Key Insights

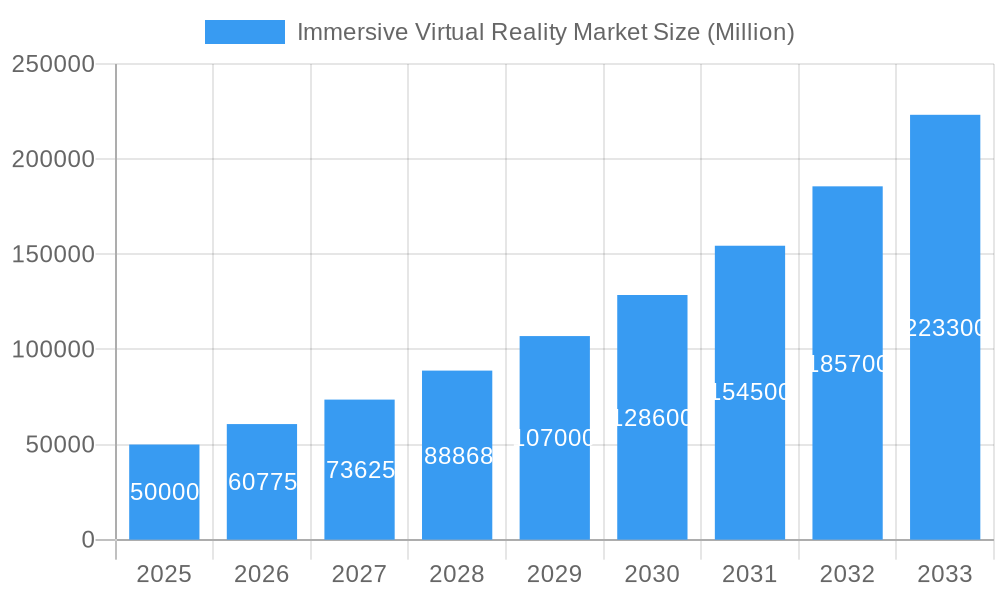

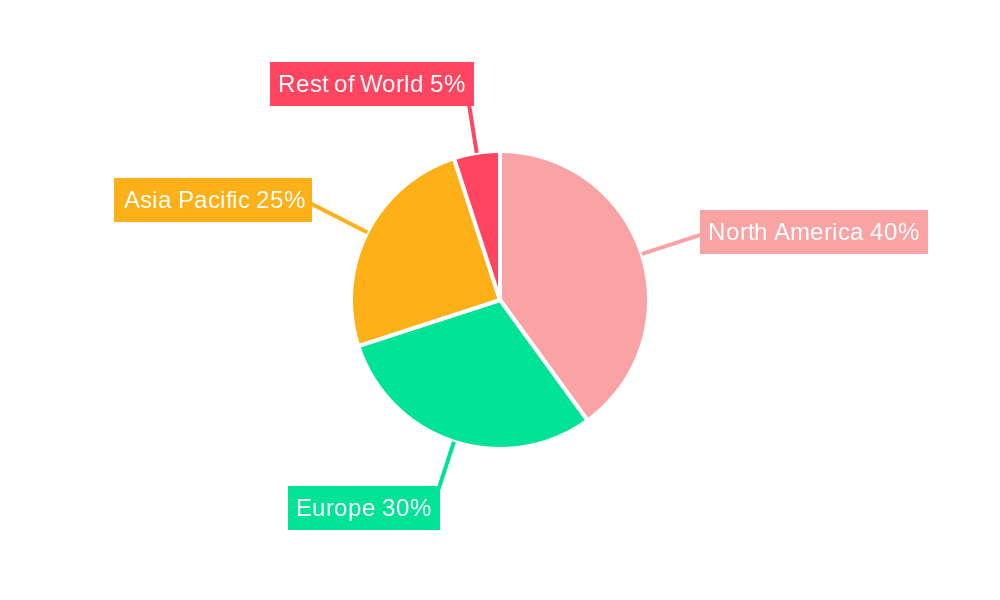

The Immersive Virtual Reality (IVR) market is poised for substantial expansion, driven by technological advancements and diverse application growth. Projections indicate a significant market size of $12.75 billion by 2033, with an impressive Compound Annual Growth Rate (CAGR) of 28.22% from the 2025 base year. This surge is attributed to the increasing affordability of VR hardware, enhanced user experiences via high-resolution displays and intuitive interfaces, and growing demand across entertainment, gaming, and training sectors. Head-mounted displays (HMDs) currently lead market segmentation, with gesture tracking devices gaining momentum for their natural interaction capabilities. Key end-user industries include entertainment & gaming, with emerging applications in education, healthcare for simulations and therapies, and aerospace & defense for training and planning. Leading players such as Oculus, Google, and Microsoft are actively innovating and strategizing to capture market share. North America leads the market, followed by Europe, with the Asia-Pacific region demonstrating considerable growth potential due to its expanding consumer base and increasing technology adoption.

Immersive Virtual Reality Market Market Size (In Billion)

Future market growth hinges on refining VR technology, addressing challenges like motion sickness and cost, and integrating with augmented reality (AR) and artificial intelligence (AI) to create more compelling immersive experiences. While content development and user accessibility remain factors, the IVR market presents a promising outlook. The forecast period of 2025-2033 anticipates continued HMD dominance alongside a notable increase in gesture-based tracking systems. All geographical regions are expected to experience growth, with the Asia-Pacific region projected for rapid expansion, fueled by rising disposable incomes and the popularity of gaming and entertainment. This robust growth trajectory positions the IVR market as highly attractive for investors and technology developers.

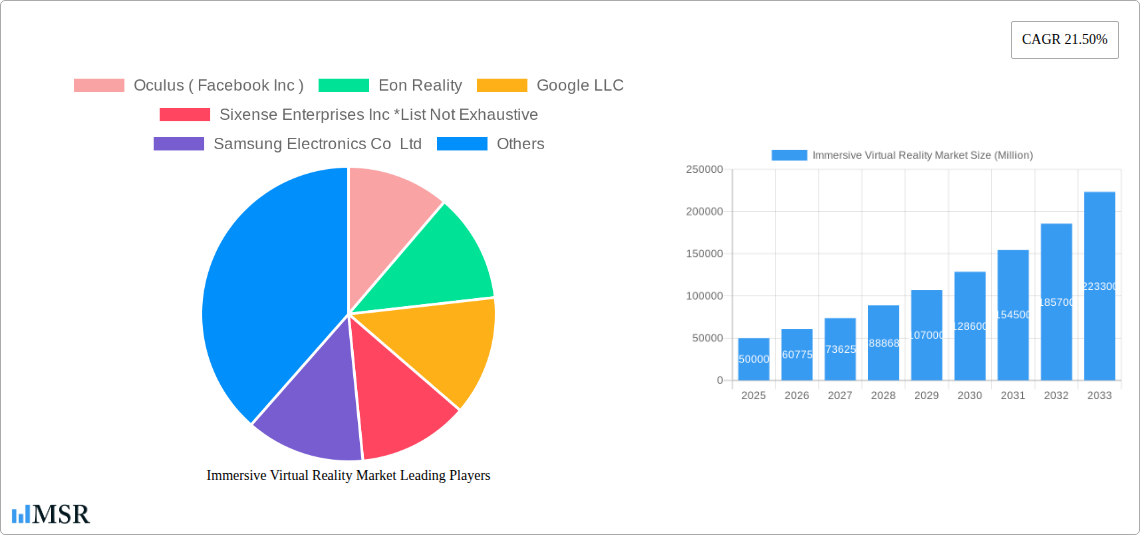

Immersive Virtual Reality Market Company Market Share

Immersive Virtual Reality Market Report: 2019-2033

Dive into this comprehensive analysis of the Immersive Virtual Reality (VR) market, projecting a future brimming with innovation and growth. This report provides a detailed examination of market dynamics, key segments, leading players, and emerging opportunities, offering invaluable insights for stakeholders across the industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. The market's size in 2025 is estimated at xx Million, exhibiting a CAGR of xx% during the forecast period.

Immersive Virtual Reality Market Concentration & Dynamics

The Immersive Virtual Reality market is characterized by a moderately concentrated landscape, with key players like Oculus (Facebook Inc), Eon Reality, Google LLC, and Microsoft Corporation holding significant market share. However, the market also displays a vibrant ecosystem of smaller, innovative companies driving technological advancements. The market share distribution in 2025 is estimated as follows: Oculus (xx%), Google (xx%), Samsung (xx%), and others (xx%). The regulatory landscape varies across different geographies, influencing adoption rates and product development strategies. Substitute products, such as augmented reality (AR) technologies, present competitive challenges. End-user trends lean towards more immersive and interactive experiences, fueled by advancements in haptic feedback and higher fidelity visuals. M&A activity in the period 2019-2024 resulted in approximately xx deals, primarily focused on strengthening technological capabilities and expanding market reach. Further consolidation is anticipated in the forecast period.

- Market Share: Oculus (xx%), Google (xx%), Samsung (xx%), Others (xx%) (2025 estimates)

- M&A Deal Count (2019-2024): xx

- Key Innovation Areas: Haptic feedback, higher resolution displays, improved processing power

Immersive Virtual Reality Market Industry Insights & Trends

The global Immersive Virtual Reality market is experiencing robust growth, driven by several key factors. The increasing affordability of VR headsets, coupled with enhanced processing power and improved visuals, is making VR technology more accessible to a wider consumer base. Technological advancements in areas like eye-tracking, gesture recognition, and haptic feedback are enriching the user experience, leading to heightened adoption across diverse sectors. The gaming industry remains a major driver, with continued releases of immersive titles and the rise of e-sports. However, other sectors, such as healthcare (surgical simulations, therapeutic applications), education (virtual field trips, interactive learning), and aerospace & defense (training simulations), are witnessing increasing VR adoption. Consumer behavior is shifting towards seeking more interactive and engaging entertainment experiences, leading to rising demand for VR-based content and applications. This strong market growth is expected to continue throughout the forecast period, with estimated market size reaching xx Million by 2033.

Key Markets & Segments Leading Immersive Virtual Reality Market

The North American market currently holds a dominant position in the global Immersive Virtual Reality market, driven by strong technological innovation, high consumer spending, and a robust gaming industry. However, significant growth is anticipated in the Asia-Pacific region, particularly in China and Japan, fueled by expanding digital infrastructure, rising disposable incomes, and government support for technological advancements.

Dominant Segments:

- By Device: Head Mounted Displays (HMDs) currently dominate the market due to their widespread adoption and mature technological base. However, Gesture Tracking Devices are showing promising growth due to their increasing integration with HMDs.

- By End-user Industry: Entertainment & Gaming currently holds the largest market share, followed by Healthcare and Education. Aerospace & Defense is poised for significant growth due to the rising demand for training and simulation applications.

Drivers by Segment:

- Entertainment & Gaming: High consumer spending on gaming, rising popularity of esports, and increasing availability of high-quality VR games.

- Healthcare: Demand for improved surgical training and therapy solutions, rising healthcare spending, and advancements in VR-based medical applications.

- Education: Demand for enhanced learning experiences, increasing adoption of technology in education, and government initiatives promoting educational technology.

- Aerospace & Defense: Demand for improved training simulations, increasing defense budgets, and growing adoption of VR for pilot training and mission rehearsal.

Immersive Virtual Reality Market Product Developments

Recent product innovations focus on enhancing user experience through improved ergonomics, higher resolution displays, and advanced haptic feedback. The integration of artificial intelligence (AI) and machine learning (ML) is further driving the development of more immersive and interactive VR applications, allowing for greater personalization and adaptive experiences. Companies are differentiating themselves through unique software ecosystems, proprietary hardware designs, and strategic partnerships.

Challenges in the Immersive Virtual Reality Market Market

The Immersive Virtual Reality market faces challenges such as the high initial cost of VR headsets, limitations in processing power leading to motion sickness in some users, and concerns regarding data privacy and cybersecurity. Supply chain disruptions, especially in the production of essential components like microchips, have also impacted manufacturing and delivery timelines, leading to limited availability and price volatility. Furthermore, intense competition among major players and the emergence of new entrants create pricing pressures.

Forces Driving Immersive Virtual Reality Market Growth

Technological advancements like improvements in display resolution, processing power, and haptic feedback are fueling market growth. Economic factors such as increasing disposable incomes and rising consumer spending on entertainment contribute significantly to market expansion. Regulatory support for technological innovation and government funding for research and development are also creating a favorable environment. Finally, the development of new applications across diverse industries is driving adoption.

Long-Term Growth Catalysts in Immersive Virtual Reality Market

Long-term growth will be driven by ongoing technological innovations, including improvements in display resolution, haptic feedback, and processing power. Strategic partnerships between hardware and software providers will enhance the development and distribution of high-quality VR content. Expansion into new markets such as enterprise applications and the metaverse will also contribute substantially to future market growth.

Emerging Opportunities in Immersive Virtual Reality Market

Emerging trends indicate significant growth opportunities in areas such as enterprise training, healthcare applications, and the metaverse. The integration of VR with other technologies such as AR and AI is also creating new opportunities for innovative products and services. The increasing demand for immersive and interactive experiences across various sectors suggests a vast untapped market potential.

Leading Players in the Immersive Virtual Reality Market Sector

- Oculus (Facebook Inc)

- Eon Reality

- Google LLC

- Sixense Enterprises Inc

- Samsung Electronics Co Ltd

- Magic Leap

- Microsoft Corporation

- Carl Zeiss AG

- Avegant Corporation

- Leap Motion (Ultrahaptics)

- Archos

- CyberGlove Systems

- Panasonic Corporation

- HTC Corporation

- Sony Corporation

Key Milestones in Immersive Virtual Reality Market Industry

- August 2022: Launch of "Artemis Ascending," an Oculus Quest VR experience providing an immersive view of the Artemis 1 moon mission launch. This enhanced the appeal of VR for educational and experiential purposes.

- October 2022: PokerStars VR announced as a launch title for Meta's Quest Pro, showcasing the potential of mixed reality gaming and highlighting the adaptability of VR technology to suit diverse player preferences.

Strategic Outlook for Immersive Virtual Reality Market Market

The Immersive Virtual Reality market holds immense potential for future growth. Strategic opportunities lie in focusing on innovation, partnerships, and expansion into new markets. Companies that can effectively leverage technological advancements, develop high-quality content, and build strong ecosystems will be best positioned to capitalize on the market's potential and lead the industry in the coming years.

Immersive Virtual Reality Market Segmentation

-

1. Device

- 1.1. Gesture Tracking Devices

- 1.2. Head Mounted Displays

-

2. End-user Industry

- 2.1. Entertainment & Gaming

- 2.2. Aerospace & Defense

- 2.3. Healthcare

- 2.4. Education

- 2.5. Other End-user Industries

Immersive Virtual Reality Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Immersive Virtual Reality Market Regional Market Share

Geographic Coverage of Immersive Virtual Reality Market

Immersive Virtual Reality Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 28.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Virtual Reality in Aerospace & Defense for Training and Simulation; Penetration of HMDs in Gaming and Entertainment Sector

- 3.3. Market Restrains

- 3.3.1. High Product Cost

- 3.4. Market Trends

- 3.4.1. Head Mounted Displays is Expected to Have Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Immersive Virtual Reality Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Gesture Tracking Devices

- 5.1.2. Head Mounted Displays

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Entertainment & Gaming

- 5.2.2. Aerospace & Defense

- 5.2.3. Healthcare

- 5.2.4. Education

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Immersive Virtual Reality Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Gesture Tracking Devices

- 6.1.2. Head Mounted Displays

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Entertainment & Gaming

- 6.2.2. Aerospace & Defense

- 6.2.3. Healthcare

- 6.2.4. Education

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Europe Immersive Virtual Reality Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Gesture Tracking Devices

- 7.1.2. Head Mounted Displays

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Entertainment & Gaming

- 7.2.2. Aerospace & Defense

- 7.2.3. Healthcare

- 7.2.4. Education

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Asia Pacific Immersive Virtual Reality Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Gesture Tracking Devices

- 8.1.2. Head Mounted Displays

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Entertainment & Gaming

- 8.2.2. Aerospace & Defense

- 8.2.3. Healthcare

- 8.2.4. Education

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Rest of World Immersive Virtual Reality Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Gesture Tracking Devices

- 9.1.2. Head Mounted Displays

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Entertainment & Gaming

- 9.2.2. Aerospace & Defense

- 9.2.3. Healthcare

- 9.2.4. Education

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Oculus ( Facebook Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eon Reality

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Google LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Sixense Enterprises Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Samsung Electronics Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Magic Leap

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Microsoft Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Carl Zeiss AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Avegant Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Leap Motion (Ultrahaptics)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Archos

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 CyberGlove Systems

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Panasonic Corporation

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 HTC Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Sony Corporation

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Oculus ( Facebook Inc )

List of Figures

- Figure 1: Global Immersive Virtual Reality Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Immersive Virtual Reality Market Revenue (billion), by Device 2025 & 2033

- Figure 3: North America Immersive Virtual Reality Market Revenue Share (%), by Device 2025 & 2033

- Figure 4: North America Immersive Virtual Reality Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America Immersive Virtual Reality Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Immersive Virtual Reality Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Immersive Virtual Reality Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Immersive Virtual Reality Market Revenue (billion), by Device 2025 & 2033

- Figure 9: Europe Immersive Virtual Reality Market Revenue Share (%), by Device 2025 & 2033

- Figure 10: Europe Immersive Virtual Reality Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe Immersive Virtual Reality Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Immersive Virtual Reality Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Immersive Virtual Reality Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Immersive Virtual Reality Market Revenue (billion), by Device 2025 & 2033

- Figure 15: Asia Pacific Immersive Virtual Reality Market Revenue Share (%), by Device 2025 & 2033

- Figure 16: Asia Pacific Immersive Virtual Reality Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Immersive Virtual Reality Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Immersive Virtual Reality Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Immersive Virtual Reality Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Immersive Virtual Reality Market Revenue (billion), by Device 2025 & 2033

- Figure 21: Rest of World Immersive Virtual Reality Market Revenue Share (%), by Device 2025 & 2033

- Figure 22: Rest of World Immersive Virtual Reality Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Rest of World Immersive Virtual Reality Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of World Immersive Virtual Reality Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of World Immersive Virtual Reality Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Immersive Virtual Reality Market Revenue billion Forecast, by Device 2020 & 2033

- Table 2: Global Immersive Virtual Reality Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Immersive Virtual Reality Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Immersive Virtual Reality Market Revenue billion Forecast, by Device 2020 & 2033

- Table 5: Global Immersive Virtual Reality Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Immersive Virtual Reality Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Immersive Virtual Reality Market Revenue billion Forecast, by Device 2020 & 2033

- Table 8: Global Immersive Virtual Reality Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Immersive Virtual Reality Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Immersive Virtual Reality Market Revenue billion Forecast, by Device 2020 & 2033

- Table 11: Global Immersive Virtual Reality Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Immersive Virtual Reality Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Immersive Virtual Reality Market Revenue billion Forecast, by Device 2020 & 2033

- Table 14: Global Immersive Virtual Reality Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Immersive Virtual Reality Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Immersive Virtual Reality Market?

The projected CAGR is approximately 28.22%.

2. Which companies are prominent players in the Immersive Virtual Reality Market?

Key companies in the market include Oculus ( Facebook Inc ), Eon Reality, Google LLC, Sixense Enterprises Inc *List Not Exhaustive, Samsung Electronics Co Ltd, Magic Leap, Microsoft Corporation, Carl Zeiss AG, Avegant Corporation, Leap Motion (Ultrahaptics), Archos, CyberGlove Systems, Panasonic Corporation, HTC Corporation, Sony Corporation.

3. What are the main segments of the Immersive Virtual Reality Market?

The market segments include Device, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.75 billion as of 2022.

5. What are some drivers contributing to market growth?

Use of Virtual Reality in Aerospace & Defense for Training and Simulation; Penetration of HMDs in Gaming and Entertainment Sector.

6. What are the notable trends driving market growth?

Head Mounted Displays is Expected to Have Significant Share.

7. Are there any restraints impacting market growth?

High Product Cost.

8. Can you provide examples of recent developments in the market?

October 2022: PokerStars VR, part of Flutter Entertainment, has announced that it will be a launch title for Meta's Quest Pro mixed reality headset. Players using Quest Pro would be able to adapt their surroundings to suit their playing habits. It would offer options including a fully immersive virtual reality experience and a partial immersion that brings objects or spaces from their physical world into the game through editable "passthrough windows."

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Immersive Virtual Reality Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Immersive Virtual Reality Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Immersive Virtual Reality Market?

To stay informed about further developments, trends, and reports in the Immersive Virtual Reality Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence