Key Insights

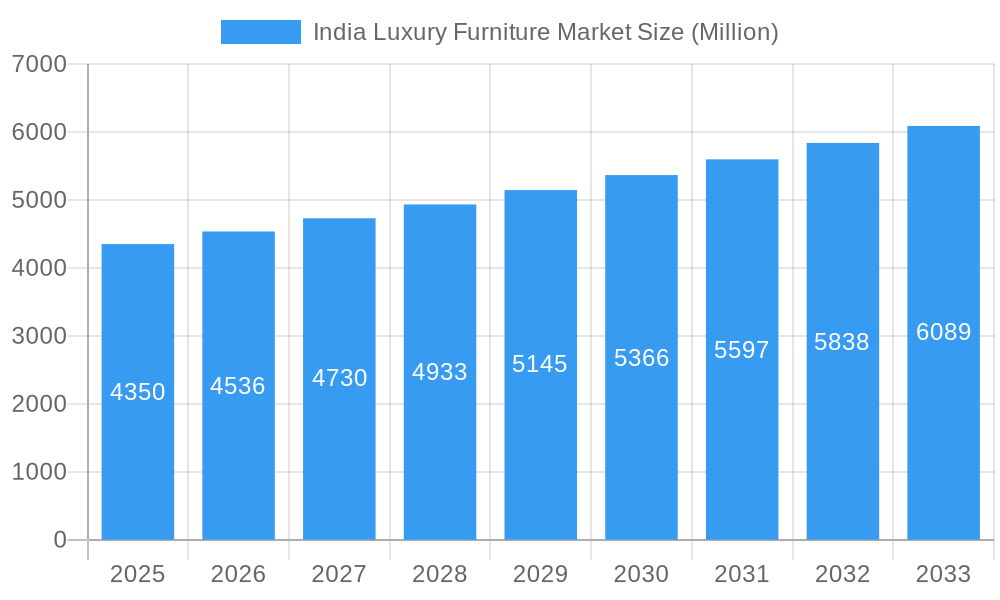

The India luxury furniture market, valued at $4.35 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.24% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes among India's burgeoning affluent class fuel demand for high-end furniture, reflecting a shift towards aspirational lifestyles and a preference for premium quality and design. The increasing popularity of minimalist and contemporary aesthetics, coupled with a growing awareness of sustainable and eco-friendly materials, further shapes consumer preferences within this segment. Furthermore, the expansion of online retail channels provides convenient access to luxury furniture, enhancing market reach and driving sales. Key players like Acme Industries, Ashley Furniture Industries Inc., Godrej and Boyce, and IKEA are strategically capitalizing on these trends, investing in product diversification, innovative designs, and enhanced customer experiences. Competition is intensifying, prompting brands to differentiate through superior craftsmanship, personalized services, and unique design collaborations.

India Luxury Furniture Market Market Size (In Billion)

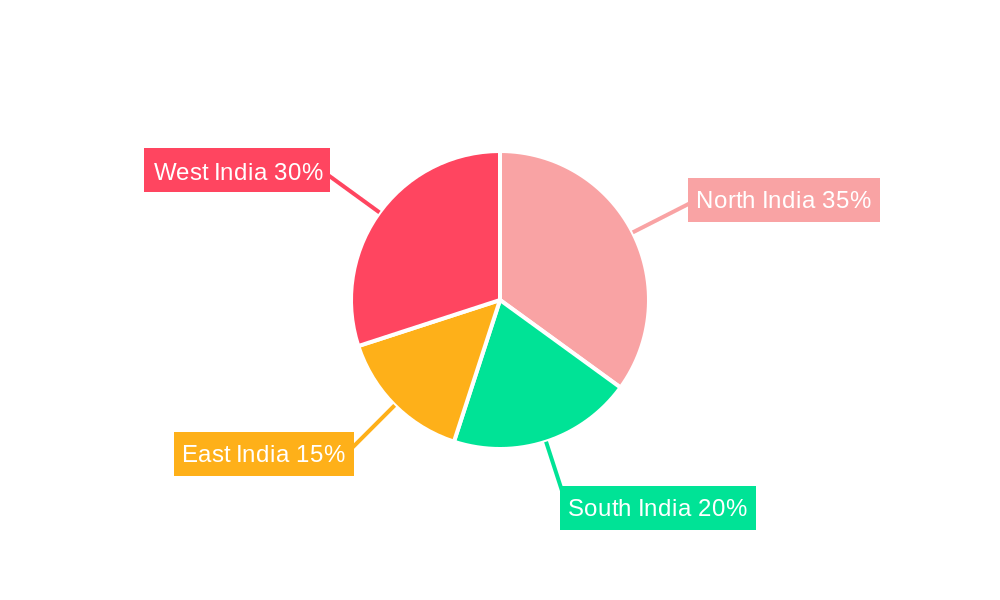

The market is segmented by product type (lighting, tables, chairs and sofas, accessories, bedroom sets, cabinets, and others), end-user (residential and commercial), and distribution channel (home centers, flagship stores, specialty stores, online, and others). While the residential sector currently dominates, the commercial segment, encompassing luxury hotels, restaurants, and offices, shows significant growth potential. Regional variations exist, with North and West India currently leading in terms of market share due to higher concentrations of affluent populations and established retail infrastructure. However, growth in South and East India is anticipated as economic development continues and purchasing power increases in these regions. Challenges include fluctuating raw material costs, supply chain complexities, and the need for skilled labor to maintain high-quality production standards. Nonetheless, the long-term outlook for the India luxury furniture market remains exceptionally positive, driven by sustained economic growth and evolving consumer preferences.

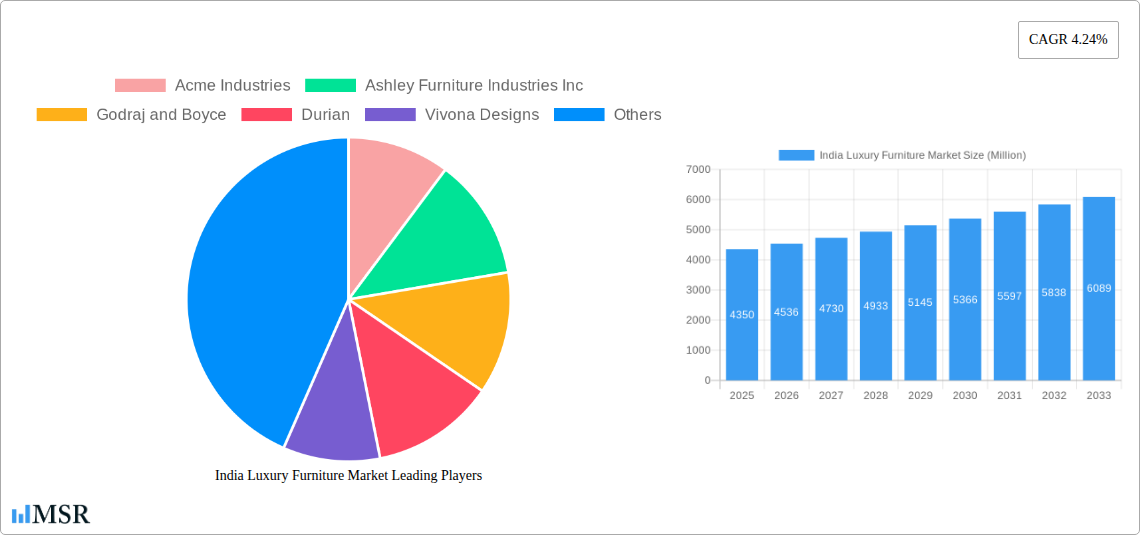

India Luxury Furniture Market Company Market Share

India Luxury Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India luxury furniture market, covering market size, growth drivers, key segments, leading players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report is crucial for industry stakeholders, investors, and businesses looking to capitalize on the burgeoning opportunities within this dynamic market. Expect detailed insights into market dynamics, segment-wise performance, competitive landscape, and future growth projections. The market is projected to reach XX Million by 2033.

India Luxury Furniture Market Market Concentration & Dynamics

The Indian luxury furniture market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Acme Industries, Ashley Furniture Industries Inc, Godrej and Boyce, Durian, and Vivona Designs are among the prominent brands. However, the market also features numerous smaller, niche players, catering to specific design aesthetics and consumer preferences. The market’s dynamics are significantly shaped by several factors:

- Market Share: The top 5 players collectively hold an estimated 40% market share, indicating opportunities for both established players and new entrants.

- Innovation Ecosystems: The market is witnessing an increase in design innovation, fueled by collaborations between established brands and emerging designers. This is reflected in the introduction of sustainable and technologically advanced furniture pieces.

- Regulatory Frameworks: Government policies on import duties and environmental regulations impact material sourcing and pricing strategies of the luxury furniture sector.

- Substitute Products: While genuine luxury furniture retains its appeal, the market faces competition from cheaper alternatives and imitation products.

- End-User Trends: The increasing disposable incomes and changing lifestyles of the affluent Indian population drive demand for luxury furniture.

- M&A Activities: The number of mergers and acquisitions in the sector has seen a moderate increase in recent years, with an estimated xx M&A deals recorded between 2020 and 2024. This consolidates market share and expands product portfolios.

India Luxury Furniture Market Industry Insights & Trends

The India luxury furniture market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for premium home furnishings. The market size was valued at approximately xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Several key trends are shaping the market:

- Market Growth Drivers: Rapid economic growth, increasing urbanization, rising disposable incomes amongst the affluent class, and a burgeoning middle class with aspirations for a luxurious lifestyle are propelling market expansion. The demand for customized, bespoke furniture is also growing steadily.

- Technological Disruptions: The adoption of technology in design, manufacturing, and retail is transforming the industry. 3D printing, virtual reality, and online design tools are enhancing customer experience and enabling personalized solutions.

- Evolving Consumer Behaviors: Consumers are increasingly conscious of sustainability, ethical sourcing, and the use of eco-friendly materials in their furniture choices. Demand for bespoke, customized pieces, reflecting individual tastes and styles, is rising.

Key Markets & Segments Leading India Luxury Furniture Market

The residential segment dominates the India luxury furniture market, driven by a growing preference for high-quality, aesthetically pleasing furniture in homes. However, the commercial sector is also showing strong growth, as businesses increasingly invest in premium furniture to enhance their brand image and create luxurious environments.

Dominant Segments:

- Product Type: Chairs and sofas, followed by bedroom sets and cabinets, hold the largest market share. The demand for lighting and accessories is also increasing steadily.

- End-User: Residential constitutes the dominant segment, followed by commercial establishments (hotels, offices, restaurants).

- Distribution Channel: Flagship stores and specialty stores account for a significant portion of sales, but online channels are experiencing a surge in popularity, driven by enhanced online retail infrastructure and consumer familiarity.

Growth Drivers by Segment:

- Residential: Rising disposable incomes, aspirational lifestyles, and increased urbanization.

- Commercial: Growth in the hospitality, corporate, and retail sectors.

- Online: Increased internet penetration, improved logistics, and enhanced online shopping experiences.

- Flagship Stores: Brand building, enhanced customer experience, and showcasing premium collections.

India Luxury Furniture Market Product Developments

Recent product innovations in the Indian luxury furniture market highlight the focus on sustainable materials, smart furniture incorporating technology, and unique designs catering to modern aesthetics. Companies are investing in research and development to create innovative pieces, using premium materials such as reclaimed wood and high-quality leather. This focus on craftsmanship and quality is a key factor driving market expansion.

Challenges in the India Luxury Furniture Market Market

Several challenges hamper the growth of the India luxury furniture market, including:

- High import duties: Increasing import costs negatively impact the profitability of imported luxury furniture, leading to higher retail prices.

- Supply chain disruptions: Fluctuations in raw material prices and logistical challenges can affect production and delivery schedules.

- Intense competition: The presence of both domestic and international brands creates an intensely competitive landscape. This competition can put downward pressure on pricing and profit margins. This results in a xx% reduction in profit for some players in 2024.

Forces Driving India Luxury Furniture Market Growth

Several factors contribute to the growth of the India luxury furniture market:

- Rising disposable incomes: The expanding affluent population creates strong demand for high-end furniture.

- Urbanization and housing boom: The increasing number of high-rise apartments and luxury homes boosts demand for premium furniture.

- Government initiatives: Policies that promote the growth of the manufacturing sector and attract foreign investments benefit the industry.

Challenges in the India Luxury Furniture Market Market

Long-term growth hinges on overcoming challenges such as ensuring a consistent supply chain, embracing sustainable practices, and adapting to changing consumer preferences. Strategic partnerships and investments in technology will be crucial for maintaining competitiveness and achieving sustainable growth.

Emerging Opportunities in India Luxury Furniture Market

Emerging opportunities lie in tapping into the growing demand for customized and sustainable furniture, leveraging technology for design and sales, and expanding into untapped regional markets. The market shows potential in personalized design options and augmented reality showrooms.

Leading Players in the India Luxury Furniture Market Sector

- Acme Industries (If applicable, replace with correct link)

- Ashley Furniture Industries Inc

- Godrej and Boyce

- Durian

- Vivona Designs

- Natuzzi

- Mobel Grace

- IKEA

- Molteni&C

- Damro

Key Milestones in India Luxury Furniture Market Industry

- January 2023: Durian launched its new Skyler sofa range, expanding its offerings in the luxury segment.

- March 2023: IKEA introduced its GOKVÄLLÅ collection, focusing on accessories to enhance home décor and aligning with the growing demand for stylish home accents.

Strategic Outlook for India Luxury Furniture Market Market

The future of the India luxury furniture market appears promising, with continued growth driven by strong economic expansion and changing consumer preferences. Companies that successfully adapt to the evolving trends, invest in technology, and focus on sustainability will be best positioned to capitalize on the significant growth opportunities in the coming years.

India Luxury Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Luxury Furniture Market Segmentation By Geography

- 1. India

India Luxury Furniture Market Regional Market Share

Geographic Coverage of India Luxury Furniture Market

India Luxury Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. The Residential Segment in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Acme Industries

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ashley Furniture Industries Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Godraj and Boyce

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Durian

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vivona Designs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Natuzzi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mobel Grace

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IKEA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Molteni&C**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Damro

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Acme Industries

List of Figures

- Figure 1: India Luxury Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Luxury Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: India Luxury Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Luxury Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Luxury Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Luxury Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Luxury Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Luxury Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India Luxury Furniture Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Luxury Furniture Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Luxury Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Luxury Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Luxury Furniture Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Luxury Furniture Market?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the India Luxury Furniture Market?

Key companies in the market include Acme Industries, Ashley Furniture Industries Inc, Godraj and Boyce, Durian, Vivona Designs, Natuzzi, Mobel Grace, IKEA, Molteni&C**List Not Exhaustive, Damro.

3. What are the main segments of the India Luxury Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

The Residential Segment in India is Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

March 2023: IKEA Launched its new GOKVALLA collection, accessories to accompany client's furniture. the GOKVÄLLÅ collection can help you create the right atmosphere. It's inspired by tile patterns from the Middle East that are mixed with modern elements to make both you and your home shine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Luxury Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Luxury Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Luxury Furniture Market?

To stay informed about further developments, trends, and reports in the India Luxury Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence