Key Insights

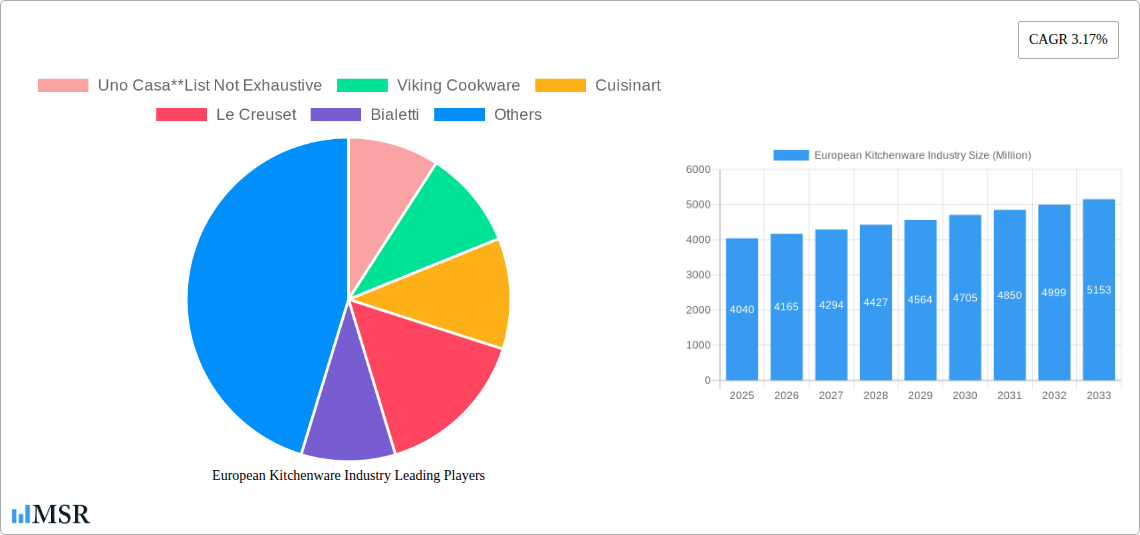

The European kitchenware market, valued at €4.04 billion in 2025, is projected to experience steady growth, driven by several key factors. Rising disposable incomes across several European nations, coupled with a growing emphasis on home cooking and meal preparation, fuels demand for high-quality cookware. The increasing popularity of healthy eating trends further contributes to this growth, as consumers seek specialized cookware suitable for steaming, grilling, and other healthy cooking methods. Furthermore, the shift towards online retail channels provides increased accessibility and convenience for consumers, driving sales. The market is segmented by product type (pots & pans, cooking racks, cooking tools, microwave cookware, pressure cookers), material (stainless steel, aluminum, glass, others), and distribution channel (hypermarkets/supermarkets, specialty stores, online, other). Stainless steel and aluminum remain dominant materials due to their durability and affordability, while the online channel witnesses significant growth due to its convenience and wider product selection. However, factors such as economic uncertainty and potential fluctuations in raw material prices could act as restraints on market growth in the coming years. Premium brands like Le Creuset and All-Clad command a significant market share, alongside more affordable options catering to budget-conscious consumers. Germany, France, and the UK represent the largest national markets within Europe, reflecting their higher average disposable incomes and established kitchenware retail landscapes.

European Kitchenware Industry Market Size (In Billion)

The projected Compound Annual Growth Rate (CAGR) of 3.17% for the forecast period (2025-2033) indicates a moderate yet consistent expansion of the market. This growth trajectory is expected to be influenced by the continuous innovation in cookware materials and design, catering to evolving consumer preferences. For instance, the emergence of eco-friendly and sustainable cookware options, made from recycled materials or with improved energy efficiency, will likely attract environmentally conscious consumers. Competition among established brands and the entry of new players will further shape the market landscape. Market players are also likely to focus on strategic partnerships and collaborations to enhance their distribution networks and broaden their reach to various consumer segments. The growth is likely to be uneven across product segments, with specific categories such as microwave cookware and pressure cookers potentially experiencing faster growth rates than others due to evolving consumer lifestyles and culinary practices.

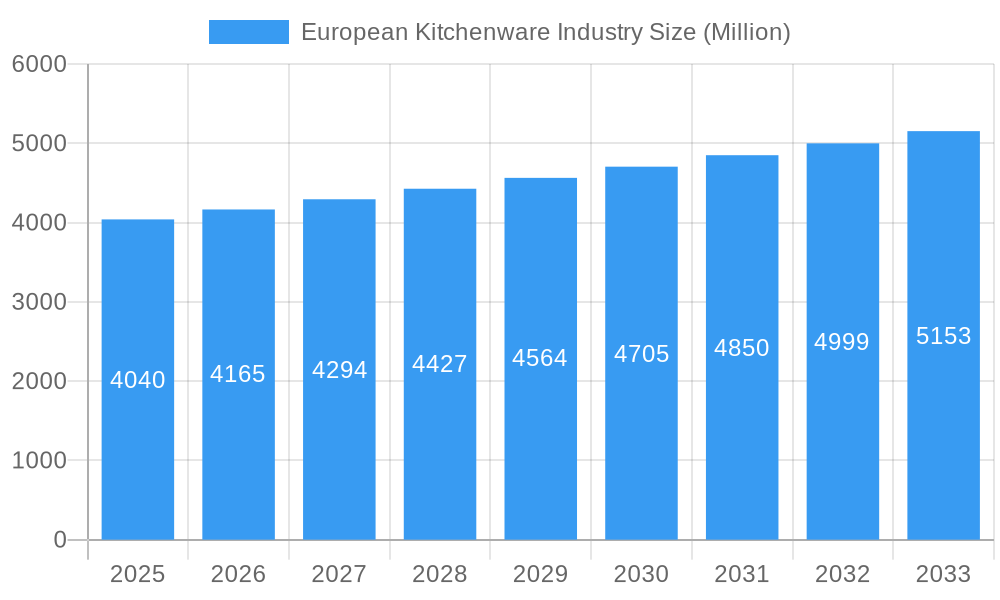

European Kitchenware Industry Company Market Share

European Kitchenware Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European kitchenware industry, covering market size, growth drivers, key segments, leading players, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within the European kitchenware market. The report features detailed analysis of key segments including Pots & Pans, Cooking Racks, Cooking Tools, Microwave Cookware, and Pressure Cookers, across materials like Stainless Steel, Aluminum, Glass, and others, and distribution channels such as Hypermarkets, Specialty Stores, and Online platforms. The market size is projected at xx Million in 2025.

European Kitchenware Industry Market Concentration & Dynamics

The European kitchenware market exhibits a moderately concentrated structure, with a handful of major players holding significant market share. However, the presence of numerous smaller, specialized brands creates a dynamic and competitive landscape. Innovation is a key driver, with companies continuously introducing new materials, designs, and functionalities to cater to evolving consumer preferences. The regulatory framework, encompassing safety standards and environmental regulations, significantly influences manufacturing practices and product development. Substitute products, such as disposable kitchenware, pose a challenge, while the increasing popularity of sustainable and eco-friendly options presents both a challenge and opportunity.

- Market Share: Top 5 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024, driven by consolidation and expansion strategies.

- End-User Trends: A growing emphasis on convenience, health, and sustainability is shaping product demand.

European Kitchenware Industry Industry Insights & Trends

The European kitchenware market is experiencing steady growth, driven by several key factors. Rising disposable incomes and a shift towards premium kitchenware are contributing to market expansion. Technological advancements, such as the introduction of innovative materials and smart kitchen appliances, are reshaping the industry. Consumers are increasingly demanding durable, high-quality products with enhanced functionalities, influencing the market towards premiumization. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Evolving consumer preferences towards healthier cooking methods and sustainable products are significantly impacting product development and marketing strategies. The adoption of e-commerce platforms has created new opportunities for brands to reach wider audiences.

Key Markets & Segments Leading European Kitchenware Industry

Germany and France are leading markets in the European kitchenware sector, driven by strong consumer demand and established retail infrastructure. The Pots & Pans segment holds the largest market share, followed by Cooking Tools. Stainless steel remains the dominant material, owing to its durability and versatility. Hypermarkets and supermarkets continue to be the primary distribution channels, although online sales are steadily increasing.

- Region/Country Drivers:

- Germany: Strong economy, high consumer spending on home goods.

- France: Established culinary culture, high demand for premium kitchenware.

- UK: Large market size, diverse consumer preferences.

- Segment Drivers:

- Pots & Pans: High demand due to versatility and essential nature.

- Cooking Tools: Growing popularity of diverse cooking methods.

- Online Distribution: Convenience and wider reach for consumers.

European Kitchenware Industry Product Developments

Recent product innovations include the introduction of non-stick coatings with enhanced durability and sustainability features, as well as smart kitchen appliances offering integrated functionalities. These advancements aim to improve user experience, enhance cooking efficiency, and cater to specific dietary needs. Manufacturers are focusing on creating aesthetically pleasing designs that complement modern kitchen aesthetics. The integration of smart technology is a key trend, creating opportunities for innovation and differentiation.

Challenges in the European Kitchenware Industry Market

The European kitchenware market faces challenges including rising raw material costs, fluctuating currency exchange rates, and intense competition. Supply chain disruptions caused by geopolitical events and the pandemic have also impacted production and distribution. Stringent environmental regulations can increase manufacturing costs.

Forces Driving European Kitchenware Industry Growth

Several factors contribute to the market's growth. Rising disposable incomes, increased urbanization, and a greater focus on home cooking fuel demand. Technological advancements provide opportunities for innovation and increased efficiency. Government initiatives promoting sustainable practices encourage the development of eco-friendly kitchenware.

Long-Term Growth Catalysts in the European Kitchenware Industry

Long-term growth in the industry is expected to be driven by the continuous development of innovative materials and technologies, strategic partnerships to enhance distribution networks, and expansion into new geographic markets. A focus on sustainability and eco-friendly product development also offers significant opportunities.

Emerging Opportunities in European Kitchenware Industry

The market presents opportunities in the development of smart kitchenware integrated with home automation systems, increased focus on personalized cooking experiences, and expansion into niche markets catering to specific dietary needs or cooking styles. The rise of subscription boxes for kitchen tools and accessories also presents new potential.

Leading Players in the European Kitchenware Industry Sector

- Uno Casa

- Viking Cookware

- Cuisinart

- Le Creuset

- Bialetti

- Abbio

- Calphalon

- All-Clad

Key Milestones in European Kitchenware Industry Industry

- February 2023: Crucible Cookware partners with DHL for EU shipping, enhancing logistics efficiency.

- February 2023: Guardini launches eco-friendly bakeware, showcasing commitment to sustainability.

Strategic Outlook for European Kitchenware Industry Market

The European kitchenware market presents a promising outlook for growth driven by innovation, sustainability, and the rising popularity of home cooking. Strategic partnerships, investments in technology, and expansion into new product categories and geographic markets are key to success in this dynamic market. The increasing focus on health-conscious and eco-conscious consumer preferences will further shape the future of this industry.

European Kitchenware Industry Segmentation

-

1. Product

- 1.1. Pots and Pans

- 1.2. Cooking Racks

- 1.3. Cooking Tools

- 1.4. Microwave Cookware

- 1.5. Pressure Cookers

-

2. Material

- 2.1. Stainless Steel

- 2.2. Aluminium

- 2.3. Glass

- 2.4. Other Materials

-

3. Distribution Channel

- 3.1. Hypermarkets and Supermarkets

- 3.2. Specialty Store

- 3.3. Online

- 3.4. Other Distribution Channels

European Kitchenware Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Poland

- 5. Italy

- 6. Rest of Europe

European Kitchenware Industry Regional Market Share

Geographic Coverage of European Kitchenware Industry

European Kitchenware Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. Non-Stick Cookware is Dominating the Cookware Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Pots and Pans

- 5.1.2. Cooking Racks

- 5.1.3. Cooking Tools

- 5.1.4. Microwave Cookware

- 5.1.5. Pressure Cookers

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Stainless Steel

- 5.2.2. Aluminium

- 5.2.3. Glass

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets and Supermarkets

- 5.3.2. Specialty Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Poland

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Pots and Pans

- 6.1.2. Cooking Racks

- 6.1.3. Cooking Tools

- 6.1.4. Microwave Cookware

- 6.1.5. Pressure Cookers

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Stainless Steel

- 6.2.2. Aluminium

- 6.2.3. Glass

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets and Supermarkets

- 6.3.2. Specialty Store

- 6.3.3. Online

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. United Kingdom European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Pots and Pans

- 7.1.2. Cooking Racks

- 7.1.3. Cooking Tools

- 7.1.4. Microwave Cookware

- 7.1.5. Pressure Cookers

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Stainless Steel

- 7.2.2. Aluminium

- 7.2.3. Glass

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets and Supermarkets

- 7.3.2. Specialty Store

- 7.3.3. Online

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. France European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Pots and Pans

- 8.1.2. Cooking Racks

- 8.1.3. Cooking Tools

- 8.1.4. Microwave Cookware

- 8.1.5. Pressure Cookers

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Stainless Steel

- 8.2.2. Aluminium

- 8.2.3. Glass

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets and Supermarkets

- 8.3.2. Specialty Store

- 8.3.3. Online

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Poland European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Pots and Pans

- 9.1.2. Cooking Racks

- 9.1.3. Cooking Tools

- 9.1.4. Microwave Cookware

- 9.1.5. Pressure Cookers

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Stainless Steel

- 9.2.2. Aluminium

- 9.2.3. Glass

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets and Supermarkets

- 9.3.2. Specialty Store

- 9.3.3. Online

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Italy European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Pots and Pans

- 10.1.2. Cooking Racks

- 10.1.3. Cooking Tools

- 10.1.4. Microwave Cookware

- 10.1.5. Pressure Cookers

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Stainless Steel

- 10.2.2. Aluminium

- 10.2.3. Glass

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hypermarkets and Supermarkets

- 10.3.2. Specialty Store

- 10.3.3. Online

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Europe European Kitchenware Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Pots and Pans

- 11.1.2. Cooking Racks

- 11.1.3. Cooking Tools

- 11.1.4. Microwave Cookware

- 11.1.5. Pressure Cookers

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Stainless Steel

- 11.2.2. Aluminium

- 11.2.3. Glass

- 11.2.4. Other Materials

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Hypermarkets and Supermarkets

- 11.3.2. Specialty Store

- 11.3.3. Online

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Uno Casa**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Viking Cookware

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cuisinart

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Le Creuset

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bialetti

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Abbio

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Calphalon

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 All-Clad

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Uno Casa**List Not Exhaustive

List of Figures

- Figure 1: European Kitchenware Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Kitchenware Industry Share (%) by Company 2025

List of Tables

- Table 1: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 3: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: European Kitchenware Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 7: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 11: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 15: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 19: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 22: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 23: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: European Kitchenware Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 26: European Kitchenware Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 27: European Kitchenware Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: European Kitchenware Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Kitchenware Industry?

The projected CAGR is approximately 3.17%.

2. Which companies are prominent players in the European Kitchenware Industry?

Key companies in the market include Uno Casa**List Not Exhaustive, Viking Cookware, Cuisinart, Le Creuset, Bialetti, Abbio, Calphalon, All-Clad.

3. What are the main segments of the European Kitchenware Industry?

The market segments include Product, Material, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

Non-Stick Cookware is Dominating the Cookware Industry.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

February 2023: Crucible Cookware, a leading manufacturer and supplier of high-quality kitchenware, announced it had signed a contract with DHL for shipping its products within the European Union (EU). DHL is one of the leading logistics companies. This new partnership will allow Crucible Cookware to provide its customers with faster and more efficient shipping options for their orders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Kitchenware Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Kitchenware Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Kitchenware Industry?

To stay informed about further developments, trends, and reports in the European Kitchenware Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence