Key Insights

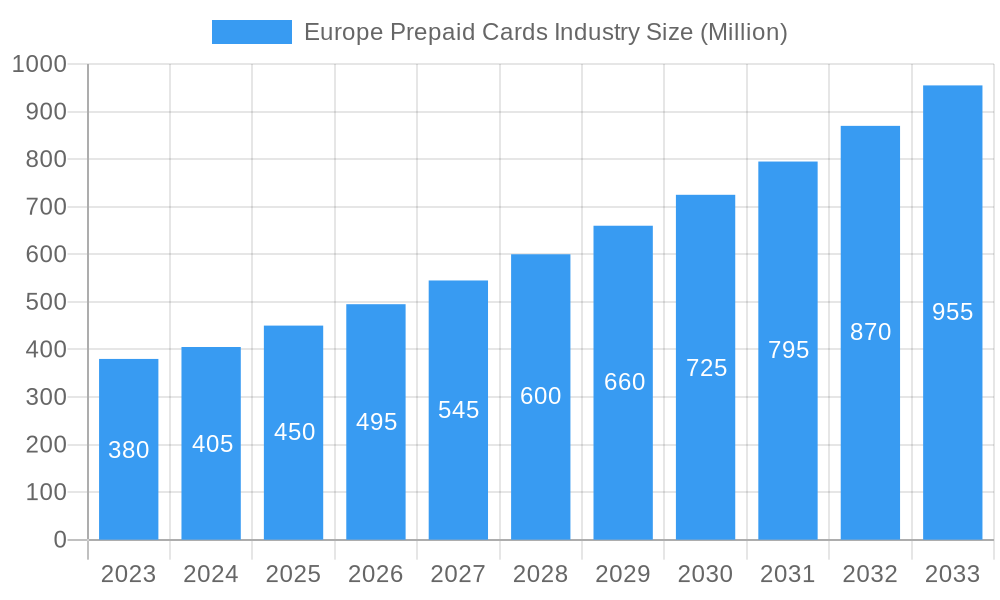

The Europe Prepaid Cards Industry is set for significant expansion, with a projected market size of USD 340.86 billion by 2025, driven by a compelling CAGR of 10.05%. This growth is fueled by increasing demand for secure, convenient digital payment solutions and a rising consumer preference for budget-controlled spending. The versatility of prepaid cards, from general-purpose reloadable (GPR) options to specialized gift and e-commerce cards, is enhancing market penetration. Key trends include advanced security, contactless payments, and tailored solutions for cross-border transactions, supported by expanding offerings from financial institutions and fintech companies.

Europe Prepaid Cards Industry Market Size (In Billion)

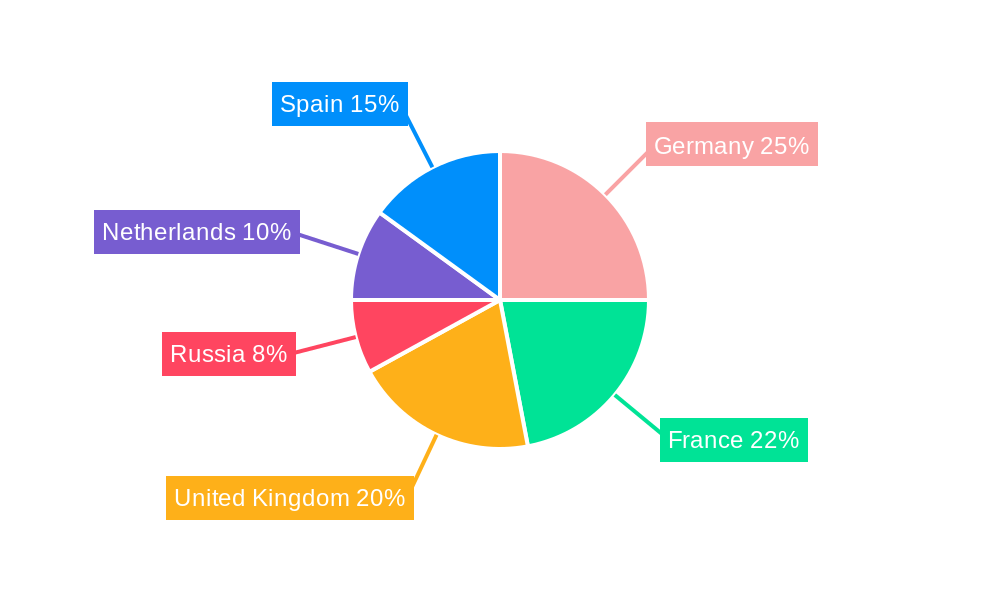

Evolving consumer behaviors and regulatory landscapes are key influencers. Growing emphasis on financial inclusion and the adoption of alternative payment methods across retail, corporate, government, and financial services sectors present substantial opportunities. While the market is robust, potential challenges include evolving digital payment ecosystems and country-specific regulatory complexities. Strategic initiatives by major players like Visa, Mastercard, and American Express, alongside innovative offerings from companies like Payoneer and PayPal, are expected to drive industry growth. Germany, France, and the United Kingdom are anticipated to be leading markets due to strong consumer bases and advanced payment infrastructure.

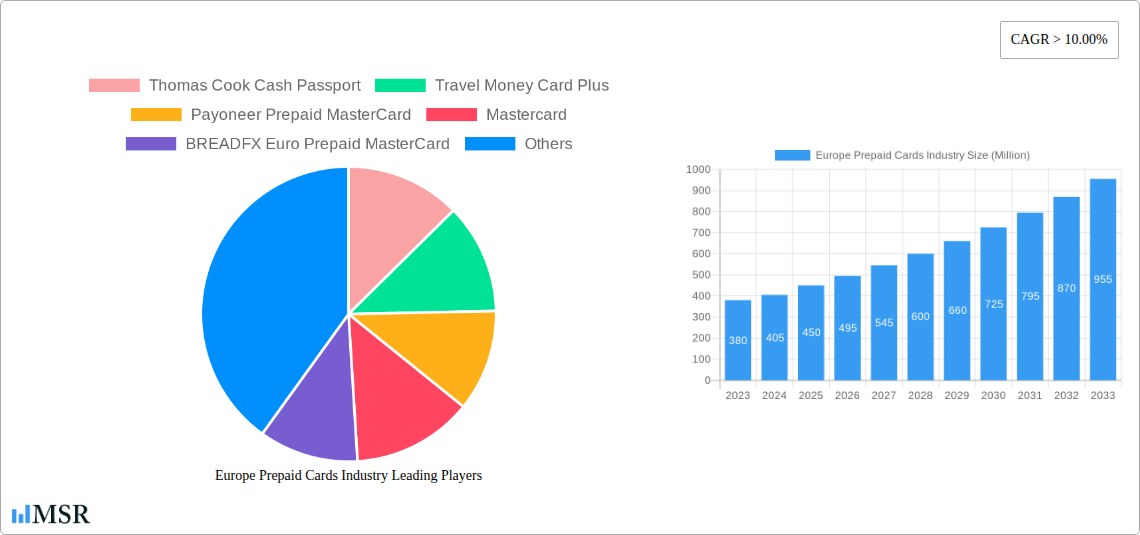

Europe Prepaid Cards Industry Company Market Share

Europe Prepaid Cards Industry Report: Market Analysis, Trends, and Growth Forecast (2019-2033)

Unlock the full potential of the European prepaid cards market with this comprehensive, data-driven report. Gain actionable insights into market dynamics, key players, emerging trends, and future growth opportunities within the dynamic prepaid card landscape. This indispensable resource is designed for financial institutions, payment processors, fintech innovators, retail businesses, government agencies, and industry stakeholders seeking to navigate and capitalize on this rapidly evolving sector. Explore detailed analyses of market concentration, segmentation, product innovations, and strategic outlooks, all presented with actionable intelligence and precise market valuations.

Europe Prepaid Cards Industry Market Concentration & Dynamics

The Europe prepaid cards industry exhibits a moderate to high market concentration, with a significant presence of established global payment networks like Mastercard and Visa, alongside specialized prepaid card providers and emerging fintech players. The innovation ecosystem is driven by a confluence of technological advancements, regulatory shifts, and evolving consumer demands for secure, convenient, and flexible payment solutions. Key competitive factors include card features, network acceptance, fee structures, and value-added services such as loyalty programs and fraud protection. Regulatory frameworks, including PSD2 and evolving AML/KYC requirements, significantly influence market entry and operational strategies, fostering a landscape where compliance and security are paramount. Substitute products, such as mobile payment solutions and direct bank transfers, continue to present competitive pressures, necessitating continuous innovation in prepaid card offerings to maintain market relevance. End-user trends are increasingly leaning towards digital-first solutions, contactless payments, and cards tailored for specific use cases like travel and gig economy payments. Merger and acquisition (M&A) activities, while not pervasive, are observed as companies seek to consolidate market share, acquire new technologies, or expand their geographic reach. For instance, the Green Dot Corporation has historically been involved in strategic acquisitions to bolster its prepaid offerings. The market share distribution is dynamic, with major players holding substantial portions, while niche providers carve out their segments. M&A deal counts are anticipated to remain steady, driven by consolidation and strategic partnerships to enhance product portfolios and market penetration.

Europe Prepaid Cards Industry Industry Insights & Trends

The European prepaid cards industry is poised for robust growth, projected to reach approximately XX Million by the end of 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily fueled by several key market growth drivers. Technological disruptions are at the forefront, with the proliferation of contactless payment technology, mobile wallet integration, and the increasing adoption of closed-loop and open-loop prepaid card systems significantly enhancing user experience and transaction efficiency. The rise of Buy Now, Pay Later (BNPL) functionalities, often integrated into prepaid card platforms, is further augmenting their appeal. Evolving consumer behaviors are also playing a crucial role. There is a growing demand for prepaid cards as a tool for budgeting and financial management, particularly among younger demographics and those seeking to avoid traditional credit products. The increasing popularity of the gig economy and freelance work also drives demand for flexible payroll solutions, with incentive payroll cards gaining traction. Furthermore, government initiatives aimed at financial inclusion and facilitating digital payments, especially for benefits disbursement, are creating substantial market opportunities. The market size was estimated at XX Million in 2024, with strong historical growth observed from 2019–2024, laying a solid foundation for future expansion. The seamless integration of prepaid cards into e-commerce platforms and the increasing trust in digital transactions are further propelling this growth trajectory.

Key Markets & Segments Leading Europe Prepaid Cards Industry

The United Kingdom consistently emerges as a leading market within the Europe prepaid cards industry, driven by its advanced financial infrastructure, high digital adoption rates, and a mature e-commerce landscape. Germany and France follow closely, exhibiting significant growth due to increasing consumer adoption of digital payment methods and supportive government initiatives.

Dominant Segments:

Card Type:

- Multi-Purpose Prepaid Cards are leading the charge due to their versatility, offering consumers the flexibility to use them for a wide range of transactions, from everyday purchases to online shopping and international remittances. Companies like Thomas Cook Cash Passport have historically catered to this segment, particularly for travel-related expenses.

- Single-purpose cards, primarily gift cards, also hold a significant share, driven by the gifting culture and promotional activities by retailers.

Vertical:

- Retail is a major vertical, with prepaid cards integrated into loyalty programs, gift card schemes, and promotional offers, driving both consumer spending and brand engagement.

- Corporate Institutions are increasingly adopting prepaid cards for employee incentives, payroll distribution, and expense management, recognizing their efficiency and cost-effectiveness. Payoneer Prepaid MasterCard is a notable player in this space.

- Financial Institutions & Others play a crucial role in issuing and managing prepaid card programs, including co-branded cards and white-label solutions.

Usage:

- General Purpose Reloadable (GPR) Cards are the dominant usage category, providing consumers with a flexible and controllable alternative to traditional banking products.

- Gift Cards remain a strong performer, fueled by seasonal demand and corporate gifting.

- Government Benefits Disbursement Cards are gaining prominence as governments seek efficient and secure ways to distribute welfare payments and aid.

- Incentive Payroll Cards are becoming increasingly popular for businesses looking to manage temporary worker payments and reward employees.

Dominance Analysis:

The dominance of the United Kingdom is attributed to factors such as early adoption of contactless payments, a strong regulatory environment that fosters innovation, and a high propensity for online spending. Economic growth, coupled with a well-developed retail and corporate sector, further bolsters its position. In Germany, the emphasis on secure and privacy-conscious payment solutions, alongside a growing e-commerce market, drives prepaid card adoption. France benefits from initiatives like American Express's Shop Small operations, which encourage local spending and the use of card-based payment solutions. The infrastructure for electronic payments is well-established across these leading countries, supported by widespread acceptance by merchants and accessibility through various distribution channels. The increasing demand for secure, transparent, and budget-friendly payment options continues to fuel the growth of multi-purpose and GPR cards across these key European economies.

Europe Prepaid Cards Industry Product Developments

The Europe prepaid cards industry is witnessing continuous product innovation, driven by the need to enhance security, convenience, and functionality. Mastercard's collaboration with Microsoft Corp. to launch an upgraded identification solution is a prime example of advancements in combating online fraud and improving the digital shopping experience. Companies like BREADFX Euro Prepaid MasterCard are focusing on catering to specific regional needs with branded currency solutions. Furthermore, the integration of contactless technology, exemplified by The Big Issue Group's use of Zettle by PayPal card readers, is transforming transaction accessibility. Innovations also include the development of eco-friendly card materials and digital-only prepaid solutions by providers like ecoCard, catering to environmentally conscious consumers. These developments aim to provide seamless, secure, and personalized payment experiences, solidifying the competitive edge of innovative players in the market.

Challenges in the Europe Prepaid Cards Industry Market

The Europe prepaid cards industry faces several significant challenges that impact its growth trajectory. Regulatory hurdles remain a constant concern, with evolving compliance requirements, such as stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, increasing operational costs and complexity for issuers. Supply chain issues, particularly concerning the physical production and distribution of cards, can lead to delays and increased expenses. Intense competitive pressures from traditional payment methods, direct bank transfers, and emerging digital wallets necessitate continuous innovation and cost optimization. Furthermore, perceptions of higher fees compared to debit cards can deter some consumer segments, requiring effective communication of the unique benefits prepaid cards offer. The fraudulent use of prepaid cards also presents a persistent challenge, demanding robust security measures and ongoing investment in fraud detection technologies.

Forces Driving Europe Prepaid Cards Industry Growth

Several key forces are propelling the growth of the Europe prepaid cards industry. Technological advancements are paramount, with the widespread adoption of contactless payments, NFC technology, and mobile wallet integrations significantly enhancing user convenience and transaction speed. The increasing digitalization of economies and the burgeoning e-commerce sector create a fertile ground for prepaid card usage, offering a secure and accessible payment method for online transactions. Growing consumer demand for financial control and budgeting tools is a significant driver, particularly among younger demographics and individuals seeking alternatives to traditional credit. Government initiatives promoting financial inclusion and the digitization of payments, especially for benefits disbursement and aid, also contribute substantially. Furthermore, the expansion of the gig economy fuels demand for flexible payroll and incentive cards.

Challenges in the Europe Prepaid Cards Industry Market

While facing challenges, the Europe prepaid cards industry is also shaped by long-term growth catalysts. Continuous innovation in product features is a key catalyst, with providers developing enhanced loyalty programs, integrated budgeting tools, and specialized cards for niche markets like travel or gaming. Strategic partnerships between card issuers, technology providers, and retailers are crucial for expanding reach and offering integrated solutions. For instance, collaborations between fintechs and established financial institutions can unlock new customer segments. The ongoing expansion into emerging European markets and the development of localized prepaid solutions tailored to specific regional needs represent significant long-term growth opportunities. Furthermore, the increasing acceptance of prepaid cards as a secure and convenient alternative to cash and traditional banking products by a broader consumer base is a fundamental growth accelerator.

Emerging Opportunities in Europe Prepaid Cards Industry

Emerging opportunities within the Europe prepaid cards industry are abundant, driven by evolving consumer preferences and technological advancements. The growing demand for personalized and segmented payment solutions presents a significant avenue, with opportunities for cards tailored to specific lifestyles, age groups, or spending habits. The expansion of closed-loop prepaid programs within retail ecosystems, offering exclusive benefits and rewards, is another area of growth. Furthermore, the increasing adoption of contactless and mobile-first payment solutions necessitates the development of prepaid cards that seamlessly integrate with digital wallets and mobile payment platforms. The burgeoning fintech landscape offers opportunities for innovative startups to disrupt the market with novel prepaid card offerings, potentially focusing on areas like cryptocurrency-linked prepaid cards or sustainable finance options. The growing focus on financial literacy and responsible spending also creates a demand for prepaid cards that offer integrated budgeting and spending tracking tools.

Leading Players in the Europe Prepaid Cards Industry Sector

- Thomas Cook Cash Passport

- Travel Money Card Plus

- Payoneer Prepaid MasterCard

- Mastercard

- BREADFX Euro Prepaid MasterCard

- PayPal Holdings Inc

- ecoCard

- FairFX Anywhere Card

- American Express Company

- Visa

- Acorn Account Prepaid Debit MasterCard

- Green Dot Corporation

Key Milestones in Europe Prepaid Cards Industry Industry

- May 2022: The Big Issue Group (TBIG) equipped 1,000 suppliers with contactless technology via Zettle by PayPal card readers, a 68 percent year-on-year increase, and with PayPal's Tap to Pay, is nearing its goal of enabling all 1,500 sellers to go cashless.

- May 2022: American Express launched the third edition of its Shop Small operation in France to support small businesses.

- April 2022: Mastercard, in collaboration with Microsoft Corp., launched an upgraded identification solution to enhance online shopping experiences and combat digital fraud.

Strategic Outlook for Europe Prepaid Cards Industry Market

The strategic outlook for the Europe prepaid cards industry is one of sustained growth and innovation. Key growth accelerators will include the continued integration of prepaid solutions with mobile ecosystems and the development of value-added services such as budgeting tools, loyalty programs, and personalized offers. Strategic partnerships between fintech companies, traditional financial institutions, and retailers will be crucial for expanding market reach and offering comprehensive payment solutions. The industry will also witness a greater focus on security enhancements and regulatory compliance to build consumer trust. Emerging markets and niche segments, such as those catering to the gig economy and government benefits disbursement, offer significant future potential. Embracing digital transformation and adapting to evolving consumer preferences for seamless, secure, and personalized payment experiences will be paramount for sustained success.

Europe Prepaid Cards Industry Segmentation

-

1. Card Type

- 1.1. Multi-Purpose

- 1.2. Single-purpose

-

2. Vertical

- 2.1. Retail

- 2.2. Corporate Institutions

- 2.3. Government

- 2.4. Financial Institutions & Others

-

3. Usage

- 3.1. General Purpose Reloadable Cards

- 3.2. Gift Card

- 3.3. Government Benefits Disbursement Card

- 3.4. Incentive Payroll Card

-

4. Geography

- 4.1. Germany

- 4.2. France

- 4.3. United Kingdom

- 4.4. Russia

- 4.5. Netherlands

- 4.6. Spain

Europe Prepaid Cards Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Russia

- 5. Netherlands

- 6. Spain

Europe Prepaid Cards Industry Regional Market Share

Geographic Coverage of Europe Prepaid Cards Industry

Europe Prepaid Cards Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Consumer Electronics Sales and Explosion of IOT; Increased Focus on Sophisticated Testing Methods Leading to Multiple Test Cases

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With Testing Equipment

- 3.4. Market Trends

- 3.4.1. Demand for Cash Replacement Is Growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 5.1.1. Multi-Purpose

- 5.1.2. Single-purpose

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. Retail

- 5.2.2. Corporate Institutions

- 5.2.3. Government

- 5.2.4. Financial Institutions & Others

- 5.3. Market Analysis, Insights and Forecast - by Usage

- 5.3.1. General Purpose Reloadable Cards

- 5.3.2. Gift Card

- 5.3.3. Government Benefits Disbursement Card

- 5.3.4. Incentive Payroll Card

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Germany

- 5.4.2. France

- 5.4.3. United Kingdom

- 5.4.4. Russia

- 5.4.5. Netherlands

- 5.4.6. Spain

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. France

- 5.5.3. United Kingdom

- 5.5.4. Russia

- 5.5.5. Netherlands

- 5.5.6. Spain

- 5.1. Market Analysis, Insights and Forecast - by Card Type

- 6. Germany Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Card Type

- 6.1.1. Multi-Purpose

- 6.1.2. Single-purpose

- 6.2. Market Analysis, Insights and Forecast - by Vertical

- 6.2.1. Retail

- 6.2.2. Corporate Institutions

- 6.2.3. Government

- 6.2.4. Financial Institutions & Others

- 6.3. Market Analysis, Insights and Forecast - by Usage

- 6.3.1. General Purpose Reloadable Cards

- 6.3.2. Gift Card

- 6.3.3. Government Benefits Disbursement Card

- 6.3.4. Incentive Payroll Card

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Germany

- 6.4.2. France

- 6.4.3. United Kingdom

- 6.4.4. Russia

- 6.4.5. Netherlands

- 6.4.6. Spain

- 6.1. Market Analysis, Insights and Forecast - by Card Type

- 7. France Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Card Type

- 7.1.1. Multi-Purpose

- 7.1.2. Single-purpose

- 7.2. Market Analysis, Insights and Forecast - by Vertical

- 7.2.1. Retail

- 7.2.2. Corporate Institutions

- 7.2.3. Government

- 7.2.4. Financial Institutions & Others

- 7.3. Market Analysis, Insights and Forecast - by Usage

- 7.3.1. General Purpose Reloadable Cards

- 7.3.2. Gift Card

- 7.3.3. Government Benefits Disbursement Card

- 7.3.4. Incentive Payroll Card

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Germany

- 7.4.2. France

- 7.4.3. United Kingdom

- 7.4.4. Russia

- 7.4.5. Netherlands

- 7.4.6. Spain

- 7.1. Market Analysis, Insights and Forecast - by Card Type

- 8. United Kingdom Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Card Type

- 8.1.1. Multi-Purpose

- 8.1.2. Single-purpose

- 8.2. Market Analysis, Insights and Forecast - by Vertical

- 8.2.1. Retail

- 8.2.2. Corporate Institutions

- 8.2.3. Government

- 8.2.4. Financial Institutions & Others

- 8.3. Market Analysis, Insights and Forecast - by Usage

- 8.3.1. General Purpose Reloadable Cards

- 8.3.2. Gift Card

- 8.3.3. Government Benefits Disbursement Card

- 8.3.4. Incentive Payroll Card

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Germany

- 8.4.2. France

- 8.4.3. United Kingdom

- 8.4.4. Russia

- 8.4.5. Netherlands

- 8.4.6. Spain

- 8.1. Market Analysis, Insights and Forecast - by Card Type

- 9. Russia Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Card Type

- 9.1.1. Multi-Purpose

- 9.1.2. Single-purpose

- 9.2. Market Analysis, Insights and Forecast - by Vertical

- 9.2.1. Retail

- 9.2.2. Corporate Institutions

- 9.2.3. Government

- 9.2.4. Financial Institutions & Others

- 9.3. Market Analysis, Insights and Forecast - by Usage

- 9.3.1. General Purpose Reloadable Cards

- 9.3.2. Gift Card

- 9.3.3. Government Benefits Disbursement Card

- 9.3.4. Incentive Payroll Card

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Germany

- 9.4.2. France

- 9.4.3. United Kingdom

- 9.4.4. Russia

- 9.4.5. Netherlands

- 9.4.6. Spain

- 9.1. Market Analysis, Insights and Forecast - by Card Type

- 10. Netherlands Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Card Type

- 10.1.1. Multi-Purpose

- 10.1.2. Single-purpose

- 10.2. Market Analysis, Insights and Forecast - by Vertical

- 10.2.1. Retail

- 10.2.2. Corporate Institutions

- 10.2.3. Government

- 10.2.4. Financial Institutions & Others

- 10.3. Market Analysis, Insights and Forecast - by Usage

- 10.3.1. General Purpose Reloadable Cards

- 10.3.2. Gift Card

- 10.3.3. Government Benefits Disbursement Card

- 10.3.4. Incentive Payroll Card

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Germany

- 10.4.2. France

- 10.4.3. United Kingdom

- 10.4.4. Russia

- 10.4.5. Netherlands

- 10.4.6. Spain

- 10.1. Market Analysis, Insights and Forecast - by Card Type

- 11. Spain Europe Prepaid Cards Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Card Type

- 11.1.1. Multi-Purpose

- 11.1.2. Single-purpose

- 11.2. Market Analysis, Insights and Forecast - by Vertical

- 11.2.1. Retail

- 11.2.2. Corporate Institutions

- 11.2.3. Government

- 11.2.4. Financial Institutions & Others

- 11.3. Market Analysis, Insights and Forecast - by Usage

- 11.3.1. General Purpose Reloadable Cards

- 11.3.2. Gift Card

- 11.3.3. Government Benefits Disbursement Card

- 11.3.4. Incentive Payroll Card

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Germany

- 11.4.2. France

- 11.4.3. United Kingdom

- 11.4.4. Russia

- 11.4.5. Netherlands

- 11.4.6. Spain

- 11.1. Market Analysis, Insights and Forecast - by Card Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Thomas Cook Cash Passport

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Travel Money Card Plus

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Payoneer Prepaid MasterCard

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Mastercard

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 BREADFX Euro Prepaid MasterCard

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PayPal Holdings Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ecoCard

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 FairFX Anywhere Card

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 American Express Company

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Visa

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Acorn Account Prepaid Debit MasterCard**List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Green Dot Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Thomas Cook Cash Passport

List of Figures

- Figure 1: Europe Prepaid Cards Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Prepaid Cards Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 2: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 3: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 4: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Europe Prepaid Cards Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 7: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 8: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 9: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Europe Prepaid Cards Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 12: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 13: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 14: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Europe Prepaid Cards Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 17: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 18: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 19: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Europe Prepaid Cards Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 22: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 23: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 24: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Europe Prepaid Cards Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 27: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 28: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 29: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Europe Prepaid Cards Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Europe Prepaid Cards Industry Revenue billion Forecast, by Card Type 2020 & 2033

- Table 32: Europe Prepaid Cards Industry Revenue billion Forecast, by Vertical 2020 & 2033

- Table 33: Europe Prepaid Cards Industry Revenue billion Forecast, by Usage 2020 & 2033

- Table 34: Europe Prepaid Cards Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 35: Europe Prepaid Cards Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Prepaid Cards Industry?

The projected CAGR is approximately 10.05%.

2. Which companies are prominent players in the Europe Prepaid Cards Industry?

Key companies in the market include Thomas Cook Cash Passport, Travel Money Card Plus, Payoneer Prepaid MasterCard, Mastercard, BREADFX Euro Prepaid MasterCard, PayPal Holdings Inc, ecoCard, FairFX Anywhere Card, American Express Company, Visa, Acorn Account Prepaid Debit MasterCard**List Not Exhaustive, Green Dot Corporation.

3. What are the main segments of the Europe Prepaid Cards Industry?

The market segments include Card Type, Vertical, Usage, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 340.86 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Consumer Electronics Sales and Explosion of IOT; Increased Focus on Sophisticated Testing Methods Leading to Multiple Test Cases.

6. What are the notable trends driving market growth?

Demand for Cash Replacement Is Growing.

7. Are there any restraints impacting market growth?

High Costs Associated With Testing Equipment.

8. Can you provide examples of recent developments in the market?

In May 2022, The Big Issue Group (TBIG) reached a new milestone by equipping 1,000 suppliers with contactless technology via the Zettle by PayPal card reader, an increase of 68 percent over last year. Furthermore, with PayPal's acceptance of Zettle's Tap to Pay, it is swiftly approaching its goal of enabling all 1,500 sellers to go cashless by the end of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Prepaid Cards Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Prepaid Cards Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Prepaid Cards Industry?

To stay informed about further developments, trends, and reports in the Europe Prepaid Cards Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence