolving consumer preferences for personalized offers, convenient shopping journeys across all channels, and instant gratification are compelling retailers to invest heavily in omnichannel retail solutions powered by enterprise mobility. The proliferation of smart devices in retail, including smartphones, tablets, and specialized rugged devices for field staff, underscores the pervasive integration of mobile technology. Furthermore, the increasing focus on employee productivity through mobile workforce management for retail is a significant trend, enabling store associates to access critical information, manage tasks, and provide superior customer service on the go. This shift towards a mobile-first strategy is not merely an operational upgrade but a strategic imperative for retailers seeking to remain competitive in a rapidly digitizing world. The report highlights how solutions from Microsoft Corporation, SAP SE, and VMware Inc are central to this transformation, offering comprehensive suites for retail digital transformation.

Key Markets & Segments Leading Enterprise Mobility in Retail Industry

The dominance in the enterprise mobility in retail industry sector is notably pronounced in North America, particularly within the United States, driven by strong economic growth, advanced technological infrastructure, and a high adoption rate of mobile technologies by both consumers and businesses. This region accounts for an estimated 35% of the global market share. Economic growth in this region has fostered substantial investment in retail technology solutions, including advanced point-of-sale (POS) systems and mobile inventory management. The robust infrastructure, characterized by widespread high-speed internet and reliable cellular networks, provides a fertile ground for the deployment and seamless operation of enterprise mobility solutions.

- Smartphones: This segment holds the largest market share, estimated at 60%, due to their ubiquitous nature, affordability, and versatile functionality for both customers and employees. Smartphones are instrumental in enabling mobile commerce, customer engagement applications, and empowering store associates with real-time data access. Companies like Gizmeon Inc and InnoMind Technologies are at the forefront of developing innovative smartphone-based retail solutions.

- Tablets: Accounting for approximately 25% of the market, tablets offer a larger screen real estate compared to smartphones, making them ideal for tasks requiring more visual interaction, such as detailed product information display, interactive training modules, and sophisticated inventory scanning. Their portability and ease of use make them a valuable asset in various retail settings, from back-office operations to in-store customer assistance.

- Laptops: While constituting a smaller but significant portion, around 10%, laptops remain crucial for more complex back-end operations, data analysis, and management tasks within the retail environment. Their processing power and full-fledged operating systems cater to roles requiring extensive data manipulation and reporting.

- Other Devices: This segment, comprising approximately 5%, includes specialized rugged devices, wearable technology, and IoT sensors. These devices are critical for specific use cases like warehouse management, field service, and advanced customer tracking within the retail ecosystem.

The leading position of North America is further solidified by the presence of major technology providers such as Citrix Systems Inc and Credencys Solutions Inc, who are instrumental in developing and deploying these solutions. The region's proactive approach to embracing digital transformation in retail ensures continued leadership in the adoption of enterprise mobility.

Enterprise Mobility in Retail Industry Product Developments

Product development in enterprise mobility for the retail sector is characterized by rapid innovation, focusing on enhancing user experience and operational efficiency. Key advancements include the development of AI-powered mobile retail analytics, intuitive mobile POS applications that support contactless payments and personalized promotions, and robust MDM solutions offering advanced security features for retail data protection. The integration of augmented reality (AR) for virtual try-ons and enhanced product visualization, alongside the development of highly customizable field service management (FSM) apps for mobile workforces, signifies a strong push towards delivering richer, more engaging, and efficient retail operations. Companies like Sonata Software are actively contributing to this wave of innovation.

Challenges in the Enterprise Mobility in Retail Industry Market

Despite significant growth, the enterprise mobility in retail industry market faces several challenges. Security vulnerabilities associated with widespread mobile device usage in retail remain a paramount concern, requiring robust mobile security solutions for retail. Ensuring seamless integration of disparate mobile retail platforms with existing legacy systems can be complex and costly. Furthermore, the rapid pace of technological change necessitates continuous investment in upgrades and employee training, posing a budgetary challenge. Regulatory compliance, particularly concerning data privacy and handling of sensitive customer information, adds another layer of complexity. The estimated cost of data breaches in the retail sector alone is projected to reach $100,000 Million annually, highlighting the critical need for secure mobility.

Forces Driving Enterprise Mobility in Retail Industry Growth

The primary forces propelling the growth of enterprise mobility in the retail industry are multifaceted. The insatiable demand for enhanced customer experiences, epitomized by the rise of the "connected consumer," is a major catalyst. Retailers are increasingly relying on mobile solutions for customer engagement to deliver personalized offers, loyalty programs, and seamless omnichannel journeys. Technological advancements, such as the widespread availability of 5G networks, cloud computing, and AI, are enabling more sophisticated and performant mobile applications. The need for operational efficiency and cost reduction is also driving adoption, with mobile workforce management empowering employees and streamlining inventory control, leading to an estimated 10% reduction in operational costs for early adopters.

Challenges in the Enterprise Mobility in Retail Industry Market

Long-term growth in the enterprise mobility in retail industry market is underpinned by continuous innovation and strategic market expansions. The development of advanced analytics capabilities within mobile retail apps to derive actionable customer insights will be crucial. Partnerships between technology providers and retail giants are fostering ecosystems that accelerate the adoption of new technologies like blockchain for supply chain transparency and IoT for smart store operations. As emerging markets mature and their digital infrastructure improves, there will be significant opportunities for global expansion, extending the reach of digital retail solutions beyond developed economies.

Emerging Opportunities in Enterprise Mobility in Retail Industry

Emerging opportunities in enterprise mobility for the retail sector are abundant and diverse. The integration of AI and ML into retail mobile platforms presents a significant avenue for hyper-personalization of customer experiences and predictive analytics for inventory management. The metaverse and Web3 technologies offer nascent but exciting possibilities for immersive virtual shopping experiences and new forms of customer engagement. Furthermore, the increasing focus on sustainability and ethical sourcing in retail creates opportunities for mobile solutions to track and communicate product provenance, appealing to a growing segment of conscious consumers. The demand for contactless retail solutions is also expected to persist, driving innovation in payment and order fulfillment technologies.

Leading Players in the Enterprise Mobility in Retail Industry Sector

- Workspot Inc

- MobileIron Inc

- IBM Corporation

- Brainvire Infotech Inc

- Cisco Systems Inc

- Microsoft Corporation

- Credencys Solutions Inc

- InnoMind Technologies

- Gizmeon Inc

- VMware Inc

- Citrix Systems Inc

- SAP SE

- Sonata Software

Key Milestones in Enterprise Mobility in Retail Industry Industry

- 2019: Increased adoption of BYOD (Bring Your Own Device) policies in retail, driving demand for robust MDM solutions.

- 2020: Accelerated growth of mobile commerce and contactless payment solutions due to global pandemic.

- 2021: Introduction of 5G networks in key markets, enabling faster and more responsive mobile applications for retail.

- 2022: Enhanced integration of AI and ML in retail mobile apps for personalized customer experiences and inventory optimization.

- 2023: Significant investments in mobile workforce management solutions to improve in-store associate productivity.

- 2024: Rise in demand for secure and scalable cloud-based mobility solutions for retailers.

Strategic Outlook for Enterprise Mobility in Retail Industry Market

The strategic outlook for the enterprise mobility in retail industry market is exceptionally bright. Growth will be further accelerated by the continued evolution of AI and ML for predictive analytics and hyper-personalized customer journeys. The exploration of immersive technologies like AR/VR for engaging shopping experiences will unlock new revenue streams and customer loyalty. Retailers who strategically invest in robust, secure, and adaptable mobile solutions will be best positioned to navigate the dynamic retail landscape, enhance operational efficiencies, and capture a larger market share. The focus will remain on creating seamless, intuitive, and valuable experiences for both customers and employees.

Enterprise Mobility in Retail Industry Segmentation

-

1. Device

- 1.1. Smart Phones

- 1.2. Laptops

- 1.3. Tablets

- 1.4. Other Devices

Enterprise Mobility in Retail Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia pacific

- 4. Latin America

- 5. Middle East

Enterprise Mobility in Retail Industry Regional Market Share

Geographic Coverage of Enterprise Mobility in Retail Industry

Enterprise Mobility in Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Substantial Growth in E-commerce; Increasing Adoption of Bring-your-own-device (BYOD)

- 3.3. Market Restrains

- 3.3.1. ; Security Concerns

- 3.4. Market Trends

- 3.4.1. Substantial Growth in E-commerce to Spearhead the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Mobility in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Smart Phones

- 5.1.2. Laptops

- 5.1.3. Tablets

- 5.1.4. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Enterprise Mobility in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Smart Phones

- 6.1.2. Laptops

- 6.1.3. Tablets

- 6.1.4. Other Devices

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Europe Enterprise Mobility in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Smart Phones

- 7.1.2. Laptops

- 7.1.3. Tablets

- 7.1.4. Other Devices

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Asia pacific Enterprise Mobility in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Smart Phones

- 8.1.2. Laptops

- 8.1.3. Tablets

- 8.1.4. Other Devices

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Latin America Enterprise Mobility in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Smart Phones

- 9.1.2. Laptops

- 9.1.3. Tablets

- 9.1.4. Other Devices

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Middle East Enterprise Mobility in Retail Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Smart Phones

- 10.1.2. Laptops

- 10.1.3. Tablets

- 10.1.4. Other Devices

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Workspot Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MobileIron Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBM Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brainvire Infotech Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Credencys Solutions Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 InnoMind Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gizmeon Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VMware Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Citrix Systems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SAP SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sonata Software

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Workspot Inc

List of Figures

- Figure 1: Global Enterprise Mobility in Retail Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Enterprise Mobility in Retail Industry Revenue (Million), by Device 2025 & 2033

- Figure 3: North America Enterprise Mobility in Retail Industry Revenue Share (%), by Device 2025 & 2033

- Figure 4: North America Enterprise Mobility in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Enterprise Mobility in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Enterprise Mobility in Retail Industry Revenue (Million), by Device 2025 & 2033

- Figure 7: Europe Enterprise Mobility in Retail Industry Revenue Share (%), by Device 2025 & 2033

- Figure 8: Europe Enterprise Mobility in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Enterprise Mobility in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia pacific Enterprise Mobility in Retail Industry Revenue (Million), by Device 2025 & 2033

- Figure 11: Asia pacific Enterprise Mobility in Retail Industry Revenue Share (%), by Device 2025 & 2033

- Figure 12: Asia pacific Enterprise Mobility in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia pacific Enterprise Mobility in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Enterprise Mobility in Retail Industry Revenue (Million), by Device 2025 & 2033

- Figure 15: Latin America Enterprise Mobility in Retail Industry Revenue Share (%), by Device 2025 & 2033

- Figure 16: Latin America Enterprise Mobility in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Enterprise Mobility in Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Enterprise Mobility in Retail Industry Revenue (Million), by Device 2025 & 2033

- Figure 19: Middle East Enterprise Mobility in Retail Industry Revenue Share (%), by Device 2025 & 2033

- Figure 20: Middle East Enterprise Mobility in Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East Enterprise Mobility in Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 2: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 4: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 6: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 8: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 10: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Device 2020 & 2033

- Table 12: Global Enterprise Mobility in Retail Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Mobility in Retail Industry?

The projected CAGR is approximately 26.25%.

2. Which companies are prominent players in the Enterprise Mobility in Retail Industry?

Key companies in the market include Workspot Inc , MobileIron Inc, IBM Corporation, Brainvire Infotech Inc, Cisco Systems Inc, Microsoft Corporation, Credencys Solutions Inc, InnoMind Technologies, Gizmeon Inc, VMware Inc, Citrix Systems Inc, SAP SE, Sonata Software.

3. What are the main segments of the Enterprise Mobility in Retail Industry?

The market segments include Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Substantial Growth in E-commerce; Increasing Adoption of Bring-your-own-device (BYOD).

6. What are the notable trends driving market growth?

Substantial Growth in E-commerce to Spearhead the Growth.

7. Are there any restraints impacting market growth?

; Security Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Mobility in Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Mobility in Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Mobility in Retail Industry?

To stay informed about further developments, trends, and reports in the Enterprise Mobility in Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence