Key Insights

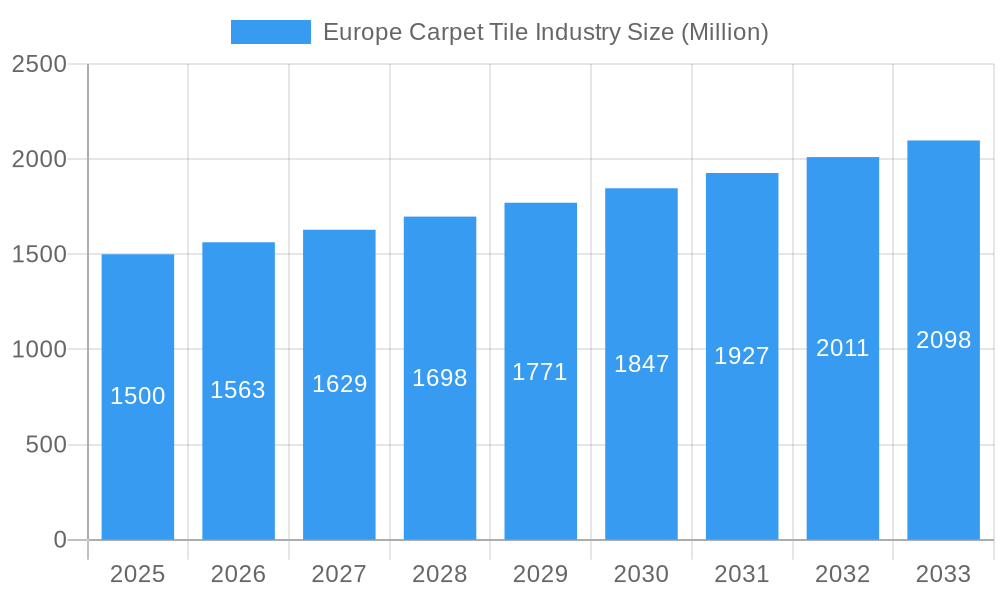

The European carpet tile market is projected to reach €0.89 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.2% from 2025 to 2033. Key growth drivers include escalating demand from the commercial sector, especially offices and hospitality, due to carpet tiles' practicality, ease of maintenance, and design versatility. The increasing preference for sustainable options, such as recycled materials and low-VOC emissions, is also a significant factor. Innovations in design, durability, and advanced features like sound absorption and thermal insulation further support market expansion. The growing online retail channel enhances consumer choice and convenience.

Europe Carpet Tile Industry Market Size (In Million)

Challenges include price volatility of raw materials, economic downturns affecting residential demand, and competition from alternative flooring solutions like vinyl and hardwood. Despite these headwinds, continuous innovation, evolving design trends, and sustained demand for durable, aesthetic flooring are expected to drive healthy market growth. The commercial segment dominates, with both offline and online distribution channels being crucial. Leading companies are strategically focused on product diversification and market expansion.

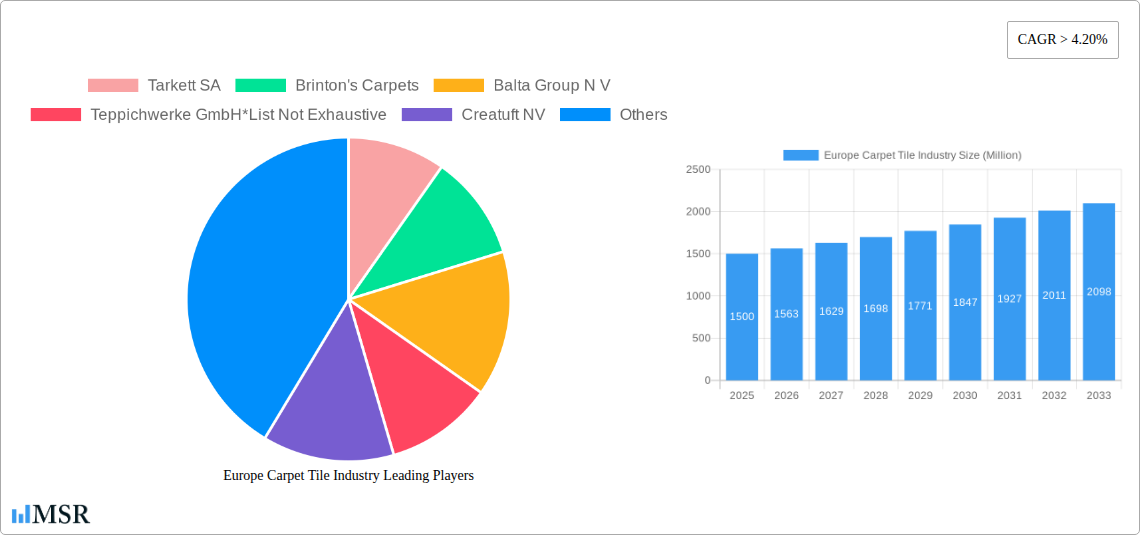

Europe Carpet Tile Industry Company Market Share

Europe Carpet Tile Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European carpet tile industry, covering market dynamics, key segments, leading players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The market size is expected to reach xx Million by 2025.

Europe Carpet Tile Industry Market Concentration & Dynamics

The European carpet tile market exhibits a moderately concentrated structure, with key players like Tarkett SA, Balta Group N.V., Mohawk Industries Inc., and Brinton's Carpets holding significant market share. The combined market share of the top five players is estimated at xx%. Innovation in materials, designs, and manufacturing processes is driving competition. The industry is subject to EU regulations concerning environmental sustainability and chemical safety, influencing product development and manufacturing practices. Substitute products, such as hardwood flooring and vinyl tiles, present competitive pressure. End-user trends, particularly towards sustainable and aesthetically pleasing flooring solutions, are shaping demand. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024. This activity is driven by companies seeking expansion, technological advancements, and cost synergies.

- Market Share: Top 5 players - xx%

- M&A Deal Count (2019-2024): xx

- Key Regulatory Frameworks: EU REACH, RoHS

Europe Carpet Tile Industry Industry Insights & Trends

The European carpet tile industry witnessed a CAGR of xx% during the historical period (2019-2024), driven by factors such as increasing construction activity, rising disposable incomes, and growing preference for aesthetically pleasing and comfortable flooring solutions in both residential and commercial sectors. Technological advancements in manufacturing processes, such as improved dyeing and tufting techniques, have led to more durable and high-quality carpet tiles. Consumer behavior is shifting towards eco-friendly, sustainable, and recyclable products, influencing the industry to adopt more sustainable practices. The market size is projected to reach xx Million by 2033, fueled by the ongoing growth in construction and renovation projects across various segments, including offices, hospitality, and healthcare.

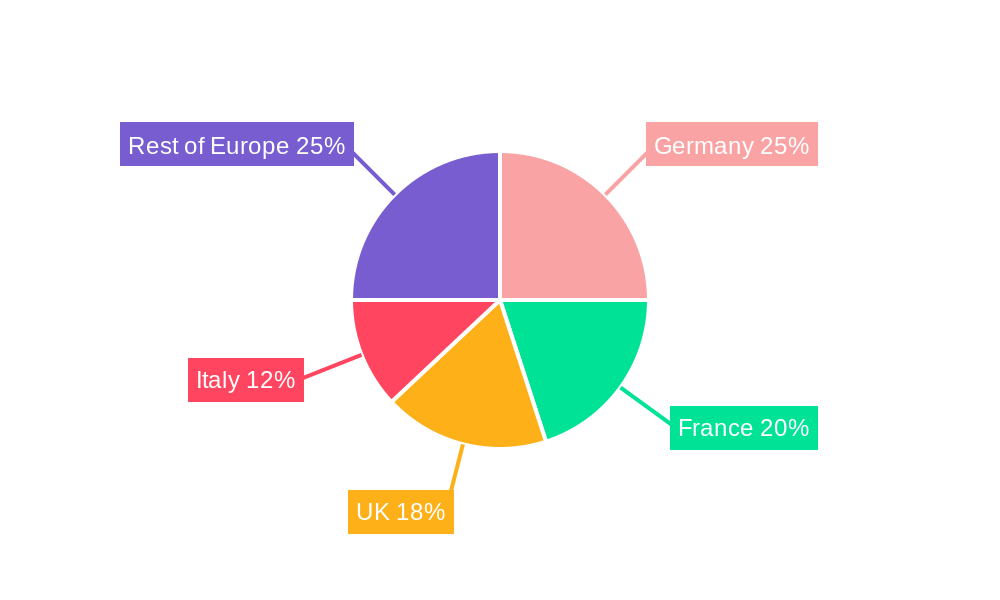

Key Markets & Segments Leading Europe Carpet Tile Industry

The commercial segment dominates the Europe carpet tile market, accounting for approximately xx% of total revenue in 2024, driven by high demand for durable and easy-to-maintain flooring solutions in offices, retail spaces, and hospitality settings. The square carpet tile format holds a larger share compared to rectangular tiles due to its versatility and ease of installation. Offline stores remain the dominant distribution channel; however, online sales are steadily growing, driven by increased e-commerce penetration and convenience. Germany and the UK are the leading markets within Europe, driven by strong economic growth and robust construction activity.

Key Market Drivers:

- Commercial Segment: High demand for durable and easy-to-maintain flooring in office spaces.

- Square Tiles: Versatility and ease of installation.

- Offline Stores: Established distribution network and customer familiarity.

- Germany & UK: Strong construction sectors and economic growth.

Europe Carpet Tile Industry Product Developments

Recent product innovations focus on enhanced durability, stain resistance, sound absorption, and sustainability. Manufacturers are incorporating recycled materials, implementing eco-friendly dyeing techniques, and developing carpet tiles with improved acoustic properties. These advancements cater to evolving consumer preferences and address environmental concerns. The incorporation of innovative designs and textures expands the aesthetic appeal, enhancing the competitive edge of products in the market.

Challenges in the Europe Carpet Tile Industry Market

The industry faces challenges including fluctuations in raw material prices, increasing competition from substitute flooring options, and stricter environmental regulations. Supply chain disruptions, particularly in raw material sourcing, have impacted production costs and availability. Furthermore, intense competition from other flooring materials necessitates continuous product innovation and marketing efforts.

Forces Driving Europe Carpet Tile Industry Growth

Several factors drive market growth. Sustainable and eco-friendly carpet tile options are gaining popularity among environmentally conscious consumers. Growing urbanization and infrastructure development necessitate flooring solutions for new construction and renovation projects, propelling market expansion. Technological advancements in production processes enhance efficiency and product quality.

Long-Term Growth Catalysts in the Europe Carpet Tile Industry

Long-term growth is fueled by continued innovation in materials and designs, strategic partnerships to expand market reach, and exploration of new market segments. Investment in R&D to enhance sustainability and functionality will further drive growth.

Emerging Opportunities in Europe Carpet Tile Industry

Emerging opportunities include the development of modular carpet tile systems, offering increased design flexibility. The integration of smart technologies, such as underfloor heating systems, presents growth potential. Focus on sustainable and recycled materials caters to the growing environmental awareness among consumers and facilitates market expansion.

Leading Players in the Europe Carpet Tile Industry Sector

- Tarkett SA

- Brinton's Carpets

- Balta Group N.V.

- Teppichwerke GmbH

- Creatuft NV

- Mohawk Industries Inc.

- Dekowe GmbH & Co KG

- Fletco Carpets A/S

- Royal Carpet SA

- Agnella S.A

Key Milestones in Europe Carpet Tile Industry Industry

- March 2020: Brinton's Carpets expanded into the American tufted carpet manufacturing market with a new guest room kit.

- January 2021: Balta Group N.V. demonstrated its commitment to sustainability by introducing six electric cars.

Strategic Outlook for Europe Carpet Tile Industry Market

The European carpet tile industry is poised for sustained growth, driven by ongoing construction activity, technological advancements, and increasing consumer demand for sustainable and aesthetically pleasing flooring solutions. Companies with a focus on innovation, sustainability, and strategic partnerships are well-positioned to capitalize on the market's long-term potential.

Europe Carpet Tile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Carpet Tile Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Carpet Tile Industry Regional Market Share

Geographic Coverage of Europe Carpet Tile Industry

Europe Carpet Tile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction and Renovation Activities; Increasing Percentage of 65+ year of Age in Europe

- 3.3. Market Restrains

- 3.3.1. High Competitiveness in Players Resilient Flooring Market; Substitution by Other Products

- 3.4. Market Trends

- 3.4.1. Germany is One of the Prominent Markets for Carpet Tile in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Carpet Tile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tarkett SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brinton's Carpets

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Balta Group N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Teppichwerke GmbH*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Creatuft NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mohawk Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dekowe GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fletco Carpets A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Royal Carpet SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agnella S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tarkett SA

List of Figures

- Figure 1: Europe Carpet Tile Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Carpet Tile Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Carpet Tile Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Carpet Tile Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Carpet Tile Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Carpet Tile Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Carpet Tile Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Carpet Tile Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Carpet Tile Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Carpet Tile Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Carpet Tile Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Carpet Tile Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Carpet Tile Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Carpet Tile Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Carpet Tile Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Carpet Tile Industry?

The projected CAGR is approximately 2.2%.

2. Which companies are prominent players in the Europe Carpet Tile Industry?

Key companies in the market include Tarkett SA, Brinton's Carpets, Balta Group N V, Teppichwerke GmbH*List Not Exhaustive, Creatuft NV, Mohawk Industries Inc, Dekowe GmbH & Co KG, Fletco Carpets A/S, Royal Carpet SA, Agnella S A.

3. What are the main segments of the Europe Carpet Tile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.89 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction and Renovation Activities; Increasing Percentage of 65+ year of Age in Europe.

6. What are the notable trends driving market growth?

Germany is One of the Prominent Markets for Carpet Tile in the Region.

7. Are there any restraints impacting market growth?

High Competitiveness in Players Resilient Flooring Market; Substitution by Other Products.

8. Can you provide examples of recent developments in the market?

January 2021- Balta confirmed its sustainable approach with the introduction of six electric cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Carpet Tile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Carpet Tile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Carpet Tile Industry?

To stay informed about further developments, trends, and reports in the Europe Carpet Tile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence