Key Insights

The European Non-Destructive Testing (NDT) equipment and services market is experiencing robust growth, driven by increasing demand across key sectors like oil and gas, aerospace and defense, and automotive. The market's 5.80% CAGR from 2019-2024 indicates a healthy expansion, projected to continue through 2033. This growth is fueled by several factors: stringent safety regulations mandating regular inspections in critical infrastructure and manufacturing processes; the rising adoption of advanced NDT technologies like ultrasonic and radiography for improved accuracy and efficiency; and the increasing need for predictive maintenance strategies to minimize downtime and operational costs. Germany, the UK, and France are major contributors to the market size, benefiting from established industrial bases and significant investments in infrastructure. The services segment, including inspection and certification services, is expected to witness strong growth due to the increasing outsourcing of NDT activities by companies focusing on core competencies. While competitive intensity among service providers is high, technological advancements and a focus on specialized NDT techniques for specific applications offer avenues for differentiation and market expansion.

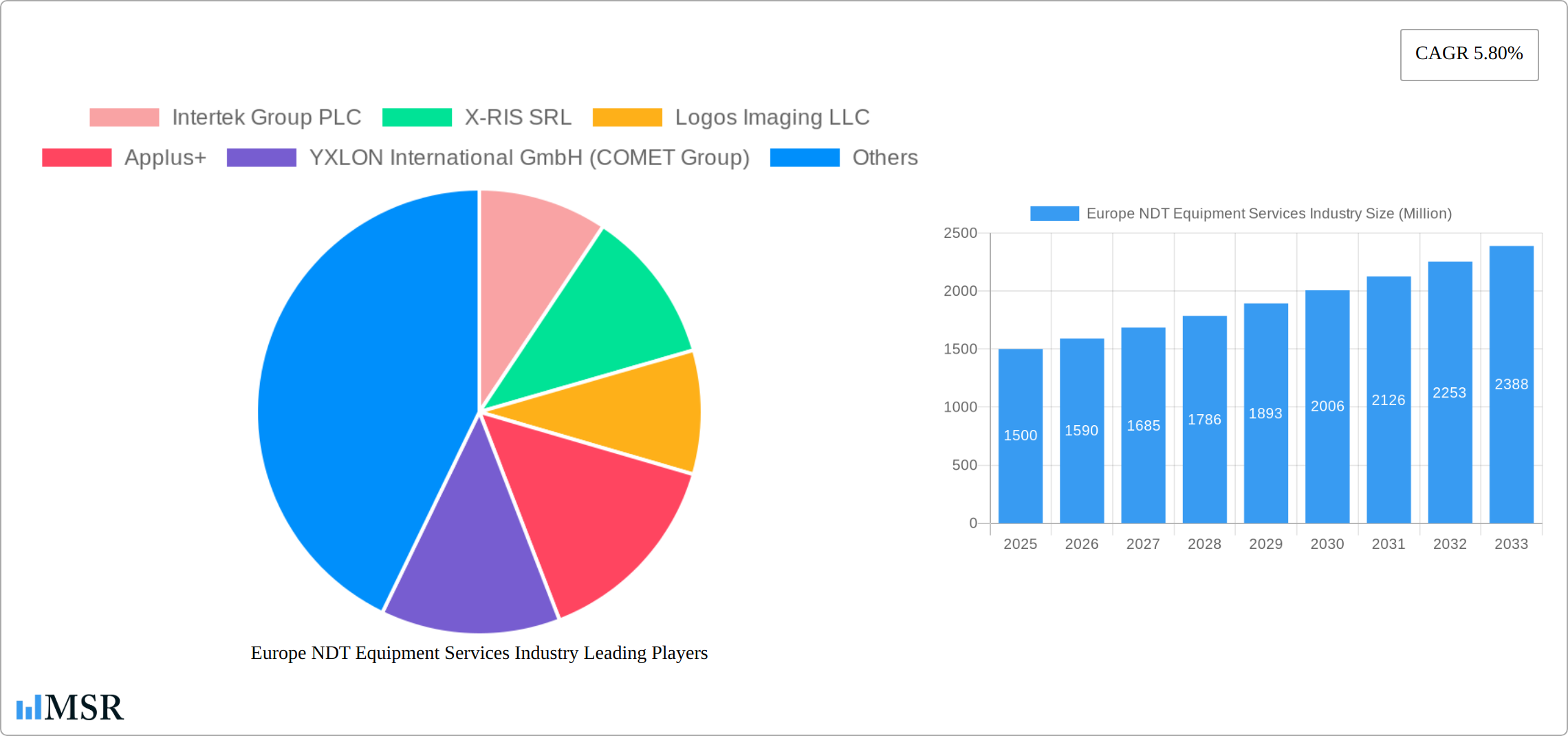

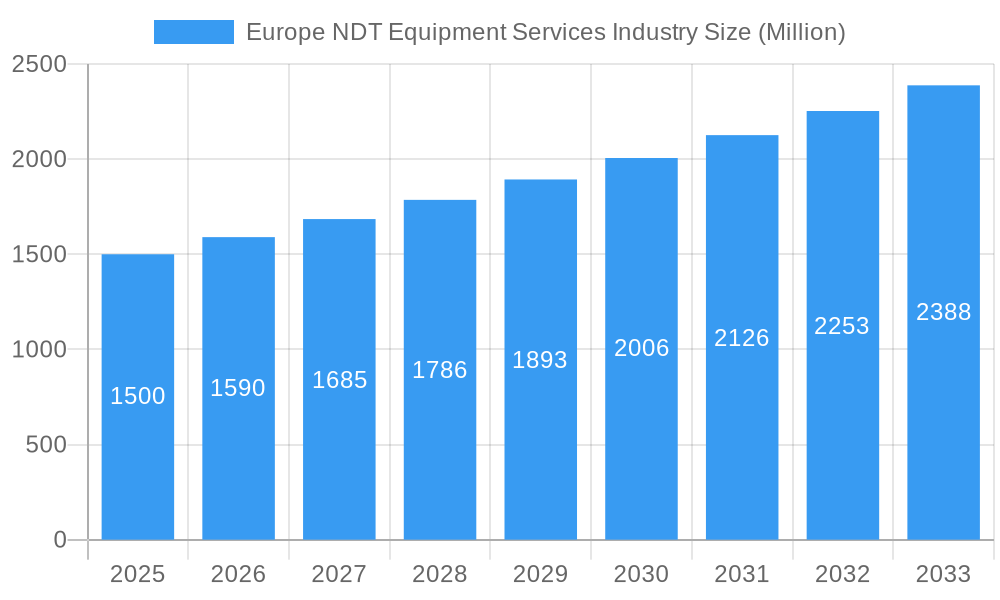

Europe NDT Equipment Services Industry Market Size (In Billion)

However, the market faces some challenges. High initial investment costs for advanced NDT equipment can hinder adoption, especially among smaller businesses. The skilled labor shortage in NDT professionals represents a bottleneck for growth, demanding greater investment in training and education programs. Furthermore, fluctuating commodity prices and economic downturns in specific sectors can impact the demand for NDT services. Nevertheless, the long-term outlook remains positive, with the market poised to capitalize on global industrial growth and the increasing importance of safety and reliability across diverse industries. Specific opportunities lie in developing innovative and cost-effective NDT solutions that address the needs of emerging sectors and applications. The ongoing development of automation and AI in NDT, coupled with the growing demand for real-time data analysis, will significantly influence the future landscape.

Europe NDT Equipment Services Industry Company Market Share

Europe NDT Equipment Services Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the European Non-Destructive Testing (NDT) equipment and services market from 2019 to 2033. It offers invaluable insights into market dynamics, key players, technological advancements, and future growth opportunities for stakeholders across the NDT industry. The report covers equipment and services across various testing technologies and end-user industries in key European countries. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024.

Europe NDT Equipment Services Industry Market Concentration & Dynamics

The European NDT equipment and services market is characterized by a moderately concentrated landscape, with a few prominent global players commanding a significant market share. Key industry leaders such as Intertek Group PLC, Applus+, YXLON International GmbH (COMET Group), and Teledyne ICM are instrumental in shaping the market, collectively contributing an estimated xx% of the total revenue in 2025. Alongside these major entities, a robust ecosystem of smaller, highly specialized companies actively participates, often carving out niche markets with their unique expertise. The market continues to witness dynamic consolidation through mergers and acquisitions (M&A) activity, with approximately xx M&A deals recorded between 2019 and 2024. This strategic trend underscores companies' efforts to broaden their service offerings, enhance technological capabilities, and expand their geographical footprints across the European region. The prevailing regulatory environment is becoming increasingly stringent, thereby fostering a greater demand for sophisticated NDT technologies and services that adhere to rigorous safety and compliance mandates. While advanced imaging techniques represent a moderate competitive threat, the overall market dynamics are largely influenced by the drive for enhanced safety and asset integrity.

- Market Share: Intertek Group PLC: xx%, Applus+: xx%, YXLON International GmbH: xx%, Teledyne ICM: xx%, Others: xx% (2025 estimated)

- M&A Deal Count: xx (2019-2024)

- Key Drivers: Stringent regulations, escalating demand for advanced NDT technologies and automation, continuous digitalization efforts, and strategic M&A activities.

- Challenges: Persistent competitive pressure from substitute technologies and agile smaller market players.

Europe NDT Equipment Services Industry Industry Insights & Trends

The European NDT equipment and services market is forecasted to experience robust growth, projecting a Compound Annual Growth Rate (CAGR) of xx% throughout the forecast period spanning 2025 to 2033. This anticipated expansion is predominantly fueled by the escalating demand from pivotal end-user industries, including the oil and gas sector, aerospace and defense, and power generation. The market's valuation is estimated at €xx Million in 2025 and is expected to reach an impressive €xx Million by 2033. Significant technological advancements, particularly in the realm of automated NDT systems and cutting-edge imaging techniques such as phased array ultrasonic testing and digital radiography, are profoundly influencing market trajectories. These innovations are instrumental in augmenting inspection efficiency, enhancing accuracy, and improving data analysis capabilities, consequently driving wider adoption. Furthermore, evolving end-user preferences are placing a greater emphasis on sophisticated data management, real-time remote monitoring, and scalable cloud-based solutions. This burgeoning demand is propelling the development of integrated NDT platforms and advanced data analytics tools designed to deliver comprehensive, real-time NDT insights.

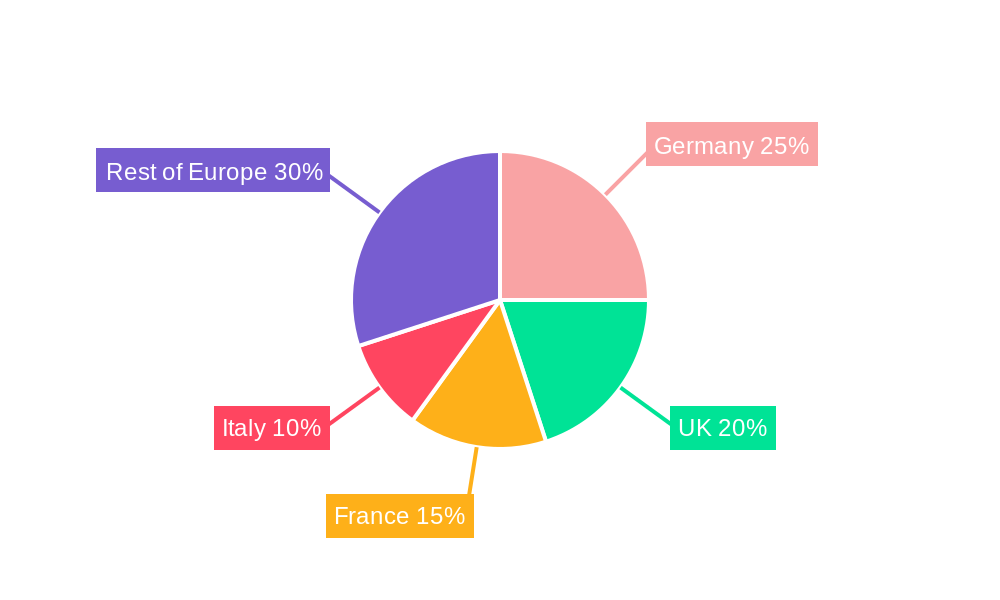

Key Markets & Segments Leading Europe NDT Equipment Services Industry

The United Kingdom, Germany, and France stand out as the foremost national markets within Europe, collectively accounting for approximately xx% of the total market revenue in 2025. Concurrently, promising growth avenues are emerging in other significant regions such as Italy and the broader "Rest of Europe" segment.

Dominant Segments:

- By Type: In 2025, the Equipment segment commands a larger market share compared to the Services segment, largely attributed to substantial capital expenditure allocated towards advanced NDT equipment procurement.

- By Testing Technology: Ultrasonic testing emerges as the dominant technology segment, owing to its inherent versatility and widespread applicability across a diverse range of industries. Radiography also maintains a substantial market presence.

- By End-user Industry: The Oil and Gas sector leads the end-user segment, closely followed by Aerospace & Defense and Power & Energy, driven by the critical emphasis on stringent safety protocols and quality assurance measures within these industries.

Key Growth Enablers:

- Economic Expansion: Sustained economic growth across major European economies is a significant catalyst, stimulating investment in critical infrastructure and industrial projects, thereby bolstering the demand for NDT services.

- Infrastructure Development: Ambitious infrastructure development initiatives, including the expansion of renewable energy facilities and transportation networks, are creating a substantial need for comprehensive NDT inspections.

- Regulatory Stringency: The continuous tightening of safety and quality regulations across various sectors necessitates the diligent application of NDT for effective asset integrity management.

Europe NDT Equipment Services Industry Product Developments

Recent years have witnessed significant innovation in NDT technologies, particularly in areas such as phased array ultrasonic testing (PAUT), digital radiography, and advanced data analytics platforms. These advancements provide enhanced inspection capabilities, improved accuracy, and faster data processing, resulting in increased efficiency and reduced inspection costs. The integration of artificial intelligence (AI) and machine learning (ML) into NDT systems is also gaining traction, automating defect detection and improving the overall quality of inspections. These product developments are enhancing the competitive landscape and are expected to drive market growth further in the coming years.

Challenges in the Europe NDT Equipment Services Industry Market

The European NDT market is navigating several significant challenges. Adhering to stringent regulatory compliance requirements often mandates substantial investments in certifications and personnel approvals for both equipment and operators. Furthermore, disruptions within global supply chains and volatility in raw material prices can impact the cost-effectiveness and availability of NDT equipment and associated services. The competitive landscape, characterized by the presence of both established industry leaders and agile new entrants, exerts considerable pressure on pricing strategies and overall profitability. These interconnected factors collectively influence the market's overarching dynamics and growth trajectory. It is estimated that these challenges could lead to an approximate xx% reduction in the overall market CAGR.

Forces Driving Europe NDT Equipment Services Industry Growth

The European NDT market growth is significantly driven by several factors. Firstly, increasing investments in infrastructure projects across various sectors necessitate comprehensive NDT services. Secondly, technological advancements, such as AI-powered automated systems and advanced imaging techniques, enhance efficiency and accuracy of inspections. Lastly, stringent safety and quality regulations across different industries create a constant demand for NDT testing. These factors collaboratively propel market growth.

Long-Term Growth Catalysts in the Europe NDT Equipment Services Industry

Long-term growth in the European NDT market will be driven by strategic collaborations between NDT service providers and technology developers. This will lead to the development of innovative, integrated solutions. Furthermore, expansion into emerging markets and applications within sectors like renewable energy and construction are poised to drive future growth. The continued investment in research and development of advanced NDT techniques will be crucial in maintaining long-term market competitiveness.

Emerging Opportunities in Europe NDT Equipment Services Industry

Emerging opportunities exist in the development and adoption of integrated NDT platforms that combine various testing technologies and data analytics capabilities. The use of AI and ML for automated defect detection and predictive maintenance offers significant potential. Expanding into new applications, such as the inspection of wind turbines and other renewable energy infrastructure, will also open new market avenues. Moreover, a focus on providing specialized NDT solutions for specific industries, such as aerospace or medical devices, can unlock further growth.

Leading Players in the Europe NDT Equipment Services Industry Sector

- Intertek Group PLC

- X-RIS SRL

- Logos Imaging LLC

- Applus+

- YXLON International GmbH (COMET Group)

- Teledyne ICM

- Novo DR Ltd

- SAS novup (VisioConsult)

- Zetec Inc

- 3DX-RAY Ltd (Image Scan Holdings Plc)

- Scanna MSC

- GE Measurement and Control

- Bureau Veritas

Key Milestones in Europe NDT Equipment Services Industry Industry

- 2020: Introduction of AI-powered defect detection software by a major NDT service provider.

- 2021: Acquisition of a smaller NDT company by a larger multinational corporation.

- 2022: Launch of a new generation of phased array ultrasonic testing equipment by a leading manufacturer.

- 2023: Implementation of new European Union regulations concerning NDT practices in the energy sector.

- 2024: Significant increase in investment in NDT solutions for renewable energy projects.

Strategic Outlook for Europe NDT Equipment Services Industry Market

The European NDT equipment and services market is strategically positioned for substantial future growth, propelled by ongoing technological innovations, increasingly rigorous regulatory frameworks, and the expanding operational demands of key industrial sectors. Promising strategic avenues for growth lie in the development of pioneering NDT solutions, the adept integration of Artificial Intelligence (AI) and big data analytics, and the cultivation of strategic partnerships to effectively address evolving industry requirements. A dedicated focus on sustainability and the development of environmentally responsible NDT solutions will further amplify the market's potential for sustained growth and profitability. The market presents fertile ground for both established industry stalwarts and innovative emerging players capable of adeptly navigating and capitalizing on the industry's dynamic challenges.

Europe NDT Equipment Services Industry Segmentation

-

1. Type

- 1.1. Equipment

- 1.2. Services

-

2. Testing Technology

- 2.1. Radiography

- 2.2. Ultrasonic

- 2.3. Magnetic Particle

- 2.4. Liquid Penetrant

- 2.5. Visual Inspection

- 2.6. Other Technologies

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Power and Energy

- 3.3. Aerospace and Defense

- 3.4. Automotive and Transportation

- 3.5. Construction

- 3.6. Other End-user Industries

Europe NDT Equipment Services Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe NDT Equipment Services Industry Regional Market Share

Geographic Coverage of Europe NDT Equipment Services Industry

Europe NDT Equipment Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulations Mandating Safety Standards

- 3.3. Market Restrains

- 3.3.1. ; Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Increasing Investment in Aerospace and Defense

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe NDT Equipment Services Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Testing Technology

- 5.2.1. Radiography

- 5.2.2. Ultrasonic

- 5.2.3. Magnetic Particle

- 5.2.4. Liquid Penetrant

- 5.2.5. Visual Inspection

- 5.2.6. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Power and Energy

- 5.3.3. Aerospace and Defense

- 5.3.4. Automotive and Transportation

- 5.3.5. Construction

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Intertek Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 X-RIS SRL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logos Imaging LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Applus+

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 YXLON International GmbH (COMET Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledyne ICM

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novo DR Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAS novup (VisioConsult)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zetec Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3DX-RAY Ltd (Image Scan Holdings Plc)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Scanna MSC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GE Measurement and Control

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bureau Veritas*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Intertek Group PLC

List of Figures

- Figure 1: Europe NDT Equipment Services Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe NDT Equipment Services Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Testing Technology 2020 & 2033

- Table 3: Europe NDT Equipment Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Testing Technology 2020 & 2033

- Table 7: Europe NDT Equipment Services Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Europe NDT Equipment Services Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: France Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe NDT Equipment Services Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe NDT Equipment Services Industry?

The projected CAGR is approximately 7.97%.

2. Which companies are prominent players in the Europe NDT Equipment Services Industry?

Key companies in the market include Intertek Group PLC, X-RIS SRL, Logos Imaging LLC, Applus+, YXLON International GmbH (COMET Group), Teledyne ICM, Novo DR Ltd, SAS novup (VisioConsult), Zetec Inc, 3DX-RAY Ltd (Image Scan Holdings Plc), Scanna MSC, GE Measurement and Control, Bureau Veritas*List Not Exhaustive.

3. What are the main segments of the Europe NDT Equipment Services Industry?

The market segments include Type, Testing Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulations Mandating Safety Standards.

6. What are the notable trends driving market growth?

Increasing Investment in Aerospace and Defense.

7. Are there any restraints impacting market growth?

; Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe NDT Equipment Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe NDT Equipment Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe NDT Equipment Services Industry?

To stay informed about further developments, trends, and reports in the Europe NDT Equipment Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence