Key Insights

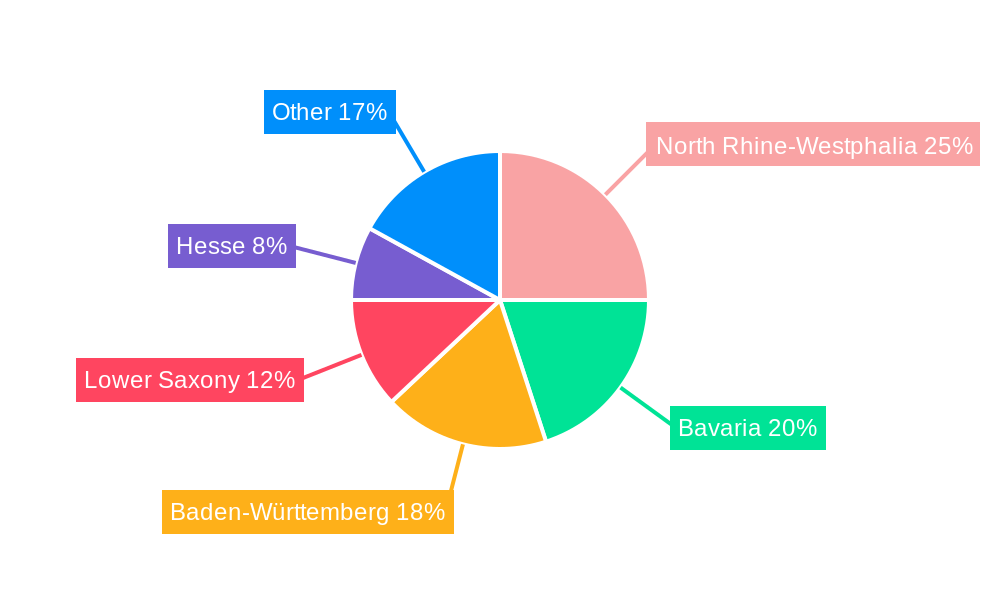

The German DIY home improvement market is projected for significant growth, with a projected Compound Annual Growth Rate (CAGR) of 3.1%. In the base year of 2024, the market size was valued at 46.2 billion. Key growth drivers include an expanding homeowner demographic, rising disposable incomes, and a growing consumer preference for personalized living spaces. The surge in e-commerce further fuels market expansion. Prominent segments include lumber and landscaping, kitchen renovations, and flooring and painting, indicating consistent demand for home enhancement projects. Challenges to growth include volatile material costs, particularly for lumber, and potential economic downturns affecting discretionary spending. Major competitors like OBI, Bauhaus, and Hornbach engage in strategic pricing and product innovation to maintain market share. Demand is concentrated in populous states such as North Rhine-Westphalia, Bavaria, and Baden-Württemberg.

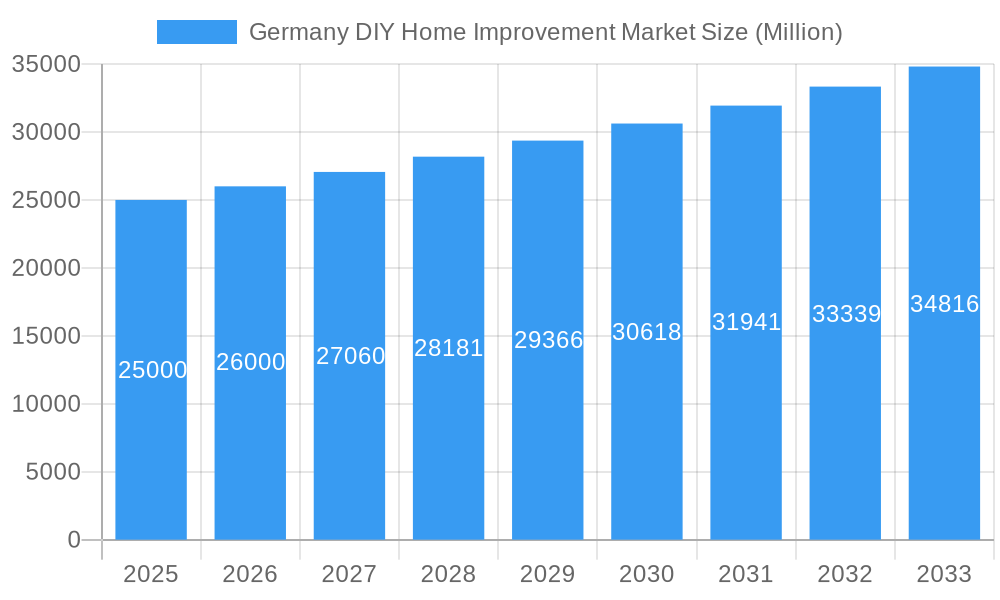

Germany DIY Home Improvement Market Market Size (In Billion)

The forecast period (2024-2033) indicates sustained expansion, influenced by economic conditions and material price stability. The adoption of sustainable building materials and eco-friendly practices will be a defining trend. Intense competition is expected to persist, with established retailers focusing on omnichannel strategies and specialized businesses targeting niche markets. While DIY home improvement stores remain the primary sales channel, online retail is anticipated to experience substantial growth due to convenience and a broader product assortment, necessitating a strong digital presence for all market participants. Market segmentation will become more granular, addressing diverse consumer needs and budgets.

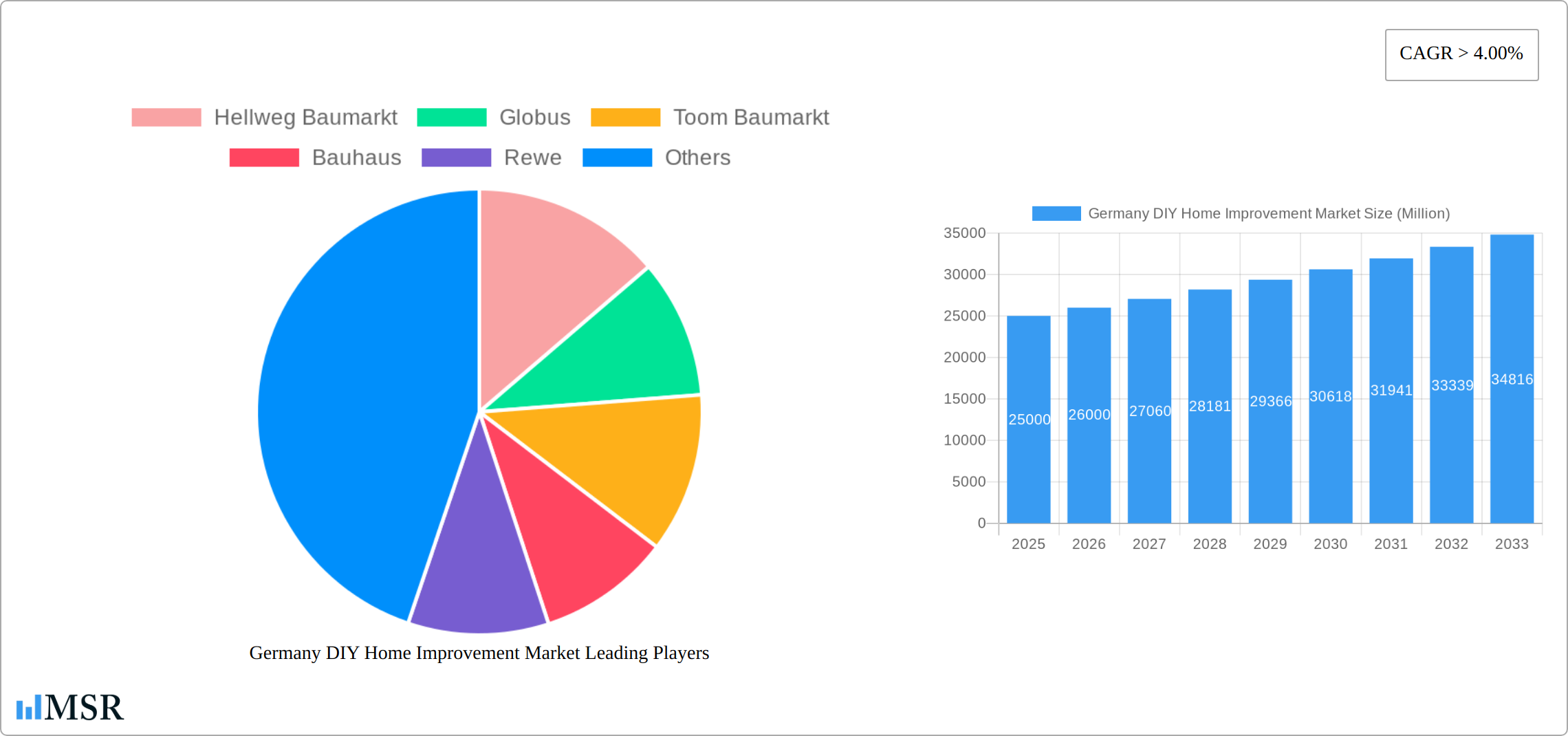

Germany DIY Home Improvement Market Company Market Share

Germany DIY Home Improvement Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Germany DIY Home Improvement Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, key players, emerging trends, and future growth opportunities, making it an essential resource for industry stakeholders, investors, and strategic planners. The report utilizes a robust methodology combining primary and secondary research, offering a data-driven perspective on this dynamic market. The market size is projected to reach xx Million by 2025 and is expected to exhibit a CAGR of xx% during the forecast period (2025-2033).

Note: "xx" represents values that were unavailable for this report generation, and are placeholders for future data input.

Germany DIY Home Improvement Market Market Concentration & Dynamics

The German DIY home improvement market presents a moderately concentrated landscape, dominated by key players such as OBI, Bauhaus, Hornbach, and Hellweg Baumarkt, which collectively hold a substantial market share. However, a vibrant ecosystem of smaller players and regional chains ensures a competitive market dynamic. Several key factors shape the market's evolution:

Market Share Dynamics: While precise figures for 2025 are still emerging, OBI and Bauhaus maintain leading positions, followed closely by Hellweg Baumarkt. Smaller chains, including Globus and Toom Baumarkt, contribute significantly to the overall market volume. Detailed market share analysis for 2025 will be available in [insert report release date/link to report].

Innovation and Digital Transformation: The market is characterized by a strong focus on innovation, with both established players and new entrants driving advancements in digitalization, sustainable product offerings, and personalized customer services. Initiatives such as OBI's "Squared" innovation hub and Hornbach's logistics investments exemplify this commitment to modernization.

Regulatory Landscape and Sustainability: German building codes and environmental regulations play a pivotal role, influencing product development, material sourcing, and overall market practices. Adherence to these regulations is paramount for success in this market.

Competitive Pressures and Substitute Products: The market experiences competition from substitute products, particularly readily available furniture from mass retailers, impacting certain product categories more than others. This necessitates a constant adaptation and differentiation strategy from DIY players.

Evolving Consumer Preferences: Several macro-trends are impacting the market. Increasing urbanization, rising disposable incomes, and a growing preference for home improvement projects are driving demand. The simultaneous shift toward sustainability and eco-friendly products presents both a challenge and an opportunity.

Mergers and Acquisitions (M&A): The German DIY market has witnessed a moderate level of M&A activity in recent years (approximately xx deals between 2019-2024). This trend is expected to continue as players seek to enhance efficiency and expand their market reach. Future M&A activity will likely focus on [mention expected trends like digital capabilities, regional expansion, etc.].

Germany DIY Home Improvement Market Industry Insights & Trends

The German DIY home improvement market demonstrates robust growth, fueled by a confluence of economic, social, and technological factors. The market expanded from €xx million in 2019 to €xx million in 2024, representing a [calculate percentage] increase. This positive trajectory is expected to continue, with projections suggesting a [percentage]% Compound Annual Growth Rate (CAGR) between 2025 and 2030, reaching a market size of €xx million.

Market Growth Drivers: Robust economic growth in Germany, coupled with rising homeownership rates and significant investments in home renovation projects, are fundamental growth drivers. Government incentives promoting energy-efficient renovations further bolster market expansion. [Add specific examples of government schemes if possible].

Technological Disruption and E-commerce: The integration of e-commerce platforms is reshaping the retail landscape, creating new competitive dynamics between online and brick-and-mortar stores. The adoption of digital tools for project planning, virtual design, and online purchasing is accelerating rapidly. [Add statistics on e-commerce growth if possible].

Evolving Consumer Behavior: Consumers are increasingly demanding high-quality, sustainable, and innovative products, coupled with personalized services and customized solutions. Post-pandemic trends reveal a heightened interest in home improvement projects. Furthermore, the increasing integration of smart home technology, including smart lighting and appliances, is a significant driver of market growth. [Add any supporting data, like survey results, if available].

Key Markets & Segments Leading Germany DIY Home Improvement Market

The German DIY home improvement market exhibits regional variations, with major metropolitan areas displaying higher demand. However, the growth is relatively consistent across major regions. Among the product segments, Tools and Hardware, Building Materials, and Kitchen renovation demonstrate the highest growth potential.

Product Segment Drivers:

- Lumber and Landscape Management: Driven by increasing gardening interest and landscaping projects.

- Decor and Indoor Garden: Fueled by a rising trend toward home interior improvements and creating aesthetically pleasing indoor environments.

- Kitchen: High growth due to significant investment in kitchen renovation projects.

- Painting and Wallpaper: Consistent demand driven by regular home maintenance and renovation needs.

- Tools and Hardware: Essential for most DIY projects, leading to sustained demand.

- Building Materials: Large market share with high demand in both new construction and renovation projects.

- Lighting: Growing demand for energy-efficient and smart lighting solutions.

- Plumbing: Consistent demand fueled by maintenance and renovation activities.

- Flooring: Regular replacement and renovation needs drive consistent growth.

- Repair and Replacement: Significant market due to ongoing maintenance requirements.

- Electric Work: Increasing demand driven by smart home technology adoption and electrical upgrades.

Distribution Channel Dominance: DIY home improvement stores remain the dominant distribution channel, although online sales are gaining significant traction. Specialty stores cater to niche markets, while furniture stores often offer complementary home improvement products.

Germany DIY Home Improvement Market Product Developments

Recent product innovations focus on sustainability, digitalization, and enhanced user experience. Manufacturers are introducing eco-friendly building materials, smart home-integrated tools, and user-friendly design software. These innovations provide competitive advantages, improving product appeal and efficiency. For example, the rise of 3D-printed building materials is slowly creating ripples in the market.

Challenges in the Germany DIY Home Improvement Market Market

The German DIY home improvement market faces several challenges:

Supply Chain Disruptions: Global supply chain issues continue to impact the availability of raw materials and finished goods, leading to price increases and potential shortages. The impact is estimated to be around xx Million Euros in lost revenue annually.

Increased Competition: Intense competition from established players and emerging online retailers creates pricing pressure and necessitates continuous innovation.

Regulatory Hurdles: Strict environmental regulations and building codes impose additional costs and complexities for manufacturers and retailers.

Forces Driving Germany DIY Home Improvement Market Growth

Key growth drivers include:

Economic Growth: Sustained economic growth fuels disposable income and expenditure on home improvement projects.

Technological Advancements: Smart home technology, digital design tools, and e-commerce platforms are transforming the market.

Government Initiatives: Government incentives for energy-efficient renovations are stimulating market demand.

Long-Term Growth Catalysts in the Germany DIY Home Improvement Market

Long-term growth will be driven by continuous innovation in sustainable materials, smart home integration, and personalized services. Strategic partnerships between manufacturers, retailers, and technology providers will further accelerate market expansion.

Emerging Opportunities in Germany DIY Home Improvement Market

Emerging opportunities include:

Sustainable Products: Growing demand for eco-friendly materials and energy-efficient solutions.

Smart Home Technology: Integration of smart home devices and systems into home improvement projects.

Personalized Services: Increased demand for customized design and installation services.

Leading Players in the Germany DIY Home Improvement Market Sector

- Hellweg Baumarkt

- Globus

- Toom Baumarkt

- Bauhaus

- Rewe

- OBI

- Hagebau Retail

- Hammer

- Harrys Fliesenmarket

- Hornbach

- Dehner Gartencenter

Key Milestones in Germany DIY Home Improvement Market Industry

- October 2021: OBI launched "Squared," its innovation hub aimed at boosting production volume.

- February 2022: Hornbach invested in a new logistics center for bulky goods, expanding its supply chain capacity.

Strategic Outlook for Germany DIY Home Improvement Market Market

The German DIY home improvement market presents significant long-term growth potential. Companies that prioritize innovation, sustainability, and digitalization are poised for success. Strategic partnerships and investments in advanced technologies will be crucial for capturing market share and driving future expansion.

Germany DIY Home Improvement Market Segmentation

-

1. Product

- 1.1. Lumber and Landscape Management

- 1.2. Decor and Indoor Garden

- 1.3. Kitchen

- 1.4. Painting and Wallpaper

- 1.5. Tools and Hardware

- 1.6. Building Materials

- 1.7. Lighting

- 1.8. Plumbing

- 1.9. Flooring

- 1.10. Repair and Replacement

- 1.11. Electric Work

-

2. Distribution channel

- 2.1. DIY Home Improvement Stores

- 2.2. Online

- 2.3. Specialty Stores

- 2.4. Furniture

Germany DIY Home Improvement Market Segmentation By Geography

- 1. Germany

Germany DIY Home Improvement Market Regional Market Share

Geographic Coverage of Germany DIY Home Improvement Market

Germany DIY Home Improvement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions

- 3.4. Market Trends

- 3.4.1. DIY Home Improvement Becoming a Better Option During Spare Time

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany DIY Home Improvement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Lumber and Landscape Management

- 5.1.2. Decor and Indoor Garden

- 5.1.3. Kitchen

- 5.1.4. Painting and Wallpaper

- 5.1.5. Tools and Hardware

- 5.1.6. Building Materials

- 5.1.7. Lighting

- 5.1.8. Plumbing

- 5.1.9. Flooring

- 5.1.10. Repair and Replacement

- 5.1.11. Electric Work

- 5.2. Market Analysis, Insights and Forecast - by Distribution channel

- 5.2.1. DIY Home Improvement Stores

- 5.2.2. Online

- 5.2.3. Specialty Stores

- 5.2.4. Furniture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hellweg Baumarkt

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Globus

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toom Baumarkt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bauhaus

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rewe

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OBI

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hagebau Retail

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hammer

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Harrys Fliesenmarket**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hornbach

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dehner Gartencenter

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hellweg Baumarkt

List of Figures

- Figure 1: Germany DIY Home Improvement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany DIY Home Improvement Market Share (%) by Company 2025

List of Tables

- Table 1: Germany DIY Home Improvement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Germany DIY Home Improvement Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 3: Germany DIY Home Improvement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany DIY Home Improvement Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Germany DIY Home Improvement Market Revenue billion Forecast, by Distribution channel 2020 & 2033

- Table 6: Germany DIY Home Improvement Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany DIY Home Improvement Market?

The projected CAGR is approximately 3.1%.

2. Which companies are prominent players in the Germany DIY Home Improvement Market?

Key companies in the market include Hellweg Baumarkt, Globus, Toom Baumarkt, Bauhaus, Rewe, OBI, Hagebau Retail, Hammer, Harrys Fliesenmarket**List Not Exhaustive, Hornbach, Dehner Gartencenter.

3. What are the main segments of the Germany DIY Home Improvement Market?

The market segments include Product, Distribution channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency.

6. What are the notable trends driving market growth?

DIY Home Improvement Becoming a Better Option During Spare Time.

7. Are there any restraints impacting market growth?

Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions.

8. Can you provide examples of recent developments in the market?

In February 2022 , Hornbach has invested new logistics center for lengthy and bulky goods intending to launch its operations in order to expand its supplying power across Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany DIY Home Improvement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany DIY Home Improvement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany DIY Home Improvement Market?

To stay informed about further developments, trends, and reports in the Germany DIY Home Improvement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence