Key Insights

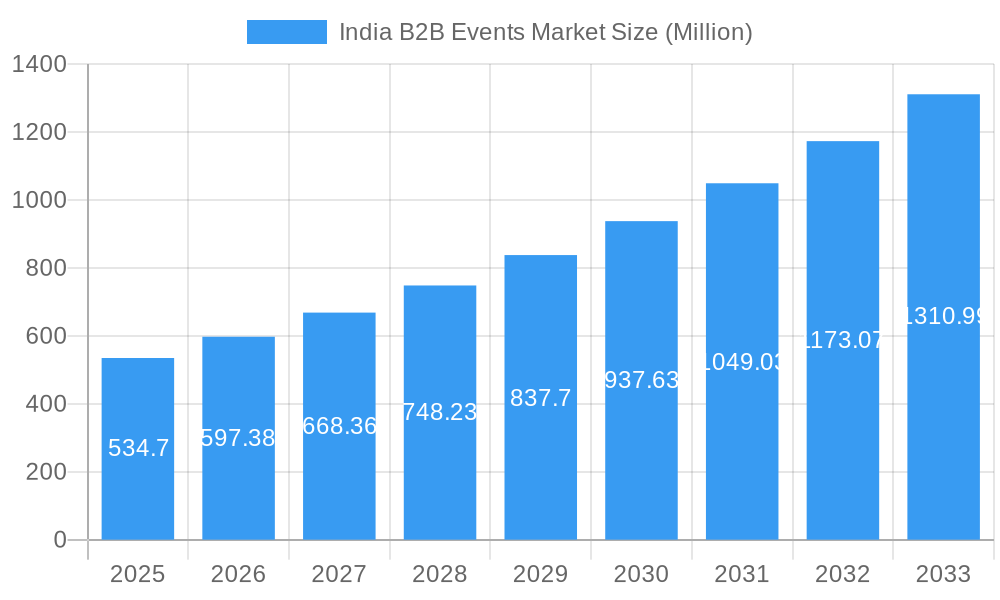

The India B2B events market, valued at ₹534.70 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.72% from 2025 to 2033. This surge is driven by several key factors. Firstly, the increasing adoption of both physical and virtual event formats caters to diverse business needs and preferences. The shift towards digital platforms enhances accessibility and cost-effectiveness, attracting a wider range of participants. Secondly, various end-user verticals, including BFSI (Banking, Financial Services, and Insurance), FMCG (Fast-Moving Consumer Goods), and the burgeoning healthcare sector, are actively leveraging B2B events for networking, lead generation, and brand building. Furthermore, strategic government initiatives promoting business growth and infrastructure development are indirectly fueling the demand for such events. The market's segmentation across platforms (physical and virtual) and end-user verticals provides ample opportunities for specialized event organizers. However, challenges remain, such as the need for robust digital infrastructure in certain regions and maintaining consistency in engagement levels across different event formats.

India B2B Events Market Market Size (In Million)

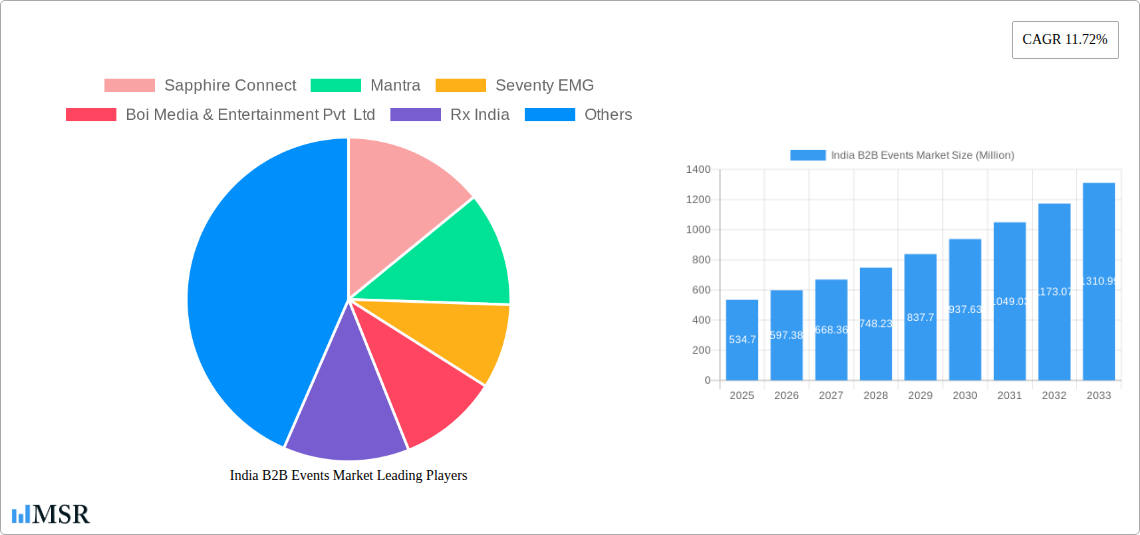

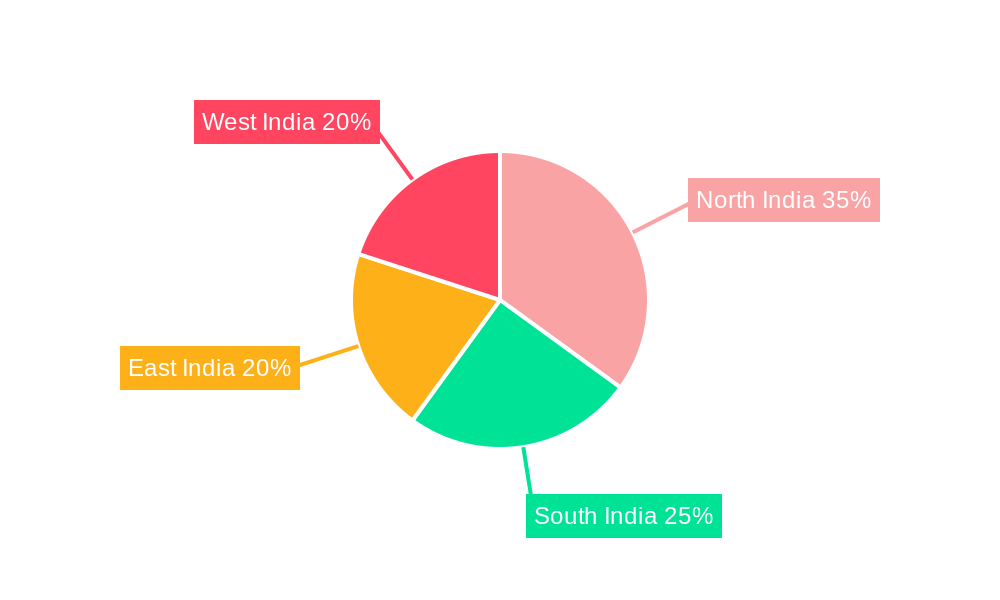

The regional distribution of the market reveals varied growth patterns. While data specifics are unavailable, it's reasonable to expect that more developed regions like North and West India currently hold larger market shares, due to higher concentrations of businesses and established infrastructure. However, the growth potential in regions like East and South India is significant, given their expanding economies and increasing business activity. The presence of established players like Sapphire Connect, Mantra, and Wizcraft, alongside numerous smaller specialized agencies, indicates a competitive yet dynamic market landscape. This competitive environment fosters innovation and the development of unique event offerings, further enhancing market attractiveness and growth trajectory. The forecast period of 2025-2033 presents significant opportunities for both established players and new entrants to capitalize on the burgeoning demand for B2B events in India.

India B2B Events Market Company Market Share

India B2B Events Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning India B2B Events Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The report leverages data from the historical period (2019-2024) to predict future trends accurately. Market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%.

India B2B Events Market Market Concentration & Dynamics

The Indian B2B events market exhibits a moderately concentrated landscape, with a few large players like Wizcraft Entertainment Agency Pvt Lt and Laqshya Group (Event Capital) holding significant market share (estimated at xx% and xx% respectively in 2025). However, the presence of numerous smaller and specialized event management companies fosters competition. The market is characterized by a dynamic innovation ecosystem, with ongoing technological advancements driving the adoption of virtual and hybrid event formats. Regulatory frameworks, while generally supportive, present some challenges regarding licensing and permits. Substitute products, primarily digital marketing and online webinars, are impacting market growth but have not significantly reduced demand for physical events. End-user trends reveal a growing preference for engaging and immersive experiences, leading to the rise of experiential marketing. Mergers and acquisitions (M&A) activity has been moderate in recent years, with approximately xx M&A deals recorded between 2019 and 2024.

- Market Share (2025 Estimates):

- Wizcraft Entertainment Agency Pvt Lt: xx%

- Laqshya Group (Event Capital): xx%

- Other Major Players: xx%

- Fragmented Market: xx%

- M&A Activity (2019-2024): xx deals

India B2B Events Market Industry Insights & Trends

The Indian B2B events market is experiencing robust growth, driven primarily by the country's expanding economy, increasing business activity across various sectors, and a growing preference for face-to-face networking. The market size in 2025 is estimated at xx Million, demonstrating substantial growth from xx Million in 2019. Technological disruptions, including the rise of virtual and hybrid event platforms, are reshaping the industry, creating both challenges and opportunities. Evolving consumer behaviors, particularly a demand for more personalized and engaging experiences, are further shaping market trends. The adoption of advanced technologies, such as AI-powered event management tools and virtual reality (VR) solutions, enhances event efficiency and attendee engagement.

Key Markets & Segments Leading India B2B Events Market

The Indian B2B events market is diverse and fragmented, with significant growth opportunities across various segments and regions.

- By Platform: Physical events continue to dominate, although virtual and hybrid events are gaining traction. The preference for physical events stems from the inherent networking opportunities and face-to-face interactions they offer. Growth drivers for physical events include increasing disposable income and improved infrastructure.

- By End-user Verticals: The Food and Beverage, BFSI (Banking, Financial Services, and Insurance), and FMCG (Fast-Moving Consumer Goods) sectors are key drivers of market growth. The PSU sector also displays a notable market share.

- By Region: The North and West regions, fueled by concentrated business activity and robust infrastructure, lead in market share. However, other regions such as South India show potential for accelerated growth, with increasing infrastructure investments and business development.

Drivers for Key Segments:

- Food and Beverage: Government initiatives promoting food processing and increasing foreign investment are key drivers. The mega B2B food event in Delhi in November 2023, which had 1208 exhibitors and attracted 715 foreign buyers, exemplifies the substantial growth potential of this vertical.

- BFSI: The rapidly growing financial sector in India fuels demand for B2B events for networking and knowledge sharing.

- FMCG: The expansion of FMCG companies and the growing adoption of marketing and distribution events drives the demand for B2B events.

- North Region: Established business hubs and strong infrastructure contribute to higher market activity.

- West Region: The presence of key industrial centers and a concentration of businesses contributes to higher market activity.

India B2B Events Market Product Developments

Recent product innovations have focused on enhancing the attendee experience through technology integration. This includes the use of mobile apps for event navigation, scheduling, and networking; virtual reality (VR) and augmented reality (AR) experiences to enhance engagement; and data analytics to personalize the event experience. These innovations provide competitive advantages by offering more efficient, engaging, and data-driven event solutions.

Challenges in the India B2B Events Market Market

The Indian B2B events market faces challenges such as obtaining necessary permits and licenses, navigating complex regulatory frameworks, and managing potential supply chain disruptions, particularly regarding venue availability and logistics. Intense competition and the increasing popularity of digital marketing alternatives also pose a challenge, impacting the market growth by an estimated xx% annually.

Forces Driving India B2B Events Market Growth

Several factors propel the growth of the Indian B2B events market. These include the burgeoning economy, increased business activity across numerous sectors, government initiatives to promote business events and tourism, and the rising adoption of technologically advanced event solutions. The continuous expansion of infrastructure in key cities also fuels growth.

Challenges in the India B2B Events Market Market

Long-term growth will hinge on continuous innovation in event formats and technologies. Strategic partnerships between event organizers and technology providers will be crucial. Expanding into newer regions and tapping into underserved market segments will contribute to long-term sustainability and growth.

Emerging Opportunities in India B2B Events Market

Emerging opportunities include the increasing adoption of hybrid and virtual event formats, the growth of niche B2B events catering to specific industry sectors, and the increasing demand for experiential marketing and immersive event experiences. The integration of AI and data analytics to optimize event planning and attendee engagement presents a significant opportunity.

Leading Players in the India B2B Events Market Sector

- Sapphire Connect

- Mantra

- Seventy EMG

- Boi Media & Entertainment Pvt Ltd

- Rx India

- TechnologyCounter

- CAB

- Hexagon Events Private Limited

- Wizcraft Entertainment Agency Pvt Lt

- Neoniche Integrated Solutions Pvt Ltd

- Craftworld Events Management Company

- Seventy Seven Entertainment Pvt Ltd

- Experiential Marketing Solutions Pvt Ltd (Collective Heads)

- Toast

- Blackboard Communications

- Laqshya Group (Event Capital)

- XP&D (XP and Land)

Key Milestones in India B2B Events Market Industry

- March 2024: Bharat Tex 2024, a massive textile industry event in New Delhi, showcased India's capabilities with 3,500 exhibitors and 100,000 visitors. This event highlighted the potential of large-scale B2B events in driving economic activity.

- November 2023: A mega B2B food event in Delhi, with 1208 exhibitors, 14 country pavilions, and significant international participation, underscored the growing interest in India's food processing sector and its potential to attract global investment. This event demonstrated the effectiveness of large-scale events in promoting international collaboration and business development within the food sector.

Strategic Outlook for India B2B Events Market Market

The Indian B2B events market holds immense future potential, driven by sustained economic growth, increased business activity, and technological advancements. Strategic opportunities lie in developing innovative event formats, leveraging technology for enhanced engagement, and fostering strong partnerships to expand market reach and cater to the evolving needs of businesses across various sectors. Focus on experiential marketing and data-driven event management will be vital for success.

India B2B Events Market Segmentation

-

1. Platform

- 1.1. Physical Events

- 1.2. Virtual Events

-

2. End-user Verticals

- 2.1. Food and Beverage

- 2.2. PSU

- 2.3. Luxury

- 2.4. BFSI

- 2.5. FMCG

- 2.6. Retail

- 2.7. Healthcare

- 2.8. Automotive

- 2.9. Other End-user Verticals

India B2B Events Market Segmentation By Geography

- 1. India

India B2B Events Market Regional Market Share

Geographic Coverage of India B2B Events Market

India B2B Events Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Government Organizations About New Technologies

- 3.4. Market Trends

- 3.4.1. Retail Sector to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India B2B Events Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Physical Events

- 5.1.2. Virtual Events

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Food and Beverage

- 5.2.2. PSU

- 5.2.3. Luxury

- 5.2.4. BFSI

- 5.2.5. FMCG

- 5.2.6. Retail

- 5.2.7. Healthcare

- 5.2.8. Automotive

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sapphire Connect

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mantra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Seventy EMG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Boi Media & Entertainment Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rx India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TechnologyCounter

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CAB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexagon Events Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wizcraft Entertainment Agency Pvt Lt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Neoniche Integrated Solutions Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CraftworldEvents Management Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seventy Seven Entertainment Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Experential Marketing Solutions Pvt Ltd (Collective Heads)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Toast

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Blackboard Communications

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Laqshya Group(Event Capital)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 XP&D (XP and Land)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Sapphire Connect

List of Figures

- Figure 1: India B2B Events Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India B2B Events Market Share (%) by Company 2025

List of Tables

- Table 1: India B2B Events Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 3: India B2B Events Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India B2B Events Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: India B2B Events Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India B2B Events Market?

The projected CAGR is approximately 11.72%.

2. Which companies are prominent players in the India B2B Events Market?

Key companies in the market include Sapphire Connect, Mantra, Seventy EMG, Boi Media & Entertainment Pvt Ltd, Rx India, TechnologyCounter, CAB, Hexagon Events Private Limited, Wizcraft Entertainment Agency Pvt Lt, Neoniche Integrated Solutions Pvt Ltd, CraftworldEvents Management Company, Seventy Seven Entertainment Pvt Ltd, Experential Marketing Solutions Pvt Ltd (Collective Heads), Toast, Blackboard Communications, Laqshya Group(Event Capital), XP&D (XP and Land).

3. What are the main segments of the India B2B Events Market?

The market segments include Platform, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers.

6. What are the notable trends driving market growth?

Retail Sector to be the Largest End User.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Government Organizations About New Technologies.

8. Can you provide examples of recent developments in the market?

In March 2024, by bringing together 3,500 exhibitors from across the entire value chain under one roof for the first time, the theme of Bharat Tex 2024 emphasized India’s capability to provide end-to-end textile solutions. Spread across nearly two million square feet and attracting 100,000 visitors, this huge event, staged in New Delhi, was organized by a consortium of 11 textile export promotion councils and sponsored by the country’s Ministry of Textile.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India B2B Events Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India B2B Events Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India B2B Events Market?

To stay informed about further developments, trends, and reports in the India B2B Events Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence