Key Insights

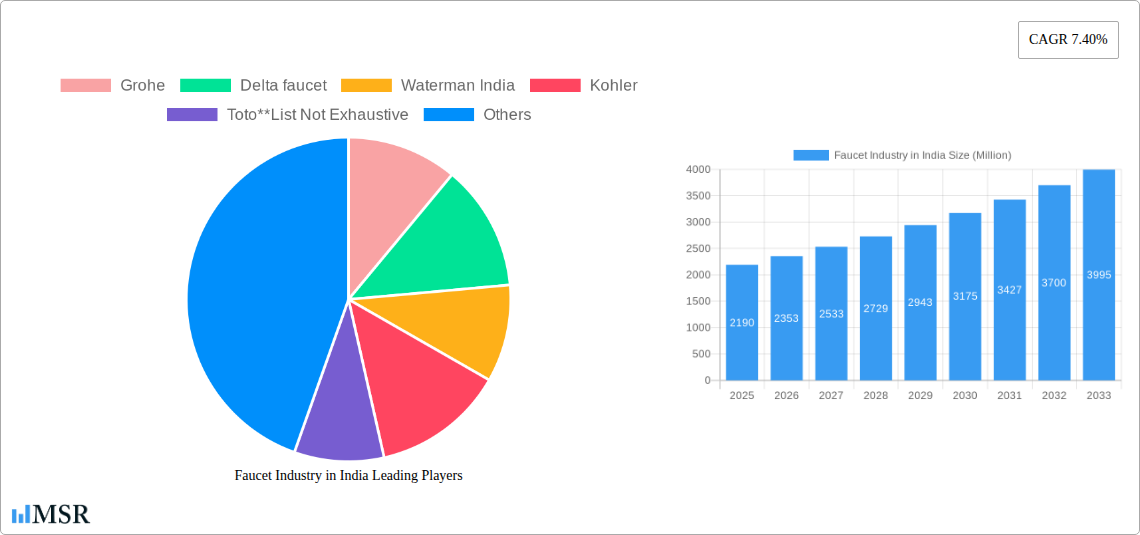

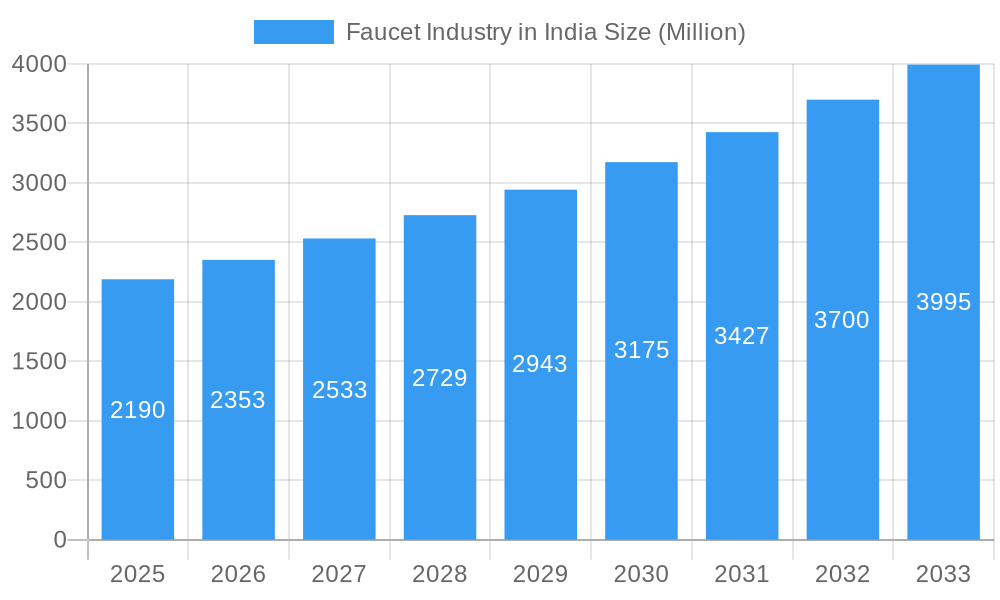

The Indian faucet market, valued at $2.19 billion in 2025, is experiencing robust growth, projected to expand at a CAGR of 7.40% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and a burgeoning middle class are driving increased spending on home improvement and renovation projects, significantly boosting demand for high-quality faucets. Furthermore, a shift towards modern, aesthetically pleasing bathroom and kitchen designs is creating a preference for stylish and technologically advanced faucet models, such as sensor faucets and those with integrated features. The increasing urbanization and rapid construction of residential and commercial buildings further contribute to market expansion. Segmentation analysis reveals strong growth in automatic faucets driven by convenience and hygiene concerns, as well as increasing popularity of stainless steel and brass faucets due to durability and aesthetic appeal. The market is also witnessing a rise in online sales, signifying a crucial shift in consumer behavior and presenting significant opportunities for e-commerce platforms. Competition in the market is intense, with major players like Grohe, Delta Faucet, Kohler, and Jaquar vying for market share alongside several prominent domestic brands. Regional variations exist, with metropolitan areas showing higher demand compared to rural regions; however, increasing infrastructure development in tier-2 and tier-3 cities suggests a potential for future growth in these areas.

Faucet Industry in India Market Size (In Billion)

The market is segmented by product type (ball, disc, cartridge, compression), technology (manual, automatic), installation type (deck mount, wall mount), material (chrome, stainless steel, brass, PTMT plastic), application (kitchen, bathroom), end-user (residential, commercial), and distribution channel (B2C/retail, online B2B). While the residential sector currently dominates, the commercial segment is expected to witness substantial growth driven by new constructions and renovations in hotels, offices, and other commercial establishments. Challenges include fluctuating raw material prices and the potential impact of economic downturns on consumer spending. However, the long-term outlook remains positive given India's sustained economic growth and the increasing focus on improving sanitation and hygiene standards. Manufacturers are also focusing on innovation and developing energy-efficient and water-saving models to cater to the growing environmental consciousness among consumers.

Faucet Industry in India Company Market Share

Faucet Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Faucet Industry in India, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025, this report meticulously examines market dynamics, growth drivers, key segments, leading players, and future opportunities within the Indian faucet market, projected to be worth xx Million by 2033.

Faucet Industry in India Market Concentration & Dynamics

The Indian faucet market is characterized by a moderately concentrated competitive landscape. A dynamic interplay of established multinational giants and robust domestic manufacturers actively vies for significant market share. Prominent players that consistently shape the market include Grohe, Delta Faucet, Kohler, Toto, Jaquar, Hindware, Cera Sanitaryware Ltd, Roca, and Waterman India. While these key entities hold substantial influence, a diverse array of smaller manufacturers also contribute meaningfully to the overall market volume, underscoring a vibrant and competitive environment.

Emerging innovation ecosystems are actively being fostered, propelled by continuous technological advancements in faucet design, material science, and manufacturing processes. The regulatory framework, particularly the stringent adherence to BIS standards, plays a pivotal role in dictating product quality, safety benchmarks, and consumer trust. Furthermore, the rise of substitute products, such as advanced sensor-based faucets, presents an evolving challenge and opportunity, pushing traditional faucet designs towards greater innovation and user-centricity. End-user trends are increasingly leaning towards faucets that offer a harmonious blend of sophisticated aesthetics, superior water efficiency, and cutting-edge technological integration. Merger and acquisition (M&A) activity, while currently moderate, indicates potential for further industry consolidation, with approximately XX major deals recorded between 2019 and 2024, signaling a strategic shift towards market consolidation.

Faucet Industry in India Industry Insights & Trends

The Indian faucet market is currently experiencing a phase of robust and sustained growth. This expansion is primarily propelled by a confluence of factors, including rising disposable incomes, accelerated urbanization, and a discernible shift in consumer preference towards more modern and aesthetically pleasing bathroom and kitchen fittings. The market size in 2024 was impressively estimated at approximately XX Million, reflecting a healthy Compound Annual Growth Rate (CAGR) of XX% during the historical period spanning from 2019 to 2024. This upward trajectory is further invigorated by supportive government initiatives aimed at promoting affordable housing projects and enhancing overall infrastructure development across the nation. Technological disruptions, notably the widespread adoption of smart faucets equipped with advanced features such as voice control capabilities and intelligent water monitoring systems, are actively reshaping the market dynamics and consumer expectations. Moreover, evolving consumer behavior, with a pronounced inclination towards sustainable and water-efficient products, is profoundly influencing industry trends and product development priorities. The forecast period, from 2025 to 2033, anticipates continued expansion, with the market projected to reach an impressive XX Million by 2033. This sustained growth is expected to be fueled by factors including escalating construction activity, a burgeoning tourism sector, and continuous improvements in the overall living standards of the Indian populace.

Key Markets & Segments Leading Faucet Industry in India

The Indian faucet market is diverse, with various segments contributing to its overall growth. The analysis suggests that the following are key drivers:

- Economic Growth: Rising disposable incomes fuel higher spending on home improvement and renovation.

- Urbanization: Increased urbanization leads to greater demand for modern housing with upgraded bathroom and kitchen fixtures.

- Infrastructure Development: Government initiatives promoting affordable housing and infrastructure projects contribute significantly to market expansion.

Dominant Segments:

- By Product Type: Cartridge faucets hold the largest market share, followed closely by disc faucets, reflecting the popularity of their durability and ease of use.

- By Technology: Manual faucets currently dominate the market, though the demand for automatic faucets is growing rapidly, particularly in commercial settings.

- By Installation Type: Deck mount faucets are widely preferred, while wall mount installations are common in traditional settings and luxury projects.

- By Material Type: Chrome-plated brass remains the most popular material, although stainless steel and plastic alternatives are increasingly adopted.

- By Application: Bathroom faucets constitute a larger market segment than kitchen faucets, reflecting higher demand in residential and commercial spaces.

- By End User: The residential segment holds the largest market share, while the commercial sector shows strong potential for growth.

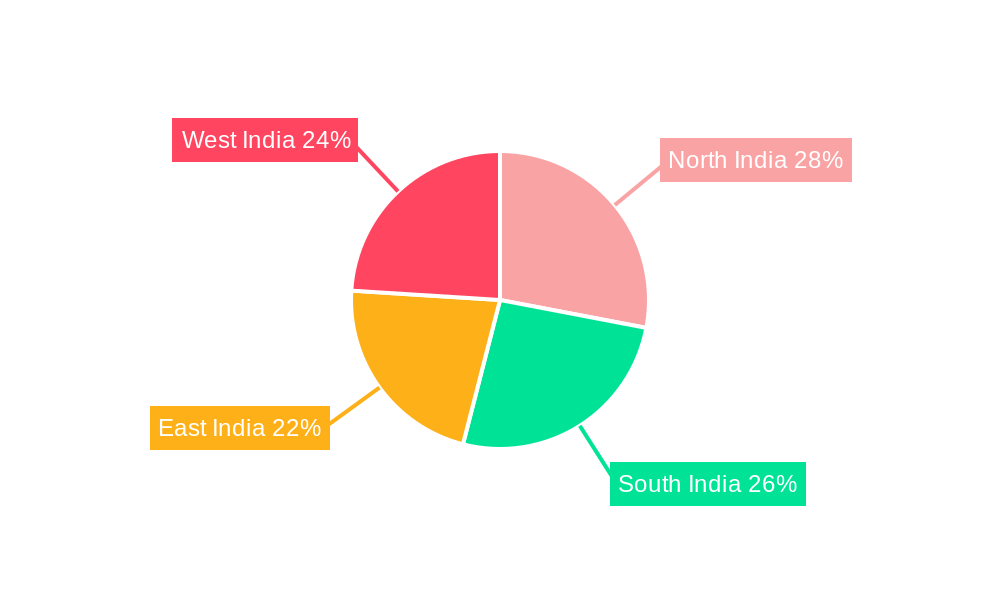

- By Distribution Channel: B2C/Retail channels continue to dominate, but online sales and B2B/Project sales are expanding rapidly, offering new avenues for growth. The geographical distribution is heavily concentrated in metropolitan areas, with significant growth potential in tier-2 and tier-3 cities.

Faucet Industry in India Product Developments

Recent product innovations within the Indian faucet industry are predominantly centered around three key pillars: enhanced water conservation technologies, seamless integration of smart technology, and a significant uplift in aesthetic appeal. Manufacturers are actively introducing faucets that feature advanced functionalities such as touchless operation for improved hygiene, precise water flow regulation for optimal usage, and integrated LED lighting to enhance user experience and ambiance. A notable market trend is the accelerating shift towards sensor-based and smart faucets, which offer unparalleled convenience and substantial water-saving benefits, thereby addressing growing environmental concerns. This progressive trend is not only intensifying market competitiveness but also empowering consumers with an increasingly diverse and sophisticated array of choices that cater to their evolving needs and preferences.

Challenges in the Faucet Industry in India Market

The Indian faucet market faces challenges such as intense competition, fluctuating raw material prices, and supply chain disruptions. Regulatory compliance, especially adherence to BIS standards, adds to the operational complexity. Furthermore, counterfeiting of popular brands poses a significant threat to legitimate players. These issues collectively contribute to reduced profit margins and market uncertainty.

Forces Driving Faucet Industry in India Growth

Several factors contribute to the growth of the Indian faucet market, including government infrastructure projects, rising urbanization, and an increase in disposable incomes, fostering higher spending on home improvements. Technological advancements, such as the introduction of water-efficient and smart faucets, are also major drivers.

Challenges in the Faucet Industry in India Market

Long-term growth will depend on adapting to changing consumer preferences, technological advancements and navigating the challenges of intense competition. Strategic collaborations, innovation in water-saving technologies and expansion into untapped markets will be crucial for long-term success.

Emerging Opportunities in Faucet Industry in India

The rising demand for sustainable and water-efficient products, the growing adoption of smart home technology, and the expansion of e-commerce platforms present significant opportunities. Targeting tier-2 and tier-3 cities and offering customized designs tailored to specific customer needs could significantly boost market growth.

Leading Players in the Faucet Industry in India Sector

- Grohe

- Delta Faucet

- Waterman India

- Kohler

- Toto

- Cavier

- Cera Sanitaryware Ltd

- Roca

- Jaquar

- Hindware

Key Milestones in Faucet Industry in India Industry

- August 2023: Hindware Limited strategically launched its innovative "Fabio" and "Agnese" faucet ranges. These new collections incorporated advanced technology and contemporary design, significantly bolstering their product portfolio and enhancing their competitive standing in the market.

- January 2022: Pearl Precision unveiled a new and comprehensive line of C.P. Faucets and P.T.M.T. Taps. This expansion of their product offerings effectively strengthened their presence and appeal within the competitive retail segment.

Strategic Outlook for Faucet Industry in India Market

The Indian faucet market presents a highly promising and dynamic outlook, underpinned by consistent economic growth, substantial infrastructure development initiatives, and a growing consumer demand for modern and high-quality bathroom fittings. Companies that strategically prioritize innovation, champion water efficiency, and forge robust partnerships are exceptionally well-positioned to capitalize on the market's considerable growth potential. The pervasive focus on developing and integrating sustainable and smart technologies will undoubtedly be a critical determinant of long-term success and market leadership within this evolving and vibrant industry.

Faucet Industry in India Segmentation

-

1. Product Type

- 1.1. Ball

- 1.2. Disc

- 1.3. Cartridge

- 1.4. Compression

-

2. Technology

- 2.1. Manual

- 2.2. Automatic

-

3. Installation Type

- 3.1. Deck Mount

- 3.2. Wall Mount

-

4. Material Type

- 4.1. Chrome

- 4.2. Stainless Steel

- 4.3. Brass

- 4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 4.5. Other Material Types

-

5. Application

- 5.1. Kitchen Faucets

- 5.2. Bathroom Faucets

-

6. End User

- 6.1. Residential

- 6.2. Commercial

-

7. Distribution Channel

-

7.1. B2C/Retail

- 7.1.1. Multi-brand Stores

- 7.1.2. Exclusive Stores

- 7.1.3. Online

- 7.2. B2B/Proj

-

7.1. B2C/Retail

Faucet Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Faucet Industry in India Regional Market Share

Geographic Coverage of Faucet Industry in India

Faucet Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction of Residential and Commercial Space; Government Policies Favoring Sales of Faucets in the Market

- 3.3. Market Restrains

- 3.3.1. Highly Competitive Market Affecting Small Faucet Manufacturing Businesses; Price Fluctuation in Raw Materials Affecting the Manufacturers

- 3.4. Market Trends

- 3.4.1. Rising Demand for Automatic Faucets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ball

- 5.1.2. Disc

- 5.1.3. Cartridge

- 5.1.4. Compression

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by Installation Type

- 5.3.1. Deck Mount

- 5.3.2. Wall Mount

- 5.4. Market Analysis, Insights and Forecast - by Material Type

- 5.4.1. Chrome

- 5.4.2. Stainless Steel

- 5.4.3. Brass

- 5.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 5.4.5. Other Material Types

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Kitchen Faucets

- 5.5.2. Bathroom Faucets

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. Residential

- 5.6.2. Commercial

- 5.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.7.1. B2C/Retail

- 5.7.1.1. Multi-brand Stores

- 5.7.1.2. Exclusive Stores

- 5.7.1.3. Online

- 5.7.2. B2B/Proj

- 5.7.1. B2C/Retail

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.8.2. South America

- 5.8.3. Europe

- 5.8.4. Middle East & Africa

- 5.8.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Ball

- 6.1.2. Disc

- 6.1.3. Cartridge

- 6.1.4. Compression

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Manual

- 6.2.2. Automatic

- 6.3. Market Analysis, Insights and Forecast - by Installation Type

- 6.3.1. Deck Mount

- 6.3.2. Wall Mount

- 6.4. Market Analysis, Insights and Forecast - by Material Type

- 6.4.1. Chrome

- 6.4.2. Stainless Steel

- 6.4.3. Brass

- 6.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 6.4.5. Other Material Types

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Kitchen Faucets

- 6.5.2. Bathroom Faucets

- 6.6. Market Analysis, Insights and Forecast - by End User

- 6.6.1. Residential

- 6.6.2. Commercial

- 6.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.7.1. B2C/Retail

- 6.7.1.1. Multi-brand Stores

- 6.7.1.2. Exclusive Stores

- 6.7.1.3. Online

- 6.7.2. B2B/Proj

- 6.7.1. B2C/Retail

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Ball

- 7.1.2. Disc

- 7.1.3. Cartridge

- 7.1.4. Compression

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Manual

- 7.2.2. Automatic

- 7.3. Market Analysis, Insights and Forecast - by Installation Type

- 7.3.1. Deck Mount

- 7.3.2. Wall Mount

- 7.4. Market Analysis, Insights and Forecast - by Material Type

- 7.4.1. Chrome

- 7.4.2. Stainless Steel

- 7.4.3. Brass

- 7.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 7.4.5. Other Material Types

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Kitchen Faucets

- 7.5.2. Bathroom Faucets

- 7.6. Market Analysis, Insights and Forecast - by End User

- 7.6.1. Residential

- 7.6.2. Commercial

- 7.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.7.1. B2C/Retail

- 7.7.1.1. Multi-brand Stores

- 7.7.1.2. Exclusive Stores

- 7.7.1.3. Online

- 7.7.2. B2B/Proj

- 7.7.1. B2C/Retail

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Ball

- 8.1.2. Disc

- 8.1.3. Cartridge

- 8.1.4. Compression

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Manual

- 8.2.2. Automatic

- 8.3. Market Analysis, Insights and Forecast - by Installation Type

- 8.3.1. Deck Mount

- 8.3.2. Wall Mount

- 8.4. Market Analysis, Insights and Forecast - by Material Type

- 8.4.1. Chrome

- 8.4.2. Stainless Steel

- 8.4.3. Brass

- 8.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 8.4.5. Other Material Types

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Kitchen Faucets

- 8.5.2. Bathroom Faucets

- 8.6. Market Analysis, Insights and Forecast - by End User

- 8.6.1. Residential

- 8.6.2. Commercial

- 8.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.7.1. B2C/Retail

- 8.7.1.1. Multi-brand Stores

- 8.7.1.2. Exclusive Stores

- 8.7.1.3. Online

- 8.7.2. B2B/Proj

- 8.7.1. B2C/Retail

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Ball

- 9.1.2. Disc

- 9.1.3. Cartridge

- 9.1.4. Compression

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Manual

- 9.2.2. Automatic

- 9.3. Market Analysis, Insights and Forecast - by Installation Type

- 9.3.1. Deck Mount

- 9.3.2. Wall Mount

- 9.4. Market Analysis, Insights and Forecast - by Material Type

- 9.4.1. Chrome

- 9.4.2. Stainless Steel

- 9.4.3. Brass

- 9.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 9.4.5. Other Material Types

- 9.5. Market Analysis, Insights and Forecast - by Application

- 9.5.1. Kitchen Faucets

- 9.5.2. Bathroom Faucets

- 9.6. Market Analysis, Insights and Forecast - by End User

- 9.6.1. Residential

- 9.6.2. Commercial

- 9.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.7.1. B2C/Retail

- 9.7.1.1. Multi-brand Stores

- 9.7.1.2. Exclusive Stores

- 9.7.1.3. Online

- 9.7.2. B2B/Proj

- 9.7.1. B2C/Retail

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Faucet Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Ball

- 10.1.2. Disc

- 10.1.3. Cartridge

- 10.1.4. Compression

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Manual

- 10.2.2. Automatic

- 10.3. Market Analysis, Insights and Forecast - by Installation Type

- 10.3.1. Deck Mount

- 10.3.2. Wall Mount

- 10.4. Market Analysis, Insights and Forecast - by Material Type

- 10.4.1. Chrome

- 10.4.2. Stainless Steel

- 10.4.3. Brass

- 10.4.4. Polytetra Methylene Terephthalate (PTMT) Plastic

- 10.4.5. Other Material Types

- 10.5. Market Analysis, Insights and Forecast - by Application

- 10.5.1. Kitchen Faucets

- 10.5.2. Bathroom Faucets

- 10.6. Market Analysis, Insights and Forecast - by End User

- 10.6.1. Residential

- 10.6.2. Commercial

- 10.7. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.7.1. B2C/Retail

- 10.7.1.1. Multi-brand Stores

- 10.7.1.2. Exclusive Stores

- 10.7.1.3. Online

- 10.7.2. B2B/Proj

- 10.7.1. B2C/Retail

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Grohe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Delta faucet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Waterman India

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kohler

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toto**List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cavier

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cera Sanitaryware Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Roca

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jaquar

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hindware

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Grohe

List of Figures

- Figure 1: Global Faucet Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 7: North America Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 8: North America Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 9: North America Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: North America Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 13: North America Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: North America Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: North America Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 19: South America Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: South America Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 21: South America Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 23: South America Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 24: South America Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 25: South America Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 26: South America Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 27: South America Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 29: South America Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Europe Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Europe Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 37: Europe Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Europe Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 39: Europe Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 40: Europe Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 41: Europe Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 42: Europe Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 43: Europe Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 44: Europe Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 45: Europe Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 46: Europe Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Europe Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Europe Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 49: Europe Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 51: Middle East & Africa Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 52: Middle East & Africa Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 53: Middle East & Africa Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 54: Middle East & Africa Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 55: Middle East & Africa Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 56: Middle East & Africa Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 57: Middle East & Africa Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 58: Middle East & Africa Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 59: Middle East & Africa Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 60: Middle East & Africa Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 61: Middle East & Africa Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East & Africa Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 64: Middle East & Africa Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 65: Middle East & Africa Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 66: Asia Pacific Faucet Industry in India Revenue (Million), by Product Type 2025 & 2033

- Figure 67: Asia Pacific Faucet Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 68: Asia Pacific Faucet Industry in India Revenue (Million), by Technology 2025 & 2033

- Figure 69: Asia Pacific Faucet Industry in India Revenue Share (%), by Technology 2025 & 2033

- Figure 70: Asia Pacific Faucet Industry in India Revenue (Million), by Installation Type 2025 & 2033

- Figure 71: Asia Pacific Faucet Industry in India Revenue Share (%), by Installation Type 2025 & 2033

- Figure 72: Asia Pacific Faucet Industry in India Revenue (Million), by Material Type 2025 & 2033

- Figure 73: Asia Pacific Faucet Industry in India Revenue Share (%), by Material Type 2025 & 2033

- Figure 74: Asia Pacific Faucet Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 75: Asia Pacific Faucet Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 76: Asia Pacific Faucet Industry in India Revenue (Million), by End User 2025 & 2033

- Figure 77: Asia Pacific Faucet Industry in India Revenue Share (%), by End User 2025 & 2033

- Figure 78: Asia Pacific Faucet Industry in India Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific Faucet Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 80: Asia Pacific Faucet Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 81: Asia Pacific Faucet Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 4: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Faucet Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 9: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 12: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 13: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United States Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Canada Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Mexico Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 23: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 24: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 33: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 34: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 35: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 37: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 39: United Kingdom Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: France Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Italy Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Spain Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Russia Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Benelux Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Nordics Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 49: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 50: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 51: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 52: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 53: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 54: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 55: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Turkey Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Israel Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: GCC Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: North Africa Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Global Faucet Industry in India Revenue Million Forecast, by Product Type 2020 & 2033

- Table 63: Global Faucet Industry in India Revenue Million Forecast, by Technology 2020 & 2033

- Table 64: Global Faucet Industry in India Revenue Million Forecast, by Installation Type 2020 & 2033

- Table 65: Global Faucet Industry in India Revenue Million Forecast, by Material Type 2020 & 2033

- Table 66: Global Faucet Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 67: Global Faucet Industry in India Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Faucet Industry in India Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Faucet Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 70: China Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 71: India Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Japan Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 73: South Korea Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: ASEAN Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 75: Oceania Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Faucet Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Faucet Industry in India?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Faucet Industry in India?

Key companies in the market include Grohe, Delta faucet, Waterman India, Kohler, Toto**List Not Exhaustive, Cavier, Cera Sanitaryware Ltd, Roca, Jaquar, Hindware.

3. What are the main segments of the Faucet Industry in India?

The market segments include Product Type, Technology, Installation Type, Material Type, Application, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction of Residential and Commercial Space; Government Policies Favoring Sales of Faucets in the Market.

6. What are the notable trends driving market growth?

Rising Demand for Automatic Faucets is Driving the Market.

7. Are there any restraints impacting market growth?

Highly Competitive Market Affecting Small Faucet Manufacturing Businesses; Price Fluctuation in Raw Materials Affecting the Manufacturers.

8. Can you provide examples of recent developments in the market?

August 2023: Hindware Limited launched an array of innovative faucets in its product line, which consists of two new faucet ranges, “Fabio” and “Agnese,” featuring ground-breaking technology, style, and creativity. The expansion is aimed at providing integrated solutions with improved customer convenience, targeting its range of customers, Architects, Dealers, and Builders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Faucet Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Faucet Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Faucet Industry in India?

To stay informed about further developments, trends, and reports in the Faucet Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence