Key Insights

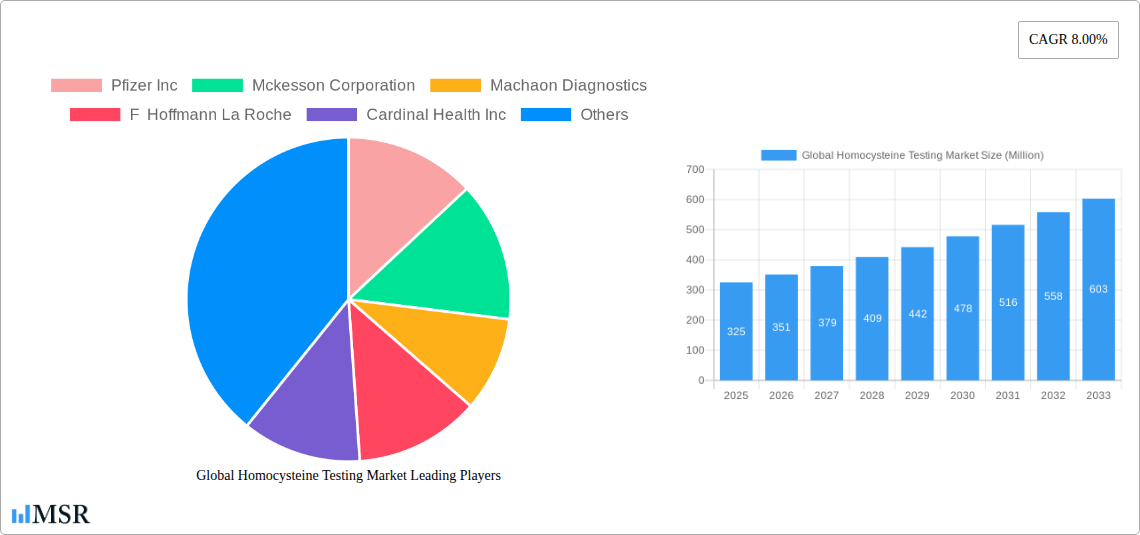

The Global Homocysteine Testing Market is poised for significant expansion, projected to reach approximately \$520 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 8.00% from its 2025 estimated value. This growth is primarily fueled by the increasing awareness surrounding homocysteine's role as a crucial biomarker for cardiovascular diseases, neurological disorders like Alzheimer's and dementia, and pregnancy complications. The rising prevalence of these chronic conditions globally, coupled with advancements in diagnostic technologies, is further accelerating market adoption. Furthermore, the proactive inclusion of homocysteine testing in routine health check-ups and the growing demand for early disease detection solutions are key contributors to this positive market trajectory. The market is characterized by a strong emphasis on Type segments, with Folic Acid, Pyridoxine, and Cobalamin-based testing dominating due to their established efficacy in managing elevated homocysteine levels. In terms of Form, tablets and syrups are expected to lead, offering convenient patient administration. The distribution channel landscape is largely shaped by hospital pharmacies and drug stores, reflecting established healthcare access points.

Global Homocysteine Testing Market Market Size (In Million)

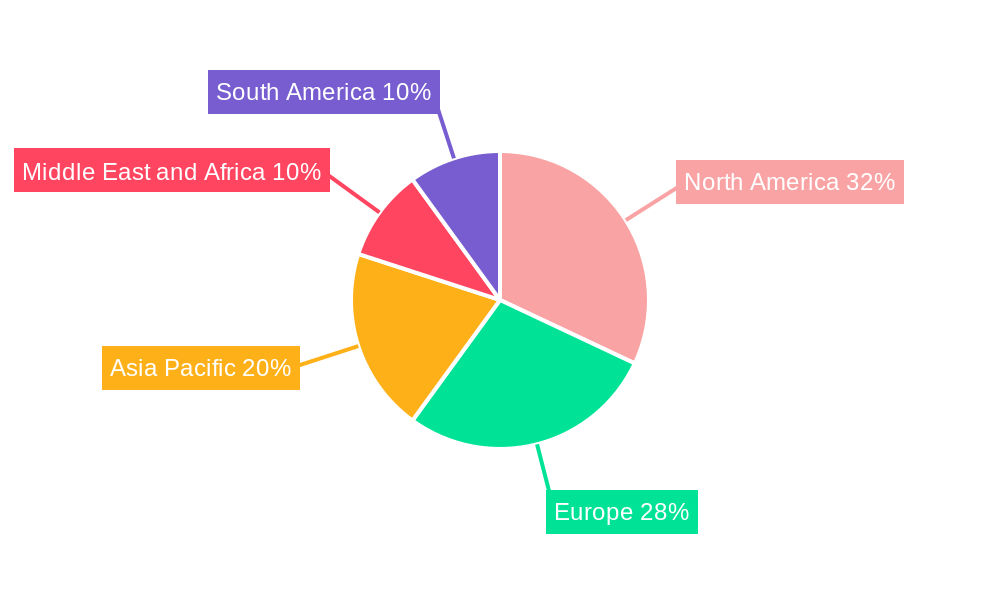

The market's growth trajectory is further supported by the increasing integration of advanced immunoassay and chromatographic techniques in diagnostic kits, enabling faster and more accurate results. Emerging economies, particularly in the Asia Pacific and South America, present substantial untapped potential due to improving healthcare infrastructure and rising disposable incomes, driving demand for accessible and affordable diagnostic solutions. However, certain restraints, such as the initial cost of advanced testing equipment and the need for specialized training for laboratory personnel, might present temporary challenges. Despite these, the overarching trend towards preventative healthcare and personalized medicine is expected to propel sustained market expansion. Leading companies like Pfizer Inc., McKesson Corporation, and F. Hoffmann La Roche are actively involved in research and development, aiming to introduce innovative and cost-effective homocysteine testing solutions, thereby shaping the competitive landscape and driving market growth in the coming years.

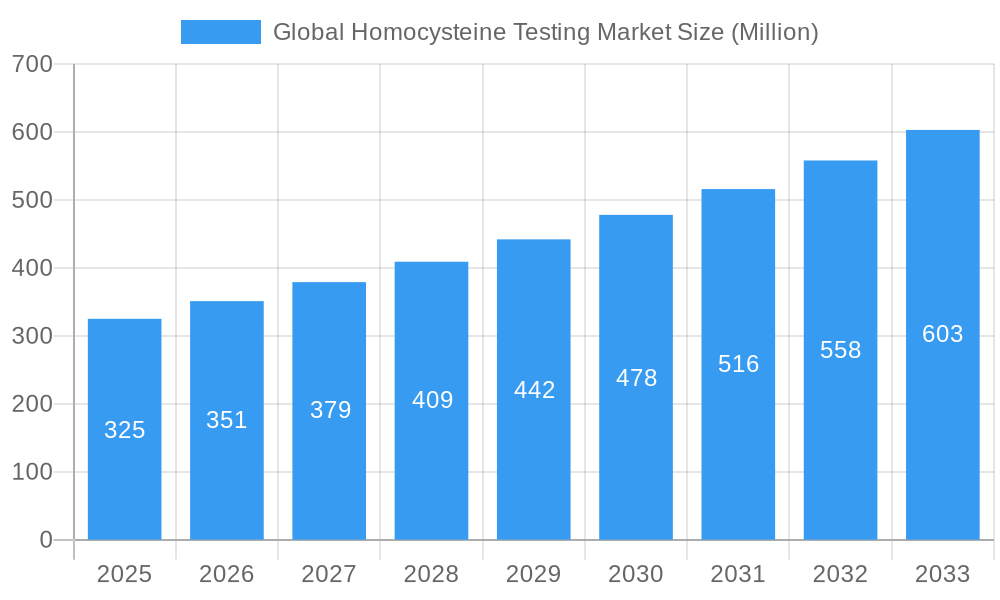

Global Homocysteine Testing Market Company Market Share

This in-depth report delivers an authoritative analysis of the global homocysteine testing market, providing crucial insights for pharmaceutical companies, diagnostic laboratories, healthcare providers, and investment firms. With a detailed market size estimate of $XX Million in 2025, growing at a CAGR of XX% from 2025 to 2033, this study covers the historical period of 2019-2024 and projects a robust forecast period of 2025-2033. Dive deep into homocysteine blood tests, cardiovascular risk assessment, folate deficiency testing, and vitamin B12 deficiency screening to understand market dynamics, key players, and emerging trends shaping the future of biomarker testing and clinical diagnostics.

Global Homocysteine Testing Market Market Concentration & Dynamics

The global homocysteine testing market exhibits a moderate to high level of concentration, driven by a blend of established diagnostic giants and specialized players. Key companies like Pfizer Inc, McKesson Corporation, Roche Diagnostics, and Cardinal Health Inc maintain significant market shares through extensive distribution networks and strong brand recognition. The innovation ecosystem is characterized by continuous advancements in assay technologies for more accurate and faster homocysteine detection, alongside the development of point-of-care testing solutions. Regulatory frameworks, including FDA approvals and CE markings, play a pivotal role in market entry and product validation. Substitute products, such as traditional lipid panels and genetic testing for cardiovascular risk, present a competitive challenge, but the unique diagnostic value of homocysteine assays in assessing hyperhomocysteinemia ensures sustained demand. End-user trends lean towards increased adoption of preventive healthcare and personalized medicine, fueling the need for early risk identification. Merger and acquisition (M&A) activities, evidenced by recent strategic expansions by players like ARUP Laboratories, aim to consolidate market positions and enhance testing capacity, with an estimated XX M&A deals in the past five years contributing to market consolidation.

Global Homocysteine Testing Market Industry Insights & Trends

The global homocysteine testing market is experiencing robust growth, propelled by an escalating awareness of cardiovascular disease (CVD) risk factors and the critical role of homocysteine levels in predicting these risks. The market size was valued at approximately $XX Million in 2025, with projections indicating a substantial expansion throughout the forecast period. Key growth drivers include the increasing prevalence of CVD, stroke, and neurological disorders, for which elevated homocysteine is a significant risk factor. Technological advancements in immunoassays and LC-MS/MS techniques have led to more sensitive, specific, and cost-effective homocysteine detection methods, thereby enhancing diagnostic accuracy and broadening market accessibility. Evolving consumer behaviors, marked by a proactive approach to health and a greater demand for preventive health screenings, further contribute to market expansion. The integration of homocysteine testing into routine health check-ups and chronic disease management programs is becoming increasingly common. Furthermore, the growing emphasis on nutritional deficiency diagnostics, particularly concerning folate and Vitamin B12, which are crucial for homocysteine metabolism, is a significant trend. The rise of telemedicine and remote patient monitoring also presents opportunities for the wider dissemination of diagnostic testing services, including homocysteine assays. The market is also witnessing a rise in home-use testing kits and direct-to-consumer diagnostic solutions, though regulatory oversight remains a key consideration. The overall CAGR of XX% underscores the promising trajectory of this market as it becomes an indispensable tool in the modern healthcare landscape for early disease detection and management.

Key Markets & Segments Leading Global Homocysteine Testing Market

North America currently dominates the global homocysteine testing market, driven by high healthcare expenditure, advanced diagnostic infrastructure, and a strong emphasis on preventive medicine. The United States, in particular, accounts for a substantial share due to the high prevalence of cardiovascular diseases and a well-established market for diagnostic reagents and equipment.

Dominant Segments:

Type:

- Folic Acid: This segment is a significant driver, as folic acid plays a crucial role in the metabolic pathway that regulates homocysteine levels. Increased awareness of folate deficiency as a risk factor for various health conditions contributes to the demand for folic acid-related diagnostic tests, including homocysteine assays.

- Cobalamin (Vitamin B12): Similar to folic acid, cobalamin is essential for homocysteine metabolism. Growing concerns about Vitamin B12 deficiencies, particularly among aging populations and vegetarians/vegans, bolster the demand for diagnostic tests that assess its impact on homocysteine levels.

- Pyridoxine (Vitamin B6): While also involved in homocysteine metabolism, the pyridoxine segment is generally smaller compared to folic acid and cobalamin, reflecting its relatively lesser impact on overall homocysteine levels in the broader population.

Form:

- Tablet: The prevalent form of Vitamin supplementation (folic acid, pyridoxine, cobalamin) directly influences the demand for testing. As tablets are the most common dosage form for these vitamins, the associated testing for their metabolic impact, including homocysteine, remains high.

- Syrup: While less common than tablets, syrup formulations are relevant for specific patient populations, such as children or individuals with swallowing difficulties, contributing to the overall demand for homocysteine testing.

- Others: This category encompasses various other delivery methods like capsules, injections, and fortified foods, each contributing to the overall consumption of these vitamins and, consequently, the demand for related diagnostic testing.

Distribution Channel:

- Hospital Pharmacies: These are leading channels due to the direct correlation with patient care and diagnosis within hospital settings. Hospital pharmacies are crucial for dispensing diagnostic kits and facilitating laboratory testing ordered by physicians for conditions related to elevated homocysteine.

- Drug Stores: The increasing trend of over-the-counter vitamin sales and readily accessible health screenings in drug stores makes this a significant distribution channel for home-use diagnostic kits and related educational materials, indirectly driving homocysteine testing awareness.

- Others: This includes direct-to-consumer (DTC) platforms, online pharmacies, and specialized diagnostic centers, which are gaining traction due to convenience and accessibility, further expanding the reach of homocysteine testing.

The growth in these segments is propelled by factors such as rising disposable incomes, increasing health consciousness, government initiatives promoting early disease detection, and the expanding healthcare infrastructure in emerging economies.

Global Homocysteine Testing Market Product Developments

Product developments in the global homocysteine testing market are primarily focused on enhancing assay sensitivity, specificity, and turnaround time. Innovations in immunoassay platforms and mass spectrometry-based methods are leading to more accurate and reliable detection of homocysteine in biological samples. The development of high-throughput diagnostic kits supports larger-scale laboratory testing, while the emergence of point-of-care testing (POCT) devices promises faster results and increased accessibility for patients. These advancements aim to improve the diagnostic utility of homocysteine testing for cardiovascular risk stratification, neurological disorder diagnosis, and monitoring of vitamin deficiencies. The market relevance lies in enabling earlier and more precise interventions, ultimately contributing to improved patient outcomes and reduced healthcare costs associated with chronic diseases.

Challenges in the Global Homocysteine Testing Market Market

The global homocysteine testing market faces several challenges that can impede its growth trajectory.

- Regulatory Hurdles: Obtaining and maintaining approvals from various health authorities (e.g., FDA, EMA) for new diagnostic assays and devices can be a time-consuming and costly process.

- Cost of Testing: While improving, the cost of advanced homocysteine testing methods can still be a barrier to widespread adoption in certain healthcare systems and for low-income populations, leading to approximately XX% of potential tests being foregone due to cost concerns.

- Lack of Standardization: Variations in testing methodologies and reference ranges across different laboratories can lead to discrepancies in results, impacting clinical decision-making.

- Reimbursement Policies: Inconsistent or limited reimbursement policies for homocysteine testing in some regions can affect the economic viability for healthcare providers and limit patient access.

- Awareness and Education: While growing, a lack of comprehensive awareness among both healthcare professionals and the general public about the significance of homocysteine levels and its implications for health can hinder demand.

Forces Driving Global Homocysteine Testing Market Growth

Several forces are propelling the global homocysteine testing market forward. The escalating global burden of cardiovascular diseases (CVDs) and stroke, for which elevated homocysteine is a well-established risk factor, is a primary driver. Increased emphasis on preventive healthcare and early disease detection initiatives by governments and healthcare organizations worldwide further boosts demand for diagnostic tools like homocysteine assays. Technological advancements in diagnostic assay development, leading to more accurate, rapid, and cost-effective testing methods, are also significant growth catalysts. Furthermore, the growing recognition of homocysteine's role in neurological disorders and pregnancy complications is expanding its diagnostic utility and market reach.

Challenges in the Global Homocysteine Testing Market Market

Long-term growth catalysts for the global homocysteine testing market are rooted in ongoing scientific research and strategic market developments. Continued research into the intricate role of homocysteine in a broader spectrum of diseases, beyond cardiovascular and neurological conditions, will uncover new diagnostic applications. Partnerships between diagnostic companies and pharmaceutical firms for developing targeted therapies based on homocysteine levels will create a synergistic growth environment. Furthermore, expansions into emerging markets with growing healthcare infrastructure and increasing health awareness will unlock significant untapped potential. The integration of homocysteine testing into routine health screenings and personalized medicine programs will solidify its position as an indispensable diagnostic tool.

Emerging Opportunities in Global Homocysteine Testing Market

Emerging opportunities in the global homocysteine testing market are diverse and promising. The development of more user-friendly point-of-care testing devices for home use or decentralized clinical settings presents a significant avenue for market expansion, catering to patient convenience and faster results. The increasing focus on nutrigenomics and personalized nutrition creates an opportunity for homocysteine testing to guide individualized dietary interventions aimed at managing homocysteine levels. Furthermore, the growing demand for early screening of cognitive decline and neurodegenerative diseases, where homocysteine plays a role, offers a substantial growth area. The expansion of telemedicine platforms also provides a fertile ground for remote homocysteine testing and consultation services, particularly in underserved regions.

Leading Players in the Global Homocysteine Testing Market Sector

- Pfizer Inc

- McKesson Corporation

- Machaon Diagnostics

- F Hoffmann La Roche

- Cardinal Health Inc

- Teligent Inc

- Sekisui Diagnostics

- Kripps Pharmacy Ltd

- ARUP Laboratories

- Jamp Pharma Corporation

Key Milestones in Global Homocysteine Testing Market Industry

- June 2021: ARUP Laboratories officially opened its four-story, 220,000-square-foot laboratory in Salt Lake City, designed to optimize quality laboratory testing and featuring total lab automation to further increase testing capacity and accommodate growth at ARUP. This expansion enhances their capability to perform high-volume homocysteine testing.

- April 2021: Cardinal Health was awarded a USD 57.8 million contract, including options that could be exercised by the United States Department of Health and Human Services to reach USD 91.6 million. This significant contract underscores the increasing demand for diagnostic supplies and services, potentially including homocysteine testing components, within the US healthcare system.

Strategic Outlook for Global Homocysteine Testing Market Market

The strategic outlook for the global homocysteine testing market is characterized by sustained growth and innovation. Key growth accelerators include the continued advancement of diagnostic technologies, leading to more accessible and affordable testing options. Strategic partnerships between diagnostic manufacturers and healthcare providers will be crucial for expanding market reach and integrating homocysteine testing into routine clinical practice. The growing emphasis on preventive healthcare and personalized medicine will further fuel demand, positioning homocysteine testing as a critical biomarker for risk assessment and disease management. Investing in research and development to explore new applications of homocysteine testing in emerging health concerns will unlock significant future market potential.

Global Homocysteine Testing Market Segmentation

-

1. Type

- 1.1. Folic Acid

- 1.2. Pyridoxine

- 1.3. Cobalamin

-

2. Form

- 2.1. Tablet

- 2.2. Syrup

- 2.3. Others

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Drug Stores

- 3.3. Others

Global Homocysteine Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Homocysteine Testing Market Regional Market Share

Geographic Coverage of Global Homocysteine Testing Market

Global Homocysteine Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Increasing life style habits leading to risks of heart and renal diseases

- 3.3. Market Restrains

- 3.3.1. Lack of awareness regarding the deficiency of vitamins in blood

- 3.4. Market Trends

- 3.4.1. The Folic Acid Segment is Expected to Hold a Major Market Share in the Homocysteine Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Folic Acid

- 5.1.2. Pyridoxine

- 5.1.3. Cobalamin

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Tablet

- 5.2.2. Syrup

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Drug Stores

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Folic Acid

- 6.1.2. Pyridoxine

- 6.1.3. Cobalamin

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Tablet

- 6.2.2. Syrup

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Drug Stores

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Folic Acid

- 7.1.2. Pyridoxine

- 7.1.3. Cobalamin

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Tablet

- 7.2.2. Syrup

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Drug Stores

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Folic Acid

- 8.1.2. Pyridoxine

- 8.1.3. Cobalamin

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Tablet

- 8.2.2. Syrup

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Drug Stores

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Folic Acid

- 9.1.2. Pyridoxine

- 9.1.3. Cobalamin

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Tablet

- 9.2.2. Syrup

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Drug Stores

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Folic Acid

- 10.1.2. Pyridoxine

- 10.1.3. Cobalamin

- 10.2. Market Analysis, Insights and Forecast - by Form

- 10.2.1. Tablet

- 10.2.2. Syrup

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospital Pharmacies

- 10.3.2. Drug Stores

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Global Homocysteine Testing Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Pfizer Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Mckesson Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Machaon Diagnostics

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 F Hoffmann La Roche

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Cardinal Health Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Teligent Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Sekisui Diagnostics

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Kripps Pharmacy Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 ARUP laboratories

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Jamp Pharma Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Pfizer Inc

List of Figures

- Figure 1: Global Global Homocysteine Testing Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 3: North America Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Europe Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: South America Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 13: North America Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 15: North America Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 16: North America Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: North America Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: North America Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: North America Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Europe Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 23: Europe Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 24: Europe Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 25: Europe Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Europe Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 27: Europe Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 28: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 31: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 32: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 35: Asia Pacific Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 36: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 37: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 39: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 40: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 41: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 42: Middle East and Africa Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 43: Middle East and Africa Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: South America Global Homocysteine Testing Market Revenue (undefined), by Type 2025 & 2033

- Figure 45: South America Global Homocysteine Testing Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: South America Global Homocysteine Testing Market Revenue (undefined), by Form 2025 & 2033

- Figure 47: South America Global Homocysteine Testing Market Revenue Share (%), by Form 2025 & 2033

- Figure 48: South America Global Homocysteine Testing Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 49: South America Global Homocysteine Testing Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: South America Global Homocysteine Testing Market Revenue (undefined), by Country 2025 & 2033

- Figure 51: South America Global Homocysteine Testing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Homocysteine Testing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 4: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Homocysteine Testing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: France Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Italy Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Spain Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: China Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Australia Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: GCC Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Africa Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Middle East and Africa Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 34: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: United States Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Canada Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Mexico Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 41: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Germany Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: France Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Italy Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Spain Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 50: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 51: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 52: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 53: China Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: India Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Australia Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: South Korea Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 60: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 61: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 62: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 63: GCC Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Global Homocysteine Testing Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 67: Global Homocysteine Testing Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 68: Global Homocysteine Testing Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global Homocysteine Testing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Brazil Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 71: Argentina Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of South America Global Homocysteine Testing Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Homocysteine Testing Market?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the Global Homocysteine Testing Market?

Key companies in the market include Pfizer Inc, Mckesson Corporation, Machaon Diagnostics, F Hoffmann La Roche, Cardinal Health Inc, Teligent Inc, Sekisui Diagnostics, Kripps Pharmacy Ltd, ARUP laboratories, Jamp Pharma Corporation.

3. What are the main segments of the Global Homocysteine Testing Market?

The market segments include Type, Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Increasing life style habits leading to risks of heart and renal diseases.

6. What are the notable trends driving market growth?

The Folic Acid Segment is Expected to Hold a Major Market Share in the Homocysteine Testing Market.

7. Are there any restraints impacting market growth?

Lack of awareness regarding the deficiency of vitamins in blood.

8. Can you provide examples of recent developments in the market?

In June 2021, ARUP laboratories officially opened its four-story, 220,000-square-foot laboratory in Salt Lake City. It is designed to optimize quality laboratory testing, it features total lab automation to further increase testing capacity and accommodate growth at ARUP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Homocysteine Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Homocysteine Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Homocysteine Testing Market?

To stay informed about further developments, trends, and reports in the Global Homocysteine Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence