Key Insights

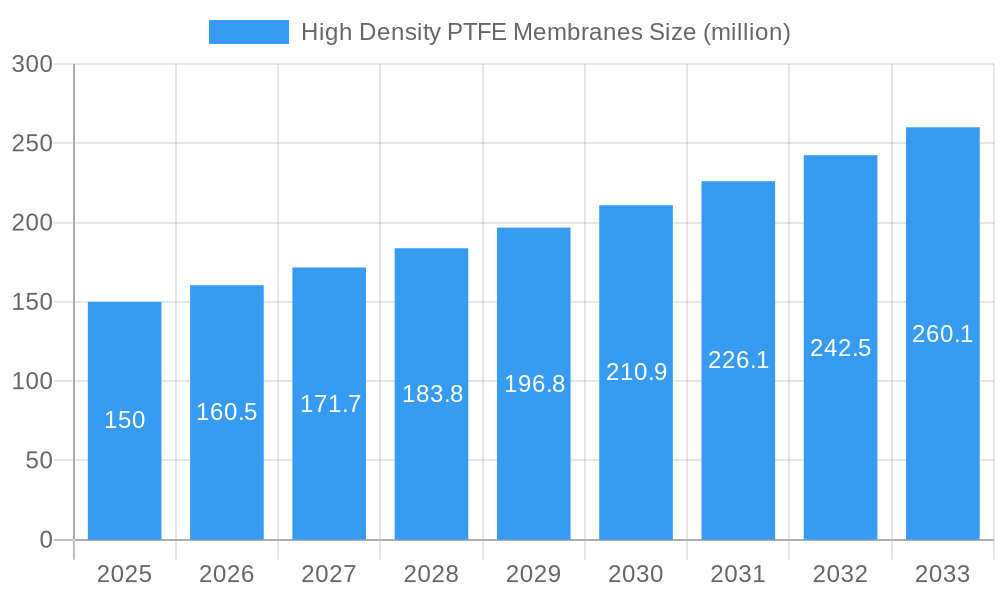

The global High Density PTFE Membranes market is poised for significant expansion, projected to reach an estimated $150 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 7% through 2033. This upward trajectory is fueled by the increasing adoption of these advanced membranes in critical healthcare applications, particularly within hospitals and dental clinics, where their superior biocompatibility and pore structure are essential for procedures requiring precise fluid management and tissue integration. The demand for high-density PTFE membranes is being driven by advancements in regenerative medicine and the growing need for innovative solutions in wound healing and surgical interventions. As research and development continue to unlock new applications, the market is expected to witness sustained growth, attracting further investment and innovation from key players.

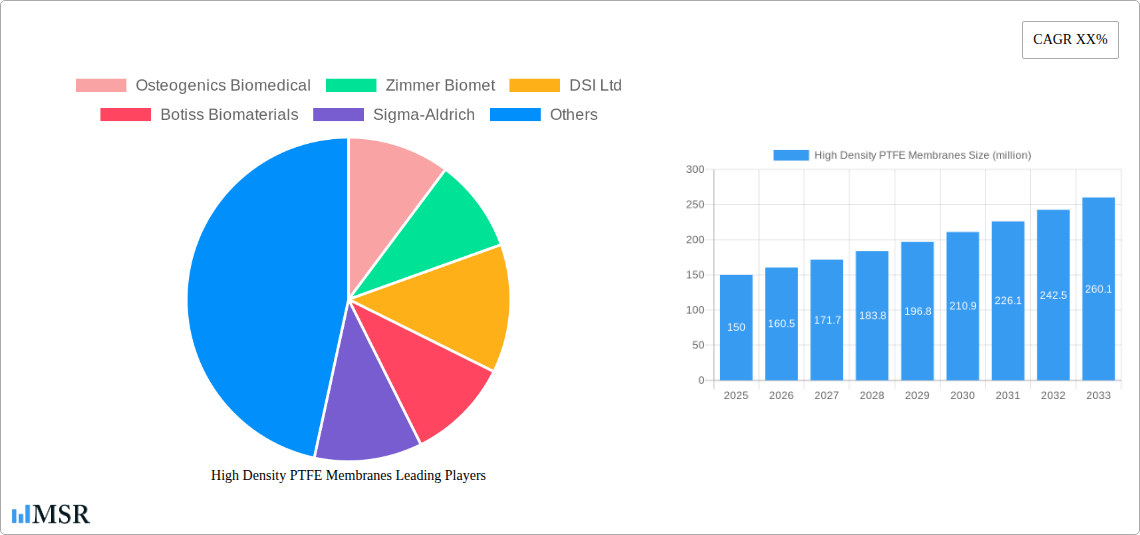

High Density PTFE Membranes Market Size (In Million)

The market's growth is further supported by the escalating prevalence of chronic diseases and the corresponding increase in surgical procedures, creating a consistent demand for high-performance biomaterials. While the market demonstrates strong growth potential, certain factors could present challenges. The cost associated with the manufacturing of high-density PTFE membranes and the stringent regulatory approvals required for medical devices can act as a restraint. However, ongoing technological advancements in manufacturing processes are expected to mitigate cost concerns over time. The competitive landscape features established companies like Osteogenics Biomedical and Zimmer Biomet, alongside emerging players, fostering innovation and driving market expansion across diverse geographical regions, with North America and Europe expected to lead in terms of market share due to their advanced healthcare infrastructures and high adoption rates of new medical technologies.

High Density PTFE Membranes Company Market Share

Sure, here is an SEO-optimized, engaging report description for High Density PTFE Membranes, embedded with high-ranking keywords and structured as requested.

Unlock critical insights into the High Density PTFE Membranes market with this definitive report. Analyzing the period from 2019 to 2033, with a base year of 2025, this study provides in-depth intelligence on market dynamics, key players, technological advancements, and future growth trajectories. Essential for stakeholders seeking to navigate the evolving landscape of advanced biomaterials and medical devices.

This report offers a panoramic view of the global High Density PTFE Membranes market, detailing its present state and projecting its future. With a focus on driving search visibility for terms like "PTFE membranes medical," "high density PTFE implants," "biomaterial market analysis," and "dental barrier membranes," this research is indispensable for manufacturers, suppliers, R&D professionals, investors, and policymakers. We delve into the intricate details of market concentration, technological innovations, regulatory landscapes, and strategic opportunities that will shape the industry's trajectory.

High Density PTFE Membranes Market Concentration & Dynamics

The High Density PTFE Membranes market exhibits a moderate concentration, with key players such as Osteogenics Biomedical, Zimmer Biomet, DSI Ltd, Botiss Biomaterials, Sigma-Aldrich, and Unicare Biomedical holding significant market share. Innovation ecosystems are robust, driven by continuous research into enhanced biocompatibility and improved performance in demanding medical applications, particularly in dental and orthopedic regenerative procedures. Regulatory frameworks, including FDA and CE certifications, play a crucial role in market entry and product development, ensuring patient safety and efficacy. Substitute products, while present, often lack the specific combination of porosity, strength, and biocompatibility offered by high-density PTFE. End-user trends are increasingly focused on minimally invasive procedures and accelerated healing, directly influencing demand for advanced barrier membranes. Merger and acquisition activities, projected to remain steady, are strategically aimed at expanding product portfolios and geographic reach, with an estimated xx M&A deals in the forecast period. The overall market share of these leading companies is estimated to be over 70%.

High Density PTFE Membranes Industry Insights & Trends

The High Density PTFE Membranes industry is poised for substantial growth, fueled by a confluence of technological advancements, increasing demand in healthcare, and evolving patient needs. The global market size for High Density PTFE Membranes is projected to reach approximately $1,500 million by the base year of 2025, with a projected compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This upward trajectory is driven by the expanding applications of these membranes in regenerative medicine, particularly in dental implantology, guided bone regeneration (GBR), and guided tissue regeneration (GTR). Technological disruptions are at the forefront, with ongoing research focusing on developing membranes with optimized pore sizes for selective cell ingress, enhanced vascularization properties, and tailored degradation rates. The development of ePTFE (expanded polytetrafluoroethylene) with precisely controlled density and pore structure is a key innovation area. Evolving consumer behaviors, characterized by a growing preference for aesthetic and functional restoration, further stimulate the demand for advanced biomaterials like high-density PTFE membranes. The increasing prevalence of periodontal diseases and the rising number of dental implant procedures worldwide are significant market drivers. Furthermore, the growing awareness among healthcare professionals and patients about the benefits of regenerative techniques contributes to the market's expansion. The development of new formulations and manufacturing processes that reduce production costs without compromising quality will also play a pivotal role in widening market access and adoption. The global market valuation reached an estimated $1,300 million in 2024.

Key Markets & Segments Leading High Density PTFE Membranes

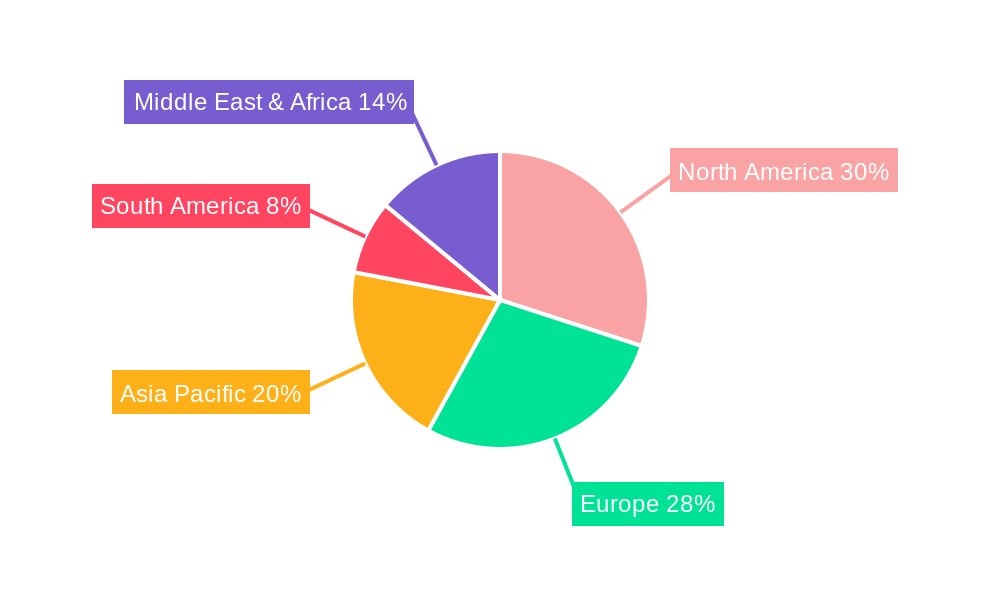

The dominance of the High Density PTFE Membranes market is significantly influenced by regional economic growth, healthcare infrastructure development, and the prevalence of specific medical needs.

Dominant Region: North America

- Economic Growth: Robust healthcare spending, advanced technological adoption, and a high disposable income in countries like the United States and Canada are primary drivers.

- Infrastructure: Well-established hospital networks and a high concentration of specialized dental clinics provide extensive adoption platforms.

- Regulatory Approval: Streamlined and recognized regulatory processes (FDA) facilitate quicker market entry for innovative products.

- Research & Development: Significant investment in R&D by leading companies like Osteogenics Biomedical and Zimmer Biomet fuels continuous product innovation and market penetration.

Dominant Segment: Dental Clinic

- Application Focus: The application within Dental Clinics is a leading segment due to the widespread use of high-density PTFE membranes in dental implantology, GBR, and GTR procedures. The aesthetic and functional restoration needs in dentistry are substantial.

- Market Size: This segment is estimated to constitute over 50% of the total market revenue, driven by an increasing number of dental implant surgeries and a growing demand for predictable and successful outcomes in oral reconstructions.

- Technological Integration: Dental professionals are quick to adopt advanced biomaterials that offer improved handling, predictable results, and enhanced patient comfort.

Dominant Type: Titanium Reinforced

- Structural Integrity: Titanium-reinforced PTFE membranes offer superior stability and maintain space in critical bone regeneration applications, reducing the risk of collapse. This structural advantage is highly valued in complex regenerative procedures.

- Clinical Efficacy: Clinical studies consistently demonstrate the efficacy of titanium-reinforced membranes in achieving predictable bone fill and soft tissue integration.

- Market Share: This type accounts for an estimated 60% of the total market, as it addresses the need for robust support in challenging bone augmentation scenarios, particularly in posterior jaw areas and significant ridge deficiencies.

Other applications within Hospitals for reconstructive surgeries and the "Others" segment, encompassing research institutions and specialized medical facilities, also contribute to the market, albeit with smaller shares compared to dental clinics. The Non-Reinforced segment caters to less demanding applications where flexibility is prioritized over rigid support.

High Density PTFE Membranes Product Developments

Product developments in the High Density PTFE Membranes sector are characterized by advancements in material science and manufacturing techniques. Innovations focus on optimizing pore size distribution for controlled cellular infiltration and vascularization, enhancing biocompatibility, and tailoring degradation profiles. Manufacturers are developing membranes with improved handling characteristics and increased tensile strength to ensure stability during surgical procedures. Examples include membranes with micro-perforations for enhanced tissue integration and variations in thickness and rigidity to suit specific anatomical requirements. These advancements aim to improve clinical outcomes, reduce healing times, and expand the scope of applications in regenerative medicine and tissue engineering, providing a competitive edge for companies investing in cutting-edge solutions.

Challenges in the High Density PTFE Membranes Market

The High Density PTFE Membranes market faces several challenges that can impede its growth.

- High Cost of Production: The specialized manufacturing processes for high-density PTFE can lead to higher product costs, potentially limiting adoption in cost-sensitive markets.

- Surgical Skill Dependency: The successful application of these membranes requires specialized surgical expertise, which can be a barrier in regions with limited access to trained professionals.

- Competition from Alternatives: While offering unique benefits, PTFE membranes face competition from other biomaterials, such as collagen membranes and bioabsorbable barriers, which may be preferred for specific applications or cost considerations.

- Regulatory Hurdles: Navigating complex and evolving regulatory approvals across different geographies can be time-consuming and resource-intensive for manufacturers. The global market is expected to face regulatory compliance costs of approximately $xx million annually.

Forces Driving High Density PTFE Membranes Growth

The growth of the High Density PTFE Membranes market is propelled by several powerful forces. An increasing global aging population, leading to a higher incidence of dental and orthopedic issues requiring regenerative solutions, is a primary driver. Advancements in medical technology, enabling more sophisticated surgical techniques and improved patient outcomes, further fuel demand. The expanding applications in guided bone and tissue regeneration, particularly in dentistry and reconstructive surgery, are critical growth catalysts. Furthermore, rising disposable incomes in emerging economies translate to greater accessibility and adoption of advanced medical treatments, including those utilizing high-density PTFE membranes, boosting the market's overall valuation.

Challenges in the High Density PTFE Membranes Market

Long-term growth catalysts for the High Density PTFE Membranes market are rooted in continuous innovation and strategic market expansion. The development of bio-integrative PTFE membranes that actively promote tissue healing and integration, rather than merely acting as a barrier, represents a significant future opportunity. Partnerships between membrane manufacturers and dental/medical device companies for integrated solutions will accelerate market penetration. Expanding into underserved emerging markets with tailored product offerings and educational initiatives will unlock new revenue streams. Moreover, exploring novel applications beyond traditional regenerative procedures, such as in advanced wound care or tissue engineering research, will solidify the market's long-term growth potential.

Emerging Opportunities in High Density PTFE Membranes

Emerging opportunities in the High Density PTFE Membranes market are centered on innovation and market diversification. The development of resorbable or partially resorbable high-density PTFE membranes could address patient concerns about foreign body materials and simplify post-operative care. Expanding applications in complex reconstructive surgeries beyond dental and orthopedic fields, such as in craniofacial reconstruction or abdominal wall repair, presents a significant growth avenue. Furthermore, the integration of growth factors or stem cells directly onto the membrane surface could create advanced regenerative scaffolds, commanding premium pricing. Targeting emerging economies with increasing healthcare expenditure and a growing awareness of advanced treatment options offers substantial untapped potential.

Leading Players in the High Density PTFE Membranes Sector

- Osteogenics Biomedical

- Zimmer Biomet

- DSI Ltd

- Botiss Biomaterials

- Sigma-Aldrich

- Unicare Biomedical

Key Milestones in High Density PTFE Membranes Industry

- 2019: Introduction of enhanced porosity ePTFE membranes for improved vascularization.

- 2020: FDA clearance for new titanium-reinforced PTFE membrane designs for complex GBR cases.

- 2021: Strategic partnership between a leading biomaterial supplier and a dental implant manufacturer to co-develop integrated solutions.

- 2022: Significant investment in R&D by major players to explore bio-active surface modifications on PTFE membranes.

- 2023: Increased adoption of High Density PTFE Membranes in veterinary regenerative medicine.

- 2024: Market penetration in emerging Asian markets shows robust growth, estimated at xx% year-over-year.

Strategic Outlook for High Density PTFE Membranes Market

The strategic outlook for the High Density PTFE Membranes market remains highly positive, driven by continuous innovation and unmet clinical needs. Growth accelerators include the development of next-generation membranes with enhanced bioactivity, the expansion of applications into more complex surgical procedures, and the increasing demand for minimally invasive restorative treatments. Strategic opportunities lie in forging deeper collaborations with healthcare providers, investing in emerging markets, and exploring novel functionalities such as drug delivery or enhanced cell scaffolding. By focusing on these areas, stakeholders can secure a significant share of the projected market growth, estimated to reach approximately $2,500 million by 2033.

High Density PTFE Membranes Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Dental Clinic

- 1.3. Others

-

2. Types

- 2.1. Non Reinforced

- 2.2. Titanium Reinforced

High Density PTFE Membranes Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Density PTFE Membranes Regional Market Share

Geographic Coverage of High Density PTFE Membranes

High Density PTFE Membranes REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Density PTFE Membranes Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Dental Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Non Reinforced

- 5.2.2. Titanium Reinforced

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Density PTFE Membranes Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Dental Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Non Reinforced

- 6.2.2. Titanium Reinforced

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High Density PTFE Membranes Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Dental Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Non Reinforced

- 7.2.2. Titanium Reinforced

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High Density PTFE Membranes Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Dental Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Non Reinforced

- 8.2.2. Titanium Reinforced

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High Density PTFE Membranes Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Dental Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Non Reinforced

- 9.2.2. Titanium Reinforced

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High Density PTFE Membranes Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Dental Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Non Reinforced

- 10.2.2. Titanium Reinforced

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Osteogenics Biomedical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zimmer Biomet

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DSI Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Botiss Biomaterials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sigma-Aldrich

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Unicare Biomedical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Osteogenics Biomedical

List of Figures

- Figure 1: Global High Density PTFE Membranes Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global High Density PTFE Membranes Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America High Density PTFE Membranes Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America High Density PTFE Membranes Volume (K), by Application 2025 & 2033

- Figure 5: North America High Density PTFE Membranes Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America High Density PTFE Membranes Volume Share (%), by Application 2025 & 2033

- Figure 7: North America High Density PTFE Membranes Revenue (undefined), by Types 2025 & 2033

- Figure 8: North America High Density PTFE Membranes Volume (K), by Types 2025 & 2033

- Figure 9: North America High Density PTFE Membranes Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America High Density PTFE Membranes Volume Share (%), by Types 2025 & 2033

- Figure 11: North America High Density PTFE Membranes Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America High Density PTFE Membranes Volume (K), by Country 2025 & 2033

- Figure 13: North America High Density PTFE Membranes Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America High Density PTFE Membranes Volume Share (%), by Country 2025 & 2033

- Figure 15: South America High Density PTFE Membranes Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America High Density PTFE Membranes Volume (K), by Application 2025 & 2033

- Figure 17: South America High Density PTFE Membranes Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America High Density PTFE Membranes Volume Share (%), by Application 2025 & 2033

- Figure 19: South America High Density PTFE Membranes Revenue (undefined), by Types 2025 & 2033

- Figure 20: South America High Density PTFE Membranes Volume (K), by Types 2025 & 2033

- Figure 21: South America High Density PTFE Membranes Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America High Density PTFE Membranes Volume Share (%), by Types 2025 & 2033

- Figure 23: South America High Density PTFE Membranes Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America High Density PTFE Membranes Volume (K), by Country 2025 & 2033

- Figure 25: South America High Density PTFE Membranes Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America High Density PTFE Membranes Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe High Density PTFE Membranes Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe High Density PTFE Membranes Volume (K), by Application 2025 & 2033

- Figure 29: Europe High Density PTFE Membranes Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe High Density PTFE Membranes Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe High Density PTFE Membranes Revenue (undefined), by Types 2025 & 2033

- Figure 32: Europe High Density PTFE Membranes Volume (K), by Types 2025 & 2033

- Figure 33: Europe High Density PTFE Membranes Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe High Density PTFE Membranes Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe High Density PTFE Membranes Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe High Density PTFE Membranes Volume (K), by Country 2025 & 2033

- Figure 37: Europe High Density PTFE Membranes Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe High Density PTFE Membranes Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa High Density PTFE Membranes Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa High Density PTFE Membranes Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa High Density PTFE Membranes Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa High Density PTFE Membranes Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa High Density PTFE Membranes Revenue (undefined), by Types 2025 & 2033

- Figure 44: Middle East & Africa High Density PTFE Membranes Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa High Density PTFE Membranes Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa High Density PTFE Membranes Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa High Density PTFE Membranes Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa High Density PTFE Membranes Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa High Density PTFE Membranes Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa High Density PTFE Membranes Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific High Density PTFE Membranes Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific High Density PTFE Membranes Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific High Density PTFE Membranes Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific High Density PTFE Membranes Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific High Density PTFE Membranes Revenue (undefined), by Types 2025 & 2033

- Figure 56: Asia Pacific High Density PTFE Membranes Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific High Density PTFE Membranes Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific High Density PTFE Membranes Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific High Density PTFE Membranes Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific High Density PTFE Membranes Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific High Density PTFE Membranes Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific High Density PTFE Membranes Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global High Density PTFE Membranes Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global High Density PTFE Membranes Volume K Forecast, by Region 2020 & 2033

- Table 3: Global High Density PTFE Membranes Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global High Density PTFE Membranes Volume K Forecast, by Application 2020 & 2033

- Table 5: Global High Density PTFE Membranes Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global High Density PTFE Membranes Volume K Forecast, by Types 2020 & 2033

- Table 7: Global High Density PTFE Membranes Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global High Density PTFE Membranes Volume K Forecast, by Region 2020 & 2033

- Table 9: Global High Density PTFE Membranes Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global High Density PTFE Membranes Volume K Forecast, by Application 2020 & 2033

- Table 11: Global High Density PTFE Membranes Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global High Density PTFE Membranes Volume K Forecast, by Types 2020 & 2033

- Table 13: Global High Density PTFE Membranes Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Global High Density PTFE Membranes Volume K Forecast, by Country 2020 & 2033

- Table 15: United States High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United States High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Canada High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Canada High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Mexico High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Mexico High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 21: Global High Density PTFE Membranes Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global High Density PTFE Membranes Volume K Forecast, by Application 2020 & 2033

- Table 23: Global High Density PTFE Membranes Revenue undefined Forecast, by Types 2020 & 2033

- Table 24: Global High Density PTFE Membranes Volume K Forecast, by Types 2020 & 2033

- Table 25: Global High Density PTFE Membranes Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: Global High Density PTFE Membranes Volume K Forecast, by Country 2020 & 2033

- Table 27: Brazil High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Brazil High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Argentina High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 33: Global High Density PTFE Membranes Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global High Density PTFE Membranes Volume K Forecast, by Application 2020 & 2033

- Table 35: Global High Density PTFE Membranes Revenue undefined Forecast, by Types 2020 & 2033

- Table 36: Global High Density PTFE Membranes Volume K Forecast, by Types 2020 & 2033

- Table 37: Global High Density PTFE Membranes Revenue undefined Forecast, by Country 2020 & 2033

- Table 38: Global High Density PTFE Membranes Volume K Forecast, by Country 2020 & 2033

- Table 39: United Kingdom High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 41: Germany High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Germany High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 43: France High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: France High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Italy High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Italy High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Spain High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Spain High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Russia High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Russia High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Benelux High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Benelux High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Nordics High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Nordics High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Rest of Europe High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Rest of Europe High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 57: Global High Density PTFE Membranes Revenue undefined Forecast, by Application 2020 & 2033

- Table 58: Global High Density PTFE Membranes Volume K Forecast, by Application 2020 & 2033

- Table 59: Global High Density PTFE Membranes Revenue undefined Forecast, by Types 2020 & 2033

- Table 60: Global High Density PTFE Membranes Volume K Forecast, by Types 2020 & 2033

- Table 61: Global High Density PTFE Membranes Revenue undefined Forecast, by Country 2020 & 2033

- Table 62: Global High Density PTFE Membranes Volume K Forecast, by Country 2020 & 2033

- Table 63: Turkey High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Turkey High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 65: Israel High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Israel High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 67: GCC High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: GCC High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 69: North Africa High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: North Africa High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 71: South Africa High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: South Africa High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East & Africa High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East & Africa High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 75: Global High Density PTFE Membranes Revenue undefined Forecast, by Application 2020 & 2033

- Table 76: Global High Density PTFE Membranes Volume K Forecast, by Application 2020 & 2033

- Table 77: Global High Density PTFE Membranes Revenue undefined Forecast, by Types 2020 & 2033

- Table 78: Global High Density PTFE Membranes Volume K Forecast, by Types 2020 & 2033

- Table 79: Global High Density PTFE Membranes Revenue undefined Forecast, by Country 2020 & 2033

- Table 80: Global High Density PTFE Membranes Volume K Forecast, by Country 2020 & 2033

- Table 81: China High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: China High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 83: India High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: India High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 85: Japan High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: Japan High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 87: South Korea High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: South Korea High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 89: ASEAN High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: ASEAN High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Oceania High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Oceania High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

- Table 93: Rest of Asia Pacific High Density PTFE Membranes Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: Rest of Asia Pacific High Density PTFE Membranes Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Density PTFE Membranes?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the High Density PTFE Membranes?

Key companies in the market include Osteogenics Biomedical, Zimmer Biomet, DSI Ltd, Botiss Biomaterials, Sigma-Aldrich, Unicare Biomedical.

3. What are the main segments of the High Density PTFE Membranes?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Density PTFE Membranes," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Density PTFE Membranes report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Density PTFE Membranes?

To stay informed about further developments, trends, and reports in the High Density PTFE Membranes, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence