Key Insights

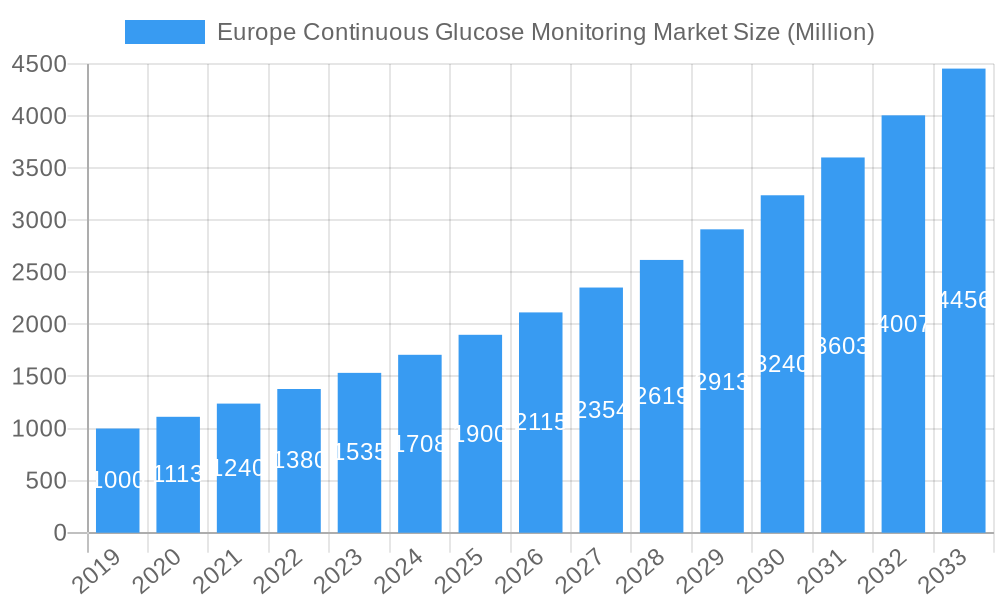

The European Continuous Glucose Monitoring (CGM) market is poised for significant expansion, projected to reach \$2.04 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 11.33% anticipated throughout the forecast period of 2025-2033. This impressive growth is primarily driven by an increasing prevalence of diabetes across the continent, coupled with a growing awareness and adoption of advanced diabetes management technologies. Factors such as favorable reimbursement policies, technological advancements leading to improved sensor accuracy and user convenience, and a rising demand for personalized healthcare solutions are acting as powerful catalysts for this market's upward trajectory. The integration of CGM systems with insulin pumps and other diabetes management platforms further enhances their appeal, offering a more holistic approach to patient care and contributing to better glycemic control.

Europe Continuous Glucose Monitoring Market Market Size (In Billion)

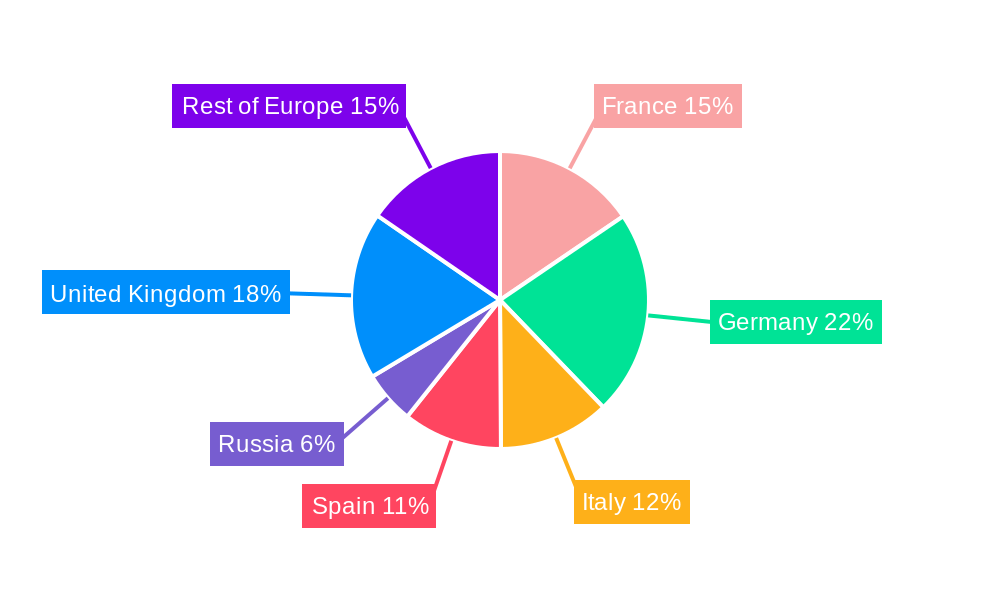

The market segmentation reveals a strong focus on both continuous glucose monitoring sensors and durable components. Key industry players like Medtronic, Abbott, Dexcom, Senseonics, and Ascensia are actively engaged in innovation and market penetration, vying for a substantial share of this dynamic landscape. While the overall market is experiencing sustained growth, certain segments and regions may present unique opportunities and challenges. The European region, encompassing countries like France, Germany, Italy, Spain, Russia, and the United Kingdom, is a critical market due to its substantial diabetic population and advanced healthcare infrastructure. Addressing the cost-effectiveness and accessibility of these devices will be crucial for unlocking their full potential and ensuring widespread adoption among diverse patient demographics.

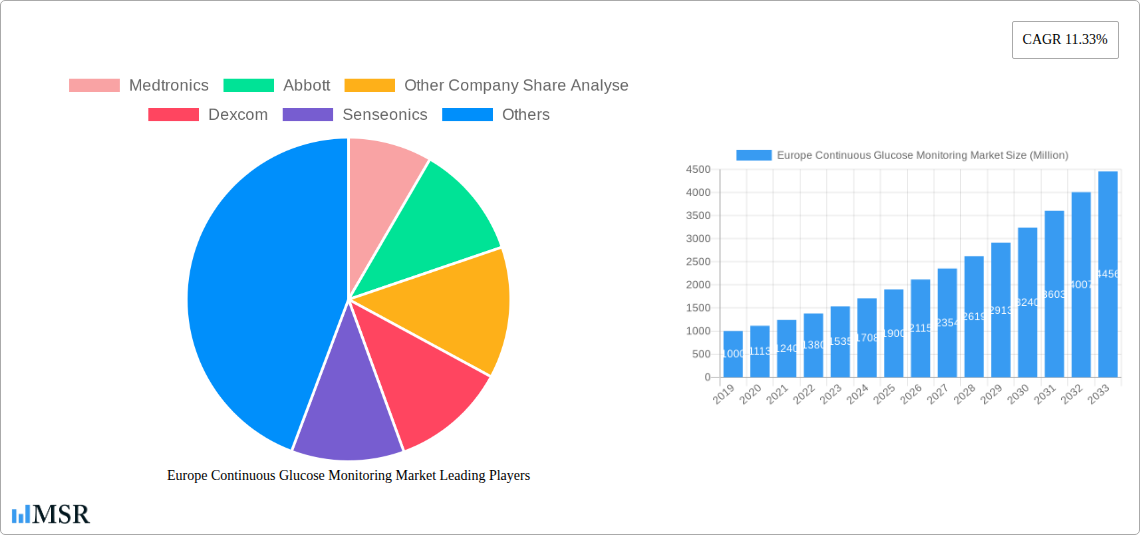

Europe Continuous Glucose Monitoring Market Company Market Share

This report offers an in-depth analysis of the Europe Continuous Glucose Monitoring (CGM) market, a rapidly expanding sector critical for diabetes management. Covering the study period of 2019–2033, with 2025 as the base and estimated year, this comprehensive report provides actionable insights for stakeholders. Our forecast period of 2025–2033 and historical period of 2019–2024 segments paint a complete picture of market evolution. Dive into key drivers, technological advancements, regulatory landscapes, and competitive strategies shaping the future of CGM devices in Europe.

Europe Continuous Glucose Monitoring Market Market Concentration & Dynamics

The Europe Continuous Glucose Monitoring market exhibits a moderate to high concentration, driven by the significant market share held by key players such as Medtronic, Abbott, and Dexcom. Senseonics and Ascensia also play crucial roles, particularly in specialized segments. Other Company Share Analyse reveals a fragmented landscape of emerging players and niche technology providers. The innovation ecosystem is robust, with substantial R&D investments fueling the development of more accurate, less invasive, and user-friendly CGM sensors and durables. Regulatory frameworks in Europe, while complex, are generally supportive of medical device innovation, facilitating market entry for approved technologies. Substitute products, primarily traditional blood glucose meters (BGMs), are gradually being displaced by the superior data insights and trend analysis offered by CGM systems. End-user trends are heavily influenced by increasing diabetes prevalence, a growing demand for personalized health solutions, and a rising awareness of the benefits of proactive diabetes management. M&A activities, though not always at record highs, are strategic, focused on consolidating market positions, acquiring innovative technologies, and expanding geographical reach. The M&A deal counts are expected to remain steady, with companies seeking to enhance their portfolios and competitive edge.

- Market Share Dominance: Medtronic, Abbott, and Dexcom collectively hold a substantial portion of the European CGM market.

- Innovation Hubs: Strong R&D activities are concentrated in regions with established medical technology sectors.

- Regulatory Approvals: CE Mark approvals are critical for market access across EU member countries.

- End-User Demand: Increasing awareness of diabetes complications and the benefits of real-time glucose monitoring drives adoption.

- M&A Focus: Strategic acquisitions target technology integration and market expansion.

Europe Continuous Glucose Monitoring Market Industry Insights & Trends

The Europe Continuous Glucose Monitoring market is on an upward trajectory, driven by a confluence of factors that are fundamentally reshaping diabetes care. The estimated market size in 2025 is projected to reach XX Million Euros, with an impressive Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This robust growth is underpinned by several key market growth drivers, including the escalating prevalence of Type 1 and Type 2 diabetes across the continent, coupled with an aging population that often presents with more complex comorbidities. Advances in sensor technology are at the forefront of market expansion; newer generations of CGM sensors are offering enhanced accuracy, longer wear times, and improved patient comfort, significantly reducing the need for traditional fingerstick calibrations. Furthermore, the integration of CGM systems with smart devices, mobile applications, and data analytics platforms is empowering individuals with diabetes to gain deeper insights into their glucose patterns, enabling more informed lifestyle and treatment decisions. This shift towards personalized and proactive health management is a significant consumer behavior evolution. Technological disruptions are also playing a pivotal role. The development of hybrid closed-loop insulin delivery systems, which combine CGM data with insulin pumps, is revolutionizing diabetes management, offering greater automation and improved glycemic control. The increasing focus on telehealth and remote patient monitoring solutions further amplifies the demand for connected CGM devices, allowing healthcare providers to remotely track patient glucose levels and intervene proactively. Economic factors, such as increasing disposable incomes and growing healthcare expenditures in various European nations, also contribute to the market's expansion by making these advanced technologies more accessible. The market is witnessing a paradigm shift from reactive glucose monitoring to proactive, data-driven diabetes management, fueled by technological innovation and a growing patient-centric approach to healthcare.

Key Markets & Segments Leading Europe Continuous Glucose Monitoring Market

The Europe Continuous Glucose Monitoring market is witnessing dynamic growth across its key segments, with Continuous Glucose Monitoring: Sensors emerging as the dominant force driving market expansion. This segment's leadership is propelled by relentless innovation in miniaturization, accuracy, and longevity of the sensor technology itself.

Dominant Segment: Continuous Glucose Monitoring: Sensors

- Driver: Technological Advancements: Continuous improvements in biosensor technology, electrochemical sensing, and materials science are leading to more accurate, reliable, and longer-lasting sensors. This directly addresses a primary concern for users – the accuracy and frequency of replacement.

- Driver: Minimally Invasive Designs: The push towards even less invasive sensor designs, reducing patient discomfort and improving adherence, is a significant growth catalyst for the sensors segment.

- Driver: Cost-Effectiveness: As manufacturing processes mature and economies of scale are achieved, the cost of individual sensors is gradually becoming more accessible, fueling higher unit sales.

- Dominance Analysis: The sensor segment is the core of any CGM system. Without advanced, reliable, and user-friendly sensors, the entire market cannot progress. Companies are investing heavily in R&D for next-generation sensors that offer superior performance and user experience. The ability to continuously collect glucose data with minimal disruption is paramount for effective diabetes management, making this segment the bedrock of the market.

Significant Segment: Durables

- Driver: System Integration: The development of integrated CGM systems, often paired with smartphone applications and data management platforms, enhances the value proposition of the durable transmitter and receiver components.

- Driver: Smart Features and Connectivity: The inclusion of advanced connectivity features, such as Bluetooth and NFC, enables seamless data transmission and integration with other health devices, appealing to tech-savvy consumers.

- Driver: Longevity and Reusability: While sensors are disposable, the durable transmitter units offer a longer lifespan, providing a more sustainable and potentially cost-effective solution over time.

- Dominance Analysis: While sensors are the consumables, the durable components, such as transmitters and readers, are essential for the functionality of the entire CGM system. Innovations in this segment focus on enhancing connectivity, user interface design, and overall system integration to provide a seamless user experience. The increasing adoption of connected health ecosystems further boosts the demand for smart and integrated durable devices.

Europe Continuous Glucose Monitoring Market Product Developments

The Europe Continuous Glucose Monitoring market is characterized by a robust pipeline of innovative products designed to enhance patient outcomes and user experience. Medtronic's recent introduction of Simplera, a cutting-edge CGM designed for individuals with diabetes aged 2 and above, highlights a significant advancement. This new system, currently undergoing FDA evaluation for clearance in the United States, features a modern, disposable design that notably eliminates the need for fingersticks, a major pain point for many CGM users. In June 2022, Ascensia Diabetes Care, in partnership with Senseonics Holdings, Inc., announced CE Mark approval for the Eversense E3 Continuous Glucose Monitoring (CGM) System, paving the way for its deployment within European Union member countries. This system offers extended wear duration and improved accuracy, further solidifying the trend towards more convenient and long-term glucose monitoring solutions within the European market. These developments underscore the industry's commitment to providing users with more discreet, accurate, and user-friendly CGM technologies, driving market adoption and improving the quality of life for individuals managing diabetes.

Challenges in the Europe Continuous Glucose Monitoring Market Market

The Europe Continuous Glucose Monitoring market faces several challenges that could potentially temper its growth. Regulatory hurdles, while often a pathway to market, can also be a significant barrier, with varied approval timelines and requirements across different European nations leading to fragmented market access. The high cost of CGM devices, particularly the ongoing expense of disposable sensors, remains a considerable restraint for a significant portion of the population, impacting affordability and widespread adoption. Supply chain disruptions, exacerbated by global events, can lead to product shortages and affect the consistent availability of CGM sensors and other essential components. Furthermore, the market grapples with patient and healthcare provider education; a lack of comprehensive understanding regarding the benefits and proper usage of CGM systems can hinder uptake. Competitive pressures from both established players and emerging technologies also necessitate continuous innovation and strategic pricing to maintain market share.

- High Cost of Devices: Ongoing sensor replacement and initial device investment limit accessibility.

- Complex Regulatory Landscape: Navigating diverse national regulations within the EU presents a challenge.

- Supply Chain Vulnerabilities: Geopolitical and logistical issues can impact product availability.

- Education and Awareness Gaps: Insufficient understanding of CGM benefits and usage restricts adoption.

- Intense Competition: Market saturation requires continuous innovation and competitive pricing strategies.

Forces Driving Europe Continuous Glucose Monitoring Market Growth

Several powerful forces are propelling the Europe Continuous Glucose Monitoring market forward. The accelerating prevalence of diabetes across all age groups in Europe is a primary driver, creating a growing patient pool actively seeking effective management solutions. Technological innovation is another significant force; continuous advancements in CGM sensors are leading to enhanced accuracy, improved user comfort, and longer wear times, making these devices more appealing and practical for daily use. The integration of CGM systems with smartphones, wearable technology, and cloud-based data analytics platforms is transforming diabetes care into a more personalized and data-driven experience. Furthermore, a growing awareness among patients and healthcare professionals about the long-term benefits of proactive glucose monitoring, including reduced complication rates and improved quality of life, is fostering increased demand. Supportive reimbursement policies in certain European countries also play a crucial role by increasing the affordability of these advanced technologies.

Challenges in the Europe Continuous Glucose Monitoring Market Market

While growth is robust, the Europe Continuous Glucose Monitoring market must navigate specific long-term growth catalysts. The ongoing development of artificial pancreas systems, which leverage CGM data to automate insulin delivery, represents a significant technological leap that will further drive adoption and improve patient outcomes. Partnerships between CGM manufacturers, pharmaceutical companies developing diabetes medications, and technology providers are crucial for creating integrated diabetes management ecosystems. Market expansions into emerging European economies, where diabetes prevalence is rising and healthcare infrastructure is developing, present substantial untapped potential. Continued investment in clinical research to further demonstrate the long-term economic and health benefits of CGM systems will also be instrumental in solidifying their position as a standard of care.

Emerging Opportunities in Europe Continuous Glucose Monitoring Market

The Europe Continuous Glucose Monitoring market is ripe with emerging opportunities for growth and innovation. The expanding use of CGM technology in non-diabetes populations, such as individuals with prediabetes or those at high risk, presents a new avenue for market penetration. The development of "wellness" CGMs focused on general health and metabolic tracking, beyond strict clinical diabetes management, is another promising trend. Furthermore, the increasing demand for telehealth and remote patient monitoring solutions post-pandemic creates a fertile ground for connected CGM devices that allow for real-time data sharing with healthcare providers. Innovations in sensor technology, such as non-invasive or minimally invasive approaches, if successfully brought to market, could revolutionize the field and unlock a massive new user base. The growing focus on preventative healthcare and personalized medicine across Europe further amplifies the potential for CGM systems to become an integral part of broader health management strategies.

Leading Players in the Europe Continuous Glucose Monitoring Market Sector

- Medtronic

- Abbott

- Dexcom

- Senseonics

- Ascensia

Key Milestones in Europe Continuous Glucose Monitoring Market Industry

- October 2023: Medtronic introduced Simplera, a cutting-edge CGM for individuals aged 2 and above, currently undergoing FDA evaluation for US clearance, featuring a modern, disposable design that eliminates fingersticks.

- June 2022: Ascensia Diabetes Care announced that its partner Senseonics Holdings, Inc. received CE Mark approval for the Eversense E3 Continuous Glucose Monitoring (CGM) System, enabling its use in European Union member countries.

Strategic Outlook for Europe Continuous Glucose Monitoring Market Market

The strategic outlook for the Europe Continuous Glucose Monitoring market is exceptionally positive, fueled by a relentless pursuit of technological advancement and a growing recognition of CGM's vital role in modern diabetes care. Future market growth will be accelerated by the increasing integration of CGM systems into comprehensive digital health platforms and the development of more sophisticated closed-loop systems that offer enhanced automation. Strategic opportunities lie in expanding market access through favorable reimbursement policies and in penetrating underserved regions within Europe. Collaboration between manufacturers, healthcare providers, and patient advocacy groups will be crucial to foster wider adoption and ensure that the benefits of CGM technology reach a broader segment of the population. The focus on user-centric design, affordability, and demonstrable clinical outcomes will be paramount for sustained success in this dynamic market.

Europe Continuous Glucose Monitoring Market Segmentation

-

1. Continuous Glucose Monitoring

- 1.1. Sensors

- 1.2. Durables

Europe Continuous Glucose Monitoring Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Spain

- 5. Russia

- 6. United Kingdom

- 7. Rest of Europe

Europe Continuous Glucose Monitoring Market Regional Market Share

Geographic Coverage of Europe Continuous Glucose Monitoring Market

Europe Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Continuous Glucose Monitoring Devices Prove to be an Instrumental Tool in maintaining Glycemic Balance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.2.2. Germany

- 5.2.3. Italy

- 5.2.4. Spain

- 5.2.5. Russia

- 5.2.6. United Kingdom

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 6. France Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 6.1.1. Sensors

- 6.1.2. Durables

- 6.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 7. Germany Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 7.1.1. Sensors

- 7.1.2. Durables

- 7.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 8. Italy Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 8.1.1. Sensors

- 8.1.2. Durables

- 8.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 9. Spain Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 9.1.1. Sensors

- 9.1.2. Durables

- 9.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 10. Russia Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 10.1.1. Sensors

- 10.1.2. Durables

- 10.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 11. United Kingdom Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 11.1.1. Sensors

- 11.1.2. Durables

- 11.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 12. Rest of Europe Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 12.1.1. Sensors

- 12.1.2. Durables

- 12.1. Market Analysis, Insights and Forecast - by Continuous Glucose Monitoring

- 13. Germany Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 14. France Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 15. Italy Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 16. United Kingdom Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 17. Netherlands Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 18. Sweden Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 19. Rest of Europe Europe Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2025

- 20.2. Company Profiles

- 20.2.1 Medtronics

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Abbott

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Other Company Share Analyse

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Dexcom

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Senseonics

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Ascensia

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.1 Medtronics

List of Figures

- Figure 1: Europe Continuous Glucose Monitoring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Continuous Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 3: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 4: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 5: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: France Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Italy Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Netherlands Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Sweden Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Europe Continuous Glucose Monitoring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Europe Continuous Glucose Monitoring Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 24: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 25: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 27: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 28: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 29: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 32: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 33: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 36: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 37: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 39: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 40: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 41: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 44: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 45: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 47: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 48: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Continuous Glucose Monitoring 2020 & 2033

- Table 49: Europe Continuous Glucose Monitoring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Europe Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Continuous Glucose Monitoring Market?

The projected CAGR is approximately 11.33%.

2. Which companies are prominent players in the Europe Continuous Glucose Monitoring Market?

Key companies in the market include Medtronics, Abbott, Other Company Share Analyse, Dexcom, Senseonics, Ascensia.

3. What are the main segments of the Europe Continuous Glucose Monitoring Market?

The market segments include Continuous Glucose Monitoring.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Continuous Glucose Monitoring Devices Prove to be an Instrumental Tool in maintaining Glycemic Balance.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2023: Medtronic has recently introduced Simplera, a cutting-edge CGM designed for individuals with diabetes aged 2 and above. Currently undergoing FDA evaluation for clearance in the United States, Simplera boasts a modern, disposable design and eliminates the need for fingersticks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the Europe Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence