Key Insights

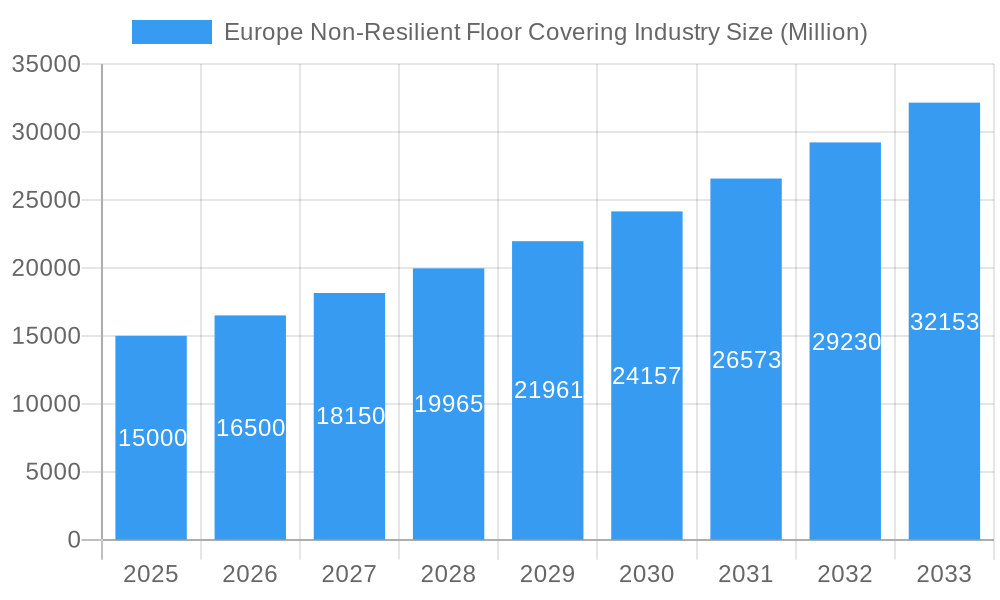

The European Non-Resilient Floor Covering market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 5.7%. This robust growth is anticipated from the base year 2025 to 2033. The market size was valued at 312.46 billion in the base year. Key growth drivers include increasing urbanization and construction activities in major European economies such as Germany, France, and the UK. A growing preference for aesthetically appealing and durable flooring solutions in both residential and commercial spaces is further accelerating adoption. The market is also witnessing a pronounced shift towards sustainable and eco-friendly options, aligning with rising environmental consciousness among consumers and businesses. Ceramic and stone tiles, favored for their exceptional longevity and low maintenance, are particularly popular. Despite potential economic fluctuations, the market's resilience is underpinned by the long-term growth trajectory of the European construction sector and sustained demand for premium flooring. Leading market players include BerryAlloc, Forbo Flooring, Porcelanosa Group, and Mohawk Industries, who are actively pursuing market share through innovation and strategic alliances. Distribution channels are diverse, encompassing home centers, specialized retailers, and a rapidly expanding online presence, effectively serving varied consumer preferences.

Europe Non-Resilient Floor Covering Industry Market Size (In Billion)

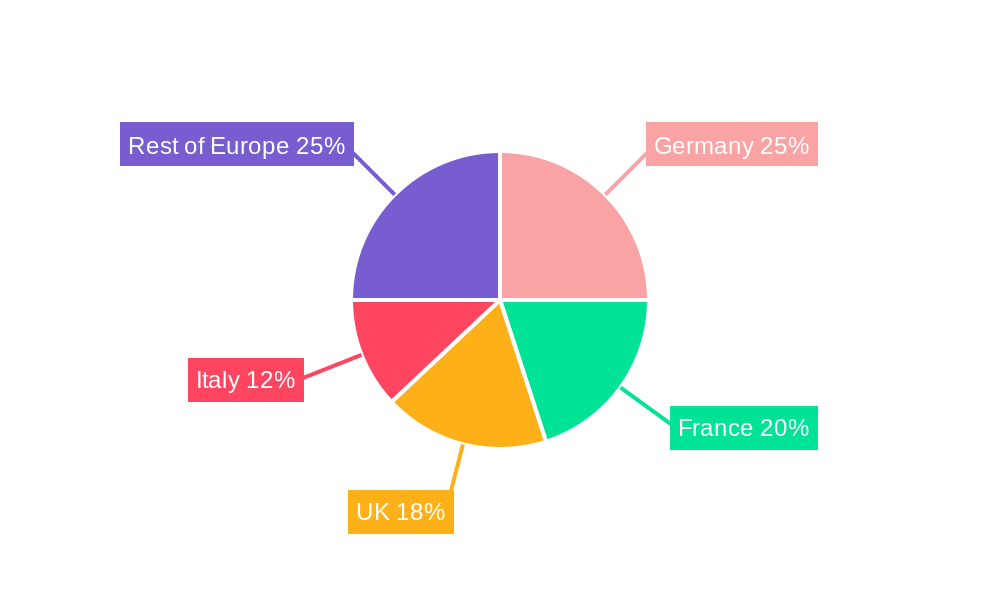

Market segmentation highlights strong performance across product categories. Ceramic tile flooring continues to dominate due to its versatility and cost-effectiveness. However, laminate and wood tile flooring segments are experiencing substantial growth, driven by their design appeal and suitability for a wide range of applications. The commercial sector demonstrates more significant growth than the residential sector, attributed to larger-scale projects and higher investment capacities. Regional dynamics show Germany, France, and the UK leading the market, supported by their developed economies and substantial construction investments. Other European nations are also making notable contributions to overall market expansion. Future growth prospects remain optimistic, fueled by continuous technological advancements in material science and design, leading to enhanced performance and a broader spectrum of styles and finishes to satisfy diverse consumer demands.

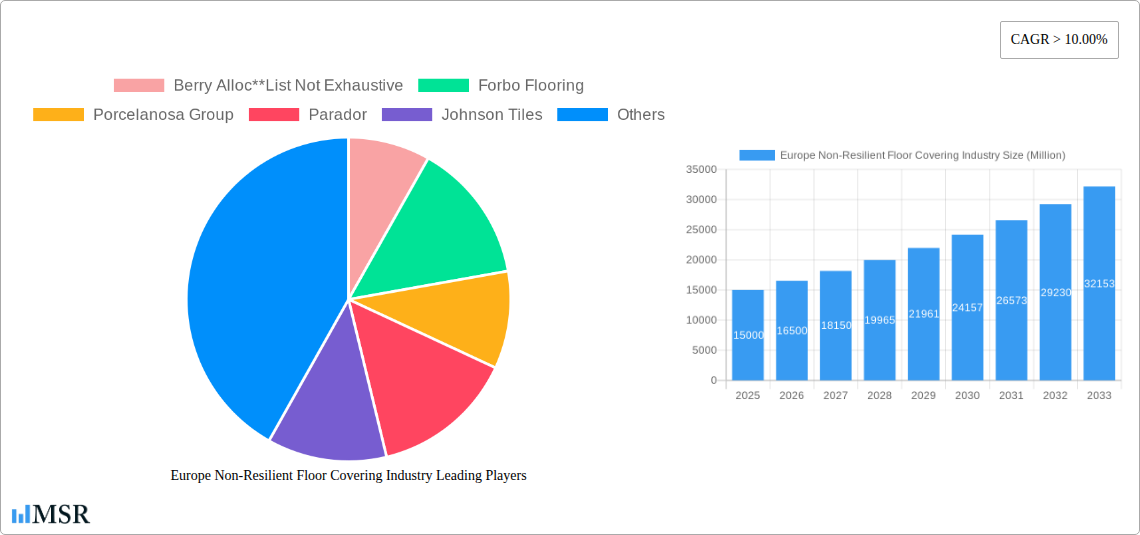

Europe Non-Resilient Floor Covering Industry Company Market Share

Europe Non-Resilient Floor Covering Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Non-Resilient Floor Covering Industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report meticulously analyzes market size, growth drivers, and challenges, forecasting market trends through 2033.

Europe Non-Resilient Floor Covering Industry Market Concentration & Dynamics

This section analyzes the competitive landscape, innovation, regulations, and market activities within the European non-resilient floor covering industry from 2019 to 2024. The market is moderately concentrated, with key players holding significant market share. However, the presence of numerous smaller players ensures a competitive environment.

Market Share: Mohawk Industries Inc. and Tarkett Inc. hold approximately xx% and xx% of the market share respectively, reflecting their strong brand presence and extensive distribution networks. Other significant players like Berry Alloc, Forbo Flooring, and Porcelanosa Group collectively command approximately xx% of the market.

Innovation Ecosystems: Innovation is primarily driven by material advancements, focusing on sustainability and durability. This includes the development of eco-friendly materials, advanced manufacturing processes, and improved design aesthetics.

Regulatory Framework: EU regulations concerning emissions, sustainability, and worker safety significantly influence the industry. Compliance costs and evolving standards are key considerations for market participants.

Substitute Products: The industry faces competition from substitute products like vinyl flooring and engineered wood, putting pressure on pricing and market share. However, the superior durability and aesthetic appeal of non-resilient options sustain market demand.

End-User Trends: The residential segment is a primary driver, propelled by rising disposable incomes and a preference for aesthetically pleasing and durable flooring solutions. Commercial applications are experiencing steady growth, driven by refurbishment projects and new constructions.

M&A Activities: The historical period (2019-2024) witnessed xx merger and acquisition deals, mostly driven by consolidation efforts within the industry. This trend is expected to continue, with larger players seeking to expand their market reach and product portfolio.

Europe Non-Resilient Floor Covering Industry Industry Insights & Trends

The European non-resilient floor covering market is expected to reach €xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Growth is driven by robust construction activity across several European countries, increasing demand for renovation and refurbishment projects, and a rising preference for high-quality, durable flooring solutions. The market is experiencing significant technological disruption, with the adoption of advanced manufacturing techniques and sustainable materials. Consumer behavior is shifting toward eco-friendly products and digital purchasing channels, influencing product development and distribution strategies. The market is witnessing a rise in demand for high-quality, aesthetically-pleasing flooring solutions, as consumers prioritize design and durability in their homes and businesses. Key trends include increased adoption of large-format tiles, rising preference for natural stone and wood alternatives, and growing use of digital design tools for personalized flooring solutions. The industry is also witnessing an increased focus on sustainable and eco-friendly products, driven by environmental awareness and stringent regulations.

Key Markets & Segments Leading Europe Non-Resilient Floor Covering Industry

The key markets and segments driving the European non-resilient floor covering industry are analysed below.

By End-User: The residential segment holds the largest market share, primarily due to its extensive consumer base, high demand for home improvements, and increased construction activity. The commercial segment is also witnessing considerable growth driven by expanding infrastructure and commercial real estate developments across Europe.

By Distribution Channel: Home centers remain the dominant distribution channel, offering convenience and wide reach. However, specialty stores and online channels are gaining popularity, offering specialized expertise and convenience, respectively.

By Product: Ceramic tiles flooring remains the most dominant product segment, owing to its versatility, affordability, and aesthetic appeal. The demand for stone tiles and laminate flooring is also growing steadily, driven by increased disposable income and consumer preference for more luxurious and durable flooring solutions.

Drivers:

- Economic Growth: Strong economic performance in several European countries fuels construction activity and demand for home improvements.

- Infrastructure Development: Ongoing infrastructure projects across Europe drive demand for non-resilient floor coverings in commercial and public spaces.

- Rising Disposable Incomes: Increased consumer spending power supports demand for premium and high-quality flooring solutions.

- Urbanization: Increasing urbanization fuels residential and commercial construction, driving demand for floor coverings.

Europe Non-Resilient Floor Covering Industry Product Developments

Recent product innovations focus on improved durability, eco-friendly materials, and enhanced aesthetics. Manufacturers are introducing large-format tiles, incorporating advanced surface treatments for scratch resistance and stain protection, and developing sustainable materials with reduced environmental impact. These advancements provide competitive edges by improving product performance and meeting evolving consumer demands for sustainable and high-quality products.

Challenges in the Europe Non-Resilient Floor Covering Industry Market

The industry faces challenges including volatile raw material prices, fluctuations in energy costs, escalating logistics expenses, increasing competition, and stringent environmental regulations. These factors impact profit margins and require companies to adapt their strategies to remain competitive. The supply chain disruptions caused by geopolitical events in recent years have added another layer of complexity to the industry's operational landscape. These disruptions have resulted in increased lead times and material shortages, impacting production and delivery schedules.

Forces Driving Europe Non-Resilient Floor Covering Industry Growth

Key growth drivers include technological advancements in material science and manufacturing, resulting in more sustainable and durable products. Increasing construction activity across Europe, driven by economic growth and infrastructural development, significantly contributes to market expansion. Favorable government policies promoting sustainable construction practices provide a further boost to the sector.

Long-Term Growth Catalysts in the Europe Non-Resilient Floor Covering Industry

Long-term growth will be fueled by continuous innovation in materials and designs, leading to more sustainable, durable, and aesthetically appealing flooring options. Strategic partnerships between manufacturers and designers will result in innovative and market-leading products. Expansion into new geographic markets and tapping into underserved segments will open avenues for growth.

Emerging Opportunities in Europe Non-Resilient Floor Covering Industry

Emerging opportunities lie in the growing demand for sustainable and eco-friendly flooring solutions, catering to the rising environmental consciousness of consumers. The increasing adoption of digital technologies in design and sales provides opportunities for personalized customer experiences and improved efficiency. Exploring niche markets with specialized flooring needs (e.g., healthcare, hospitality) offers potential for growth.

Leading Players in the Europe Non-Resilient Floor Covering Industry Sector

- Berry Alloc

- Forbo Flooring

- Porcelanosa Group

- Parador

- Johnson Tiles

- Shaw Industries Inc

- Mohawk Industries Inc

- Beaulieu International Group

- Tarkett Inc

- Atlas Concorde SPA

Key Milestones in Europe Non-Resilient Floor Covering Industry Industry

2022 (Q3): Beaulieu International Group announces further price increases across its flooring portfolio due to sustained pressure on raw material and energy costs. This highlights the impact of macroeconomic factors on pricing and profitability within the industry.

2022: Tarkett releases its 2021 CSR report, outlining its ambitious climate roadmap for 2030. This demonstrates a growing industry focus on environmental sustainability and corporate social responsibility.

Strategic Outlook for Europe Non-Resilient Floor Covering Industry Market

The European non-resilient floor covering industry is poised for sustained growth, driven by ongoing construction activity, evolving consumer preferences, and technological advancements. Companies that successfully adapt to changing market dynamics, prioritize sustainability, and leverage innovation will be best positioned to capture market share and drive long-term success. The focus on sustainable and durable products, along with strategic partnerships and expansion into new markets, will be crucial for future growth.

Europe Non-Resilient Floor Covering Industry Segmentation

-

1. Product

- 1.1. Ceramic Tiles Flooring

- 1.2. Stone Tiles Flooring

- 1.3. Laminate Tiles Flooring

- 1.4. Wood Tiles Flooring

- 1.5. Others

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Europe Non-Resilient Floor Covering Industry Segmentation By Geography

- 1. Spain

- 2. Germany

- 3. Italy

- 4. United Kingdom

- 5. Rest Countries in Europe

Europe Non-Resilient Floor Covering Industry Regional Market Share

Geographic Coverage of Europe Non-Resilient Floor Covering Industry

Europe Non-Resilient Floor Covering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Growing Residential Construction Industry Across Europe is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Ceramic Tiles Flooring

- 5.1.2. Stone Tiles Flooring

- 5.1.3. Laminate Tiles Flooring

- 5.1.4. Wood Tiles Flooring

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. United Kingdom

- 5.4.5. Rest Countries in Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Spain Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Ceramic Tiles Flooring

- 6.1.2. Stone Tiles Flooring

- 6.1.3. Laminate Tiles Flooring

- 6.1.4. Wood Tiles Flooring

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Specialty Stores

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Germany Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Ceramic Tiles Flooring

- 7.1.2. Stone Tiles Flooring

- 7.1.3. Laminate Tiles Flooring

- 7.1.4. Wood Tiles Flooring

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Specialty Stores

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Italy Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Ceramic Tiles Flooring

- 8.1.2. Stone Tiles Flooring

- 8.1.3. Laminate Tiles Flooring

- 8.1.4. Wood Tiles Flooring

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Specialty Stores

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United Kingdom Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Ceramic Tiles Flooring

- 9.1.2. Stone Tiles Flooring

- 9.1.3. Laminate Tiles Flooring

- 9.1.4. Wood Tiles Flooring

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Specialty Stores

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Rest Countries in Europe Europe Non-Resilient Floor Covering Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Ceramic Tiles Flooring

- 10.1.2. Stone Tiles Flooring

- 10.1.3. Laminate Tiles Flooring

- 10.1.4. Wood Tiles Flooring

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Specialty Stores

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Berry Alloc**List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Forbo Flooring

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Porcelanosa Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Parador

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson Tiles

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shaw Industries Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mohawk Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Beaulieu International Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tarkett Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Atlas Concorde SPA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Berry Alloc**List Not Exhaustive

List of Figures

- Figure 1: Europe Non-Resilient Floor Covering Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Non-Resilient Floor Covering Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 11: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 14: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 18: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 22: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 23: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Europe Non-Resilient Floor Covering Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Non-Resilient Floor Covering Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Europe Non-Resilient Floor Covering Industry?

Key companies in the market include Berry Alloc**List Not Exhaustive, Forbo Flooring, Porcelanosa Group, Parador, Johnson Tiles, Shaw Industries Inc, Mohawk Industries Inc, Beaulieu International Group, Tarkett Inc, Atlas Concorde SPA.

3. What are the main segments of the Europe Non-Resilient Floor Covering Industry?

The market segments include Product, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 312.46 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Growing Residential Construction Industry Across Europe is Driving the Market.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

In 2022, Beaulieu International Group To Implement Further Price Increases Across Its Flooring Solutions Portfolio. B.I.G. is a leading producer of resilient flooring, hard flooring, tufted carpet and mats, needle felt and artificial grass, in Europe, North America, Russia-CIS and Australia. The sustained price pressure of polymers, plasticizers, logistics and energy is obliging us to further adapt our list prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Non-Resilient Floor Covering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Non-Resilient Floor Covering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Non-Resilient Floor Covering Industry?

To stay informed about further developments, trends, and reports in the Europe Non-Resilient Floor Covering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence